1. From Impossible to Inevitable: The Global Shift to Onchain Assets

You’ll learn:

- Why stablecoins became the blueprint for tokenizing real-world assets.

- How TradFi applies this model across new asset classes.

- Where founders still have leverage, and where it’s too late to play catch-up.

- What you’ll uncover in chapters 2 and 3 of the report.

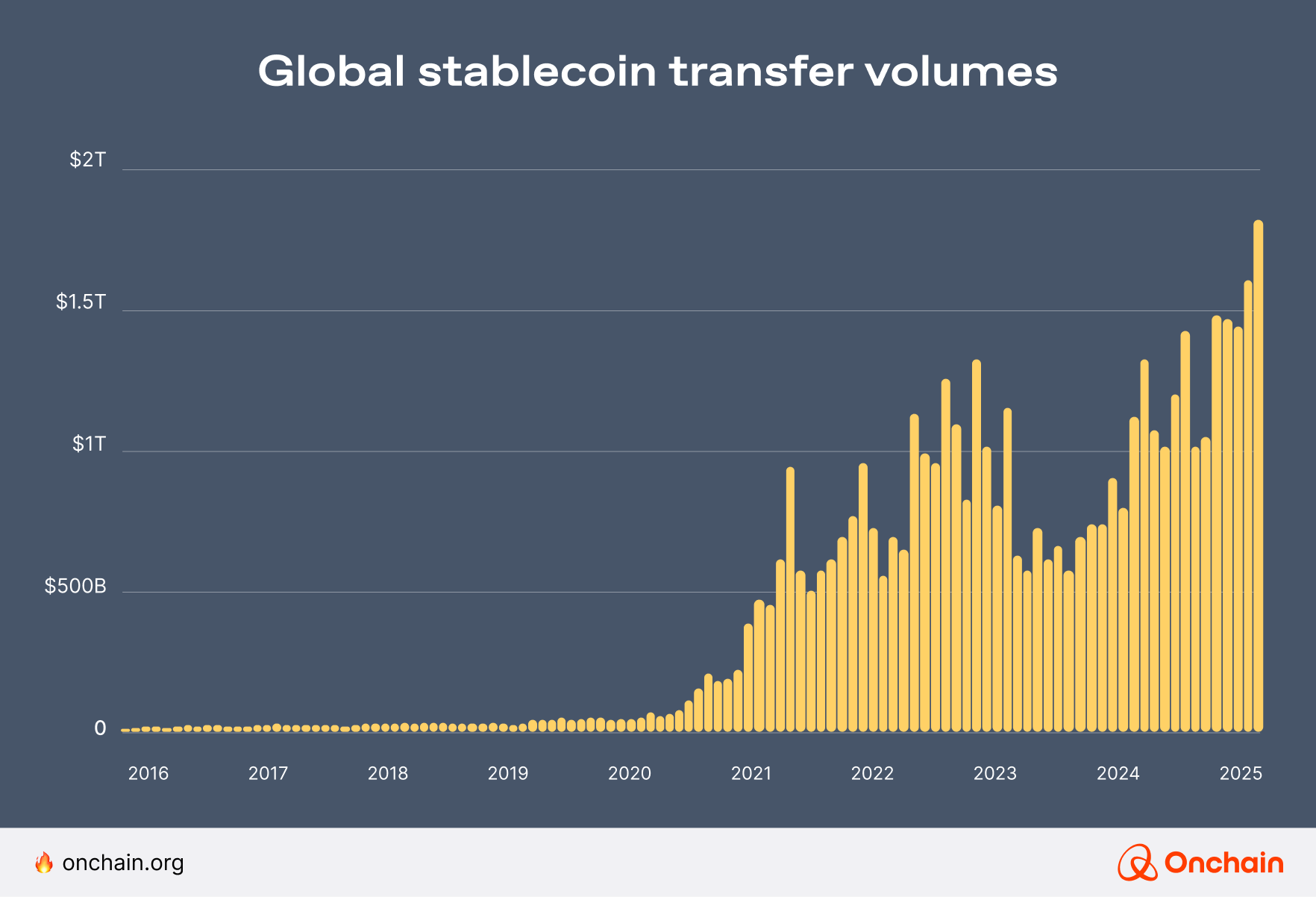

Tokenization turns assets into code and markets into software. Ten years ago, the idea that tokenized dollars could rival Visa seemed laughable. But here we are. In April 2025 alone, stablecoins processed over $1.82 tril in volume and now have a combined market cap of over $246 bil. They’ve become the most adopted use case in Web3 to date and the most lucrative business onchain.

Stablecoins have demonstrated that converting real-world ownership of money into digital tokens, secured and executed on blockchain networks, works in practice as well as in theory on a global scale.

What began with crypto-native issuers like Tether and Circle is rapidly being adopted by traditional finance (TradFi). BlackRock, Fidelity, and Franklin Templeton have moved beyond experimenting; they’re operationalizing tokenization. These giants began to utilize the stablecoin blueprint to tokenize treasuries, private credit, and commodities such as gold and carbon. In the latest step, they added stocks across several blockchain networks, including Ethereum, zkSync, Stellar, Arbitrum, Aptos, and more.

