5. Token Launches in the Age of AI and Memes

You’ll learn:

- How token launches went from gated VC-led events to open, permissionless, and AI-powered processes.

- How platforms like Pump.fun and Clanker are reshaping the token creation lifecycle and what risks they introduce.

- What causes tension between democratization and chaos, and how it impacts projects.

- Why tailored approaches and balancing compliance with innovation is the way forward.

- And finally, structured takeaways for winning token launch strategies in 2025.

Token launches used to be gated, expensive, and dev-heavy. Now, anyone with a meme and a wallet can launch one in seconds. Tools like permissionless launchpads, AI agents, and composable NFT-token hybrids are lowering barriers and enabling new forms of participation.

5.1 Limitless possibilities: The new frontier of token launches

When anyone can launch a token…

Platforms like Pump.fun, Four.meme, and Sunpump have made token deployment as easy as posting on X. No devs. No audits. No roadmap. Just a wallet, a name, and some SOL.

- No smart contract required

- No exchange listing

- No community building upfront

And while that’s wildly empowering, it’s also wildly chaotic.

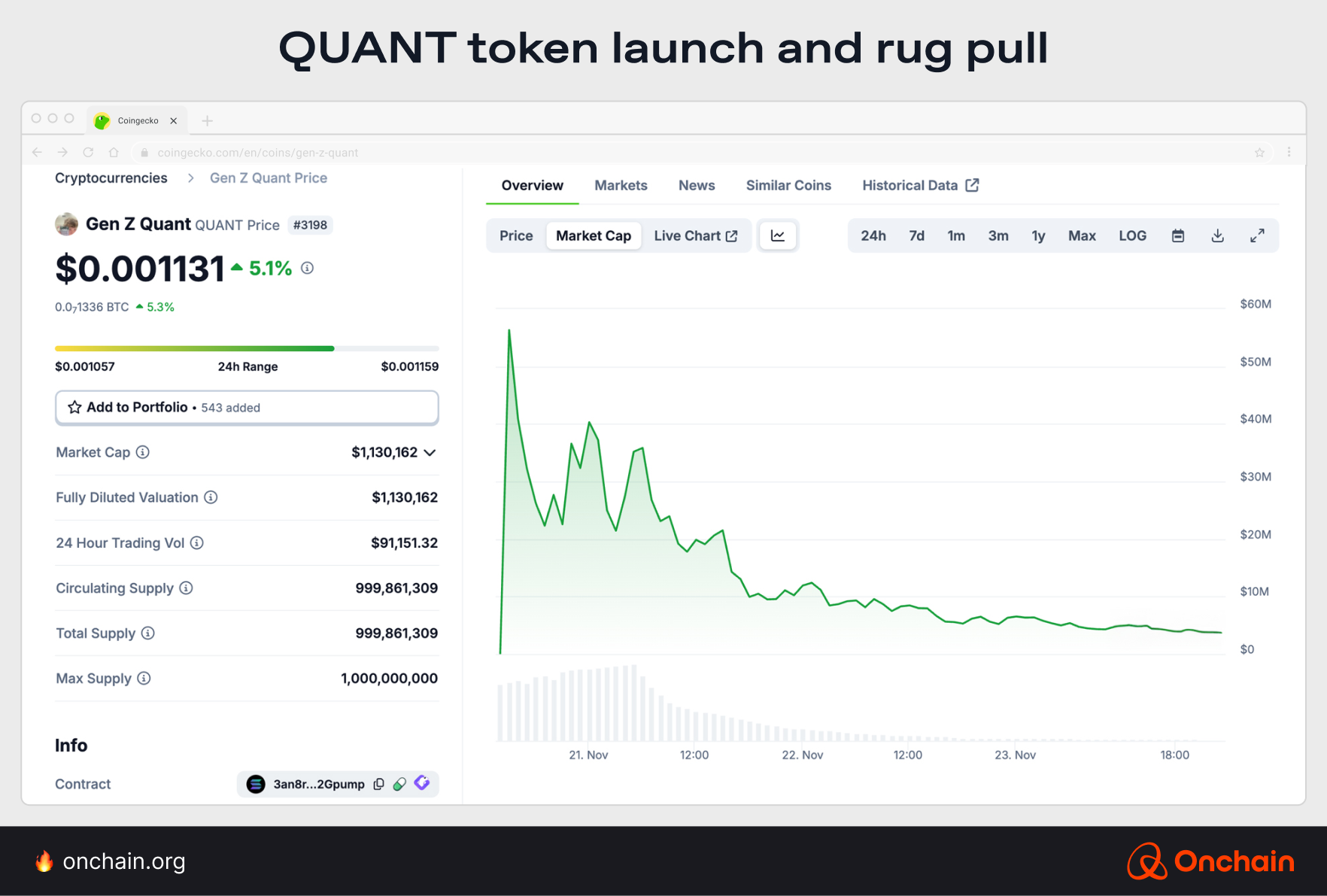

For example, in 2024, a 13-year-old kid created and rugged a memecoin, named Gen Z Quant (QUANT), pulling in thousands in SOL before the token collapsed. His token pumped on hype, drew in eager buyers, and then vanished just as quickly. The story demonstrates how low the barrier to entry (and exit) really is in this wave of permissionless launches.

While some users loved the creativity, others have raised valid concerns: Are we flooding chains with noise? What happens to user trust when 90% of tokens go to zero within hours?

TikTok-ification of tokens

These tools have turned token launches into a kind of financial TikTok with high velocity and low retention. They are entirely entertainment-driven.

Questions we must ask:

- Does making token launches too easy dilute the meaning of token ownership itself?

- If anything can be launched and anything can pump, does anything really matter?

Despite the concerns, the demand is real.

