3. New Frontiers: Where Identity, Data, and IP Become Market

You’ll learn:

- Which non-financial assets are gaining traction onchain and why they matter.

- How tokenization is opening up entirely new creator, consumer, and compute economies.

- Where early movers are experimenting with IP rights, data marketplaces, and education rails.

- How identity and reputation systems will anchor trust in the tokenized world.

- How frontier markets differ, and where founders can build without chasing or partnering with TradFi.

This chapter explores the next phase: the unconventional, high-upside, still-open asset categories that are just beginning to move onchain. These are assets no one expected to be tokenized just a few years ago — things like AI-generated intellectual property (IP), rare spirits, agricultural futures, education credentials, and even DNA sequences, time, or deep space assets.

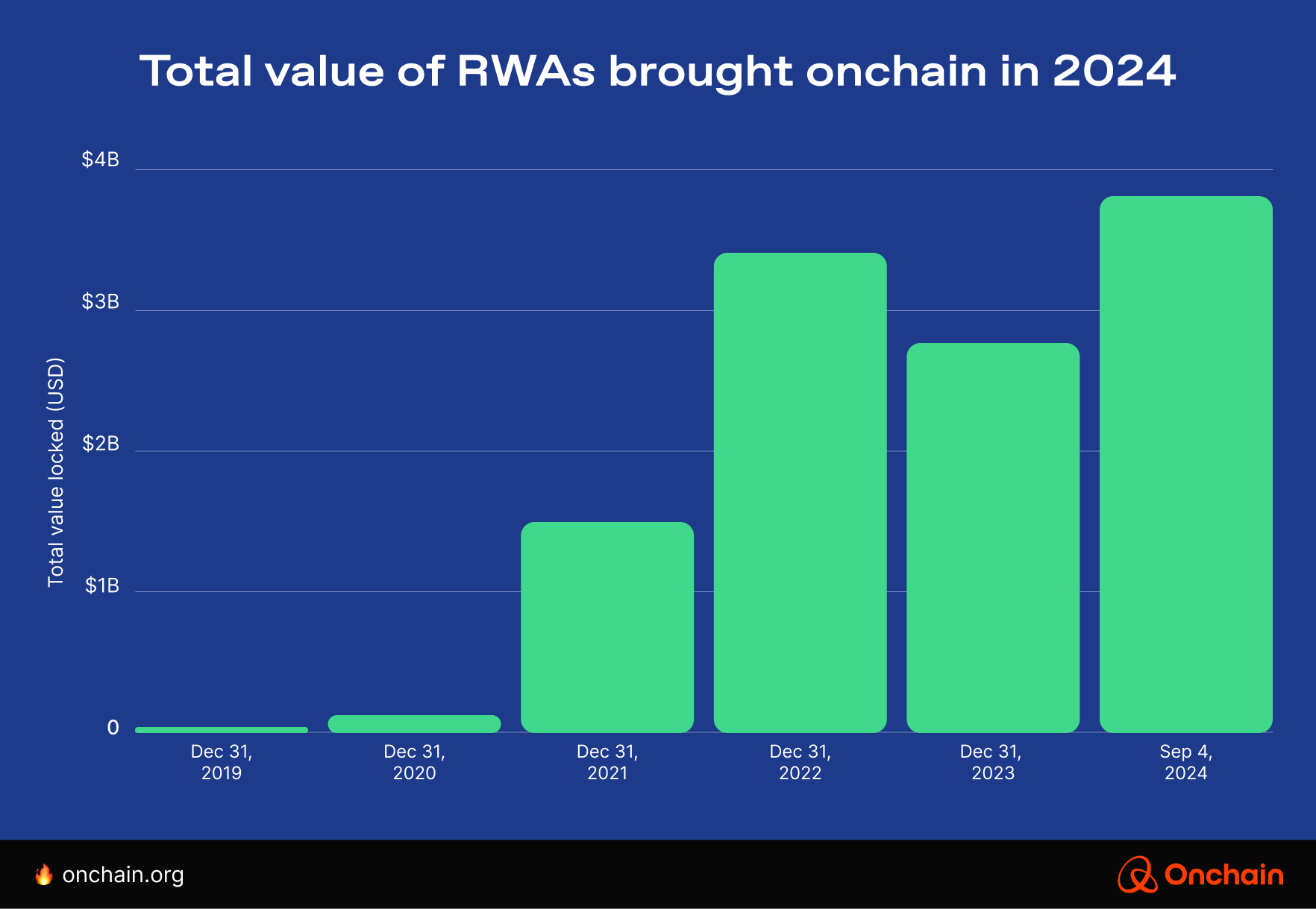

This wave of innovation builds on significant prior momentum: By September 2024 alone, $3.9 bil in real-world assets (RWAs) had already been brought onchain (excluding stablecoins).

Most new categories are still in their initial phases. That is what makes them interesting and open.

