4. DePIN as a business concept

You’ll learn:

- How top DePIN projects structure revenue streams and which cost factors impact sustainability.

- How DePIN startups position themselves in competitive landscapes dominated by Web2 giants like AWS, Google, and Verizon.

- What common business challenges emerge across DePIN sectors, from hardware deployment costs to demand generation friction.

- Which business models are most popular, most effective, and most promising for long-term success in the DePIN ecosystem.

- How DePIN projects can “cross the chasm” to mainstream adoption — especially by appealing to B2B markets through cost savings, interoperability, and real-world reliability.

It’s time to get down to business.

Our report findings will provide you with a comprehensive overview of how DePIN companies can (or can’t) make money and operate sustainably. To achieve this, we analyzed the most renowned projects, examined the DePIN categories listed above, and evaluated the business models employed by the associated projects.

Our research team analyzed their revenue streams and cost drivers, mapped the competitive landscapes, and defined how each project positions itself compared to both Web3 and Web2 rivals. The report also defines their typical DePINish mechanisms, such as incentives for the demand and supply sides of their businesses. And lastly, we assess their level of adoption and propose how they can cross the chasm and reach the mainstream (usually B2B) audience.

Below, you will find a summary of our analysis and a general overview of various parts of the DePIN business model.

We recommend not skipping the last part of this section because it provides the basis for the following ready-made business models. Their evaluation is divided according to three values:

- The most popular approach

- The most effective approach

- The most promising approach

We hope it’ll make your entrepreneurial decisions regarding DePIN projects more data-driven!

Top 8 revenue streams

Let’s start with the most intuitive part of the business model. We discovered eight ways DePIN projects make money.

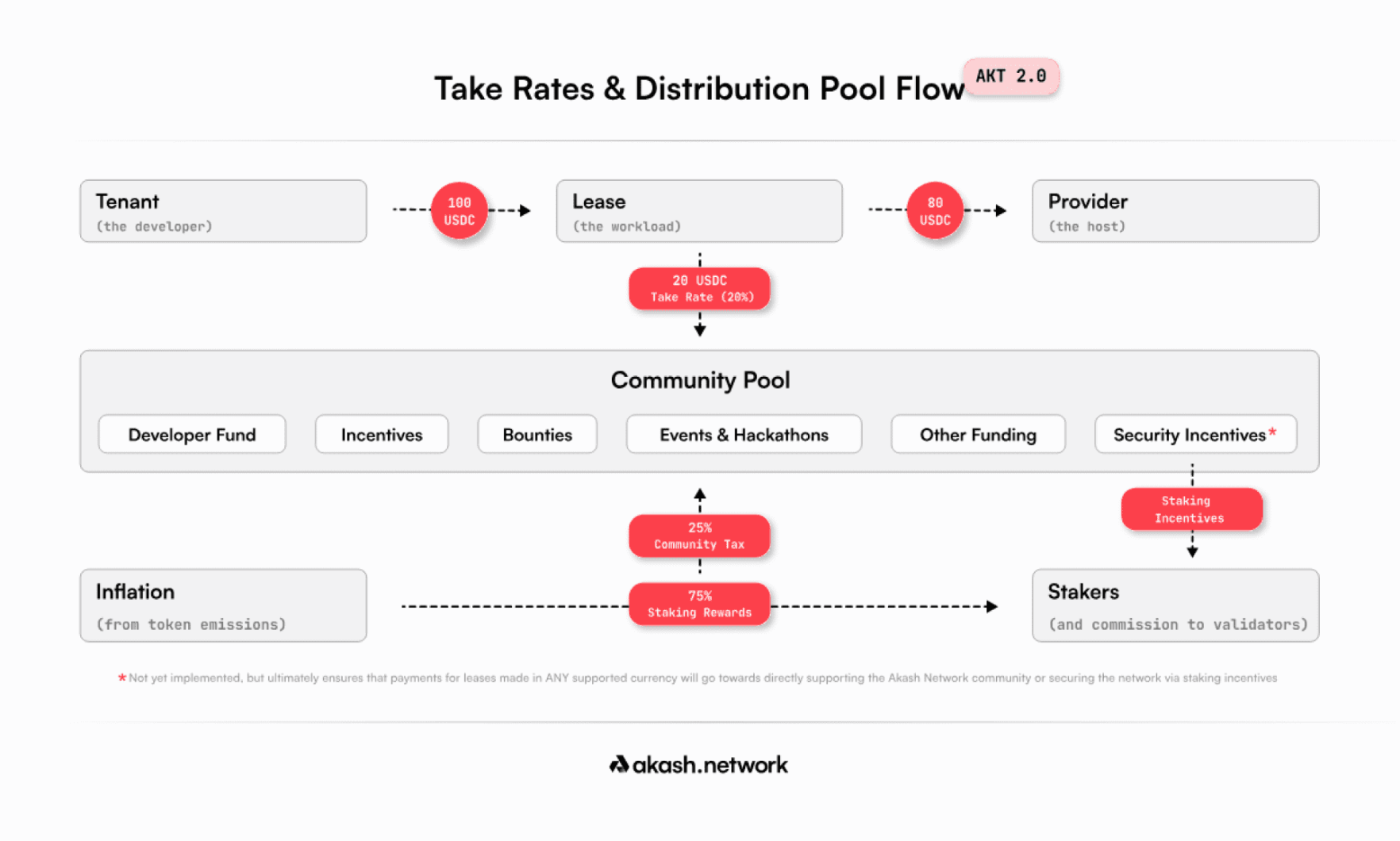

- Transaction fees/commission

This is currently the most popular approach, that is also used by non-DePIN Web3 projects. It usually involves deducting a small fee from transactions on the platform (e.g., used by computing power marketplaces such as Akash) or other activities related to running a project. In some cases (i.e., Livepeer), fees are also generated by apps built on top of the protocol.

A future commission-based revenue model developed by Akash:

- Token value appreciation

This similar approach is next in the popularity ranking and also typical for other Web3 projects. A portion of the tokens issued by DePIN projects remains in the project’s treasury and can be used to generate earnings based on token value appreciation. Because this model works only with positive price action, it is usually unsustainable in the long run, and you should only consider it a short-term booster.

Example: DIMO and their revenues generated by allocating $224M worth of DIMO tokens to the initial team. This resulted in 500% growth over the entire 2023.

- API access/onchain data selling

Some DePIN categories, such as sensor networks, are all about data, which projects can sell to businesses in need. For instance, Hivemapper sells map image APIs and grants insurance companies and similar customers access to street-level imagery from around the globe (pricing starts at $0.85 per road kilometer per week).

