Modular Blockchains’ Uncompromised Scaling Will Win the Year

Ananya Shrivastava

Research Analyst

In this prediction:

- Why modular blockchains are poised for a comeback in 2025 and how data availability layers, sovereign rollups, and consumer L2s are reshaping the ecosystem.

- Which innovations — like Celestia, Avail, and Abstract — are pushing beyond the monolithic model and driving a new wave of scalability and flexibility.

- How “rollup-as-a-service” solutions reduce complexity and let developers quickly spin up custom blockchains that attract specialized communities.

- Where entrepreneurs can capitalize on consumer-centric L2s, real-world integrations, and business models that combine modular tech with user-friendly experiences.

- Actionable strategies for building in a modular world, from managing interoperability and liquidity fragmentation to hiding behind-the-scenes complexity so end users just enjoy faster, cheaper dApps.

The future of blockchain architecture

The conversation around blockchain scalability has reached a critical juncture. On one side, we have monolithic blockchains such as Solana and Sui, which focus on scaling every aspect of their network — consensus, execution, and data availability — within a single, integrated layer. This approach aims to push the limits of execution throughput at the base layer. It also builds on the hope that breakthroughs in hardware, parallelization, and optimized consensus algorithms will achieve high performance without fragmenting the system. It’s a bet on vertical scaling that relies on ever-more-powerful nodes and cutting-edge infrastructure.

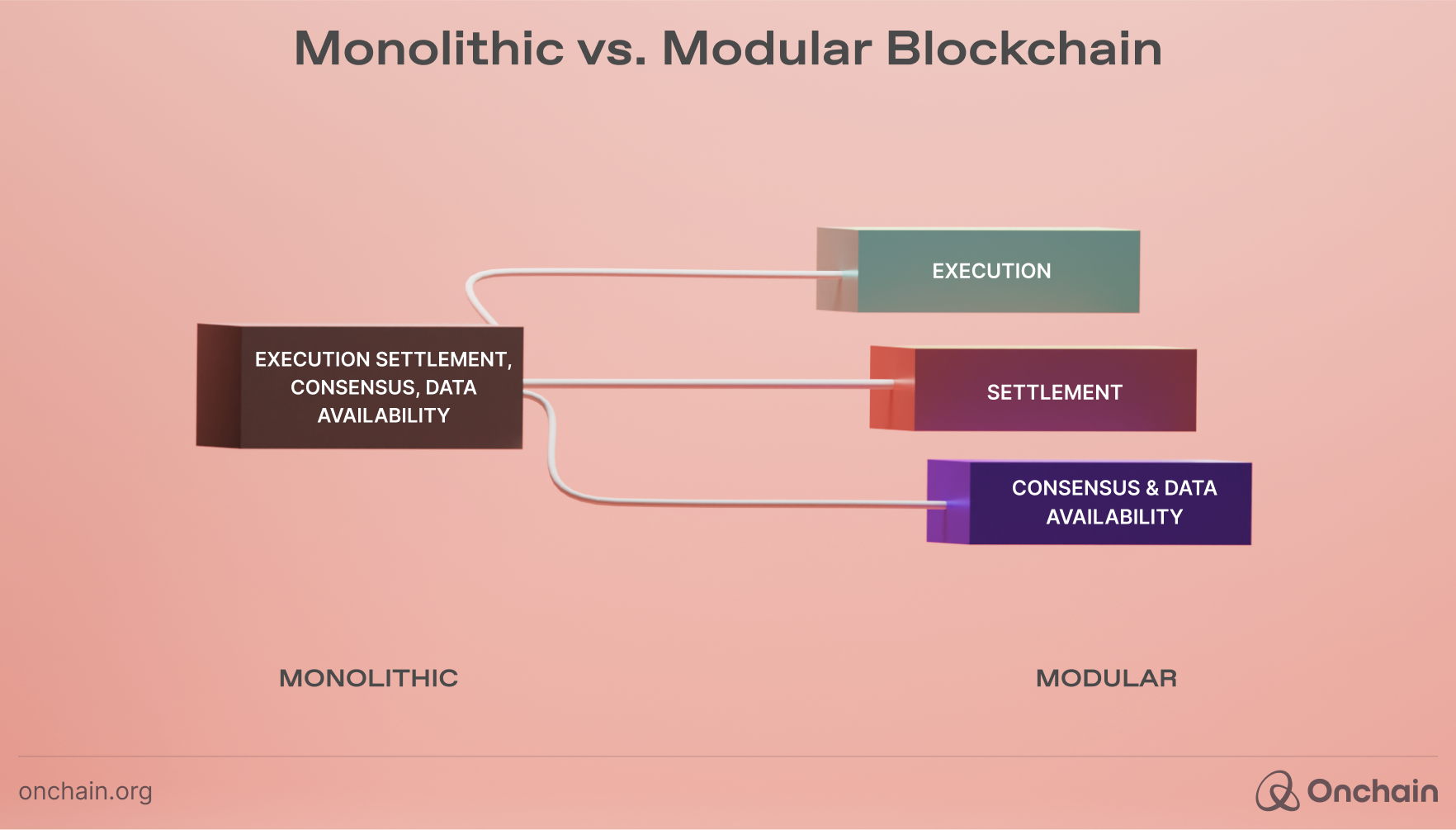

On the other side, another paradigm has emerged: modular blockchains like Ethereum. Instead of trying to handle everything in one layer, modular architectures break the blockchain into distinct layers: one for execution, another for data availability, and others for settlement or consensus.

Each layer is designed to specialize and scale independently, creating a horizontally scalable approach. Rather than pushing the entire network to scale as one massive, complex unit, modular blockchains let different pieces scale at their own pace, using rollups and external data availability layers to offload and optimize specific tasks.

The rise of modular blockchains

The concept of modularity in blockchain gained traction with the introduction of rollups by Ethereum. Vitalik Buterin envisioned a rollup-centric future for Ethereum, which was further solidified by The Merge, marking Ethereum’s transition to a fully modular architecture. As of December 2024, Layer 2 constantly handles >300 transactions per second (TPS) – scaling the performance of Ethereum by >20x.

The idea of modular blockchain is straightforward: by breaking down the core components of a blockchain (a.k.a. Monolithic blockchain) into separate layers (as shown in the figure above), we can significantly enhance each layer’s performance — sometimes by 100x. This creates a more scalable, flexible, and decentralized system.

This architecture enhances scalability and composability and also preserves decentralization and trustlessness, solving the long-standing blockchain scalability trilemma. We discussed the trilemma in our initial research report, “The Future Is Modular”.

Although the idea of modularity in blockchain is not new, its widespread adoption has accelerated only over the past two years. Cosmos stands out as one of the pioneers in implementing modular blockchain technology. The project implements a fully modular framework: execution, consensus, and DA exist separately and are connected through the IBC protocol for seamless interoperability across appchains.

Takeaway: Cosmos has demonstrated the modular concept but struggled to deliver the same scale of adoption as Ethereum. Ethereum’s network effects and the liquidity of its Layer 1 have solidified its position as the dominant platform for rollups and modular solutions. This points to the need for stronger network effects, liquidity incentives, and developer tooling to make modular blockchains competitive.

As we look toward 2025, modular blockchains are positioned to play a defining role in the evolution of decentralized systems. L2Beat currently tracks approx. 120 projects under the umbrella of “Scaling.” The modularization of Blockchain is expected to accelerate further in 2025, with the number of scalability solutions projected to exceed 2,000 by the year’s end—an approximately 17-fold increase from the current scale.

