Our report on how DePIN brings real-world opportunities for Web3 and beyond found that the future of DePIN likely depends on how much these projects can incentivize the demand side.

This article explains why that’s the case and how the different forces play together to create the DePIN flywheel.

What is the DePIN flywheel?

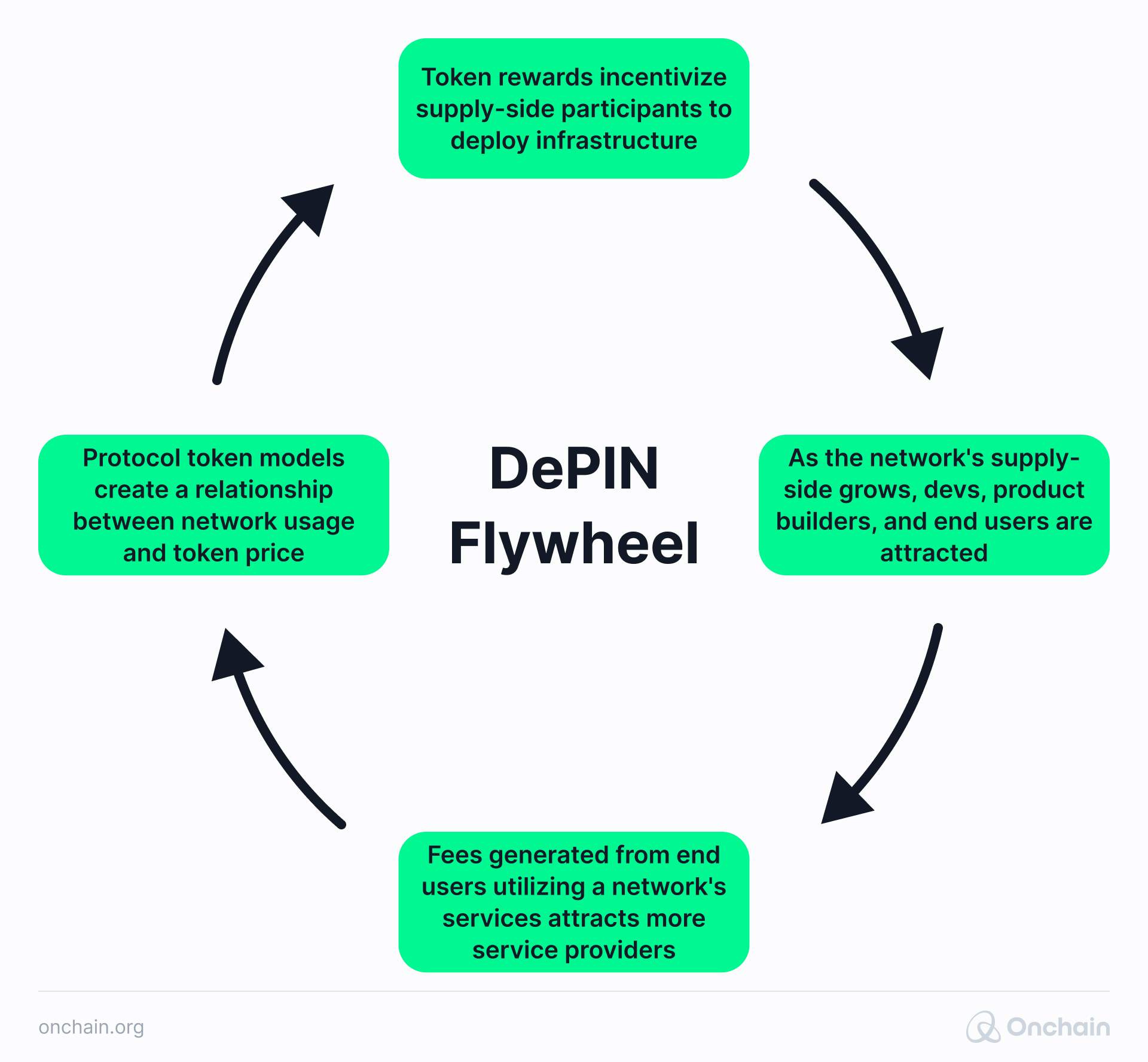

To put it simply, the DePIN flywheel is an ingenious concept that shows how tokenization boosts a network’s value as it grows.

