Private credit tokenization is the process of converting private loans or debt instruments into blockchain-based digital tokens.

According to RWA.xyz, there has been a 133% surge in active private loans via digital ledgers since early 2023. This is an impressive amount, as the total value of these loans has now reached around $581 million.

It seems private credits on blockchain may have a promising future. We’ve updated this article with some current numbers.

What is private credit?

Private credit refers to loans provided by non-bank entities. These mostly consist of investment funds and specialty finance companies.

The private credit market is experiencing a steady rise in the adoption of blockchain technology. A growing number of companies are embracing tokenized credit to leverage improved transparency and lower interest rates.

This asset class has gained substantial traction globally and comprises a total of $1.5 trillion in assets under management.

If this has piqued your interest, our Onchain research report on Real-World Assets for Real-World Purposes will reveal even more.

How to tokenize private credit?

To put it simply, it’s the process of converting traditional debt instruments such as loans and bonds into digital tokens on the blockchain.

To tokenize, smart contracts are used to transform the credit assets into their digital counterparts.

The specific mechanisms may vary. The basic process entails finalizing the deal terms before creating digital representations of the debt asset on the blockchain.

Finally, after the private debt assets are tokenized on the blockchain, it transforms them into tradable instruments.

Our article on What is Tokenization of Real-World Assets sheds more light on this.

Private credit on the blockchain – three accomplished real-world use cases

1. Tugende, from motorcycle taxis to P2P credits

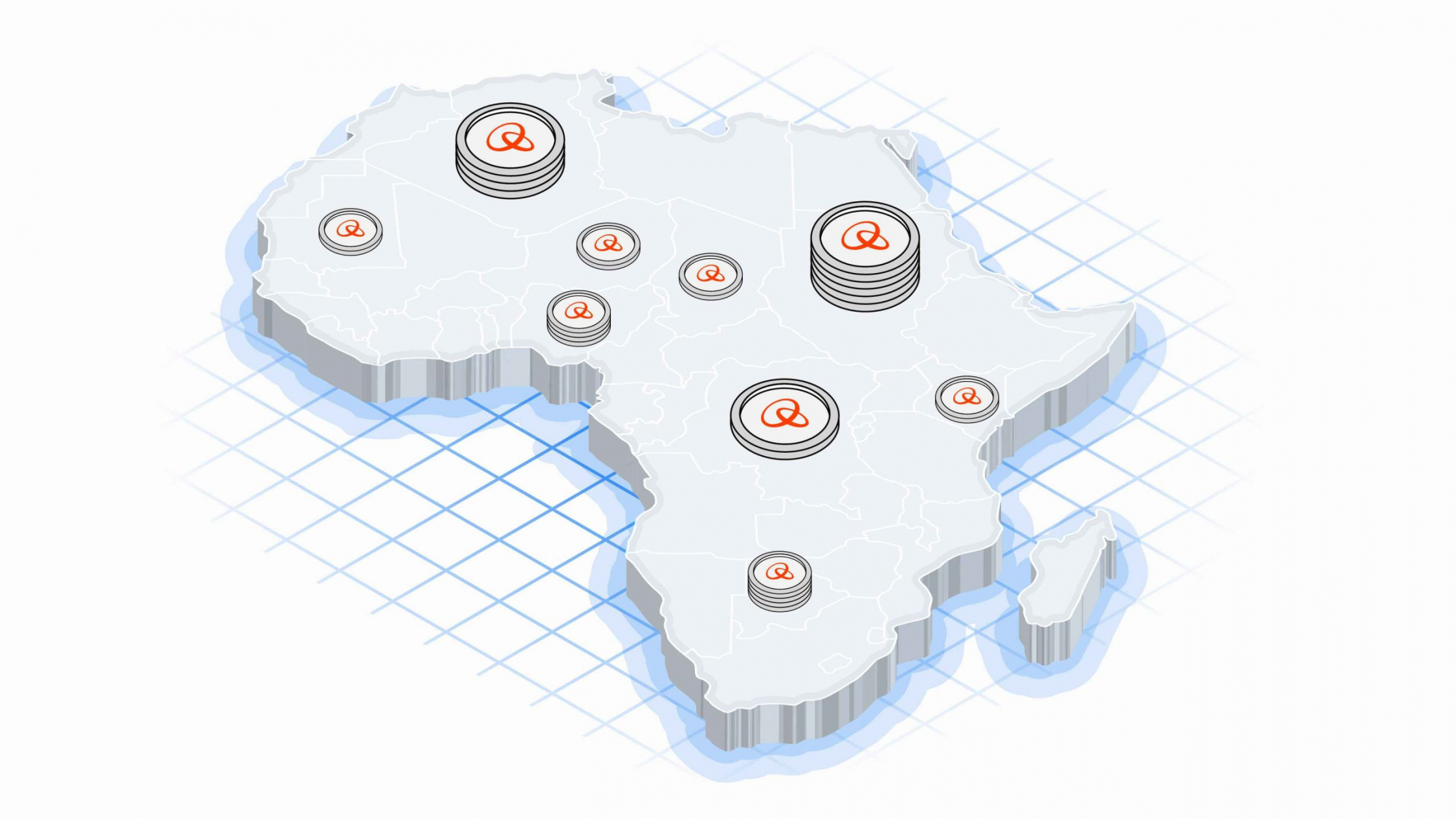

One successful enterprise that has reaped the benefits of private credit tokenization is Tugende, an African asset-financing fintech company in Kenya.

