4. Token Regulation Playbook: From High Risk to High Trust

You’ll learn:

- How business-friendly environments stimulate Web3 growth and adoption.

- How the U.S. leads the market in crypto fundraising, despite its restrictions.

- Which jurisdictions have a clear and established regulatory framework for token issuers.

- How you can take advantage of the favorable legislation and avoid regulatory risks.

In 2024, crypto fundraising hit $16.1bil, up 53% from the previous year, highlighting Web3’s rapid growth.

But if your jurisdiction isn’t aligned with that growth, your launch may not last. This section identifies regions that got it right and why. You’ll also discover where you should act with care as a Web3 founder.

4.1 Comparison of business-friendly environments vs. restricted markets

Business-friendly jurisdictions: UAE and MiCA-compliant nations as case studies

As regulatory clarity becomes a key driver of Web3 growth, certain jurisdictions stand out for their balanced approach to oversight and innovation. The United Arab Emirates (UAE) and EU countries are compelling examples of regions fostering crypto adoption through thoughtful regulation.

UAE: A hub for crypto innovation

In 2024, the Middle East & North Africa (MENA) ranked as the seventh-largest crypto market, accounting for 7.5% of global transaction value. Leading the charge is the UAE, which has emerged as a global blockchain hub thanks to its clear, structured regulations overseen by various regulatory bodies, including:

🔸 Securities and Commodities Authority (SCA)

🔸 Financial Services Regulatory Authority (FSRA) – Abu Dhabi Global Market (ADGM)

🔸 Dubai Financial Services Authority (DFSA) – Dubai International Financial Centre (DIFC)