What to expect from modular blockchains in 2025

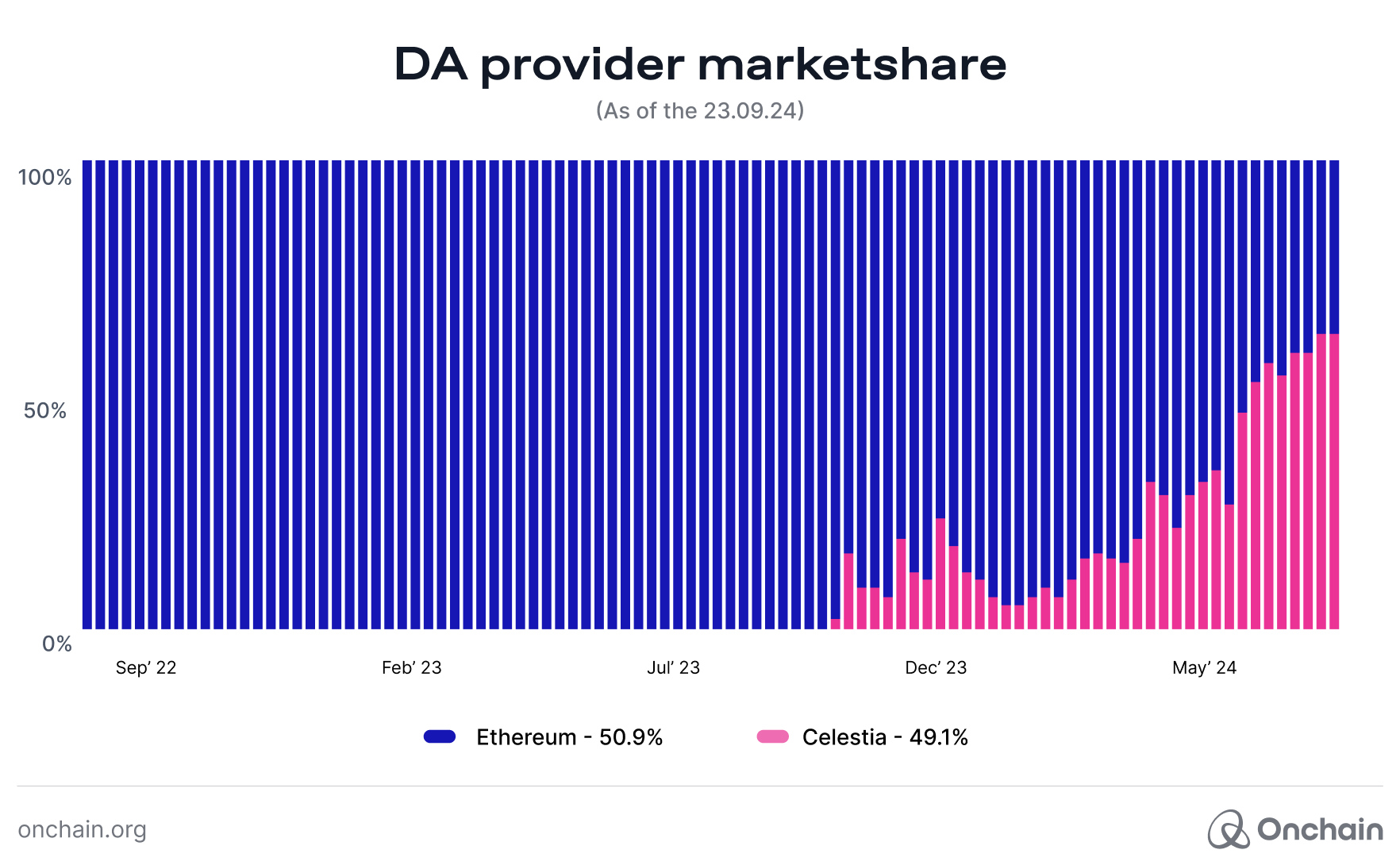

Modular blockchains are back in the spotlight! In 2024, we saw a surge in innovation, particularly around ‘Data Availability’ (DA). By October 2024, the market share of DA has increased to ~50% and is expected to continue gaining traction in 2025 as well.

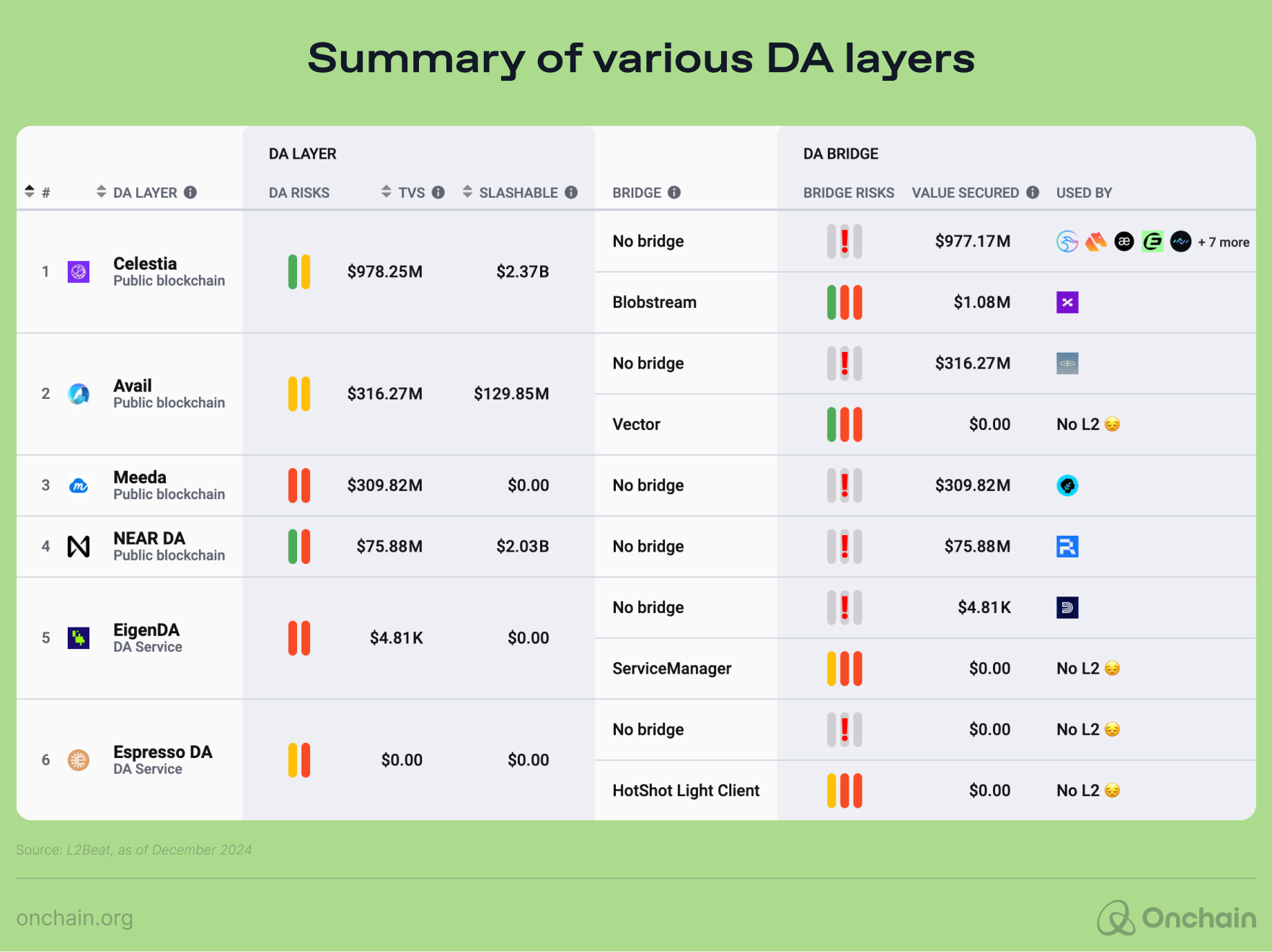

Think of DA as the bedrock of a blockchain. It ensures everyone can access and verify transaction information. Projects like Celestia, NearDA, Avail, and EigenLayer are leading the charge, offering specialized DA services that supercharge blockchain efficiency.

