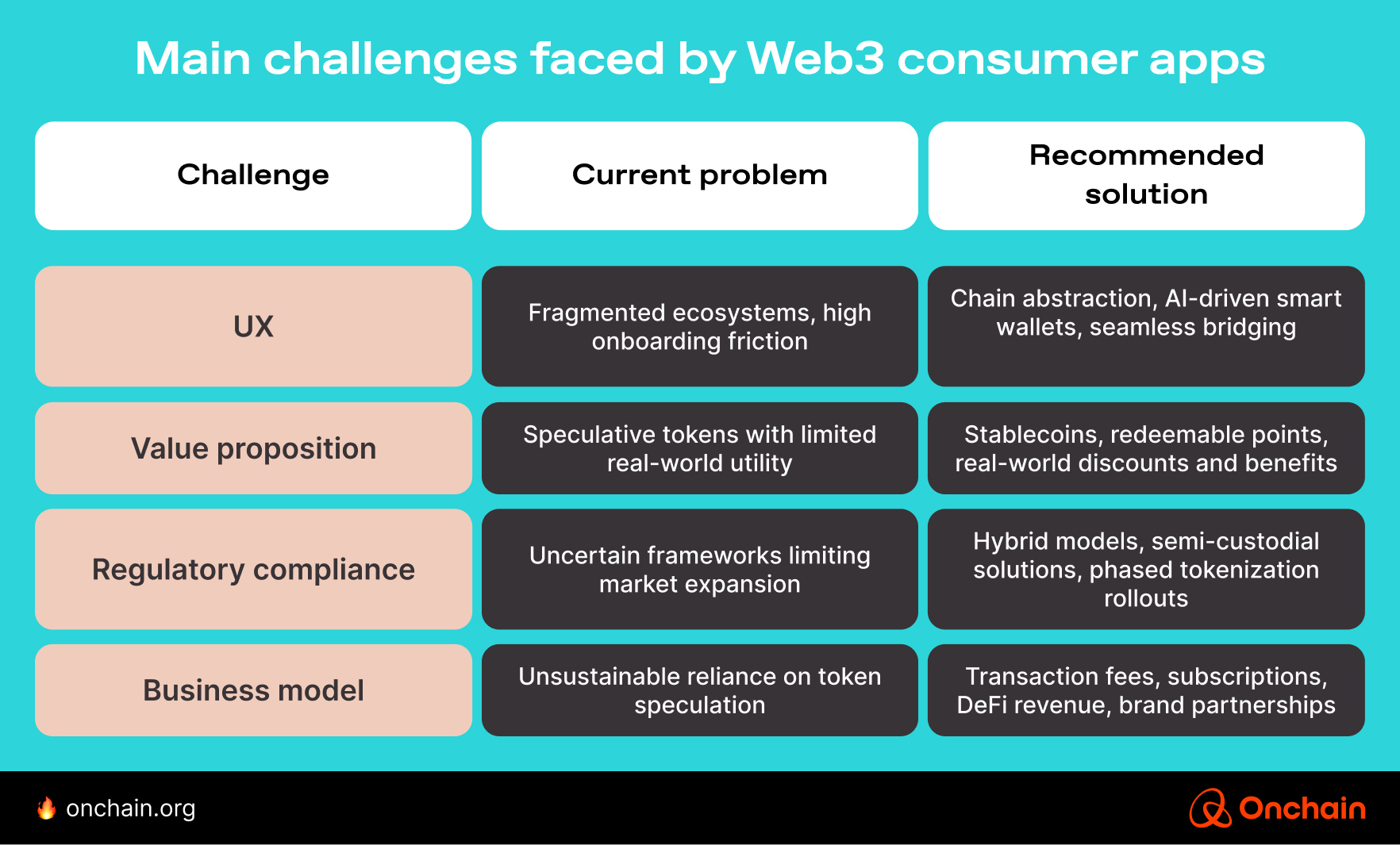

5. What Crypto Consumer Apps Must Fix to Achieve Mass Adoption

You’ll learn

- Why subpar UX and fragmented ecosystems cause mainstream users to abandon Web3 apps, and how chain abstraction plus AI-based wallets can reduce onboarding friction.

- How important stable, real-world token incentives are over purely speculative models illustrated by examples like Blackbird and KaiChing.

- Which compliance-first strategies used by WiFi Map, Gnosis Pay, and others pave the way for large-scale adoption in a tightening regulatory landscape.

- Which proven business frameworks (transaction fees, subscriptions, DeFi revenue, brand partnerships) boost sustainability and drive real consumer value beyond initial hype.