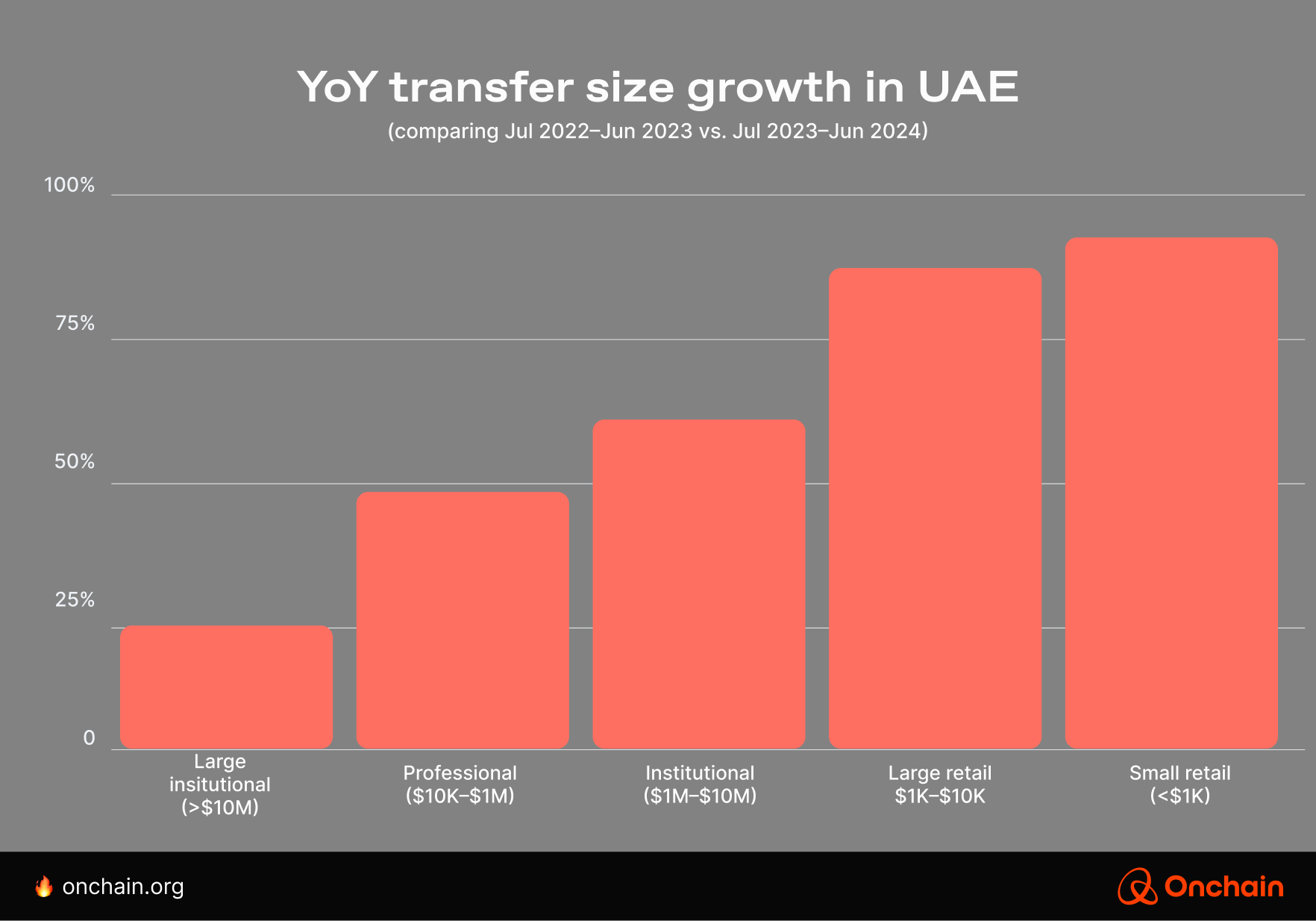

With dedicated free zones like DIFC and ADGM, the UAE offers a supportive, compliant environment for Web3 businesses. Its proactive regulatory approach has attracted a wide range of users and enabled growth across all transaction sizes. We’re looking at a well-rounded and rapidly maturing crypto ecosystem.