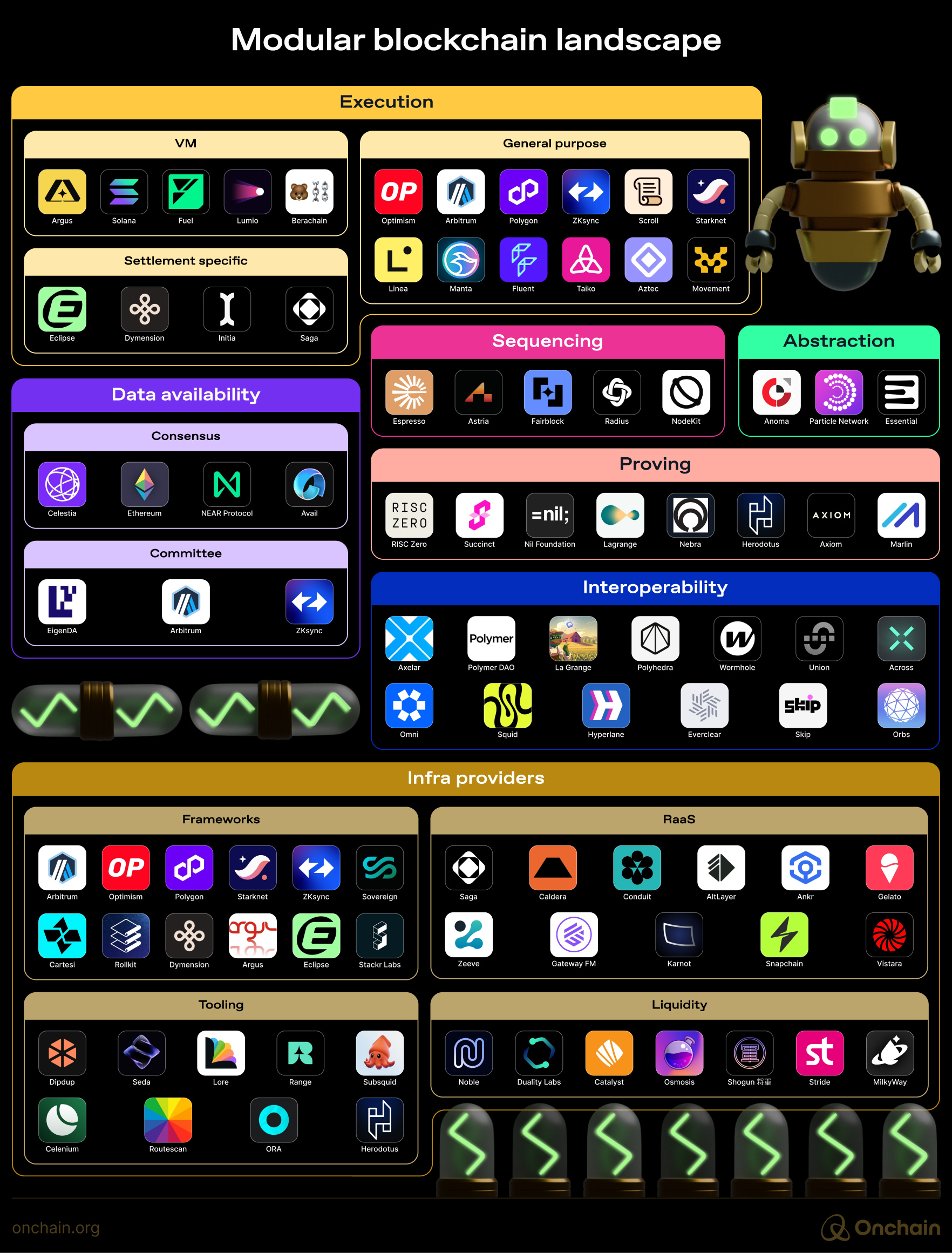

But it doesn’t stop there. The modular paradigm is unbundling the entire blockchain. It’s like taking apart a Lego creation. Now, developers can pick and choose specialized services for everything from executing smart contracts to achieving consensus and even proving transaction validity. This ‘mix-and-match’ approach unlocks incredible flexibility and scalability and paves the way for a new era of blockchain customization.

Data availability layers

“Don’t trust, verify” is a common rule in Blockchain.

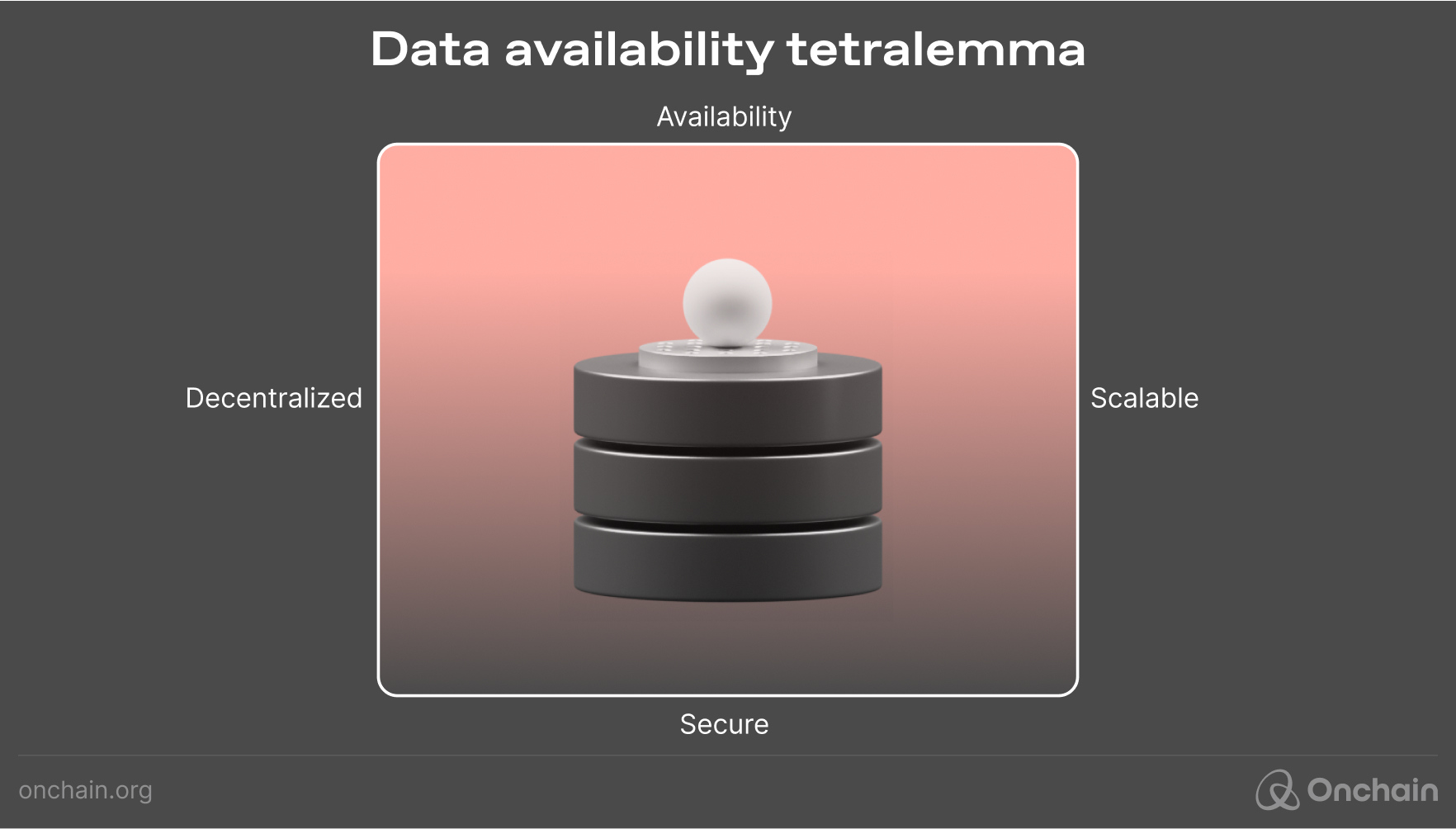

Data availability (DA) guarantees that all nodes in the network can obtain the necessary data to independently verify the validity of a block. This prevents fraud and ensures consensus. The data availability problem is perhaps the crux of the blockchain trilemma. It impacts all the scaling efforts, creating a data availability tetralemma.