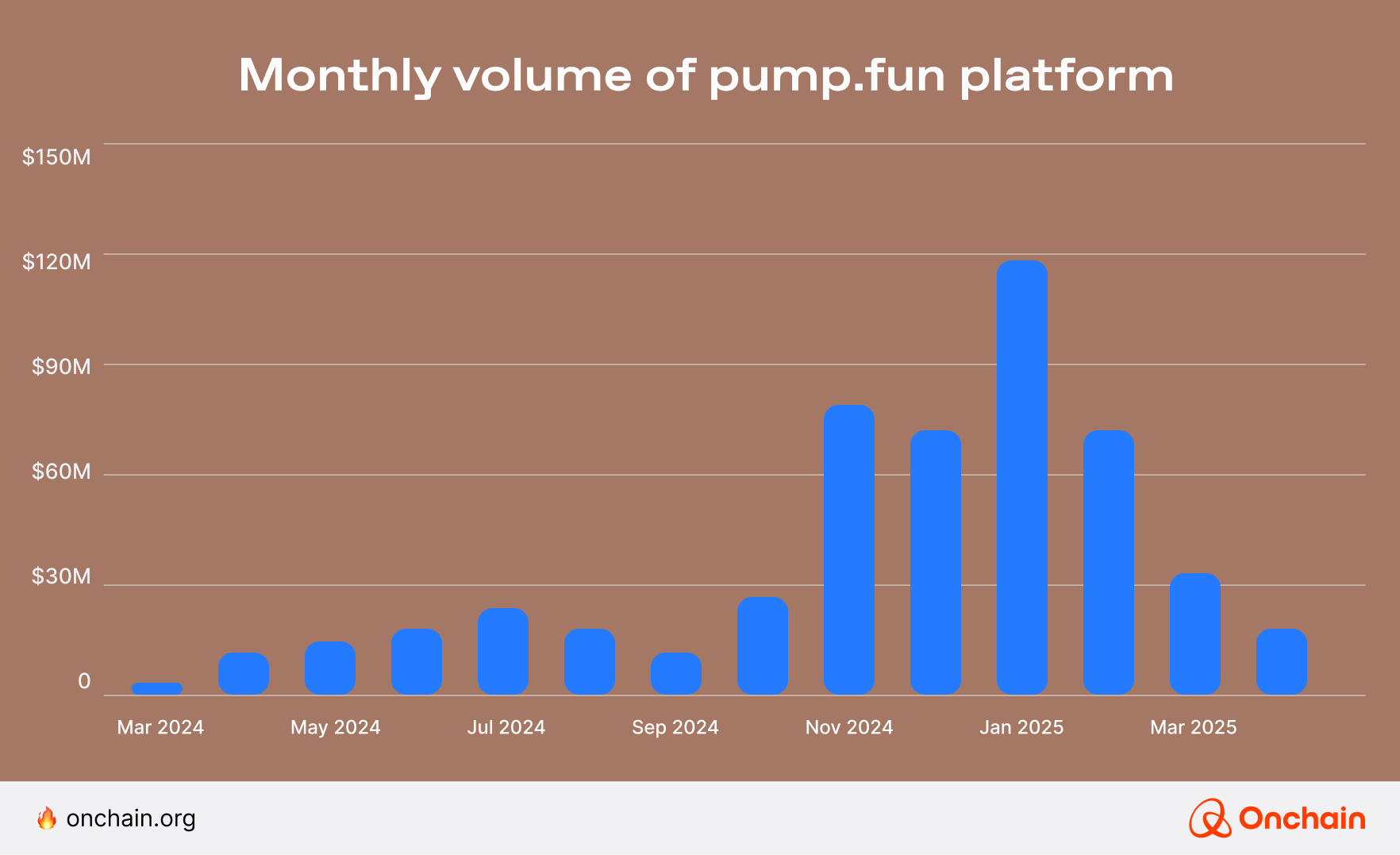

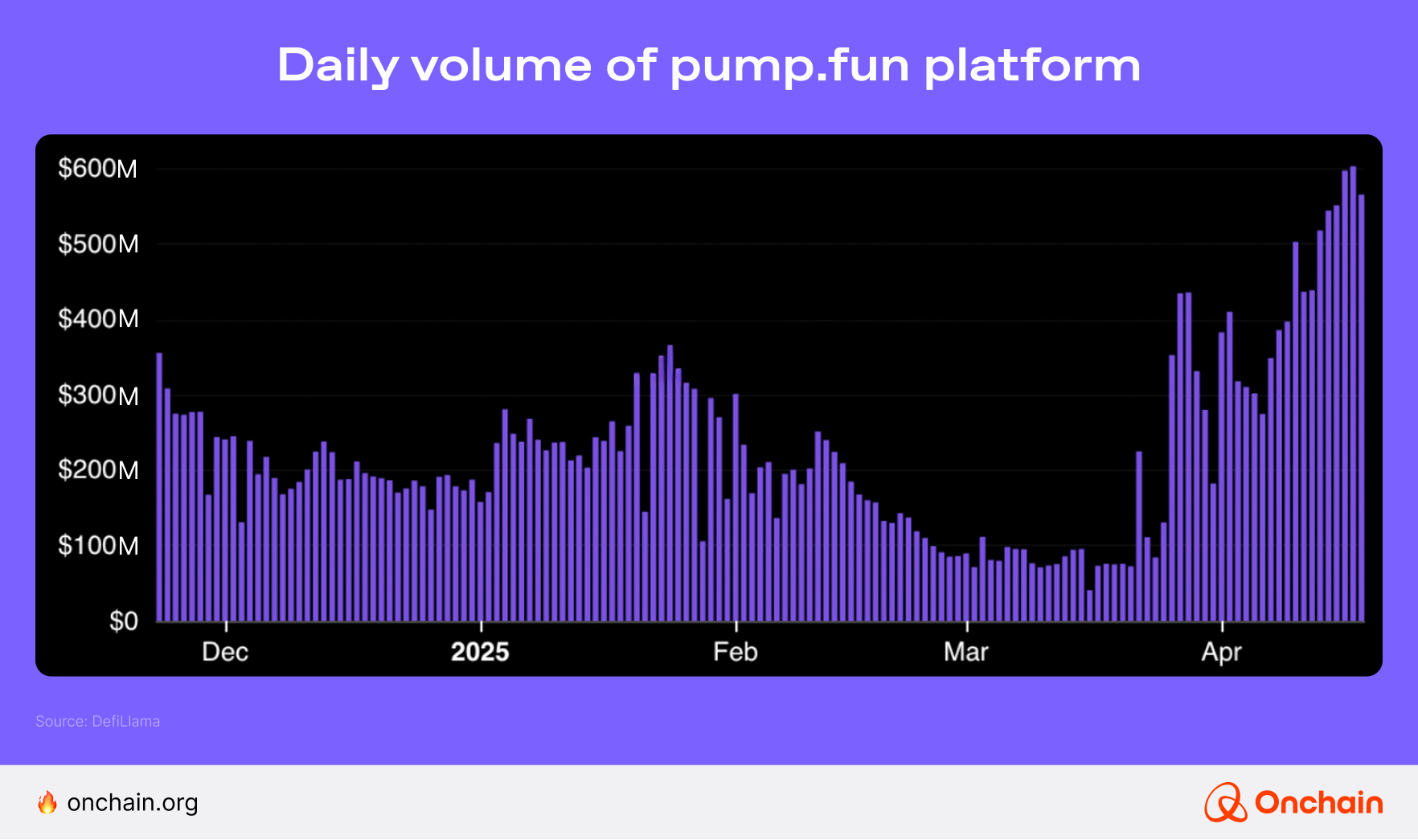

- Even amidst the volatility, the numbers speak volumes. In March 2025, platforms like Pump.fun generated over $38.25 mil in revenue, showcasing user appetite and market interest.