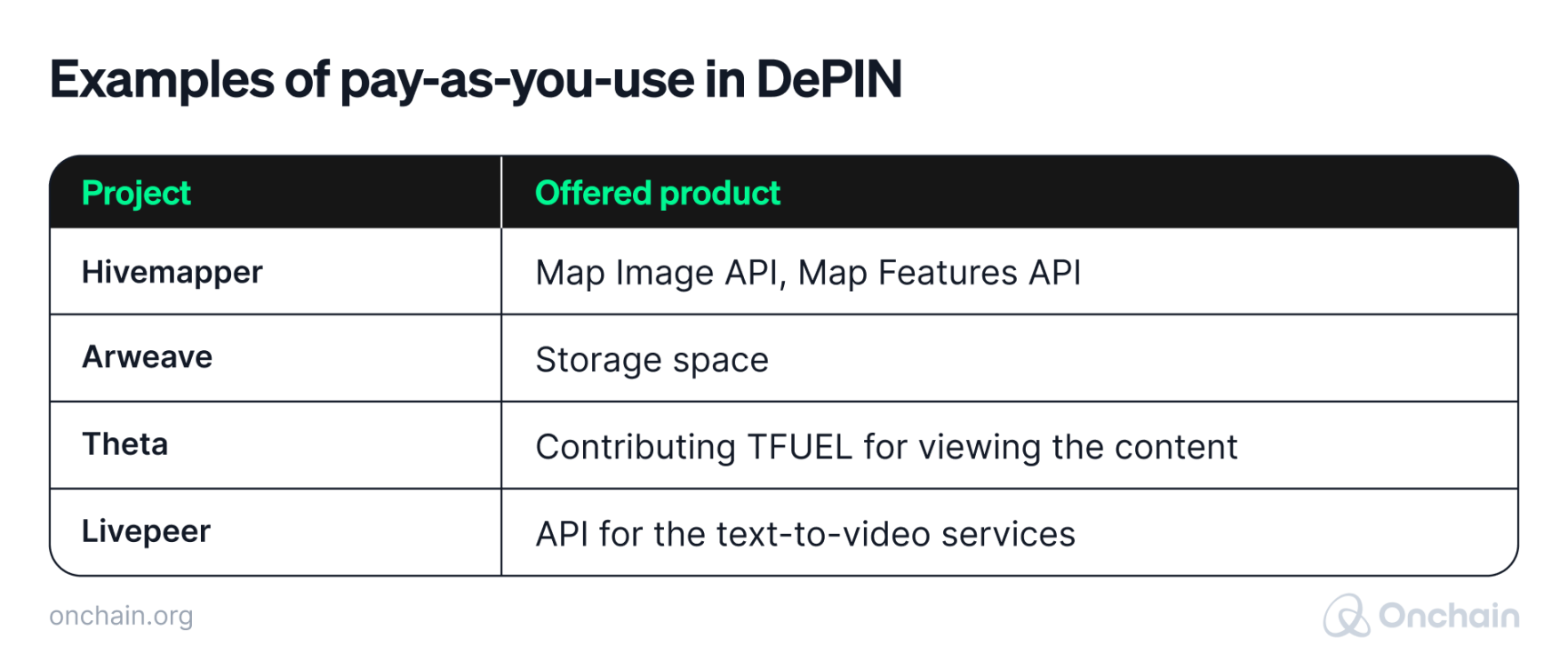

- Pay-as-you-use

Pay-as-you-use pricing is used more and more frequently in the DePIN space and can be seen as a separate revenue stream category. Given the diversity of industries in which DePIN projects operate, this approach provides customers access to a very broad range of products.

- Upfront payment/hardware

This revenue model is native to DePIN. It enables a project to put a specific margin on hardware that is required to use the application, e.g., sensors to collect the data for the DIMO Network.

Projects may require onchain upfront payments, too. Helium users pay a one-time fee in HNT and Solana tokens to acquire the device for hotspot onboarding and potentially additional fees for activation or data plans.

So far, we’ve talked about models that are common to Web3 projects in general (transaction fees) and DePIN in particular (upfront payment, API access). As you’ll see further throughout the report, DePIN businesses must be creative to grab and hold on to their piece of the market. So, open your mind and be ready for some more out-of-the-box models that may just take the cake in the long run.