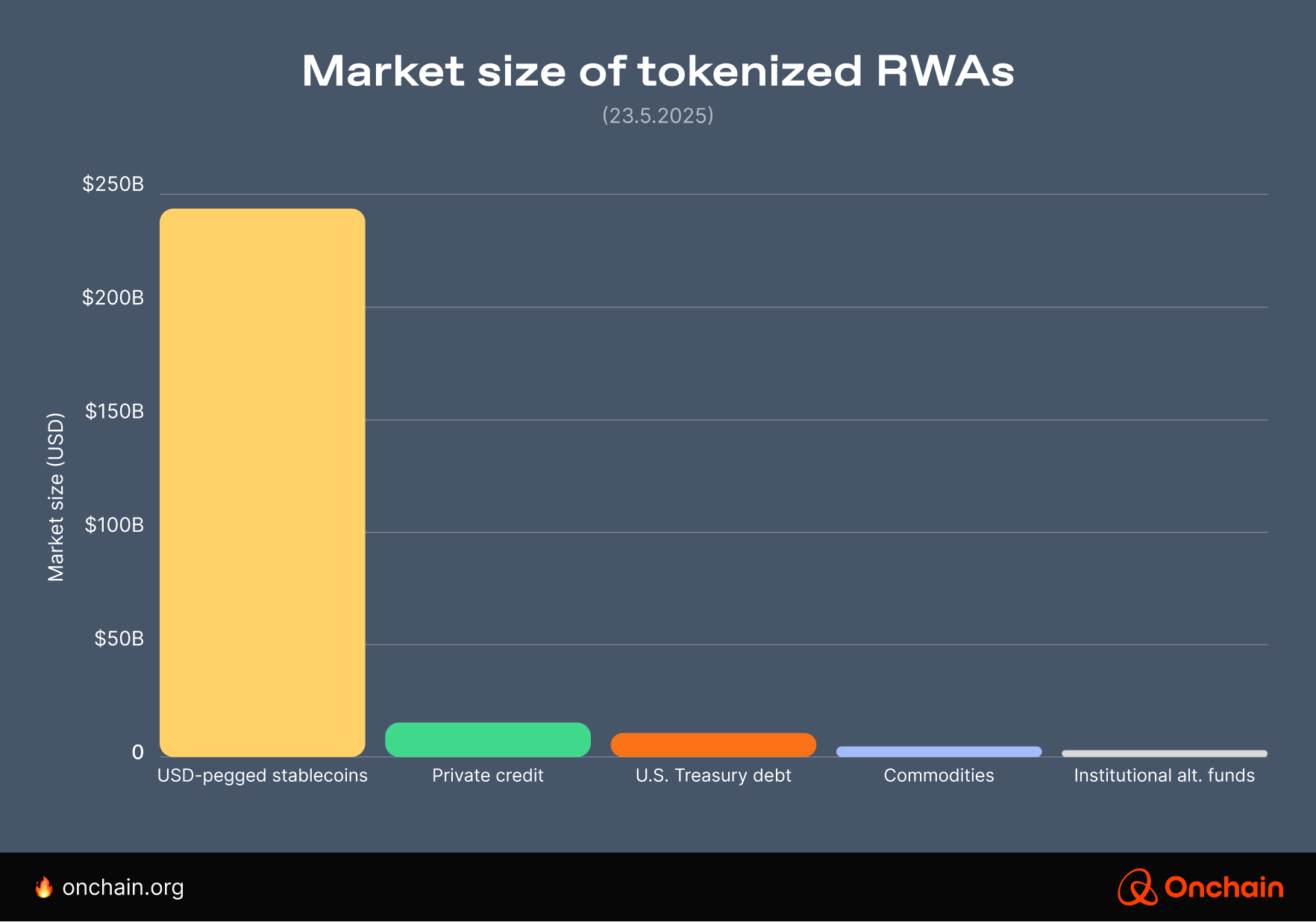

Yet, despite the rapid growth of stablecoins, real-world asset (RWA) tokenization remains in an early developmental stage relative to its full potential. As of April 2025, the total value of tokenized RWAs is approximately $22.74 bil vs. the aforementioned $246 bil in stablecoins.

While the $22.7 bil now locked in tokenized RWAs (excluding stablecoins) is significant, it still equals only about 0.009% of the roughly $246.8 tril in global tradable assets. To put this into context, even the entire $246 bil stablecoin market is tiny. It is less than 0.14% of the world’s ≈$177.2 tril global liquidity pool as tracked by Cross Border Capitals, which, in addition to money supply, includes credit, collateral, and capital market funding capacity across 80+ economies.

Seen in this light, the onchain economy is still operating on the outer edges of the financial system. But that’s precisely why the opportunity is so compelling: The infrastructure is live, the regulatory frameworks are hardening, and capital is starting to flow.

