1. Why Real-World Assets Matter In the Global Economy

You’ll learn:

- A clear definition of RWAs and why they matter now more than ever.

- How blockchain addresses critical challenges in emerging markets.

- The evolution of tokenization from gold standards to NFTs and stablecoins.

- Key benefits of RWAs: accessibility, transparency, and verifiable ownership.

- Market forecasts showing RWAs could reach $15T in value by 2030, with emerging economies capturing up to 20% of the market.

The world of blockchain is full of vague and ambiguous terms: Web3, decentralization, metaverse, to name just a few. All these concepts lack concrete and commonly shared definitions. No wonder there’s a lot of bafflement in and around the crypto space.

The term Real-World Assets adds to the confusion and may well win a disorientation award. Despite its status as the hottest narrative in Web3, you’ll hardly find two people who share the same understanding of the term RWA.

So, let’s make sure we’re on the same page. In this report, the term RWA refers to:

- Assets that exist in the physical world but can be brought onchain.

- Assets that can be tokenized on blockchain.

- Assets whose ownership couldn’t be proven beyond doubt without blockchain technology.

1.1 The scope and diversity of RWA usage

Our initial research revealed the most prominent areas of Real-World Asset usage. Because they are quite diverse, we divided them into 9 primary domains, shown in the following table.

Focus point: emerging markets

The hype around RWAs may primarily affect western countries, but that’s because the affluent world jumps on any new technology that smells of profit. The likelihood that these economies will leverage the benefits and revolutionize their real-world business activities is rather low.

We see so-called emerging countries as the most promising markets for Real-World Assets. Our focus will be on these and other markets where RWAs can have a significant, wide-scale real-world impact.

What are emerging markets, and why focus on them?

Emerging markets are countries that have reached the state of a developed country in some areas but are far from meeting all criteria. Characteristics associated with emerging markets are:

ONE

Economic growth is fast

ONE

Economic growth is fast

Emerging markets often experience high economic growth rates, fostering opportunities for businesses and investors.

TWO

Market liberalization is ongoing

TWO

Market liberalization is ongoing

Emerging countries are aware that a free market can attract foreign investment, encourage competition, and stimulate economic growth.

THREE

Infrastructure development is encouraged

THREE

Infrastructure development is encouraged

You often see significant investment in infrastructure but a lack of quality, efficiency, and long-term maintenance in such countries.

FOUR

Financial markets are volatile

FOUR

Financial markets are volatile

Financial markets in these countries are often volatile, posing risks but also providing opportunities for investors.

FIVE

Currency risks are high

FIVE

Currency risks are high

Countries with an insignificant or unstable currency suffer an increased risk of exchange rate fluctuations.

SIX

Capital accessibility is obstructed

SIX

Capital accessibility is obstructed

It’s difficult to access capital in underdeveloped financial markets typical for emerging countries, and this hampers economic development.

SEVEN

Financial inclusion is a struggle

SEVEN

Financial inclusion is a struggle

Emerging countries don’t offer equal financial opportunities and affordable financial products to everyone.

EIGHT

Technology adoption is rapid

EIGHT

Technology adoption is rapid

Consumers in emerging markets usually adopt new technologies faster than in developed countries.

NINE

Technological infrastructure is insufficiently developed

NINE

Technological infrastructure is insufficiently developed

Despite the openness to new tech, the technological infrastructure is still poorly developed, but is essential to harnessing the benefits of digitalization.

The obvious contradictions in emerging markets’ characteristics point towards the basic nature of their challenges. They need solutions that can help level the financial and technological imbalances to keep moving forward. RWAs address both and are, therefore, more interesting for emerging markets than developed countries.

Which countries are most commonly referred to as “emerging markets”? Relying on the MSCI Market Classification, we can list the following: Brazil, Chile, Colombia, Mexico, Peru, Czech Republic, Egypt, Greece, Hungary, Kuwait, Poland, Qatar, Saudi Arabia, South Africa, Turkey, UAE, China, India, Indonesia, Korea, Malaysia, Philippines, Taiwan, Thailand.

You will find some countries in the report that fall outside this list – usually countries the MSCI categorizes as so-called frontier markets. We don’t want to limit ourselves to a small selection of countries just because of a label. If we found a real-world purpose for RWAs outside of emerging economies, you’ll read about it here (we made sure to state it clearly).

