Tokenization is the New Trade Layer

Let’s pick up where the previous report left off. Here’s a quick recap of what you found out in Tokenization Works: Where Founders Should Focus Now.

You now understand the success of stablecoins and what it could signify for the future of tokenization. Moreover, you have a good grasp of the relevant market opportunities.

There are two primary areas you could focus on:

- Using the White Spaces Analysis identified underserved niches in crowded markets and demonstrated the need to complement existing structures with additional services. In these markets, your chances to grab market share grow when you specialize your offering in support of existing projects, i.e., with abstraction, UX, or compliance.

- If you prefer to dive into a Blue Ocean, you now have an idea of where to find them. They include fractional ownership of real estate, fine art, or other collectibles, as well as tokenized carbon credits or intellectual property.

Whichever way you decide to turn, the previous report provided you with a rough map of what to expect. But you also understand that the name of the game is no longer digitizing traditional assets only. It’s about creating infrastructure (infra) and intuitive applications that unlock the true potential of tokenized assets at scale.

That is what this report will address.

Marko Vidrih, Co-Founder of RWA.io, describes this critical transition point:

“The first wave of tokenization was about putting existing assets onchain. The next, more significant wave is about building the connective tissue - the APIs, compliance layers, and user interfaces - that make those assets usable at scale. The opportunity isn’t in creating another tokenized treasury; it’s in building the ‘Stripe’ for tokenized treasuries.”

- Marko Vidrih

However, knowing what to build, where to build, and why to build demands deeper insight, especially given today’s rapidly evolving economic realities.

Why tokenization is more important than ever before

The world’s old economic system is breaking apart. Global tensions are rising, economies are pulling away from each other, and trust in traditional institutions is wearing thin. According to the World Bank, since the 2008 financial crisis, international trade has stayed below 50% of global GDP. This is a clear sign that global integration has stalled.

At the same time, economic nationalism is on the rise. The IMF (International Monetary Fund) warns that trends like “friend-shoring,” geopolitical shifts, and growing protectionism could cost the global economy up to 7% of its GDP. That’s about $7.4 trillion over time. By early 2025, more than a third of global trade was already happening under tariffs (UNCTAD, 2025).

But we’re not witnessing the end of global trade; we’re approaching a turning point. Read on to get inspiration on how to make the best of it using tokenization.

1. When the world splits, tokens connect

As the traditional financial system is splitting and being restructured into different economic blocks, the global trust in financial infrastructure erodes (SWIFT, fiat currencies, centralized institutions). Businesses and institutions need to operate in an increasingly fragmented, multipolar world, where many countries do not trust each other anymore.

Blockchains provide a trust-minimized alternative. Businesses that leverage blockchain-based systems can bridge divides and support neutral economic exchange amidst global fragmentation.

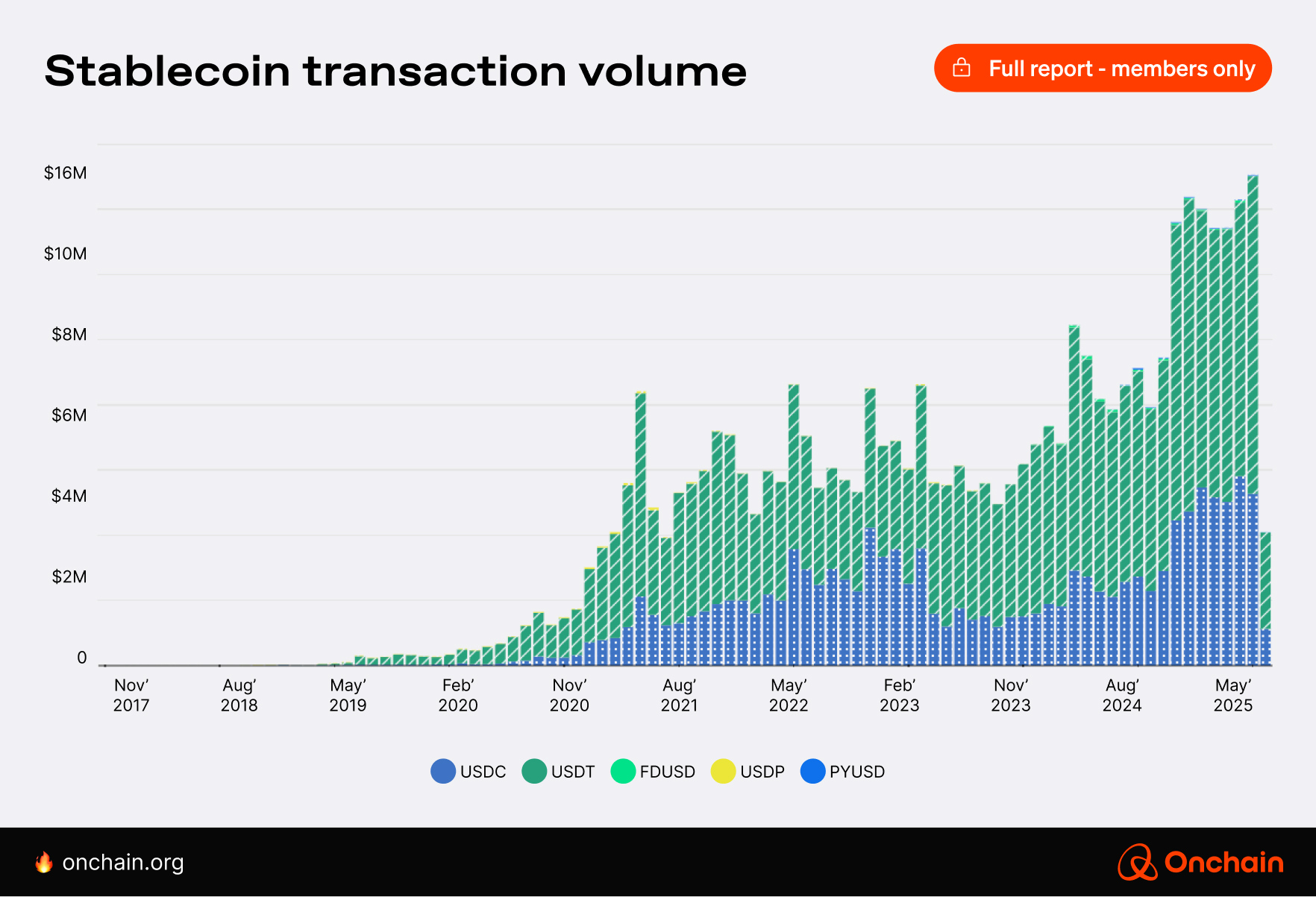

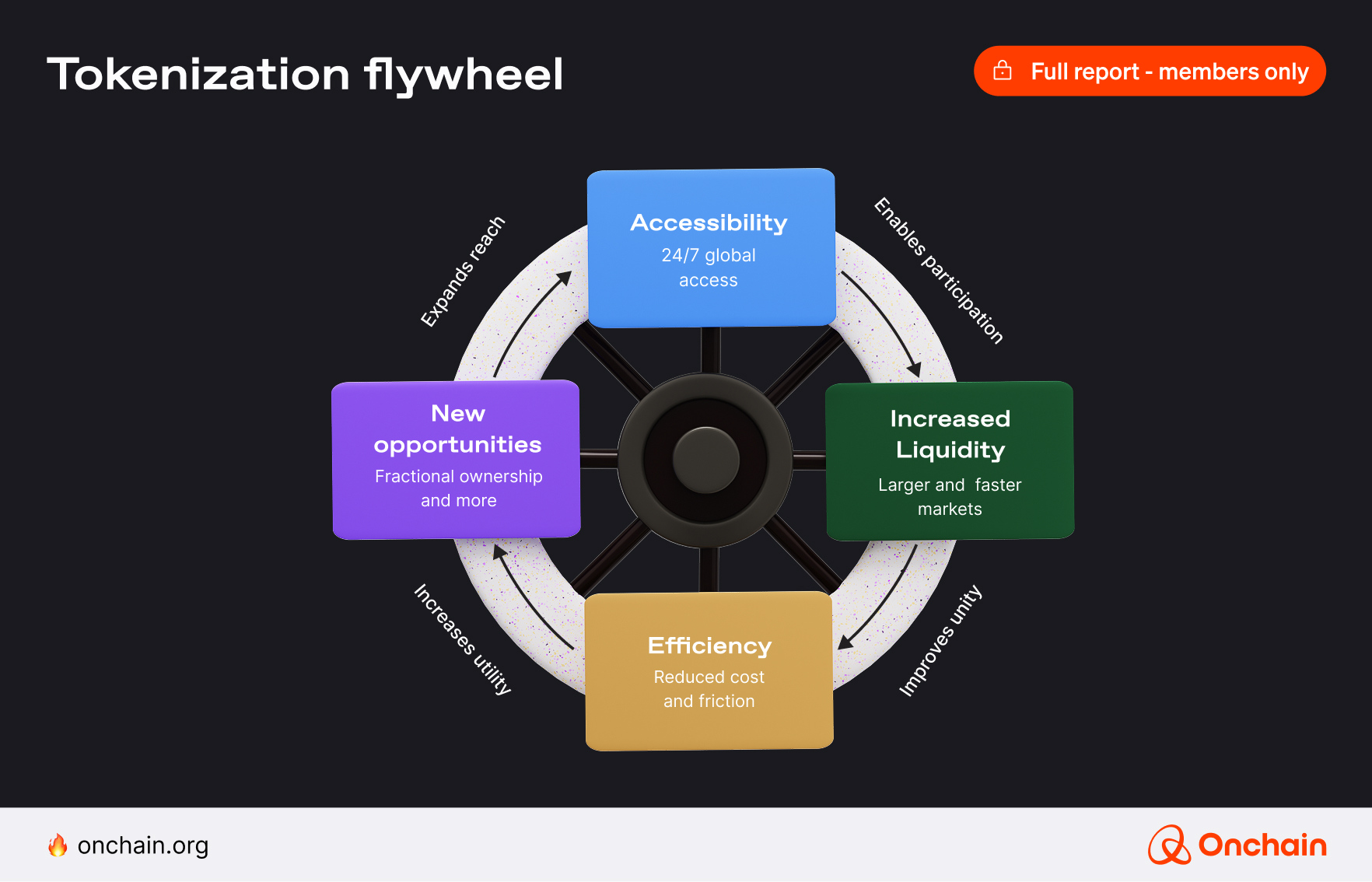

The first success is evident with stablecoins. In our 2024 Stablecoin Report, we introduced the “Stablecoin Adoption Flywheel.” It illustrates a self-reinforcing cycle that begins with cost savings and financial inclusion, expands toward greater currency stability, and culminates in widespread economic empowerment. Today, about half a year later in 2025, that flywheel is in full swing. Stablecoin market caps and transaction volumes keep rising, and more institutions are gradually entering the market.

If we look at stablecoins as the starting point, we can apply the same adoption flywheel in other areas. It expands beyond currency, powering the broader wave of real-world asset (RWA) tokenization.

Businesses and individuals who became comfortable with stablecoins are extending their attention toward tokenizing tangible and intangible assets across diverse sectors:

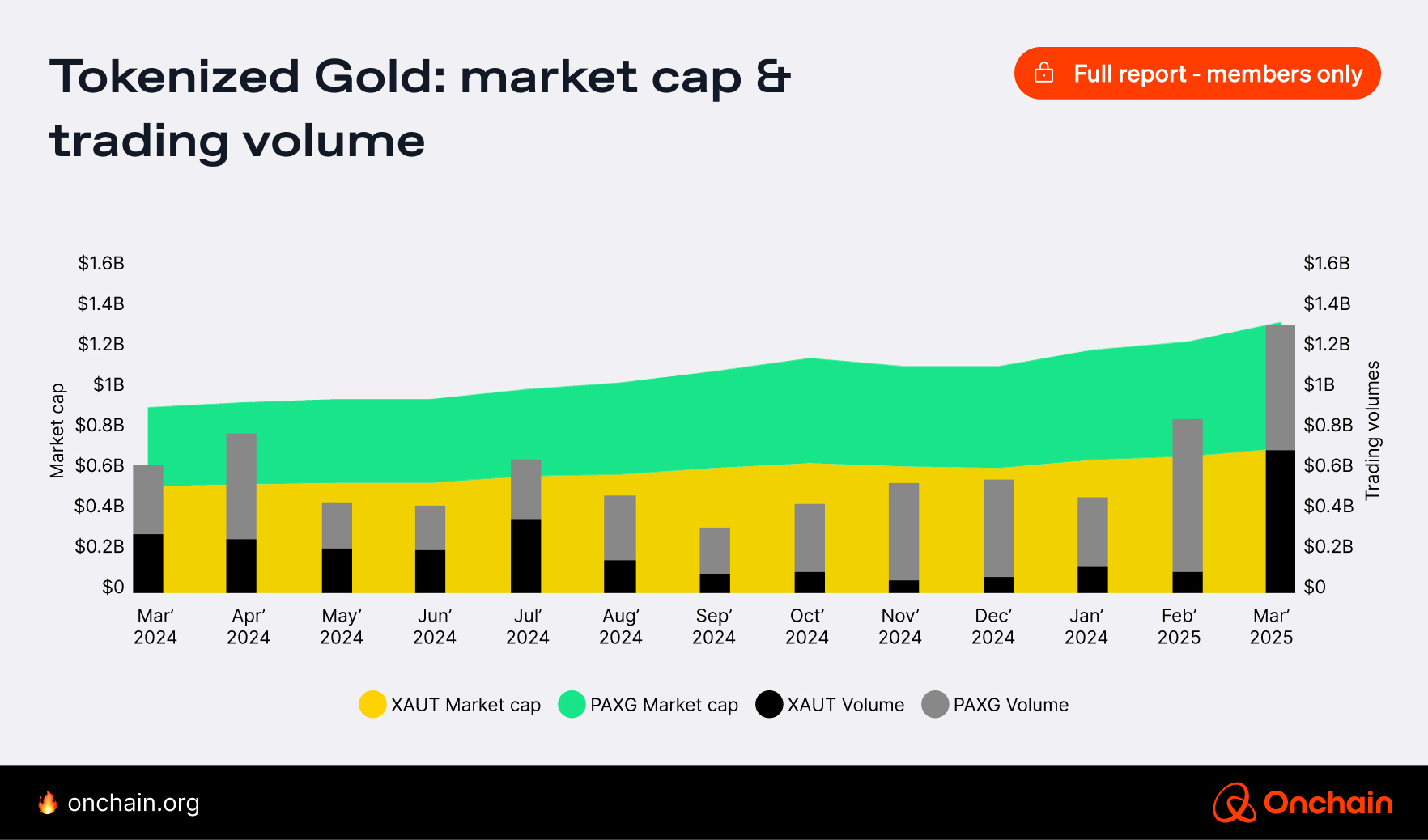

🔸 Commodities

Gold, oil, and other commodities are actively trading onchain today, detailed in our earlier report, Tokenization Works Where Founders Should Focus Now, which explores their current market adoption and underlying business models.

🔸 Treasury bills & private credit

Multi-billion-dollar markets are now trading tokenized T-bills and private credit instruments at scale. For an in-depth breakdown of key players and market dynamics, you can check out chapter two of our previous report.

🔸 AI datasets & Decentralized Physical Infrastructure (DePIN)

Rapid user adoption and clear revenue models for tokenized AI and DePIN markets are covered extensively in our AI and DePIN reports

🔸 Real estate

Real estate is often cited as a slow-moving, regulation-heavy sector where tokenization seems far-fetched. But recent data suggests that change may be underway. Notable examples include Dubai’s impressive $18.2 billion tokenized property market (19,000 deals in one month alone), Blocksquare’s launch of a $1 billion tokenized U.S. property fund, and Qatar’s $500 million initiative to tokenize real estate assets.

Concepts dawning on the horizon

Emerging “exotics” – intellectual‑property rights, carbon credits, and space‑based assets are still early in the tokenization flywheel and remain largely experimental. While promising, they have yet to achieve the widespread adoption and liquidity seen in more established sectors.

To fully seize these emerging opportunities, you must clearly understand current tokenization trends and market dynamics. Our ongoing analysis of over 200 active global tokenization projects reveals two significant insights.

