5. The third side of the DePIN market – platform development

You’ll learn:

- Why DePINs are three-sided markets, and how the platform layer acts as the bridge between physical assets and digital economies.

- How blockchain choice, middleware design, and offchain components impact decentralization, resilience, and scalability.

- What different governance models (centralized, hybrid, DAO-driven) mean for efficiency, security, and community trust.

- How IoTeX and Lisk approach DePIN architecture differently, and what builders can learn from their layered infrastructures.

- Where emerging tech fits in: how AI can optimize energy, bandwidth, and maintenance; how ZKPs protect data while proving compliance; and how memecoins may gamify onboarding—despite their volatility risks.

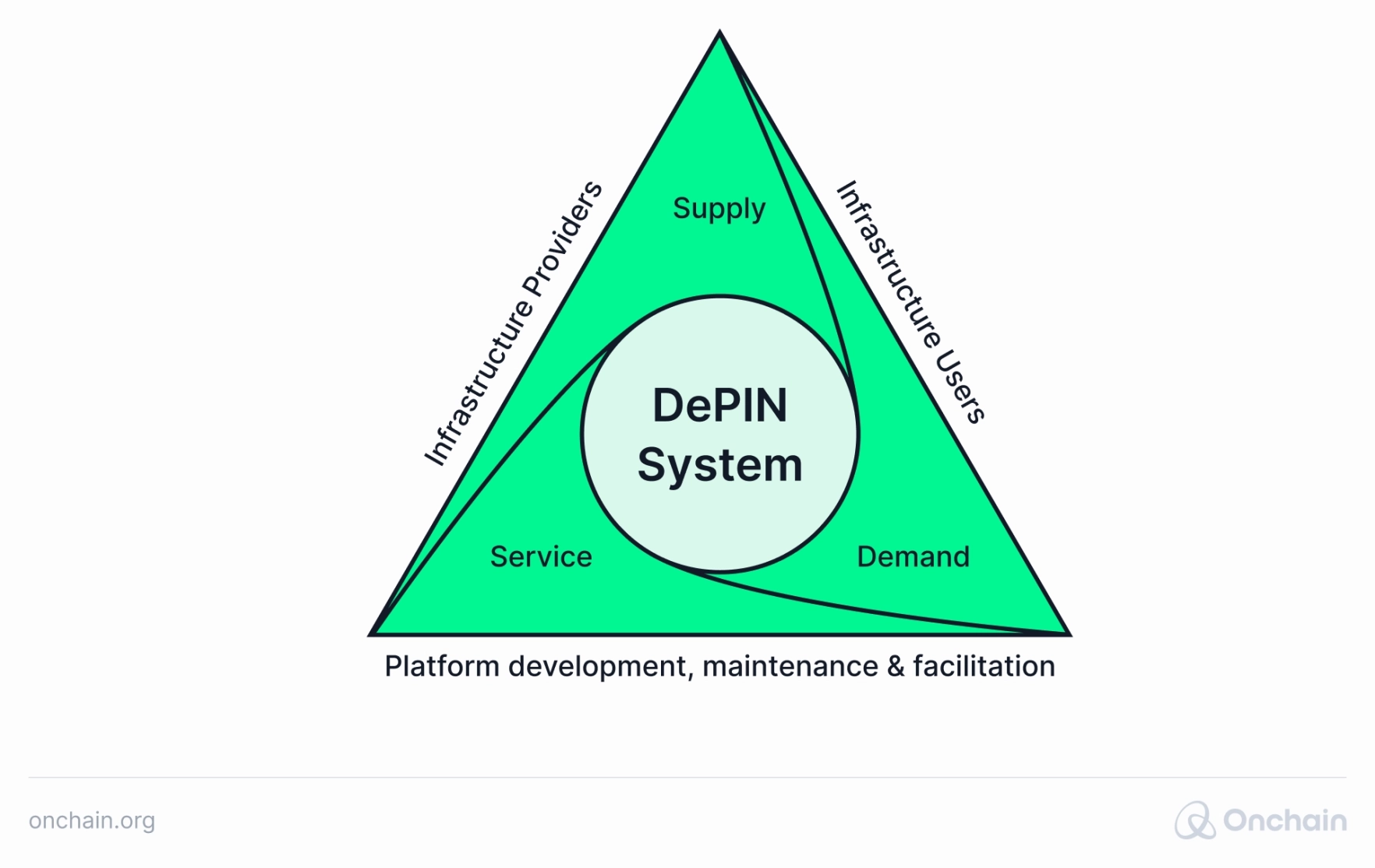

The technological needs of a DePIN project are dictated not only by the supply and demand side, that we explained above. There is also a service aspect: platform development.

To reiterate:

- The supply side is the foundation for DePIN applications. Think of it as the network of computers, the storage locations, the sensors, and all the other physical components that make decentralized services possible.

- The demand side consists of individuals, businesses, and other entities that need and use the infrastructure and services provided by the DePIN supply side.

The service side acts as the bridge between real-world infrastructure assets and the digital marketplace. It includes:

- The platform that enables seamless transactions and resource discovery.

- The individuals and organizations responsible for building and maintaining the technological backbone.

What makes DePIN work on the tech side?

The degree of decentralization of the service layer varies from project to project. So does the approach to tokenization and smart contracts.