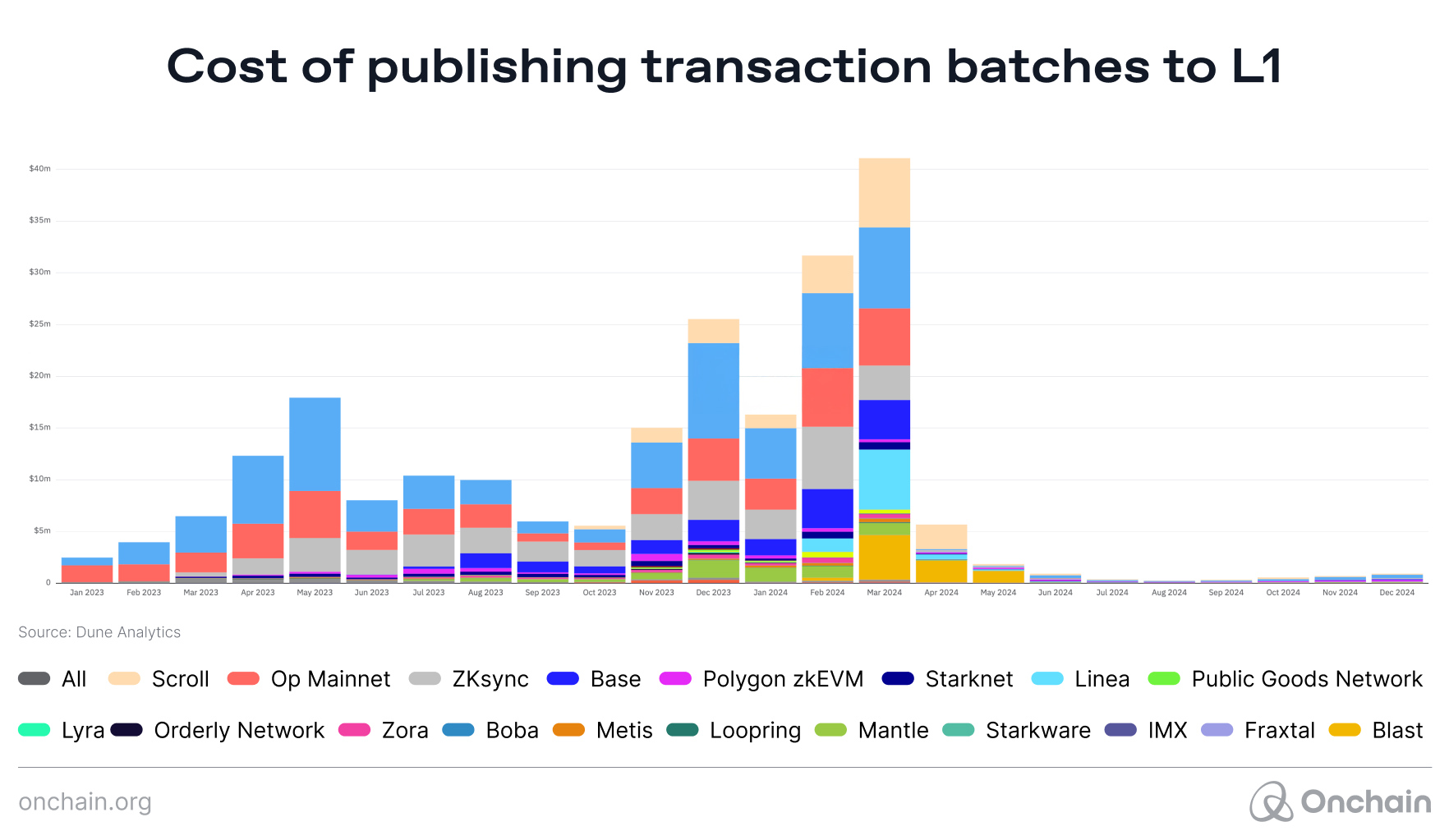

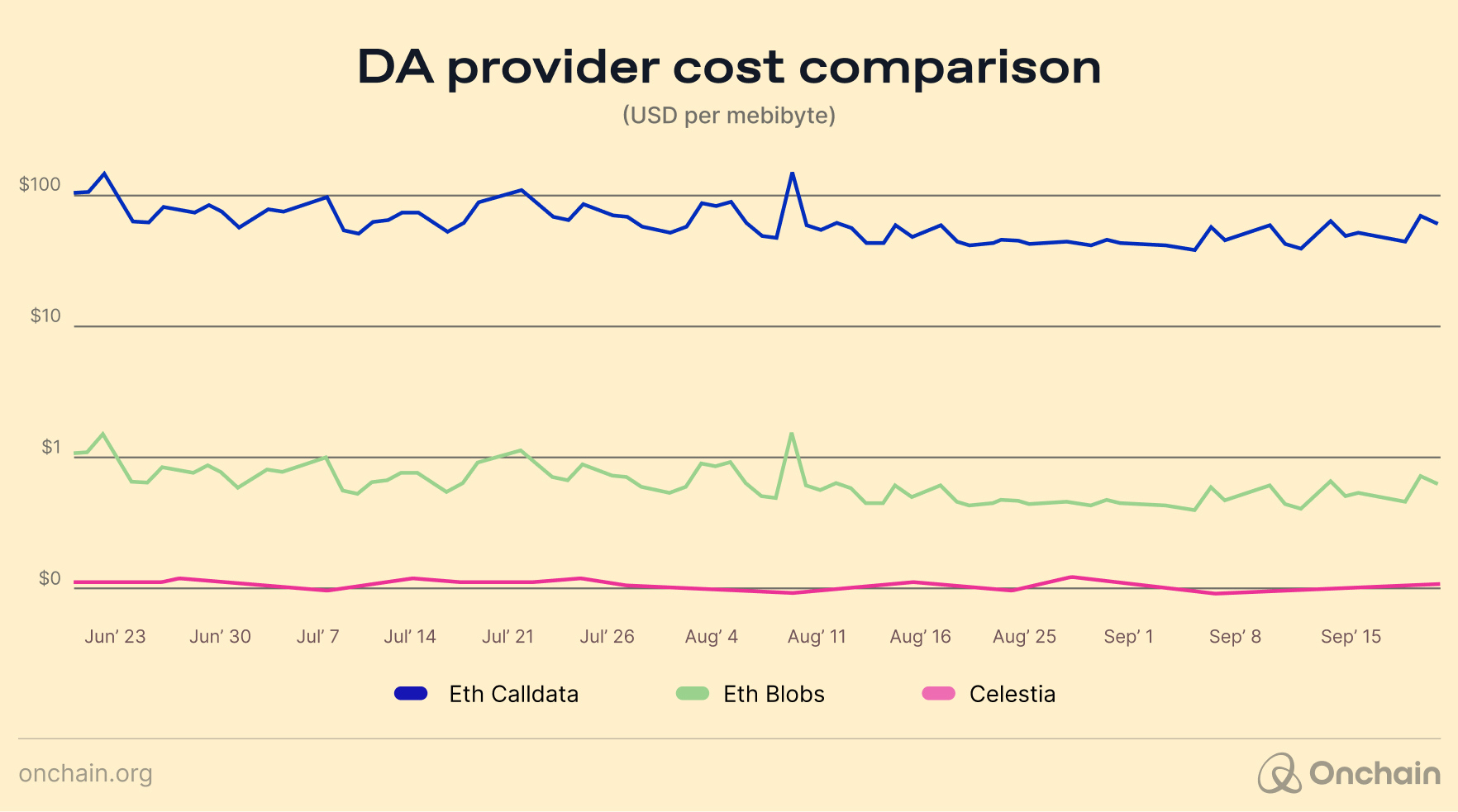

Many development teams now recognize that the primary bottleneck in blockchain scalability lies in DA, not execution. Regardless of how much Ethereum’s L2 technology advances, its performance will always be constrained by Ethereum’s limited DA speed (~15mins block time) and transaction batching cost.

Consider a future where 150 rollups on Ethereum are simultaneously competing for calldata. With DA being a critical resource, transaction fees are likely to increase, along with the number of L2 solutions. While Ethereum is working on updates for a more efficient DA layer, these improvements will take time to materialize.