You’ve gotten to know some prominent Web3 consumer apps and should have a feel for what they’re like by now. And we only tested the good ones, which explains why this app type stands at a critical crossroads.

Users today demand applications that offer tangible value, intuitive experiences, and clear regulatory alignment. Projects that meet these expectations are positioned for long-term success, while those anchored in speculative tokenomics and complex user experiences risk obsolescence. This chapter draws from our Onchain Web3 consumer survey and multiple case studies to identify the barriers facing Web3 consumer apps and offer proven strategies to succeed.

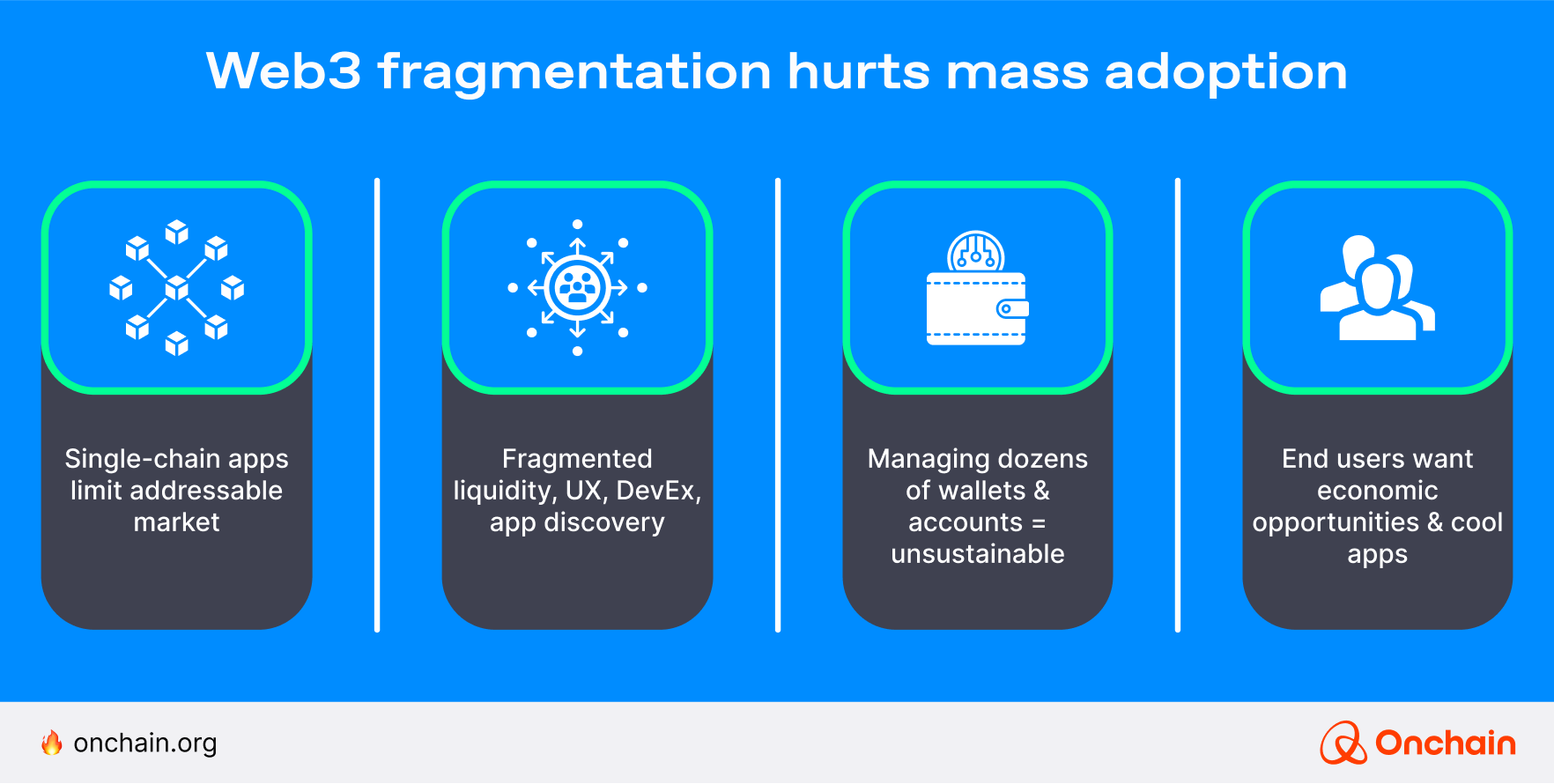

1. Fragmented UX & complex onboarding

Current problem: Web3’s multichain ecosystem is fragmented, complicated, and full of confusing workflows. What’s more, users accustomed to the seamless experience that has become ubiquitous to Web2 apps often struggle with the complexity of handling multiple wallets, tokens, and blockchains. This friction significantly hampers the mainstream adoption of Web3 apps.

