According to Milkroad, the DePIN market cap climbed by 400% to $20 billion YoY, with fundraising volumes up 296%. It has undoubtedly been a strong year for DePIN.

We had anticipated DePIN to become a top player in the crypto world and published a research report DePIN Brings Real-World Business Opportunities for Web3. already in April this year.

Now it’s time to delve back into the DePIN world and see what has changed since then. Which sectors and use cases are performing, and which are lagging? What drives them, and what to expect in 2025?

DePIN keeps reinventing itself

Decentralized infrastructure solutions are emerging as more efficient, secure, and cost-effective alternatives to traditional centralized networks. While tokenized assets within DePIN facilitate scalable, adaptive business models.

Innovation is surging, and a wave of new projects has materialized. For example, these projects have all begun to emerge in the DePIN sector.

- Decentralized Generative Energy Infrastructure (DeGEN),

- Decentralized Gaming Infrastructure (DeGIN),

- AI x DePIN,

- zk-TLS (zero-knowledge Transport Layer Security)

We decided to take a look under the hood, dive into two projects, and examine their progress.

But first, which DePIN sectors are thriving, and which use cases are generating increasing revenue streams?

DePIN use cases and projects to pay attention to

From a bird’s-eye view, decentralized computing networks and decentralized sensor networks are powering ahead.

DePIN, AI, and gaming

The rise of generative AI and its ripple effects have triggered a surge in cloud computing networks entering the market. This has benefitted the decentralized computing arena, specifically by harnessing unused GPU computing power.

According to Flipside’s Solana Data Scientist, Kellen Blumberg: “It appears that investment in, and adoption of, decentralized compute solutions will likely outpace other DePIN sectors as global GPU demand continues to outstrip supply, especially since these DePIN projects are designed to service all types of GPU users, not just Web3 projects.”

AI and gaming use cases have led the way here. Sharing and allocating unused GPU computing power has grown significantly. io.net, Aethir, and Nosana are prime examples in this space.

Decentralized data storage and more

Also, Fx-land, a secure, encrypted IPFS decentralized storage network that replaces big tech cloud providers with a network of distributed computing resources, has joined the party. It is collaborating with industry giants such as United Airlines and Discover and is on an upward trajectory.

Always pushing the boundaries of innovation, Elon Musk’s Tesla is embarking on a world-first Cybertaxi project.

Musk envisions a future where each Tesla vehicle will be part of a Decentralised Physical Infrastructure Network. This will consist of a fleet of vehicles that function as mobile compute nodes. During idle times, they will contribute to decentralized tasks like data processing, AI training, or blockchain validation.