As of March 2025, Pump.fun processed a staggering $182.46 mil in daily volume, primarily fueled by newly minted memecoins that capture the collective imagination of crypto enthusiasts.

Yet, as discussed, it is wise to be cautious due to the inherent risks in these token launches.

In stark contrast (see Chapter 2), traditional or structured models emphasize careful planning, regulatory compliance, and sustainability over rapid market capture. Remember LBPs, Legion’s merit-based system, or Echo’s transparent fundraising.

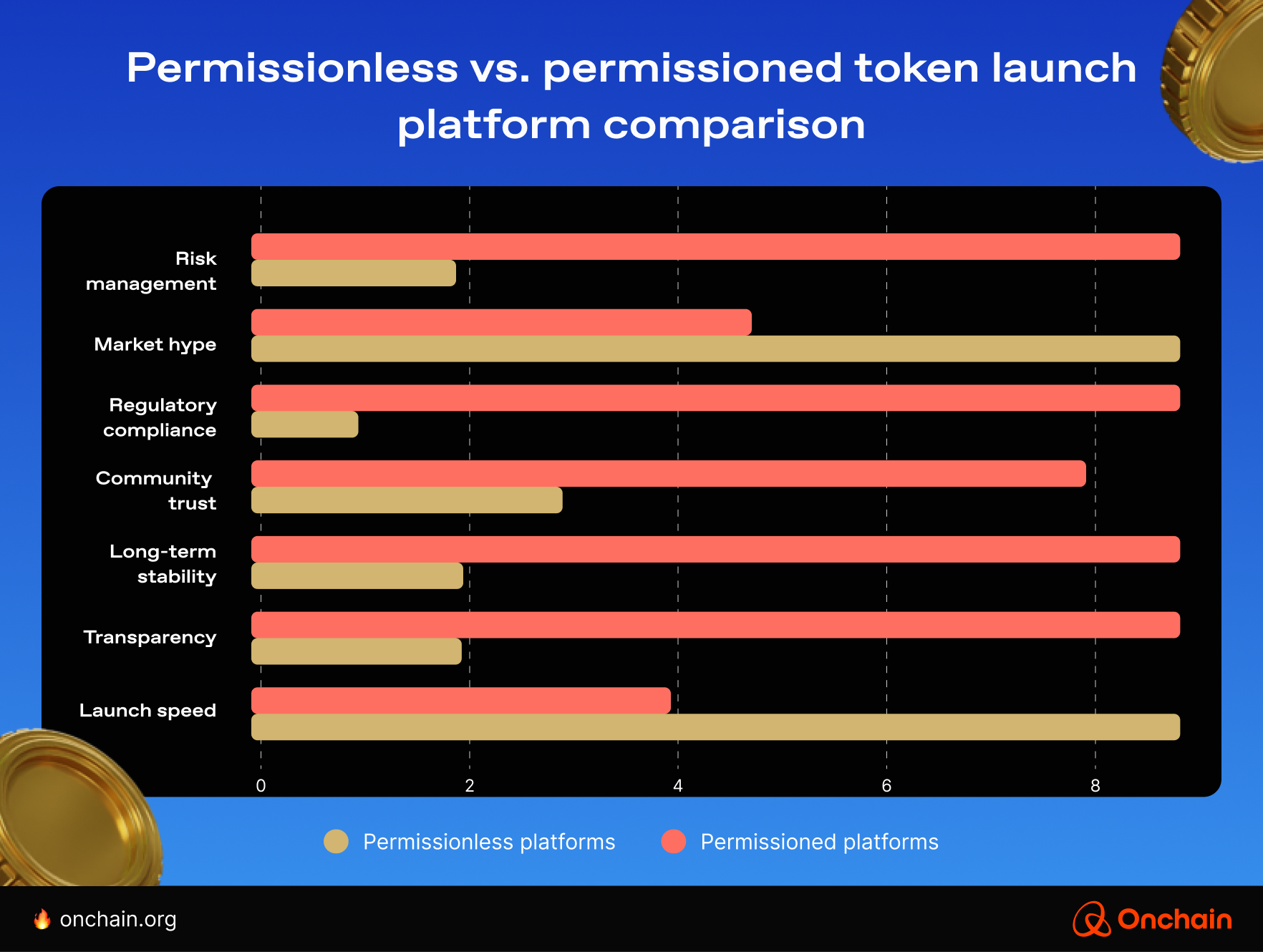

This dichotomy creates a competitive tension. The chart below compares permissionless and traditional launch platforms based on representative criteria such as risk management, market hype, etc. Each criterion is scored on a scale of 1 (Lowest) to 10 (Highest) based on real-world platform behaviors, outcomes, and qualitative assessments across major launch ecosystems (e.g., Pump.fun, Clanker, Legion, Echo, and traditional Launchpads like Coinlist) (see Chapter 2 for more details on how these platforms behave).

You can see clearly in which areas the different platforms excel. Most shouldn’t come as a surprise, especially after you’ve read this report. The chart helps you grasp the trade-offs founders must consider when developing a launch strategy.

- The permissionless approach is enticing if you want to:

- Prioritize quick market feedback and viral reach

- Enhance trading liquidity, but with higher risk

- The traditional approach remains superior if you want to:

- Commit to long-term impact and regulatory compliance

- Sustain community engagement over the long term

- The future likely belongs to hybrid strategies that:

- Blend the excitement of permissionless launches with stable and transparent structured approaches

- Use a hybrid approach to capitalize on both immediate urgency and enduring trust

AI agents: welcome to token launch 2.0 — built by bots

Artificial intelligence is moving up in the Web3 world. Once an assistant in launch strategy, it’s now taking over end-to-end execution as well. Tools like ChainGPT’s AI Token Generator enable anyone to launch a memecoin on BNB Chain using nothing but a prompt.

If you want to test how easy it is to do the launch with ChainGPT, simply follow this four-step guide:

- Go to app.chaingpt.org.