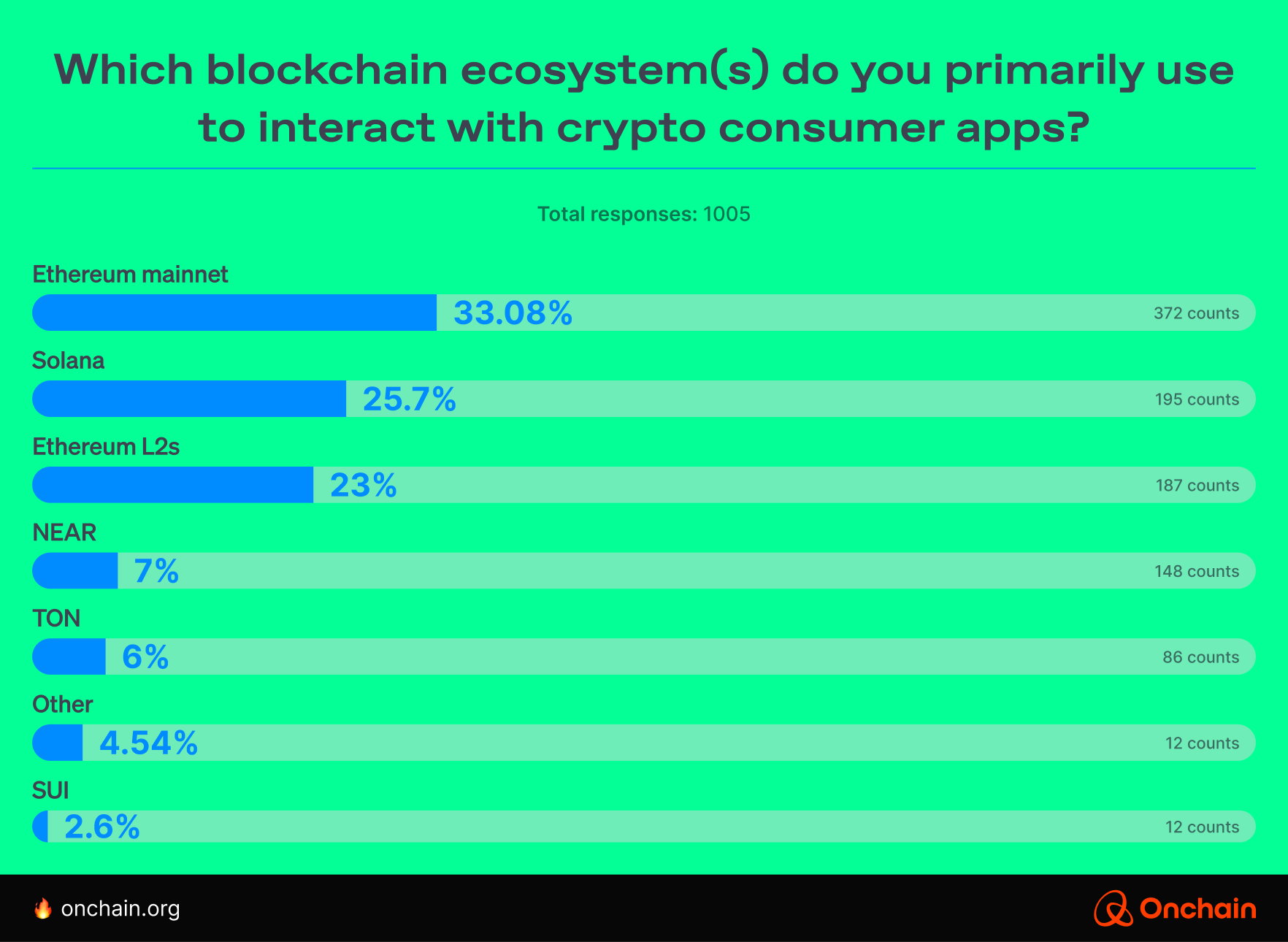

According to our survey, Ethereum is still the most popular blockchain for crypto apps.

