2. DePIN - a crypto trend or a real-world opportunity?

You’ll learn:

-

- Why DePINs gains traction from triple-digit growth in project valuations to mainstream search spikes and media buzz.

- What makes DePINs technologically unique and how they fuse IoT, blockchain, and real-world infrastructure into a verifiable, incentive-driven system.

- Why demand generation is equally as important as infrastructure build-out, and how Web3 projects are grappling with mainstream adoption barriers.

- How individuals contribute to and benefit from DePIN networks, whether through social impact, environmental efforts, or financial rewards.

- What real-world challenges — device saturation, uneven returns, and user frustration — reveal about the maturing (and messiness) of DePIN deployments.

The Web3 world loves new narratives. And if one involves a clear investment opportunity and token incentivization at the same time, the crypto Twitter (or crypto X these days?) madness is inevitable.

For speculators, it’s all they need. But for people with a long-term perspective who want to build a prospering business or those who want to make a difference in the world, it can be a trap if it turns out to be a passing fad. You must see the whole picture to navigate the odds properly.

Why DePIN is such a hot topic these days

1. The financial growth

Anyone following the crypto space is aware that DePINs have shown significant growth in market capitalization in recent months. A lot of money has been pumped into this blockchain use case.

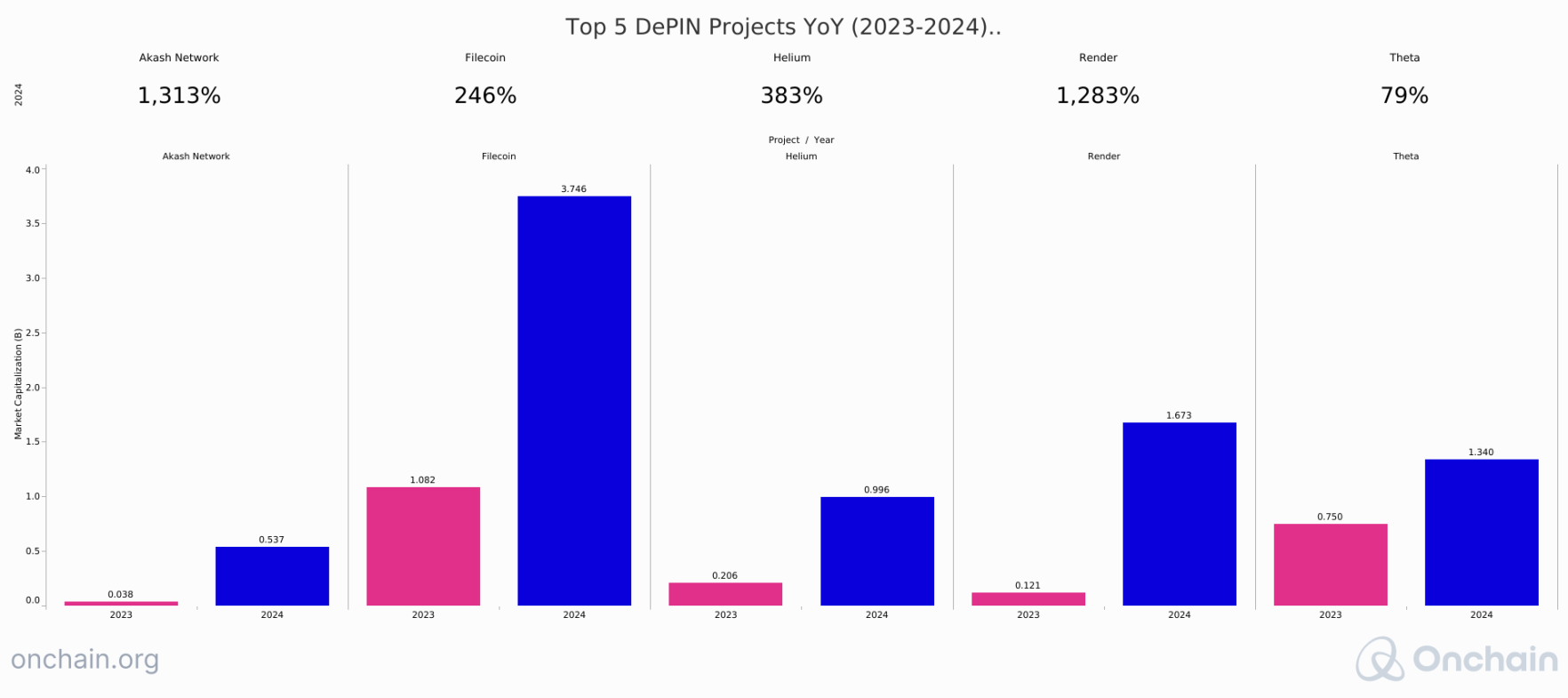

When we compare DePIN projects’ valuations at the beginning of 2023 with early 2024, the numbers speak for themselves. Akash blew the top with a YoY increase of 1313%; several other protocols experienced growth of over 200%.

The table below lists the top 5 DePIN projects (projects with a high market cap:

2. The hype factor

Hype isn’t created through financial opportunities alone and it’s not only about crypto prices. DePIN is community talk.

The Web3 media is all over the topic. We’ve looked at Web3 predictions for 2024 given by various experts and researchers and found DePIN to be present in nearly all of them:

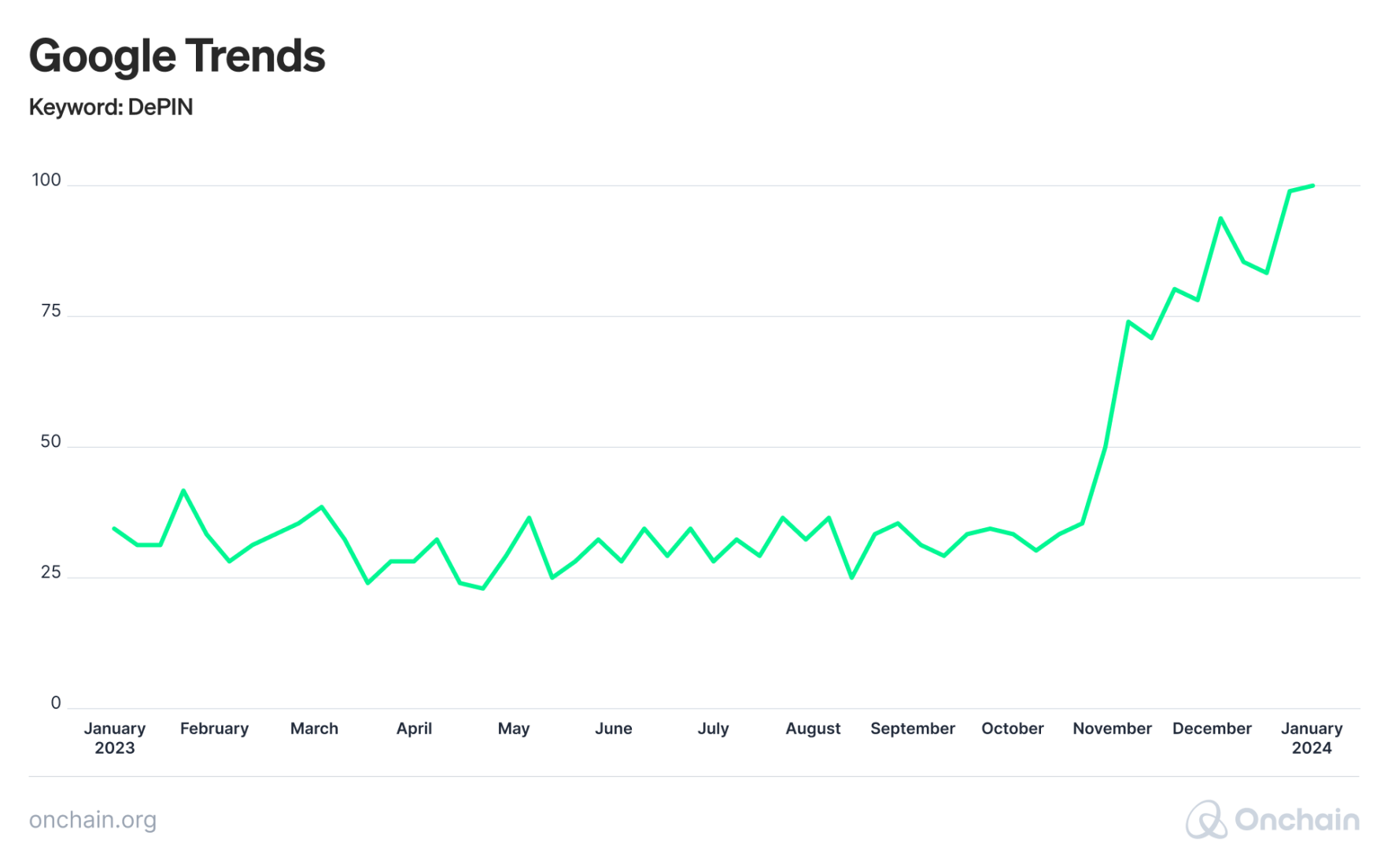

Trends like this spill over into Web2, and retail interest follows. A glimpse at Google Trends shows a large spike in the search volume for DePIN, signifying the growing interest over the past year. What’s more, despite the brevity of most Web3 narratives, it appears to be relatively sustainable.