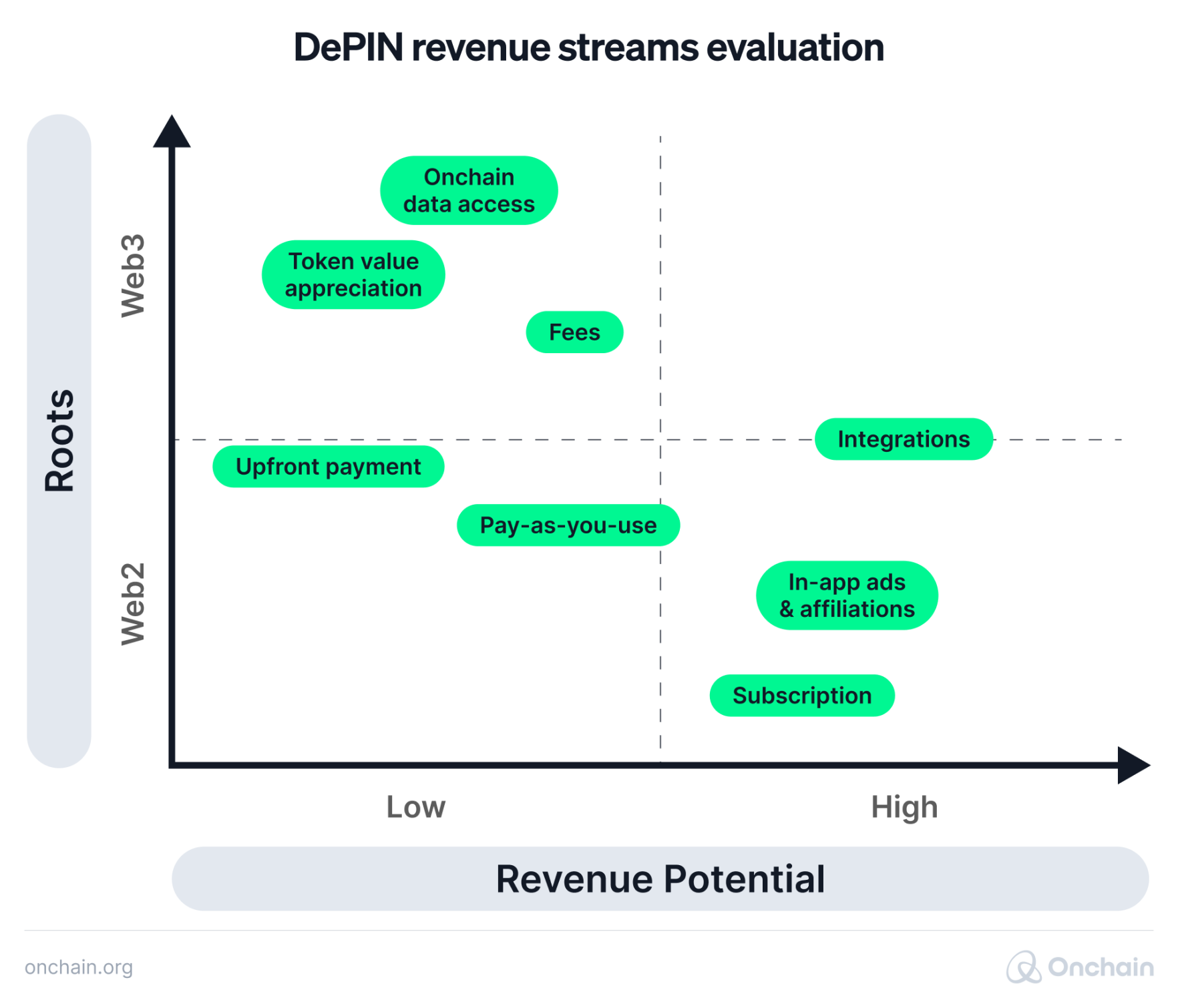

Interestingly, what’s common in the Web2 space is rather offbeat for Web3.

- Subscription model

Similar to the pay-as-you-use concept, subscription is another model borrowed from the Web2 space. For some projects, it looks like the easiest way to attract non-Web3 users and compete directly with companies they’re more familiar with. We’re talking about DePINs such as Orchid offering VPN subscriptions, Sweatcoin offering a subscription to their premium membership, or Geodnet offering subscription plans for companies seeking GNSS data.

- Enterprise / governmental integrations

For many DePIN projects, mass adoption largely depends on integrations, either into existing businesses or governmental projects. This is true for services that address the basic needs of people today: access to a wireless network, affordable energy, etc., which includes most of the projects we are discussing here.

Being implemented on an enterprise or even local government level can immediately enable DePINs to cross the mythical chasm and bring revenue that specifically comes from these integrations.

Power Ledger is a good example of an infrastructure that can only bring benefit to its participants, with a vast network of P2P energy traders. Therefore, you’ll find entities such as E-NEXT by Energie Steiermark (an Austrian energy company), Feníe Energía (a Spanish energy company), and the Government of Uttar Pradesh (a state in northern India).

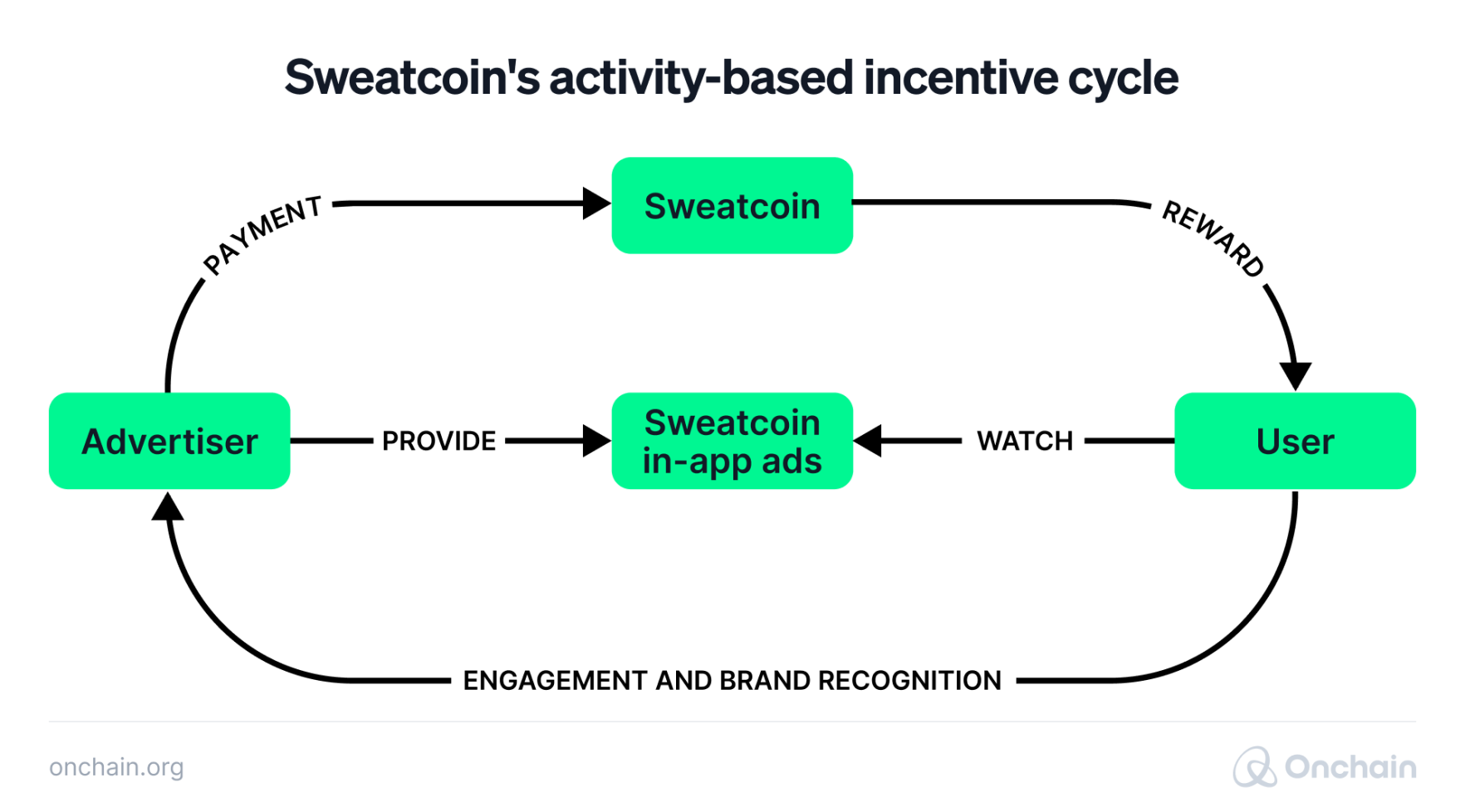

- In-app advertising/brand affiliations

Sweatcoin is not a typical Web3 DePIN project. Their roots are in Web2, which is evident in their business model. Besides subscriptions and commissions on their SWEAT token, they generate revenue through:

- In-app advertising and promotion of other brands – tailored to their fitness-oriented users.