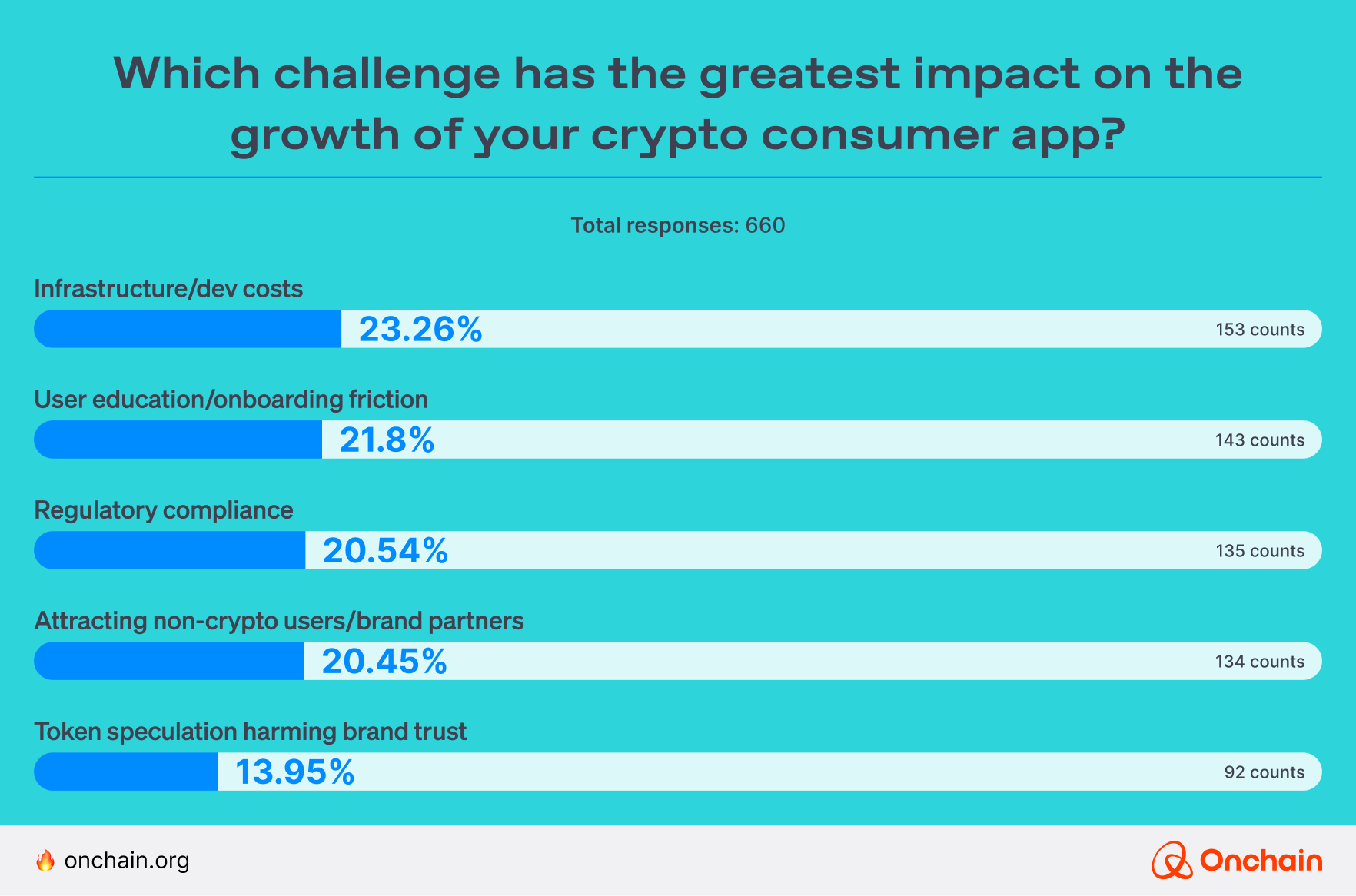

- Additionally, we found that 20% of founders identified infrastructure complexity and high development costs as critical barriers to growth.

This complexity pushes the non-Web3 native away.

Impacts of fragmentation:

- 😕 Increased user frustration and confusion

- 📉 High user drop-off rates post-onboarding

- 🚧 Significant barrier to mainstream adoption

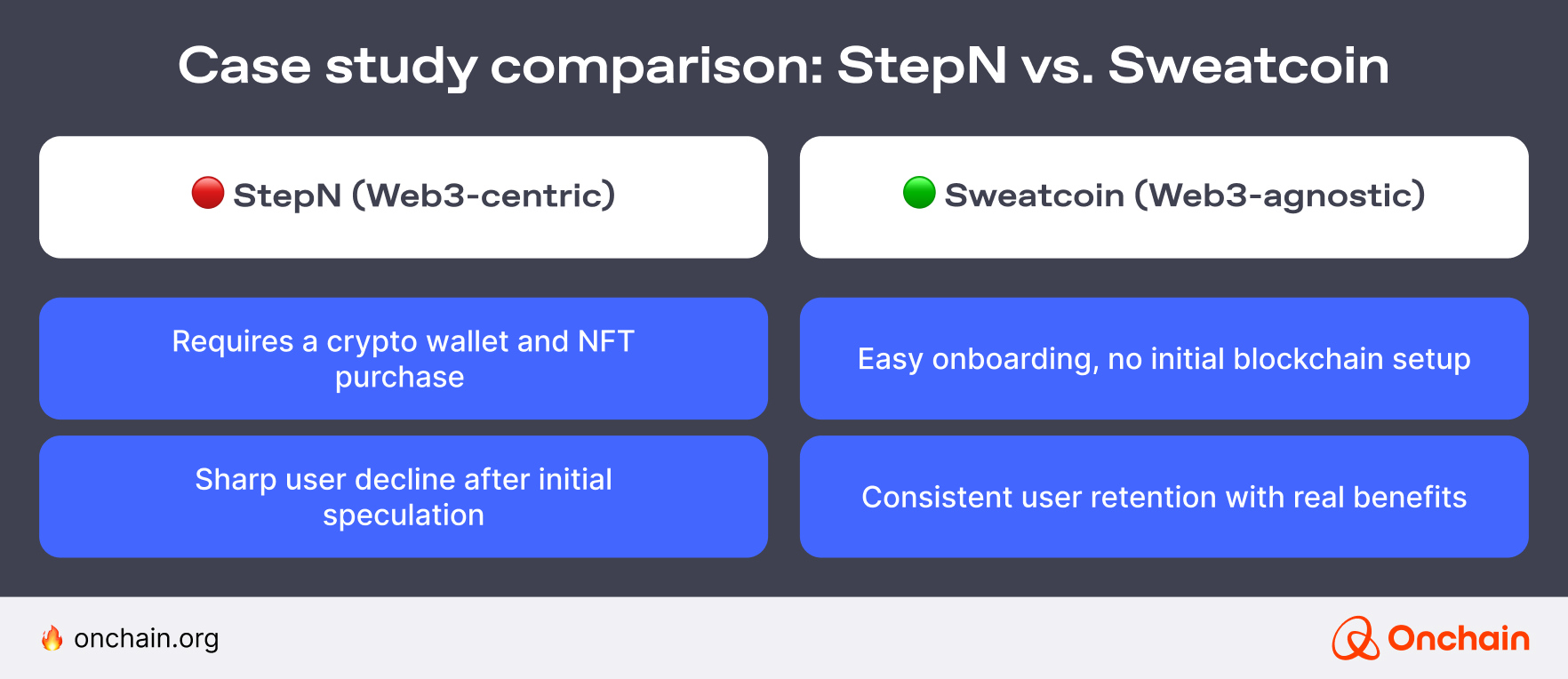

While StepN successfully attracted an early wave of crypto-native users, its complex onboarding and speculative incentives proved unsustainable. Interestingly, this challenge is also reflected in its lower market cap ($12.4 million as of March 3). Sweatcoin, although not fully decentralized or blockchain-native, demonstrates how reducing friction and offering straightforward benefits can sustain mainstream engagement. This is reflected in its significantly higher market cap ($47.5 million as of March 3).

However, Sweatcoin itself is not without flaws:

- Rewards lack the genuine decentralization and transparency inherent in Web3.

- The app provides limited exposure to blockchain capabilities, sacrificing many of Web3’s intrinsic advantages.

- Long-term user engagement still depends heavily on continuous brand partnerships, potentially limiting growth if such deals falter.

Despite these limitations, Sweatcoin offers a critical lesson to Web3 developers: Reducing friction through chain abstraction while providing immediate practical utility leads directly to improved mainstream adoption.