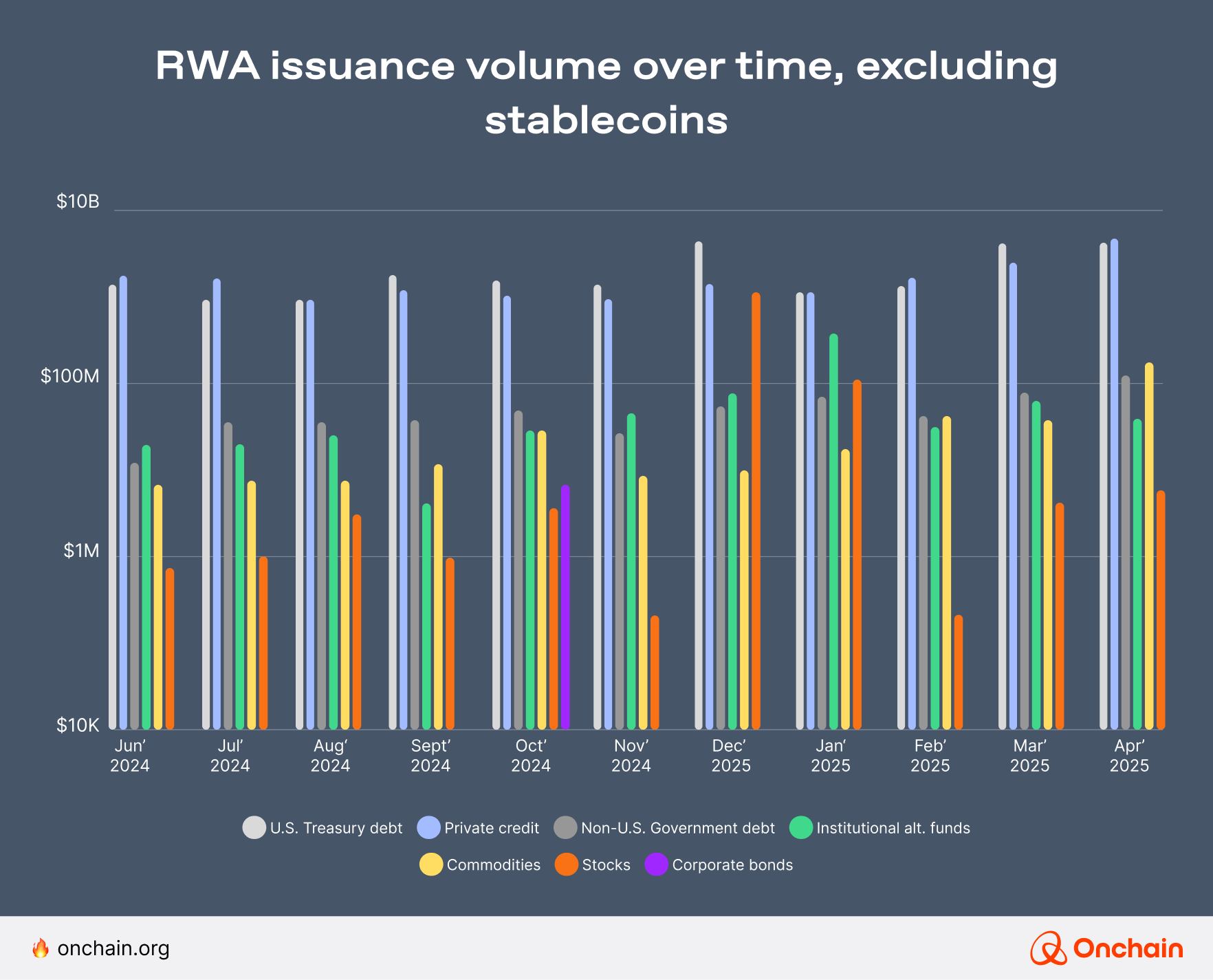

And while we’re early in the adoption cycle of tokenized assets, the trend is unmistakable. Onchain data already shows a surge of activity and growing institutional confidence. Monthly issuance of new tokenized RWAs (excluding stablecoins) consistently surpasses $100 mil, driven by robust growth, particularly in commodities, private credit, and institutional funds.