To make an informed decision in this area, a DePIN needs to consider the following points:

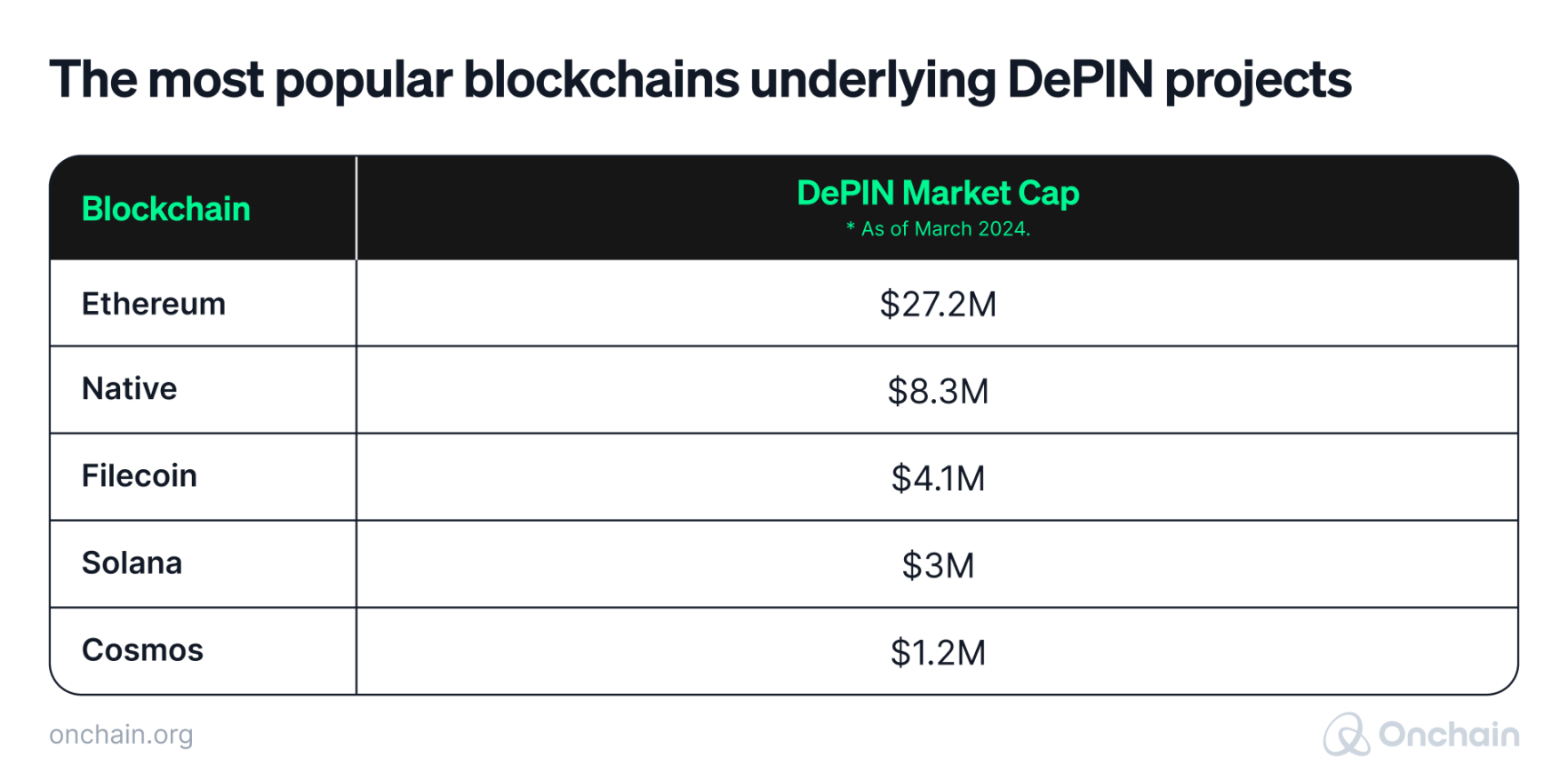

1. Blockchain Choice: Most DePIN systems opt for established Layer 1 blockchains and deploy smart contracts on top of them.

Popular choices include Ethereum for general-purpose use, while most projects prefer to build their own distributed ledgers. This offers maximum control but increases development complexity.

Worth noting: although Solana has recently been intensely DePIN oriented and has higher transaction throughput, it can still not take over Ethereum in DePIN market cap.

Here’s why:

- First mover advantage of Ethereum.

- One of Solana’s biggest challenges is network outages due to different congestion criteria and spam events.

- There are already established standards and norms for the processing of assets and transactions (EIPs) on Ethereum.

2. Offchain Component: The offchain functionalities of DePINs, such as data access, computation, and routing, rely on middleware components.

Here, developers must decide on the degree of decentralization:

- Centralized: Self-hosting on private servers for maximum control.

- Intermediate: Using cloud services for convenience and scalability.

- Decentralized: Leveraging solutions like w3bstream (routing) or Filecoin/Siacoin (storage) for greater resilience and censorship resistance.

3.Governance: DePIN projects show a significant diversity in governance structures. This has implications for stakeholder engagement and the degree of decentralization.

The models range across these key paradigms:

- Centralized: A core team or organization retains primary decision-making authority. This allows for streamlined development but carries the potential risk of limited community input and single points of failure.

- Hybrid: Elements of centralized and decentralized control blend together. Centralized management controls some functions, while community voting or onchain mechanisms control others. This model balances efficiency with participation but can introduce complexity into decision-making processes.

- Fully Decentralized: The community drives key decisions, typically through token-based voting systems or DAOs. This approach is in line with the DePIN ideals but requires careful design to achieve efficient consensus building.

4. Tokenomics: After reading the previous part of this report, you are aware of the powerful role tokens play in incentivizing participation in DePINs. Although cash rewards may seem like the easiest solution, they have limitations.

We have analyzed leading DePIN projects and identified their key tokenomic principles. These principles will maximize your chances of success when building new DePIN protocols:

- Minting tied to utility: To maintain a sustainable economy, it’s critical to link the issuance (minting) of tokens to the creation of real value within the network. Ideally, token issuance reflects the value that users and providers find in the system.

- Staking, collateral, and their role in DePIN security: DePIN projects often install staking and collateral mechanisms. These ensure reliable service and protect the network from malicious behavior. In the Data Union DAO, for example, data providers stake tokens. If they provide faulty or inaccurate data, the mechanism slashes (takes away) their stake and redistributes it to other participants. This creates a strong financial incentive for data quality.