As Ethereum’s Layer 2 rollup ecosystem expands, the demand for calldata space will intensify. Imagine a future where hundreds of rollups compete for Ethereum’s limited DA bandwidth. Transaction costs will likely rise, creating opportunities for modular DA providers to dominate the market.

Prediction 1: specialized DA solutions will see increased adoption, driving value accrual to DA infrastructure providers.

Projects like Celestia, Avail, EigenDA, and NearDA are leading the way in offering modular DA solutions.

This hints at an opportunity for entrepreneurs to build rollups that seamlessly integrate with DA providers like Celestia. It would ensure scalability without relying on expensive Layer 1 transaction data.

Benefits for entrepreneurs:

- Interoperability and flexibility: The chain-agnostic nature of solutions like Celestia and Avail enables businesses to build dApps or rollups compatible with multiple ecosystems. At the same time, they would expand their potential user base and avoid lock-in to a single blockchain.

- Scalability and customization: Modular blockchain architectures allow businesses to create tailor-made solutions that suit specific needs without the limitations of monolithic blockchains. This could be applied in various areas like DeFi, gaming, or enterprise applications.

- Lower costs and greater efficiency: Entrepreneurs can reduce infrastructure costs by outsourcing DA and consensus layers. This would allow them to focus on building core products. Projects like Celestia and Avail offer cost-effective solutions compared to Ethereum’s high transaction fees.

- For example, with 680K transactions processed, Celestia is roughly 5x cheaper to post (~0.0012 gwei fees per trade) than Ethereum blobs and utilizes just 10% of its current capacity.

- Faster time-to-market: By leveraging external DA and consensus providers, entrepreneurs can accelerate development timelines and deploy scalable blockchain solutions more quickly.

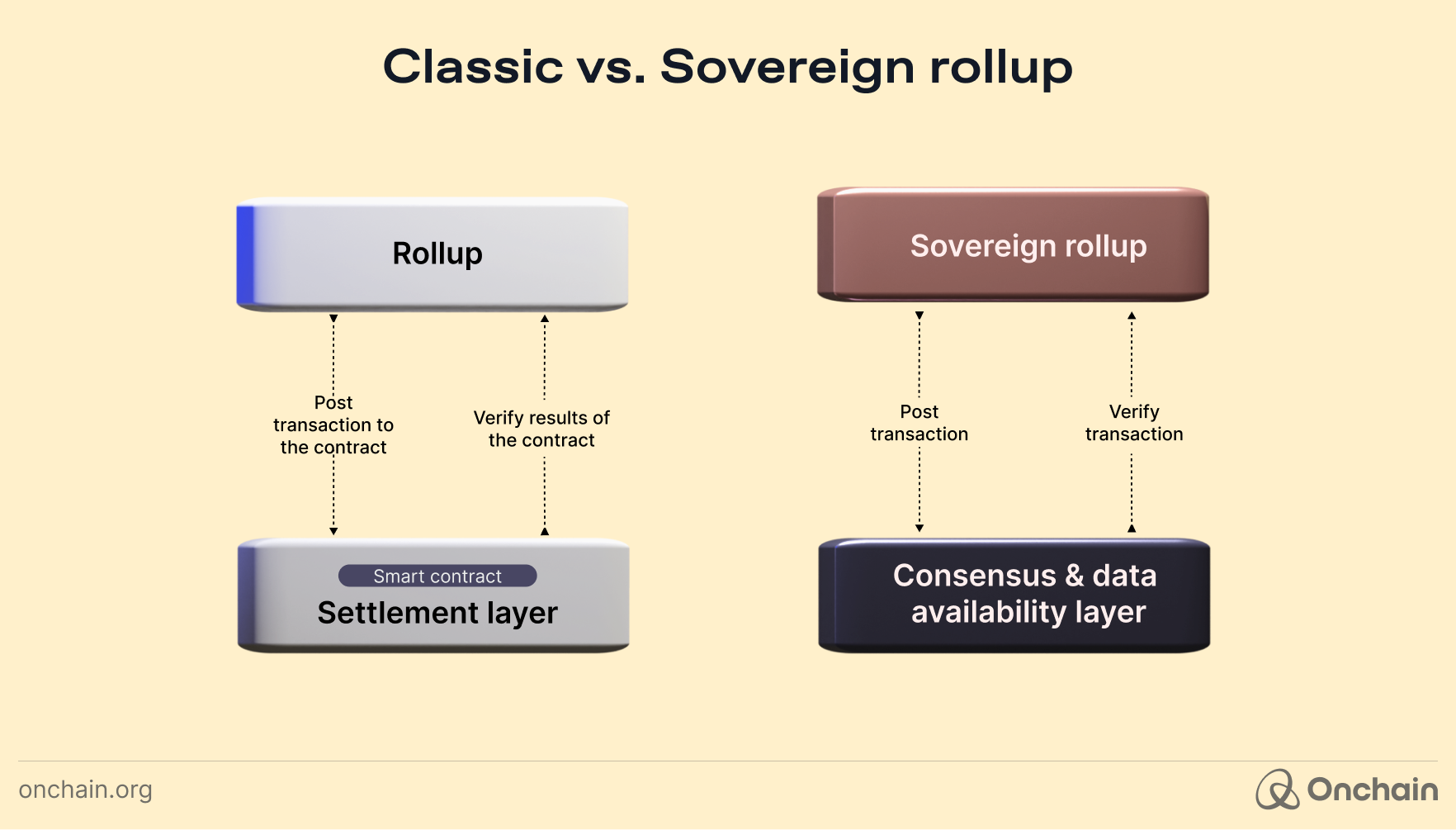

Sovereign rollups: A path to industry-specific innovation

The chain-agnostic approach by Celestia and Avail has fueled the rise of sovereign rollups bearing witness to the growing appeal of modular blockchain architectures. These specific rollups rely on external DA and consensus services.

Unlike traditional rollups that depend on Ethereum (or another L1) for consensus and Data Availability, sovereign rollups outsource these components to modular DA layers like Celestia, Avail, or others.

Projects like Rollkit, Dymension, Initia, and Saga operate in this sector. These rollups don’t lean on an L1 for governance, giving the developer full control over the execution environment, governance rules, and upgrade mechanisms.

Although sovereign rollup ecosystems offer significant advantages concerning transaction speed and lower fees, their security remains largely unproven. Separating a critical component, such as the data availability (DA) layer, introduces potential security trade-offs that need to be evaluated carefully.

Benefits for entrepreneurs:

- By using external DA layers, sovereign rollups achieve high throughput and scalability. This is especially beneficial for applications with high transaction volumes, such as gaming, DeFi, or social applications.

- Sovereign rollups avoid the high fees associated with L1 networks like Ethereum. By outsourcing DA and consensus to cost-effective modular solutions like Celestia or Avail, businesses can significantly lower operational costs.

- Entrepreneurs are not bound by the governance mechanisms or upgrade timelines of Ethereum or other L1s. Sovereign rollups give startups the flexibility to innovate without waiting for upstream improvements.

As we look toward 2025, sovereign rollups are not only addressing key limitations of existing blockchains but also opening the door to a wealth of new opportunities, from cross-chain interoperability to industry-specific rollup designs.

Prediction 2: Sovereign rollups will enable scalable, industry-specific innovation, unlocking new business opportunities for startups and enterprises.

Opportunities in 2025:

- Sovereign rollups are inherently chain-agnostic. Entrepreneurs can capitalize on this by building tools and services that facilitate seamless interactions between rollups and L1s, such as cross-chain bridges, oracles, and liquidity hubs.

- Entrepreneurs can develop sovereign rollups tailored to industries like finance, gaming, supply chain, or healthcare.

Some existing examples:

- A gaming-focused rollup like Argus with projects like Dark Frontier, optimized for microtransactions and NFT minting.

- A DeFi rollup like Osmosis (powered by Cosmos) and Neutron offers low-latency trading with cross-chain communication.