3. The technological uniqueness

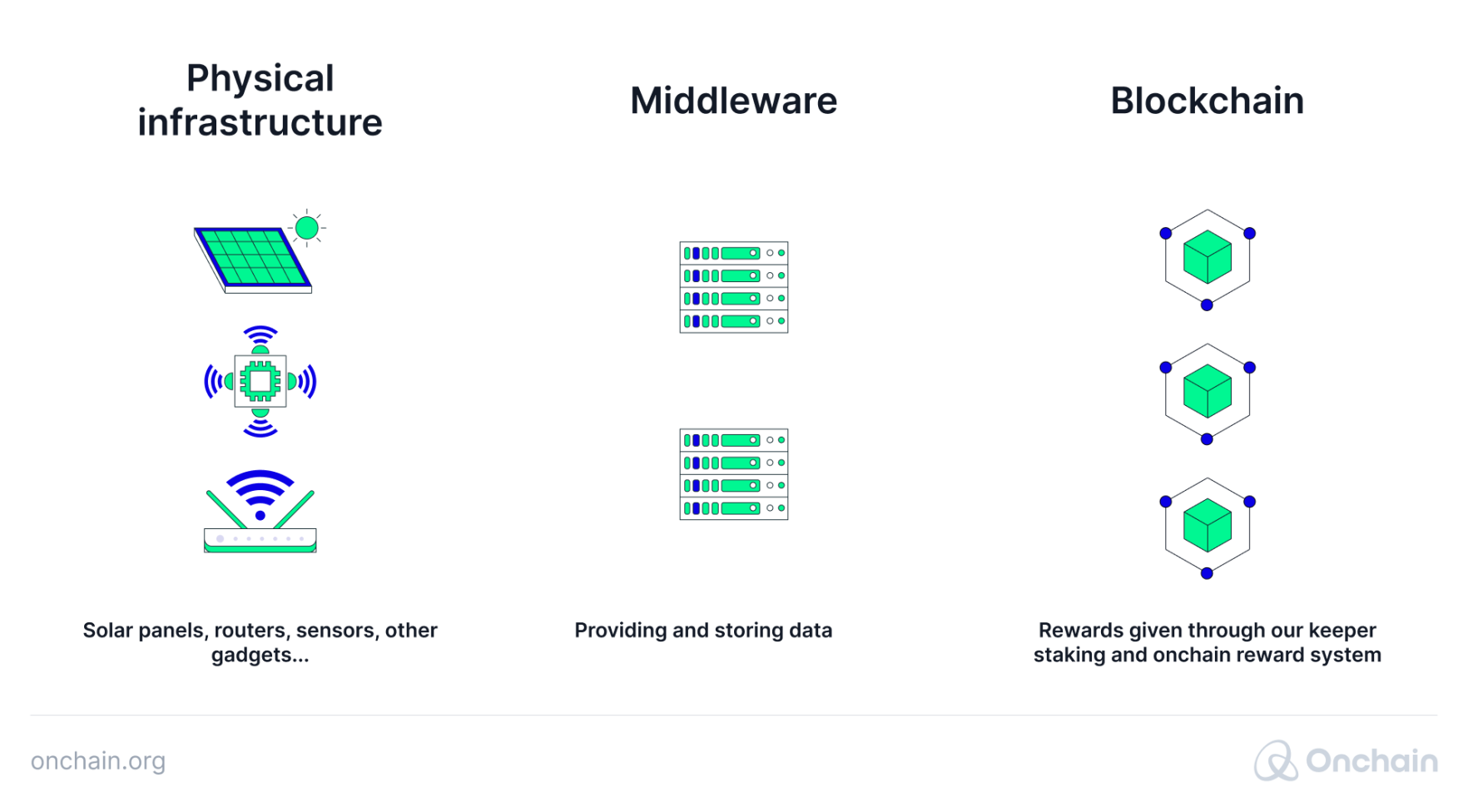

Imagine a world where building and maintaining critical infrastructure like roads, power grids, and communication networks isn’t controlled by centralized authorities but by a global community. That’s the vision behind DePINs. It offers an innovative way of merging blockchain, the Internet of Things (IoT), and the physical world.

DePINs leverage blockchain technology to create a transparent and tamper-proof ledger recording network activity. This ensures secure and verifiable proof of contribution, eliminating trust issues and centralized control.

What makes DePIN so interesting as a technology is that it reaches beyond the digital realm. Using the IoT as the bridge to connect physical infrastructure components to the network closes the circle back to the real world.

Sensor-equipped hardware like routers, towers, and renewable energy generators collect data and interact with the blockchain. This real-time data flow enables efficient monitoring, maintenance, and optimization of the physical infrastructure.

The key to DePINs’ success lies in its token-based incentivization system. Participants who contribute physical hardware or provide valuable services are rewarded with tokens. These hold economic value and can be used within the network to pay for services, participate in governance decisions, and so on.

It creates a self-sustaining economic model that incentivizes continued growth and maintenance. In addition, this ingenious incentivization system brings down a major stumbling block for startups – the cold-start problem. It encourages people to join and contribute even when the network is young and small, fostering strong network effects early on.

4. Other factors

- Environmental and Economic Efficiency: DePIN projects often emphasize their potential to improve environmental and economic efficiency. By leveraging crowdsourced infrastructure and renewable energy sources, these projects can reduce costs and carbon footprints, making them attractive in an era where sustainability is a growing global concern. Moreover, some of them, such as Power Ledger, directly contribute to the increase in using clean energy.