- Navigate to the “Smart Contract Generator.”

- Input a token name, symbol, optional image, and optional burn mechanics and liquidity features.

- The AI tool generates the smart contract with all the details and deploys it onchain.

ChainGPT Launchpad has facilitated 52 IDO events, achieving an average token generation event (TGE) multiple of 9.3x, based on the launch-to-ATH (all-time-high) price data sourced from ChainGPT’s official metrics and public dashboards. A standout example is Solidus AI Tech, which surged by 3,500% from its initial TGE price.

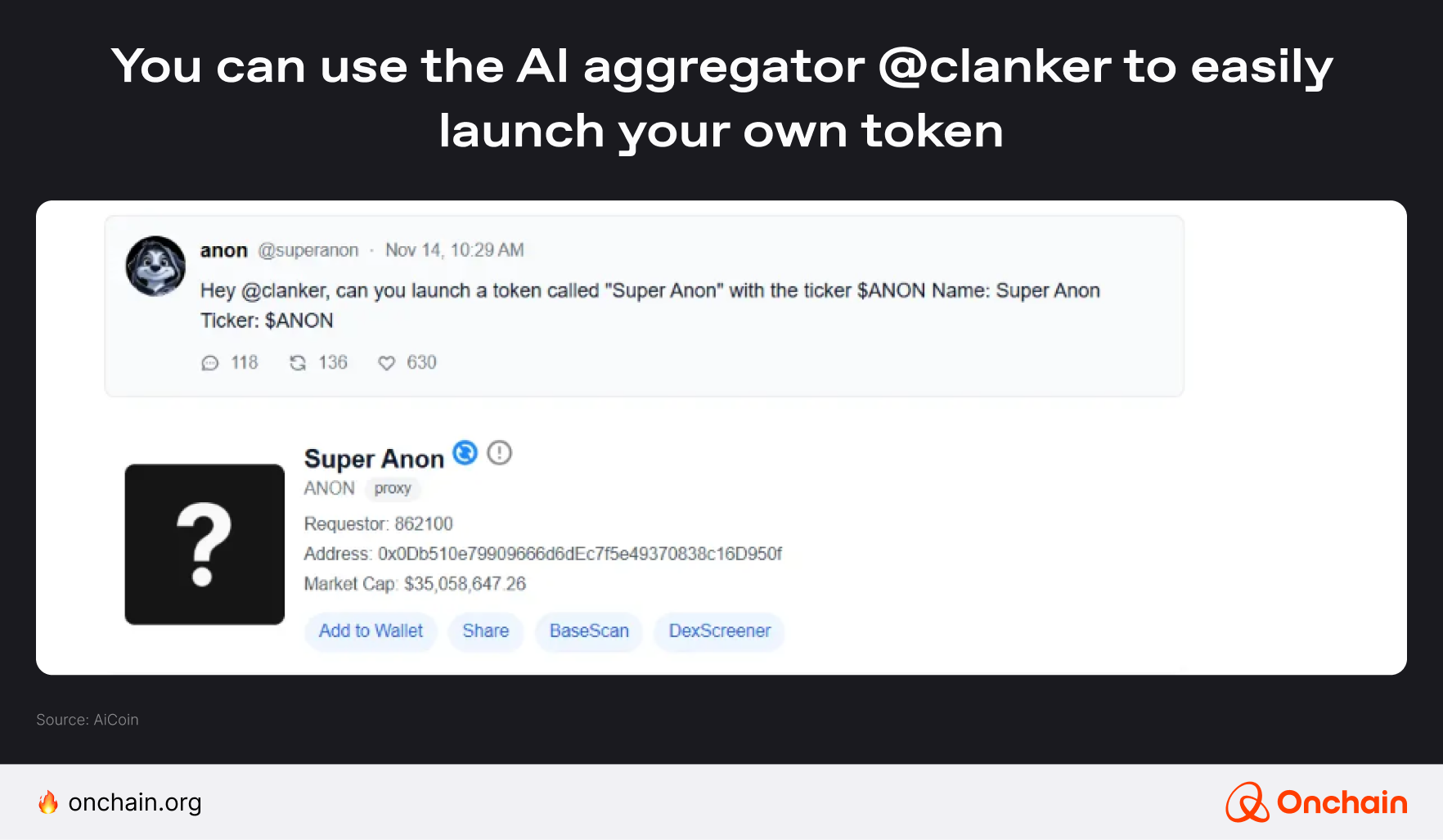

Similarly, Clanker, an AI aggregator on Base, scans user parameters including desired blockchain, token distribution, and liquidity goals before orchestrating an entire token launch lifecycle. Its user-friendly interface allows individuals to create ERC-20 tokens by simply tagging @clanker on platforms like Farcaster.