- Cross-chain interoperability will be a major growth driver. Sovereign rollups’ chain-agnostic design positions them perfectly for this trend. For example, Axelar’s Interchain Amplifier integration with Rollkit simplifies the development of interoperable rollups, making the process as straightforward as creating a smart contract.

“Opportunities are emerging rapidly in new ecosystems – we’re not far from a future where one in four transactions will be cross-chain”

- Georgios Vlachos, co-founder and director, Axelar Foundation.

- The growing competition among rollups for Ethereum DA will push transaction costs higher, incentivizing projects to explore sovereign rollups for better scalability and lower fees.

Sovereign rollups represent the next wave of blockchain innovation, combining scalability, autonomy, and flexibility to unlock unprecedented opportunities in the decentralized ecosystem. Entrepreneurs who embrace this technology early will be well-positioned to lead in a rapidly evolving and lucrative market.

Rollup-as-a-service: Accelerating customization

One of the emerging business models in 2024 (that will continue in 2025) based on modular blockchain design will be rollup-as-a-service (RAAS). RaaS refers to a service that provides infrastructure, tools, or support for projects wanting to implement rollup solutions without having to build the entire stack themselves. These services handle the complexities of rollup architecture, including execution environments, Data Availability (DA), consensus, and interoperability, while allowing clients to focus on their core application logic.

Arbitrum and Optimism are two leading RaaS platforms that simplify the creation of Layer 2 blockchains. Arbitrum provides RaaS solutions through Arbitrum Orbit, enabling developers to build and deploy custom rollups with enhanced flexibility.

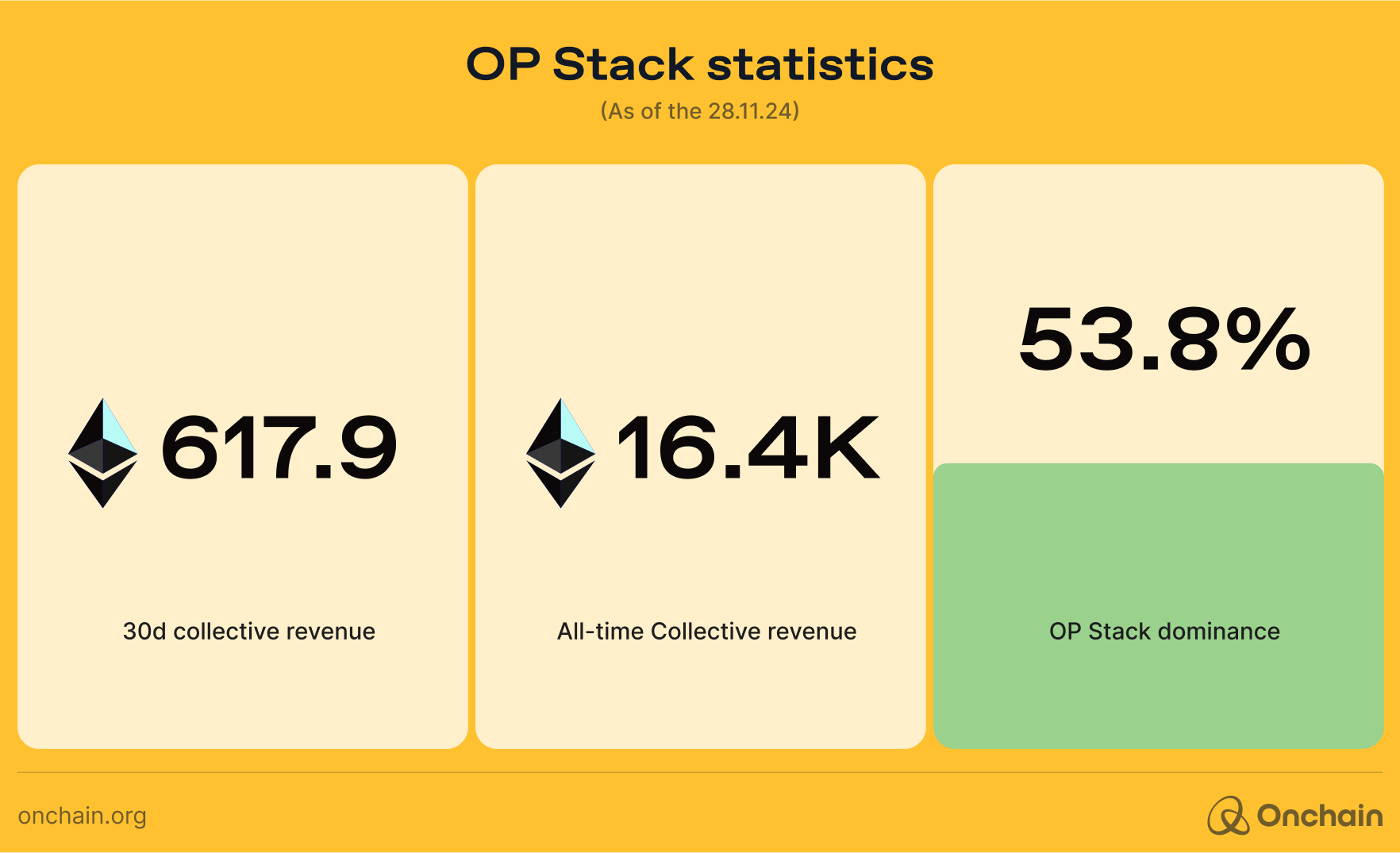

Optimism, on the other hand, offers the OP Stack, a modular framework for building Layer 2 solutions, as well as the Superchain ecosystem, which facilitates interoperability and scalability between chains within its network.