- Regulatory Evolution: As governments and regulatory bodies around the world begin to understand and adapt to blockchain technology, chances for DePIN projects to integrate with traditional systems and markets grow. This regulatory evolution can open up new avenues for growth and mainstream adoption.

- Global Connectivity Goals: With a significant portion of the world’s population still lacking reliable internet access, DePIN projects that aim to expand connectivity can tap into a vast market. This aligns with global initiatives to bridge the digital divide and provides a strong use case for investment and development in the sector.

The DePIN tug-of-game between supply and demand

Building the supply side for a DePIN

The foundation for every DePIN project is the physical assets that form the physical infrastructure. Storage providers, computing power lenders, or some form of physical asset providers are the cornerstone of the decentralized network structure.

Attracting suppliers who own or can deploy these assets is the first step in establishing a DePIN. This is the supply side.

Early DePIN projects incentivize the supply side primarily using token-based rewards (we also explore other incentives under DePIN Business). This approach helps bootstrap the network by creating a clear value proposition for potential participants – they can earn rewards for contributing their resources.

For example, Helium’s initial focus was incentivizing the rollout of their physical network hotspots, creating a geographically widespread foundation for their decentralized wireless services.

This approach helps attract individuals or companies to contribute their time and resources if it meets a few critical criteria. Below, you’ll find the set of initial considerations every new DePIN project should take into account.

Openness of hardware systems

Closed systems provide tighter control over device quality, ensuring network performance and simplifying technical support. At the same time, it limits the types of hardware that can be used, which may stifle innovation and potentially drive up costs.