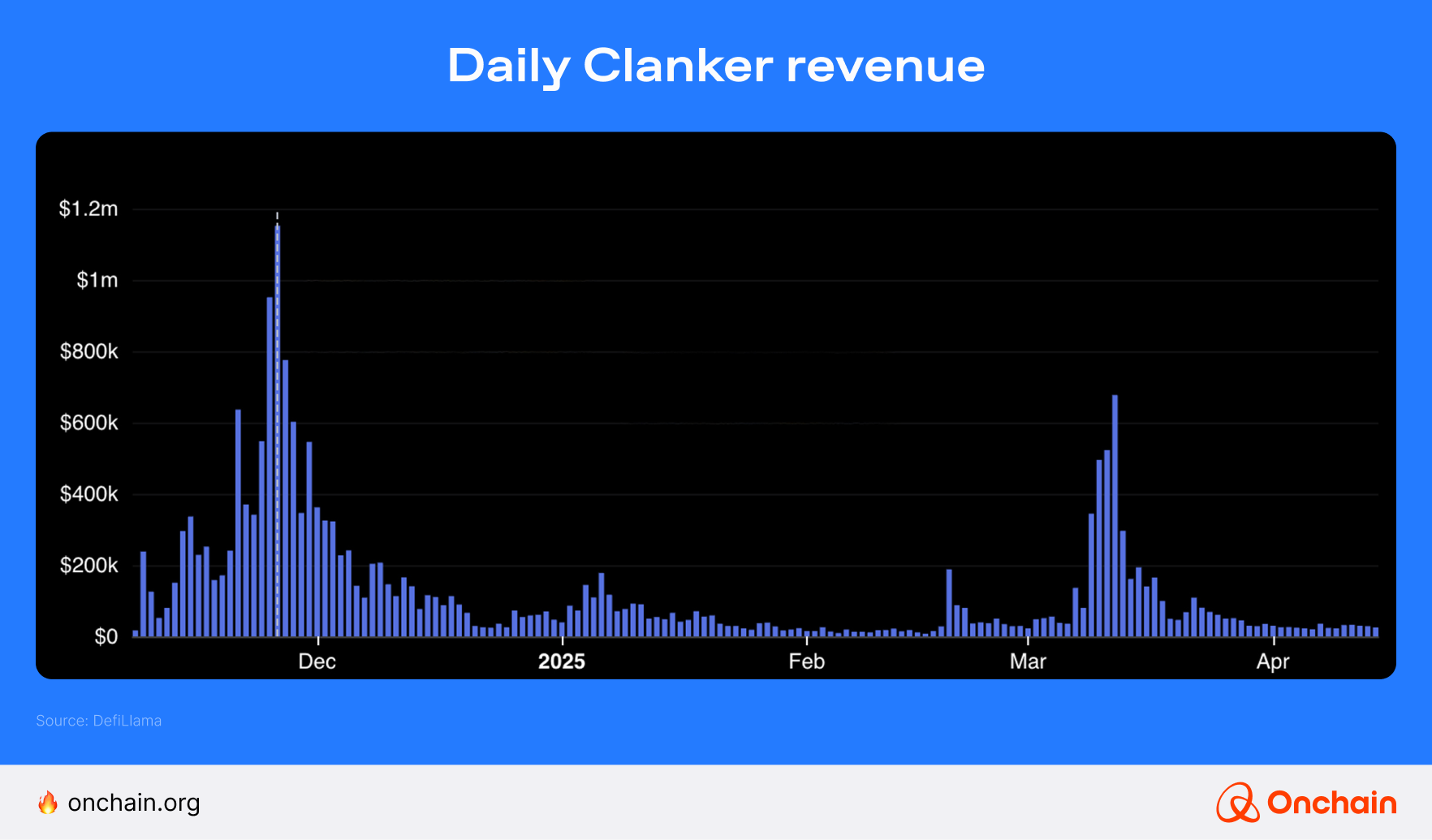

Clanker attracted nearly 5,000 unique token creations and facilitated over $15 mil in cumulative liquidity, bringing ~$1.15 mil in revenue within just two months. These numbers indicate strong user enthusiasm for frictionless, AI-driven launches.

Autonomous AI launch agents like Clanker bring about a shift in the Web3 builder-investor dynamics.

AI-native launch agents are pushing founders toward programmable tokenomics, also known as Tokenomics 2.0. This dynamic model reacts in real time to user behavior, market shifts, or governance feedback.

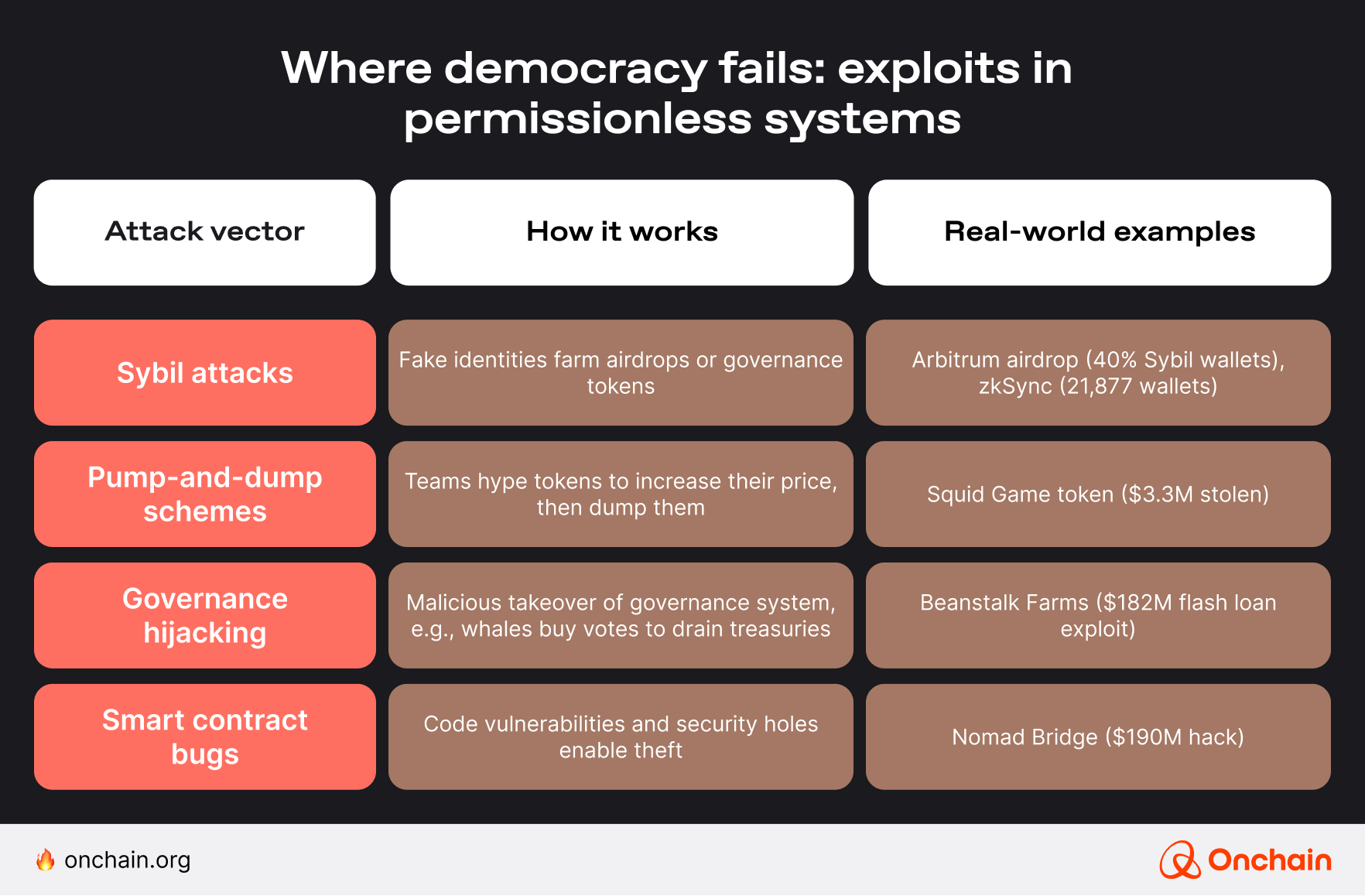

These techniques also come with a darker side: rug pulls, Sybil attacks, and high-velocity hype cycles. We are moving from gatekeeping to mass participation, and this raises a critical question: Is Web3 fundraising truly democratized, or just more chaotic than ever? Let’s try to find answers.