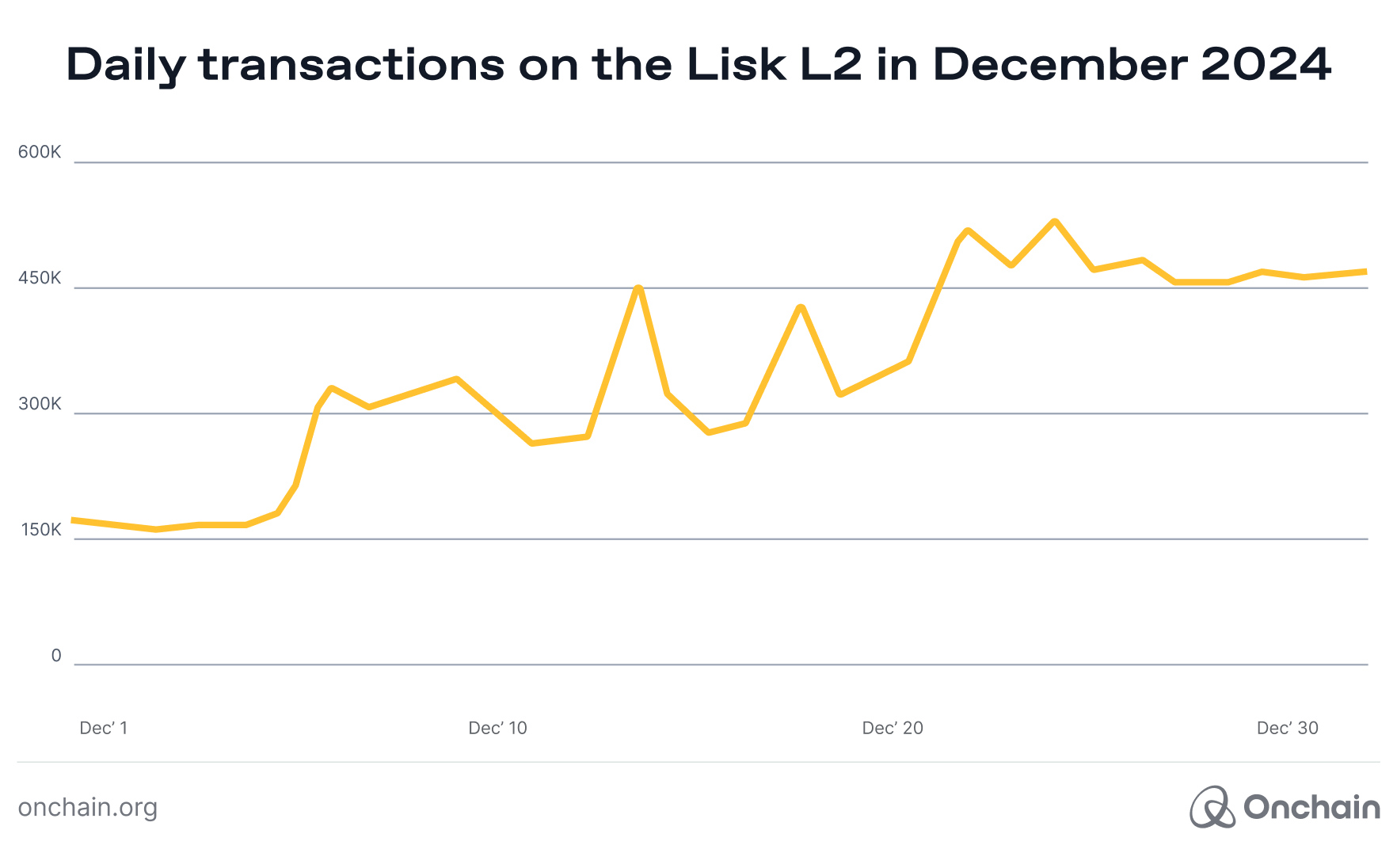

For example, Lisk is the fastest growing rollup on the Optimism Superchain by transaction volume since its launch on mainnet, ramping up +84% growth as of December 10, 2024. This ranks Lisk as the 2nd largest RaaS rollup on the Superchain and the 8th rollup on Ethereum.

With Lisk achieving remarkable growth in transaction volume and positioning itself as a leader among RaaS rollups, the adoption of customizable rollups is an emerging trend in the blockchain space.

Now, let’s explore the specific benefits RaaS offers to entrepreneurs and why it’s an attractive option for startups and enterprises alike.

Benefits for entrepreneurs:

- If developers choose to design their own customized rollup, they can capture the settlement fees and design a sustainable business model for their project.

- Just take the example of Lisk above, where developers can create scalable applications while benefiting from the fees generated on their network. Its rapid growth highlights the profitability of customized rollups within an established ecosystem.

- By operating a separate rollup, businesses can avoid the congestion seen in general-purpose Layer 1 blockchains such as Ethereum. This improves transaction speed, reduces costs, and enhances the overall user experience, especially for applications with high activity.

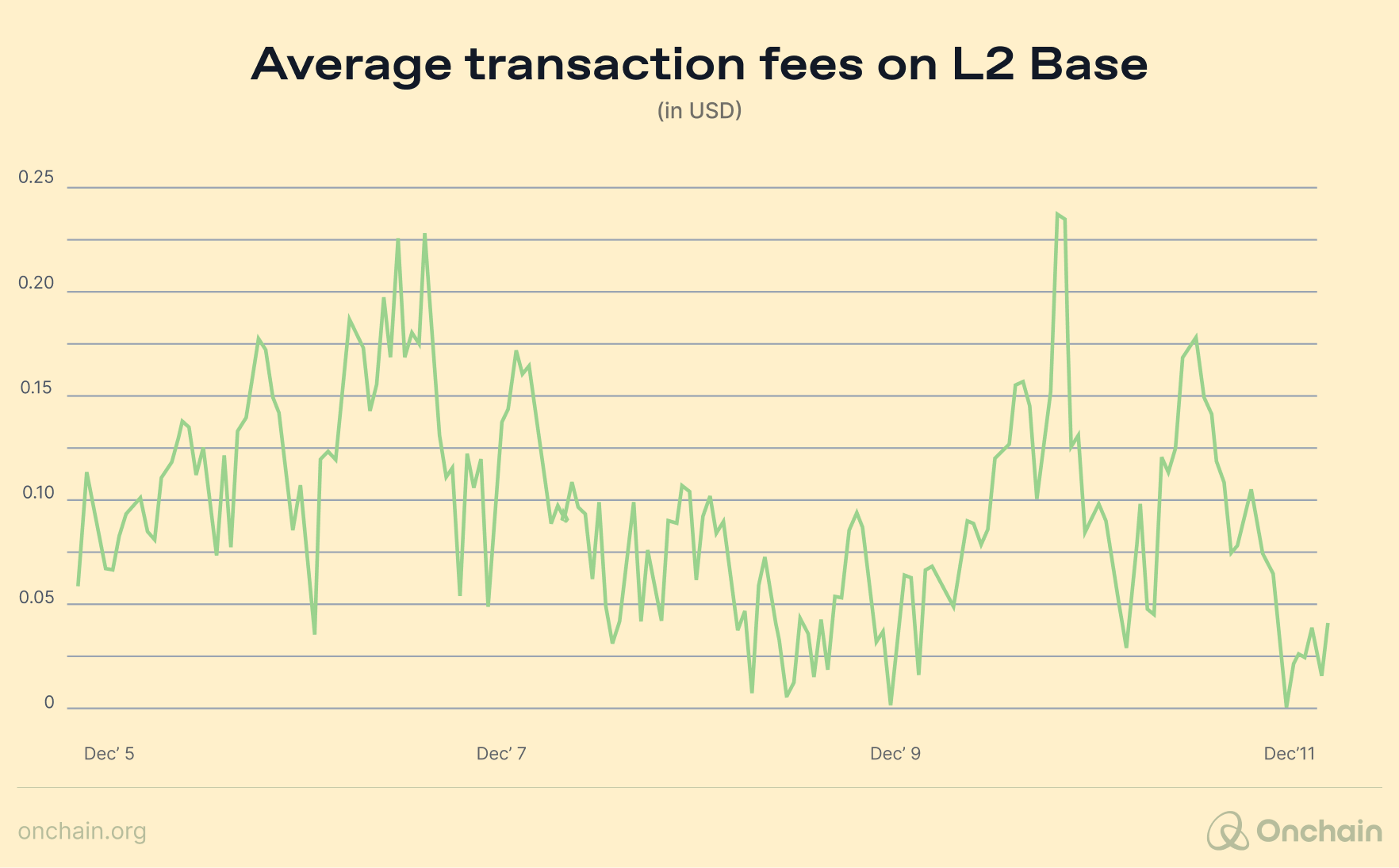

- For example, Base, Coinbase’s Ethereum rollup, provides fast and cost-effective transaction processing for its ecosystem, enabling smoother interactions for decentralized finance (DeFi) and gaming applications.

- RaaS eliminates the need to invest heavily in blockchain development teams and infrastructure, making it a cost-effective solution for startups and enterprises looking to scale quickly.

As more RaaS solutions become available, the opportunities for entrepreneurs to innovate and capture value in the blockchain space will continue to expand.

Opportunities in 2025:

- As modular architectures become the standard, RaaS providers are well-positioned to help businesses leverage the benefits of modularity without requiring in-depth technical expertise.

- Entrepreneurs can launch DAOs on RaaS platforms, taking advantage of their scalability, low costs, and ability to integrate across multiple ecosystems.

- With the projected rise of over 2,000 modular scaling solutions in 2025, RaaS providers have a massive market to capture. This growth is further fueled by enterprises transitioning to blockchain and the increasing demand for chain-agnostic rollup solutions.

L2s for consumer crypto

Why should an average user need to grasp the concept of “blockchain” to enjoy the app? The focus should simply be on having fun and engaging in-app activities.

Looking ahead, the future of L2 solutions will lie in creating user-centric applications that simplify the transition to Web3 by abstracting complex blockchain processes. These solutions will focus on enhancing the user experience and making decentralized technologies more accessible and intuitive for everyday consumers.