Open systems foster greater flexibility and potentially faster expansion by allowing participants to utilize compatible off-the-shelf or even repurposed devices. Please note, however, that they introduce challenges in guaranteeing consistency and quality of service and may increase management complexity.

Device placement requirements

DePIN systems, where physical coverage is an issue, often require careful spacing. In wireless networks (Helium) or positioning systems (Geodnet), extreme local device density can lead to interference and poorer service.

In contrast, projects like the Render Network focus on maximizing total available computing power (GPUs) without the need for geographic spacing restrictions. Here, systems with distancing requirements can incentivize deployment in underserved areas or penalize oversaturation.

Affordability

Lower device costs reduce the entry barrier for contributors. This is crucial for DePIN projects, which leverage crowdsourced infrastructure and attract a broad participant base. Highly accessible DePIN systems benefit from crowdsourced deployment. Projects relying on expensive specialized hardware may find it more challenging to attract a large, distributed contributor base.

Scalability through network expansion.

Scalability is a key consideration for DePIN projects that want to expand reach and impact. By attracting more asset providers and expanding infrastructure deployment, projects can meet growing demand, enhance network coverage, and support a larger user base.

Along with scalability, supply-side distribution should be meticulously planned to avoid limiting exposure to specific regions. Take Filecoin as an example. The network’s miners in China account for over 80% of the network’s testnet storage mining power. This area’s concentration has caused centralization concern and criticism and poses a challenge to its growth.

Demand side considerations for DePIN

“Supply First, But Demand Must Not Be Neglected”

Many DePIN projects initially prioritize building a robust supply base. That’s not a bad approach; however, neglecting the demand side early on can be detrimental. A network delivering data for which there is insufficient demand will bring a limited return for the supply side unless demand is generated. And if there is demand, the available market needs to be reachable.

Unlike other Web3 verticals, DePIN systems can potentially generate early revenue by addressing the existing market’s needs and offering solutions that exceed the existing ones. This is arguably the greatest advantage DePIN holds over other Web3 sectors.

It also means DePIN can offer solutions that reach beyond the Web3 ecosystem and get its teeth into Web2-dominated markets. However, attracting users outside of Web3 turns out to be challenging for nearly all of the DePIN projects. We dive deeper into the competitive landscape further into the report.