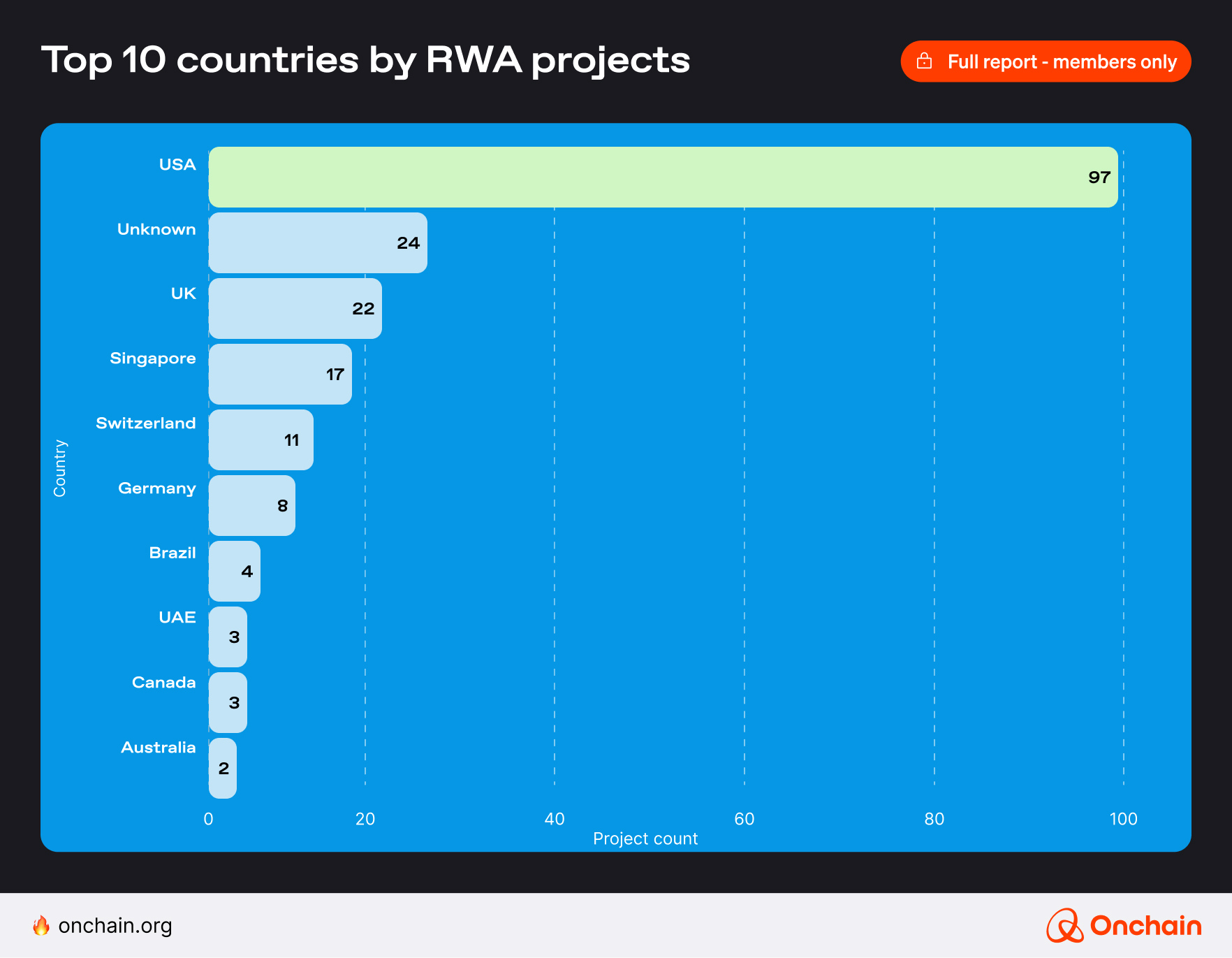

1. Strong geographic concentration in the United States

The United States remains the primary hub for tokenization, with more than 60% of all active projects based there.

This isn’t surprising, given that the U.S. boasts a mature capital market, robust financial infrastructure, and an established technology ecosystem. Even though comprehensive regulation around tokenization is still not mature, the U.S. is progressing toward regulatory clarity. It aims to position itself as a global hub for blockchain-based financial innovation.

As a result, capital, talent, and innovation continue to flow into the U.S., reinforcing its position at the frontier of tokenization. Founders who want to stay at the cutting edge will find the U.S. market to be a playground for strategic growth.

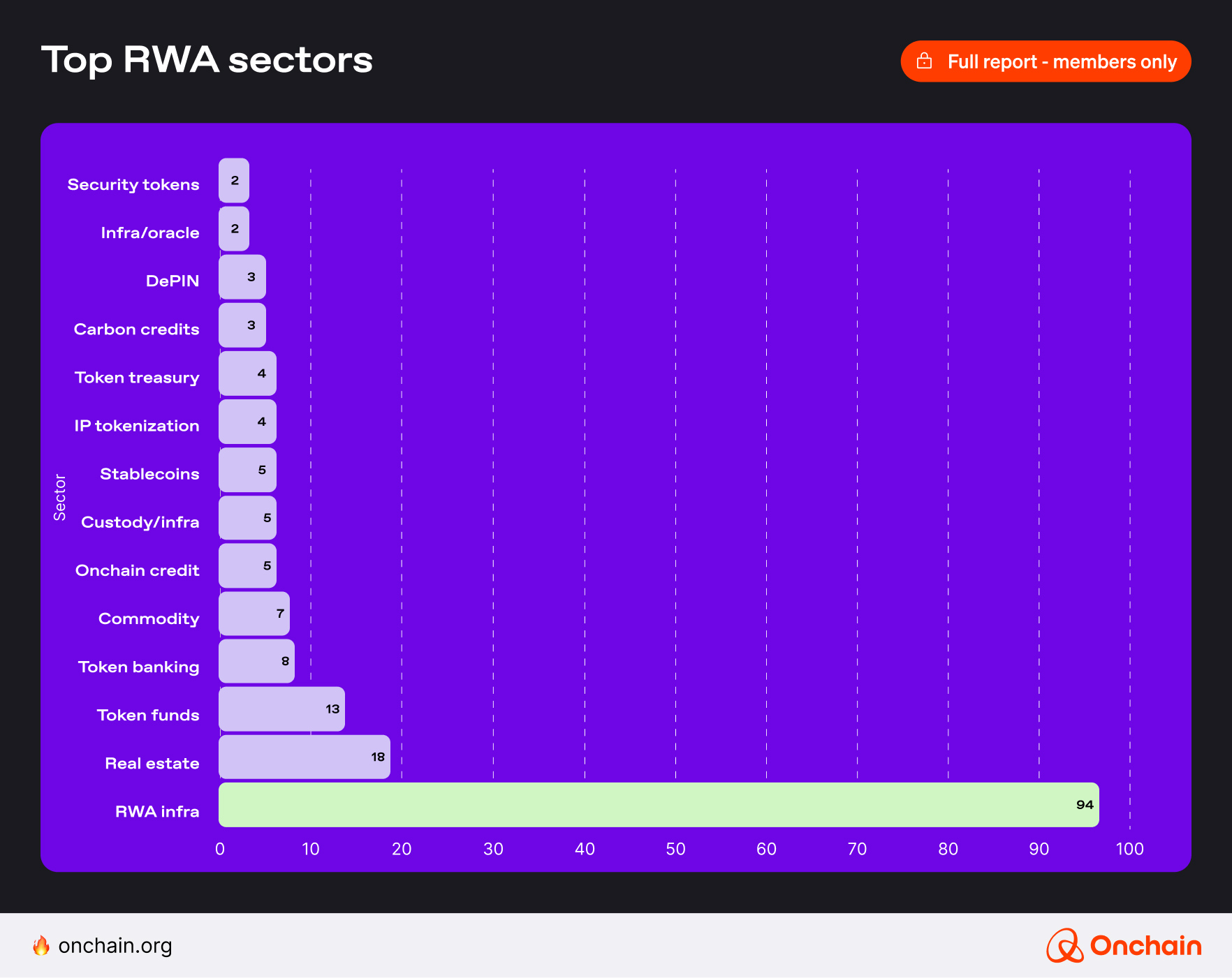

2. Dominance of infrastructure in current tokenization projects

Our research reveals that 59.12% of all active tokenization projects focus on infrastructure. This segment includes:

- Compliance platforms, e.g., Tokeny, Securitize

- Custody solutions, e.g., Fireblocks, Copper

- Cross-chain oracle infrastructure, e.g., Chainlink

- Token issuance platforms, e.g., Polymesh, Circle

Such infrastructure has been foundational for market growth, becoming intensely competitive as numerous established providers now compete to serve both institutional and retail markets.

However, as this base-layer matures, the next wave of tokenization innovation shifts upwards towards the application layer. This reinforces a trend we identified in our previous report, “Crypto Apps for Consumers Are Here to Stay.” User experience, intuitive interfaces, seamless integrations, and consumer-facing applications built on existing infrastructure represent emerging opportunities.

As the tokenization market evolves, your strategic approach as a founder or investor must evolve as well. We will apply several strategic frameworks to help identify where the most significant business opportunities lie.

Elementary frameworks, such as the Blue Ocean Strategy and White Spaces Analysis, which we discussed in our previous report, remain critical. Let’s expand the strategic toolkit further by adding nuanced frameworks that consider today’s more complex economic and competitive environment. Specifically, we will apply:

- Porter’s Five Forces adapted for Web3 tokenization

- Beyond White Spaces and Blue Oceans

- Trust Vacuum Theory: Targeting markets experiencing institutional decline

- Purple Ocean Strategy: Capturing regulated innovation markets

- Grey Ocean Strategy: Defining emerging frontier territories

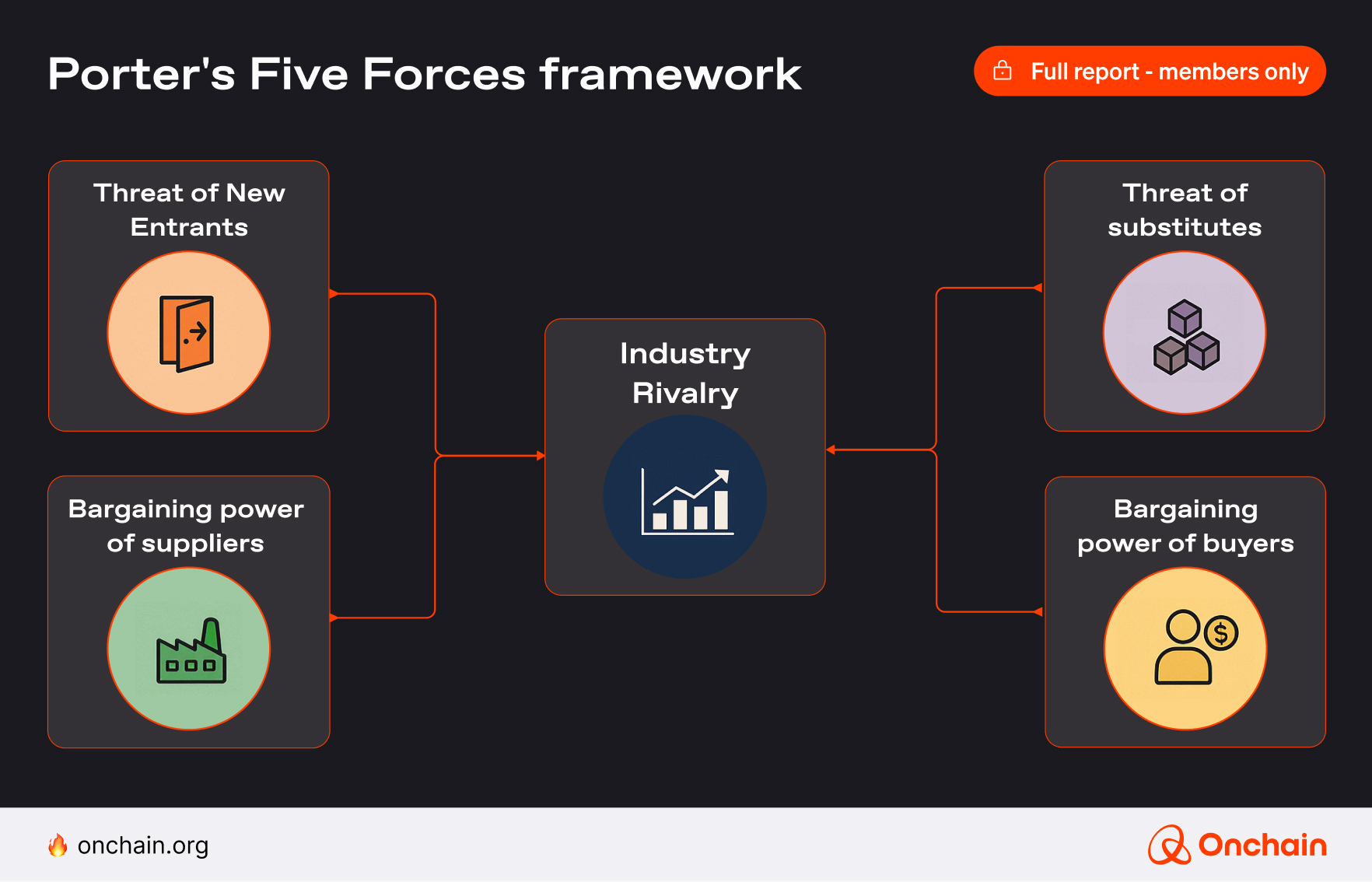

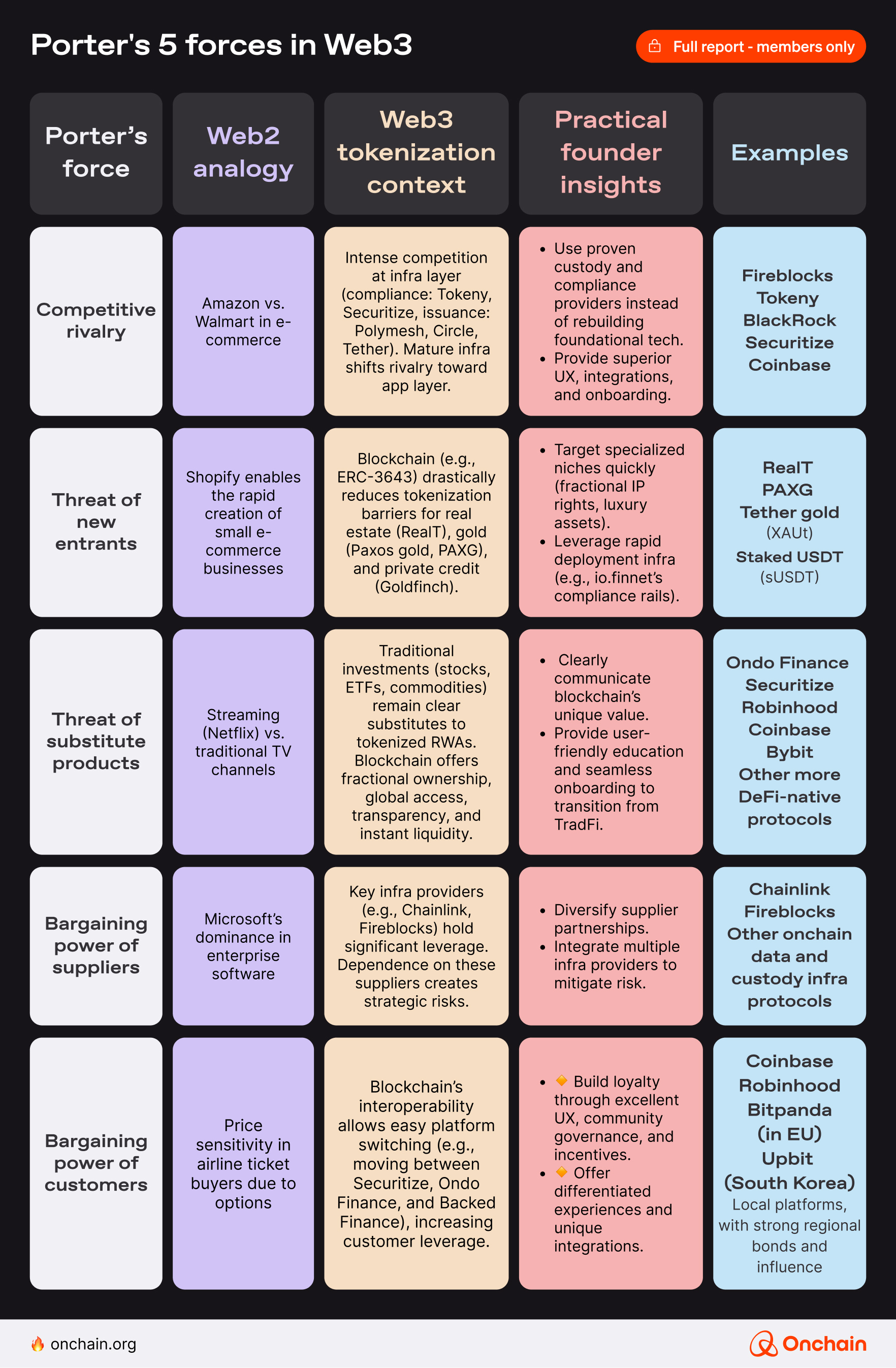

1. Porter’s Five Forces framework adapted for tokenization in Web3

Michael Porter’s Five Forces model was first introduced in 1979. The framework is used to explain industry competitiveness and the strategic pressures it faces. While some might question its relevance to the novel concept of Web3 tokenization, its fundamental principles remain insightful.

In Web3, core ideas such as competition, threats from new entrants, substitutes, and the bargaining power of suppliers and buyers hold true. However, Porter’s model may not fully account for the decentralized governance structures, open-source nature, and community-driven value creation. These are unique dynamics specifically introduced through blockchain.

Thoughtfully adapting Porter’s concepts to Web3 helps understand the distinct competitive forces shaping blockchain-based markets. Founders can pinpoint where and how to position their offerings strategically.

Understanding competitive pressures within tokenization enables founders to focus their efforts on critical parts of the value chain, whether infrastructure or the application layer.

