As DePIN continues to conquer Web3 and eyes Web2 giants, we decided to revisit its meteoric rise and uncover what’s driving the next wave of decentralized innovation in 2025.

How is DePIN really faring with the competition heating up and innovation surging?

What has changed, and where are we headed?

Ten months after publishing our in-depth report, DePIN brings real-world opportunities for Web3, we decided to check what new insights we could uncover as we head into 2025.

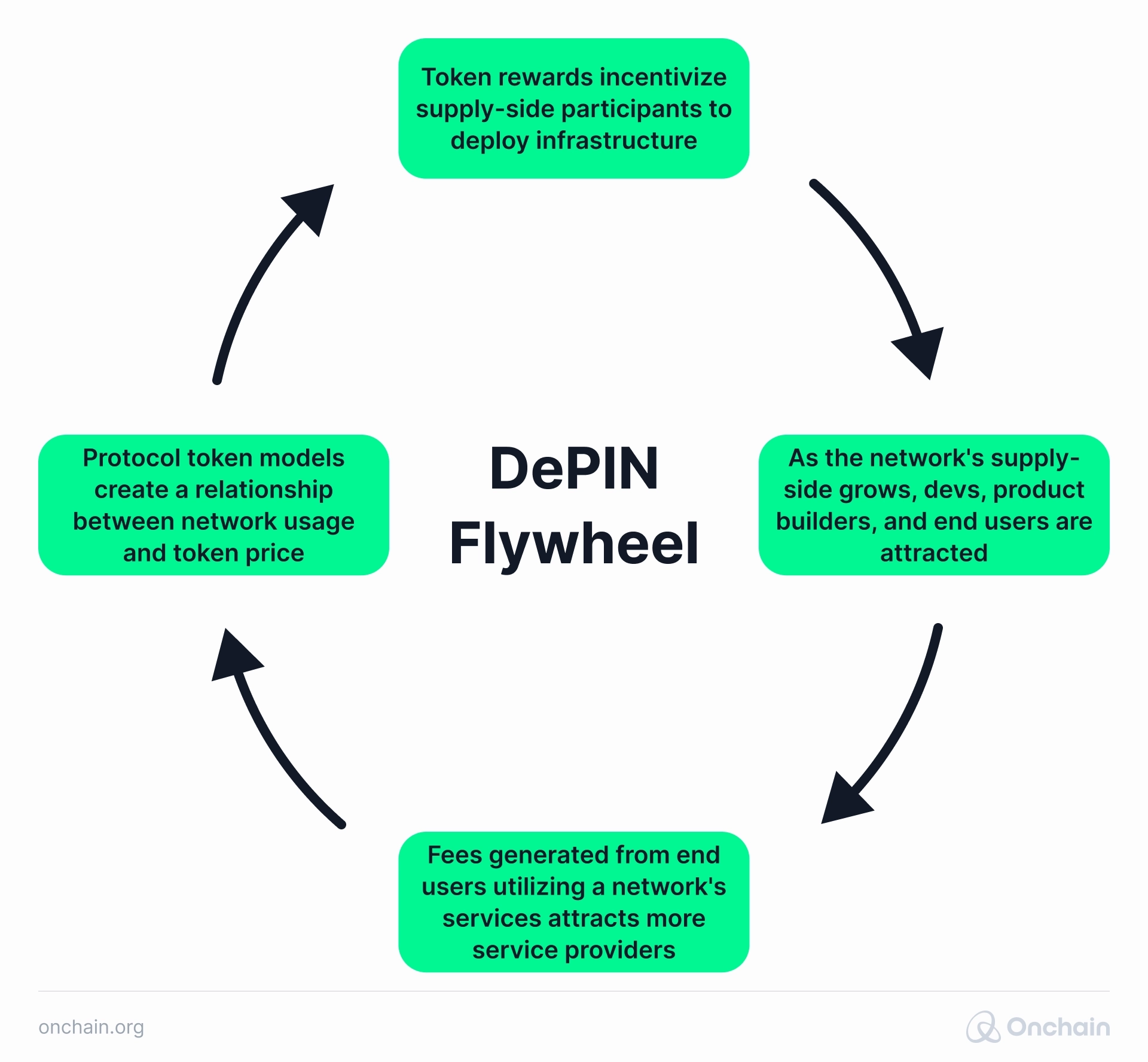

The DePIN flywheel still plays an integral part in how the different forces play together to create the DePIN flywheel.