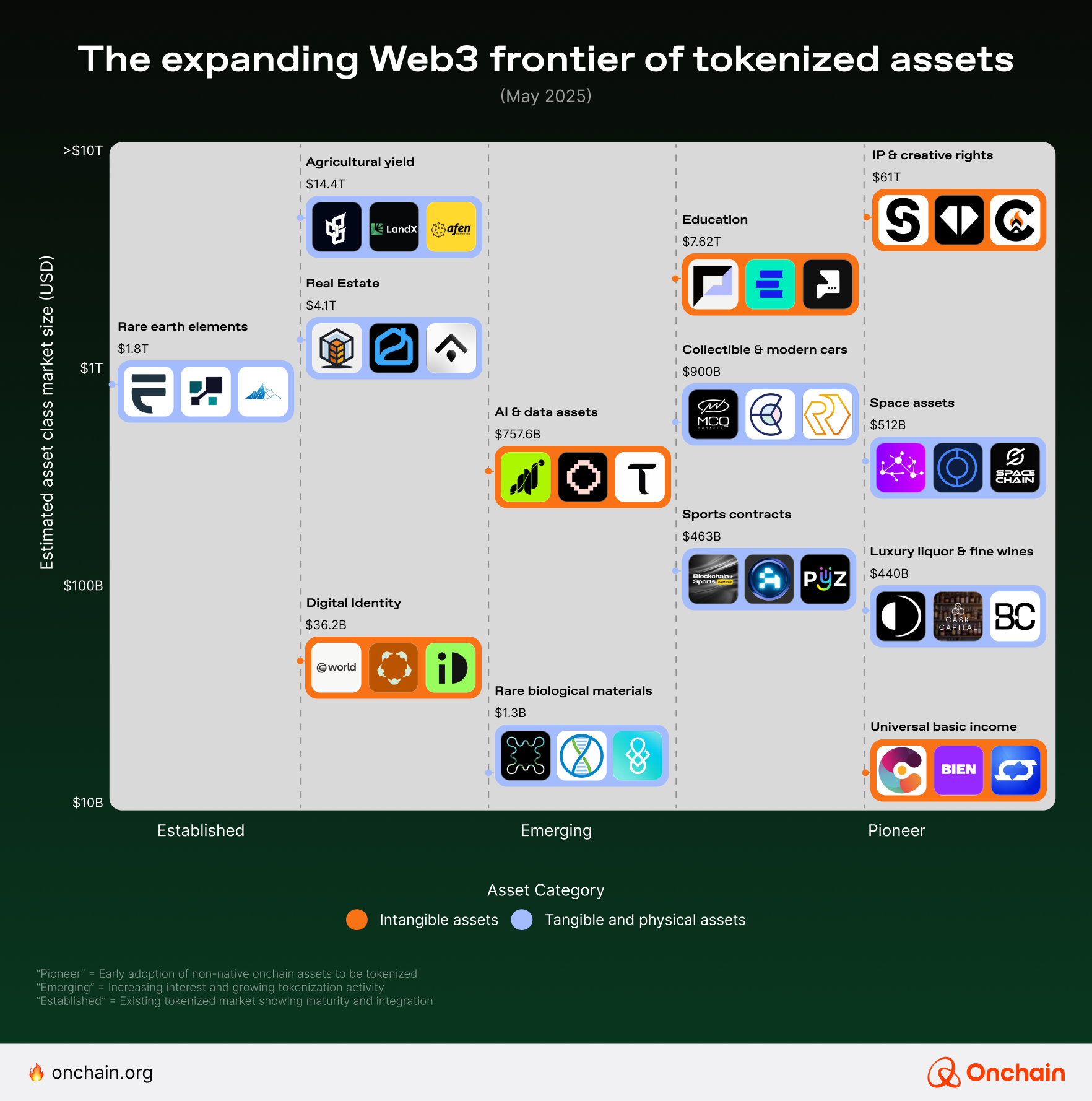

To help visualize this extensive landscape, we have mapped out the tokenized assets below. It’s a snapshot of where novel tokenized assets are being tested and where founders can shape the playbook.