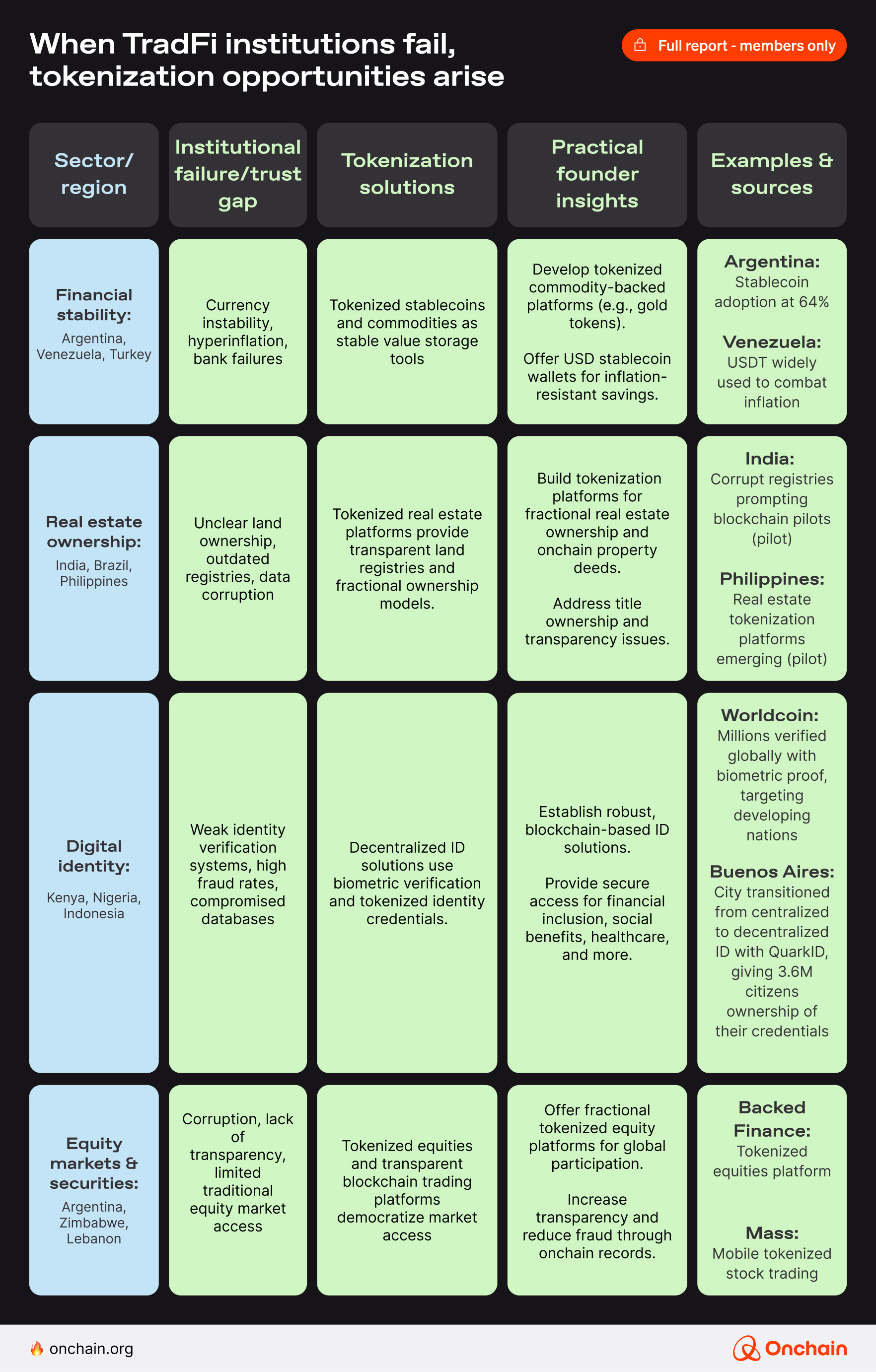

2. Trust Vacuum Theory: Tokenization in regions of institutional decline

The Trust Vacuum Theory describes scenarios where institutional reliability erodes, creating a vacuum that attracts innovative solutions. The concept was originally promoted by trust-economics expert Rachel Botsman and sociologist Anthony Giddens, and it pinpoints markets that suffer significant credibility loss. Such environments enable blockchain-based solutions to emerge as trustworthy alternatives.

In the Web3 context, this dynamic translates into tokenization opportunities wherever centralized institutions falter, leading to unstable currencies, corrupted property registries, compromised digital identity systems, or opaque equity markets.

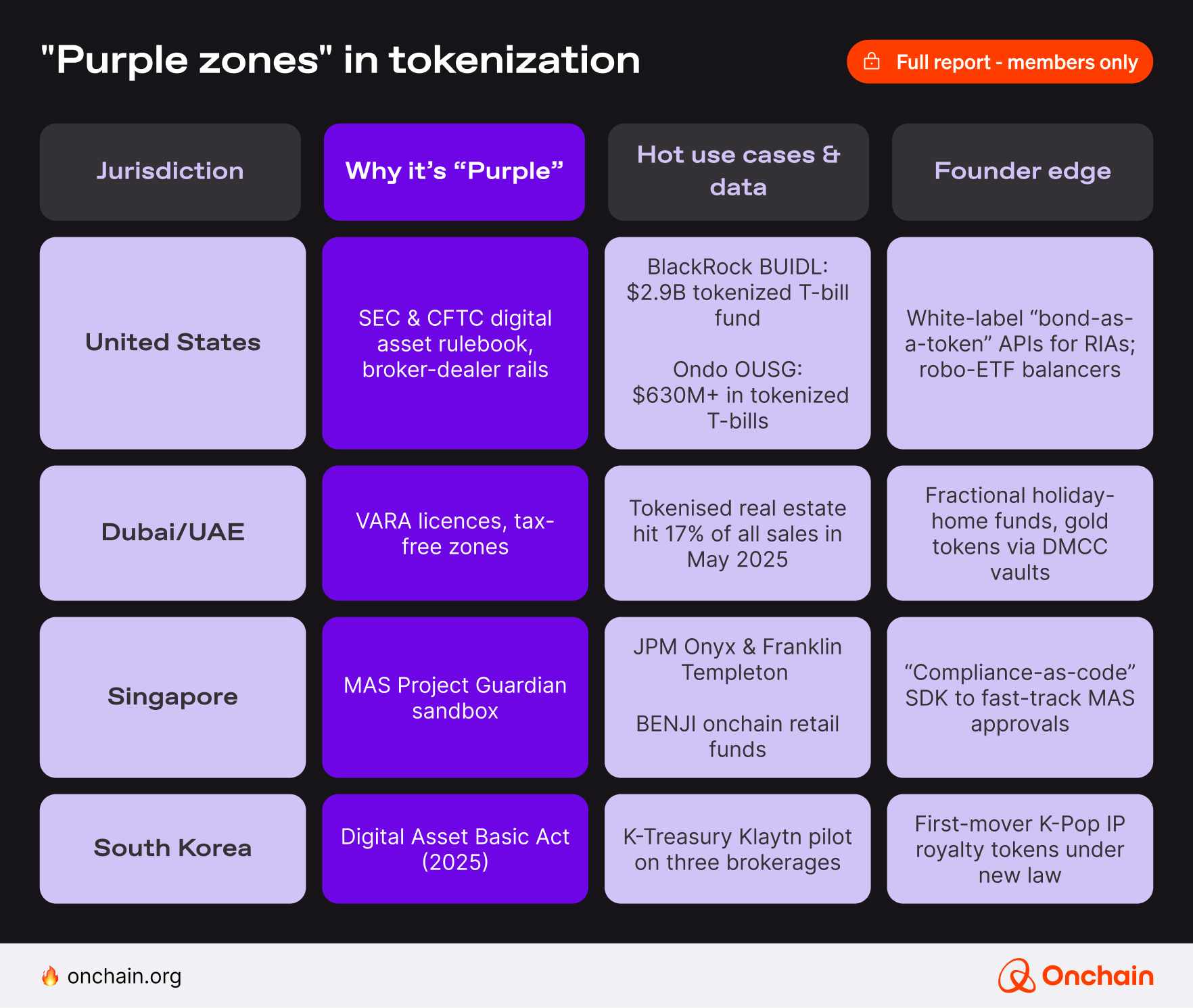

3. Purple Ocean Strategy: Capturing regulated innovation markets

Purple Oceans refer to regulated markets that provide stability and clarity for blockchain innovation. Such areas include the U.S., Singapore, UAE, and South Korea, in other words, jurisdictions that proactively clarify blockchain regulation and compliance frameworks.

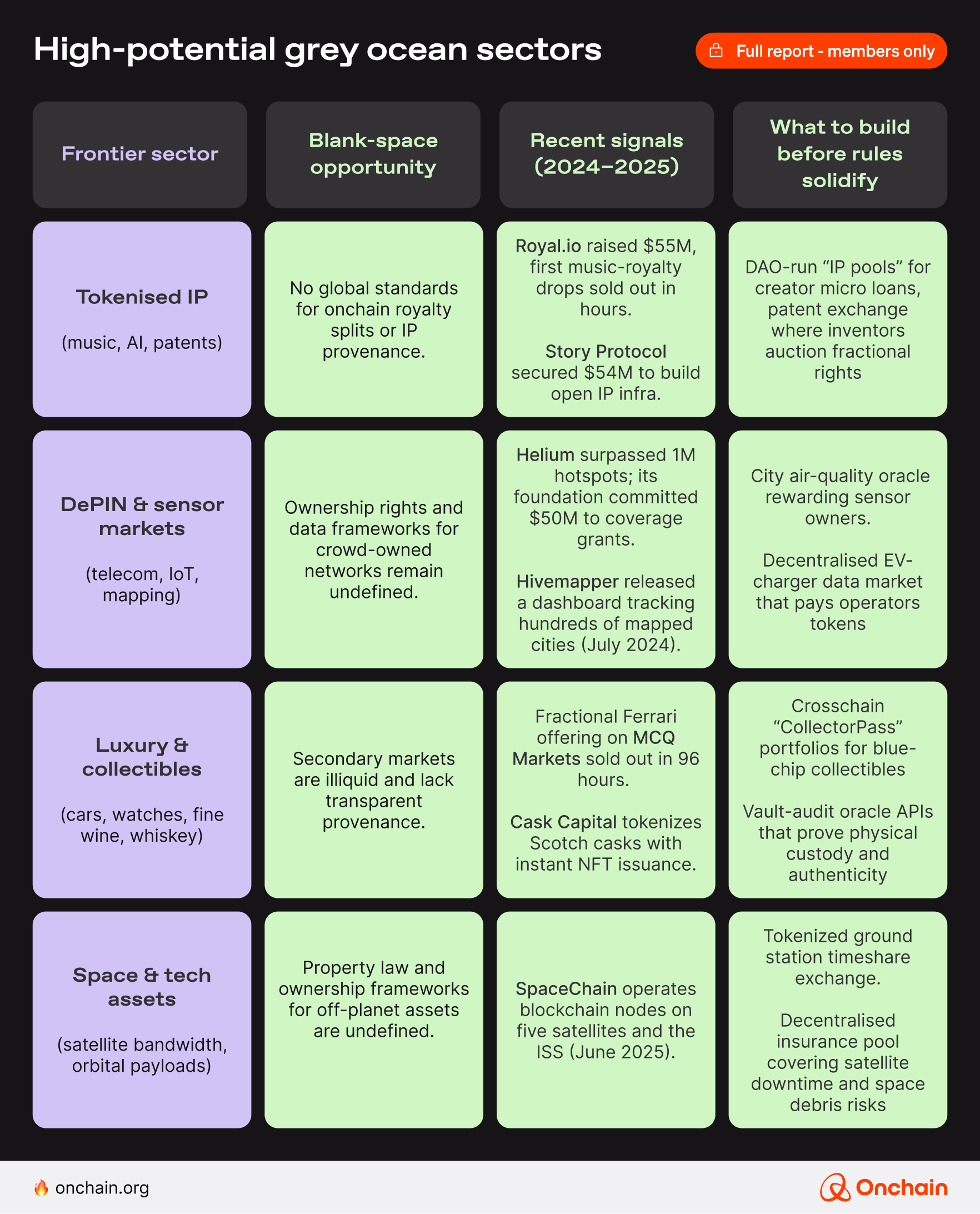

While Purple Ocean markets offer clear regulations and established frameworks, many promising sectors still lack defined rules or recognized leaders. At first glance, these frontier sectors, known as Grey Oceans, might appear similar to the “White Spaces” we explored in our previous open-access report, Tokenization Works: Where Founders Should Focus Now.

However, the term Grey Oceans pertains to something fundamentally different. White Spaces are overlooked niches within existing regulated markets. Grey Oceans, in contrast, describe entirely new and undefined sectors where regulatory frameworks have not yet been established and market standards remain unset. Here, visionary founders have the opportunity to address unmet needs and also shape industry standards. These are optimal places to become pioneering leaders who lay the foundation in emerging fields.

4. Grey Ocean Strategy: Defining emerging frontier markets

Without established market leaders or mature regulations, there is ample opportunity to develop both.

From strategic vision to technical execution

We’ve established the core reality: a fractured global economy makes onchain rails indispensable. As trust in traditional institutions collapses and geopolitical fragmentation accelerates, tokenization becomes the essential connectivity layer — the infrastructure that enables value transfer when everything else divides. Through Trust Vacuum Theory, Purple Ocean Strategy, and Grey Ocean Strategy, we’ve mapped where the opportunities lie and why they matter.

2. How to build in the tokenization stack

In the previous chapter, you discovered details on where tokenization creates the most value, from dollarized economies seeking stability to failing property registries needing transparency. Your next step is execution: how to transform these opportunities into working products. Read on to find out.

Success requires mastering four interconnected layers:

- Chain selection: Where you build determines who can access your product

- Asset structuring: How you tokenize determines compliance and functionality

- Infrastructure integration: The rails that make your tokens actually usable

- Distribution channels: How you reach and onboard your target market

Each decision cascades into the next.

“The biggest friction point will always be the issuer's understanding of how tokenization works, what assets can be tokenized, and how to fit that in a regulatory frame. IXS can launch a tokenized asset in as little as 2 weeks. But helping issuers understand the nuances of tokenization and RWAs will always be the friction point.”

- Jean-Claude Maruyama, VP of Marketing, IXS & InvestaX

This chapter breaks down exactly how to build, starting with your most basic decision.

Set a solid foundation: Chain selection

Your choice of blockchain determines everything: who can access your product, what it costs to use, and whether regulators will approve it. Make the wrong choice and you’ll face higher gas fees, limited liquidity, and regulatory roadblocks.

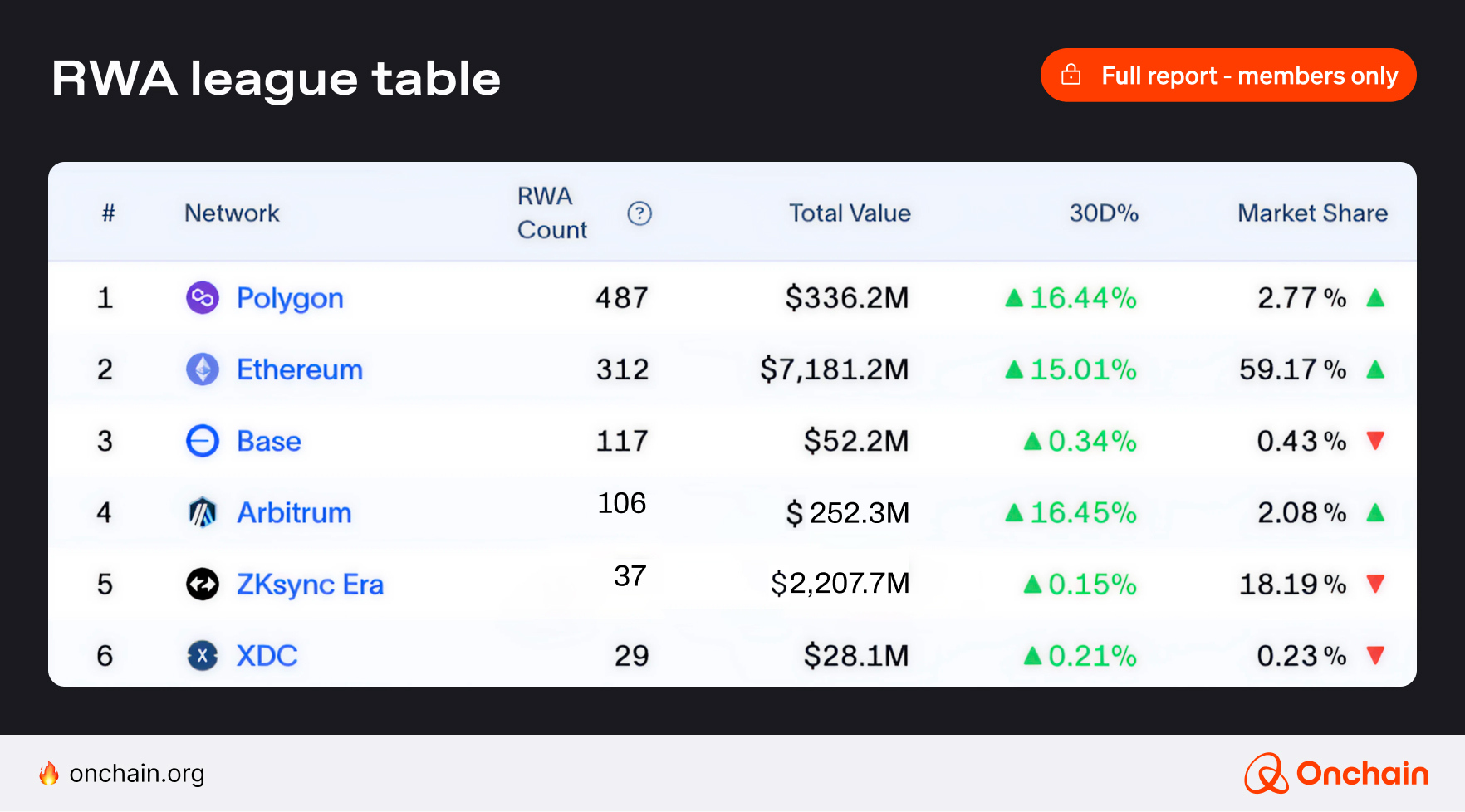

By 2025, over 90% of tokenized assets will be consolidated on just five chains.