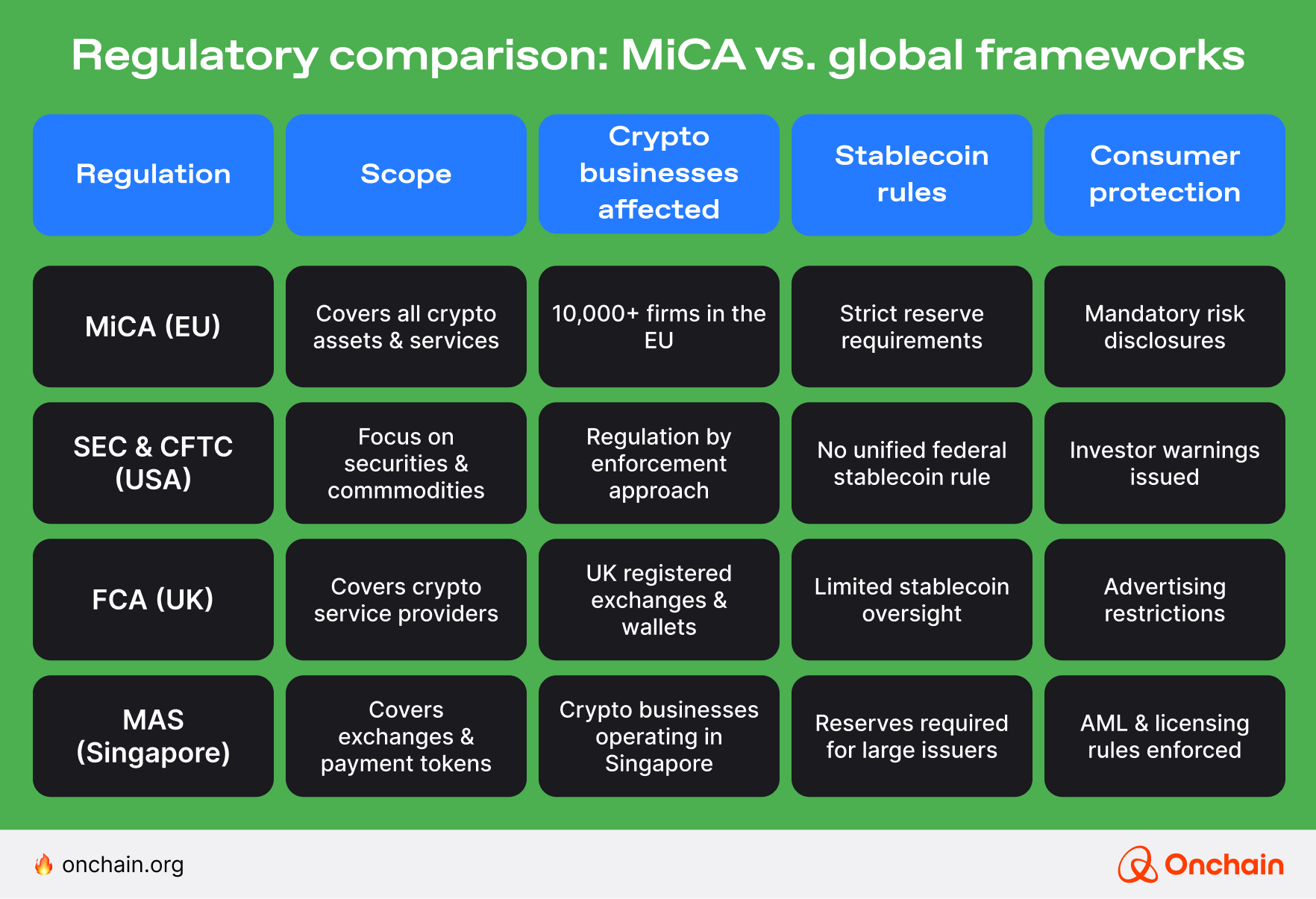

MiCA: A blueprint for sustainable token issuance

The European Union’s implementation of the Markets in Crypto-Assets (MiCA) Regulation has established a comprehensive and uniform framework for crypto assets for its member states.

MiCA-compliant EU nations have become attractive destinations for token issuers seeking a stable and business-friendly environment. For the industry, this marks a significant regulatory milestone. MiCA creates a more structured and transparent crypto market and is expected to increase mainstream adoption in the long run.

Let’s see what makes MiCA unique.

MiCA provides a pan-European framework, however, individual member states have been preparing for its application. Examples of member state implementation in April 2025 include:

-

- Germany, Europe’s largest economy, has integrated MiCA regulations into its legal framework, providing a clear pathway for token issuers.

- France has proactively embraced MiCA. The Financial Markets Authority (FMA) oversees crypto-asset activities, ensuring a regulated and supportive environment for token launches.

- Malta, known for its innovative approach to digital assets, aligns with MiCA standards. It offers a conducive setting for crypto businesses that seek regulatory certainty.

Liechtenstein, Denmark, and Estonia’s regulatory bodies have also issued dedicated guidelines under MiCA.

Switzerland’s Financial Market Supervisory Authority (FINMA) aligns closely with MiCA principles, despite not being an EU member. In particular, startups located in the Crypto Valley (Zug) benefit from clear tokenization laws and a mature investor ecosystem.

The dynamic yet effective implementation of such a unified regulatory framework provides a blueprint for other nations to adhere to. It also presents an opportunity to global regulators in regions such as the UK and the United States, where regimes are more stringent, to adopt similar frameworks.

Why onchain founders should care

Compliance produces clarity. Clarity builds community trust, attracts institutional capital, and gives teams room to scale.

Why it matters to you:

✅ You want to know how your token will be taxed and treated.

✅ Your users want to avoid rug-pulls, shutdowns, or gray zones.

✅ Your investors need legal certainty before participating.