5.2 Democratization or chaos? critical evaluation

The shift toward decentralized and democratized crypto fundraising (e.g., ICO 2.0, permissionless launches, LBPs) has empowered retail investors and reduced gatekeeping. These emerging fundraising models benefit from open participation, reduced VC dominance, and fairer distribution.

While the push for democratic fundraising in crypto has been revolutionary, it has also created a paradox in how open access enables both innovation and exploitation.

Various types of exploits can thrive in open systems. Anyone can launch tokens without the need for verification, and in most cases, anonymity means no repercussions for pseudonymous founders. In unregulated environments, there’s no official authority to reprimand these malicious actors, and projects have to rely on community surveillance to report incidents.

💡Strategic recommendations

It is important to remember that decentralization is necessary for Web3’s ethos; however, it does not mean safety. Democratized fundraising expands opportunity but requires better guardrails. ICO 2.0 and permissionless models reduce gatekeeping but call for:

- Effective Sybil defense tools: e.g., ZK proofs for Sybil resistance, Proof of Humanity, Gitcoin passport, POAPs.

- Smart tokenomics and progressive decentralization: vesting schedules and dynamic supply adjustments.

- Social solutions and community-led safeguards: reputation systems, white hat hacker incentives, and bounty programs.

- Investor education: avoiding “too good to be true” launches.

So, where are we heading? Before we can assess that, one question is worth asking: Can Web3 and crypto achieve true democratization without inviting chaos, or is some centralization necessary for survival?

5.3 Strategic inspiration: What will win in 2025 and beyond?

Rather than following one formula, the best token launches in 2025 will combine the best of many: Presale safety, onchain credibility, sector-specific tools, and jurisdictional agility.

🧭 The Smart strategy mix

Founders winning today are blending:

- Centralized safety (e.g., regulated private rounds)

- Decentralized reach (e.g., IDOs, merit-based airdrops)

- Lifecycle design: Building, scaling, sustaining

As much as it matters how you launch, it’s also about where, when, and why.

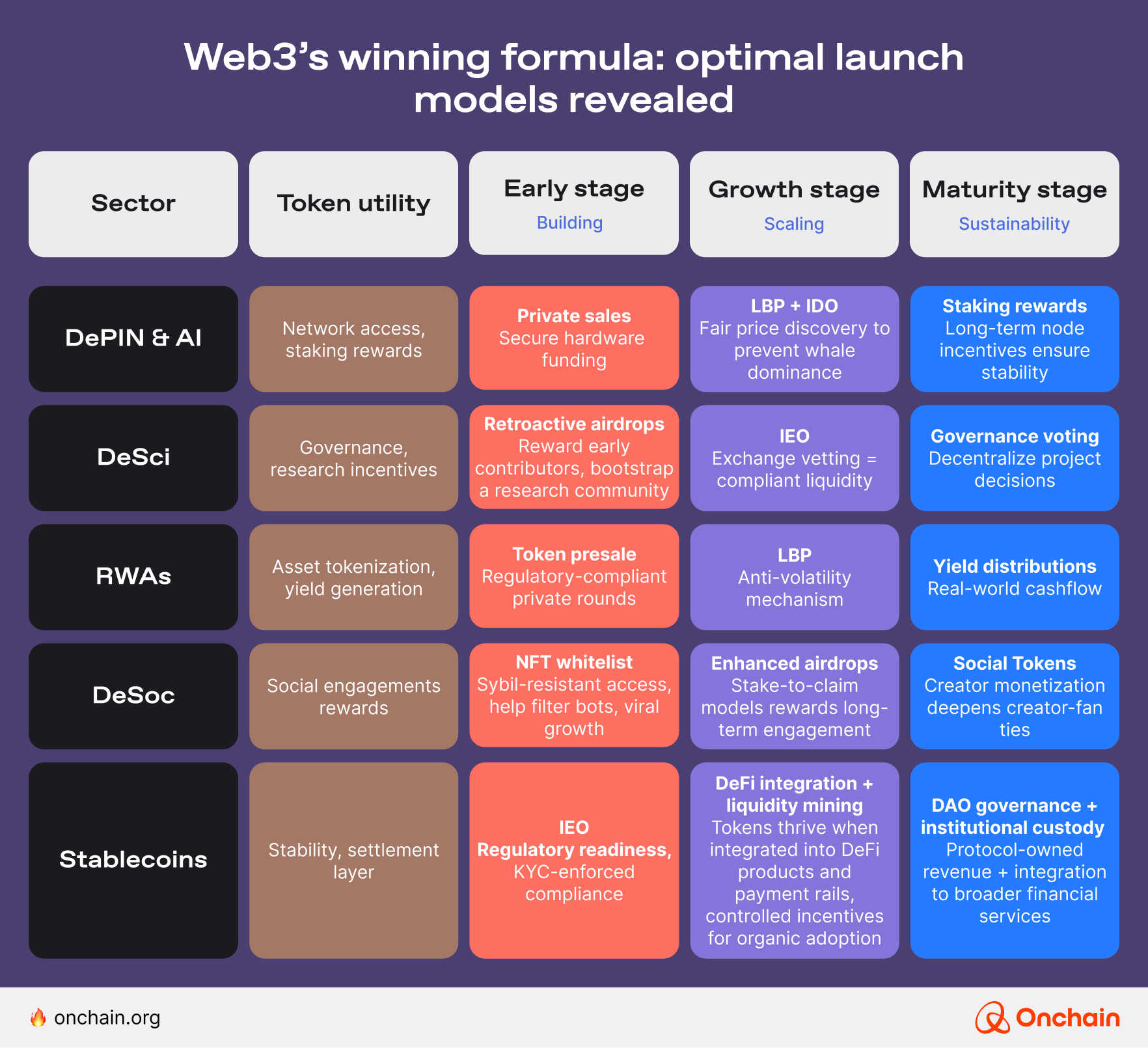

Below is a summary of key insights highlighting hybrid approaches based on the Web3 sector, token utility, and project lifecycle stage.