Where the assets live and why:

- Ethereum: The institutional standard with unmatched security (BlackRock BUIDL, Ondo)

- Polygon: Retail-friendly choice for Franklin Templeton and JP Morgan

- Stellar: Speed and regulatory alignment (Circle, Franklin BENJI)

- Avalanche: DeFi-native with institutional support (WisdomTree)

- Base: The emerging leader for Securitize and Ondo

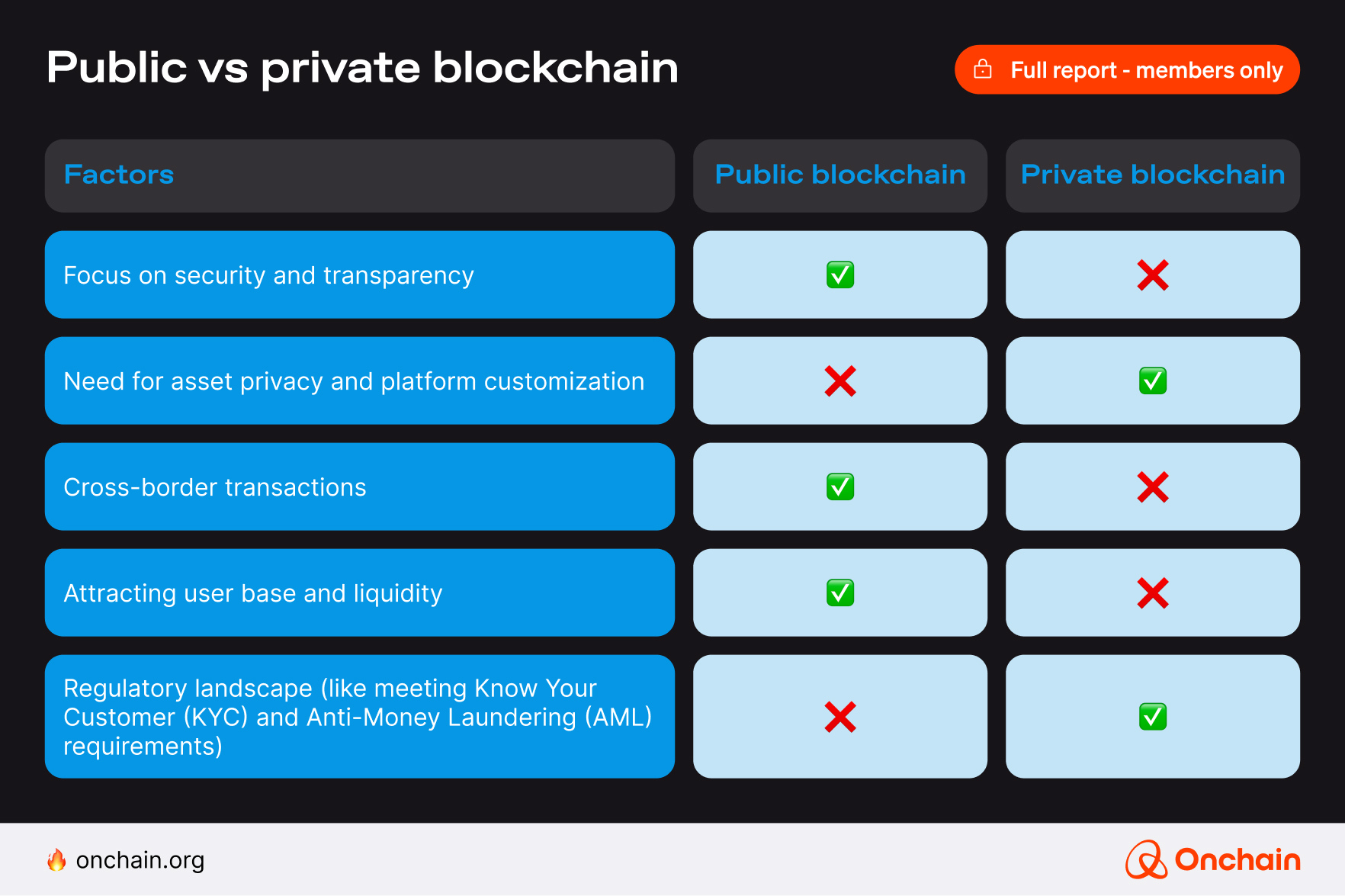

Once you’ve identified the use case you’re solving, the next big decision is which type of blockchain environment to build on: public or private. This choice will shape your product’s security model, compliance pathway, and user base.

The table below helps visualize the trade-offs between public blockchains, such as Ethereum, Polygon, or Base, and private blockchains, which are typically enterprise-grade permissioned ledgers like Hyperledger or Quorum.

We recorded a walkthrough using Spydra, an enterprise-grade platform that abstracts away blockchain complexity for illustration purposes. Spydra lets you quickly configure and launch its private blockchain network using plug-and-play tools.

Why is it interesting for founders?

➡️ If you’re building a consumer-facing savings app, yield wrapper, or DeFi integration, public blockchain is your terrain. For example, Ondo Finance launched on the Ondo chain (an L1 blockchain) to tap DeFi liquidity and reach global users.

➡️ If you’re building infrastructure for banks, custodians, or permissioned markets, private blockchain may be more effective. For example, platforms like Chintai or SIX Digital Exchange are built on the private chain to meet stringent regulatory and identity requirements in the enterprise finance sector.

Key takeaway for founders: The chain you build on is your distribution strategy. Go where your users, partners, and regulators are.

The modular stack

We’ve already covered how to tokenize the asset. Now let’s talk about what founders can actually build on top.

1. Tokenized treasuries

Tokenizing U.S. Treasury assets (like T-bills or funds holding them) has become a prominent trend.

These onchain instruments unlock new business models: Providers create digital tokens that represent claims on ultra-safe government debt or money market fund shares. Revenue can come from management fees or spreads on yield.

For example, Franklin Templeton and BlackRock funds have modest expense ratios built into the product on the order of 15–25 basis points per year. These fees, although small per user, scale with AUM. For instance, at a total sector AUM of $5 billion, a 0.2% fee implies $10 million in annual revenue spread across issuers.

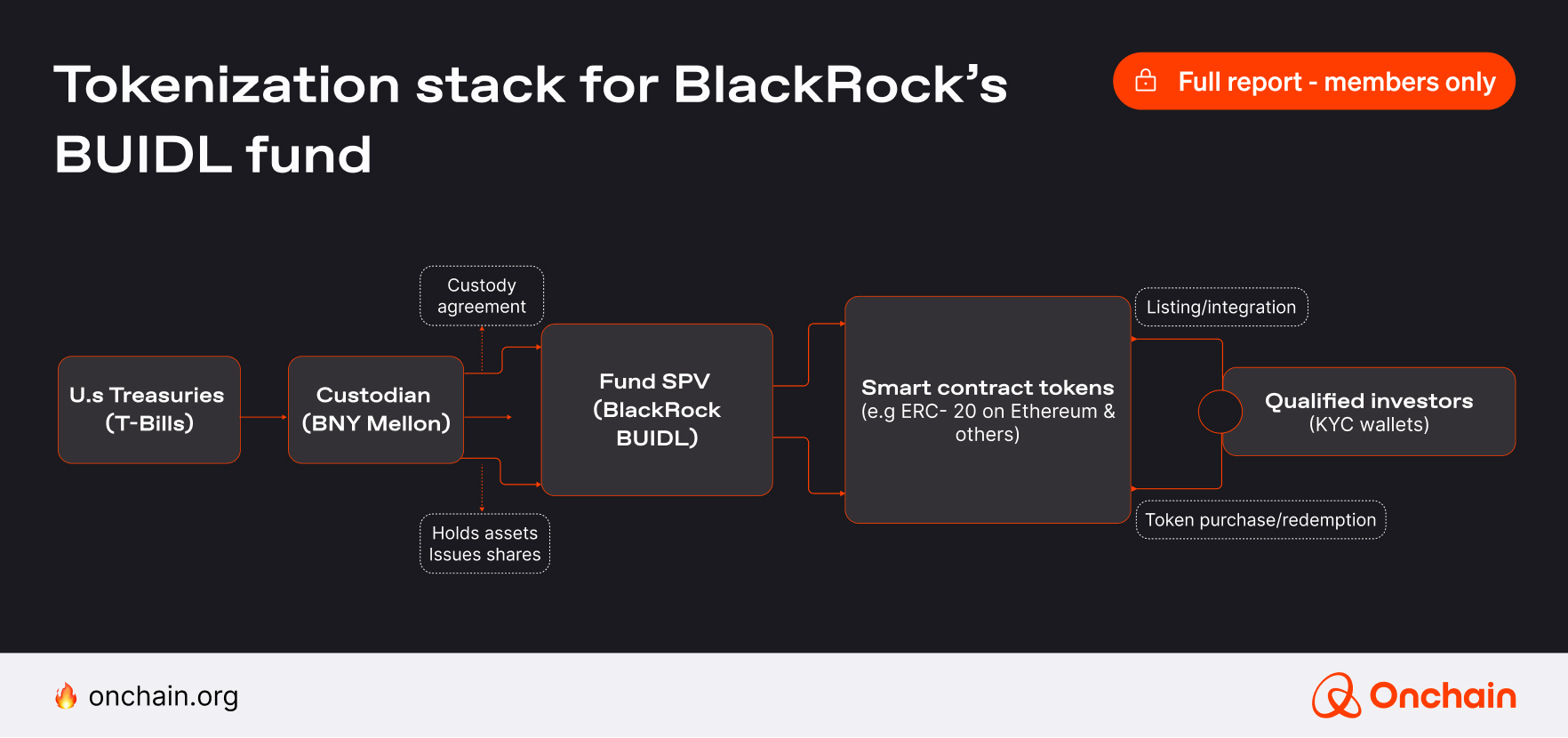

Case study: BlackRock’s BUIDL

One landmark of 2024 was BlackRock’s entry into tokenized treasuries with its USD Institutional Digital Liquidity Fund (BUIDL).

Structurally, BUIDL is a regulated fund – a BVI-based special purpose vehicle (SPV) under a Reg D exemption, that invests in short-duration U.S. government bonds.

The figure below shows the tokenization stack for BlackRock’s BUIDL fund.

Securitize’s stack enabled onchain share issuance and investor onboarding, ensuring only verified “U.S. Qualified Purchasers” (high-net-worth investors under U.S. law) could hold the tokens.

Notably, the BUIDL tokens are available on multiple blockchains to meet investors where they are. The smart contracts implement regulatory transfer restrictions. While tokens might be on public chains, only authorized addresses (investor wallets that passed KYC/AML checks) can transact them – an example of onchain compliance.

What you can build: Tokenized treasuries provide a stable, yield-bearing asset that can be used as “money-legos” in DeFi and fintech applications.

- Savings wrappers: A founder could build a wallet or “high-yield savings” dApp that automatically allocates user cash into the best yield from tokenized Treasury bills. This would effectively create a “T-bill-backed stablecoin” or an alternative to bank savings.

For example, Ondo’s OUSG token pools T-bills and provides a stable onchain yield, which other apps could integrate. - DeFi collateral and lending: Tokenized T-bills can be used as high-quality collateral in DeFi lending protocols or for borrowing stablecoins. Founders could build services where businesses use their tokenized treasury holdings to borrow cash (similar to repo markets). They could reduce lending risks because these tokens are stable and transparent.

Key takeaway for founders: Users may not care about the token itself, but they care about safe yield. A product that hides complexity and simply pays out, say, 5% on deposits (via treasuries) can gain traction.

- Global access products: Treasuries are typically accessible mostly to U.S. or large investors. A startup could create a user-friendly mobile app for emerging markets that allows everyday people to invest in U.S. T-bill tokens (yield-bearing digital dollars) as an alternative to volatile local currency savings. This provides financial inclusion by lowering barriers to a safe asset. Compliance (KYC/AML) would need to be built in, but infrastructure now exists to facilitate this.

- Finally, given that tokens like BUIDL are currently mostly accessible only to accredited investors, a long-term goal is to create structures that open up access to a broader retail audience in a compliant manner. For example, via regulated crowdfunding or by partnering with jurisdictions that allow retail RWA exposure within certain limits.

Key takeaway for founders: Tokenized Treasuries are relatively standardized and low-risk, which means competition will focus on user experience and integration. Founders should think about how to abstract the complexity (custody, compliance, wallet management) and offer easy access, automated yield, or seamless integration with existing TradFi interfaces. The winners in this space will be those who make “treasury yields at your fingertips” a reality for broad user segments.

2. Tokenized commodities

Commodities have also entered the onchain arena, with precious metals leading the way.

Typically, a provider secures the physical commodity in custody, such as in vaults for gold or in warehouses for other commodities, and issues tokens that can be redeemed for the physical commodity. They may charge storage fees or take a small spread. The value proposition is to combine the stability and intrinsic value of commodities with the accessibility and liquidity of crypto.

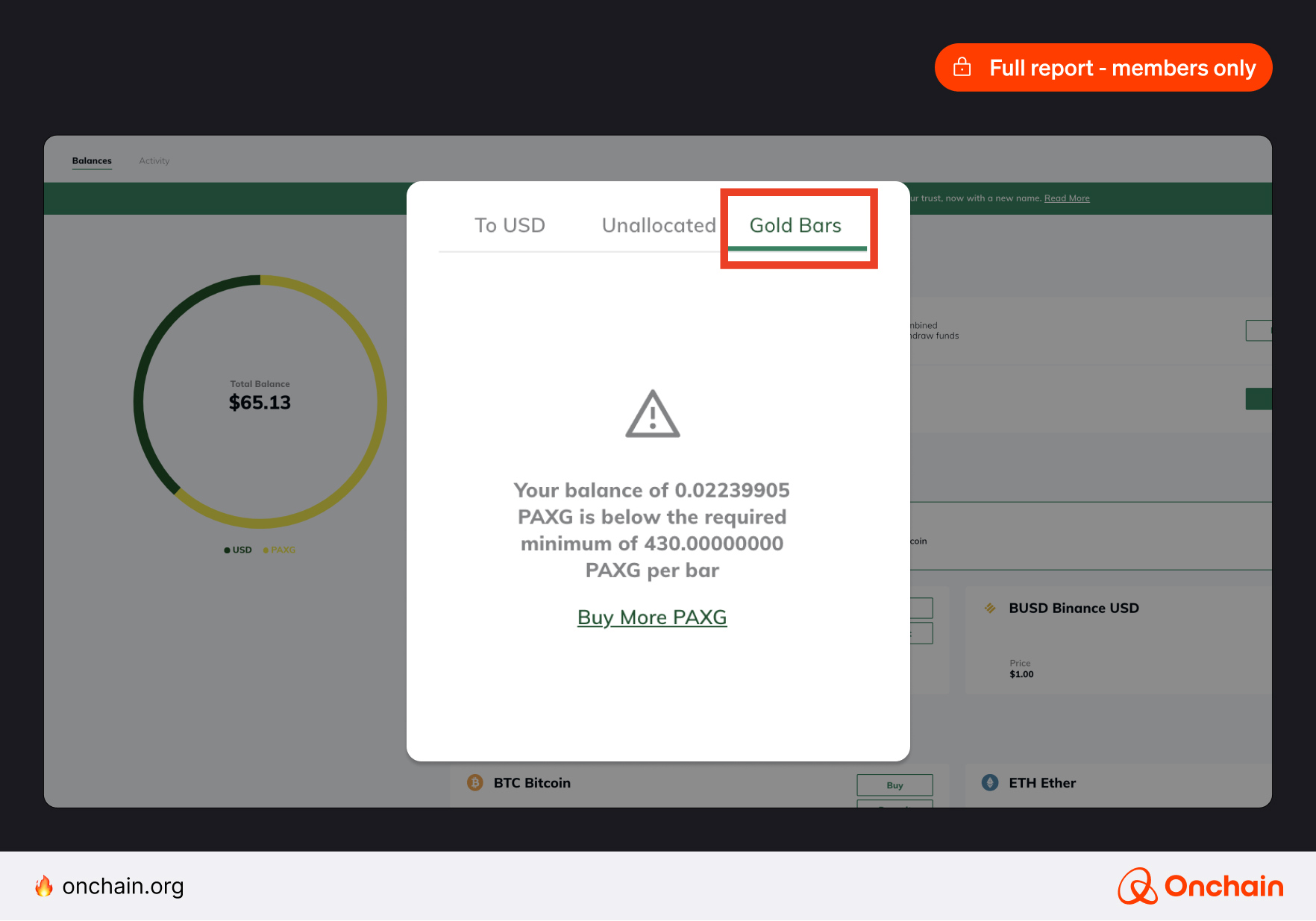

Case study: Paxos PAXG

Pax Gold (PAXG) is a pioneer in commodity tokenization and remains the largest tokenized commodity project to date.

Technically, PAXG is an ERC-20 token on Ethereum. Paxos has also enabled PAXG on other networks, such as the Binance Chain, via token bridges, although Ethereum remains the primary network.

In terms of stack, Paxos provides a web interface and APIs for institutions to buy/redeem PAXG, in other words, converting between fiat and the token. They also utilize audit firms to attest monthly that the gold reserves equal the circulating tokens, thereby reinforcing trust.

Paxos and its vault partners entirely handle the custody. Compliance involves Paxos conducting KYC/AML checks for customers who interact directly, especially for redemptions. However, onchain transfers of PAXG between arbitrary wallets are permissionless.

Key takeaway for founders: The business model for Paxos involves custody fees reflected in a small 0.02% monthly fee built into the token, as well as facilitating large redemptions. You need 430+ PAXG to redeem for a physical bar, ensuring the system is efficient for big holders.

This model shows how a traditional commodity like gold can be made “internet liquid”. Traditional instruments, such as Exchange-Traded Commodities (ETCs), gold futures, or broker-mediated gold trading, also offer liquidity and market exposure, as well as tokenized gold. However, limitations remain. Some tokens, such as Tether Gold, do not provide straightforward physical redemption for individual holders or fully transparent onchain proof-of-reserve mechanisms. This highlights the importance for users to clearly understand the specific structures and limitations of the commodity-backed tokens they choose to invest in.