- Simple exponential decay model: In this model, block rewards are high in the beginning and then rapidly decline over time. This can harm the long-term health of a DePIN network. For example:

- Short-Term Focus: It incentivizes miners to rush for early, outsized rewards. This leads to unsustainable behavior and neglects the long-term growth of the network.

- Hardware Overinvestment: Miners may overinvest in hardware to maximize early rewards. When rewards decline, they abandon the network and damage its reliability.

- Poor Value Alignment: Rewards depend on how early a miner joins rather than the actual value they provide (e.g., reliable storage). This misaligns incentives and can harm the user experience.

- Baseline Minting: The traditional, fixed vesting model releases token rewards on a strict schedule – this may not be ideal for DePIN projects. Instead, consider a baseline minting model. Here, block rewards scale in relation to the value that users create on the network.

Technological limitations for DePINs – few, but critical

The DePIN space buzzes with opportunities, offering a revolutionary approach to infrastructure management. However, the operational challenges of widespread implementation are vast. We explored some of them when outlining the main risks of DePINs. Read this next section to get a better understanding of the technological aspects and details.

- While basic sensors are affordable, advanced equipment such as drones or specialized hardware is not. This can be a barrier to entry. Tokenizing physical assets offers a promising solution. It makes them more liquid and accessible to communities through fractional ownership. This can democratize participation and unlock the full potential of DePINs.

- DePINs give autonomy to edge devices managed by diverse communities. This requires robust data verification mechanisms to prevent spoofing and ensure trust in the network. Innovative solutions such as secure multi-party computation and verifiable computation can help build trust and data integrity.

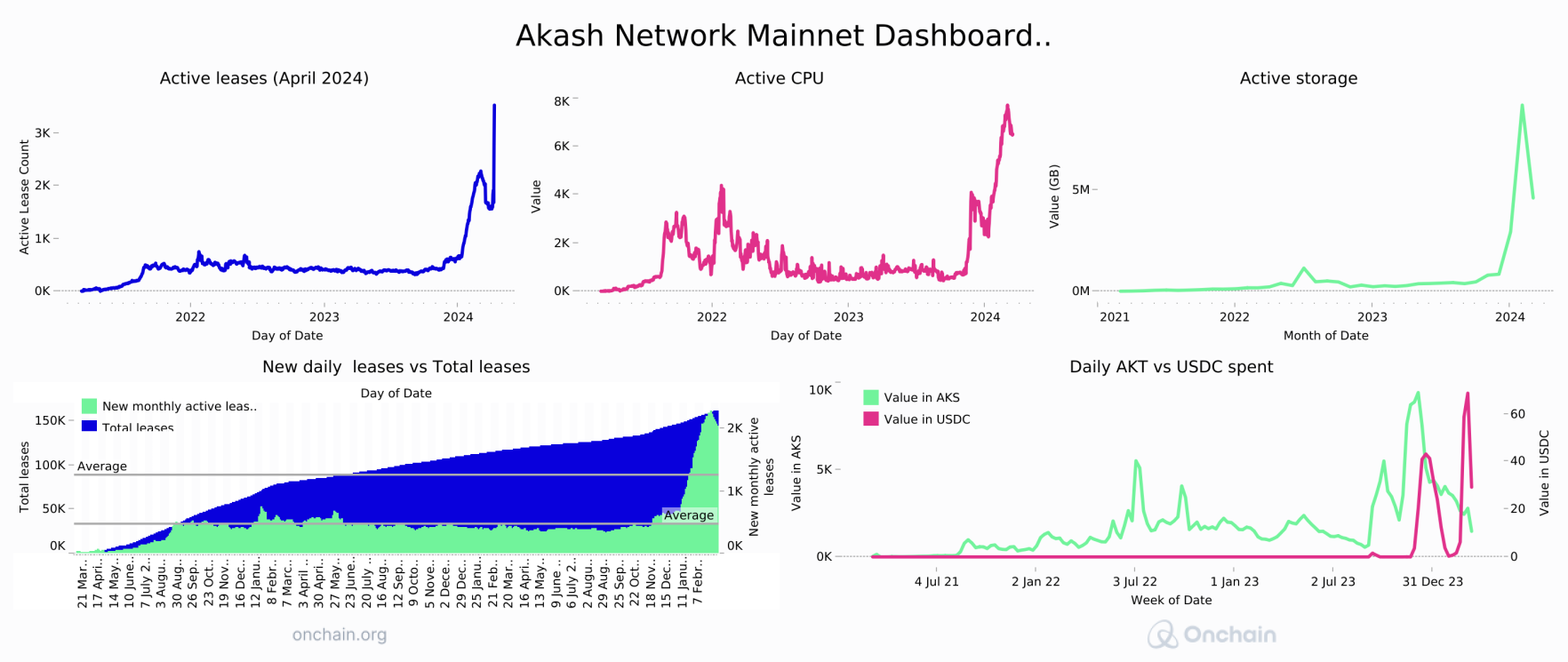

- Centralization offers advantages such as streamlined coordination, flexibility, and high performance. Decentralization promises lower fees. But matching the performance of centralized services remains a challenge. For example, it’s harder to consolidate resources for demanding ML tasks in a decentralized GPU sharing environment than in a centralized data center. If decentralized systems can’t match the performance of their centralized counterparts, their cost advantage alone may not be enough to drive widespread adoption.

As an example, see Akash’s usage dashboard below to explore their current state of adoption.

Two examples as technological benchmarks – IoTeX & Lisk

Now that you are aware of the specific technological needs and limitations, you’ll want to find examples that work. Where do you find benchmarks and look for best practices? We offer you two case studies that will lead you in the right direction: IoTeX, a benchmark platform for now, and Lisk, a probable future contender.