DePIN and IoT

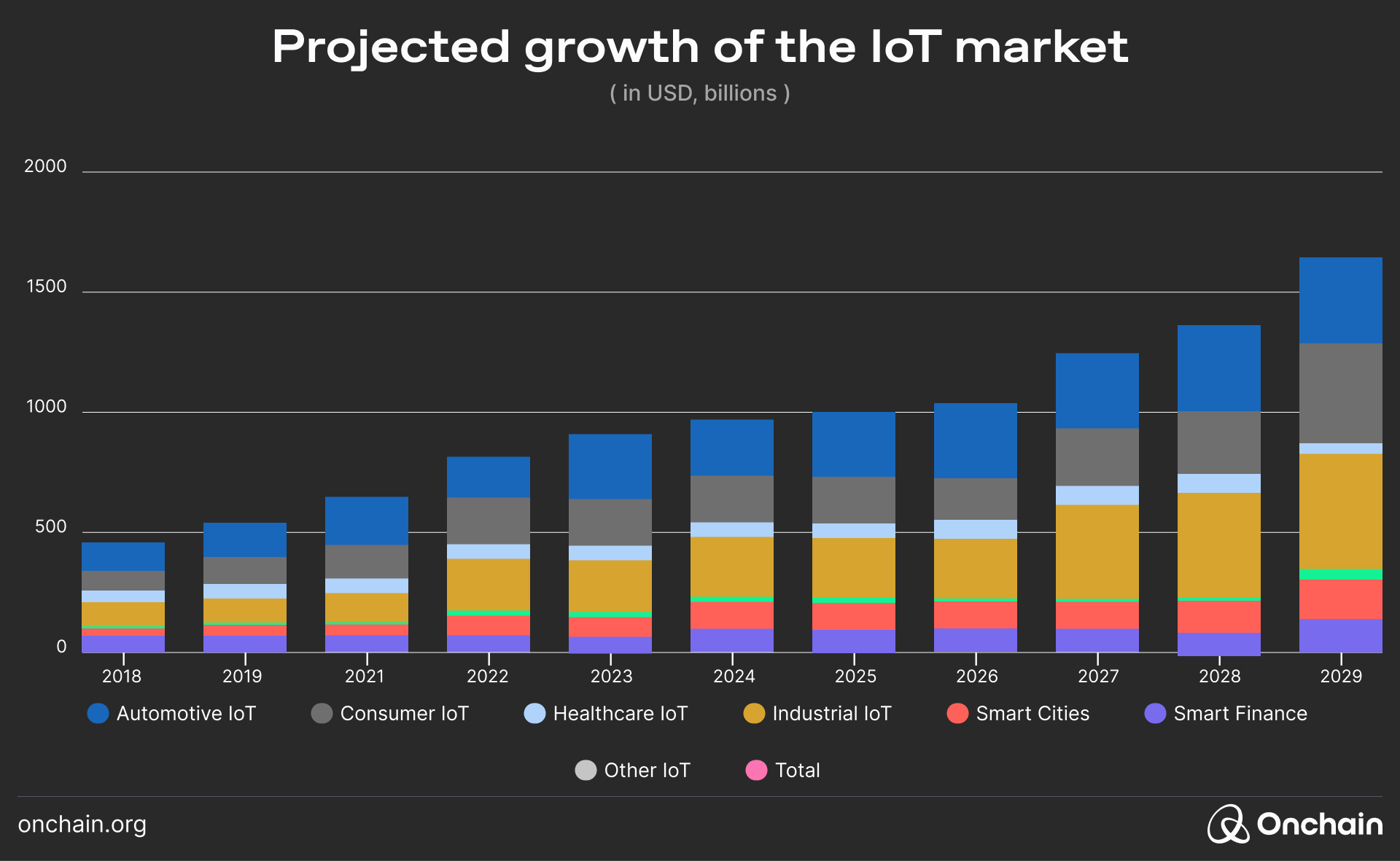

IoT (the Internet of Things) and wireless use cases have also performed well.

According to Statista, The IoT global enterprise market is predicted to grow at an annual growth rate of 10.49% to over $1.5 trillion by the end of the decade.

DePINs are well-positioned to capitalize on this sector. As you can see in the graph below:

A relative newcomer in the IoT field, Chirp has achieved considerable growth and created a unified wireless network for IoT and mobile by harnessing the power of DePIN and blockchain technology.

Chirp has formed a strategic partnership with Mysten Labs and RAKwireless to develop a bespoke gateway that operates across multiple frequencies. Their collaboration with Mysten Labs enables them to connect a vast number of IoT devices to the blockchain.

Furthermore, Chirp successfully launched a Mobile Virtual Network Operator (MVNO), increasing global reach and community engagement.

Hurdles on the path to DePIN success

These are many promising initiatives. On the other hand, Web3 DePIN projects still face significant challenges, such as obstacles from Web2 competitors, regulatory hurdles, and steep operational costs.

- Some sectors are playing catch-up. For example, mapping projects such as Hivemapper have to compete directly with giants such as Google Maps.

- Stringent regulatory requirements, complex supply chains, and high initial costs can hamper the enormous potential and hinder the growth of such projects.

- Capturing and maintaining user interest in a market mostly unfamiliar with decentralized solutions is challenging. In this case, it may prove beneficial to highlight the project’s appeal beyond Web3 users and emphasize the exceptional user experience to gain a competitive advantage.