What you can build: With commodity tokens like gold, silver, or others gaining adoption, opportunities include:

- Fintech apps for commodity investment: You can integrate tokenized commodities into consumer investment apps. For example, an app could allow users to seamlessly swap between stablecoins, tokenized gold, and Bitcoin, essentially providing an easy way to transition into safe-haven assets during periods of volatility.

- Enterprise use cases & ESG commodities: Beyond retail, tokenized commodities can streamline settlement in commodity trading or serve as collateral in traditional markets.

- Spendable gold: Crypto cards or wallets with gold-balance funding (e.g., Nexo card)

Key takeaway for founders: Ensure robust proof-of-reserve mechanisms (perhaps using oracles to attest vault holdings) to gain user trust. Additionally, consider user education, as many investors may appreciate the concept of gold on blockchain but require clarity on how redemption, insurance, and pricing work. Simplifying that user journey (e.g., insured custody, easy redemption options, transparent audits) can set a project apart.

3. Tokenized private credit

Private credit tokens represent loans or debt instruments.

These platforms often operate as marketplaces that connect borrowers seeking capital with lenders or investors seeking higher yields, using tokens to represent loan participations or debt securities.

They earn revenue through origination fees, interest spreads, or protocol fees. The promise is to bring liquidity and transparency to private lending and to open access for a broader range of investors by fractionalizing loans.

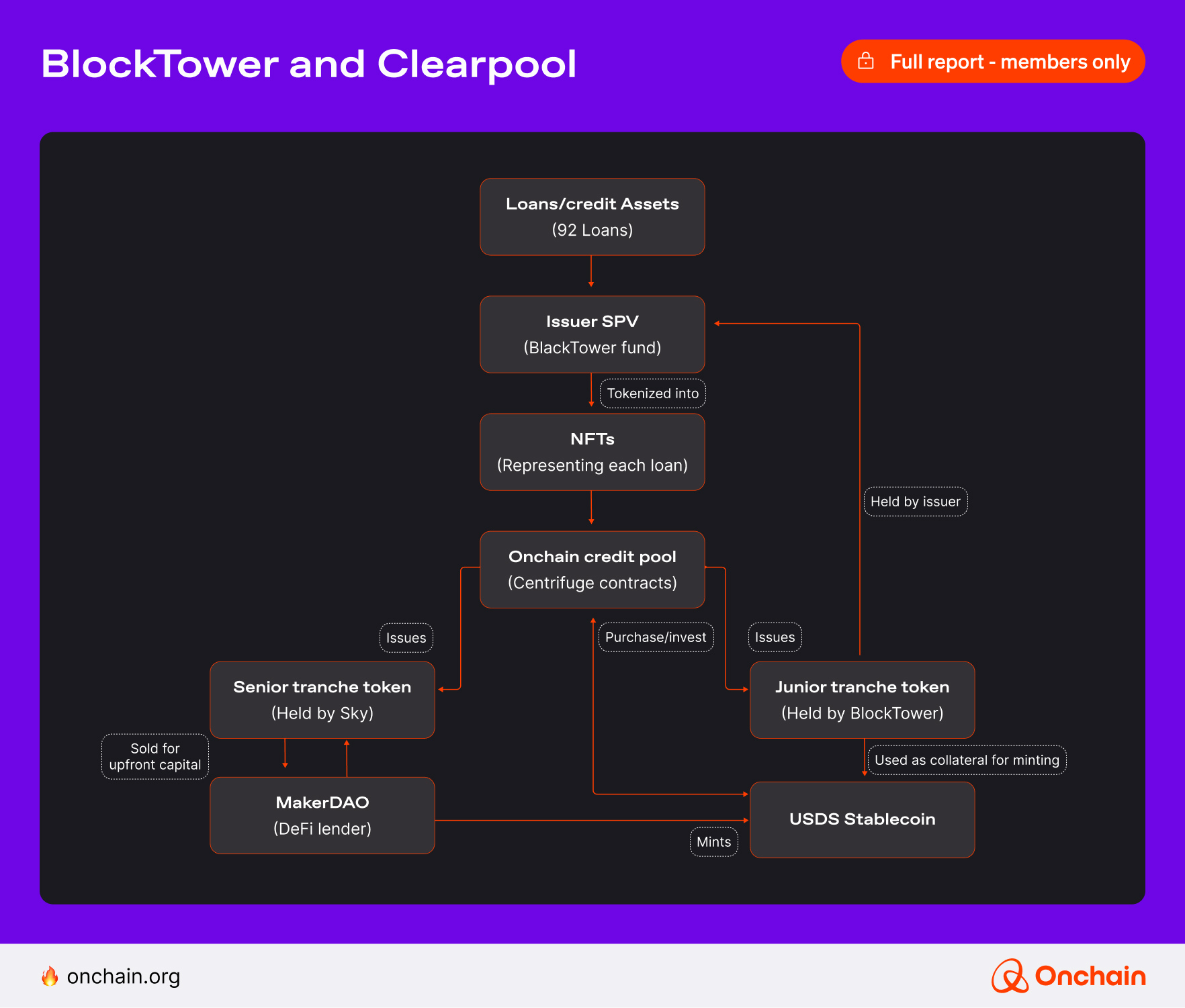

Case study: BlockTower and Clearpool

An example of tokenized private credit is the collaboration between BlockTower Capital and Centrifuge. The first is a crypto-focused investment firm, and the second is an RWA tokenization protocol. Both securitize a portfolio of private loans onchain.

Technically, much of this occurred on Ethereum (EVM) for maximum composability. MakerDAO’s involvement required Ethereum smart contracts, and over two years, running two collateralized loan obligations (CLOs) structures on Ethereum only cost approximately $60,000 in gas fees, compared to millions in traditional legal and banking fees for securitization.

The tokens were issued under legal agreements through a Special Purpose Vehicle (SPV) to ensure the real-world enforceability of loan repayments. A trustee or custodian handled the real loan documents off-chain.

This marriage of DeFi and TradFi resulted in tangible success: BlockTower’s onchain fund achieved a 97% reduction in securitization costs and delivered a 24% return to investors when the loans matured in October 2024.

What you can build: Tokenized private credit is a more complex space due to higher risk and the need for due diligence. It also offers higher yields. Founders can create value on top of these credit tokens in several ways:

- Credit investment platforms: There is room for “neo-bank” style platforms that package tokenized loans into portfolios for investors.

For example, a startup could curate a basket of tokenized SME loans or real estate debts and offer investors a diversified token that automatically pays them a blended yield. This would entail building analysis tools, risk scoring, and a user-friendly investment interface on top of protocols like Clearpool, Maple, or Goldfinch.

- Risk management and insurance: High yields come with the risk of default. You could offer insurance or hedging products for tokenized credit.

For instance, a protocol that issues an insured tranche token (with a lower yield but protected principal) on top of a pool of loans could attract more risk-averse capital. This may involve structuring junior and senior tranches and using tokens to distribute risk – essentially, structured products built on tokenized credit.

Key takeaway for founders: Founders should focus on assessing and conveying risk to investors, potentially by integrating credit scoring, borrower financial data, or utilizing AI to monitor loan performance.

Now that you understand the breakdown of how each category is being tokenized and used, let’s zoom out. What do users really want from these assets? And more importantly, where does the actual value lie for you as a founder?

The table below outlines user demand, product opportunities, and monetization models for each category, enabling you to determine where to build and how to capture value.

4. Infrastructure-as-a-service for tokenization

While building a tokenization project, founders face heavy lifting in terms of technology (smart contracts, wallets, security) and compliance (KYC/AML, legal structuring). This is where infrastructure-as-a-service providers for RWA tokenization come into play.

Two notable players in this domain are io.finnet and Fireblocks, which we will examine as examples of IaaS solutions for tokenization.

io.finnet – Compliance as a growth engine

io.finnet is built for founders like us, who want to go live quickly, with minimum regulatory headaches. Instead of offering a token, they offer rails: API-first custody vaults, KYC onboarding flows, and chain-agnostic provisioning tools across Ethereum, Polygon, Arbitrum, and Avalanche.

At its core, it’s a programmable compliance layer wrapped around MPC-based custody, enabling RWA founders to tokenize assets without reinventing infrastructure. Their REST-based architecture means you can plug vault provisioning, jurisdiction filters, and whitelisted transfers directly into your frontend.

Fireblocks

Fireblocks is another key player, known as one of the world’s most trusted digital asset custody and transfer platforms. It provides an end-to-end platform for securely minting, custody, distributing, and managing tokenized assets.

Their Tokenization Engine is a full-stack issuance suite that enables teams to define token logic, map it to off-chain assets, and launch regulated financial instruments without writing smart contracts from scratch. Fireblocks wraps this into a robust MPC custody system, enabling secure governance rules (such as dual-signer policies or transfer restrictions) and high-speed inter-institutional settlement via the Fireblocks Network.

Recently, Fireblocks integrated with Lisk, an Ethereum Layer 2 blockchain, enhancing its support for institutions seeking secure and compliant management of digital assets across multiple blockchain networks.

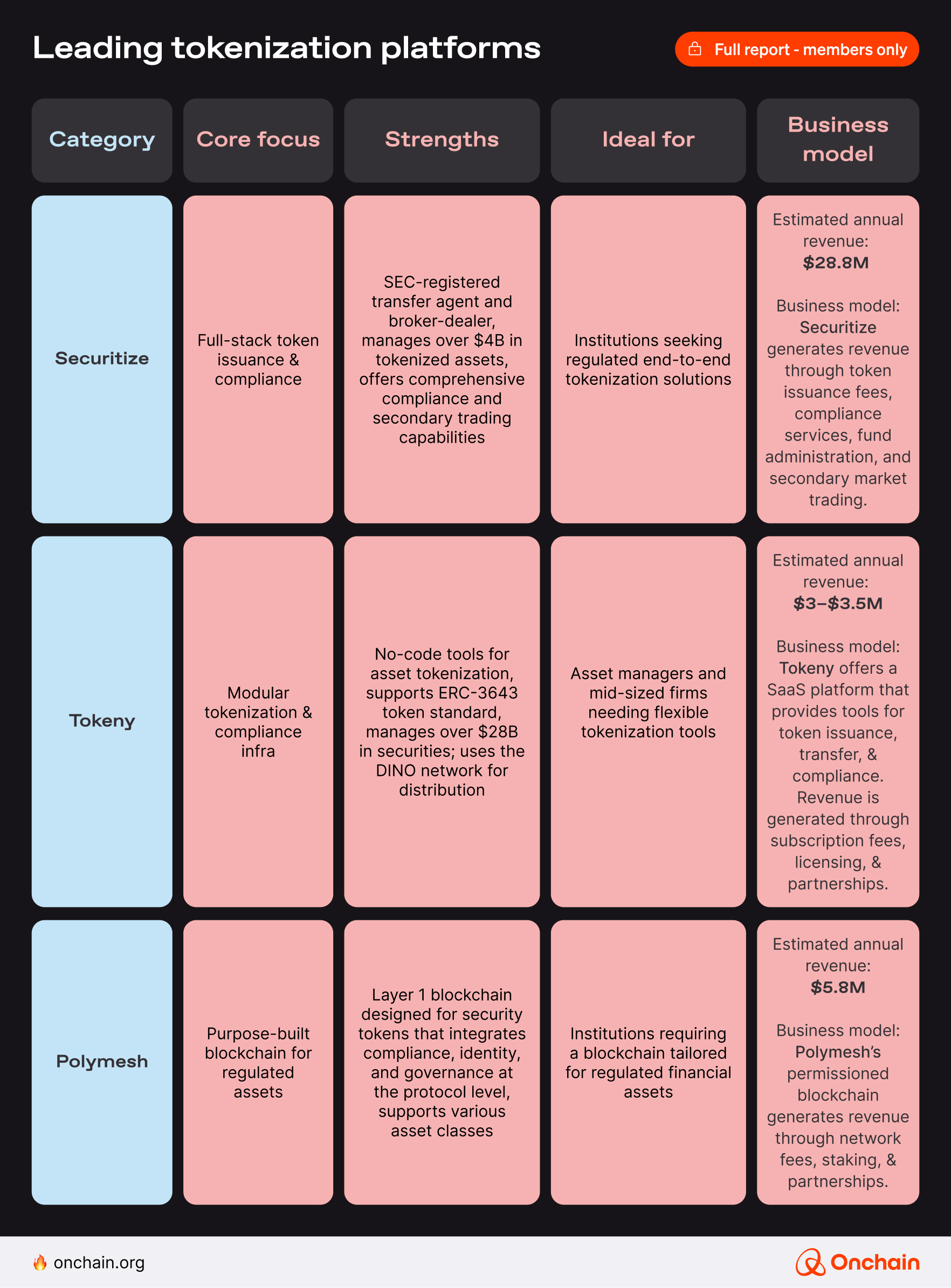

Platforms like io.finnet and Fireblocks offer a peek into how tokenization infrastructure can be built. They are part of a broader landscape of specialized players shaping the RWA stack. Platforms like Securitize, Tokeny, Polymesh, and Vertalo have taken different paths. Each addresses a specific market need, from regulated treasuries to modular compliance and cap table management.

The table below will help both founders and institutions choose the right partner for their tokenization needs.

Choosing your path in the tokenization stack

Choosing the right platform, whether it’s Securitize’s regulated compliance stack, Tokeny’s modular flexibility, or Polymesh’s blockchain infrastructure, is more than a tactical choice. It directly aligns with your strategic positioning in the tokenization landscape.

Recall the strategic theories we explored in Chapter 1: Trust Vacuum, Purple Ocean, and Grey Ocean. Each theory provides clarity on where opportunities lie and offers a strategic lens to guide your next steps. To translate theory into practical action, match your core strengths and ambitions with the ideal build path below:

Broadly, there are two entry points in tokenization:

- Build the asset layer. Bring real-world assets directly onchain, creating products and solutions around these assets.

- Build the infrastructure layer. Enable others to tokenize more efficiently, safely, and at scale by developing platforms, standards, or enabling technology.

Your background, market insights, and unique capabilities should guide this choice. Use the table below as an explicit reference:

As tokenization reshapes global finance, it not only transforms industries but also empowers individuals. From stablecoins stabilizing everyday commerce in Argentina and Nigeria to fractionalized real estate and commodity investments accessible to millions, blockchain-driven tokenization is creating tangible financial empowerment.

This naturally leads us to our next exploration: the user upside. How do everyday users adopt and benefit from these innovations?

3. The upside of fragmentation – how individuals succeed in tokenization

You can see the role of tokenization in an economically “deglobalizing” world more clearly now. Therefore, you’re also aware of the optimal ways to build today. It’s a good start. Next, you need to address the topic from a different angle and look beyond technological developments. RWA tokenization is about empowering users and enabling builders to own the infrastructure of tomorrow’s decentralized economy. We discuss the wheres, hows, and whys in detail in the following sections.

The dollarized internet economy is here

Stablecoins are the most popular way for individuals to leverage tokenization and a critical on-ramp into the broader Web3 ecosystem for users.

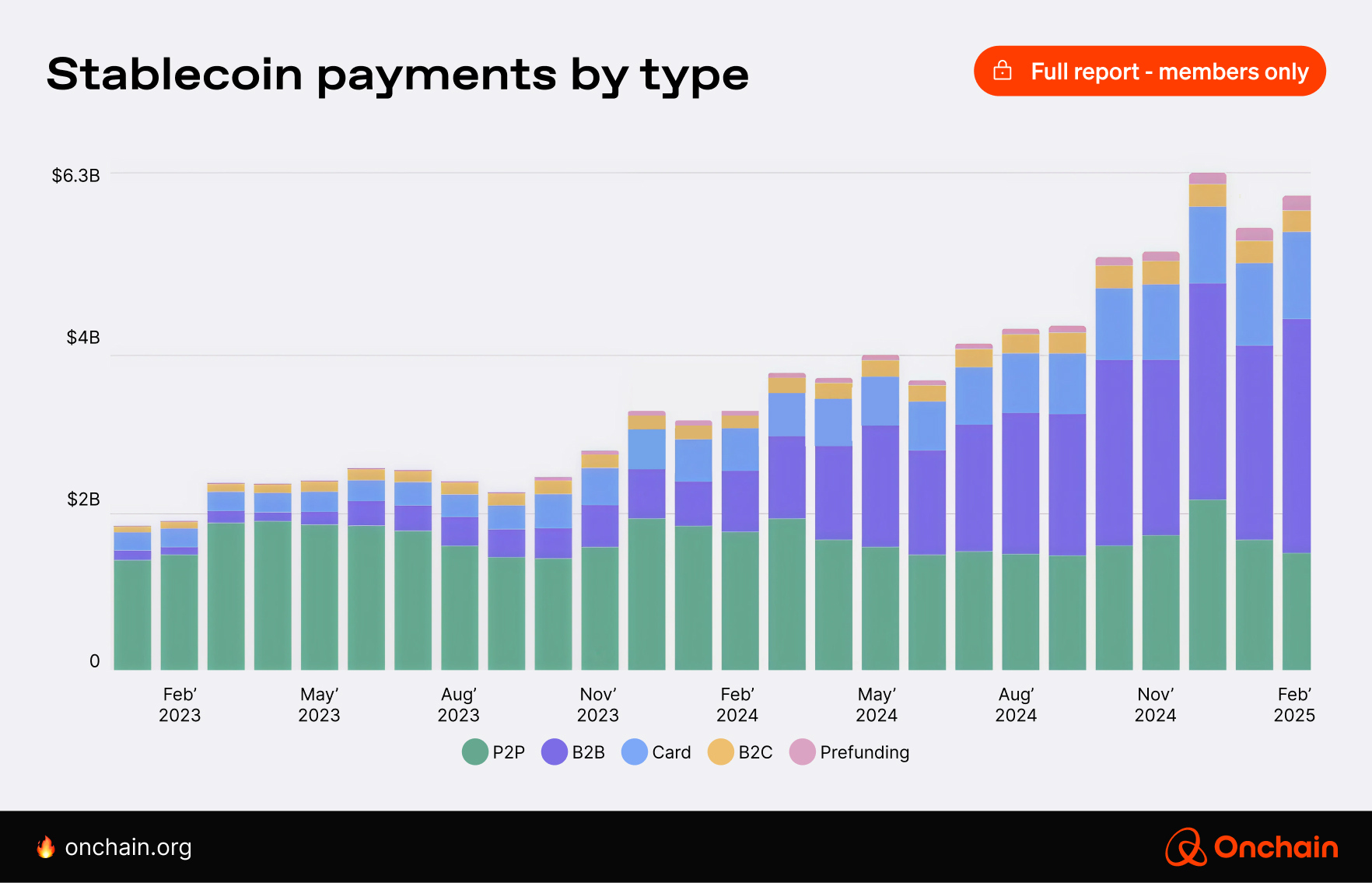

The global digital dollar is experiencing strong usage beyond speculative trading. Stablecoins processed $27.6 trillion in transfer volume in 2024, surpassing payment giants Visa and Mastercard, and demonstrating a significant shift in user behavior.