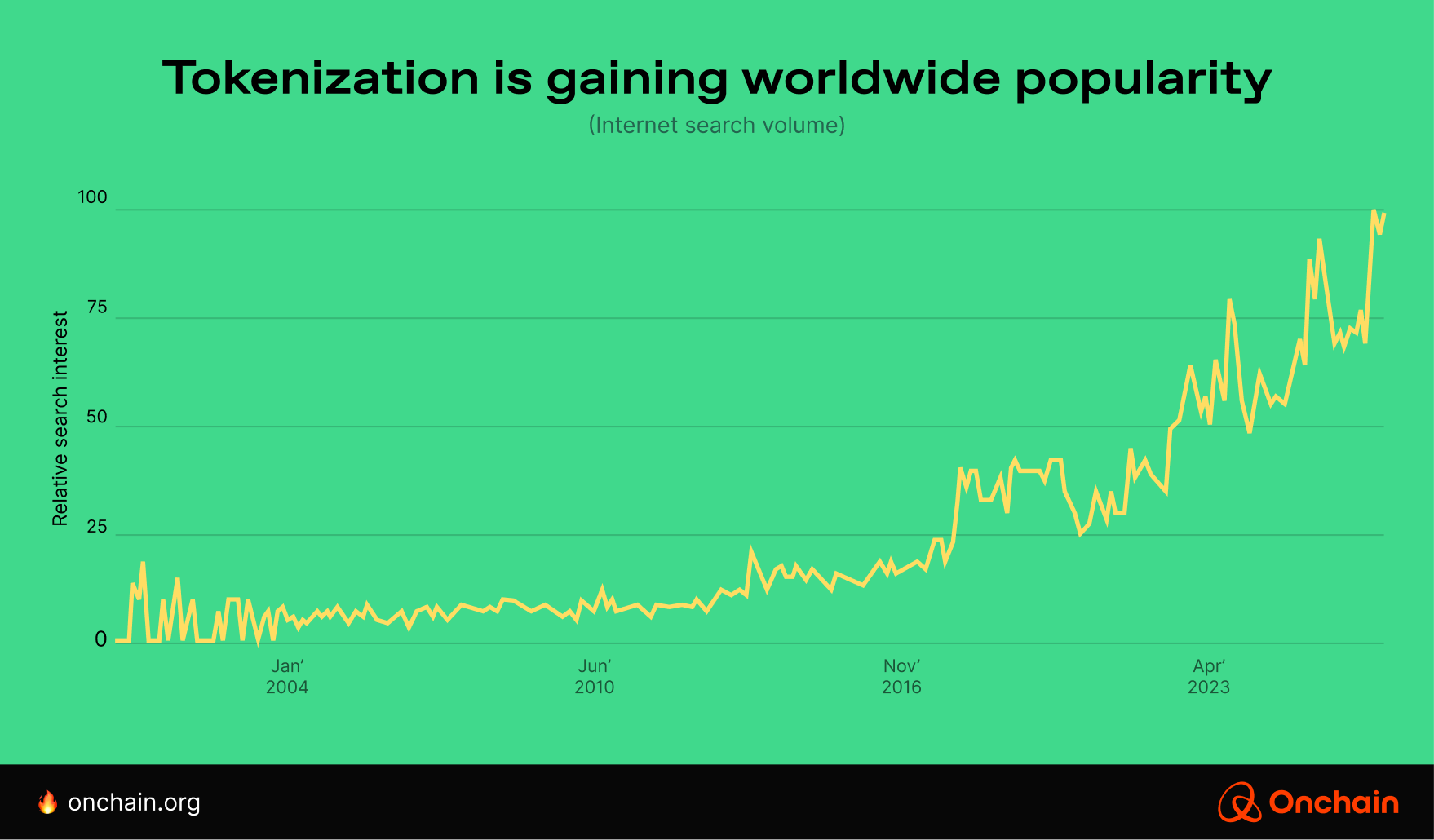

The fundamentals prove that this is among the fastest-growing sectors in Web3. Public interest in tokenization is also increasing globally. Google searches for “tokenization” recently hit an all-time high (ATH). We witness this with our own content. Onchain Magazine’s coverage on the topic consistently ranks among our most-read articles.

Check, for example, The History of Tokenization to dive deeper into the origins and evolution of tokenization.

So, what does all of this mean for founders?

First and foremost, we understand that tokenization is more than an abstract concept. It has become a transformative force that is reshaping the global financial infrastructure. Then why is it still in its initial stages, when there’s so much room for innovation?

To pinpoint exactly where the business opportunities lie, let’s consider two complementary strategic frameworks: White Spaces Analysis and the Blue Ocean Strategy.

Understanding White Spaces Analysis and the Blue Ocean Strategy

- White Spaces are areas within existing markets where clear demand exists, but established solutions or dominant market players are lacking. These gaps emerge from incomplete infrastructure, evolving regulatory frameworks, or underserved user needs.

- Blue Ocean Strategy describes markets that are entirely new or largely uncontested. In contrast to “Red Oceans,” where intense competition from incumbents leaves little room for differentiation, Blue Oceans offer opportunities to define new standards and market categories, leading to higher potential rewards and sustained competitive advantage.