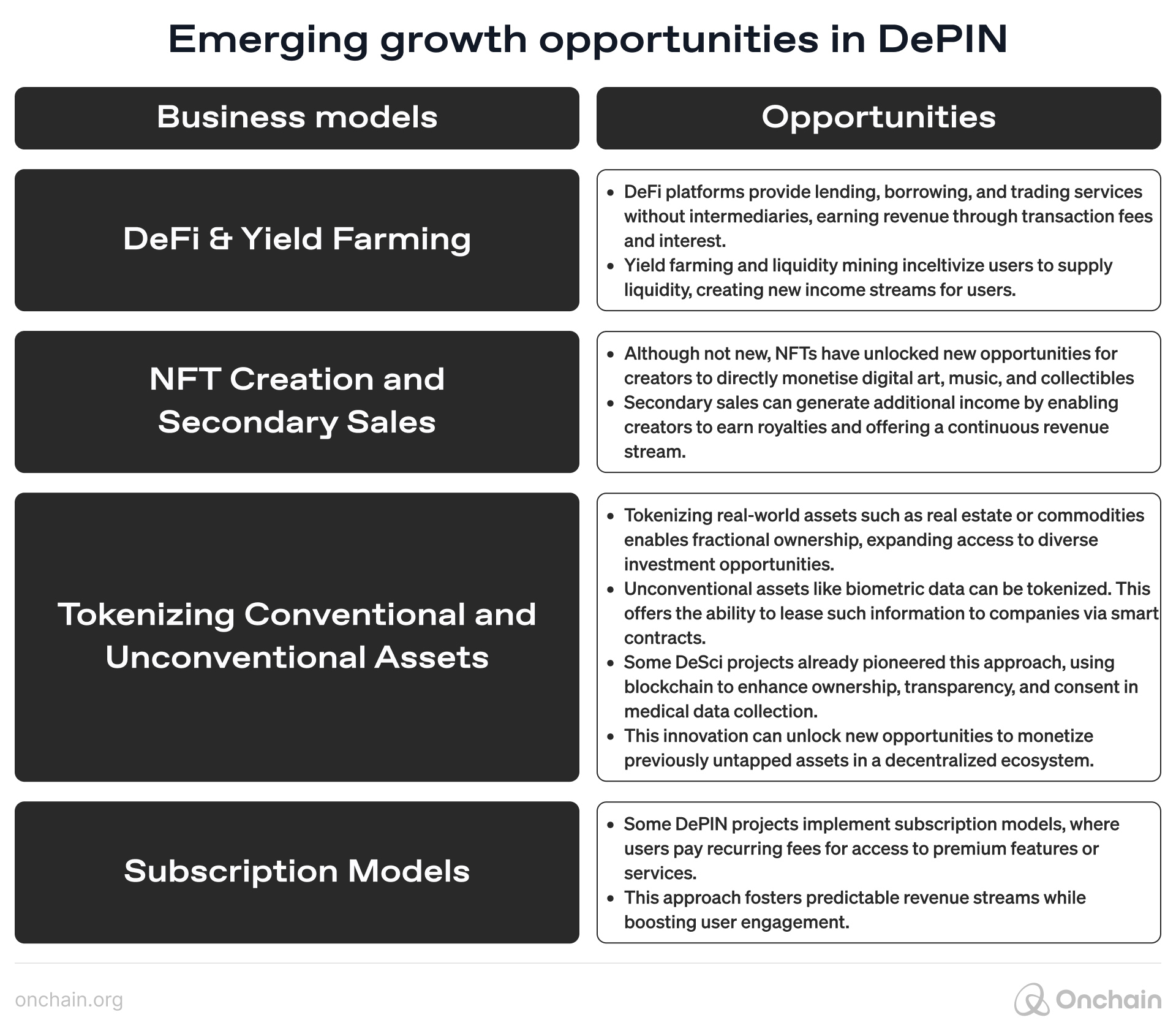

Growth opportunities for businesses in the DePIN ecosystem

A key growth area that DePIN businesses can exploit and offer transformative potential is in low to middle-income countries, where affordable and accessible infrastructure is essential.

DePINs can lower digital infrastructure costs by decentralizing data management and utilizing underused resources. The following table highlights growth areas that are still ripe for the pickings. Some of these opportunities are highlighted in the table below:

Turning innovation into revenue in DePINs

DePIN projects thrive on innovative tokenomics that incentivize resource contributions, such as processing power, storage, and connectivity. Platforms like Akash leverage rewards to drive infrastructure deployment, enabling early revenue growth and scalability.

By incorporating microtransactions, dynamic pricing, and DeFi tools, DePINs enhance resource efficiency and financial flexibility.

Exabit, a crypto-AI start-up, has just successfully completed another round of seed funding. It aims to capitalize on the exponential growth of the DePIN decentralized computing sector by tokenizing GPUs, providing direct exposure to GPU computer assets.

Exabit is thriving, reporting a 300% quarterly revenue surge and $10 million in annual recurring revenue (ARR).

It is clear that DePIN as a whole is powering ahead as more entrepreneurs and businesses enter the fray.

Let’s take a look into 2 promising projects and see where they were and where they are heading.

Two DePIN examples to keep an eye on

1. The Render Network: Past, present and future

Render’s early days

Render is a thriving project that has shown remarkable promise since its inception back in 2017 and has been tirelessly gaining more traction.

It is a decentralized GPU platform that supports applications like 3D rendering, machine learning, and generative AI. Its peer-to-peer network provides fast, efficient, scalable solutions and cost savings.

Since its launch, Render has experienced significant growth driven by infrastructure and advancements in rendering capabilities. In 2021, the Render team began its migration, planning to launch on Solana, and eventually migrated its infrastructure and token contract in 2023.

Furthermore, as covered in our research report, Render further widened their focus to include specialized rendering services, and has also established a foothold in the digital art sector.

Where is Render now?

Jumping forward to today, Render is one of the top DePIN projects, having grown by around 231% year over year.