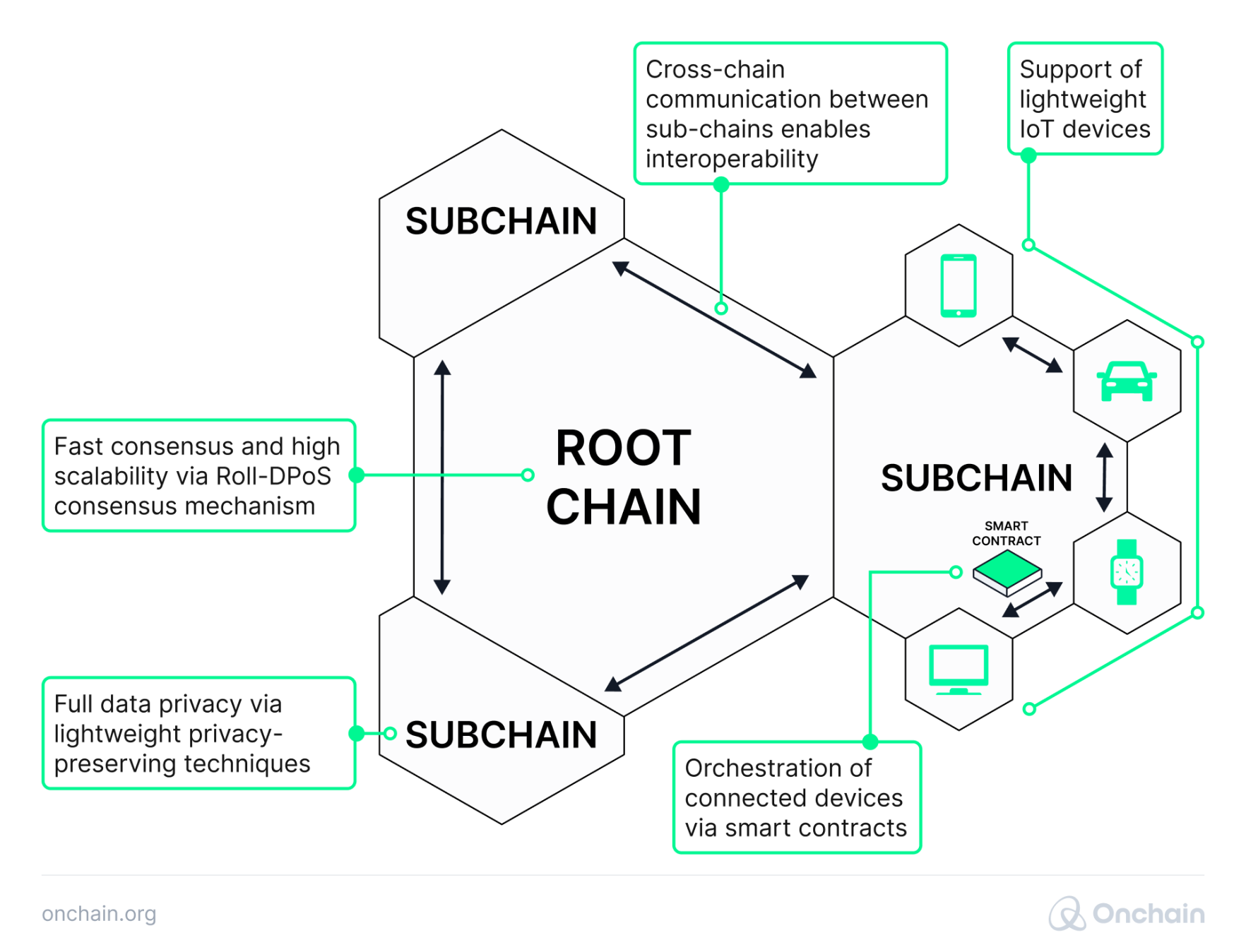

IoTeX – foundation for the infrastructure

The decentralized platform of IoTeX is designed to empower a global network of real-world devices, from smart cameras to environmental sensors, and connect them to the blockchain. IoTeX provides a layer for building innovative DePIN solutions that leverage physical appliances to ensure secure data flows and facilitate trust in decentralized infrastructure.

IoTeX utilizes both permissioned and permissionless blockchains to enhance privacy, achieve rapid consensus, and ensure immediate finality. Their approach involves specialized blockchain platforms designed to interact with specific IoT devices, providing customizable infrastructure essential for real-world applications.

IoTeX’s multi-chain architecture

IoTeX employs a flexible design with a central public permissionless root chain and various specialized subchains.

The Root Chain’s Role: The root chain serves as the backbone of the IoTeX network, focusing on:

- Scalability: Handles high transaction volumes efficiently.

- Resilience: Ensures the network remains operational and secure.

- Privacy: Supports privacy-focused features.

- Coordination: Manages interactions between subchains, facilitates data and value transfers, and oversees overall settlement.

The Subchain Role: You can think of subchains as specialized blockchains that can be either permissioned (private) or permissionless (public). They can have their own consensus mechanisms, token models, governance structures, and unique features tailored to their use cases.