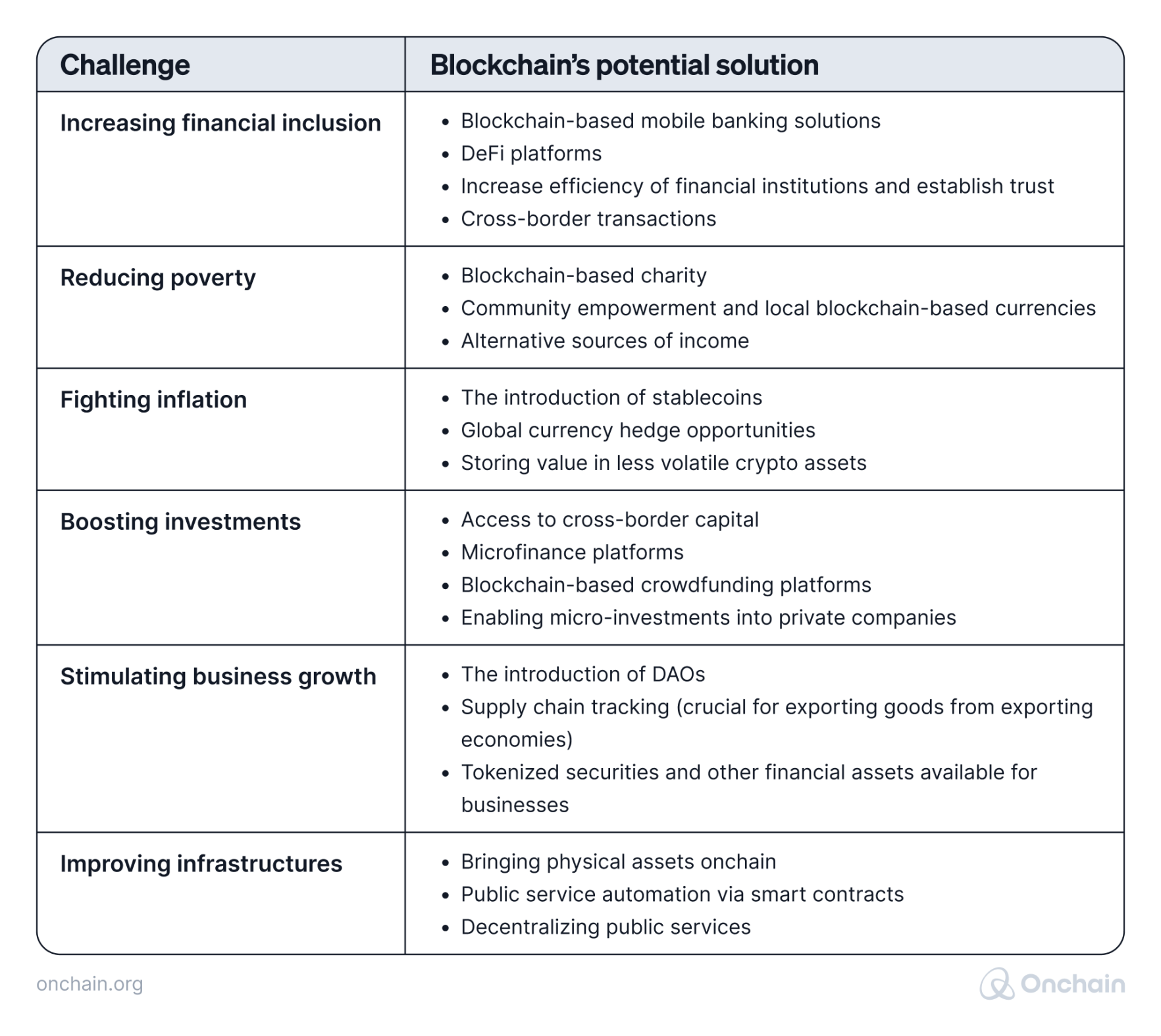

Blockchain’s promising role in emerging markets

Blockchain has been referred to as a remedy for emerging economies’ most stubborn pain points. If you take a closer look at the above characteristics and challenges, it appears a decentralized ledger indeed offers a solution for each obstacle.

Some blockchain-oriented projects already seize the opportunity and address these issues. Looking at major Layer 1 and Layer 2 protocols and their ecosystems, you quickly find dApps targeting emerging economies and their main challenges:

As you can see, the majority of blockchain solutions rely on Real-World Asset principles. The question is, do these apps really matter? And, can they actually make a difference in the real world?