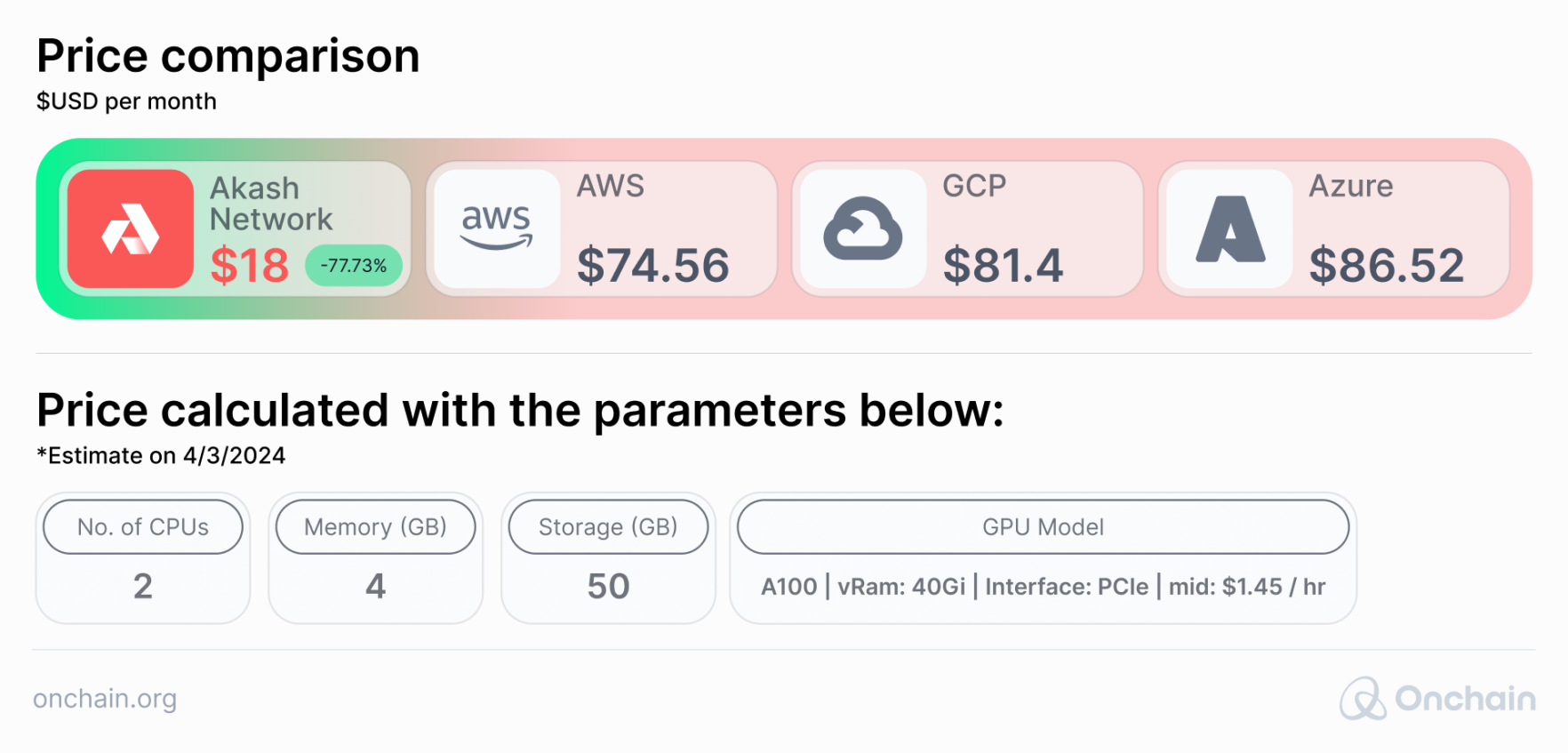

It’s difficult to convince users, even when the advantage is as striking as potential cost savings of up to 80% and more – as in the case of Akash. Below, you can see a direct cost comparison between Akash and its top Web3 competitors.

The reasons are diverse. There are high entry barriers in many mainstream markets due to the dominance of Google and AWS, which have established credibility and earned the trust of users. The convenience of staying with a more-or-less satisfactory solution and the fear of change pose substantial obstacles.

Add to this the lack of familiarity with market dynamics, leading to inconsistent communication and a lack of a clear value proposition for non-Web3 customers.

Every DePIN has its own challenges. If you are a hardware DePIN, you have supply chain issues that dampen your network growth. If you are software DePIN, then depending on active vs. passive contribution, you might have retention issues.

- Alireza Ghods, Co-Founder of NATIX Network

But Web3 actors are gaining experience and DePIN projects aiming at Web2 dominated markets are already thinking up creative solutions to help them cross the chasm (more on that later).

How individuals leverage DePIN

DePINs provide their network with sensory data. Let’s further break down the supply and demand sides of DePIN and explore how individuals leverage projects in two ways: social benefits and reward earnings.

Let’s explore how individuals leverage projects in two ways: social benefits and reward earnings.

- Making a social or environmental contribution

We’ll demonstrate this with an example: Airly offers a solution for maintaining air quality via a network of sensors and a data platform. This service is particularly beneficial for users within the Helium Network because it enables hyperlocal, real-time air quality data collection and analysis. Governments, businesses, and communities can use Airly’s insights to make informed decisions on environmental policies and actions to reduce emissions and protect public health.

The Qualitair Corse case study by Airly examines the efficiency of 12 Airly sensors deployed across Corsica to monitor particulate matter and nitrogen dioxide levels. The project’s goal was to identify pollution sources, especially in ports, evaluate air quality improvement initiatives, and advocate for environmental policy changes. It also tracked particulate matter from Saharan dust, supporting government actions and raising public awareness.

Every individual on the supply side makes a contribution to society.

Whether you're extending the cellular network to your community or if you’re monetizing your vehicle data, these are opportunities that you, as a consumer, previously had no way to grasp. People weren’t able to say, hey, I want to support the infrastructure. It wasn't cheap enough. It wasn't easy enough to go and build that infrastructure.