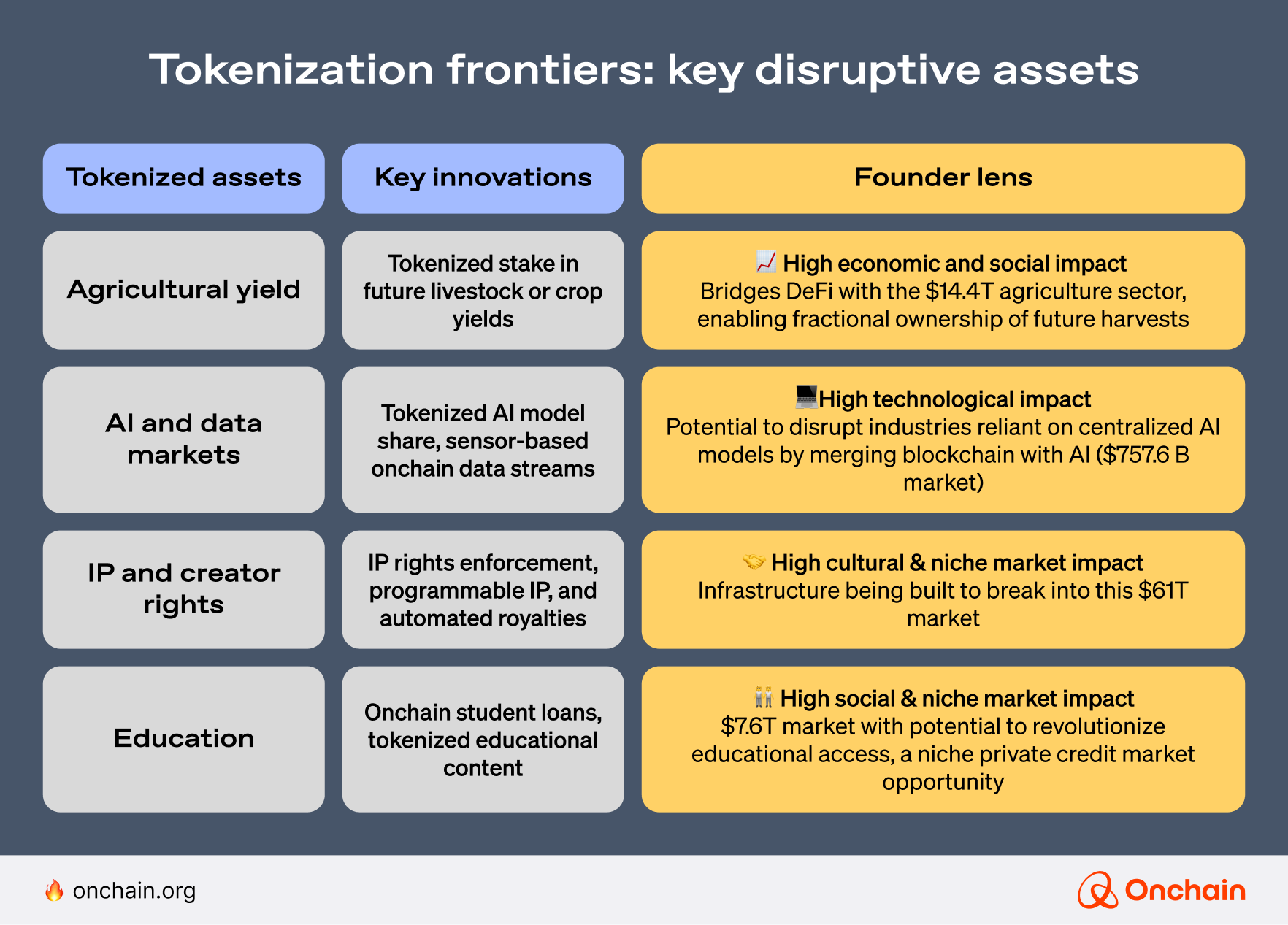

Some asset classes stand out for their potential impact to disrupt the industry. We’ve highlighted a few examples below that represent emerging paradigms and the core innovations that redefine what’s possible.

These new tokens characterize entirely new paradigms for ownership and coordination. Unlike previous financial innovations led by traditional institutions, this frontier is being actively shaped by indie developers, research DAOs, AI agents, and creator networks.

Which brings us to one of the most compelling categories on this list: IP.