- Brand affiliate deals through which people are able to spend their SWEAT tokens on various offers from partnering brands.

This is not the only revenue stream; the company uses a combination of methods. Sweatcoin creates utility for the SWEAT token, earns from typical in-app ads, and boosts a separate revenue stream related to subscriptions.

This raises the question of whether Web2-based revenue streams might generally be more sustainable than Web3-native ones. Have a look at our simple summary below:

Managing cost categories

Understanding and managing costs is crucial for all DePIN projects operating in any niche. Especially in the easier bootstrapping phase from which such projects benefit is largely due to additional expenditure on supply-side incentives. This leads us to a unique categorization of the main DePIN costs:

Incentives

Incentives are pivotal in driving engagement and participation, primarily on the supply side. Token rewards, discounted fees, and airdrops fall into this category, making it the main segment of the total costs of DePIN projects. For instance, rewarding hotspot owners with HNT tokens incurs ongoing token issuance for Helium.

General Development Costs

Developing a DePIN solution involves upfront and ongoing R&D (research and development), which costs money. Additionally, platform development and maintenance require continuous investment to ensure data access, visualization, and API functionalities.

Data Storage and Acquisition

Data costs can make up a significant chunk of the project’s costs. Efficiency is essential, particularly for projects dealing with complex information. Companies like Hivemapper, Theta, and Livepeer excel in this area by efficiently managing the storage and processing of high-resolution imagery and extracted features.

Due to blockchain integration for data verification and tokenomics, Web3 projects using offchain storage have a cost structure different from those of Web2 solutions that benefit from economies of scale.

Hardware

Hardware production costs play a crucial role in projects requiring physical components like antennas and radio modules necessary for large-scale network deployment.

ONE

⚙️ Hardware

ONE

⚙️ Hardware

Hivemapper relies on a network of contributor-owned dashcams, incurring upfront costs for development, distribution, and potential maintenance support. Compared to Web2, this may be a lower but potentially less controlled expense for Hivemapper.

TWO

📡 Data Acquisition

TWO

📡 Data Acquisition

While contributor rewards incentivize data collection, maintaining the network (e.g., onboarding, quality control) incurs high costs and high quality.

THREE

💾 Data Storage and Processing

THREE

💾 Data Storage and Processing

Storing and processing high-resolution imagery and extracted features requires considerable resources.

FOUR

🖥️ Platform Development and Maintenance

FOUR

🖥️ Platform Development and Maintenance

Building and maintaining the platform for data access, visualization, and API functionalities requires ongoing investment. However, Web2 competitors like Google Maps have larger development teams and infrastructure costs.

The diversity of incentive mechanisms

Incentives for the supply side are the heart and soul of the DePIN operating model. Creativity is king, and some projects come up with sophisticated and extraordinary mechanisms.

Token rewards

The number one incentive is still crypto rewards. Users offer their computing power, storage, mobility data, etc., and receive native tokens from the project in return. Almost all DePIN companies incorporate this incentivization model into their concept.

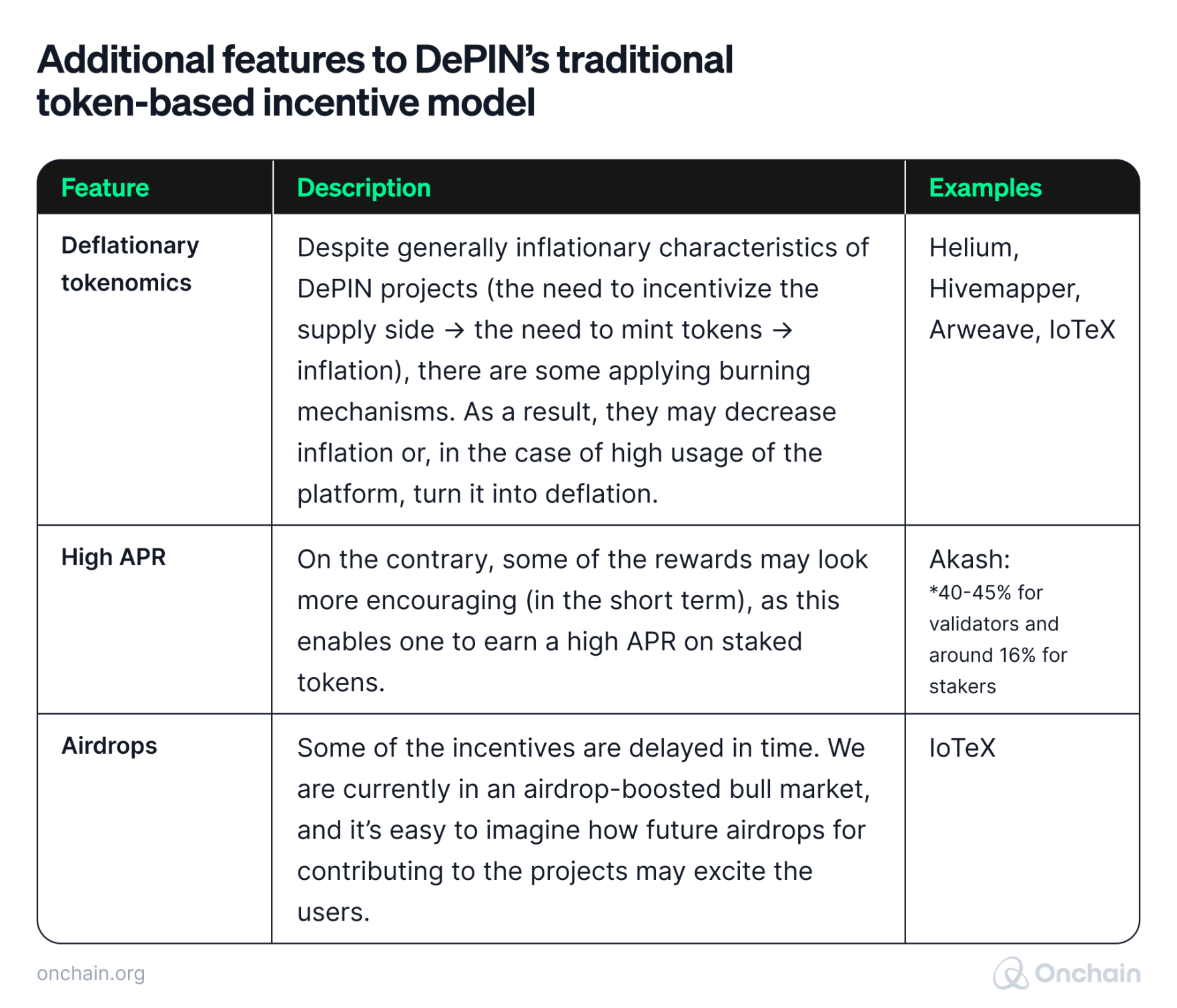

Many have made innovative additions to this model to make it more encouraging for the user:

Discounted fees

The interesting part of this incentive model is that it encourages beneficiaries to keep using the platform instead of walking away with their tokens. For example, Filecoin lets users pay storage fees with FIL tokens at a discount, promoting token adoption and potentially reducing upfront costs compared to paying with fiat.