What is the DePIN flywheel and why is it relevant?

To put it simply, the DePIN flywheel is an ingenious concept that shows how tokenization boosts a network’s value as it grows.

This innovative model showcases how DePIN incentivizes individuals to construct physical infrastructure networks.

As more users engage with the network, the demand for its tokens increases, boosting the token value.

This, in turn, inspires more people to get involved and contribute to the network’s expansion, which creates a perpetual self-reinforcing cycle known as the network effect.

The DePIN flywheel concept broadly illustrates this positive network feedback loop that enables the bootstrapping and scalability of these networks.

Messari predicts that it can add $10 trillion to the global GDP over the next decade. In the decade after that, Messari foresees a growth of $100 trillion.

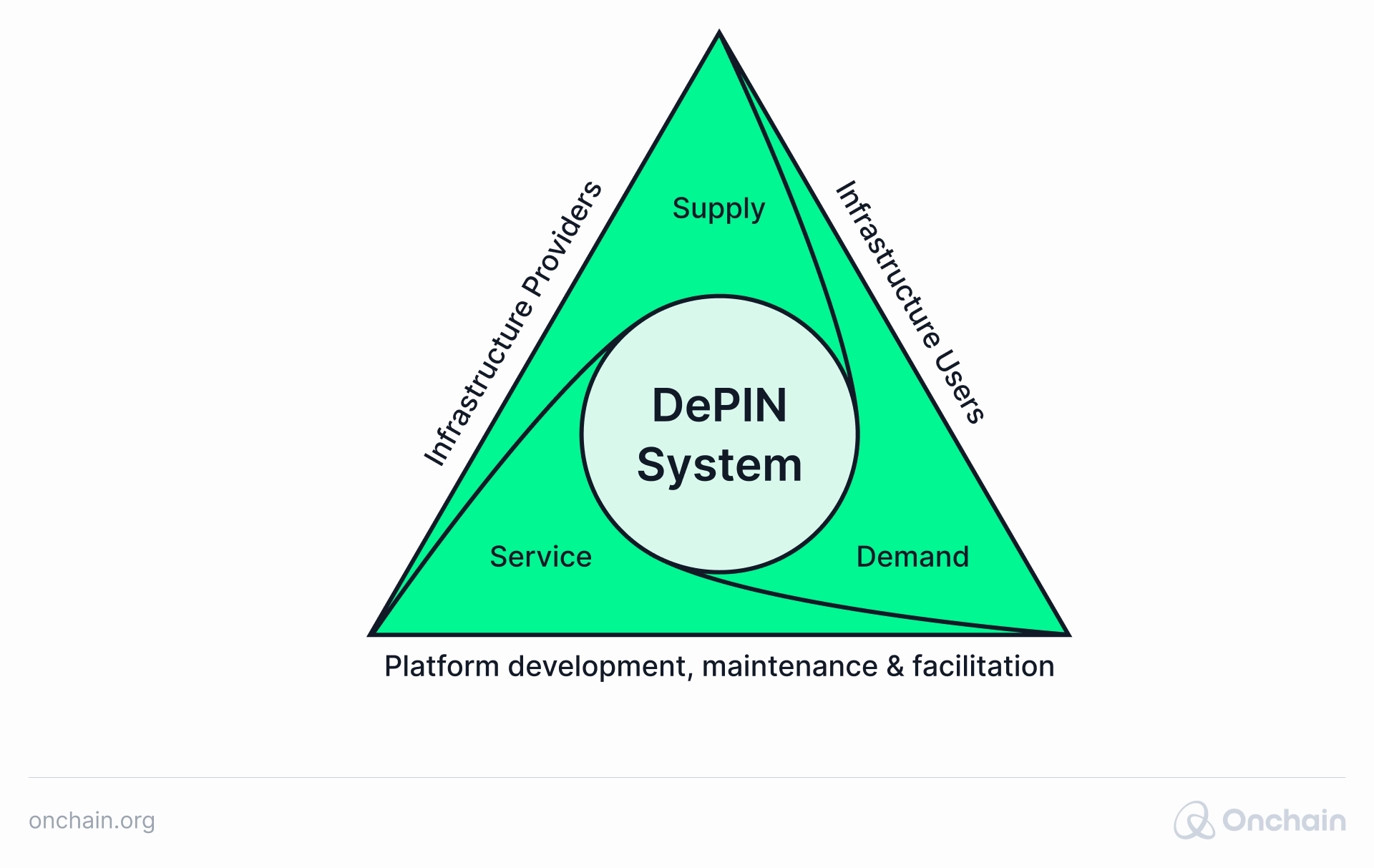

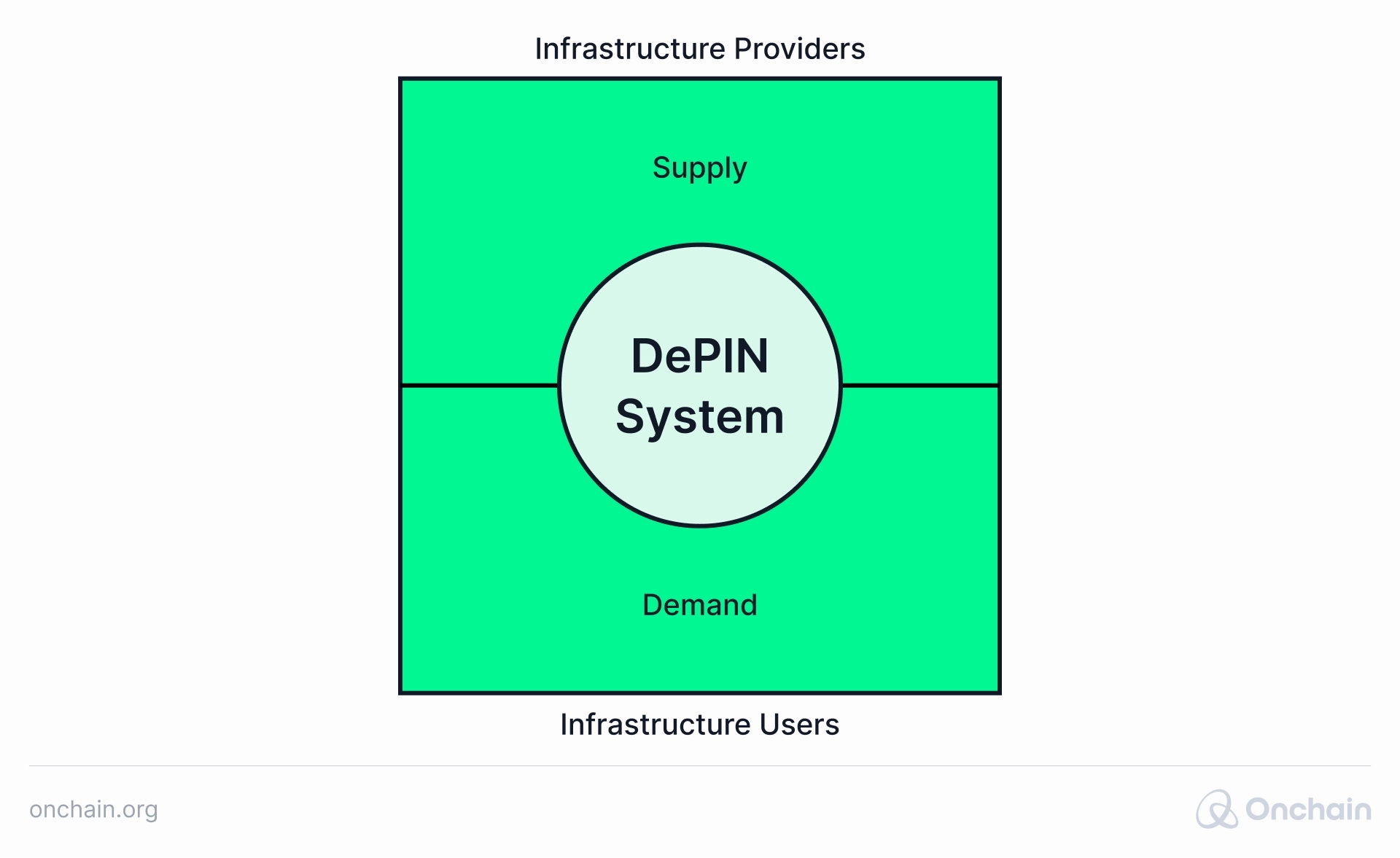

The flywheel components – demand, supply and service

Our previous article, DePIN Flywheel: Looking for a Perfect Balance covers this in more depth.

But how do you get the flywheel turning so your project can reap the benefits of DePIN?

You attract infrastructure suppliers by offering token incentives. Through fees and data monetization, you keep expanding the network infrastructure.

This attracts users, as well as developers and product builders who have demand for your services.

Further development and improvements generate more demand, leading to higher earnings for suppliers and driving up token prices.

In another previous article, we investigated how DePIN Web3 projects are Connecting the World to Crypto. Now, let’s fast forward to today and re-examine some of them to highlight their successes and challenges.

3 DePIN project case studies

1. Helium