3.1 Future-proofing creativity: Tokenized IP and creator rights

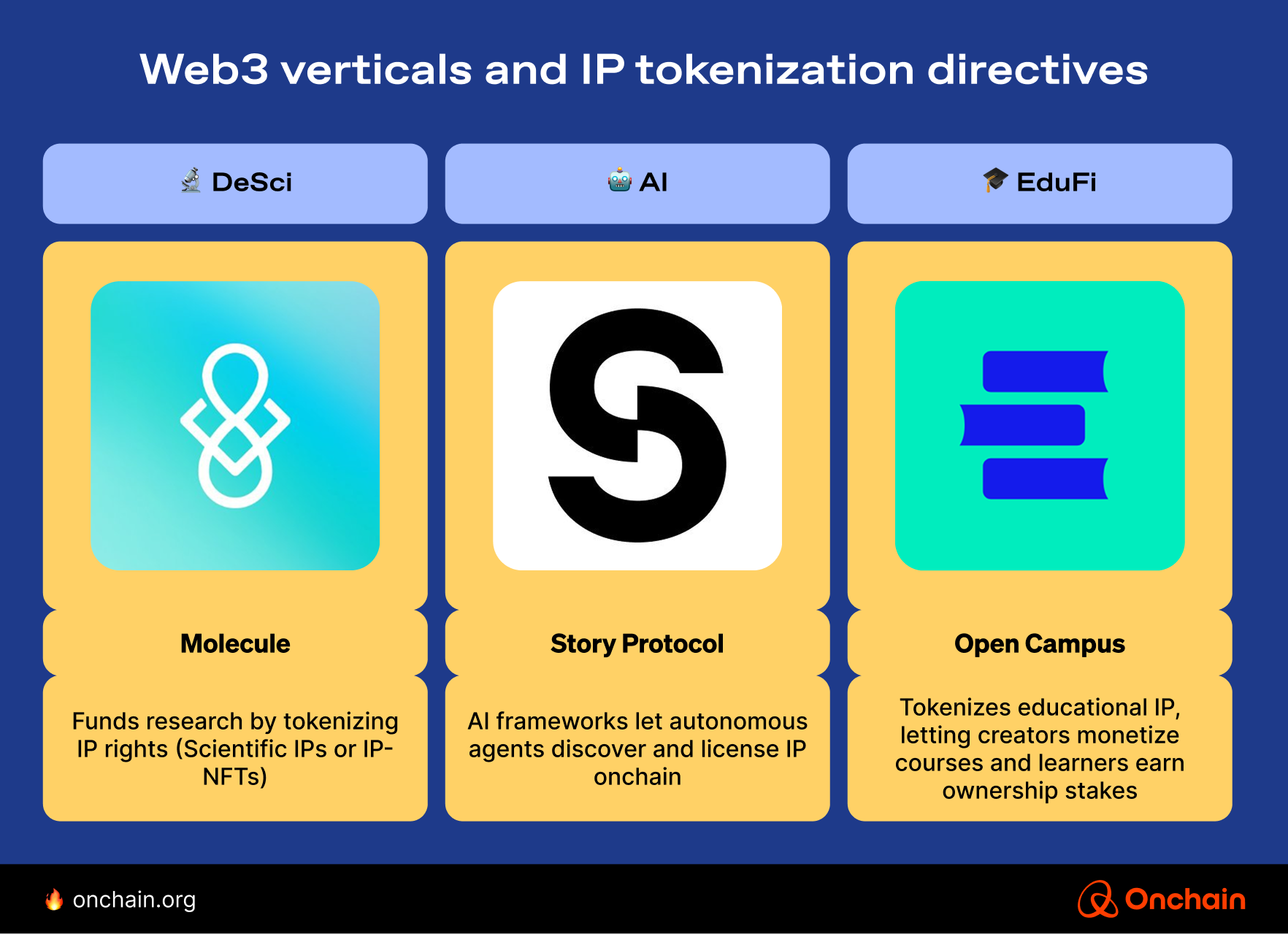

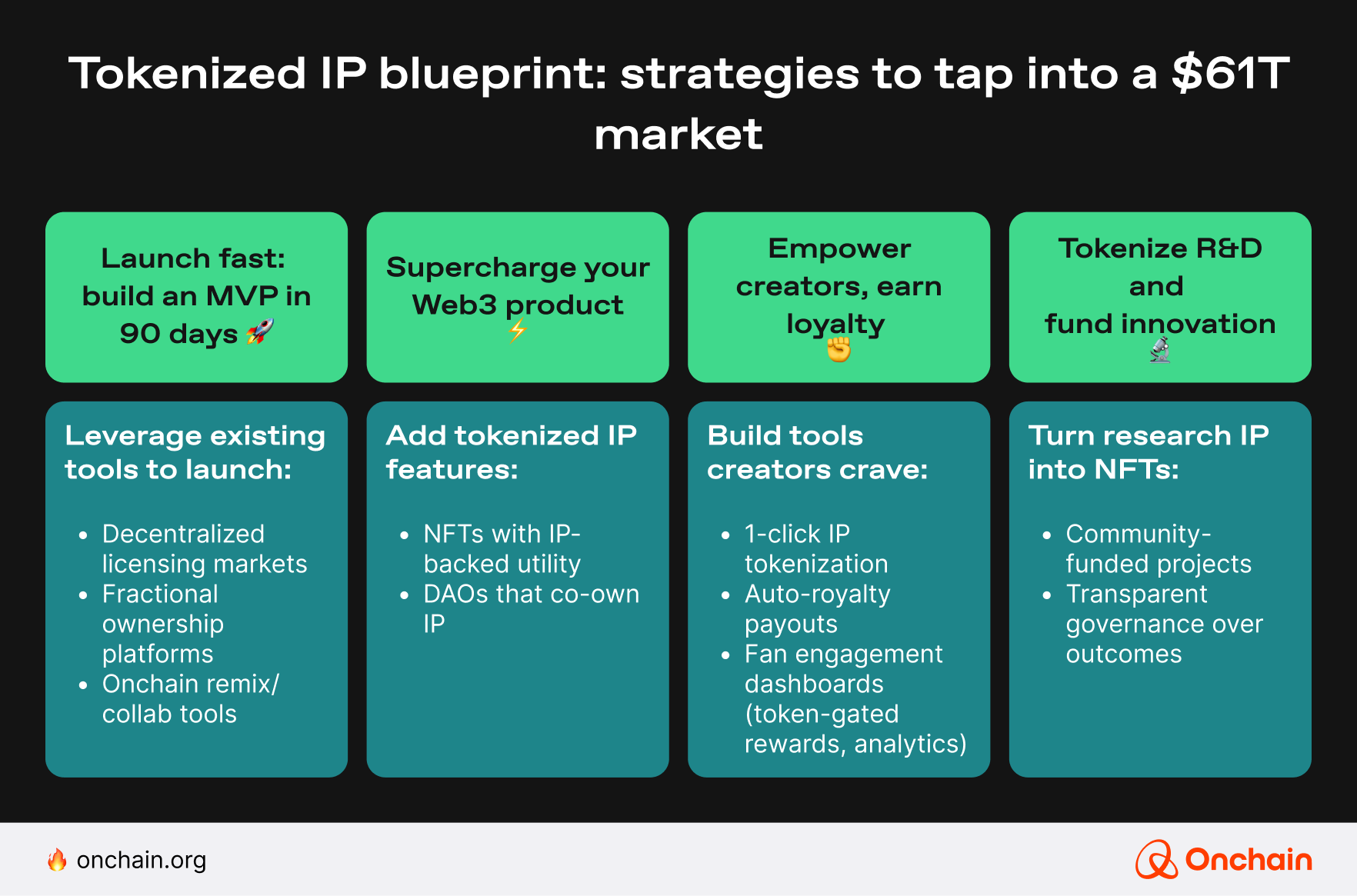

The $61 tril+ IP market faces challenges with outdated legal frameworks. Tokenization offers a solution by transforming static IP into liquid, programmable onchain assets. It lays the essential groundwork for a decentralized “ownership layer” in the digital economy. Pioneering initiatives emerge across diverse Web3 verticals:

Tokenizing IP offers a direct line to disrupting outdated systems in the massive IP market. For founders, it’s a prime opportunity to empower creators with true ownership and monetization, while building the next generation of value-driven platforms.