🛠️ Recommended solutions for reducing fragmentation and friction

Chain abstraction & unified interfaces

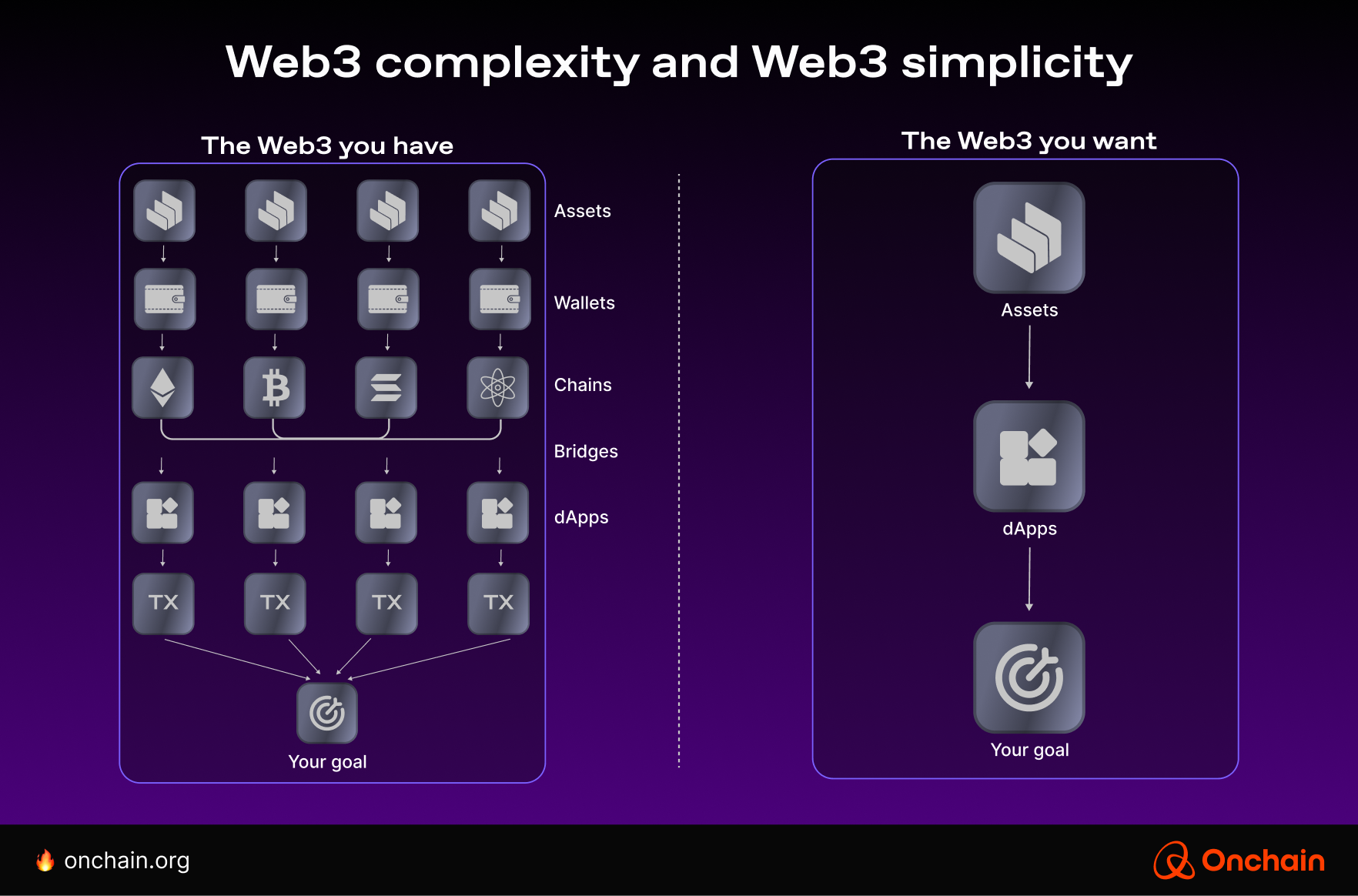

Web3 must evolve beyond fragmented, chain-specific user journeys. Instead, it should offer unified, abstracted user experiences.

- Aggregator superapps: Combine NFTs, DeFi, and gaming under one simple interface, making blockchain entirely invisible to users.

- Seamless crosschain bridging: Automating token transfers behind the scenes to eliminate manual bridging transactions.

The shift from fragmented experiences (“The Web3 you have”) to streamlined, intuitive interactions (“The Web3 you want”) is essential for mass-market appeal.

AI-driven smart wallets and account abstraction to reduce friction

Traditional non-custodial wallets have long been a barrier to adoption due to complex key management and gas fees. Creating a less complex UX is still one of the main challenges Web3 consumer app founders face.

The rise of smart wallets and AI-powered automation has significantly improved this experience by removing technical hurdles. Examples of such wallets include Pass App, Coinbase’s Smart Wallet, Phantom, and Rabby Wallet.

- Pass App’s Smart Wallet introduces a fully non-custodial experience with a passwordless recovery mechanism, allowing users to regain access without memorizing a complex seed phrase. This eliminates a major friction point while maintaining decentralization.

- Coinbase’s Smart Wallet takes usability a step further by leveraging AI agents to manage financial transactions on behalf of users. The wallet automates gas fee management, transaction approvals, and asset allocation, significantly lowering the learning curve for new users.