IoTeX’s multi-layer architecture

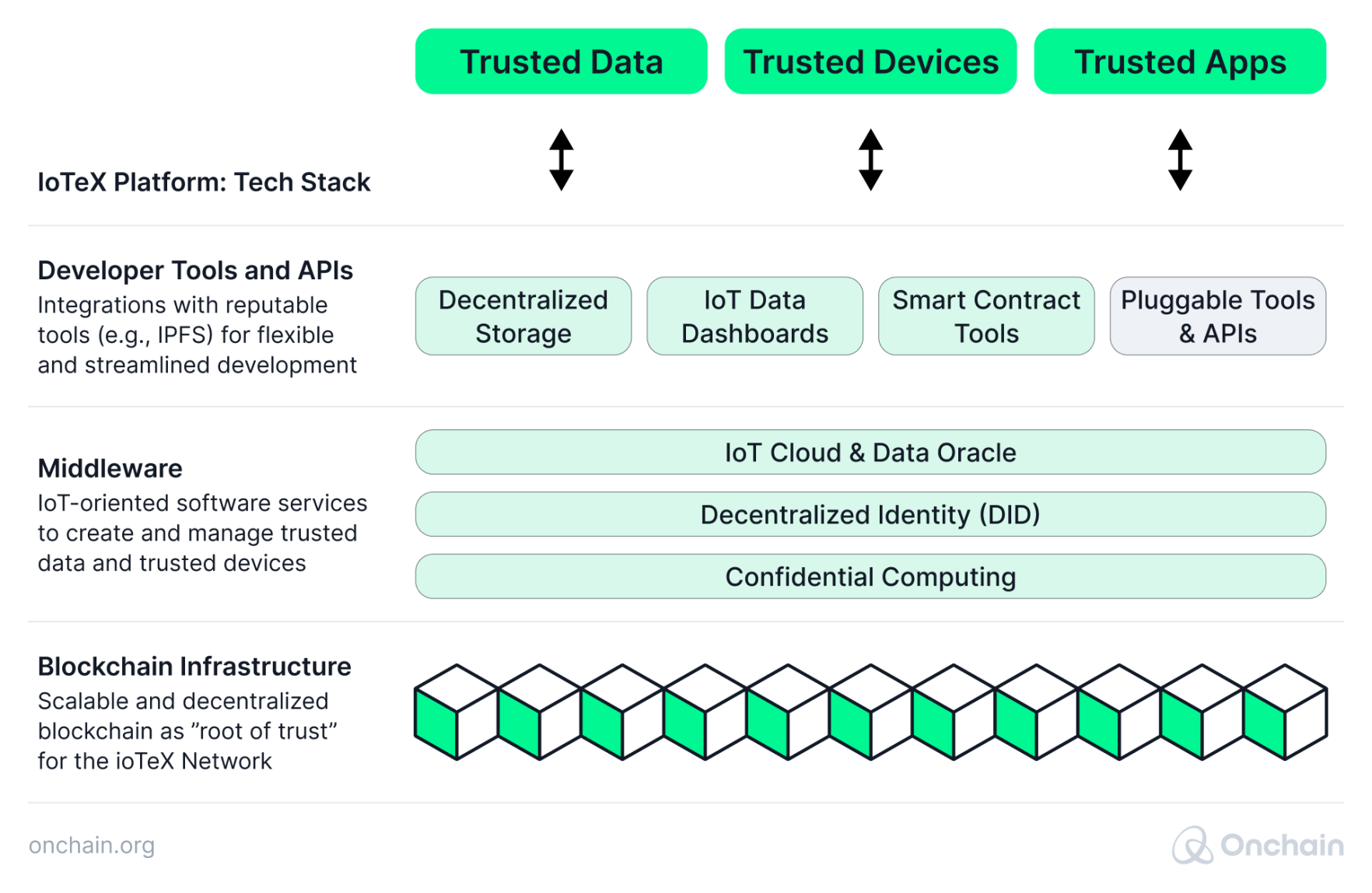

While IoTeX shares some architectural similarities with Ethereum, its focus is on powering real-world IoT devices and networks, making it a complementary platform rather than a direct competitor. The project employs a multi-layered architecture based on four pillars:

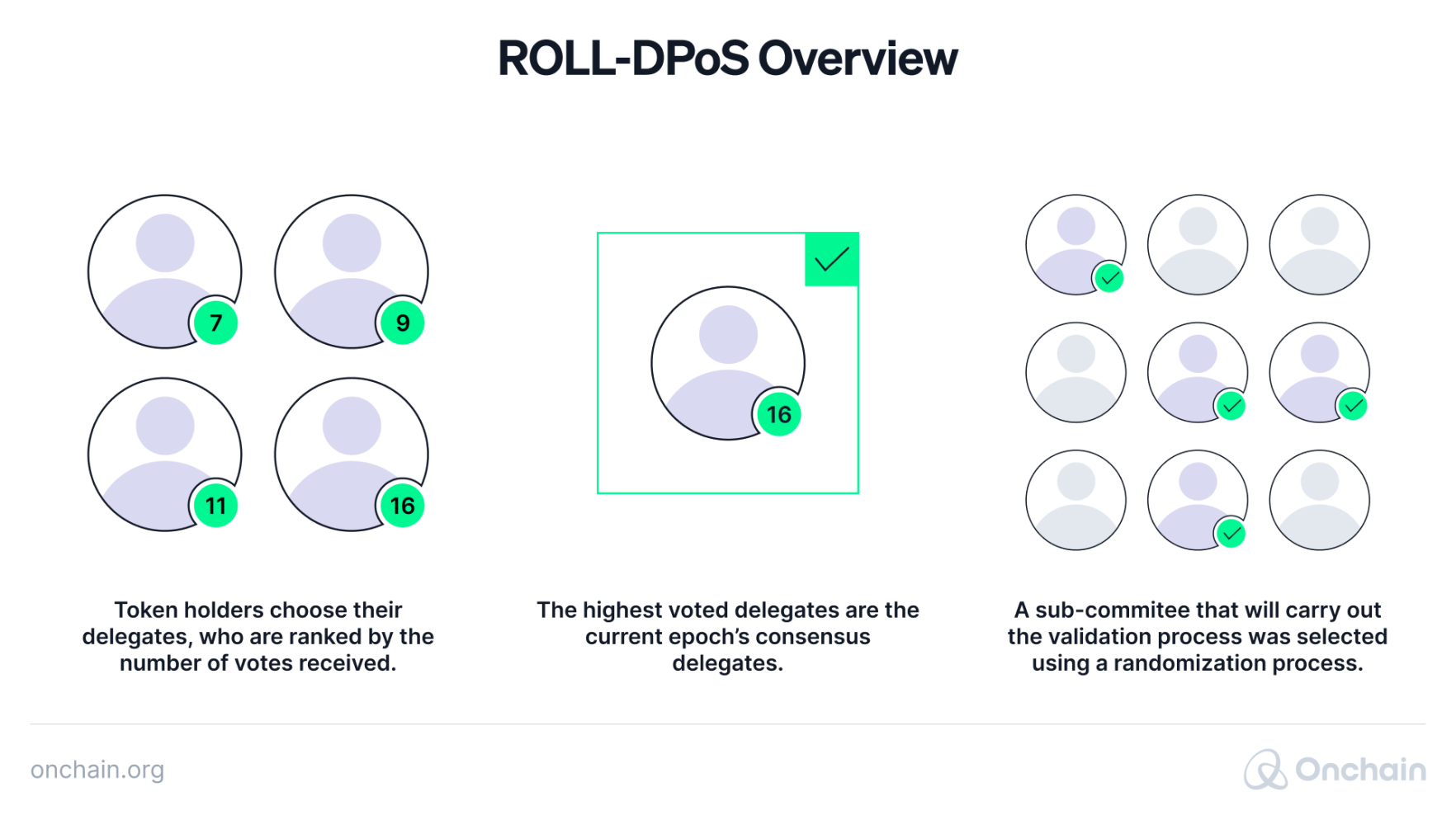

1. Roll-DPoS consensus

Roll-DPoS, an in-house consensus mechanism designed by the IoTeX research team, is a randomized variant of the traditional DPoS, which inherits all the advantages of the original DPoS consensus framework and further enhances its capability in terms of decentralization as well as extensibility to complex L1+L2s blockchain architecture.

- Xinxin Fan, Head of Cryptography, IoTeX

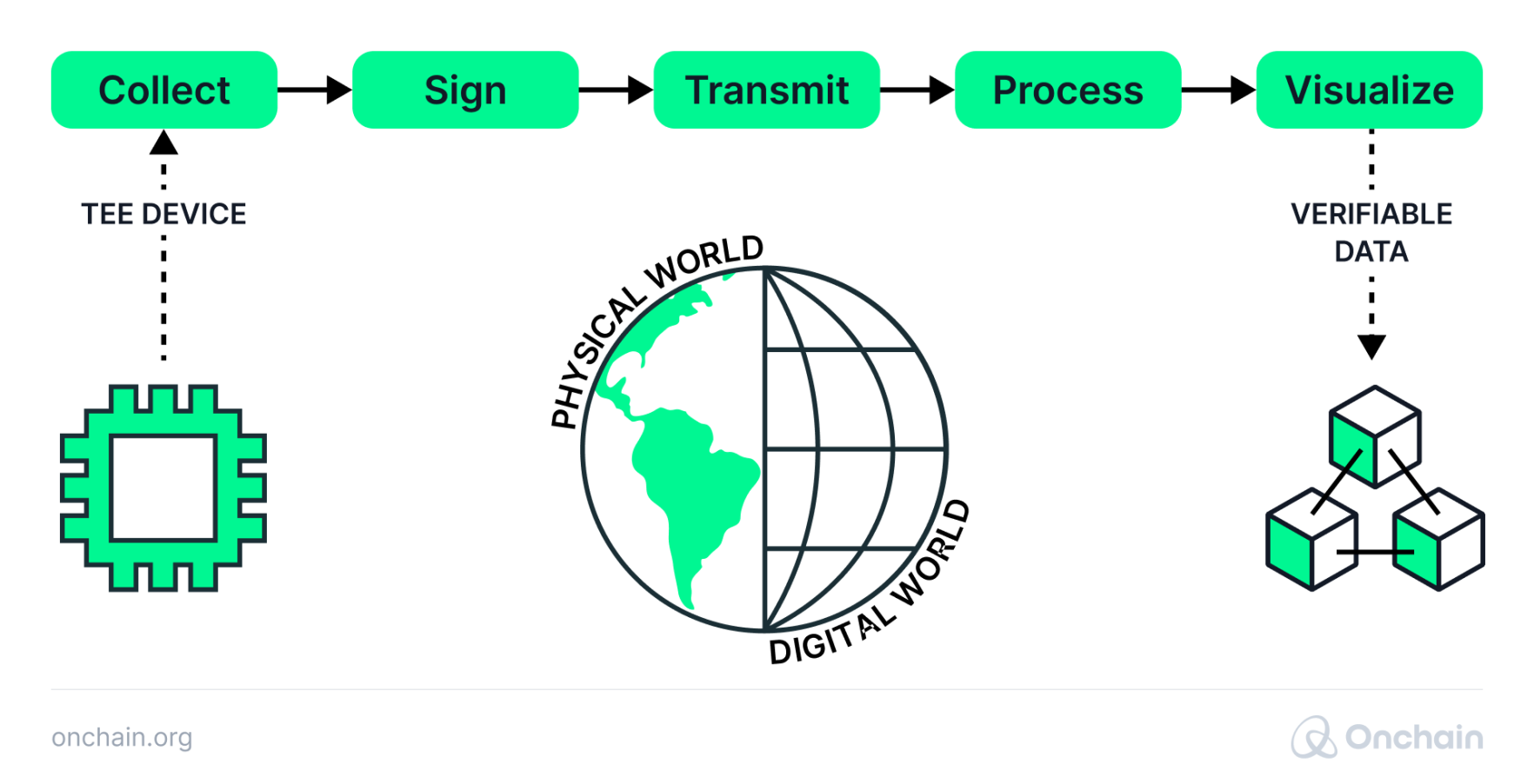

2. Secure hardware

Trusted execution environments (TEE) and zero-knowledge proof (ZKP)-based solutions to verify the trusted data collection are based on different security assumptions. While TEE-based solutions root their security on the hardware chip manufacturers (e.g., Intel, AMD, NVIDIA, etc.), the ZKP-based solutions solely rely on cryptography.

From the engineering perspective, TEE-based solutions are easier to implement and can achieve better performance than ZKP-based ones. For resource-constrained IoT devices, it is almost impossible to implement ZKP-based solutions within those devices. However, TEE-based solutions (e.g., the Arm's TrustZone technology) is widely available for low-power IoT devices.