Helium is a decentralized wireless network designed for IoT devices. It’s on a mission to revolutionize connectivity by incentivizing individuals to host hotspots instead of relying on traditional cell towers.

Successes achieved:

Helium achieved remarkable growth over 2024, gaining over 100,000 new subscribers and indirectly supporting more than 300,000 users through carrier offloading partnerships with traditional telecom providers. Helium is well-positioned to surpass legacy MVNOs in scale and profitability within a few years.

As the first Mobile Hybrid Network Operator (MHNO), it combines a growing subscriber base with a global, community-owned network infrastructure. Its deployment model enables growth at a pace unmatched by traditional telcos, and it has the potential to sustain this momentum for the foreseeable future.

Challenges ahead:

Helium faces several hurdles. The overall user experience has demonstrated that slow and clunky handoffs between Helium and other networks have led to a poor user experience. Such technical issues are paramount to keeping and further building its user base.

Furthermore, its multiple tokens add a layer of complexity that fragment liquidity and confuse users, while markets favor simplicity.

Overall, enterprise IoT adoption would appear to be still somewhat early in its lifecycle to generate significant revenues yet. The Helium LoRa nodes need to increase their annual recurring revenue and have contributed less than $50,000 ARR (Annual Recurring Revenue).

2. DIMO

DIMO is another promising project that we decided to review.

DIMO leverages vehicle data by putting drivers in control instead of manufacturers. Its innovative platform allows car owners to track performance and securely share data through a decentralized network, transforming everyday information into a valuable asset that directly benefits users.