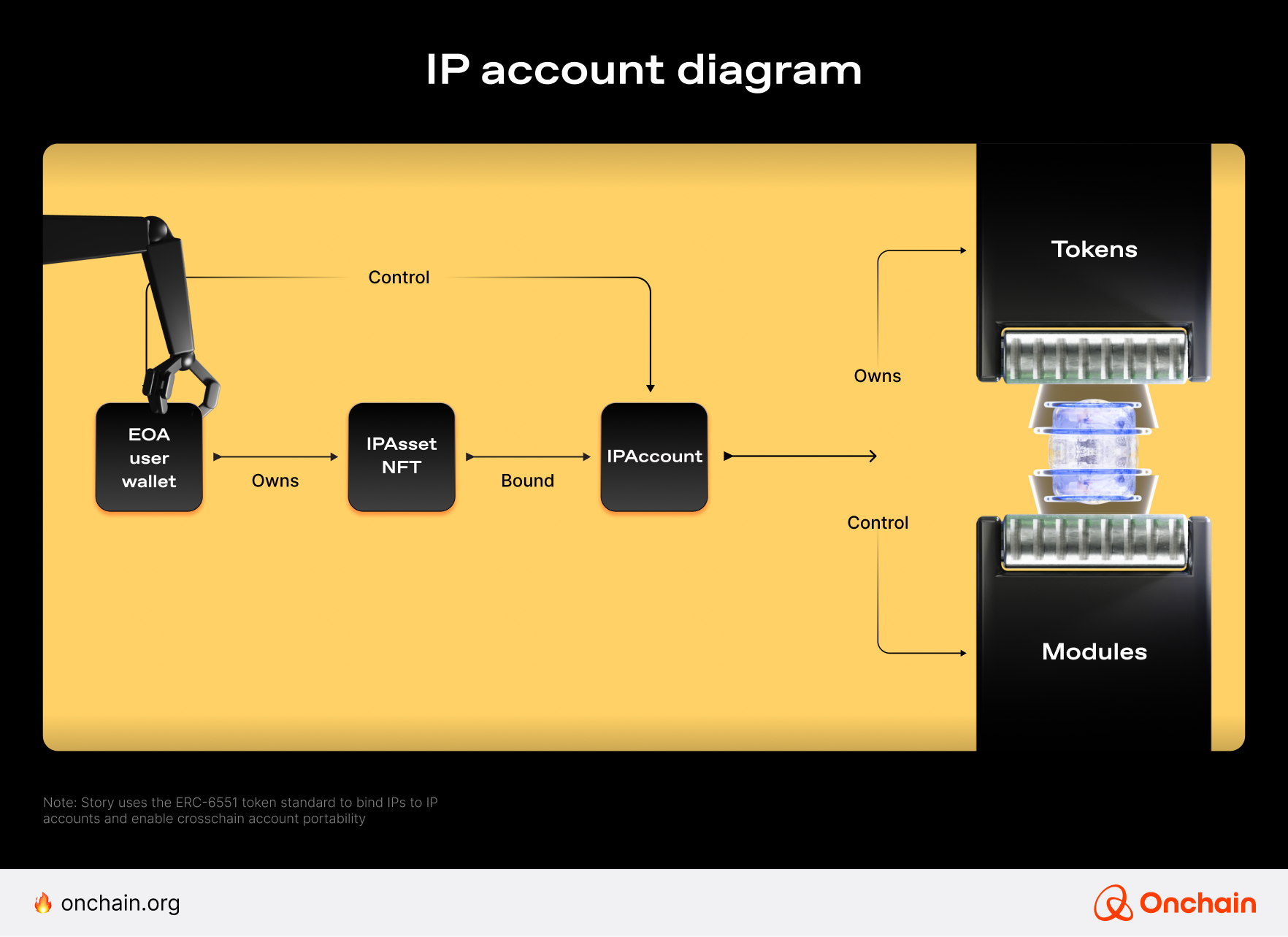

Story Protocol is a notable innovator in this niche. It builds onchain IP infrastructure for creators and AI agents to license, remix, and track ownership in real-time. Its Proof of Creativity (PoC) enables seamless tracking, and programmable IP automates licensing and royalties using ERC-6551.

Registering IP on Story is streamlined: Connect wallet, upload asset, configure terms, and mint the license onchain. Registered IP becomes part of a global IP graph, enhancing the discoverability of a growing ecosystem of creators and decentralized apps (dApps).

When an IP asset is registered, it becomes a node in a global IP graph. The discovery and integration of onchain IP assets are then made easier in Story, thanks to its rapidly growing ecosystem of creators and dApps.

A few notable platforms — Story Protocol, Royal.io, and Camp Network, in particular — are building the rails for IP tokenization, offering different approaches from infrastructure to royalty marketplaces.

We’re merely scratching the surface of the broad tokenized IP realm. There’s a lot to unpack from the problems it attempts to solve to the new opportunities it creates. The video below breaks it down and helps bring this chapter’s key ideas into focus.

On the downside, this nascent space faces significant roadblocks. Legal and regulatory frameworks are still evolving, creating uncertainties surrounding ownership and enforcement. Public understanding of the distinction between token ownership and IP rights remains a challenge. Ensuring the integrity of tokenized IPs is also a potential issue. Currently, verifiable onchain data quantifying the tokenized IP market is scarce, indicating a very early and unproven stage, despite the existence of compelling use cases today.

From a founder’s perspective … the most significant friction point when building or integrating tokenized RWAs is unequivocally compliance complexity across jurisdictions, especially when aligning regulatory-grade processes with the expectations of real-time, onchain functionality.

- Anthony Bufinsky, Head of Growth, Arca

Tokenized IP empowers creators to reclaim ownership, but trust and accountability remain pivotal. Robust identity frameworks that secure authenticity, safeguard privacy, and enable verifiable participation are the next frontier. You’ll find this outlined below.

💡 Own your rights, own your future

Founders who empower creators with rights ownership, programmability, and AI integration will dominate the next era of digital economies.

The tokenized IP ecosystem offers immediate opportunities to innovate, monetize, and own your niche. For Web3 founders and creators, here’s how you can act:

Next, let’s look into the infrastructure that will anchor trust and make it all composable, starting with identity.