This innovative model showcases how DePIN incentivizes individuals to construct physical infrastructure networks.

As more users engage with the network, the demand for its tokens increases, boosting the token value.

This, in turn, inspires more people to get involved and contribute to the network’s expansion, which creates a perpetual self-reinforcing cycle known as the network effects.

The DePIN flywheel concept broadly illustrates this positive network feedback loop that enables the bootstrapping and scalability of these networks.

Messari predicts that it can add $10 trillion to the global GDP over the next decade. In the decade after that, Messari foresees a growth of $100 trillion.

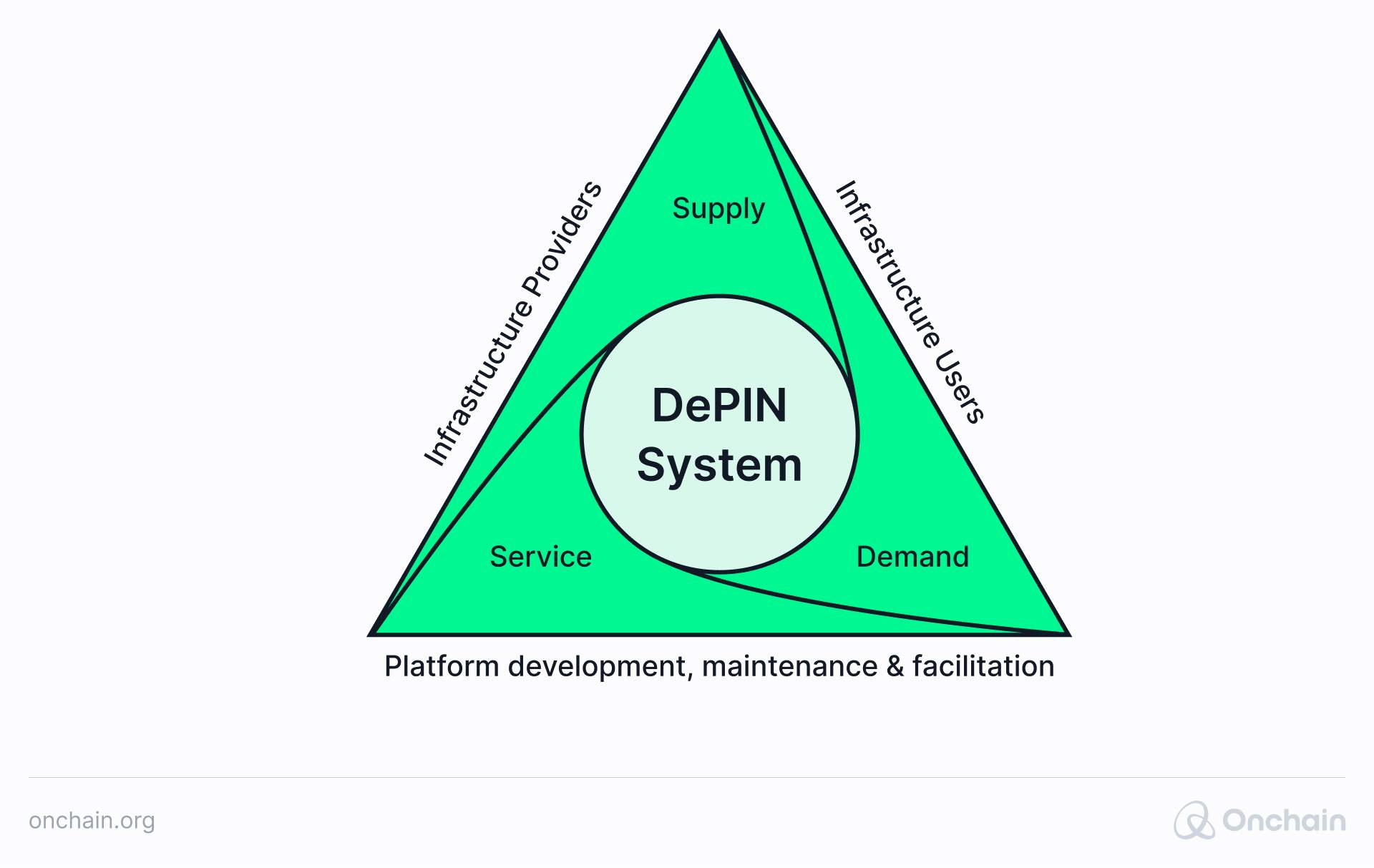

The flywheel components – demand, supply, and service

Let’s take a look at the supply, demand, and service side components and how they interact.