In the context of tokenization:

- Institutional infrastructure & integration represent White Spaces – markets where infrastructure is not yet mature and where institutions have significant unmet needs.

- Emerging frontiers represent Blue Ocean – new categories of tokenization with low competition and the opportunity to become industry standard-setters.

The largest barrier to scaling real-world-asset tokens is regulatory clarity, or the lack of it. Without clear frameworks and bankruptcy-remote structures, perceived risk stays high and adoption stalls.

- Jeremy Ng, CEO, OpenEden

Which strategic business opportunities does this open for founders?

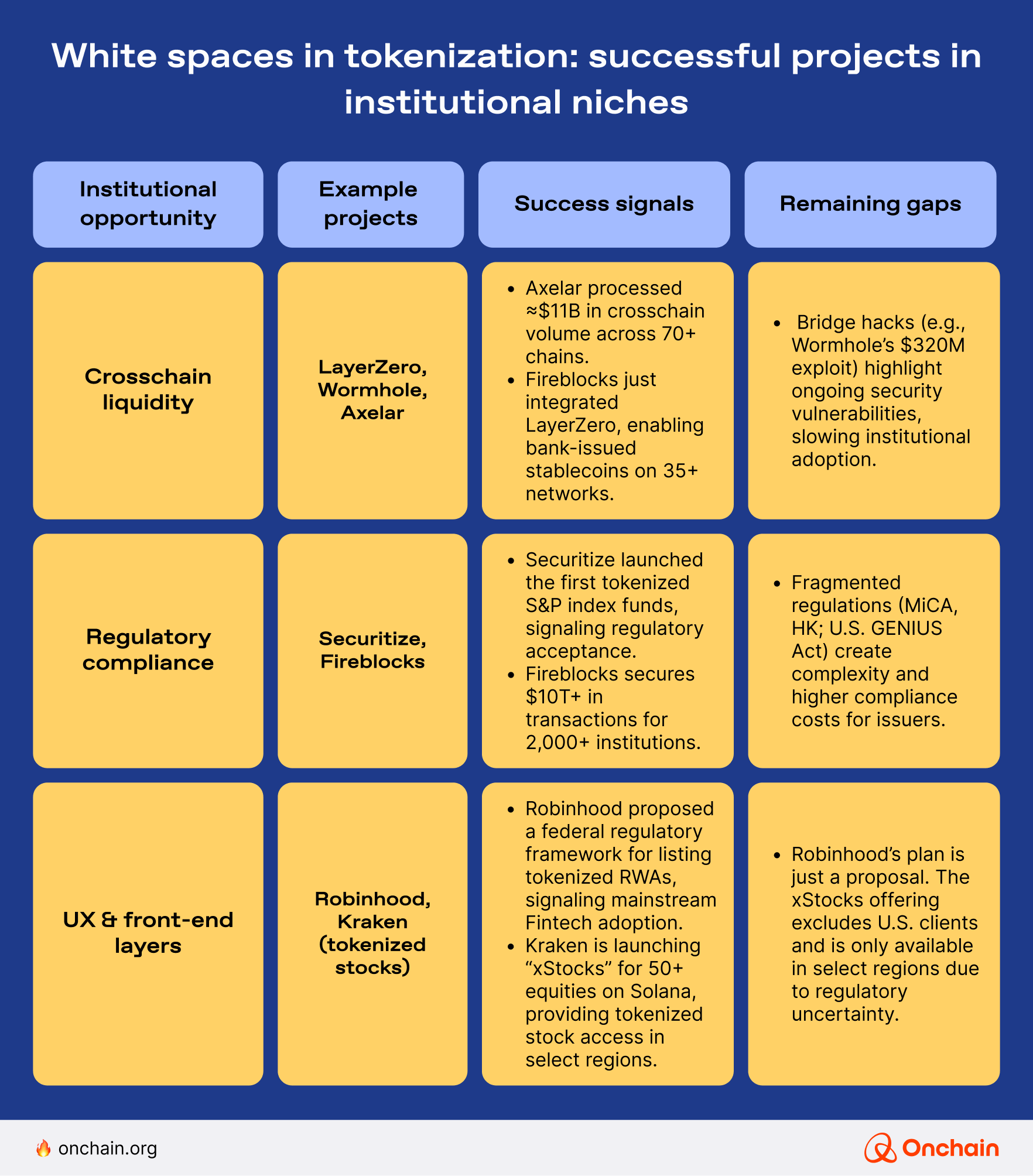

🔸 Institutional infrastructure & integration (White Spaces)

Institutional adoption of tokenization is accelerating rapidly. Tokenized U.S. Treasuries alone surged from approximately $104 mil in early 2023 to over $5 bil by 2025 (Rwa.xyz, 2025). Banking leaders, including JPMorgan, Bank of America, Citi, and Wells Fargo, actively explore joint stablecoin initiatives, signaling broad institutional confidence. Additionally, recent announcements by Kraken and Robinhood regarding the direct tokenization of stocks on blockchain networks foreshadow robust growth in tokenized equities.

This rapid institutional scaling leaves little room for founders to compete directly on asset issuance. However, significant infrastructure gaps remain unsolved that founders can tap into:

- Cross-chain liquidity fragmentation across multiple blockchain networks (Ethereum, Arbitrum, Stellar, zkSync), causing friction in institutional trading and asset management workflows (WEF, 2025).

- Complex regulatory compliance frameworks increase the need for standardized compliance-as-a-service tools and KYC/AML middleware to ease institutional adoption (Deloitte, 2025).

- User experience and abstraction challenges, hindering adoption due to complicated onboarding processes and the lack of institutional-grade interfaces (Deloitte, 2025).

💡 Founder insight

Instead of competing directly against major institutions, founders should focus on solving institutional pain points by developing complementary infrastructure.