While real-world organic payments might represent a smaller fraction of total stablecoin volume, experts expect a significant growth in other use cases. These include B2B cross-border payments, consumer remittances, and institutional capital markets activity within emerging economies.

Stablecoins have given way to a parallel financial system — the “dollarized internet economy”. This has a transformative effect, particularly in emerging markets like Argentina, Nigeria, and Turkey, where they bypass costly traditional banking rails.

💡10 out of the top 20 countries where cryptocurrencies are most widely used for payment are lower-middle-income: Vietnam, Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya, and Indonesia.

If you are building in the niche, the best way to capture value is by directly addressing critical pain points, such as those mentioned above. Other adoption drivers include:

- Solving foreign exchange (FX) volatility: For instance, Nigerian businesses are pricing goods in USDT to avoid the depreciation of the Naira.

- Enabling frictionless cross-border UX: Filipino freelancers paid instantly in USDC via platforms like Bitwage, settled in mere minutes, even seconds, not days.

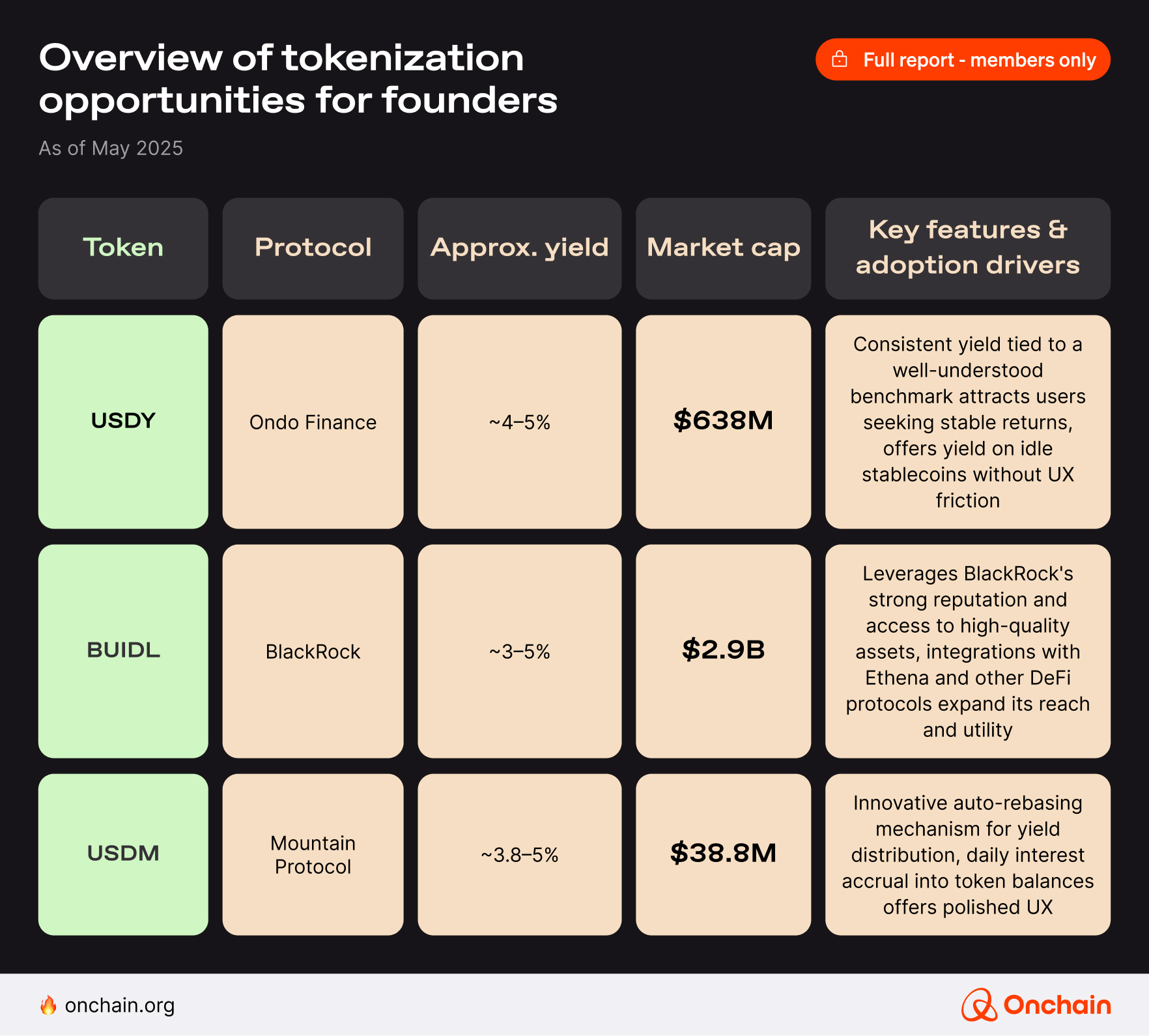

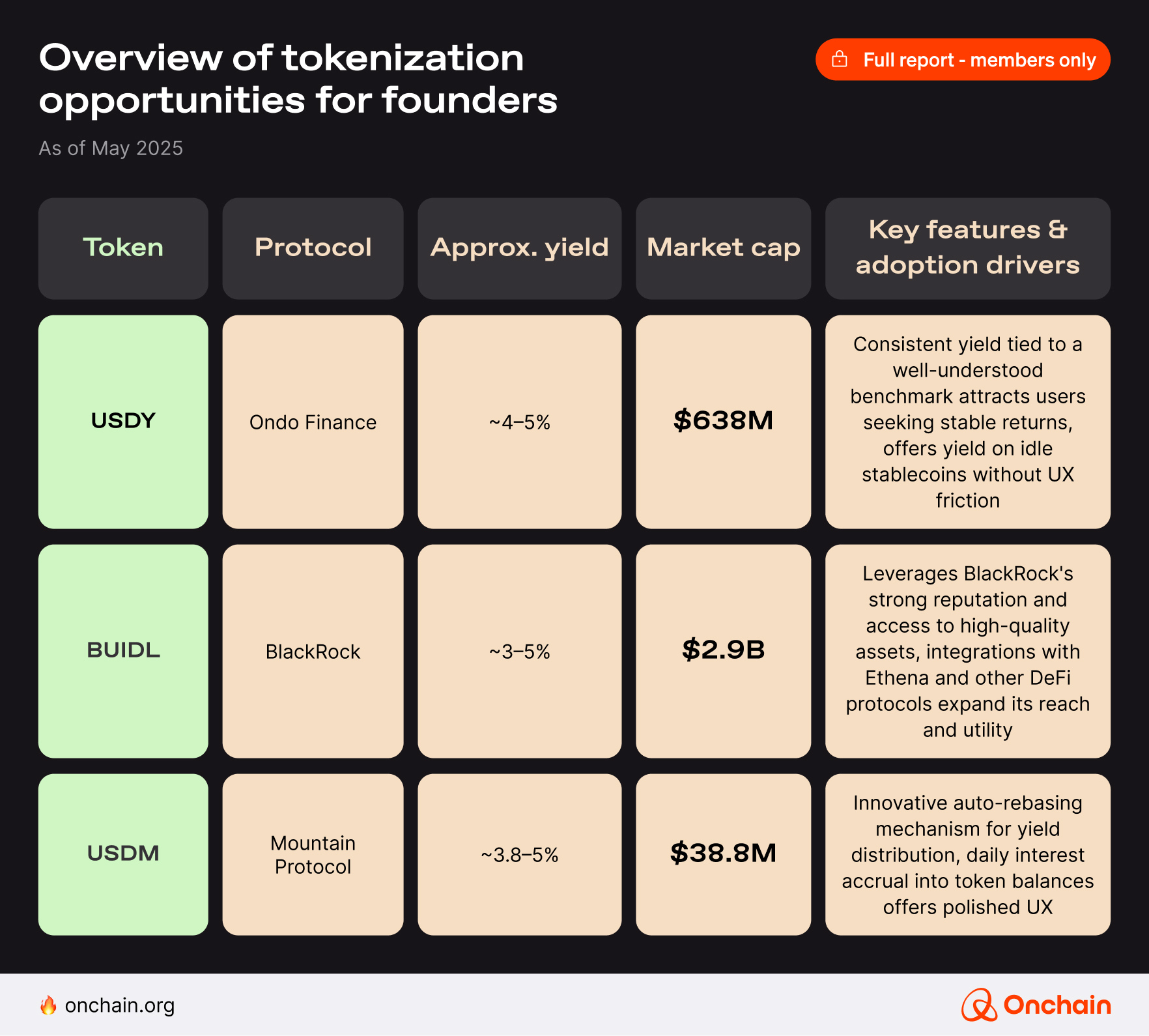

- Embedding yield for passive income: USDY, Ondo’s interest-bearing note, can offer yield on idle stablecoin balances without UX friction.

This is a call to founders and entrepreneurs to seize this massive opportunity. Leverage stablecoins to bypass traditional banking inefficiencies to facilitate faster, cheaper, and more accessible global payments. You can scale your business and reach new customer bases.

✨We’ve compiled all these opportunities in emerging and developing markets and shared them in our previous research report, Stablecoins: The Most Lucrative Business Onchain.

Now, speaking of yield.

While USDC and USDT dominate transactions, a new wave of yield-bearing stablecoins is gaining traction. They embed passive income and offer a more capital-efficient alternative to staking or DeFi yield farming.

Key takeaway for founders: The real opportunity lies in building for real-world utility. Think cross-border payments, FX hedging, and yield-bearing digital cash. For those exploring the potential of tokenized RWAs in treasury management or passive yield generation, RWA.xyz offers a practical starting point.

➡️ As stablecoins move from speculation to utility, tokenization also enables direct and fractional ownership of real-world assets. But this time, no brokers are required.

Micro-ownership without brokers

Today, individuals can own slices of the real world as part of their wealth-building strategy. They achieve this directly, without going through fund managers or custodians, and often without needing permission.

Where are the hotspots for fractional ownership and its use cases? In 2025, brokers are becoming obsolete for fractional assets. Instead, they get replaced by self-custody wallets, automated compliance, and global liquidity pools. Several asset classes and use cases are at the forefront of this change:

🥇“$25 ticket” gold investment: Projects like PAX Gold (PAXG) and Tether Gold (XAUT) offer fractional ownership of gold, each representing one troy ounce of physical gold, for as low as a $20 to $25 entry point.

🌎 Help save the climate with just a few cents: Within pioneering tokenized carbon credit platforms like KlimaDAO, your $0.20 of KLIMA token is worth over one carbon tonne in offset credit.

You can see this across niche assets as well. These tokenization platforms make the process look easy: it only takes a few minutes to select, verify, and purchase the fractionalized asset.

Navigating property purchases involves unique complexities, including administrative, legal, and financial obstacles. What users truly want is a simplified, unified process that efficiently manages these stages. Platforms like Propy do just this. It facilitates the investment process in fractional, tokenized ownership of properties, like a house in Florida.

As of September 2024, Propy reported over $10 billion in U.S. homes minted and brought $200,000 home addresses onchain through PropyKeys.

Its PRO token powers transactions such as onchain property title minting, with a growing market cap of $91 million, plus a notable increase in volume in March 2025. Propy’s partnership with Parcl strengthens its onchain real estate analytics capabilities.

Buying limited edition cars may be a good long-term investment, but the procuring process can be a let-down: Not everyone has the time and energy to find one through a trusted dealer or acquire it in an auction. Today, however, projects like MCQ Markets enable anyone to buy a $20 share of a 1984 Ferrari 512.

2025 may turn out to be pivotal for MCQ Markets. The year is marked by strategic partnerships, such as SOL Global, to build on Solana, the launch of McQueen Garage, and upcoming Dogecoin payment support, signaling strong model validation. At this time, no comprehensive onchain data is available for its fractionalized assets; however, we can clearly see the traction through initial sales and strategic initiatives.

Sourcing whisky casks appears just as notoriously challenging. Their rarity is inherent because they are not intended for individual sales. You would typically require a special network to find one. Cask Capital provides an opportunity to secure a fractional share of a rare Staoisha whisky without this. Overall, onchain traction for this type of fractionalized asset remains limited, but the growing luxury liquor and fine wine (valued at ~$440 billion) market makes for a strong underlying asset class for Cask Capital’s tokenization efforts.

The tokenized asset landscape has become more diverse, and the experience more seamless. However, the true potential of fractional ownership remains largely untapped and misunderstood. This might be partly due to a prevailing focus on speculative utility tokens, rather than the underlying assets themselves. Industry experts address this issue:

“A lot of investors now don't understand the magnitude or the radicalization of tokenization. Instead, they are hyped on the "utility" tokens of promising RWA platforms. Not the actual purchase of RWA tokens themselves. Because if they did, they would realise that almost all RWA platforms don't accept retail.”

- Jean Claude Maruyama, VP of Marketing at IX Swap / InvestaX

Key takeaway for founders: We are starting to see a synergy between fractionalized assets and DeFi rails, which means faster adoption through better marketplace integration. There’s an open opportunity here for you: those who capitalize on the growing demand for fractional ownership will have the most upside in capturing the $10 trillion+ RWA market. This will primarily occur by creating robust marketplaces that connect investors with a diverse range of tokenized assets and integrating DeFi for enhanced liquidity and utility.

➡️ But you know what’s better than buying tokenized gold with spare change? Earning your own tokens while you sleep. Intrigued? Read more below.

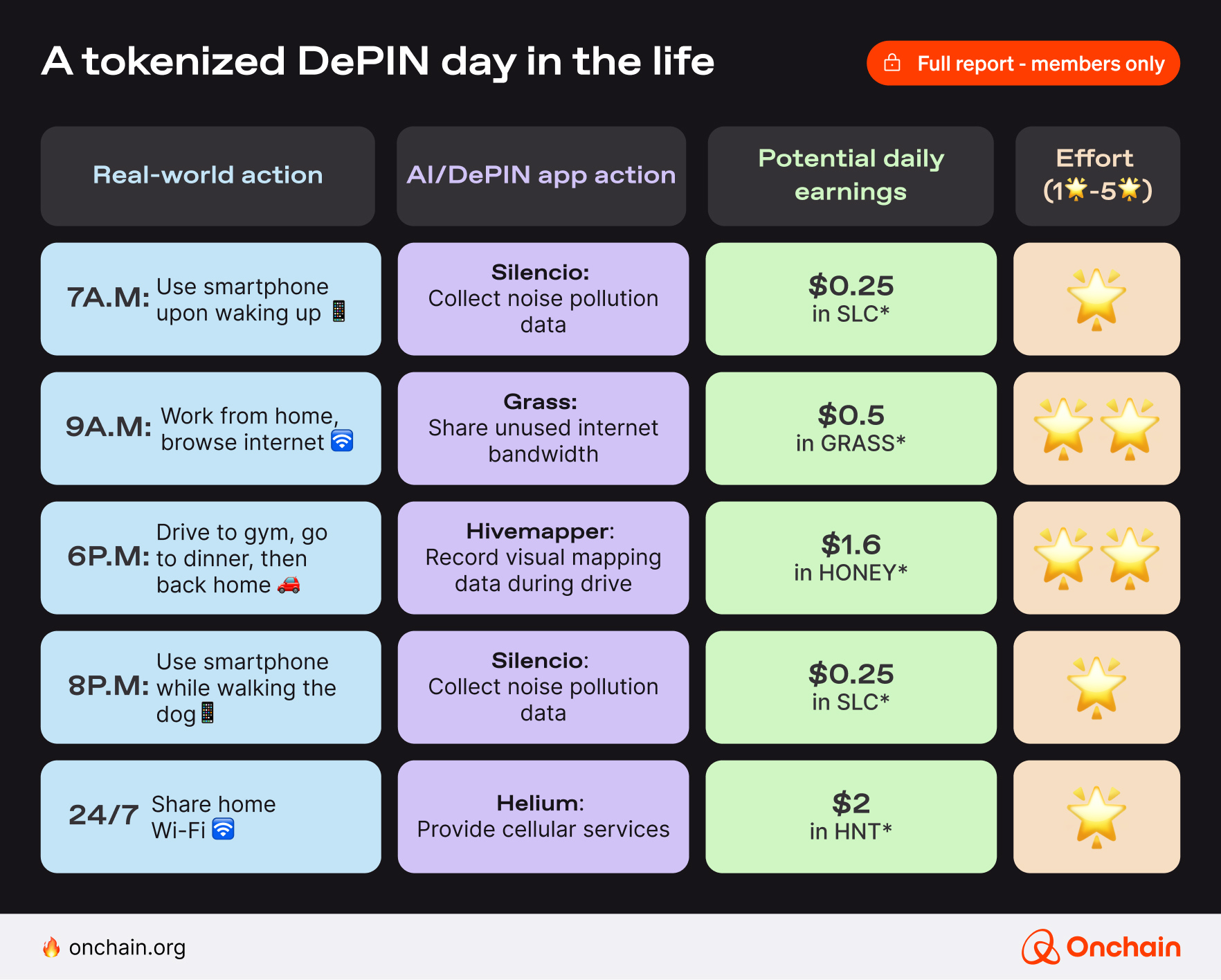

Earn your own tokens (Data & DePiN)

Web3 is witnessing the emergence of the “consumer miner” era, moving users beyond passive consumption to active network contribution. Why does it matter?

