The recent U.S. election and shift in regulations has all eyes on crypto. 2025 was already looking good with MiCA regulations just gone into effect and emerging markets rapidly adopting crypto at all levels of commerce.

There are fewer questions about working with blockchain tech and decentralized practices across businesses worldwide. Web3 ended 2024 as an exciting and resilient industry, and now the wheels are greased.

We made some predictions at the turn of the year to guide your decisionmaking across blockchain. Let’s have a look at the key areas we covered and how January has confirmed (or shifted) our guidance for your Web3 adventures.

Politics, politics, politics!

Trump’s 2024 campaign included an about-face on crypto regulations.

In the twenty-four hours following his election, the assurance of a favorable regulatory environment moved the crypto market from a $2T to $3T market cap. That growth has continued ever since, skirting $4T several times.

This indicates strong interest in cryptocurrencies, but what about the rest of the Web3 world? The MiCA rollout throughout 2024 put blockchain-based businesses within Europe on sure footing. Conferences across the Union included MiCA discussions and legal workshops to further support entrepreneurs bullish on founding within the EU.

- Vietnam issued its National Blockchain Strategy,

- Zanzibar announced a blockchain sandbox program,

- Argentina included crypto assets in its proposed tax amnesty law, and

- Australia is exploring a CBDC.

Even where unfavorable regulations were issued, they resulted in greater confidence for blockchain businesses thanks to the increased clarity about acceptable activities. You can take a deeper look at what our president Max Kordek had to say about how the regulations will affect blockchain businesses in our predictions report.

AI and the blockchain generation

In late 2024, the Galileo FX trading bot made a 500% return in one week. The shift toward combining AI agents with blockchain activity has been thunderous, its echoes resounding across the blockchain sphere.

AI utility in blockchain is a no-brainer as these technologies combine into an even more powerful output. And it’s not just for DeFi. The key for any entrepreneur’s scaling efforts is automation.

AI is like automation crack for blockchain business models. They make each other more secure, optimized, and speedy. Our head of research Leon Waidmann outlined just how AI will remain married to blockchain in 2025 in our predictions report, and January showed no slowing this trend. If you haven’t explored implementing AI in your business model, we think it’s time.