Activity-based rewards

In some cases, users can earn additional rewards for above-average activity. A good example is Pollen Mobile, which distributes Loot Boxes with random rewards to its most active users. Also, Sweatcoin managed to combine this approach with its revenue stream – it rewards users for watching in-app ads, for which the advertisers obviously had to pay.

Additional features

DePIN projects encourage supply-side participants to increase activities by offering additional features. For instance, DIMO has access to the user’s vehicle data. Based on this, it can offer private location tracking, car health diagnostics, a virtual glovebox, privacy-protected GPS, and keyless entry.

Indirect incentives

Encouragements may also be concealed and not immediately identifiable as incentives. Some projects clearly communicate the benefits users can expect in the future from contributing to their services:

- Theta – optimized costs of content streaming.

- Power Ledger – optimized energy usage.

Particularly attractive to a certain growing group of users are ESG-oriented incentives. It’s used by projects operating in socially responsible areas where a contribution to their network equals a positive impact on the environment, social, or governance (ESG).

- Sweatcoin – better health for the individual.

- Power Ledger – higher usage of green and sustainable energy.

The far horizons of DePIN’s competitive landscape

DePIN projects usually look far beyond Web3 when defining their competition, and with good reason: It’s realistic.

This means that the prospects may seem less appealing in the short term than for other crypto categories.

On the other hand, DePIN companies can aim much higher and may eventually land a place among true market leaders. Competing with Google Maps for customers sounds much more exciting for an entrepreneur than fighting to get into the top 100 on CoinMarketCap.

Before you get all excited now, let’s break that down a bit. In some areas, this idea is more viable than in others. Below, you’ll find a categorization of noteworthy DePIN projects based on their ability to compete with their non-Web3 counterparts.

Why DePIN can enter into the ring with Web2

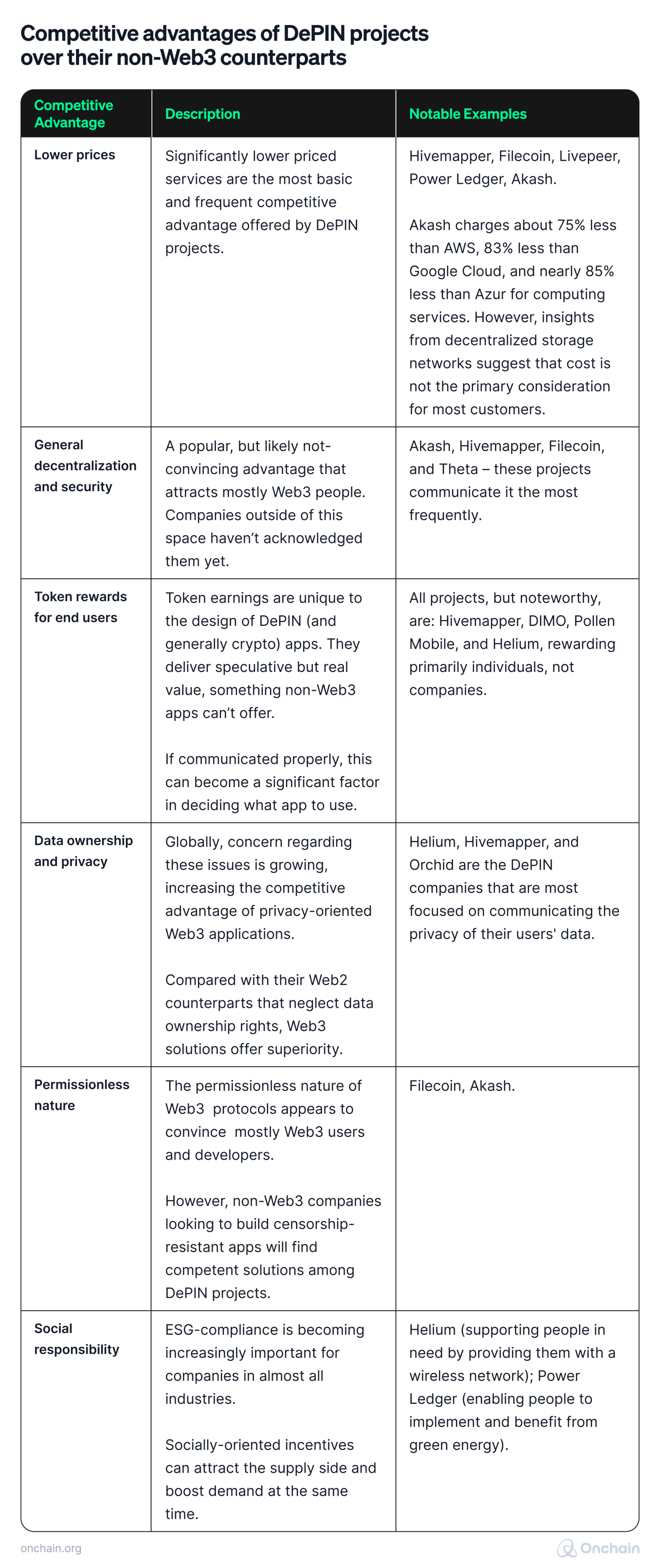

In view of the significant challenges, DePINs need to present well-defined competitive advantages to capture a chunk of the market beyond Web3.

In the following table, you’ll find the most frequent approaches and arguments. Note that in some cases, these competitive advantages are not clearly communicated by the projects. We discovered them only after a deep-dive analysis. So, on a side-note, it’s worthwhile for the projects themselves to analyse the competitive ecosystem and work out an effective value proposition.

As Akash, we're working with companies like Brave Bravo, which is a very popular machine learning app and machine learning platform as a service. Its users are generally top-notch specialists in machine learning. Leveraging the Akash chip means they can get high-quality but low-cost computing power. And since we also take the UX into consideration when designing a protocol, they can essentially get the resources they need and give it an incredible user experience on the front end.