Successes achieved:

DIMO is rapidly gaining momentum. With over 135,000+ vehicles connected to its automotive ecosystem, further growth is anticipated.

Partnerships, particularly the one with NATIX, enhance the value of vehicle data for applications such as maintenance and insurance.

DIMO has capitalized on leveraging modularity and collaborating with others, which results in faster scaling. By re-bundling hardware and software layers, DIMO has simplified user experiences, which in turn enables deeper integration across its ecosystem.

Although not quite achieved yet, DIMO is planning a protocol migration to Base in 2025, which will solidify its ecosystem for bringing more vehicles onchain.

Challenges ahead:

Regulatory scrutiny of decentralized identity solutions could put the brakes on DIMO’s growth. In addition, it needs to keep its finger on the pulse with regard to the intense competition in the identity management space, as this could further hinder its progress.

Limited partnerships, negative market sentiment, or technological failures could impact user trust and market value, threatening its long-term success.

Although Dimo’s ecosystem scaled well in terms of supply-side scale and developer activity in 2024, its onchain revenues ended the year roughly flat at around $10,000 ARR.

3. Livepeer

The Livepeer platform offers streaming by distributing, transcoding, and hosting computing power across its decentralized network, providing cost-effective access to unused resources.

Its LPT token incentivizes collaboration to maintain network affordability, efficiency, security, and reliability for all participants.

Our article from April 2024, found that Livepeer’s demand-side revenue and staking rewards increased by over 30% in 2023. So, how have they been faring since then?