We’ll get to the bottom of this and rank the top 9 domains based on our evaluation of their impact potential.

Keep in mind that RWAs may show less overall potential in lower-ranking application areas but could still be highly valuable in solving specific issues.

1.2 Why do RWAs matter now?

A brief history of tokenization and Real-Word Assets

Tokenization of assets in the non-digital world has a long history and initially wasn’t related to blockchain. Throughout history, you can find attempts to store value in physical assets such as buckskins, shells, or even cattle. To this day, cigarettes serve as a non-digital token – especially in prison.

The first significant example of asset tokenization appears to be the US Dollar. From 1944 to 1971 US banks had tokenized dollar banknotes with physical gold, known as the Gold Standard.

When the first digital currency, named Digital Gold, emerged, it was backed by physical money. Unfortunately, the first popular tokenized financial instrument quickly turned into an equally popular target of attacks. With inefficient technology to protect digital money, its history is marked by fraud, hacks, and illegal activity.

Other non-blockchain RWAs include real estate Investment Trusts (REIT) and Exchange-Traded Funds (ETF).

On the upside, the failure of electronic gold underscored the need for a more secure, reliable, and decentralized type of digital currency. We bet you know what we’re referring to.

Three common pain points RWAs could solve

All non-blockchain RWAs we’ve listed share a common set of struggles. The main concerns are:

- Lack of access for both investors and projects building in emerging markets.

- Centralized information that doesn’t allow investors and users to gain full visibility, traceability of performance, and liquidity of their investments.

- Lack of ways to digitally own assets that can be traded, often monitored by centralized entities.

The following points explain how Distributed Ledger Technology (DLT) provides solutions in these three crucial areas.

1.Accessibility

Defying physical borders, blockchain RWAs are accessible to an audience of investors beyond the local community.