- Greg Osuri, Founder of Akash

First, beat the Web3 competition

Currently, DePIN projects still focus mainly on the Web3 landscape. The idea is to prove yourself in the home court, the Web3 arena before you’re ready to venture out into the much larger market. Most DePINs emphasize the competitive advantage they have over their direct rivals.

A dominant position in a particular Web3 niche can help DePINs cross the chasm quickly and look forward to their mass adoption.

Supply-side incentivization – who’s struggling and who’s got it figured out?

Our research indicates that most projects, regardless of their position in the organizational maturity cycle, start by incentivizing supply chain participants like hotspot providers, data storage providers, or network infrastructure providers. They use various incentive mechanisms, including network token appreciation, activity-based rewards, service provider fees, or revenue-generating endowments.

With growing competition in different niche sectors within DePIN, incentivizing the supply side will become more expensive. It’s therefore crucial to create incentives that encourage long-term supplier loyalty.

Projects that face challenges:

- Filecoin: Filecoin has faced challenges due to centralization concerns, with a large presence of miners in China. Collectively, these miners account for over 80 percent of the network’s testnet storage mining power and require heavy subsidies. The project needs to diversify its miner base globally, reducing reliance on specific regions and implementing more sustainable economic models that are not as reliant on subsidies.

Projects with successful solutions:

- IoTeX: IoTeX stands out as a champion here. Storage providers receive native IOTX tokens as a reward based on the amount of data stored and the network’s demand. In addition, IoTeX uses burn-drop; in other words, 10% of all new devices added to the network trigger a burn of IOTX and a 1% distribution to long-term stakers. They also recently introduced airdrop tokenomics, where XRC20 tokens are distributed from new ecosystem projects to long-term stakers.

- Sweatcoin, Pollen: Both projects supplement the usual token reward incentives for the supply side with activity-based earnings for users.

- Arweave: Arweave has excelled in attracting miners to its decentralized storage network by offering economic incentives, such as block rewards and endowment models, along with effective network growth strategies and community engagement.

Demand-side incentivization – who’s struggling and who’s on top of it?

According to our findings, DePIN apps usually struggle more with incentivizing the demand side. It’s safe to say it’s something built in these protocols by design – the revolutionary incentivization model is targeted at the supply side, not the people/companies in need of solutions offered by DePIN companies.

Then, the future of DePIN likely depends on how much these projects can incentivize the demand side. If others don’t use their apps, the incentives for the supply side (mostly in the form of tokens or % from generated fees) will also be lower, eventually discouraging participation in the network.

The good news is that we also discovered solutions that help DePINs solve nearly all demand-related challenges.

Just like traditional infrastructure players collaborate to provide services to the end users, DePIN players will also do so to be able to provide a purely decentralized yet high-quality user experience. For example, NATIX will use a project like Geodnet to increase localization accuracy of the data collected (and hence the worth of the data) or a decomp provider like Aethir to train our AI models that run on smartphones and detect events like potholes or traffic congestion.

- Alireza Ghods, Co-Founder of NATIX Network

Common and unique risks you should know about

It shouldn’t come as a surprise that DePIN projects struggle with typical Web3 risk factors like token volatility, regulatory uncertainty, scalability of the blockchains underlying them, etc. But this blockchain use case also comes with some unique concerns.

These usually arise from specific supply-demand dependencies built into such projects. The fact that they compete with their Web2 counterparts way more than the other categories of Web3 projects also contributes its share.

Below, you will find the main risks of DePIN projects, split into three categories – business, legal, and technological. We sorted them by perceived level of severity so you can easily mitigate the ones with the most critical impact on DePIN business.

DePIN projects’ fundamental risks

Risk factors – in order of severity

- Non-Web3 competition and its already established market position and awareness.

- The lack of demand would quickly result in lower incentives for the supply side and discourage participation.

- Supply-side discouragement – growing competition or a sudden decrease in the token price (the top incentive) could lead to a quick evaporation of contributors. This would make a project practically useless (i.e., imagine Hivemapper without any map data provided by the network).

- Token price volatility and its mostly inflationary character.

- High dependence on partnerships (i.e., Theta’s success depends on partnerships with significant content creators and companies. Failure to secure or maintain these partnerships could significantly hinder its growth).

- Ethical concerns over completely decentralized or permissionless protocols (i.e., Orchid and dVPNs. Some people believe that privacy leads to illegal actions brought on by the negative effects of anonymity).

Legal

- General regulatory uncertainty regarding digital assets.

- Specific accusations of KYC and AML violations (i.e., currently, companies can deploy apps on Akash anonymously).

- Concerns regarding the privacy of data stored on decentralized protocols that were raised in docs such as GDPR (EU) or CCPA (California).

- The lack of utility in many DePIN tokens may draw the attention of the SEC (i.e., POWR token from Power Ledger).

Technology

- The scalability of the networks underlying DePIN projects. The majority rely either on native (non-specified) blockchains or Ethereum, therefore, the scalability concerns remain for now.

- The complexity of the technology itself has a discouraging effect on developers to build on top or use it (i.e., the process of retrieving data from Arweave can be more complex than in traditional storage solutions).

- The lack of a project’s influence on the infrastructure it is based on. (i.e., Power Ledger has a high scalability and adoption potential, however, it relies 100% on external technology; it doesn’t produce, manage, or promote – solar plants, wind farms, etc. Hence, scalability is subject to a higher adoption of renewable energy infrastructure.

- A relative lack of management or even development experience of many tech teams behind DePIN projects.

In some cases, high dependence on L1 blockchains (i.e., Sweatcoin is based on NEAR, which is still one of the most popular L1s on the market, but looks at a rather bleak future – see Onchain’s report on L1s/L2s).

How to cross the chasm?