3.2 New infrastructure of trust: Onchain identity

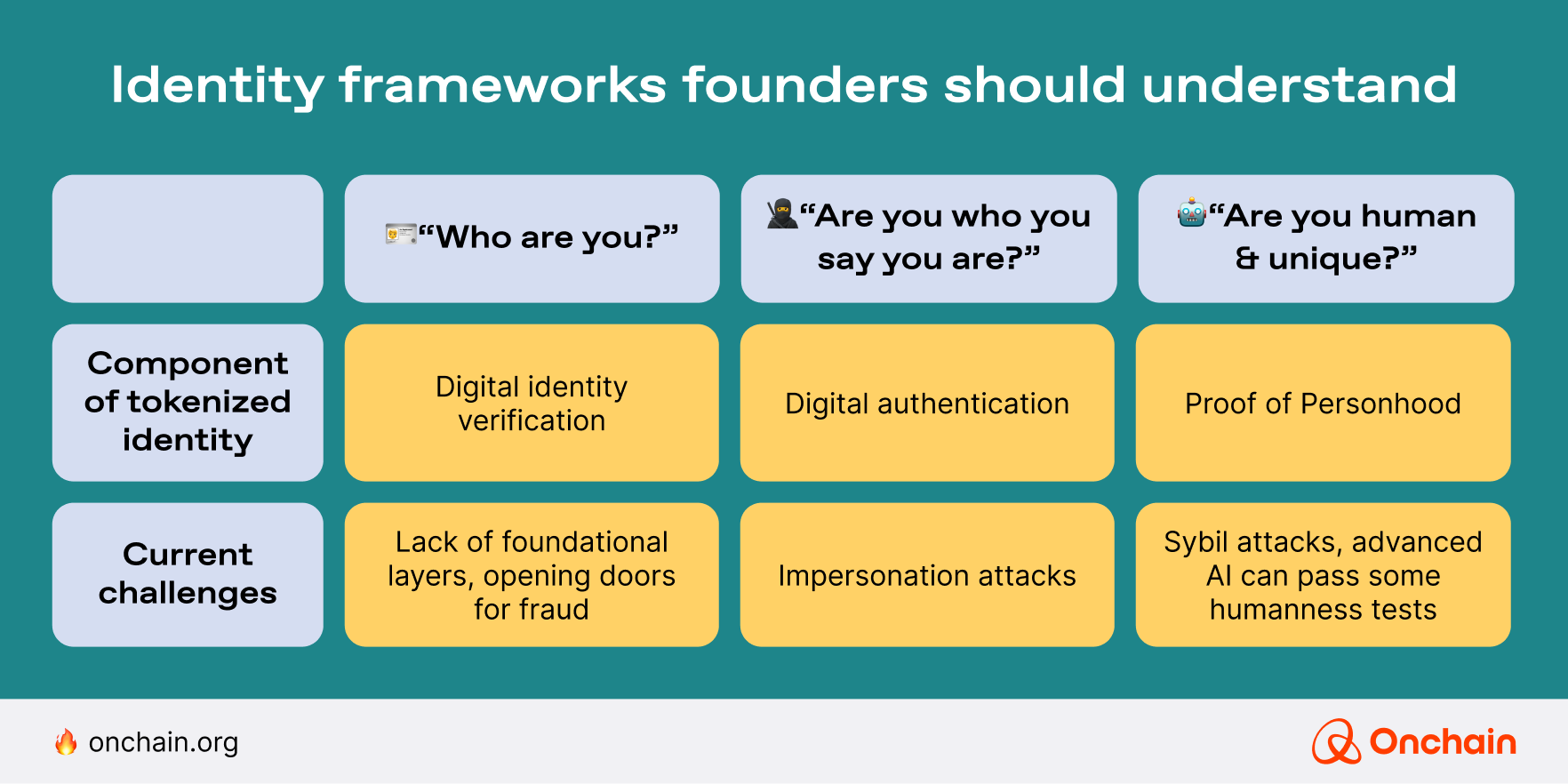

Tokenized identity is becoming the foundational layer for everything Web3 wants to do next.

As tokenization expands into IP, AI, credit, and data markets, one truth surfaces: Nothing composable can scale without a reliable, verifiable identity system. Wallets alone don’t tell you who or what you’re interacting with. Tokenized identity fills that gap — securely, transparently, and onchain.