- Xinxin Fan, Head of Cryptography, IoTeX

3. Real-world data oracles

IoTeX is pioneering a new class of data oracles specifically designed to deliver verified real-world data from trusted IoT devices. These bridge the gap between IoT sensors and the blockchain, turning real-world events into reliable data that can be used in smart contracts and decentralized applications (dApps) on the IoTeX platform.

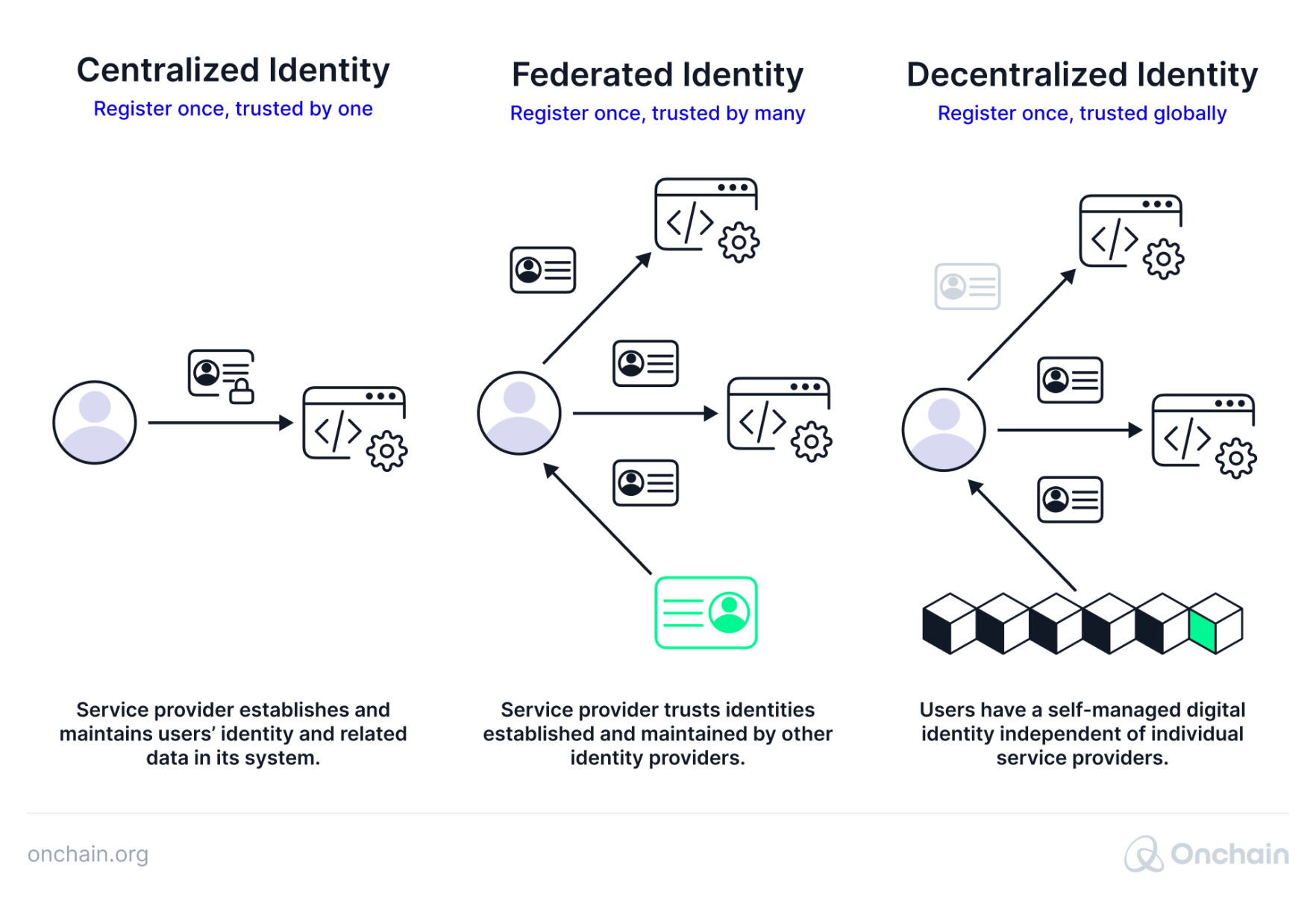

4. Decentralized identity framework

Decentralized Identity (DID) is foundational to IoTeX’s vision of user sovereignty. Unlike many blockchain networks, IoTeX has developed a DID system that uniquely caters to both individuals and machines. This unified approach allows direct, secure interactions between people and IoT devices within the network. Users and devices maintain control over their own data and credentials, enhancing user privacy and data sovereignty.

Lisk – focus on accessibility for the masses

Lisk is a secure, scalable, and affordable Layer 2 blockchain network built on top of Ethereum. Since 2016, Lisk, which was one of the earliest Layer 1 blockchains, has been a leader in Web3 infrastructure, making blockchain technology accessible to a global audience. In 2023, the Lisk team made the courageous decision to transform the blockchain into a Layer 2.

This allows Lisk to now focus on solving real-world challenges in emerging markets through innovative solutions for managing real-world assets (RWAs), off-chain assets (OCAs), and decentralized physical infrastructure networks (DePINs).

Lisk and other Layer 2s could play a crucial role in shaping the future of DePIN infrastructure for the following reasons:

- Lisk is built on the OP stack, which makes it an Ethereum Virtual Machine (EVM)-equivalent blockchain. It means we are talking about a Layer 2 network (like a rollup) that mimics the EVM so precisely that it is virtually indistinguishable from running code directly on Ethereum’s main layer (Layer 1).

- Lisk derives its security guarantees from the battle-tested Ethereum blockchain. This gives it a significant trust advantage over less-established L1 blockchains. Compared to IoTeX’s Roll-DPoS, Lisk’s reliance on Ethereum’s proof-of-stake may offer a greater sense of decentralization and trust.