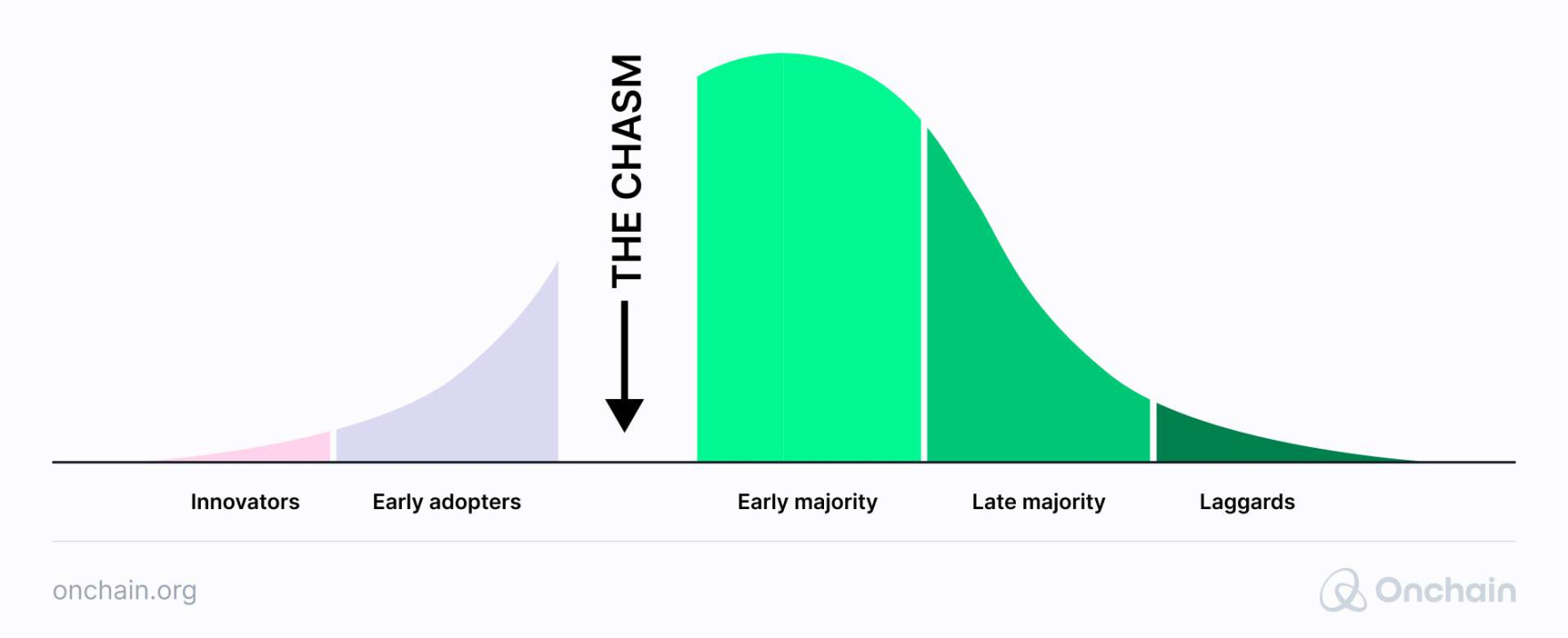

In his book Crossing the Chasm, George A. Moore identified an adoption gap that high-tech products must cross when trying to find a mass market.

Your first users are the innovators – tech geeks who love to test and develop new products. Next are the early adopters, visionary companies that want to discover a breakthrough product. The chasm lies in the latter part of this adoption cycle, as you can see in the chart below.

The challenge is to reach the early majority of pragmatic companies that prefer to use already evaluated solutions. To reach this mainstream market and become the Google or Salesforce of the 2020s, your company must first establish its position in niche customer groups (innovators, early adopters).

Then, during the chasm period, you must encourage these groups to refer to your project widely enough to attract more pragmatic customers. If you’d like to learn more about Moore’s Crossing the Chasm approach, we encourage you to watch this short video for a general overview:

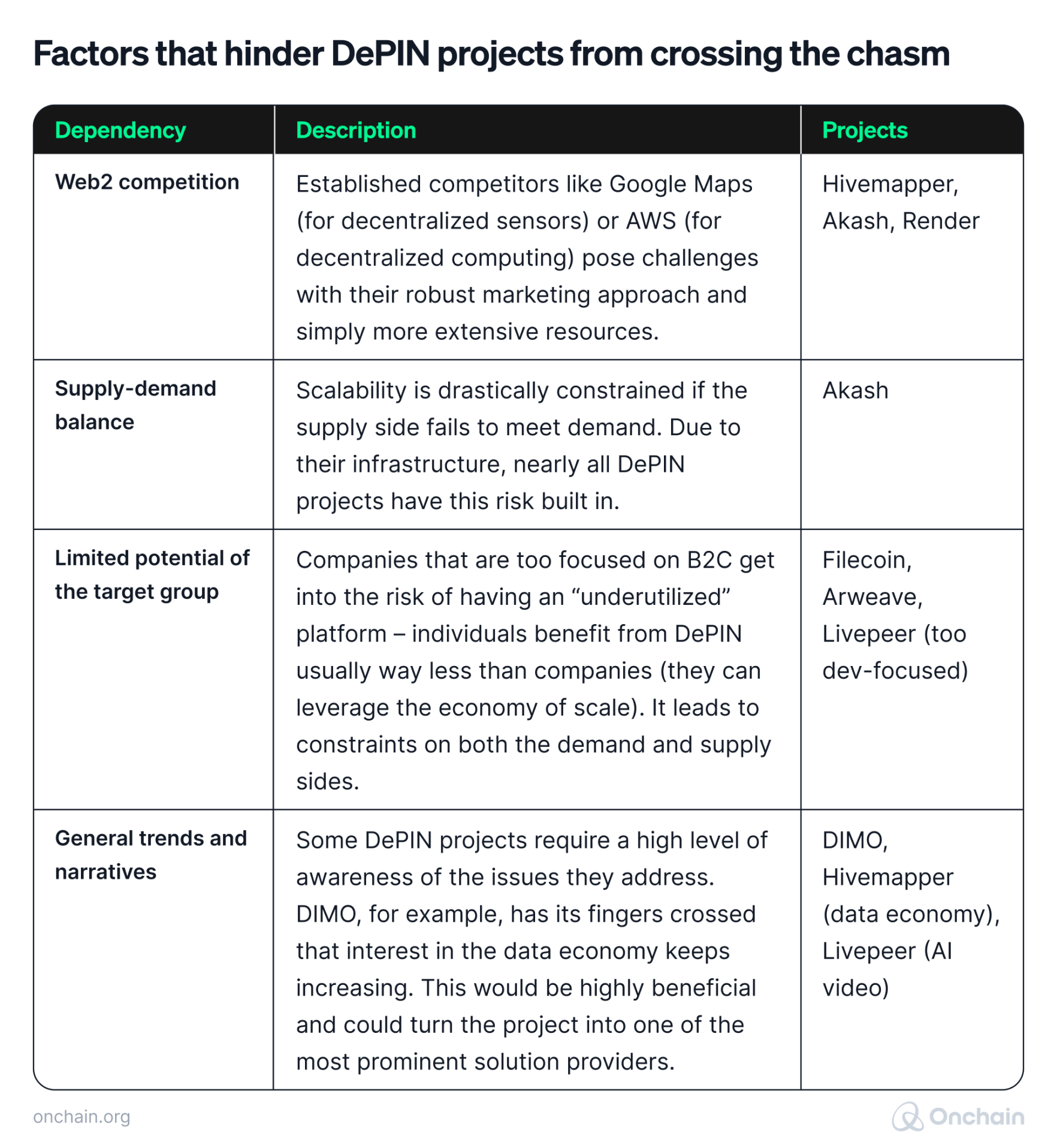

What follows are some concrete ideas to help DePIN companies succeed in crossing the chasm. It’s not yet about competing with Google on a level playing field.