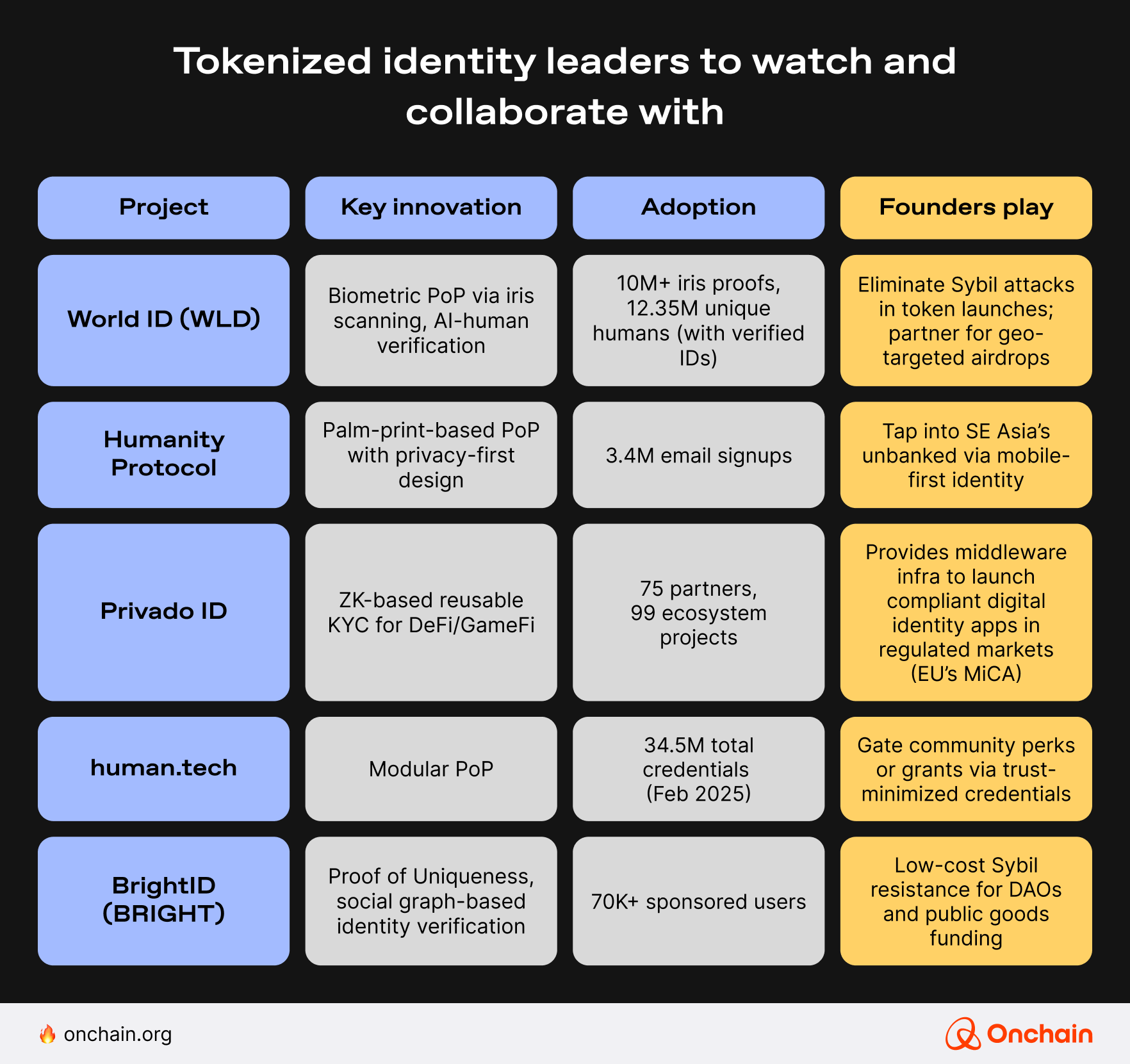

In 2025, the adoption of identity is accelerating. Platforms like World ID, Humanity Protocol, QuarkID, and Privado ID are onboarding millions, building Proof-of-Personhood (PoP) rails, and powering KYC for various platforms from airdrops to DAO voting to DeFi access and even the dating app Tinder in Japan.

Apart from making Web3 relatively safer, these identity systems open new markets, making it possible to:

- Target real people, not bots.

- Gate communities without central servers.

- Build credit systems that don’t rely on overcollateralization.

- Verify AI agents interacting with real-world capital.

Onchain identity is turning into vital infrastructure, addressing bot invasions in the AI era by verifying humanity without exposing personal data.

Distinguishing between proving humanness and verifying specific identity is key, as is ensuring accountability for AI agents.

💡 So what does all this mean for founders?

The opportunity for founders is evident: Help apps verify humans without forcing them to hand over passports or sensitive data. The demand comes from high-trust use cases in both Web2 and Web3.

🔒 Gaming

World ID integrates with games through platforms like Razer’s gaming rewards program to prevent bots and ensure fair access.

💬 Dating and social apps

World ID pilots integrations with platforms like Tinder, aiming to verify users are real humans — without invasive identity checks.

Below are a few areas in this niche where founders can take advantage to stay ahead of the game.

Onchain identity edge: 2025 founder's playbook for real-world integration

💶 Proof for pay

✅ Build a dApp where soulbound tokens (SBTs) are issued upon task completion.

👛️ “Wallets, not resumés”

✅ Create a talent platform where wallets serve as dynamic skill portfolios.

🪪️ Onchain reputation markets

✅ Build a lending protocol where DeFi credit scores replace overcollateralization.

💻️ AI agent credential marketplaces

✅ Build protocols for minting, trading, revoking, or composing credentials across agents and chains.

Provide Licensing as a Service.

Now that we can verify who is acting, the next question is, what are they contributing?

This brings us to one of the most recent verticals in tokenization: intelligence.