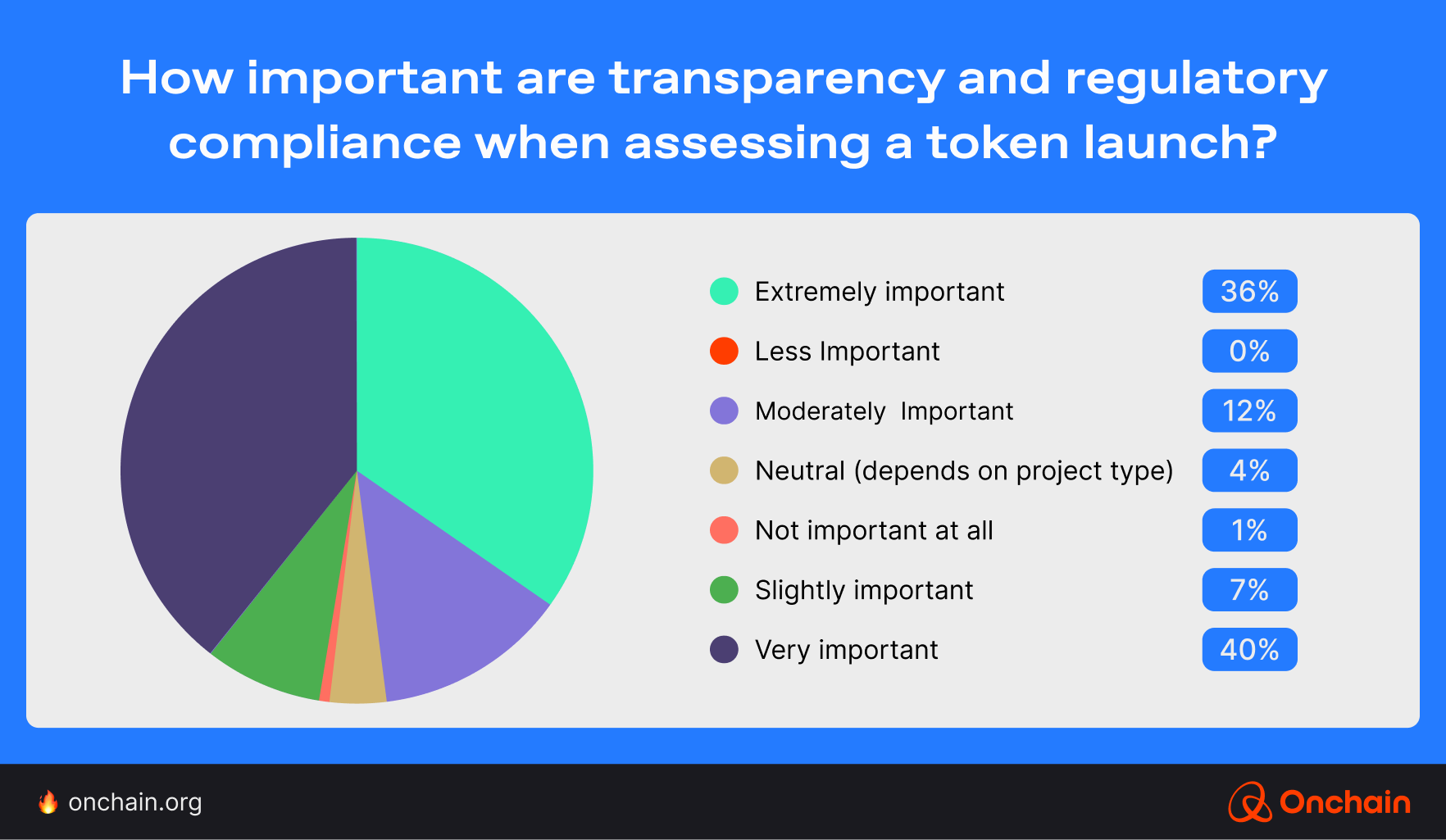

💡 Survey insight:

Regulatory transparency is one of the top three concerns for token participants. Tech is no longer the only concern — it’s about trust, which is easier to build in jurisdictions like the UAE and the MiCA-regulated EU.

