A Time for Growth - Predictions from Web3 Experts

Guest Authors

Stacy Muur & The DeFi Investor

In this prediction:

- Stacy Muur sees AI dominating the first half of 2025. It will spark demand for identity solutions (Humanity Protocol, Worldcoin) and herald AI-driven portfolio managers, airdrop farmers, and rental traders. She expects chain abstraction to become standard, more DePIN consumer apps, and fundamentals-driven institutional analysis.

- The DeFi Investor anticipates a pro-crypto U.S. climate, leading to an altseason in Q1–Q2, major hype around Hyperliquid’s HyperEVM L1, and at least one more country adding Bitcoin to its reserves. He also foresees the Bitcoin cycle top in 2025, plus an “L1 rotation” trend that might echo the 2021 SoLunAvax craze.

They are deep inside the Web3 ecosystem and want to see it mature into a fruitful business landscape. They understand the significance of data – credible data – and knowledge as a foundation. That’s why they share their predictions for 2025 exclusively with the Onchain audience.

- The DeFi Investor, crypto analyst who publishes a dedicated DeFi newsletter with 13K subscribers and has over 132K followers on X

- Stacy Muur, Web3 marketer, passionate about research and data and devoted to crypto with 51K followers on X.

Stacy Murr: Predictions for 2025

Prediction 1:

In my opinion, AI will be a major focus in the first half of 2025. As AI agents become more sophisticated and widely adopted, the need for identity protocols to distinguish between AI agents and humans will arise. In this context, it makes sense to pay attention to identity networks like Humanity Protocol and Worldcoin.

Prediction 2:

In AI, we are likely to see the emergence of AI portfolio managers, airdrop farmers, and traders available for rental.

Prediction 3:

Chain abstraction will mature and establish itself as a user experience standard for DeFi applications.

Prediction 4:

More DePIN consumer apps like Grass are expected to enter the market in 2025, attracting more Web2 users to crypto.

Prediction 5:

As institutions enter the market, fundamentals will begin to be a core analysis metric, potentially pushing protocols like Pendle and Morpho into the top 100 on CMC.