- Supply side – comprises the network’s physical components, such as computers, storage, and sensors.

- Demand side – includes people, businesses, and other entities that rely on the DePIN services by utilizing the infrastructure offered by the supply side.

- Service side – links real-world assets and the digital marketplace (e.g., online platforms for sellers and buyers), facilitates transactions and maintains the infrastructure.

Time to drill down a bit further and illustrate with Natix Network as an example.

Supply-side participants provide the necessary assets to facilitate the network’s bootstrapping. In return, they receive tokens or other benefits from the project.

Natix provides an app that participants can download to their smartphones. Using their smartphone camera and Natix’s AI-powered software, they gather valuable data on mobility, navigation, and traffic. The network rewards its suppliers with tokens.

On the demand side, you have the consumer or end users. The DePIN project needs to identify who might demand this type of intelligence and might be willing to pay for it.

In Natix’s case, this includes anyone from drivers, fleet operators, and mobility apps to city planners and smart-city builders. The data is available on Natix’s marketplace.

The service side includes facilitating transactions, identifying resources, and maintaining the technology backbone. It also involves continuously developing and advancing the app and network operations.

And the DePIN flywheel goes round and round

So, how do they all interact? And how do you get the flywheel turning to reap the benefits of DePIN for your project?

You attract infrastructure suppliers by offering token incentives. Through fees and data monetization, you keep expanding the network infrastructure. This attracts users, developers, and product builders who have a demand for what you provide. Excellent service, further development, and improvements generate more demand, leading to higher earnings for suppliers and driving up token prices. And now you can attract more infrastructure suppliers … and so on.

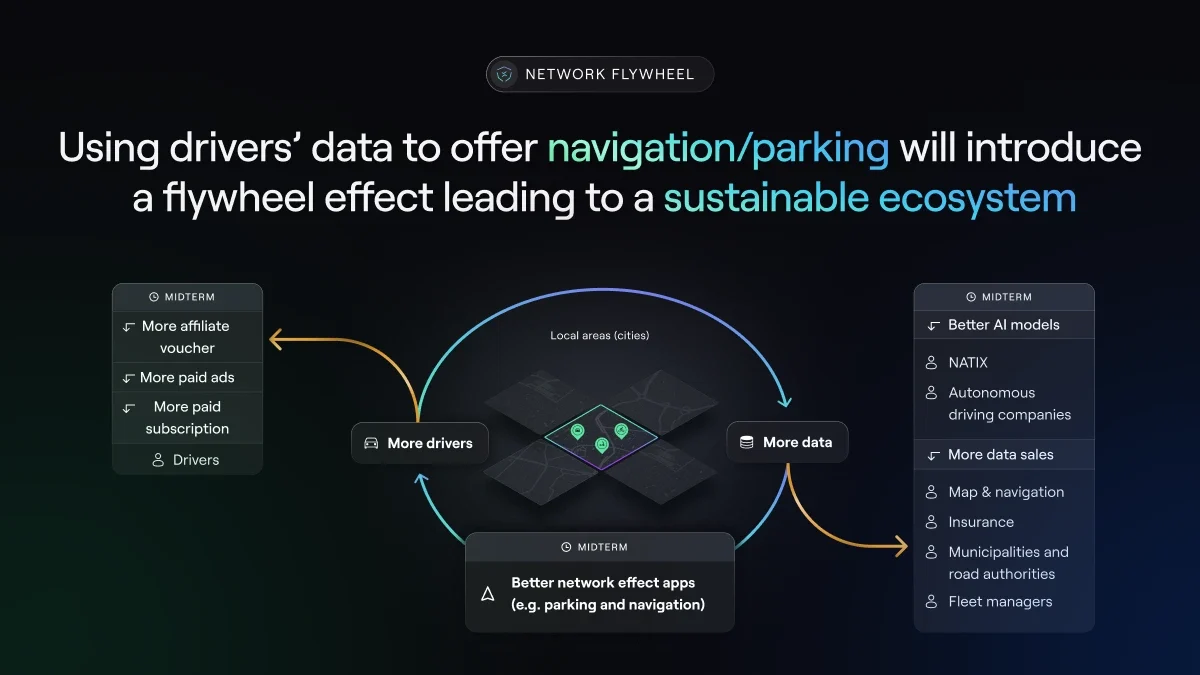

Natix has created its own version of a flywheel:

At Natix, an increase in network drivers mapping their surroundings (the supply side), leads to more comprehensive and accurate maps (for the demand side), enhancing the value of the dynamic map application. Consequently, this organically draws in more contributors to the ecosystem (the service side) and increases data quality and value together with token value.

It will be helpful to look at some other projects’ experiences from the supply and demand perspective.

DePIN: Supply vs. demand

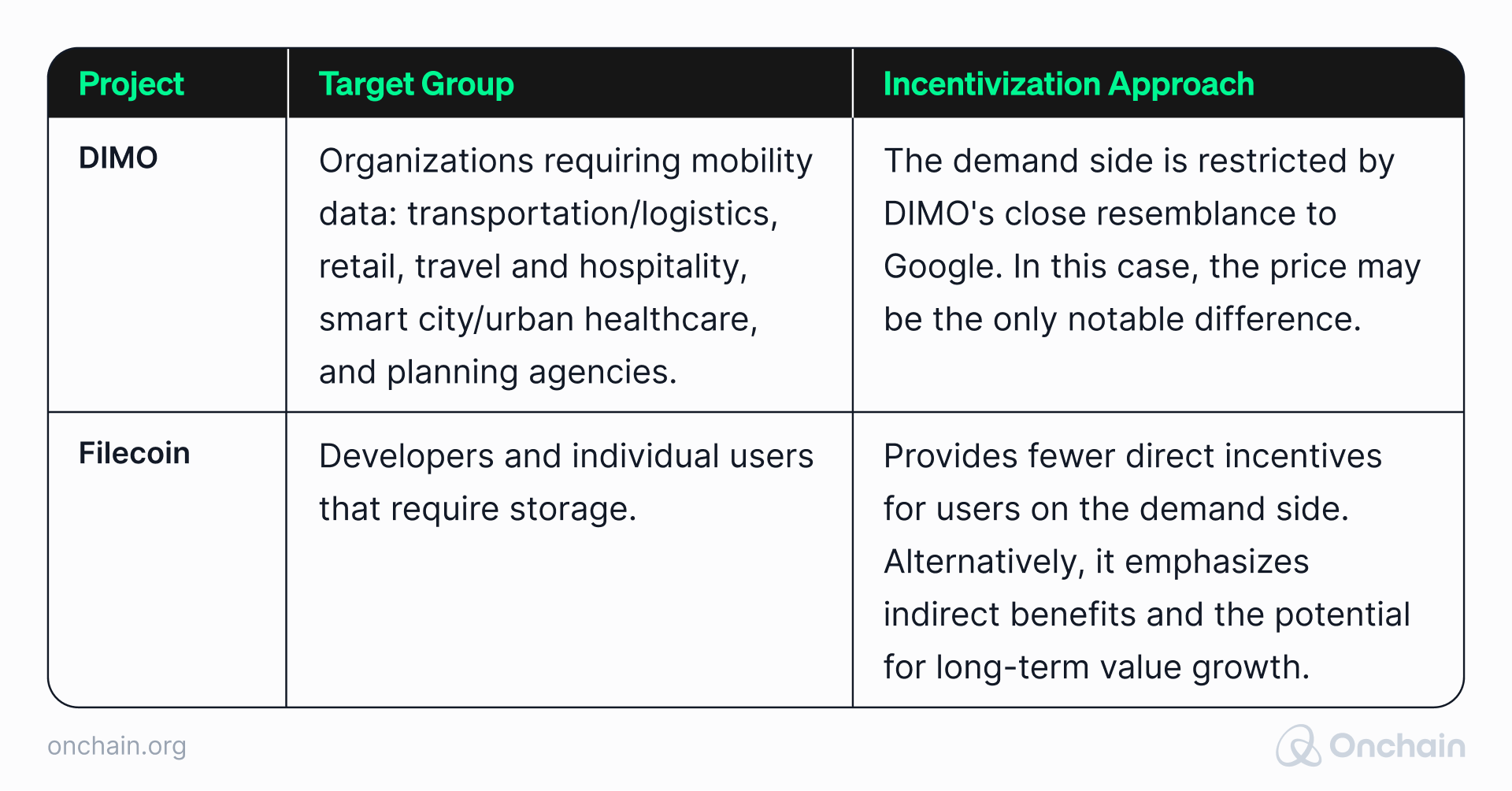

Another example of a successful DePIN supplier is DIMO. Similar to Natix, it focuses on harvesting data related to vehicles.

DIMO incentivizes supply-side participants to enhance their involvement by providing extra functionalities.

DIMO gains access to the user’s vehicle data. It provides services such as private location tracking, car health diagnostics, a virtual glovebox, privacy-protected GPS, and keyless entry.

Motivating engagement and involvement, especially among suppliers, is crucial. Incentives such as token rewards, reduced fees, and airdrops play a significant role here. This constitutes a major portion of the overall costs for DePIN projects.

The demand side is of equal importance, because one side cannot function without the other.

The Livepeer platform offers streaming by distributing, transcoding, and hosting computing power across its decentralized network. This benefits filmmakers and live streamers by providing cost-effective access to unused resources.

Their LPT token incentivizes collaboration to maintain network affordability, efficiency, security, and reliability for all participants.

Our article on DePIN Web3 Projects found that Livepeer’s demand-side revenue and staking rewards increased by over 30% last year.

Supply and demand side challenges – incentivization is the key

How can DePIN companies provide the right incentives to succeed in generating revenue and sustaining operations – in other words, keep the flywheel turning?

DePINs often struggle to incentivize the demand side because their focus is primarily on the supply side.

However, the future of DePIN hinges on its ability to attract demand. Without user adoption, incentives for suppliers decrease, potentially discouraging network participation.