⚠️High-risk regulatory environments: USA as a case study

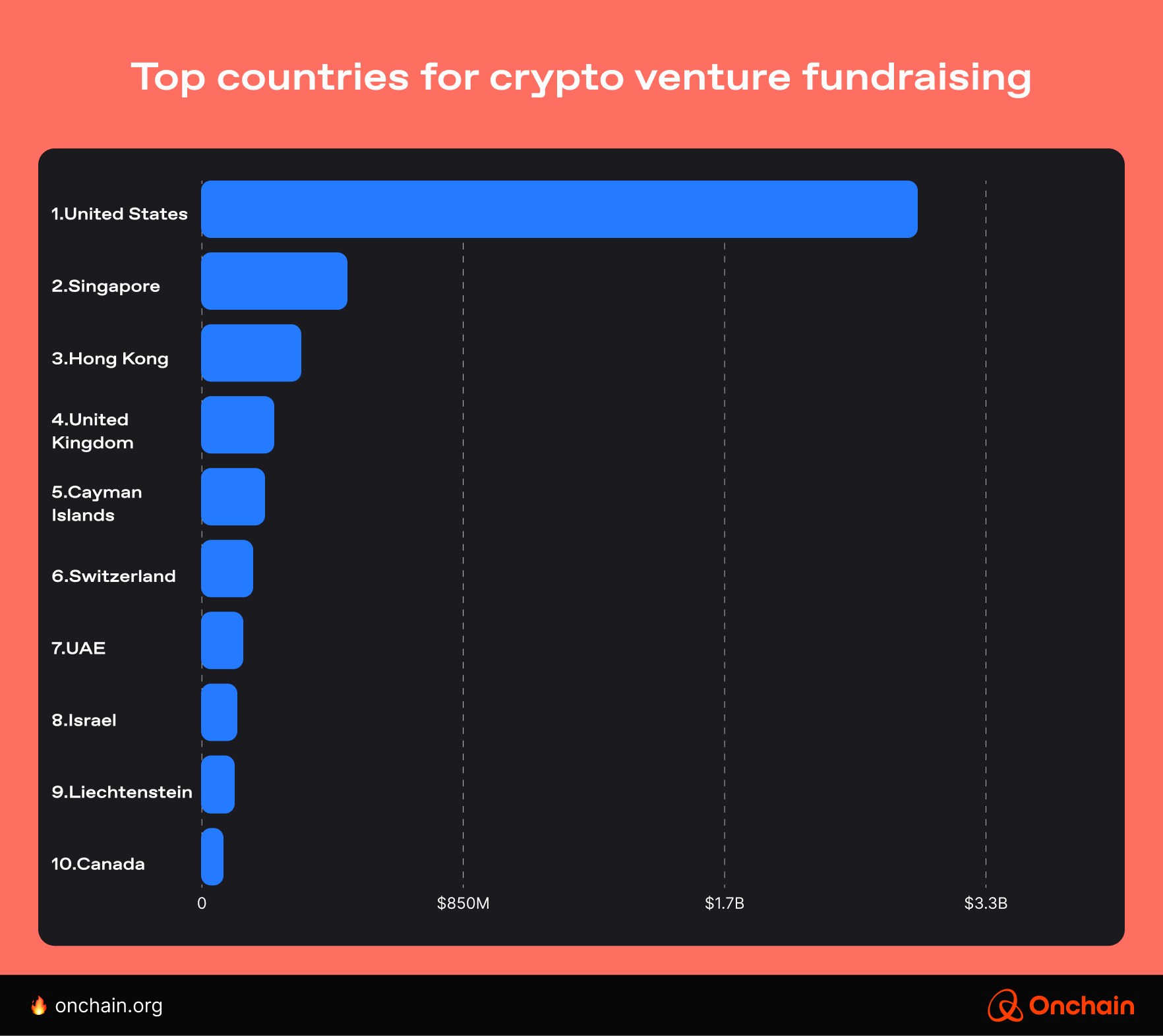

The United States remains the global leader in crypto fundraising. With $2.9 bil raised, it surpasses other jurisdictions by far. However, in 2025, it will be considered a de facto restricted market, similar to countries that allow but impose extreme barriers on crypto, which effectively limit adoption.

- The United States didn’t ban crypto (like in China), but SEC lawsuits and banking “chokepoints” (e.g., Operation Chokepoint 2.0) restrict access.

- Canada imposes strict crypto asset rules, such as securities laws and exchange pre-registration requirements.

- In the United Kingdom, the Financial Conduct Authority (FCA) bans crypto derivatives (e.g., futures) for retail investors.

The United States’ position as a leading crypto investment and adoption hub indicates a strong presence and activity from corporate investors, builders, and traders in the region. According to our survey, perception reflects this on-the-ground activity: Over 50% of respondents view it as the most favorable jurisdiction for launching a token, and projects still favor it over friendlier jurisdictions like the UK (18.67%), Dubai (9%), or Switzerland (7%).

This dominance persists, despite key industry players cautioning against public U.S. token sales and ongoing efforts to restrict tokens from re-entering the country. But how and why exactly? Our take:

✅ Access to capital: VC and institutional funding are the main drivers, along with strong participant demand.

✅ Market infrastructure: Liquidity (e.g., U.S.-based exchanges like Coinbase and Kraken, and OTC desks dominate global volume) and talent ecosystem.

✅ Network effects and cultural inertia: It hosts the majority of crypto events and media, and founders default to U.S. networks and playbooks, thanks to projects with first-mover advantages.

✅ ‘Gray zone’ exploitation: State-level flexibility (e.g., Wyoming, Florida, and Texas offer crypto-friendly laws) and strategic non-compliance (avoiding direct SEC engagement).

The U.S. regulatory environment has remained uncertain over the past few years, making it one of the riskiest jurisdictions for token launches. However, given the changes in the political landscape following the 2024 presidential election — and the crypto regulation climate, as a result — the outlook is becoming more positive in this particular region.

The current administration, which some view as pro-crypto, actively works to clarify and streamline the regulatory framework for digital assets. A few arguably positive developments include, among others:

- The Securities and Exchange Commission (SEC) established a Crypto Task Force to simplify the process of token offerings by revising registration pathways, such as Regulation A and crowdfunding.