The focus here is on effectively transforming daily real-world actions into income streams. This opens opportunities for founders to architect self-growing economic networks and directly connect data buyers with resource contributors in two-sided marketplaces.

Let’s go deeper. We first explored the DePiN customer world in our previous report, Crypto Apps for Consumers Are Here to Stay, where we conducted detailed case studies on apps such as Silencio, Grass, and Hivemapper. In the report above, we examined each app from a consumer perspective by testing the user experience, evaluating potential earnings, and assessing the value for individuals looking to try these apps.

Building on that foundation, we illustrate and quantify the broader impact here based on a few DePIN app examples below:

This sample stack scenario shows how one can generate low-effort passive income with DePIN apps, though it’s not always guaranteed. Below are some key variables that impact earnings. Users should take advantage of, but also consider:

- Network effects: Some DePIN platforms may incur higher costs in regions with higher resource demand.

- Token volatility: Earnings are token-denominated, so value can fluctuate with crypto markets.

- Founder fees: Most DePIN apps deduct 5–15% for protocol maintenance (e.g., Helium takes 10% of rewards).

✨ If you’re a founder building in this niche, check out our DePIN Brings Real-World Business Opportunities for Web3 report – all the important work is done for you here, as it examines the most successful DePIN projects, business models, growth patterns, challenges, and founder insights.

➡️ While DePIN facilitates the tokenization of everyday physical actions into income, Web3’s tokenization extends beyond the tangible world. The principle of converting participation into value is applied in the digital realm to transform online influence and attention into tradeable assets.

Day trade the new internet

Tokens now power a dynamic “attention economy” where users can day-trade the new internet.

Memecoins, NFTs, and social tokens reflect engagement and cultural relevance. We can see that this value is being captured and created across novel vectors. Pay attention to these emerging models and the opportunities they present:

🧩 Composable attention flows: Apps convert user actions into direct economic flows via tools like Frames and zk-paywalls (Lens, Farcaster, Noise.xyz)

💰 Social capital as currency: Tokenized social influence as tradable assets, priced via wallet activity and onchain reputation (Lens)

📶 Onchain data trails = valuation signals: Wallet analytics and social metrics co-determine token value (Moni, Sosovalue)

🤖 AI x crypto convergence: Searchable signals and quantified AI-curated attention platforms (Kaito AI, Cookie.fun)

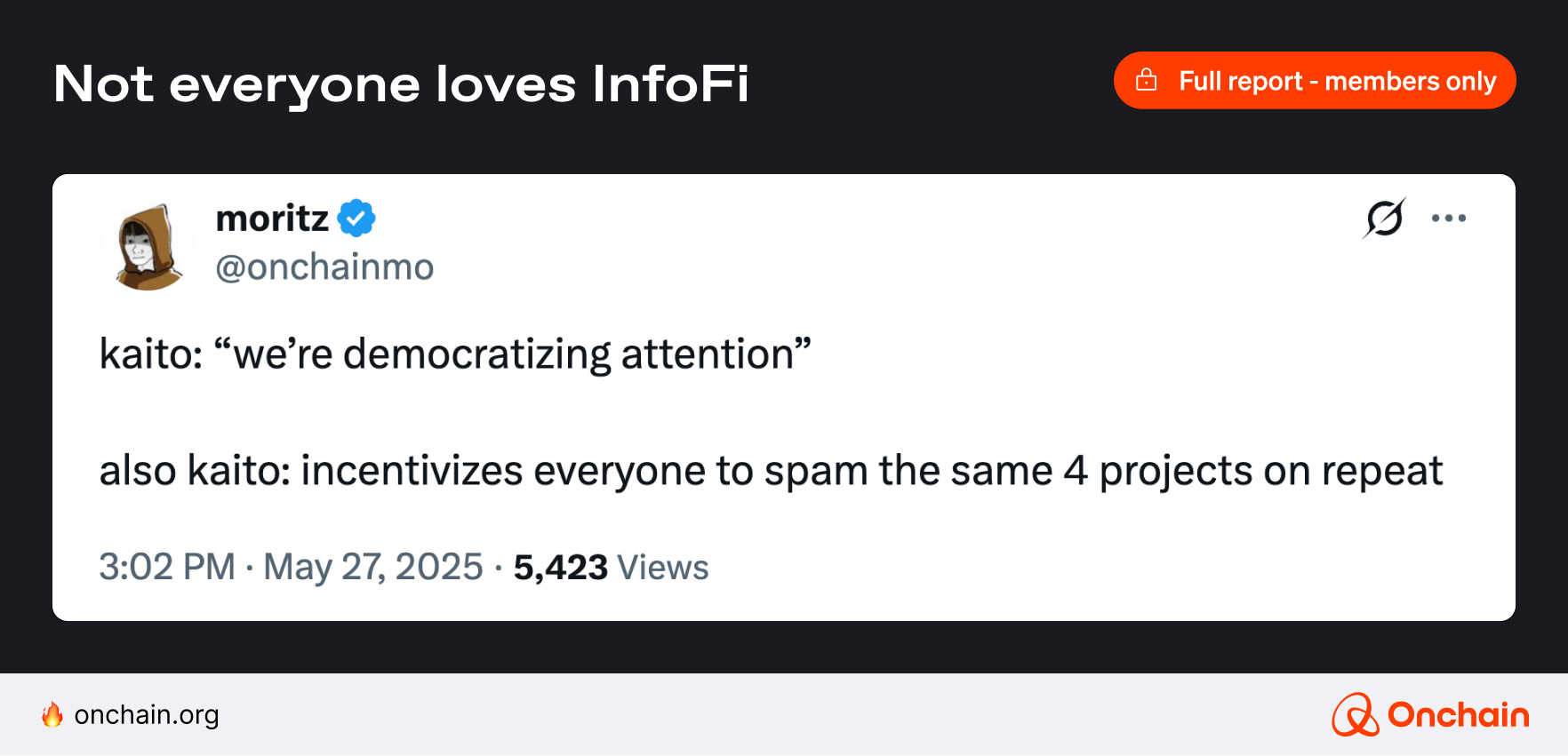

Mindshare is turning into the new Web3 gold standard. The “InfoFi” (information finance) niche captures this by tokenizing mindshare and attention and pushing their boundaries beyond monetization.

Tools like Kaito AI offer sentiment analysis for builders. Similarly, platforms like cookie.fun use point mechanisms to encourage high-quality content creation. The fundraising landscape is also changing with new launch models like “Initial Attention Offering”, which prioritizes community participation and influence over capital.

Key takeaway for founders: To navigate these new standards and primitives, you can leverage mindshare by designing point mechanisms that reward high-quality content.

At the same time, anchor tokenized attention markets in sustainable, real-world value.

InfoFi’s rise has sparked heated debate around authenticity. While it promises to monetize mindshare and engagement, critics argue it’s warping the creator economy into a speculative frenzy for the following reasons.

⚠️ Content for cash: Creators are incentivized to prioritize clickbait, hype cycles, and volume over meaningful content.

⚠️ The “shiny object” churn: When rewards are tied to trends, creators abandon long-term projects to chase whatever’s hot and new.

⚠️ Metrics over meaning: Platforms that reward “impressions” or “engagement” tokens risk optimizing for empty vanity stats.

Goodhart’s law states that “when a measure becomes a target, it ceases to be a good measure”. In InfoFi’s case, that’s mindshare and influence. This raises the questions: how do we find the balance and prevent the space from turning into a breeding ground for vaporware and clout farmers?

As more users become creators, there are fewer people left to actually read the content, much less care about it. It’s everywhere, and the systems are gamed. Real engagement drops, trust erodes, and the system starts to eat itself.

For InfoFi to stay relevant, it needs to evolve and not just reward volume, but value — not just reach, but measurable impact. This is the inflection point.

- @TheHeroOfLight, Hero of growth at Onchain

Information, including mindshare and influence, is everywhere. The real challenge for users is discerning its value and relevance and extracting genuine signals from the noise.

Emerging Web3 models tackle this by aligning incentives through tokens to surface and provide users with valuable information. Kaito, Ethos, and Onchain are a few that exemplify innovative approaches to these challenges. Founders in this niche can learn from them.

➡️ As tokenized attention markets expand the scope of what can be traded, this “Internet Capital Markets” vision accelerates a foundational shift: the migration of traditional equities and assets onchain, opening 24/7, borderless capital markets.

‘Always-on’ liquidity: 24/7 onchain capital markets

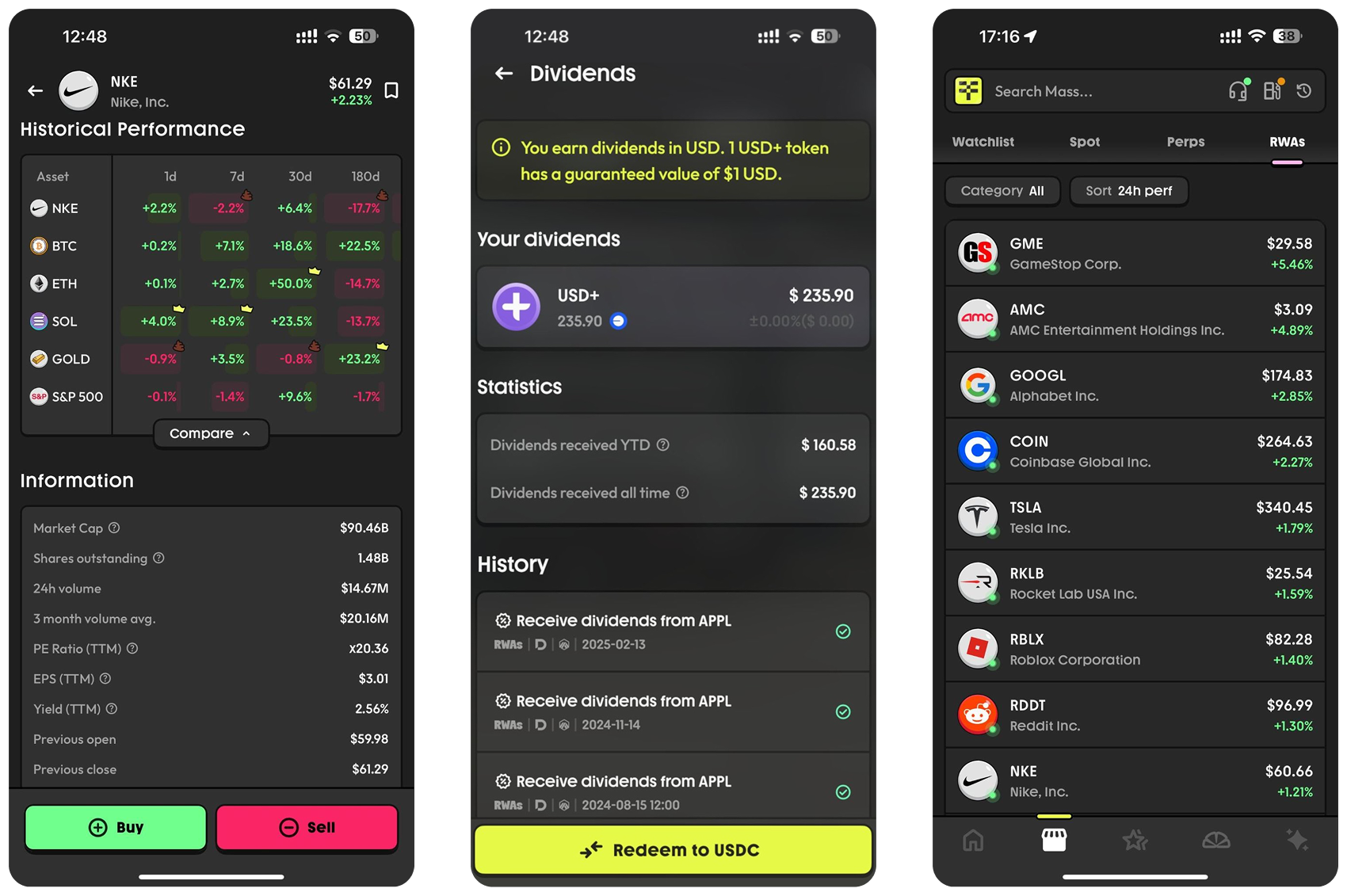

Tokenized stocks are surging in 2025, led by Exodus stock’s 94% market dominance. However, it remains a modest segment with significant growth potential.

Exodus, best known for its self-custodial wallet, made headlines when its Class A shares began trading on the New York Stock Exchange (NYSE) in 2024. The company became one of the first in the US to tokenize its common stock on the blockchain, which continues to trade on platforms like tZERO.

Exodus leads the market share, but other players are gaining ground. Backed Finance’s primary offering consists of synthetic assets in the form of bTokens, which make up nearly 90% of tokenized stock assets in the market. With the release of xStocks in partnership with Kraken, we can expect this share of the market to continue to grow.

Alongside Ondo and other emerging players, these developments speed up adoption in the tokenized equities space. We get a glimpse at what onchain capital markets could look like at scale.

While these assets represent a significant market size today, they face legacy problems like weekdays-only operations, KYC-heavy and broker-mediated processes, and slow settlement, all of which hinder further growth.

By tokenizing capital markets, these assets are always-on, leading to faster transactions and more unrestricted movement of capital than before.

TradFi is being rewritten onchain, boosted by next-gen infrastructure and tokenization frameworks.

Ethereum and zkSync Era lead the charge, collectively commanding 76.5% of the institutional tokenization market. Polygon and Algorand gain momentum as rising contenders. Oracles like Chainlink provide data infrastructure, anchoring RWAs to live market prices.

Tokenized stocks and indexes are becoming the norm, with key industry players like Solana, Coinbase, Robinhood, Kraken, and Bybit leading key initiatives.

And it’s all happening in a Web3 exchange wrapper rather than a TradFi-native product. Infrastructure providers, such as Backed Finance, are paving the way.

It’s still early, yet the demand is strong. Base creator Jesse Pollak promotes tokenization of “every asset in the world” on Base, starting with COIN, setting a precedent for the sector.

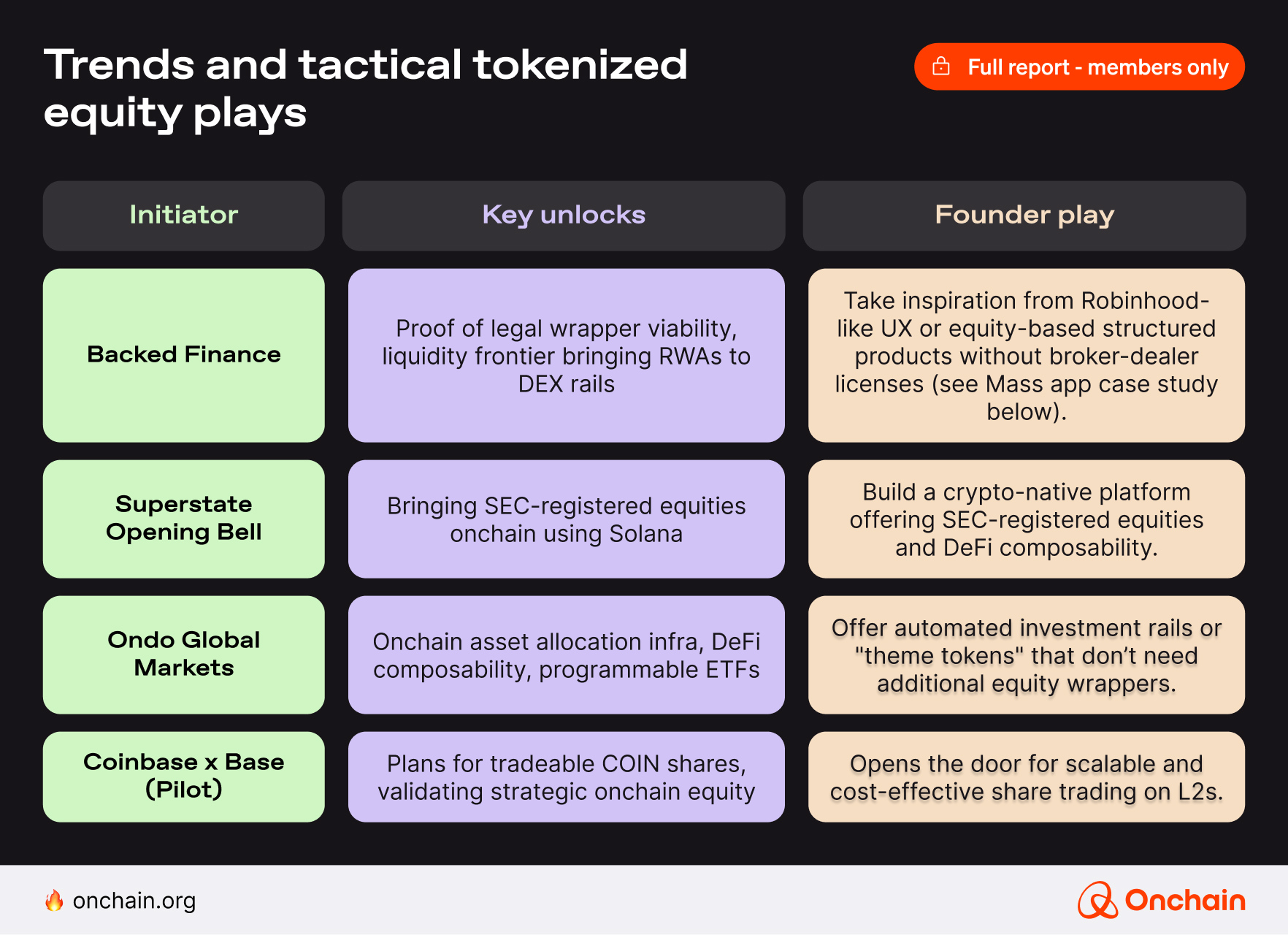

It’s a no-brainer for founders. This is your shot to disrupt ‘business as usual’ in finance. With capital markets operating 24/7 onchain, new opportunities emerge to reimagine how global equity trading is built and accessed. Below, you’ll find key trends that shape this transition, plus some takeaways for you to leverage.