DeSci continues to grow

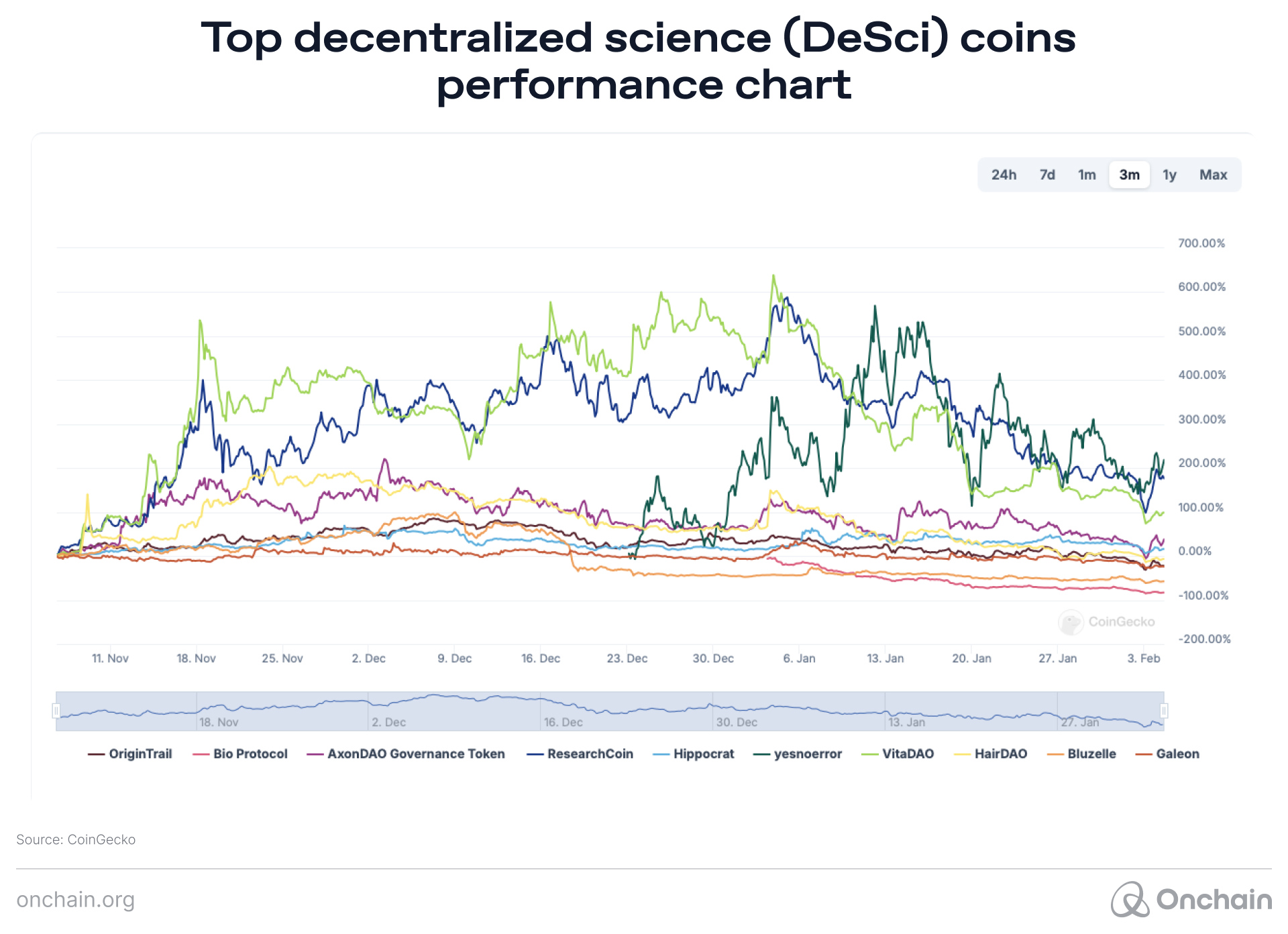

Perhaps considered the blockchain underdog, DeSci is the blockchain segment that is generating real-world change for individual consumers inside and outside Web3. DeSci as a segment got a boost in Q4 2024 when Vitalik and CZ visited several DeSci events at DevCon 12-15 November 2024.

Since that week, DeSci markets saw rapid growth. The Bio.xyz coin launched, drawing even greater interest (and some criticism) to the DeSci sector as both an entrepreneurial and investment opportunity. Though there has been a mild cooling off period in January, DeSci is still poised to do well in 2025. This is a sector to keep an eye on. Have a look at our DeSci report to get your hands on the nitty gritty.

DePIN shakes things up

Speaking of real-world impact, DePIN has been grabbing the attention of entrepreneurs and savvy investors for several quarters. The sector has grown to a $28B market cap. That growth was poised and ready when the January fires swept LA.

What at first appeared as only a natural disaster has drawn even more attention to this burgeoning sector as lawsuits emerge against failing infrastructure, with DePIN positioned as a possible solution.

AI’s exciting leap forward with the release of the energy- and resource-efficient DeepSeek early in 2025 further expanded the application of DePIN business ventures.

Alongside DeSci, DePIN is the blockchain sector most likely to impact individuals outside of Web3. However, it is still considered an emerging sector, and there are several open questions hindering its growth.

These include regulation and layperson adoption. Our CSO Michał Moneta’s predictions dig into these key issues so you can make an informed decision for your ventures as the year progresses.

NFTs are the dark horse of 2025

Are NFTs still hot or has the public gotten sick of them? We’re particularly bullish for 2025.