- Alex Rawitz, Co-Founder at DIMO

- Earning rewards from DePIN

The individual’s contribution to the network is usually rewarded with tokens. While this is a strong incentive, the stories we heard from users who power DePIN networks are diverse.

We interviewed two users who have spent approximately $600-800 on setting up equipment in busy metropolitan areas and have not seen the returns they might have expected from projects like Helium.

They both told us about their initial enthusiasm for the project. The use cases were exciting and innovative. One involved locating lost fishing nets in the ocean through chips embedded in the nets. Even authorities praised this unique application for its utility in leveraging the network to accomplish an impossible mission.

However, as the narrative unfolded, users revealed their disappointment with the practical outcomes of their investment in the technology. They put down approximately $400 for a mining kit and $250-$300 for antennas and cables but then faced delivery delays of 7-9 months.

When they were finally done with the setup, they encountered issues with network saturation as more devices were activated in their vicinity. Competition increased, and returns went down. Despite attempts to optimize the setup by experimenting with various antennas and locations, the results were underwhelming. Both of our interviewees criticized the lack of guidance on optimizing device performance and shared their frustration with the inconsistent and often poor data mining yields.

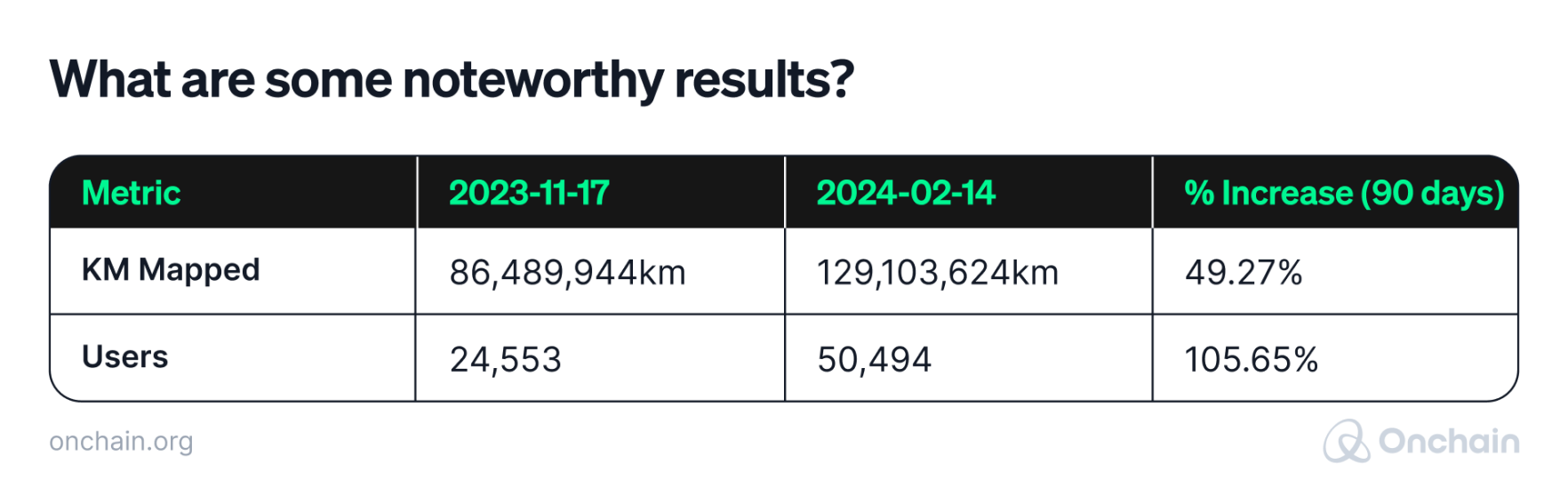

This is one story of disappointment, but many are positive and encouraging. In other cases, rewards for supply-side individuals can be truly beneficial. For example, Hivemapper’s users frequently share their earnings on social media and remain content with the bounties for contributions to expanding the networks.

DePIN projects vary at their core, and the different user experiences shouldn’t come as a surprise. We will explore the reasons in the DePIN business section in detail.