Such wallets improve immediate usability and also align closely with consumer expectations set by Web2 applications, effectively bridging the UX gap between traditional and decentralized applications (dApps).

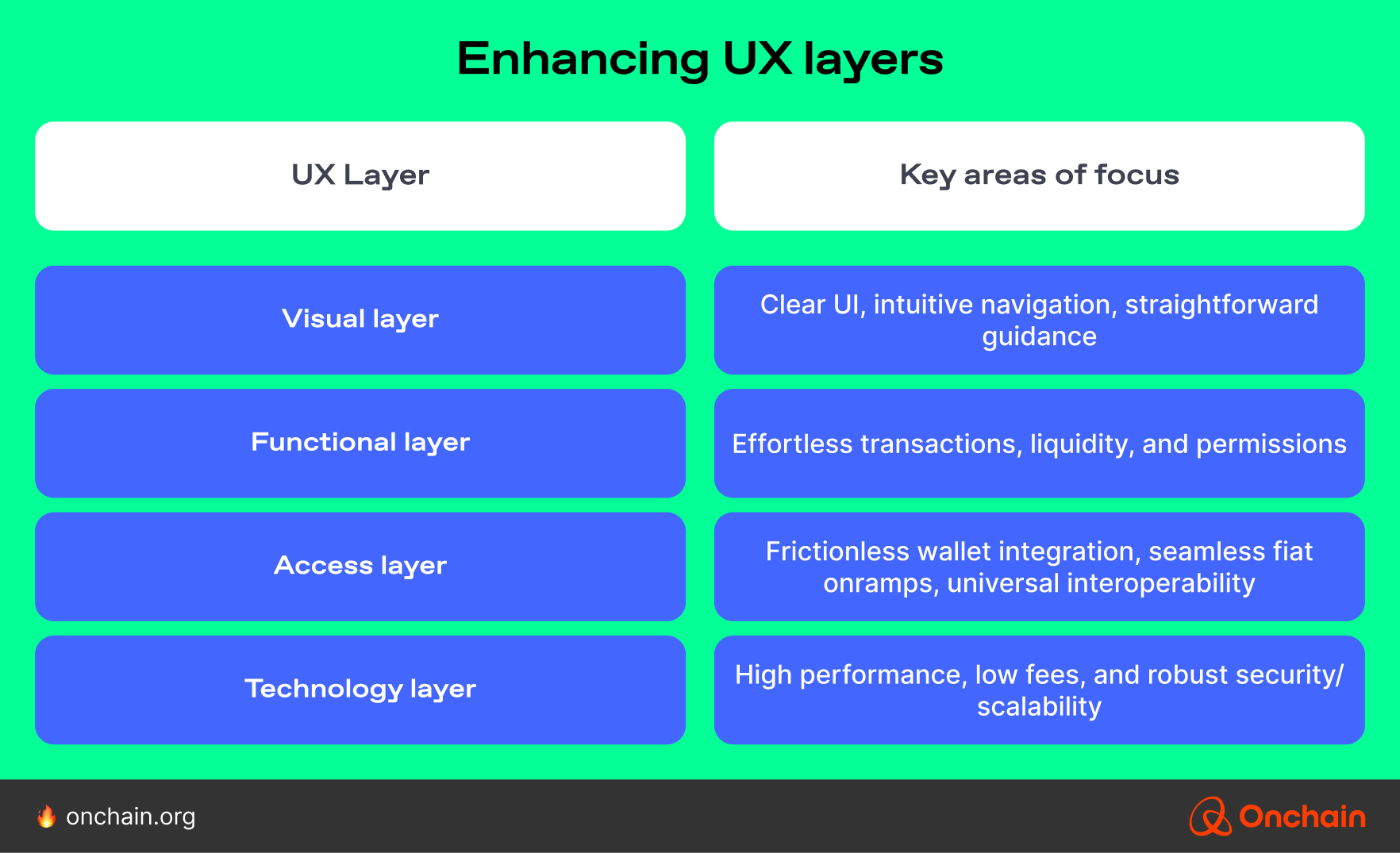

The layers of a superior Web3 UX

Creating mass-market Web3 apps involves systematically enhancing UX across multiple layers:

Addressing all four layers creates a holistic UX that naturally attracts and retains mainstream users, transforming Web3 from a niche interest to an everyday necessity.

2. Token rewards without clear real-world value

Current problem: Many Web3 consumer applications mistakenly rely on speculative token incentives — such as governance tokens, staking yields, and NFTs — to attract and retain users. While these crypto-native rewards might initially create excitement, our research consistently establishes that mainstream users prioritize tangible, practical value over speculative opportunities.