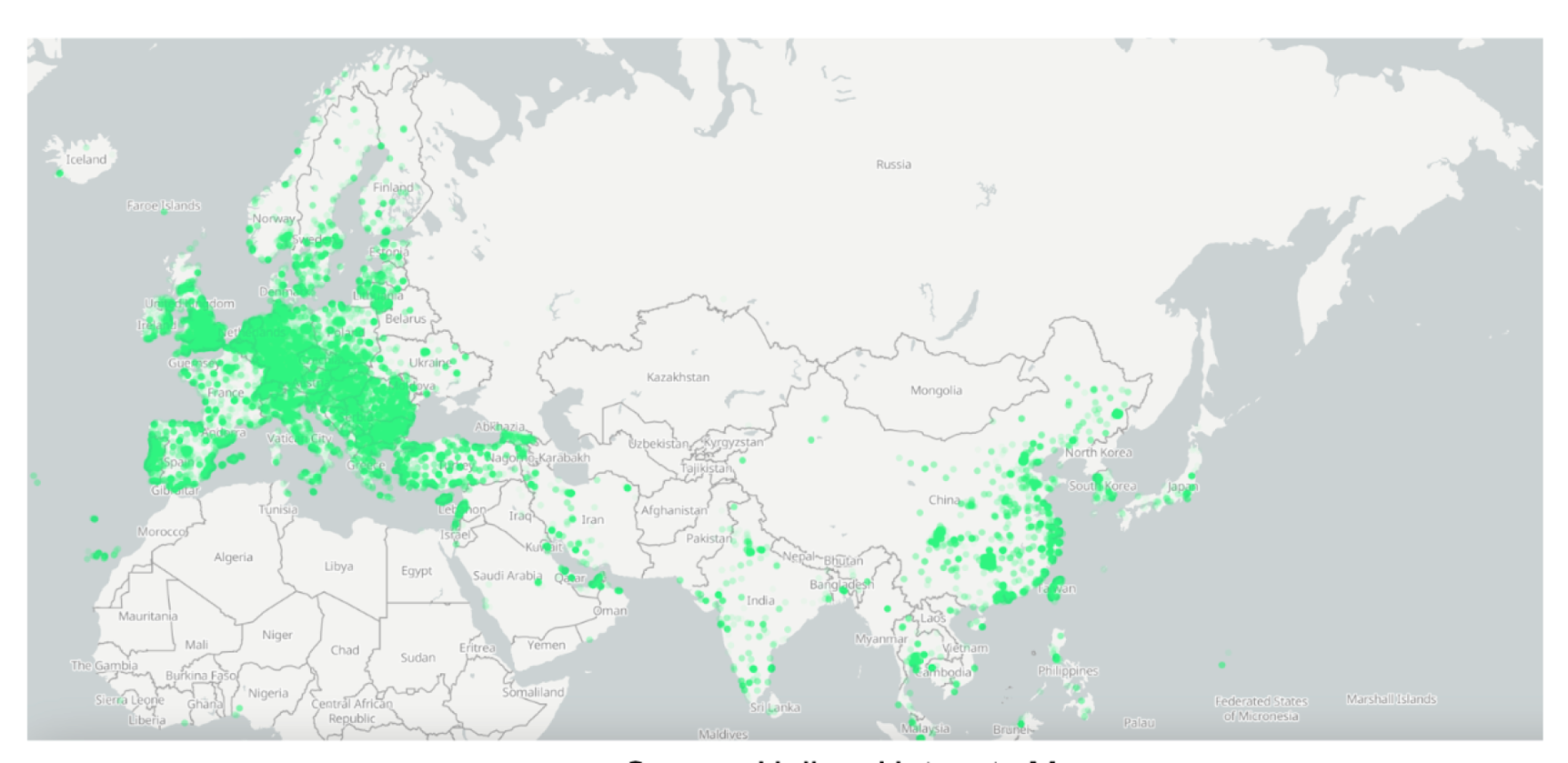

Traditional, small loans are prevalent all over Europe, the Mediterranean Area, Africa, Asia, and South America. Even in Greenland, Australia, and Russia, there’s some traditional small loan activity.

However, when we analyzed RWA loans specifically, we discovered they were distributed throughout the global south only and primarily in emerging markets. Hence, onchain loans succeed where they are needed most: in countries where local solutions are insufficient.

2. Transparency

Regardless of the type of project, transparency enables entrepreneurs and executives to make more impactful business decisions. Transparency also lies in the nature of blockchain. The technology facilitates access to the same information to everyone at any time.

Take the Helium Network as an example. A map on their portal displays all hotspots connected to the network and is visible to everyone – network participant or one-time visitor to the page. With this information, users can determine the best location to set up their equipment.

3. Ownership

RWAs such as art, shares, and real estate can be represented onchain through tokenization. Stored on the blockchain the data becomes immutable and easily verifiable. This minimizes disputes over ownership rights, royalties in case of reselling, and forgery.

The social marketplace Endemic is a good example in which a local artist’s authorship is represented by the ERC-721 token standard, in other words, a non-fungible token (NFT). This eliminates copyright issues and creates a traceable record of ownership.

The RWA movement is about updating the core primitives and components of the financial system where it interfaces with the real economy. Where traditional financial markets are fragmented, opaque, and inefficient, blockchain technology offers an opportunity to significantly improve upon these factors beyond what traditional technology can provide. With a fundamentally improved foundation for transparency, integrations, and efficiencies, we can begin to address significant gaps and challenges in traditional financial markets.

- Asad Kha, Partnerships and Business Development, Centrifuge

The taxonomy of tokenization

Okay, now you know that blockchain-based RWAs address the top challenges of digital tokens, but is that all? What is the true gain for businesses or entrepreneurs in leveraging the onchain technology?

We need to get deeper into the advantages and disadvantages of onchain technologies before we can answer this. First, let’s understand how value is created onchain and which offchain models are involved. The following table is an attempt to categorize the different industry aspects of an offchain, hybrid, and onchain business.

Market predictions and projections for RWAs

To grasp the potential impact of RWAs in driving financial inclusion, fighting inflation, and creating new business opportunities you also need to understand the current asset tokenization market.