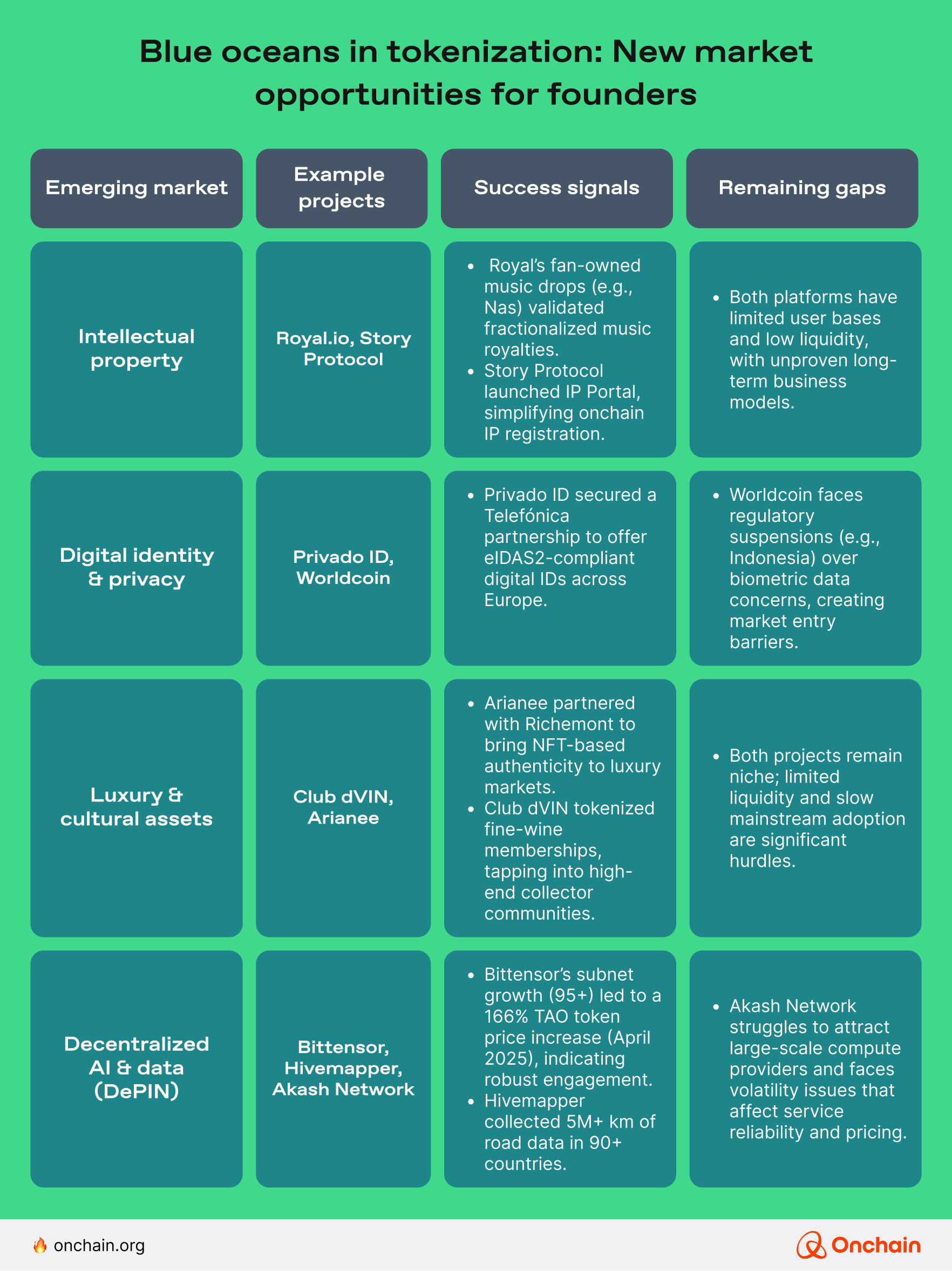

🔸 Emerging markets & new asset classes (Blue oceans)

Beyond White Spaces, Blue Oceans opens up entirely new markets, characterized by undefined standards and minimal competition. Founders entering these categories early can shape markets from the ground up rather than merely participate. Notable categories include:

- Intellectual property (IP): A vast market, which, according to the World Intellectual Property Organization, grew to over ~$61 tril in 2023 and is largely untapped by blockchain technology, despite initial successes like Royal.io and Story Protocol.

- Digital identity and privacy: Growing regulatory scrutiny and privacy concerns surrounding existing solutions, such as Worldcoin, underscore the need for privacy-preserving alternatives that leverage zero-knowledge proofs (ZK proofs)(WEF, 2025).

- Luxury goods & cultural assets: Strong blockchain alignment demonstrated by early initiatives like Club dVIN and Arianee, yet comprehensive solutions remain scarce (Deloitte, 2025).

Decentralized AI & data: Early-stage initiatives (e.g., Akash Network, Natix Network, Hivemapper) with promising use cases but lacking established market structures or standards (WEF, 2025).

💡 Founder insight

Whoever enters these emerging markets now will determine industry standards, capture first-mover advantages, and secure a sustainable competitive edge.

We are moving beyond tokenizing what is already on a balance sheet. The tokenization of financial assets was the first step, but the true opportunity lies ahead. The most important new work is in programming what has never been formally valued: identity, creative rights, personal reputation. Founders who create the systems to manage this new form of value will shape the next ten years.

- Marko Vidrih, Co-Founder, RWA.io

Does this give you ideas? It should. However, for now, we’ve only provided you with a rough framework of the strategic opportunities that exist in tokenization today. The next step is understanding how to act on them effectively.

In the following two chapters, we provide actionable guidance explicitly tailored to your strategic goals, structured around these complementary frameworks.