Tugende began its journey, starting with motorcycle taxis in Uganda and Kenya. So far, they’ve assisted over 70,000 clients in achieving ownership and boosting their earnings.

They have maintained industry-leading portfolio quality, and boast loan loss rates under 1%.

It enables operators to transform from renters to owners of their motorcycle taxis.

Furthermore, over 85% of the Kenyan population uses digital wallets. So this enhances payment possibilities and financial inclusion.

We go into more detail in our Fintech and Blockchain article.

2. Goldfinch, innovating private credit on blockchain

Goldfinch is another innovative organization that offers private credit for projects in a decentralized manner. It allows creditors and debtors to interact onchain.

Goldfinch’s decentralized lending platform transforms the crypto loan arena by removing the requirement for borrowers to over-collateralize their loans with onchain assets.

Since its inception in early 2021, Goldfinch has achieved a remarkable growth rate. They have doubled their active loans every two months, resulting in a staggering 154x expansion.

Goldfinch has increased its active loans, which now exceed $100 million, primarily benefiting fintechs and credit funds in emerging markets spanning the globe, from Indonesia, and Mexico to Peru. Importantly, there have been zero defaults recorded to date.

The capital accessed on Goldfinch has now reached over a million people across 20+ countries.

3. Jia, decentralized finance opportunities for small businesses

Finally, Jia is a prime example. Its goal is to support small businesses in emerging markets. Jia initiated a $100k pool on Huma Finance, to offer loans to over 500 creditors in Africa and Asia.

If this already astounds you, check out our article on Blockchain in Emerging Markets.

What are the benefits and challenges of private credit and tokenized debt?

The investor base for tokenized private credit is still in the early stages of development. And as with all new emerging technologies, there are both benefits and challenges to be aware of.

Benefits:

- Liquidity Enhancement: Provides greater flexibility and reduces illiquidity.

- Fractional Ownership: Enables investors to acquire and possess fractional shares of high-value assets.

- Transparency and Security: Transparent and secure maintenance of records, minimizes the likelihood of fraud, errors, and disputes.

- Asset Utilization & Diversification: Effective utilization of assets enables capital to be raised without selling the entire asset. Portfolios can be spread across various asset classes.

- Reduction of Intermediaries: Using smart contracts reduces the need for intermediaries, lowering transaction costs.

- Auditing and Compliance: Transparency and immutability bolster compliance and auditing procedures in real-time.

Challenges:

- Lack of Regulatory Standards: Evolving regulatory frameworks may cause uncertainty across different jurisdictions. Adhering to current securities laws can be intricate, and alterations in regulations may have a negative impact.

- Market Adoption: Conventional markets and institutional investors may be reluctant to accept tokenized debt assets, leading to a slow and gradual acceptance of debt tokenization.

- Smart Contract/Technology Risks: Smart contracts are susceptible to vulnerabilities, coding errors, bugs, etc. Projects may encounter technology challenges, e.g., scalability and interoperability concerns.

- Tokenized Debt Asset Overvaluation: Overvaluation can occur, primarily driven by speculative trading.

- Digital Security Risks: Threats such as hacking, phishing attacks, and unauthorized access exist. Robust security procedures are essential for the protection of debt tokenized assets.

- Market Volatility and Manipulation Risks: Tokenized securities may face high volatility, impacting their perceived value. In early stages of debt tokenization, there is susceptibility to price manipulation, pump-and-dump schemes, and other irregularities.

It is important to be aware of the challenges facing this sector. If you are interested in exploring this further, check out our What is Regenerative Finance article.

To continue delving into this further, also check out our article on Token compliance in 2025.

The private loan sector with RWA tokenized credit – The growth continues.

Most of the loans have been issued to countries in emerging markets.

The tokenized private credit sector empowers emerging markets by bypassing traditional banking systems. And provide direct lending opportunities for a more diverse and wider range of individuals and businesses than conventional financial institutions.

This democratized access to credit boosts economic growth, injects capital, fuels development initiatives, and helps fight inflation.

Private credit serves as a strong hedge against inflation and increasing interest rates.

The road ahead of tokenized private credit investing

The findings in our Real World Assets for Real World Purposes report indicate that private credit investments surged by 89% in 2022, marking a historic high compared to previous periods.

It also found that emerging markets experienced significant growth in the private credit market, with outstanding allocations reaching $1.4 trillion. And a notable increase in fundraising from 2009 to 2019.

The numbers predict that the emerging market economies have experienced stronger growth in private credit tokenization than in the developed markets. According to our research, we anticipate this trend to continue in the coming years.

Private credit tokenization is gaining increased acceptance, as more and more people are looking to leverage an otherwise illiquid credit category. And as new participants enter, a positive feedback loop is generated.

But this isn’t the only tokenized real-world asset making waves. Tokenized stocks are shifting the form and function of Wall Street — and that affects investors and businesses alike.