Successes achieved:

Not one to let the grass grow under their feet, Livepeer strode ahead in 2024 and introduced their new AI real-time pipeline model, Cascade.

With its Cascade model, advanced use cases such as creative content creation, real-time analysis, and decision-making by smart agents based on live video feeds can be implemented.

By chaining multiple AI models into powerful pipelines, Cascade leverages Livepeer’s compute infrastructure to support innovative applications across entertainment, analytics, and beyond.

According to Botsfolio.com, “The global video streaming market is projected to reach over $800 billion by 2025.” This bodes well for the likes of Livepeer.

Challenges ahead:

Livepeers’ revenue growth has increased by around 185% since we last reviewed them, which is impressive. However, if we compare this to a couple of its competitors, Akash and Render, they have achieved much better performance, with an increase of around 325%, respectively.

Livepeer needs to be mindful that regulatory issues and intense competition from centralized and decentralized platforms could impact its growth.

To ensure Livepeers’ upward trajectory continues, it will need to attract more content creators and developers and collaborate with major streaming platforms or partnerships.

Now we’ve had an update on 3 well-known DePIN projects, let’s take a look into the supply versus demand balance and how incentivization is of key importance.

Supply vs demand balance – incentivization is the key

How can DePIN companies provide the right incentives to succeed in generating revenue and sustaining operations – in other words, keep the DePIN flywheel turning?

Moving from early adoption to attracting widespread acceptance into the mainstream and into the broader non-Web3 market is a major hurdle.

To give you a clear overview, we need to re-examine the key points that can help move DePIN projects in the right direction compared to their non-Web3 rivals.

Overcoming barriers: How DePIN can attract mainstream users

The following points highlight where DePIN projects can overcome some of the hurdles ahead:

- Leverage existing hardware: Building new hardware is costly and limits scalability. A more logical approach for many DePIN projects would be to utilize commodity hardware like smartphones, which are globally widespread and equipped with advanced features.

Examples such as NATIX demonstrate how existing hardware can drive adoption without manufacturing hurdles. - Expand accessibility beyond crypto: Crypto-centric rewards and interfaces alienate non-crypto users.

Integrating familiar incentives such as discounts and offering intuitive sign-ups could result in lowering the barriers and appeal to a broader audience. - Reduce inflationary tokenomics: Where possible, implement dynamic rewards and tie incentives to meaningful contributions. Another option could be to cap token supplies and introduce reward-burning mechanisms.

Innovations like Modular DePIN and real-world asset tokenization further enhance efficiency, reduce costs, and improve liquidity. - Focus on real utility: Success depends on delivering tangible value, not just token incentives.

DePIN projects must solve real-world problems, such as reducing traffic congestion or improving data privacy, to ensure lasting engagement and meaningful adoption.

Balancing the token economy entails careful management to avoid inflation or devaluation. It is crucial to offer appropriate incentives without excessive token issuance. It should then be possible to attract more suppliers.

To achieve success and bring DePIN into the mainstream world, DePIN projects must focus on user-centered solutions that deliver real-world value rather than relying solely on speculative tokenomics.

DePIN must drive the 2025 bull market narrative, with success hinging on more than crypto-related fixes.

Although tokenomics and integrations are showing improvement, the real opportunity lies in strong marketing and business strategies.