The DeFi Investor: 🔎 My crypto predictions for 2025

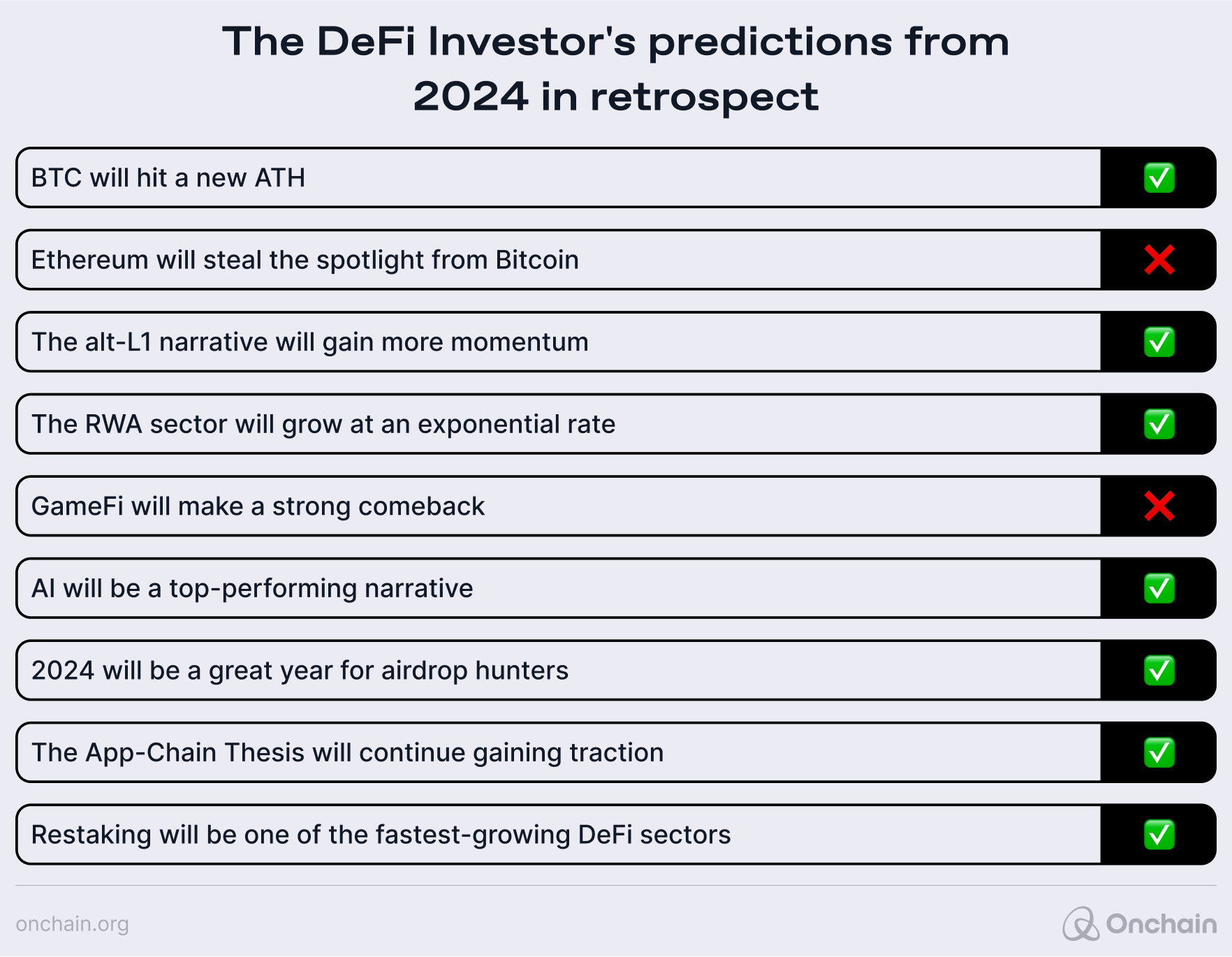

Last year, I wrote a thread where I made 9 predictions for 2024.

While not all of them came true, I believe I had a decent hit rate, so I thought it would be interesting also to share my predictions for 2025.

The best part of the bull cycle generally starts in the next year after the BTC Halving (2017, 2021, 2025), so I think the fun is not over yet.

Without further ado, let’s dive in👇

Prediction 1: The US will become very crypto-friendly

A lot of people seem to be wondering if Trump is serious about his pro-crypto stance.

I believe that the answer is yes, and here’s why:

Donald Trump’s World Liberty DeFi project has been buying several coins over the past weeks including ETH, AAVE, WBTC, LINK, and ENA

David Sacks, a big supporter of the crypto industry, was chosen as the next White House A.I. & Crypto Czar

The SEC chair that Donald Trump has chosen is a big crypto advocate

~300 pro-crypto candidates secured their seats in Congress this year

Vice President-Elect JD Vance owns up to $500k in Bitcoin

These are just a few of the things that make me think that the next few years will be great for the crypto projects that are based in the US.

Prediction 2: A massive altseason will happen in Q1 or Q2 2025

Not every altcoin will pump as there are now millions of different tokens.

But I expect BTC Dominance to drastically drop at some point next year, which could eventually lead to the beginning of a real altseason.

Currently, BTC Dominance is still close to annual highs. For context, no previous bull cycle has ended without a significant drop in BTC dominance.

And I highly doubt that this time is different.

I believe that AI, Real-world Assets, & Memecoins will be the hottest sectors in 2024, but we might also see a surge in the price of certain utility coins.