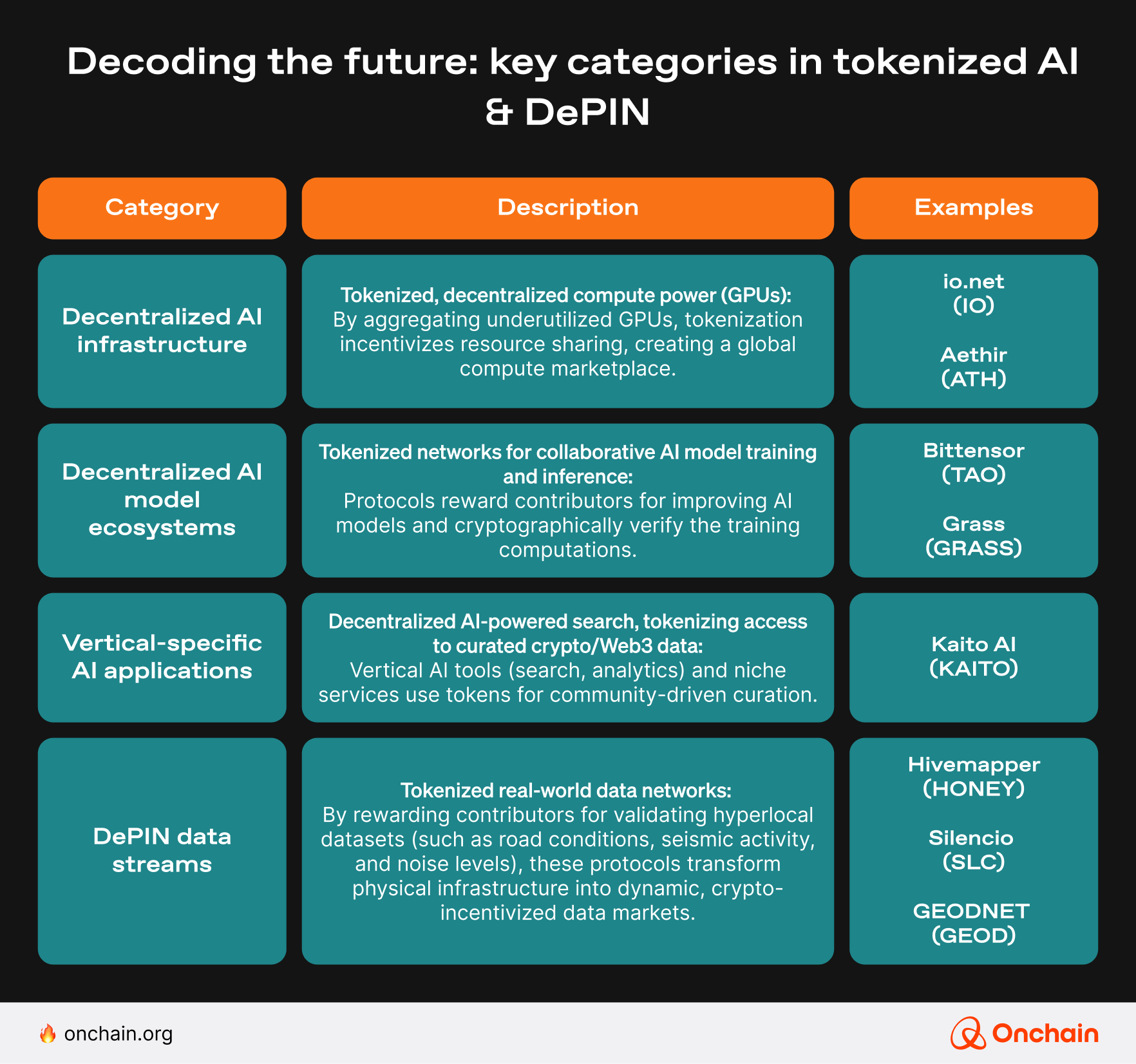

3.3 Tokenized intelligence: Onchain AI and DePIN data assets

In 2025, intelligence is becoming programmable.

We’re witnessing the rise of tokenized AI and real-world data systems, a new layer of infrastructure that rewards contributions, validates performance, and transforms raw compute and data into economic assets.

Decentralized Physical Infrastructure Networks (DePINs) are expanding to new, uncharted waters.

From decentralized GPU networks to tokenized sensor streams, this wave is transforming data from something you store to something you stake, trade, and activate.

This marks the onset of a programmable intelligence stack where value flows to data contributors, validators, and model builders. It’s a virgin niche for founders.

💡 Founder takeaway:

If you’re a founder, here’s where you can build:

☁️ Launch a product on top of decentralized compute to bypass centralized cloud costs.

🤖 Create niche vertical AI services (search, analytics, curation) and reward curators.

📡 Plug into DePIN projects and build apps that rely on verified real-world sensor feeds.

🖥️ Build middleware connecting tokenized intelligence to DeFi, identity, or commerce layers.

This convergence of tokenized AI and DePIN is forging a novel asset class: trust-minimized intelligence.

Tokenized AI for compute and cognition, coupled with DePIN grounding this intelligence in real-world data markets (for sectors such as mobility and logistics), has the potential to create an impact as significant as stablecoins.

These aren’t disparate trends, but rather complementary forces that create markets for verifiable intelligence and the physical data underlying it.

For a deeper analysis, go to recently published reports that focus specifically on these two topics:

📘 AI x Blockchain Disruption Report

📗 DePIN: Real-World Business Opportunities

Both are written for founders who are ready to build on this new stack.

3.4 From insight to impact: Next steps for Onchain builders

You now have the foundational insights to navigate the rapidly evolving tokenization landscape. We’ve unpacked how Blue Ocean opportunities open up entirely new markets, identified untapped niches through White Spaces Analysis, and provided detailed sector snapshots. But understanding these concepts and the sector landscape is just the first step. To build lucrative Web3 businesses, you need even deeper context and practical insights.

That’s exactly what our members-exclusive tokenization report will deliver. We’ll dive deeper into the strategic frameworks specifically designed to navigate today’s fragmented global economic environment, exploring how tokenization is reshaping opportunities amidst shifting global dynamics, declining institutional trust, and evolving regulations.

You’ll gain clarity on precisely where the biggest tokenization opportunities lie and why. You’ll understand how to position your project strategically, not just to capitalize on immediate market trends but to leverage deeper insights into regulatory complexities, geopolitical developments, and macroeconomic factors.

Whether you’re a builder launching products, an investor seeking opportunities, or an operator looking to strategically scale, this follow-up report will clearly show you how to move from insight to impactful execution.

Already an Onchain Founding Member?

You’ll have exclusive, immediate access to this upcoming report as soon as it’s released. Keep an eye on your inbox and our members-exclusive channels.

Not yet a member?

Become an Onchain Founding Member by purchasing the membership NFT on OpenSea. Your membership unlocks complete access to Onchain’s extensive research content, expert community interactions, opportunities to boost your industry reputation, and many additional benefits.

So, stay tuned, the playbook is dropping soon. Till then, find related topics in the Onchain Magazine or explore additional research topics we’ve published reports on.