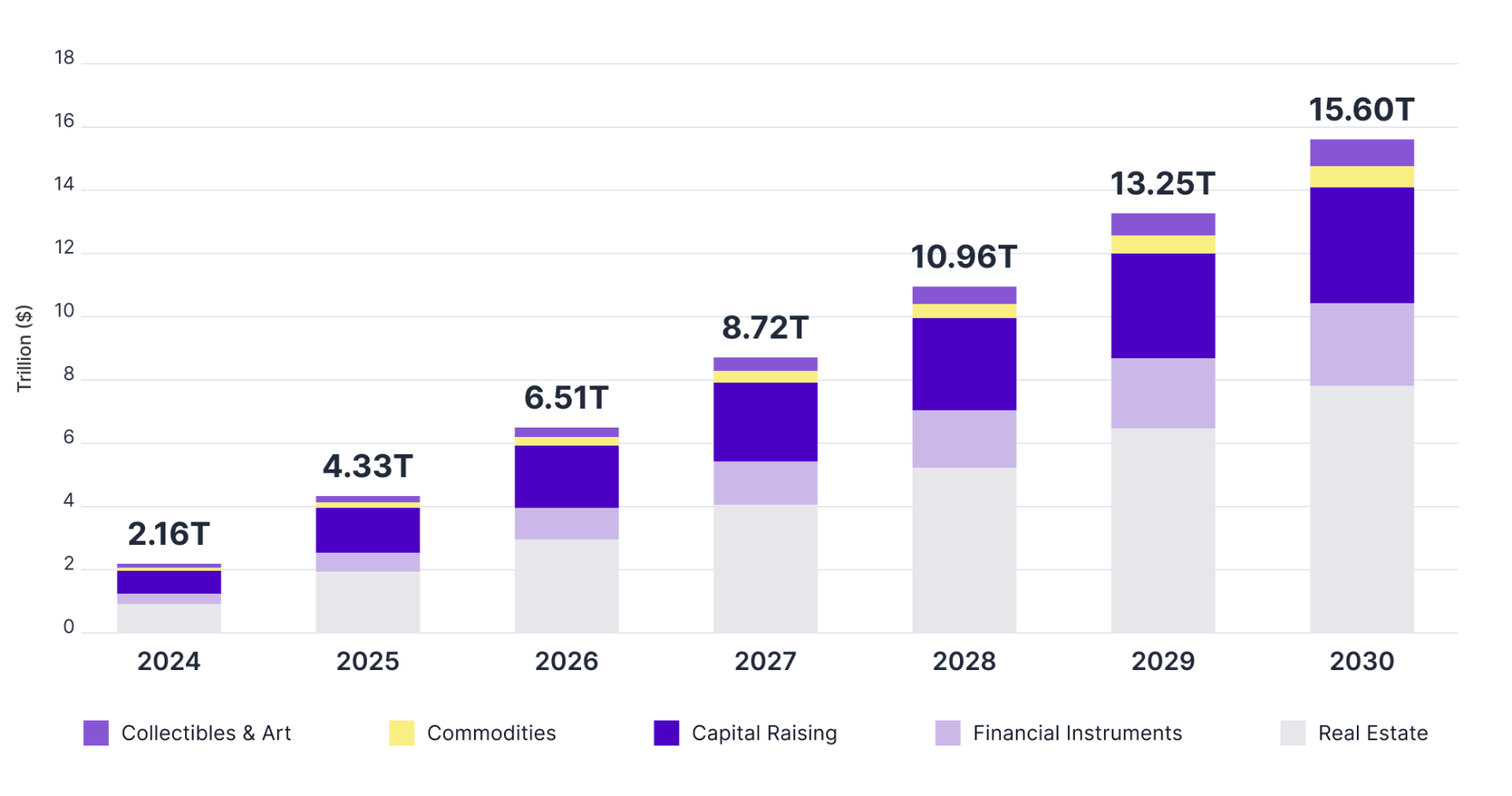

The below graph unveils our projections on this market’s size and the growth trajectory based on our in-depth analysis.

We project a substantial growth trajectory for the asset tokenization market, potentially reaching a value of USD 15 trillion by 2030. This represents a sevenfold increase in the value of tokenized assets from 2024 to 2030.

We anticipate that two asset categories – real estate and financial assets (comprising debt, capital raising, and public & private equity) – will lead the tokenization trend. This is due to their significant market size, minimal penetration, and the high prevalence of use cases.

When dividing the Real-Word Assets market geographically, our projections suggest that emerging markets could account for 18% to 20% of the tokenized market by 2030.

Tokenizing and turning Real-Word Assets into fractions, like digital shares that are transferred and settled in a completely digital environment, make it possible not only to lower investment entry points but also to reach a larger userbase of investors, generating more exposure and demand than ever for assets that sit in emerging economies.On the one hand, global capital is met with emerging economies. On the other hand, the domestic population in these economies now has better access to finance and alternative investments to compete with other emerging economies.