Prediction 3: Hyperliquid will become a top 6 L1 Ecosystem by TVL

Hyperliquid managed to hit some record numbers this year:

The perpetual DEX reached a maximum 24h trading volume of $15 billion

Its token HYPE reached a $35 billion FDV with no CEX listings

The total value of the HYPE airdrop hit $10 billion at the peak

But the main reason why I believe that the project will continue to shine in 2025 is that it has a major catalyst on the horizon:

The launch of HyperEVM L1 – a high-throughput EVM-compatible L1 blockchain developed by the Hyperliquid team for high-performance dApps

HyperEVM L1 will likely go live at some point in Q1 2025.

Many teams have already announced plans to launch their products on it.

Some notable mentions include Solv Protocol, Ethena, and Anzean Finance.

There’s already some insane hype around Hyperliquid and the release of Hyperliquid’s HyperEVM will only add more fuel to the fire.

My next prediction is the following:

Prediction 4: At least one more country will start buying Bitcoin

In 2021, El Salvador became the first country to adopt Bitcoin as a legal tender.

This year, the US, Russia, Poland, Japan, and Brazil have all started considering buying BTC as a national reserve asset too.

For instance, U.S. Senator Cynthia Lummis introduced a bill to build a strategic Bitcoin Reserve and acquire up to 1M Bitcoin over the next 5 years.

I believe that it’s likely that at least one major country will establish a national BTC strategic reserve in 2025 given the recent developments.

Prediction 5: The Bitcoin cycle top will be hit in 2025

We all want our bags to go up forever.

But realistically, a supercycle is unlikely to happen as BTC has historically always topped in the year after Halving.

Yes, institutional adoption is now happening faster than ever before. Yet the whales who bought BTC at $16k-$20k will eventually want to take profits.

I remember that in 2021 when BTC hit $69k everyone on Crypto Twitter was saying that “a supercycle is coming” and that “this time is different”.

Guess what: almost every single altcoin dropped over 90% after that.

My plan is to gradually sell my bags over the next year as I’d rather take profits too early than take profits too late.

Prediction 6: The L1 Rotation will be one of the most profitable trends

If you were paying attention to what was happening in this space in 2021, you probably remember the SoLunAvax L1 rotation.

Many tokens from fast-emerging ecosystems such as Solana, Luna, Avalanche, and Fantom had incredible runs at that time.

This year, Solana’s SOL and Hyperliquid’s HYPE also did incredibly well.

Many new hyped blockchains, such as Berachain and Monad, will finally go live in 2025, and this could help the L1 narrative gain more momentum.

With that being said, I’m very excited about what 2025 will bring.

If history repeats itself, the next months should be great for altcoin holders.

Thoughts of the Onchain research team

We appreciate how both Stacy Muur and The DeFi Investor spotlight AI’s growing impact on 2025. Some in the community remain wary of hype, though, wondering if AI-driven identity solutions or Hyperliquid’s big plans might stumble once the market calms down. Still, their optimism about chain abstraction, new L1 ecosystems, and institutional fundamentals echoes our own Onchain contributors:

- Kade (Crypto Prediction Markets): Sees AI arbitrage in outcome markets, aligning with Muur’s AI-run portfolio vision.

- Michal (DePIN): Shares Muur’s belief in more user-friendly apps like Grass to draw in mainstream users.

- Leon (Onchain AI Agents): Supports the idea of autonomous AI, which matches the call for identity solutions like Humanity Protocol.

- Max (Pro-Crypto US): Reflects The DeFi Investor’s upbeat stance on US regulations, which could boost altcoins and major L1s and L2s.

- Ananya (AI-Infused DeFi): Emphasizes advanced AI tools for real fundamentals, matching both Muur and The DeFi Investor’s focus on data-driven analysis.

Critics question whether narratives like AI, DePIN, or new L1s can really scale, but the excitement is real. Will 2025’s bold predictions converge to reshape Web3, or will some struggle to deliver? We’ll find out as these forecasts play out in the months ahead, but for now, it’s clear these thinkers see major opportunities on the horizon.