- The Office of the Comptroller of the Currency (OCC) reaffirmed that certain cryptocurrency activities are permissible within the federal banking system, indicating a broader acceptance of digital assets in traditional financial institutions.

Despite the lack of regulatory certainty, the U.S. SEC acknowledges its role in facilitating innovation and experimentation through the implementation of sandboxes. Commissioner Peirce shared her views during the recent Blockchain Legal Institute Global Summit in March 2025:

What I hope to do is to provide a regulatory framework within which the industry can do experimentation and figure out where blockchain technology has its highest and best use.

- Hester M. Peirce, Commissioner, U.S. SEC.

4.2 Jurisdictions with clear regulatory frameworks

If you’re launching a token, regulatory strategy is product strategy. Choose the wrong jurisdiction, and even a great project can stall.

RWA tokens face multi-jurisdictional regulatory complexity, securities law classification issues, and KYC/AML requirements that vary by asset class. The EU with MiCA, U.S. with SEC guidance, and Singapore with its frameworks create a fragmented landscape for cross-border offerings.

- Marko Vidrih, Co-founder, RWA.io

Naturally, it would be ideal to operate within these highly regulated jurisdictions to ensure compliance without fear of legal repercussions.

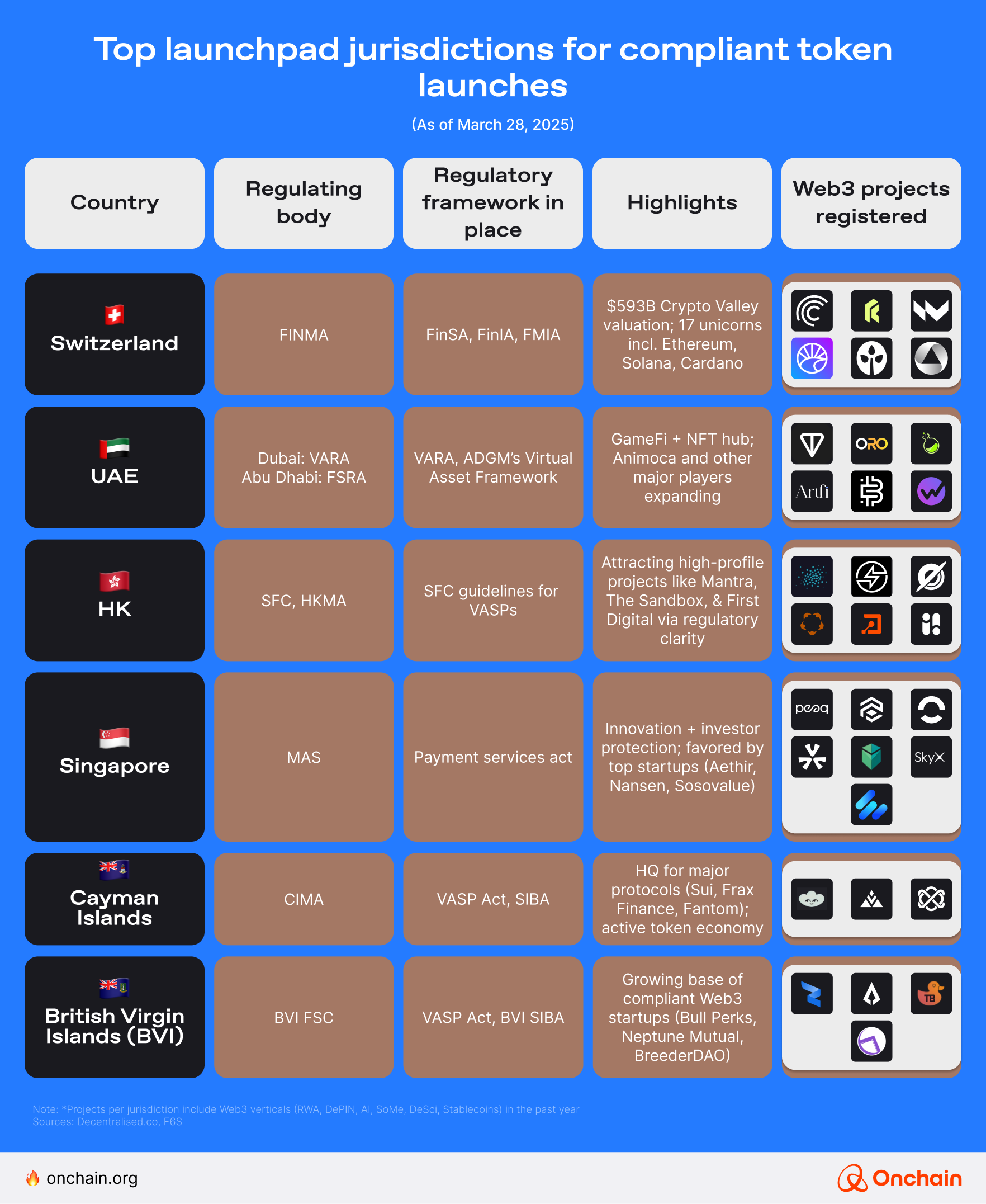

Several jurisdictions, including Switzerland, Liechtenstein, the United Arab Emirates, the Cayman Islands, Hong Kong (HK), Singapore, and the British Virgin Islands (BVI), have special VASP (Virtual Asset Service Provider) regimes in which Web3 projects can issue tokens with relative regulatory clarity.

Where regulation equals opportunity

To help you determine your product’s level of compliance, we’ve mapped out the most favorable jurisdictions for token issuances. We focused on countries with established frameworks and regulated crypto environments.

Smart moves for navigating token regulation

Launching a token in 2025 isn’t just about innovation — it’s about navigation. And to be candid, regulatory clarity is a core launch lever. If you don’t know where your token fits legally, you won’t know where it can grow.

Here’s what founders need to do, and what to avoid in this evolving legal terrain.

1. Go private first, public later

Start with private token sales in business-friendly regions (e.g., Switzerland, Singapore, and the UAE). This will give you time to build traction and avoid early-stage legal friction.

Once you’ve got product validation and jurisdictional clarity, expand to broader public rounds.

Why it works: This extra step reduces exposure to enforcement risks and positions your project as mature and compliant. Both are a major plus for investors and users.