Render traditionally grew by taking on more high-net-worth projects, such as the Las Vegas Sphere and Apple Vision Pro, and expanding its network into spatial rendering, adding additional large-scale projection mapping and light field renderings.

Among other positive developments, Render has established a synergistic partnership with Nvidia in March of 2024, a giant in the GPU world. It is still experiencing growth and is on an upward trajectory, with the Render token price more than doubling from $4 to over $10 in the last 3 months at the time of writing.

What has changed, and what opportunities are now on the horizon?

As we approach the second half of this decade, the applications of the Render network are becoming increasingly varied. These include media and entertainment, architectural visualization, AI, machine learning, and emerging technologies. Moving forward, Render has much to gain in the DePIN space.

What has changed is that Render’s collaborations with more tech giants have highlighted its role as a pioneer in the DePIN sector, which is reshaping the digital landscape.

It has now partnered with OTOY, Stability AI, and Endeavor, uniting the leaders in open-source generative AI models, media and entertainment, and GPU computing. Together, they aim to develop and standardize IP rights, production workflows, and infrastructure to support the rapid evolution of AI technologies.

By uniting blockchain technology, GPU computing, and community-driven innovation, Render has now become more than just a tool — it’s a leap forward in how GPU-based tasks like 3D rendering and AI are executed.

2. The Theta Network: Past, present and future

Theta’s early days

The Theta Network, launched in 2017, is a decentralized video delivery platform designed to enhance and improve video streaming quality through a peer-to-peer system of nodes. It incentivizes users to share bandwidth and computing power by rewarding them with tokens.

Users were incentivized to share unused bandwidth and computing power through TFUEL, the network’s utility token.

Where is Theta now?

According to CoinGecko, Theta’s market capital increased from $0.75 billion to $1.34 billion from 2023 to 2024, achieving a growth of 78%.

Theta continued to grow by introducing its Theta EdgeCloud earlier this year, combining cloud and edge computing to power AI, media, and video delivery.

This resulted in reduced overall streaming costs and created a decentralized global computing grid.

Its strongest competition comes from Web2 streaming sites such as YouTube and Netflix.

Although its major risk factor is its high dependence on partnerships with content creators and other related companies, Theta has demonstrated its success by focusing on increasing its partnerships and has shown an increase in global adoption, especially with its edge-node network.

Theta continued its journey, introducing staking features for its TNT20 tokens, enhancing the Theta Video API, and launching decentralized digital rights management (DRM) tools for NFTs.

What has changed, and what opportunities are now on the horizon?

The Theta project continues to stride ahead. In the last week of November, it implemented another key partnership to further increase its revenue streams and cement its position in this DePIN sector.

EinPresswire announced that Theta will partner with Phoenix Global Media Group, which is launching a new AI audio streaming platform for 1.3 million daily users. The platform will be powered by Theta EdgeCloud, the world’s first blockchain- and AI-driven audio streaming service.

This landmark collaboration is set to reshape the future of audio streaming. The AIR-Theta partnership will combine Theta’s Edgecloud infrastructure with AIR’s advanced AI technology.

“Through Theta’s Edgecloud technology, AIR has the foundation to go beyond traditional streaming and bring truly dynamic, customized content to users at scale.” — Larisa B. Miller, CEO, Phoenix Global Media Group.

Theta’s ambition is to continue steady adoption in the media, gaming, and AI arena. Moving ahead to 2025, it aims to establish an open marketplace where community-operated edge nodes can function in a fully decentralized environment.

DePINs: Paving the path for innovation and market adoption

DePIN has attracted considerable attention. Looking further forward, sectors such as AI are likely to continue experiencing healthy growth, driven by the increasing computational demands of large language models.

Furthermore, the IoT sector is powering ahead in tandem.

This bodes well for the DePIN arena as a whole. However, to maintain sustainable growth, DePIN business models need to continue focusing on improving revenue streams and incentivization mechanisms while simultaneously addressing their limited appeal outside Web3.

Therefore, attracting broader demand remains a critical challenge, requiring these networks to bridge the gap to mainstream markets.

Finally, to ensure DePIN can remain on its positive trajectory in this politically and economically unstable climate, its ability to deliver will be a key test of its resilience and overall potential for the future.

Want to know more and dive deeper into this exciting new sector? Visit our Onchain research report, DePIN Brings Real-World Opportunities for Web3, and learn how to avoid the pitfalls and ensure your DePIN project remains on the road to success.

DePIN is one of the most promising Web3 sectors right now. But how will DePIN fare in 2025? We will be sharing our predictions about this and other hot topics in 2025 very soon.

Don’t miss it — keep your eyes peeled on our research page!