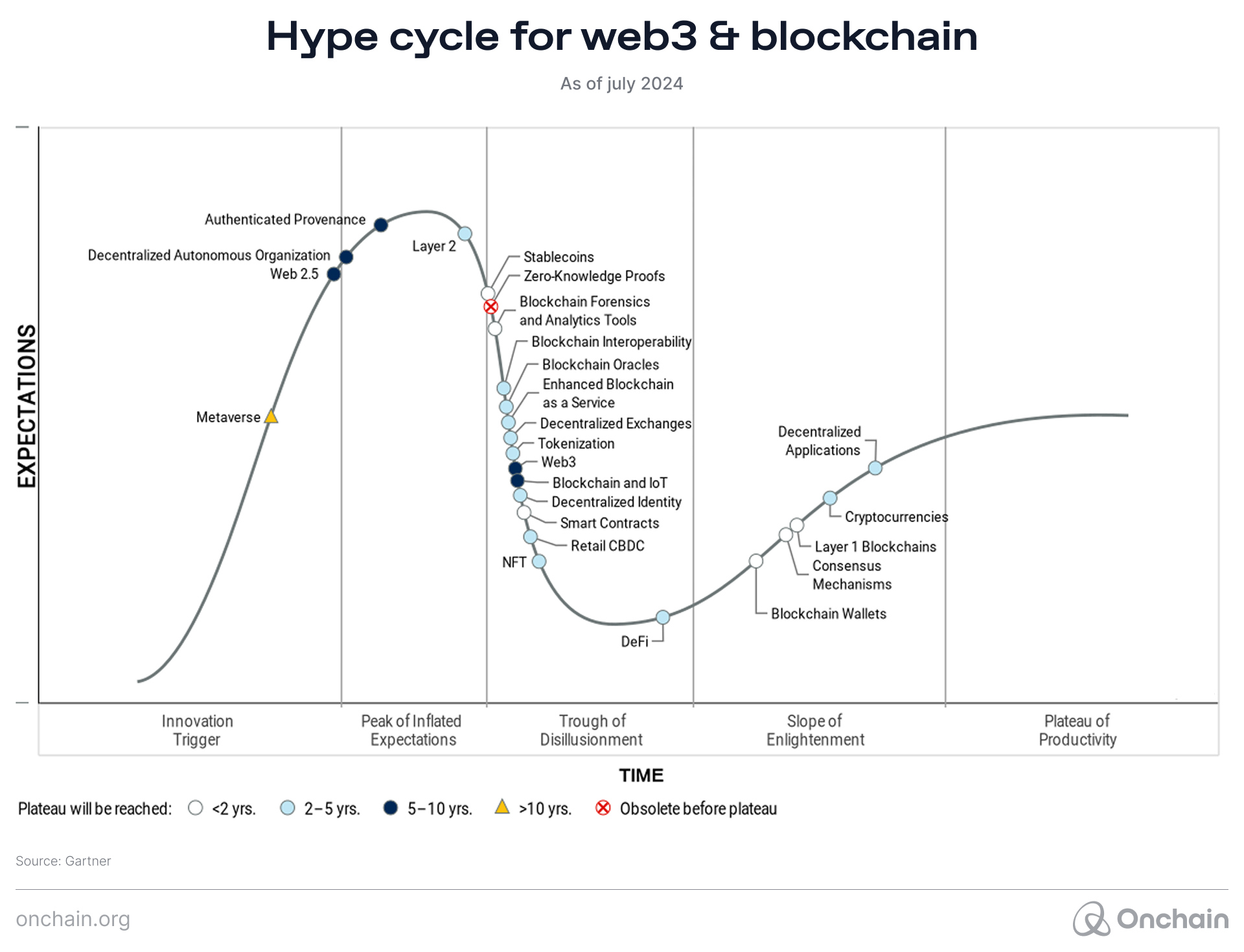

The Gartner hype cycle tells us they may be exiting the trough of disillusionment, making them interesting for mainstream investment and business application this year.

Throughout their cool-off period, NFTs retained their utility within the blockchain community, representing tickets to conferences, membership to marketplaces, and digital art exhibitions.

But, as a savvy entrepreneur, you know that they need to reach ubiquity beyond basic utility to be money makers. We’re staring down that shift in 2025.

Head to our predictions report to take a look at why Waidmann thinks they will be the dark horse of the year.

L2s are making the leap

Ever since the rollout of Coinbase’s L2, world banks have been eyeballing the opportunity for themselves. Where CBDCs have failed, layer twos may succeed. They bring scalability, reduced fees, and greater overall reach into new markets.

But that’s not what has our research analyst Dr. Ananya Shrivastava hyped. She believes the expansion of the layer two ecosystem will be driven by modular blockchains.

Modular blockchains break down the complex tasks that layer one chains are handling, making execution even faster and more efficient. Ethereum exited 2024 with a market cap above $50B, while Nomad and Connext rolled out a modular stack.

If your goal is to scale in 2025, you’ll want to keep an eye on the modular blockchain ecosystem. Shrivastava took the deep dive on modular chains to guide you in our predictions report.

DeSoc: The segment we didn’t predict

While we tried to cover the hottest sectors in our predictions report, we didn’t anticipate how much the TikTok ban would influence the general public’s interest in decentralized social media (DeSoc).

Rather than return to familiar traditional platforms as the ban loomed, the user base chose decentralized social media in droves.

While TikTok isn’t as locked down as initially anticipated (despite still being banned from app stores in the U.S.), new DeSoc platforms have been consistently rolling out across January. To us, this indicates an ongoing desire in the market, one we’re quite excited to see.

As you build your business this year, consider involving DeSoc, from posting on Warpcast and Bluesky to building your own federated social media option. It is likely you’ll have the opportunity to capture some of the user base concerned about purported censorship on traditional social media platforms.

Take a look at our DeSoc report for more hands-on guidance.

Final thoughts, or year-opening thoughts?

We’re already off to a great start in 2025, and there’s a ton of opportunity waiting for you.

Your next step is to review our 2025 predictions report and dig deeper into your sector of interest. It will give you a sense of what’s coming and how to take charge of your year. Read the report now.