2. Structure globally, launch locally

Many leading teams now operate in multi-jurisdictional setups:

📍 UAE (ADGM, DIFC): Tax perks, fast-track approvals.

📍 Switzerland (Zug): Strongest legal clarity for tokenization.

📍 Singapore, BVI, Cayman: Balanced frameworks for fundraising and retail onboarding.

This modular legal architecture helps optimize for both compliance and capital across geographies.

Why it works: It prevents you from being trapped within one country’s legal boundaries, unlocks broader investor access, and future-proofs your launch model.

3. Make the law part of your token design

Bake compliance into your token model, instead of tacking it on later.

Top teams now co-design tokenomics and governance mechanics with legal counsel:

- Choose frameworks (e.g., VASP vs. securities) based on jurisdiction.

- Align emissions with investor protections (e.g., vesting, caps).

- Document everything to build users’ and regulators’ trust.

Why it works: You signal sincerity to VCs, exchanges, and communities, and you prevent costly legal refactoring post-launch.

4. Use free zones and innovation districts

Launch where the rules are clear and the incentives are strong:

- Dubai (VARA) and Abu Dhabi (ADGM) offer Web3-friendly licensing and zero-tax environments.

- Zug’s Crypto Valley supports token startups and unicorns with legal clarity and deep networks.

These ecosystems regulate and accelerate as a result.

5. Monitor key markets actively

Markets like the United States, Singapore, and Hong Kong are tightening regulations. You must stay up-to-date, otherwise you risk falling out of step.

- United States: Progressing post-2024, but public sales remain risky.

- Singapore: Strong AML/KYC enforcement and VASP licensing.

- Hong Kong: New token listing rules and retail protections.

Why it works: Regulatory missteps cost time and credibility. In a changing environment, staying informed means staying ahead.

Final thought for founders

The days when launching a token was about chasing hype are over. Today, choosing and embedding the right regulatory strategy into your business from day one is a crucial success factor.

Your roadmap:

🌐 Structure globally

🔐 Comply locally

🚀 Scale confidently

You are now aware of the most favorable regulatory regions for launching a token. With the distinct do’s and don’ts you’ve just noted, you’re almost ready to hit the market.

The next and final chapter will inspire your imagination. You’ll discover the latest innovations in launch design: from chaotic memecoins and AI-powered drops to structured, sector-specific frameworks. Can these new models scale while preserving sustainability and decentralization, and what can you implement in your own concept?

Let’s find out. 👉