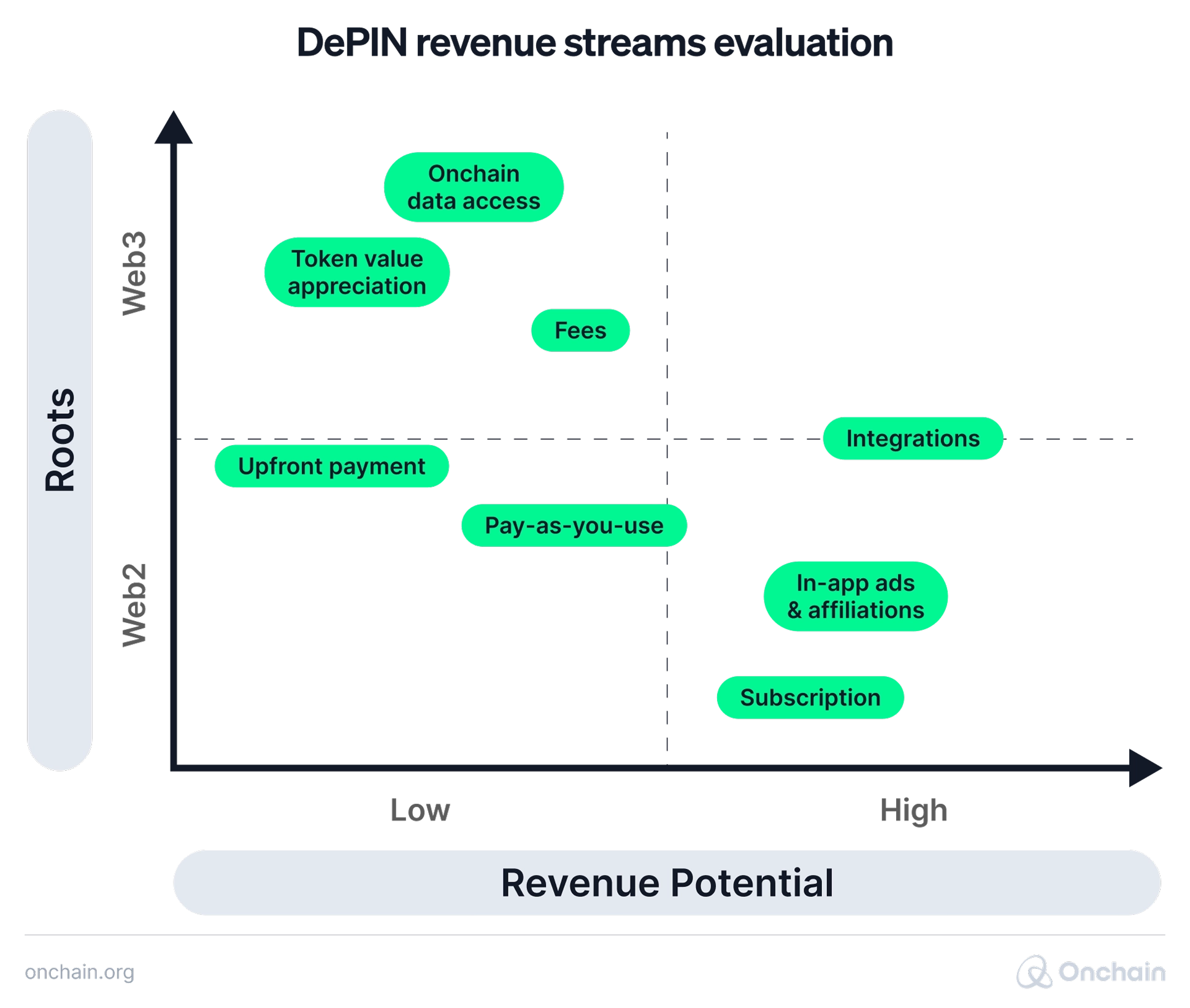

By aligning with the crypto community and focussing on the factors shown above in the revenue potential diagram, DePIN projects can bridge the gap to mainstream adoption.

For entrepreneurs, addressing these gaps is key to unlocking DePIN’s untapped market potential.

How DePIN needs to evolve from here

Long-term success hinges on bridging the gap between Web3 enthusiasts and mainstream adoption. This can be achieved by capturing the attention of pragmatic users who prefer proven solutions.

However, the focus must shift to generating significant hype within Web3 in 2025, leveraging the current positive momentum.

While tokenomics and integration challenges are now more in the limelight and being addressed, the real challenge lies in building strong marketing and business strategies to showcase DePIN’s value to non-Web3 audiences.

Success will depend on collaborative efforts to create and promote solutions that appeal to both early adopters and the broader market.

To avoid the pitfalls, check out our report, DePIN Brings Real-World Opportunities for Web3. It provides much more in-depth solutions and strategies to steer your DePIN project to success.

Furthermore, don’t miss our Onchain’s 39 Web3 Predictions for 2025 report, which includes more alpha on the DePIN market.