- Lisk applications can also interact with a much larger existing ecosystem. The L2 design allows for seamless communication and asset bridging between Lisk dApps and the greater Ethereum universe. This opens up possibilities that are restricted in standalone, siloed L1 blockchains.

- As a member of the Superchain, Lisk contributes to an ecosystem of collaborative L2s sharing security. This fosters further opportunities for cross-chain communication and value transfer.

- Lisk’s focus on Offchain Assets (OCAs) enables the secure integration of real-world data from physical infrastructure, such as sensor readings, maintenance logs, or usage metrics, into on-chain applications. This data becomes verifiable and usable within smart contracts.

- Lisk’s compatibility with Ethereum’s DeFi ecosystem could bring the benefits of decentralized finance to DePIN projects. It could provide access to liquidity pools, lending protocols, and novel financial instruments tailored for real-world assets.

Read more in our Onchain research report, The Future is Modular, which compares alternative L2s to L1.

DePIN and other emerging technologies

The current use cases and infrastructure platforms are only the first sprouts of a promising new strain of Web3 technology. At its core, DePIN is about leveraging decentralization and blockchain to manage and monetize physical infrastructure. If you think about it for a moment and think big and far – the possibilities seem infinite.

Where should you focus in the coming years? DePINs aren’t operating in a void. There are several technologies with the potential to create a powerful synergy with the existing DePIN models. It’s worth understanding and considering them.

DePIN & AI

AI’s ability to analyze vast datasets and make informed decisions can reshape the way many technological concepts, including DePIN networks operate. That’s all we can say with certainty at the moment. But speculating about the future capabilities of AI seems like a global sport, and the prophecies vary. If the subject interests you, keep your eyes open for our next report that explores AI and blockchain.

For now, let’s look at some examples of how AI and DePIN work together:

- Energy optimization: In a DePIN-based energy grid, AI can analyze real-time energy consumption data and weather patterns. This allows it to predict demand accurately and match it with renewable energy sources, reducing waste and potentially lowering costs for users.

- Efficient wireless networks: Imagine a DePIN-powered wireless network. AI can monitor traffic patterns and data flow, intelligently routing information to avoid bottlenecks. This directly improves the user experience with faster connectivity and minimizes congestion issues.

- Predictive maintenance: DePINs can use Akash’s AI-based decentralized GPU resources for real-time model training and analytics on sensor data.

- Process optimization: Livepeer’s decentralized AI video transcoding network ensures this video content can be processed efficiently and optimized for delivery across a variety of devices.

DePIN & Zero-Knowledge Proofs

Zero-knowledge proofs (ZKPs) are crucial for enhancing the privacy and scalability of Decentralized Physical Infrastructure Networks (DePIN). However, to truly align with DePIN’s principles, ZKPs also need to be decentralized.

- Decentralized ZKPs (DeZKPs): They offer the advantage of being embedded directly within the infrastructure network, eliminating reliance on third-party services and strengthening decentralization. ICME’s NovaNet network is pioneering this approach to empower DePIN applications with enhanced security and trust.

- Regulatory compliance: DePIN projects can also use ZKPs as proof of regulatory compliance (e.g., data usage aligns with rules) without revealing the underlying data, thereby protecting user information.

- ZK-based computations: While some ZKPs are designed for efficiency, they can still introduce additional computations, especially for resource-constrained IoT devices involved in DePIN networks.

DePIN & Memecoins

The playful nature of memecoins can be harnessed to introduce gamification elements within DePIN platforms. This may help simplify user onboarding, rewards programs, or community participation and create more engagement, attracting younger or less tech-savvy audiences.

- Gamified DePIN: For example, Rich Rabbit (memecoin) and Bminer (DePIN) have partnered to allow the use of RABBIT tokens to purchase Bminer devices. RABBIT holders will be able to exchange their tokens for Bminer devices.

- Accessibility thanks to affordability: The entry barrier to many memecoins is low due to their affordability. This might indirectly improve accessibility to the infrastructure provided by DePINs, especially if payment options are expanded.

It’s critical to keep in mind that the inherent price volatility of memecoins directly threatens any DePIN system that relies on them for pricing services, rewards, or financial stability. This volatility undermines DePIN’s core aim to provide reliable infrastructure solutions.

Conclusion

- Building a non-speculative business based solely on Web3 principles will always be challenging. The blockchain tetralemma is real, and it’ll take some time until projects learn how to address it (read our guidance in the modular infrastructure report) and leverage its unique components.

- Combining Web3 with the physical world is currently a potential solution to bring real-world business into the crypto world. And our report shows that this approach can make a real difference.

- Among the various Web3 niches, we perceive DePIN as having the highest business potential. This manifests in the opportunity to apply sustainable revenue mechanisms, the true competitive advantages over both Web3 and Web2 competitors, and the ability to cross the mythical chasm to reach a mass audience.

- The success of DePINs will depend on how well projects can combine their revolutionary incentive mechanism with more ordinary, non-Web3 revenue streams and cost structures. At the moment, the most promising approach seems to be a blend of the DePIN flywheel with business models borrowed from the Web2 world.

- The biggest challenge is still attracting the demand side of DePIN business. For now, most projects remain Web3-oriented and seem to target customers on the crypto rankings pages at CoinMarketCap. Their potential is, however, way bigger. Hivemapper may be able to compete with Google Maps. Akash can challenge AWSs position. And Livepeer could become the preferred AI generative video infrastructure.

- In every DePIN area and project we analyzed, we found approaches with significant business potential. The three frameworks that we proposed (especially the last one) present mechanisms that could improve both the efficiency of a DePIN company and it’s competitive advantage.

- Hence, we remain optimistic regarding the future of DePIN. Also, we promise to revisit this topic in the future to reevaluate the state of businesses, discover new models, and assess how many of the ones we proposed were implemented successfully.