To navigate regulatory complexity, Web3 founders can benefit from adopting jurisdictional agility: launch in crypto-friendly hubs first, then adapt for stricter markets later on. For the experienced players in the sector, the use of onchain compliance tools and engaging with regulators early is mandatory.

Best practices include implementing on-chain compliance tools, establishing clear legal connections between tokens and underlying assets, maintaining proper documentation, and working with regulators early in the process.

- Marko Vidrih, Co-founder, RWA.io

Today, tokens are much more than fundraising shortcuts; they’re the ecosystem infrastructure. Projects that treat their launches as such will make their tokens sustainable.

We can say that an ideal launch strategy considers lifecycle awareness, project priorities, sector-tailored models, and jurisdictional agility. For Web3 founders and businesses, a sample framework like the one above can serve as a blueprint for long-term growth.

Is ICO 2.0 the future of fundraising?

ICO 2.0 platforms like Legion and Echo bring a fairer, community-driven approach to token launches, addressing the pitfalls of traditional ICOs. Can we expect more of them in the short term?

To cap off our analysis from Chapter 2, we investigated their strengths and recommend the following based on their strategic fit.

Use Echo.xyz if:

✅ Your project benefits from VC involvement but needs to align incentives with retail investors.

✅ You seek an onchain, collaborative investment approach with structured vetting of lead investors.

✅ You prefer traditional investment mechanisms but with enhanced transparency and decentralization.

Use Legion if:

✅ You want to test and/or prioritize a merit-based token distribution over financial contribution.

✅ Your project requires community-driven participation and engagement rather than passive investment.

✅ You aim to reward long-term contributors rather than short-term speculators.

If your project is more community- and engagement-driven, Legion is a stronger fit.

If structured investment with onchain transparency is the priority, Echo.xyz is preferable.

Strategic recommendations for founders and businesses

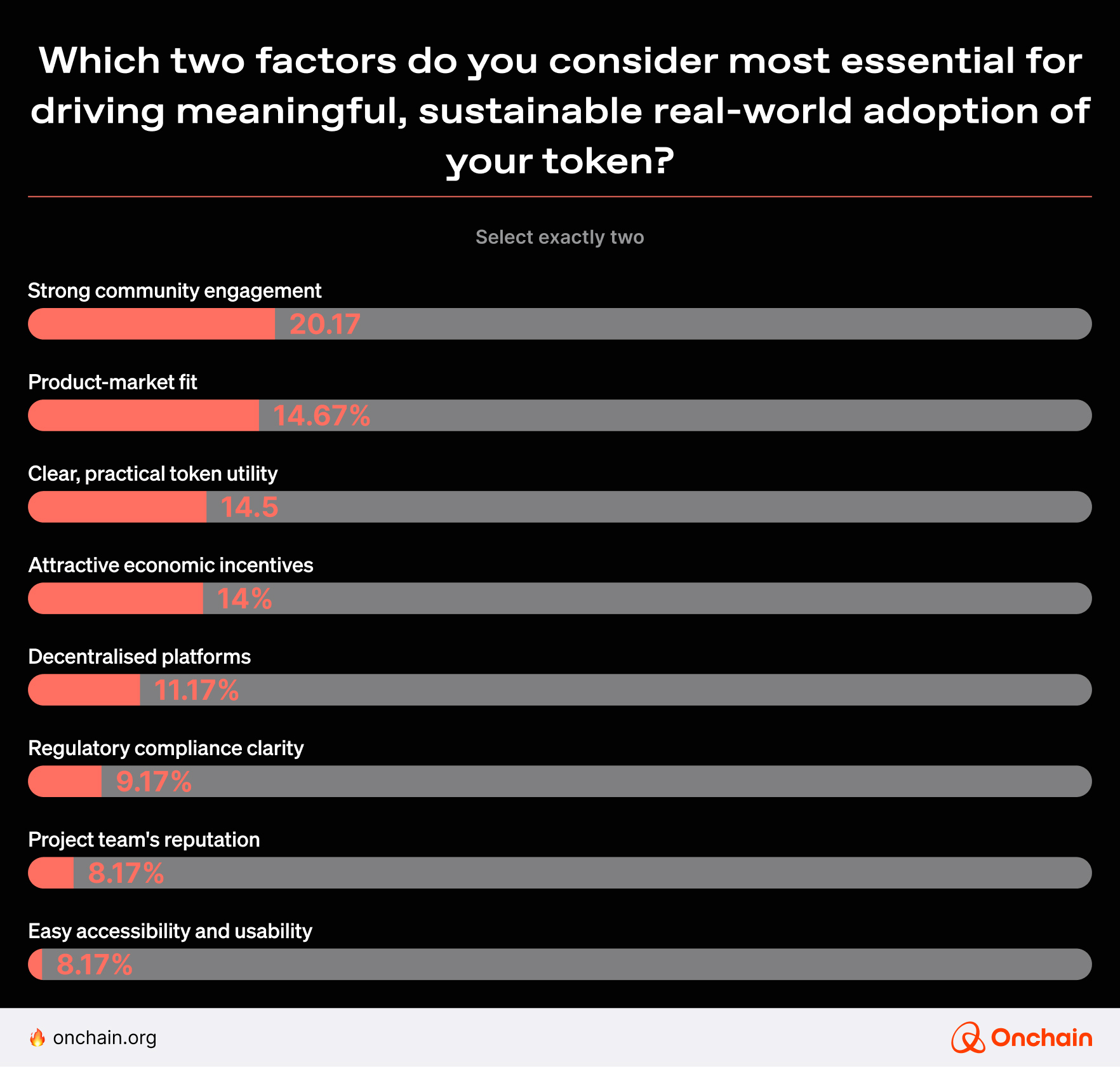

We conducted a survey among investors to understand their concerns when evaluating token launches, so we could provide a playbook that helps you launch with clarity, credibility, and community.

The results are evident: Most concerns stem from a lack of trust and clarity. If users don’t understand your token or don’t trust who’s behind it, they’re far less likely to participate.

Here’s our playbook:

TWO

🧠 Leverage AI for more than the launch

TWO

🧠 Leverage AI for more than the launch

- Set automated emissions or burn logic.

- Personalize onboarding and rewards.

- Detect Sybil activity and fake wallets with the help of Gitcoin Passport or Proof of Humanity.

THREE

🔄 Design tokenomics for long-term engagement

THREE

🔄 Design tokenomics for long-term engagement

- Use dynamic supply models or use Token Engineering Academy for simulation-based models.

- Add staking, vesting, or milestone-based token unlocks.