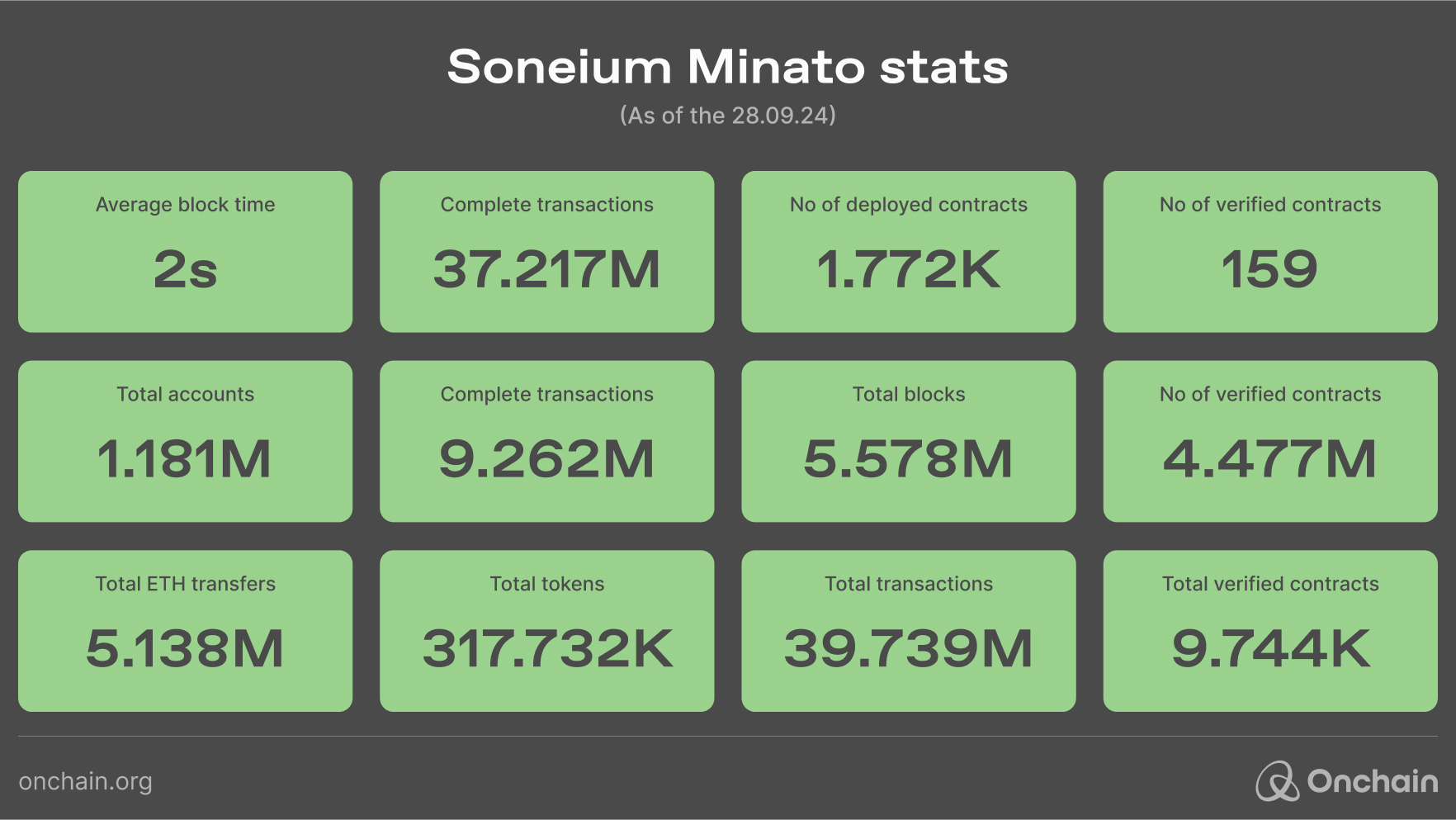

For example, the introduction of Soneium (backed by Sony’s global reach and Startale) in August 2024, an L2 solution dedicated to consumer-centric use cases, highlights this trend. Within a few months since the launch, it has seen a remarkable growth of ~1.19M accounts on the platform due to the growing number of real-world applications like mintpass, Capsule, and Yay.

Another interesting blockchain that aims to redefine how the current chains work is Abstract, which was developed by Igloo Inc., the parent company of the Pudgy Penguins NFT project and Cube Labs. True to its name, Abstract seeks to simplify the user experience by hiding blockchain complexities. Users can sign up with Google, explore apps via an intuitive “App Store,” and interact directly with dApps through the Abstract wallet. This creates a seamless entry with a focus on native account abstraction.

Set to launch in January 2025, Abstract promises to redefine user onboarding and accessibility in the Web3 space. It’s a project worth watching as it rolls out next year.

Prediction 3: 2025 will see a surge in consumer-focused Layer 2 networks that make Web3 applications accessible, scalable, and user-friendly.

Challenges in designing modular blockchain solutions

Regardless of which solution or implementation gains widespread adoption, building on modular blockchains tends to be more complex than on a common blockchain. It starts with an extensive learning curve for both developers and users. Let’s investigate the key obstacles and how they impact the broader ecosystem.

- Fragmentation of ecosystem: Modular blockchains introduce increased specialization, with different layers (execution, consensus, DA, and settlement) provided by different entities. This fragmentation can lead to interoperability issues and a lack of standardization, making it harder for applications to interact seamlessly across ecosystems.

"The interchain stack of Cosmos served us well in rapidly iterating on the Celestia vision."

- Ismail Khoffi, Celestia

- Security issues in decoupled layers: By decoupling different layers, modular blockchains introduce additional attack surfaces. For instance, a rollup that relies on an external DA layer may face risks if the DA provider is compromised or fails to operate as intended.

- Solution: Strengthen the security mechanisms of individual layers, implement cryptographic proofs like fraud proofs or validity proofs, and introduce decentralized governance for DA and consensus providers.

- Liquidity fragmentation: Modular blockchains contribute to the issue of liquidity fragmentation, a challenge also present on Ethereum. With dozens of modular blockchains operating independently, the separation can create barriers to seamless asset movement and negatively impact user experience.

- Solution: The obvious and straightforward solution to this problem is interoperability protocols that can be used by modular blockchains offering high composability.

Conclusion

While modular blockchains made a strong comeback in 2024, 2025 will determine whether they can deliver on their promise at scale. Innovations like data availability layers, sovereign rollups, and consumer-focused Layer 2 networks have set the stage for a more flexible and scalable blockchain ecosystem. However, for modular blockchains to truly succeed, the focus must shift toward the user layer.

In the coming year, the focus will shift to execution, integration, and new frontiers:

- Data availability layers will evolve into the bedrock of blockchain scalability, addressing Ethereum’s limitations and powering the next generation of rollups.

- Sovereign rollups will extend beyond experimentation, delivering customized, industry-specific solutions for DeFi, gaming, and enterprise applications.

- Consumer Layer 2 networks will move from niche successes to mainstream adoption, creating user-centric applications that simplify Web3 for everyday users.

At the end of the day, most users won’t care how modular your blockchain is or how it “inherits security.”

For widespread adoption, the complexity of modular systems must remain concealed behind seamless, intuitive applications. Users shouldn’t need to spend 50 minutes deciphering “inheriting security”. They just want faster, cheaper, and better experiences.

The modular comeback has already begun. Now, it’s time for modular blockchains to prove they can lead the next phase of Web3 evolution.

Thoughts of the Onchain research team

Back in early 2024, we released our first major research piece, The Future Is Modular, championing the potential of modular blockchains. We’ll admit, the value accrual to Ethereum and its ETH token since then has been underwhelming for some. Yet here we are in 2025 and the “modular thesis” is more alive than ever.

Base has shown just how much consumer-facing innovation can flourish atop Ethereum’s modular layers. Sony and even Deutsche Bank are eyeing L2 networks built on Ethereum’s architecture.

From our perspective, all this stresses the viability of modular designs in 2025 and beyond. We at Onchain are thrilled to see projects like Abstract and Soneium hiding technical complexities behind slick user interfaces, as well as sovereign rollups unleashing specialized solutions in gaming, DeFi, and more.

Granted, monolithic ecosystems like Solana and Sui still pose tough competition, and bridging liquidity, security, and education gaps remains challenging. But if modular architectures truly “cross the chasm,” we believe it’ll be thanks to founders delivering easy, intuitive dApps — exactly what we envisioned in The Future Is Modular — that make the benefits of modular blockchains undeniable. Let’s see who seizes the moment.