While supply-side participation is strong, attracting customers beyond Web3 remains a challenge. Moving from early adoption to attracting widespread acceptance into the mainstream and into the broader non-Web3 market is a major hurdle. Our report explains this in detail.

To get more clarity, we need to examine the key points that can both help and hinder DePIN projects compared to their non-Web3 rivals.

The supply side of DePIN

Most projects begin by motivating supply chain participants to get the ball rolling. They are incentivized by network token appreciation, activity-based rewards, service provider fees, or revenue-sharing arrangements.

As competition in DePIN niches heats up, incentivizing the supply side becomes more expensive. Thus, it’s crucial to establish incentives that promote long-term supplier loyalty while providing real value.

Strategic management of the token economy is paramount. Achieving balance is critical to ensure sufficient incentives without risking inflation or token devaluation.

One project facing supply-side challenges is Filecoin. It is grappling with centralization issues because the majority of miners are in China and are heavily subsidized.

Therefore, to ensure sustainability, it must diversify its global miner base and adopt economic models less reliant on subsidies.

On the other hand, Arweave has succeeded in successfully managing the supply side dilemma.

It has successfully drawn in miners to their decentralized storage network through economic incentives. These consist of block rewards and endowment models coupled with effective growth strategies and community engagement efforts.

The demand side struggles of DePIN

The demand side is mostly the chink in the armor of DePIN projects. This is a vulnerable area, as DePINs often face challenges in incentivizing the demand side.

It was always hot-wired into the usual strategy deployed by most conventional startups and therefore the incentivization model primarily targeted the supply side. However, this overlooks the needs of users and companies seeking solutions.

It is important to emphasize that the future success of DePIN hinges on its ability to incentivize demand.