- Henri Ndreca, Co-founder and COO, T-Blocks

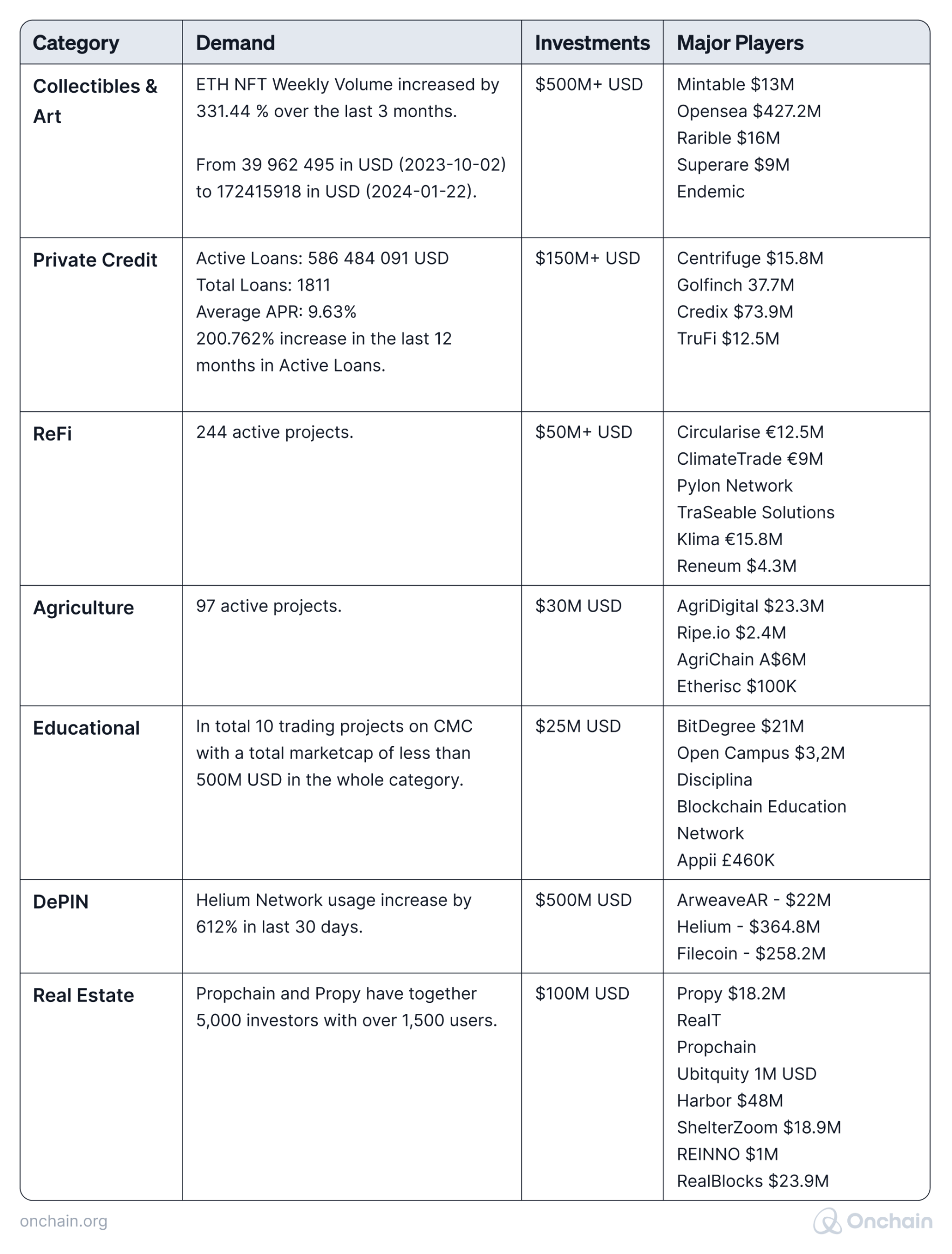

As the market for tokenization matures across various asset classes, we are witnessing a diverse range of venture capital investments and demand dynamics. This is intrinsically linked to the maturity levels of the players involved in these asset classes. The following table encapsulates the investments and key players in asset classes that will be the continuing focus of our report.

After this comprehensive overview from the history of tokenization to today’s RWA market predictions you understand better what this is all about. And you’re aware that RWAs matter most in emerging markets and why.

In the following section, you will find a detailed analysis of the different industry sectors and specific use cases where RWA can impact real world conditions. Read on to see the ranking based on impact potential.