To provide a real-world example of the innovation in this space, let’s examine the following case and its approach to tokenized stock trading.

The road ahead? This tokenized asset class accounts for only a fraction of the trillion dollars in RWAs, but its potential is enormous.

To scale, we need more than just token wrappers. We need regulated, compliant infrastructure that enables RWAs to plug seamlessly into both TradFi and DeFi ecosystems.

The next big unlock will come from building standardized and regulated protocols that simplify onboarding for institutions while ensuring user protection, transparency, and legal enforceability.

For InfoFi to stay relevant, it needs to evolve and not just reward volume, but value — not just reach, but measurable impact. This is the inflection point.

- Jeremy Ng, CEO at OpenEden

New legal frameworks, like the U.S. Broker-Dealer Tokenization Act, Germany’s eWpG, and Liechtenstein’s Blockchain Act, signal growing global regulatory clarity. Ondo’s engagement with the SEC, Solana’s Project Open initiative, and Robinhood’s proposal also hint at emerging standards and frameworks that could enable the compliant tokenization of treasuries, equities, and other assets.

Key takeaway for founders: Don’t overlook private markets. Private equity has grown 4x faster than public markets over the past two decades. With ~$70 trillion in private wealth largely underserved, investor appetite for private alternatives (especially crypto) is on the rise.

If tokenization makes private markets accessible and liquid, we can expect demand to grow.

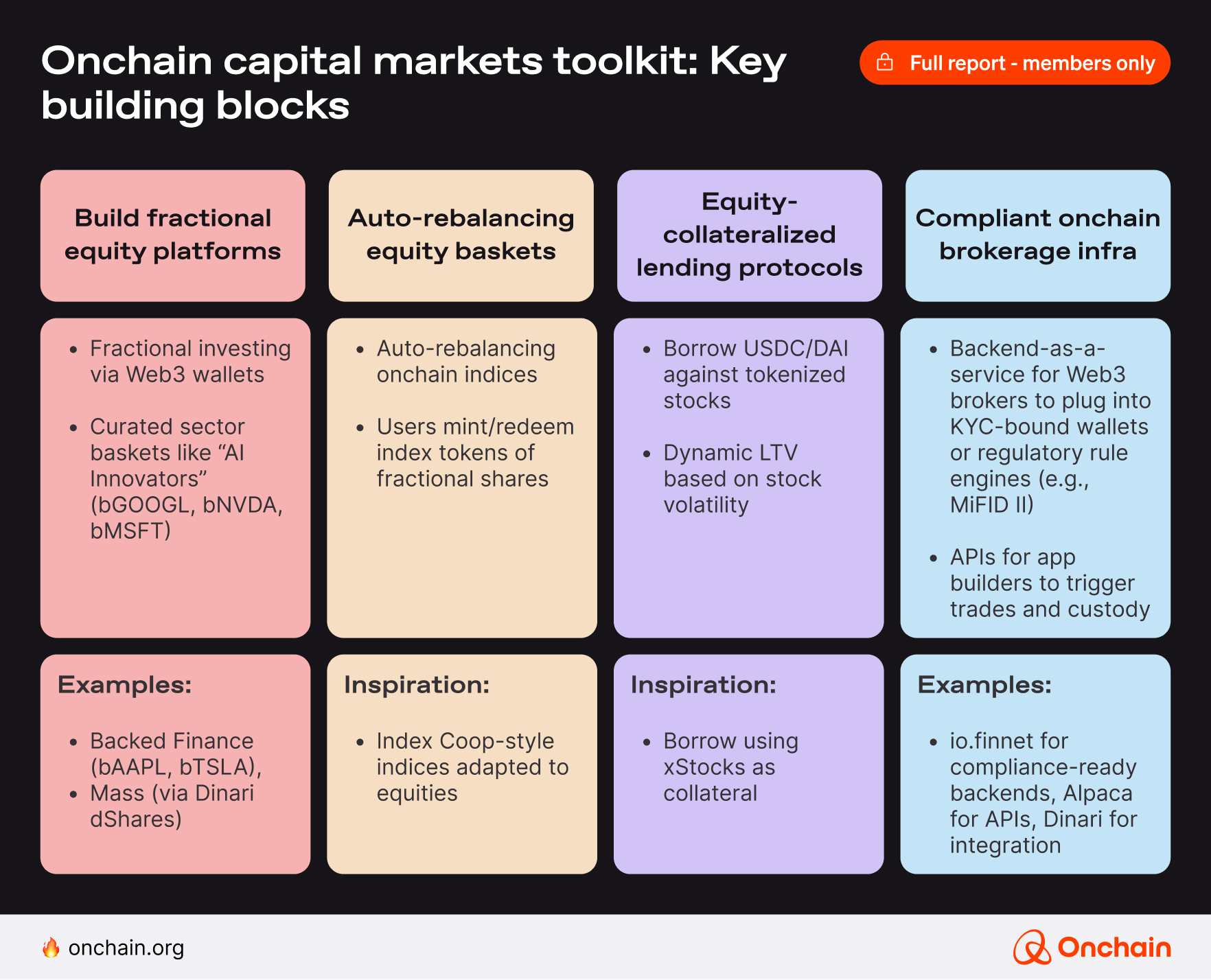

The emergence of tokenized assets operating within 24/7, borderless markets represents new, untapped opportunities for founders. Below are some product patterns and monetizable verticals that founders can leverage to drive growth.

The founders playbook

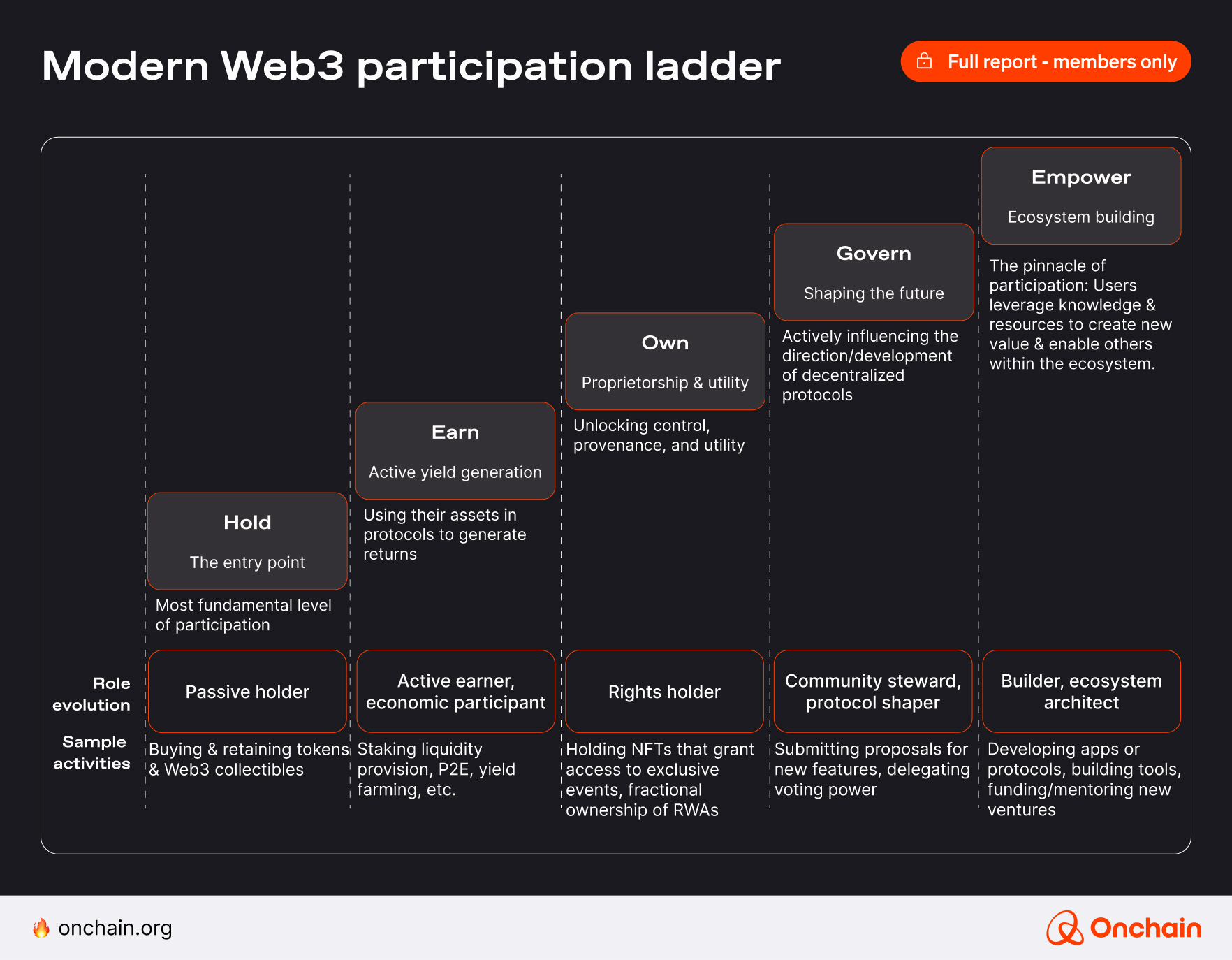

The Web3 space is maturing beyond its early focus on speculation. There is an increasing emphasis on real-world utility that’s fundamentally changing how users engage. Tokenization is a key driver in this evolution, democratizing access to value and empowering individuals to participate in ways previously limited to institutions.

We at Onchain introduce a new “participation ladder” to visualize this shift. The model describes how users today engage with the onchain economy, starting with passive holding and advancing to deeper, more capital-efficient participation. Informed by the insights from the key themes above, this ladder serves as a strategic lens for building tokenized products that align with evolving user engagement.

The opportunity? Builders who understand its dynamics will be best positioned to drive adoption and distribution for their own ventures.

Now that we’ve explored these key themes surrounding tokenization, you have to ask: What does all this mean for founders? Here’s where we get into the most promising areas where entrepreneurs and builders can leverage tokenization to create innovative solutions and build the future of Web3.

Your tokenization playbook: Build it right

ONE

The dollarized internet economy is here

ONE

The dollarized internet economy is here

From trading tools to solving real-world payment inefficiencies.

What can founders build?

💳 Enablement of FX-hedged payments and remittances (e.g., via USDT/USDC)

💰 Passive-yield integrations via stablecoins (e.g., USDY, USDM)

🌐 Onramps for low-fee, cross-border stablecoin UX

Bonus insight

🧠Design region-specific stablecoin experiences based on local adoption patterns (e.g., USDC in LatAm, USDT in Africa)

TWO

Micro-ownership without brokers

TWO

Micro-ownership without brokers

Fractionalization democratizes asset access.

What can founders build?

🧐 Curated tokenized asset marketplaces (e.g., whisky, art, livestock)

☝️ One-click ownership flows via self-custody wallets

🔌 Plug-in DeFi rails for secondary liquidity and yield

Bonus insight

🧠Fractionalization-as-a-Service; develop tools and APIs that other platforms can integrate fractional ownership features into their own offerings

THREE

Earn your own tokens (Data & DePiN)

THREE

Earn your own tokens (Data & DePiN)

Transform daily actions into income streams.

What can founders build?

🛜 Self-growing economic networks connecting data buyers and contributors

💲Reward engines that dynamically adjust incentives based on network need

💻 Dashboards for tokenized real-world earnings

Bonus insight

🧠 Partner with telecom providers to pre-install DePiN apps on devices in emerging markets

FOUR

Day trade the new internet

FOUR

Day trade the new internet

Attention flows are now composable, quantifiable, and onchain.

What can founders build?

👛 Wallet-based reputation scoring systems with token incentives

📶 Sentiment-driven point mechanics for high-signal content

🛒 Marketplaces for influence assets with clear value metrics

Bonus insight

🧠 Gamification of attention markets could create more dynamic engagement models, rewarding users for discovering and promoting valuable content

FIVE

Always-on liquidity

FIVE

Always-on liquidity

Disrupt TradFi with 24/7, borderless trading of tokenized capital markets.

What can founders build?

📱 Mobile-first, gasless trading interfaces for tokenized equities and ETFs

👷 Infrastructure for fractional, real-time equity flows and onchain dividends

🛑 Regulatory-aware APIs to tokenize real-world assets under compliant wrappers

Bonus insight

🧠 Adoption of L2 solutions can significantly reduce transaction costs and increase throughput, making 24/7 onchain capital markets more scalable

Practical implementation in these key areas hinges on a strong foundational understanding of tokenization itself. IXS supports this point.

Final takeaways

We have demonstrated how tokenization can unlock new forms of value transfer; however, the road to mass adoption is far from straightforward. Beneath the momentum lurk several hard constraints founders must address:

🔸 Regulatory headwinds: Fragmented rulesets slow institutional participation and add compliance overhead, especially across multiple jurisdictions.

🔸 Liquidity silos: Many RWA tokens still trade on isolated venues with thin order books, limiting price discovery and exit options.

🔸 UX friction: Self‑custody, gas fees, and complex on‑ramps keep mainstream users on the sidelines despite growing interest in yield and diversification.

🔸 Data and audit gaps: Not all projects offer transparent proof‑of‑reserves or real‑time asset reporting, heightening counterparty risk.

🔸 Business‑model uncertainty: Fee compression, token incentives, and unclear paths to sustainable revenue continue to challenge even well‑funded teams.

What does this mean for builders?

Success depends on directly addressing these limitations:

🔸 Treat compliance as a feature by embedding KYC, transfer rules, and jurisdiction filters at the protocol layer.

🔸 Aggregate fragmented liquidity through cross‑chain bridges, shared order books, or partnerships with regulated ATS venues.

🔸 Hide blockchain complexity behind consumer‑grade flows (social logins, gas abstraction, instant swaps).

🔸 Provide verifiable data streams, third‑party audits, and on‑chain attestations to build durable trust.

🔸 Align incentive design with real cash flows so that token rewards reinforce, rather than replace, product‑market fit.

Explore more Web3 insights by visiting our website, where you can browse all members-exclusive reports and our newly launched Funding Dashboard, highlighting precisely where capital flows in the blockchain ecosystem and where founders can best secure funding. Stay ahead – subscribe to the Onchain newsletter today.

Methodology

Scope & objectives

- Map the current state of tokenized assets and infrastructure (2024‑H1 and H2 2025).

- Identify mid-term and long-term founder opportunities across asset, infra, and application layers.

- Explain strategic implications for a fragmenting global economy.

Data inputs

Onchain analytics – RWA.xyz dashboards, Dune queries, and Visa Onchain Analytics snapshots that underpin charts on stablecoin volume, tokenized treasury AUM, and DePIN network growth.

Industry surveys – Reown × Nansen “State of Onchain UX”, Gemini “Global State of Crypto 2024”, a16z “State of Crypto 2024”, TGM Research “Crypto User Personas”, plus UX field reports from Coldchain, Spock, and Formo.

Peer‑reviewed work already quoted in the manuscripts

- Porter, M. E. (1979). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

- Botsman, R. (2017). Who can you trust? How technology brought us together and why it might drive us apart. PublicAffairs.

- Giddens, A. (1990). The consequences of modernity. Stanford University Press.

- Kim, W. C., & Mauborgne, R. (2005). Blue ocean strategy: How to create uncontested market space and make the competition irrelevant. Harvard Business School Press.

- Hizam, S. M., Ahmed, W., Akter, H., Sentosa, I., & Masrek, M. N. (2022). Web 3.0 adoption behaviour: PLS-SEM and sentiment analysis. Baltic DB&IS 2022 Doctoral Consortium and Forum (CEUR Workshop Proceedings).

Frameworks applied

- Porter Five Forces (Web3 adaptation) to size competitive intensity within each stack layer.

- Trust Vacuum, Purple Ocean, and Grey Ocean lenses to locate demand pockets and regulatory clarity gaps.

Research limitations

Theoretical frameworks are still evolving.

We apply strategic tools such as Blue Ocean Strategy (Kim & Mauborgne, 2005), White Spaces Analysis, Porter’s Five Forces (Porter, 1979), and emerging concepts like Trust Vacuum Theory, Purple Ocean Strategy, and Grey Ocean Strategy. While these frameworks provide valuable mental models for founders, many are adapted from corporate strategy or sociology and remain untested in Web3’s tokenization context. They should be seen as directional tools rather than fixed formulas.

Not every idea is backed by hard data.

Some frontier areas, such as tokenized IP rights, DePIN networks, or AI-based attention markets, lack robust quantitative benchmarks. Many examples are based on early traction, founder interviews from our Heroes Podcast, or protocol design intent. Interpret these insights as signals, not certainties.