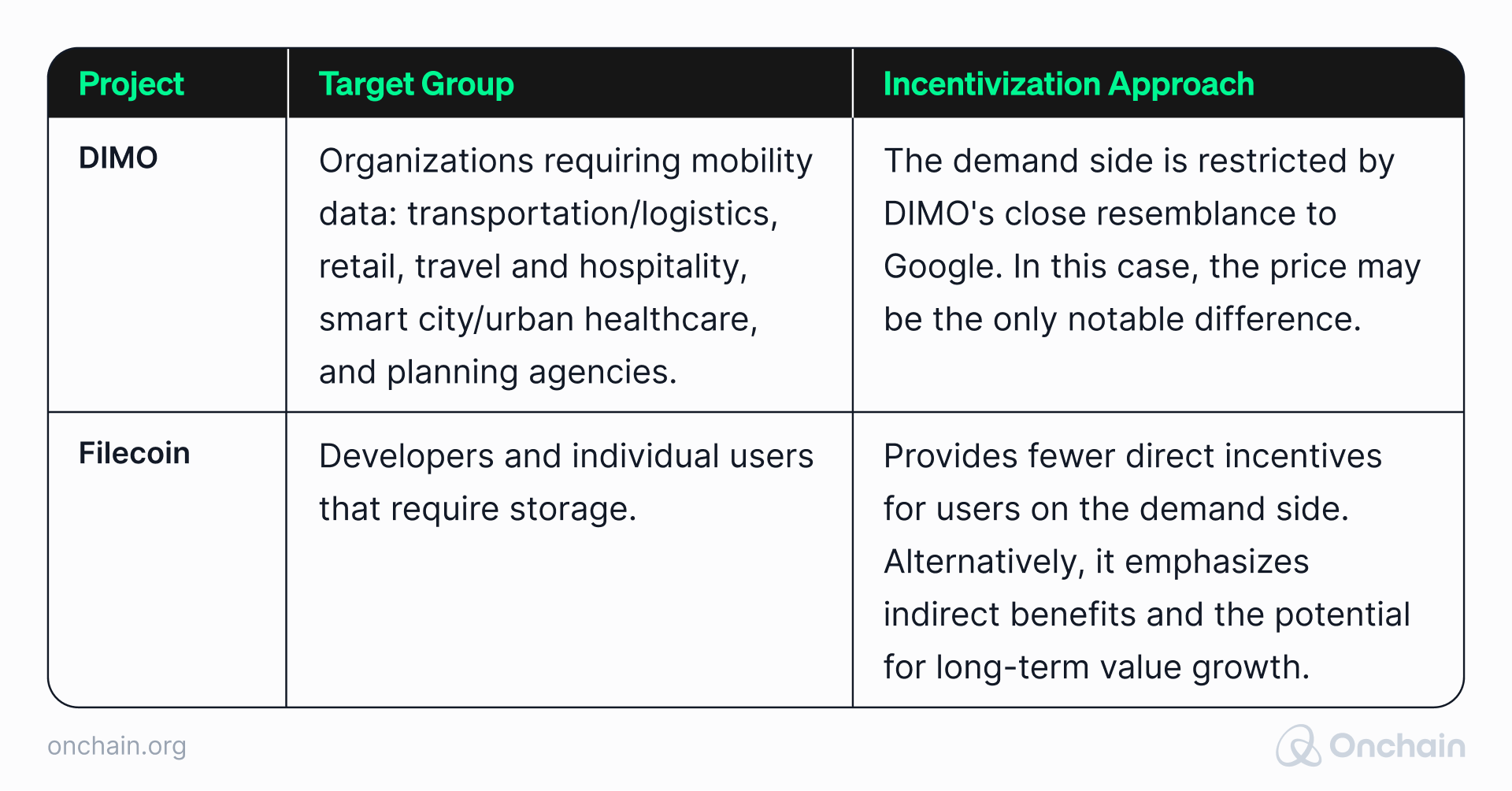

The table below shows a snapshot of two actual examples of numerous existing DePIN projects that are pushing these boundaries to achieve success by incentivizing demand.

2 DePIN projects that effectively incentivize demand:

Alternatively, achieving successful demand-side incentives presents many challenges.

Below, you’ll see two examples of these challenges:

Our research team offers potential solutions in the DePIN report.

The DePIN flywheel’s road to success – the supply and demand balance

The supply-and-demand balance is a key factor. When the supply side fails to meet demand, scalability is limited. Almost all DePIN projects face this inherent challenge.

The success of DePINs relies on integrating their innovative incentive models with traditional revenue streams and cost structures.

The most effective strategy appears to be blending the DePIN flywheel with existing business models from the Web2 realm. We’re going to explore just that in the next several articles. Progress in the Track to learn more.