Instead, crossing the chasm means first being considered established among the non-Web3 giants in their respective niches: cloud computing, storage services, mobility data, etc.

Let’s start with the factors that typically prevent DePIN projects from reaching a wider audience:

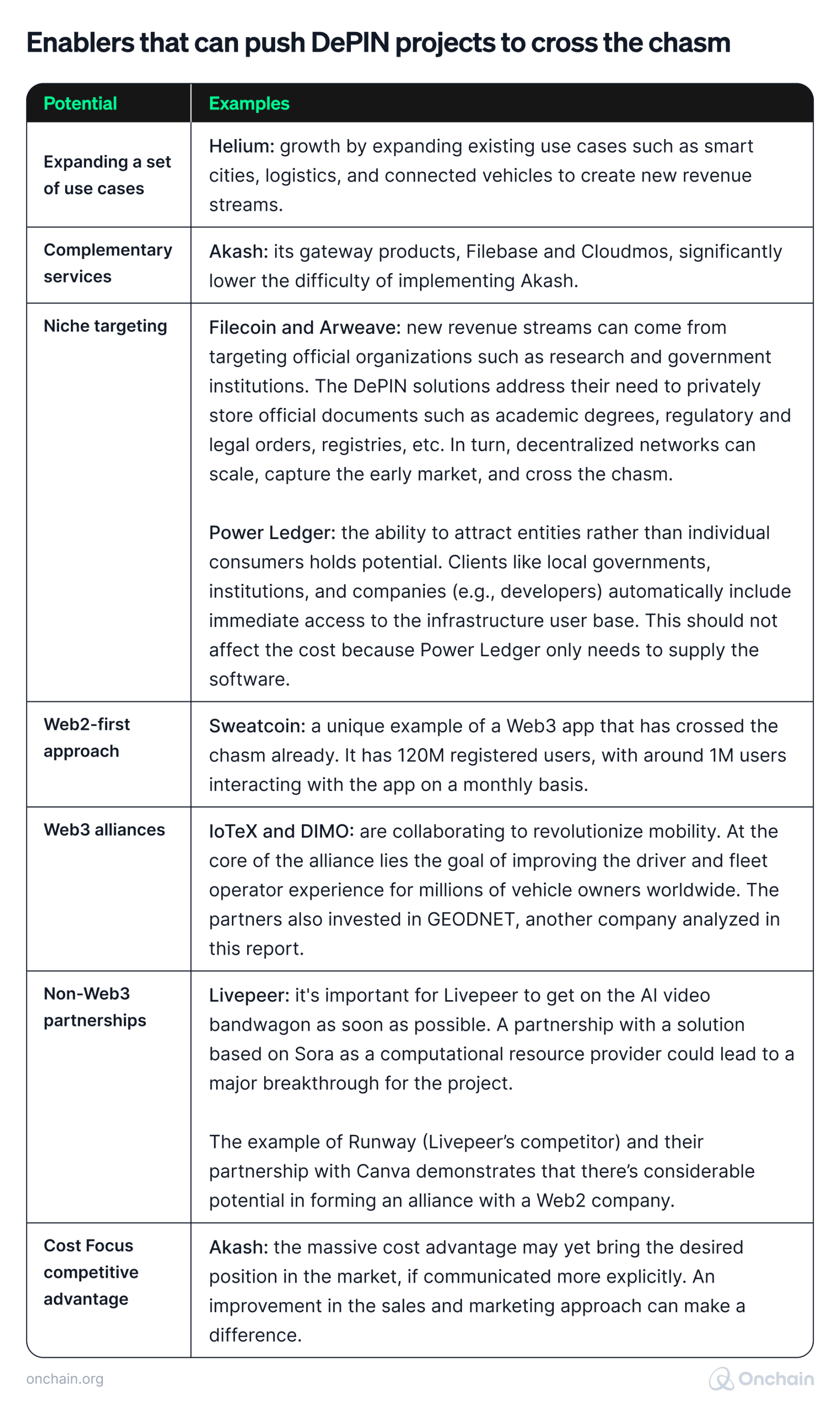

By now, you may have realized that our report is not just about flagging problems. Below, you’ll find a number of solutions that some of the DePIN projects have already implemented to make it over the inescapable gap. Take some inspiration.

Enablers that can push DePIN projects to cross the chasm

There are people who want to experiment and people who want to try something new. They want to see data about their car and they often want to try the services in the mobile app. So that's going to continue to be the focus for us, the early tech adopters. But we can take DIMO outside of the crypto space. That's an important goal and something that we think we're uniquely positioned to achieve.

- Alex Rawitz, Co-Founder at DIMO

DePIN business model optimization – three ideas outlined

So far, the analysis of existing DePIN projects. But we won’t stop here. You came here to learn how you can use our findings for your own venture. Now it’s time to take ‘what is’ to the next level and explore how it can be better. How can we optimize these approaches for you?

In this section, we reassemble the individual elements of the existing business concepts to form new possible models. We present you with these combinations as inspiration for your entrepreneurial efforts.

Three possible combinations to optimize DePIN business models:

- The ‘red carpet model’ for DePIN businesses:

This business model combines the most popular approaches (e.g., most popular revenue stream, most popular approach to incentives, etc.).

- The ‘performer model’ for DePIN businesses:

This business model is what we consider to be the most efficient at the moment. It combines a number of elements that prove to be effective, including some extraordinary approaches to incentive mechanisms or chasm-crossing activities.

- The ‘crystal-ball model’ for DePIN businesses:

We believe this is the most likely business model we’ll see in the coming years. It combines the approaches that should bring the most value to DePIN projects in the long run.

Important note: Please treat the following models as a kind of mental exercise. Each DePIN niche and business has different needs, challenges, and opportunities (e.g., some revenue streams utilized by decentralized sensor networks can’t be used by decentralized storage projects). None of these models may fit 100%. However, they can serve as inspiration for out-of-the-box approaches, and you can play around with the various elements and create a model that best suits your project.