FIVE

🔐 Secure what you build

FIVE

🔐 Secure what you build

- Engage with platforms like Code4rena and Sherlock for comprehensive smart contract audits.

- Implement Safe for multisignature wallets. Consider bug bounty programs like Immunefi to incentivize security research.

- Use custody solutions like io.finnet to manage token security from day one — particularly valuable for multi-sig teams, institutional launches, or cross-chain assets.

SIX

🤝 Enable community co-ownership

SIX

🤝 Enable community co-ownership

- Utilize governance tools like Tally, CharmVerse, and Snapshot to facilitate decentralized decision-making.

- Integrate solutions like DAOhaus to streamline governance processes.

SEVEN

⚖️ Navigate regulation without stifling innovation

SEVEN

⚖️ Navigate regulation without stifling innovation

- Adopt a multi-jurisdictional approach.

- Implement solutions like Chainalysis and Notabene to meet compliance requirements.

Bonus 1: the memecoin trenches and why they matter to founders

Launching a token is now as easy as posting a meme. Platforms like Pump.fun have lowered the barrier to near zero: a few clicks, a meme image, and some SOL is all you need. Yet, the simplicity has a price. Roughly 97% of meme tokens vanish within a year. Most tokens fade rapidly after an initial pump driven by hype rather than fundamentals. The reality is clear: Tokens fail to retain value without active communities and sustained narratives. As Alvin Kan, Bitget Wallet’s COO, explains:

Memecoins are fueling significant activity, particularly on Solana, where strong communities and innovative developers are reinvigorating the market. However, the space is rife with challenges, from token overload to market manipulation. Bitget Wallet’s toolkit equips traders with the necessary tools to discover, analyze, and trade memecoins strategically, empowering them to navigate this fast-evolving landscape with confidence.

- Alvin Kan, Chief Operating Officer, Bitget Wallet

Success stories like PEPE, which achieved a $1 bil valuation purely through viral community momentum, remain rare exceptions, not the rule.

🔸Instant launch, immediate risks

Pump.fun’s interface makes token launches trivial:

- Name (full coin name)

- Ticker (short trading symbol)

- Description (often includes social links)

- Image (usually meme-based)

Tokens launch instantly via an automated bonding curve. Founders often pre-buy 10–30% of tokens immediately, aiming to use them for liquidity and promotions. But critically, Pump.fun doesn’t enforce locked liquidity, leaving token holders vulnerable to potential rug pulls or liquidity withdrawals.

🔸Pump mechanics: organized hype

Success on platforms like Pump.fun often hinges on coordinated promotion, sometimes through crypto influencer “cabals.” These groups create temporary, artificial hype before exiting, usually leaving latecomers with heavy losses.

Binance research highlights the magnitude: Pump.fun token founders cumulatively sold over 1.77 mil SOL (~$310 mil) back into the market, illustrating the scale at which they profit at token-holders’ expense.

🔸Next-gen memecoin platforms: Zora & Boop.fun

Emerging platforms like Zora and Boop.fun shift token creation towards sustainable engagement models rather than short-lived hype. For example, Zora tokenized Coinbase’s viral phrase “Base is for Everyone,” generating a token market cap reaching ~$20 mil overnight, demonstrating the new power of meme-driven financial culture.

Similarly, Boop.fun introduced “cult tokens,” incentivizing sustained engagement through staking and community rewards. The platform rapidly scaled thanks to influencer-driven promotion, achieving a peak valuation exceeding $500 mil. These platforms hint at a potential future for memecoins beyond mere speculation.

🔸Why it matters for founders:

For founders, these new platforms present both opportunity and risk. They offer powerful tools for rapid community-building and market capture by leveraging cultural virality and structured engagement incentives. However, this approach remains volatile, subject to quick market reversals, and highly dependent on influencer credibility and community sentiment. Founders must navigate carefully, balancing immediate virality with clear tokenomics and sustainable engagement strategies to mitigate the inherent risks of fast-moving memecoin ecosystems.

Bonus 2: the base launch playbook

A comprehensive guide for launching a token or an app onchain.

The Base Launch Playbook breaks the process into three distinct stages:

- Pre-launch → Learn, test, deploy.

Learn to build onchain, join builder communities, and test on Base Sepolia.

- Launch → Announce, go live, activate.

Announce publicly, make it easy for users to join, and apply for ecosystem funding.

- Post-launch → Measure, grow, sustain.

Track token performance, explore aggregator visibility, and connect to partnerships.

For each step, you receive battle-tested actions for projects launching on Base.

🔍 Why it matters

This guide turns a complex process into actionable activities. It teaches you how to treat your launch like a product sprint, not a press release. It outlines a launch strategy with real steps and fundamental tools.

As Jesse Pollak, creator of Base, emphasizes:

We’re working to bring a billion people onchain, and that means that getting your project onchain - whether that’s a token or an app - needs to be easier. Base is aiming to support teams who are launching a token with guidance and best practices to help them succeed. Our goal is to make the process more accessible to builders, and to set teams up to help their projects grow over time."

- Jesse Pollak, creator of Base

You can access the full guide here.

Final takeaway

“The best launches aren’t the loudest. They’re the most aligned.”

The evolution of token launches from the speculative frenzy of ICOs to the strategic, compliance-driven models of 2025 reflects a maturing industry. This report has explored the most effective strategies, regulatory landscapes, and emerging trends shaping the future of Web3 fundraising.

To Web3 founders and business owners, the path toward a successful token launch in 2025 looks like this:

✅ Launching when the token has real economic utility.

✅ Thinking beyond one-time distribution into ongoing alignment.

✅ Balancing growth, governance, and regulatory foresight.

✅ Building communities that feel like owners, not exit liquidity.

Based on our research, Onchain foresees projects that treat tokens as living ecosystem components, rather than fundraising shortcuts, will ultimately thrive.

Your move, builders

The blueprint is clear — now execute.

🔹Founders: Ditch the hype. Launch tokens that work, not just trade.

🔹Investors: Back projects with real utility, not just vaporware.

🔹Communities: Demand transparency, explore and engage with the project, and hold teams accountable.

The future belongs to those who launch with purpose, align with stakeholders, and build for longevity. Start now.

But don’t stop there.

We’ve done the homework for you; now use it to elevate your project.

Prep for the next wave: Explore early insights on our Web3 Insights Marketplace. Sign up for the Onchain newsletter and head to our Magazine page. Take it to the next level: Read more of our industry takes from the Onchain Research page, and follow us on socials.