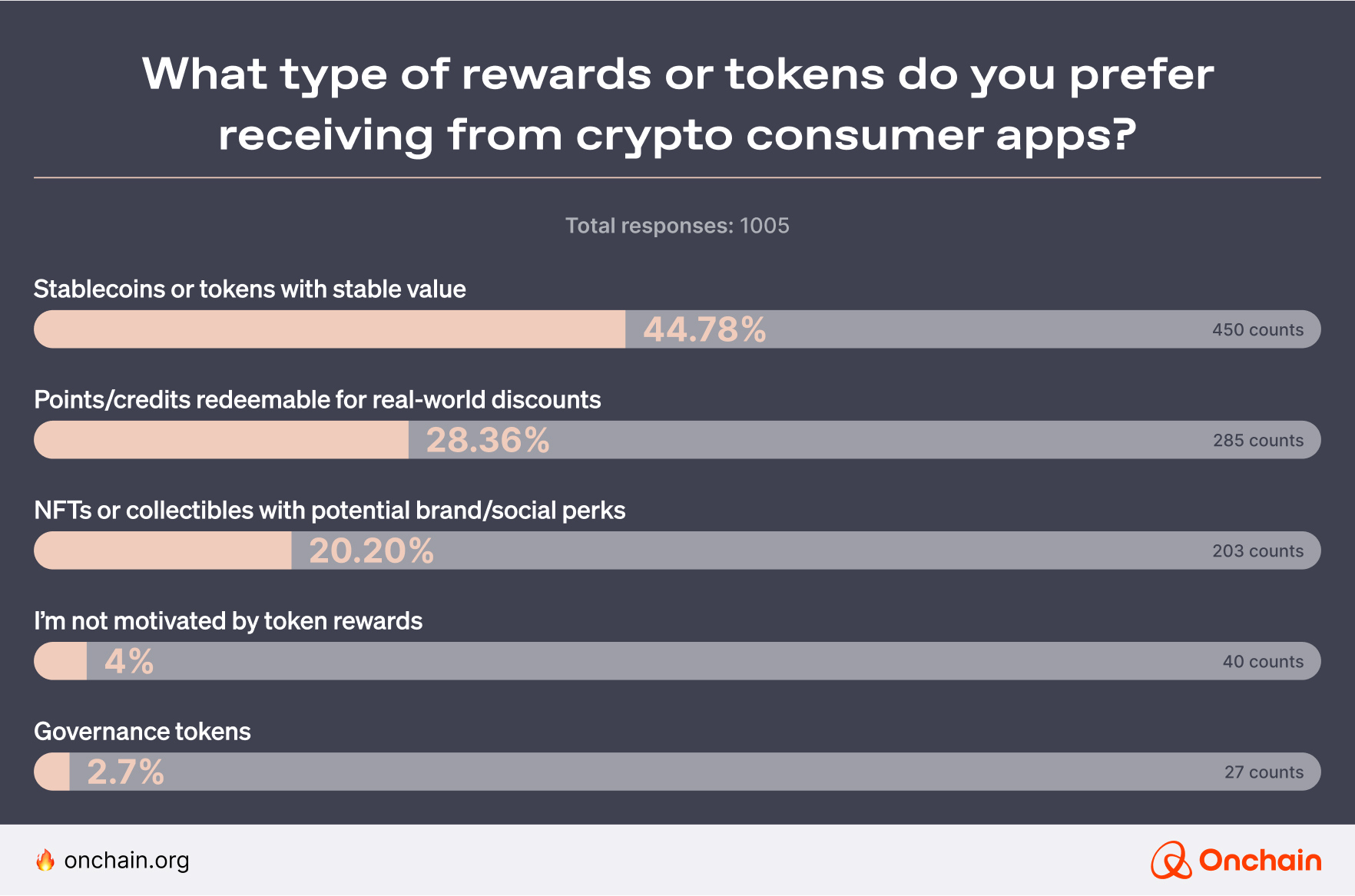

What users actually want: key survey insights 📊

User preferences reveal a stark mismatch between what apps offer and what mainstream users truly value.

Mainstream users clearly favor stability, practicality, and real-world benefits over tokens intended solely for speculation or governance. Ignoring this insight leads to a cycle of fleeting adoption and rapid user churn.

Impact of speculative reward models:

- 🚩 Unsustainable growth: Short-term user spikes driven by token price surges rapidly evaporate once prices decline.

- 🔄 Poor retention: Users abandon apps when speculative incentives fail to deliver lasting practical value.

- ❗ Damaged trust: Overemphasis on speculation harms long-term trust in both brands and blockchain technology.

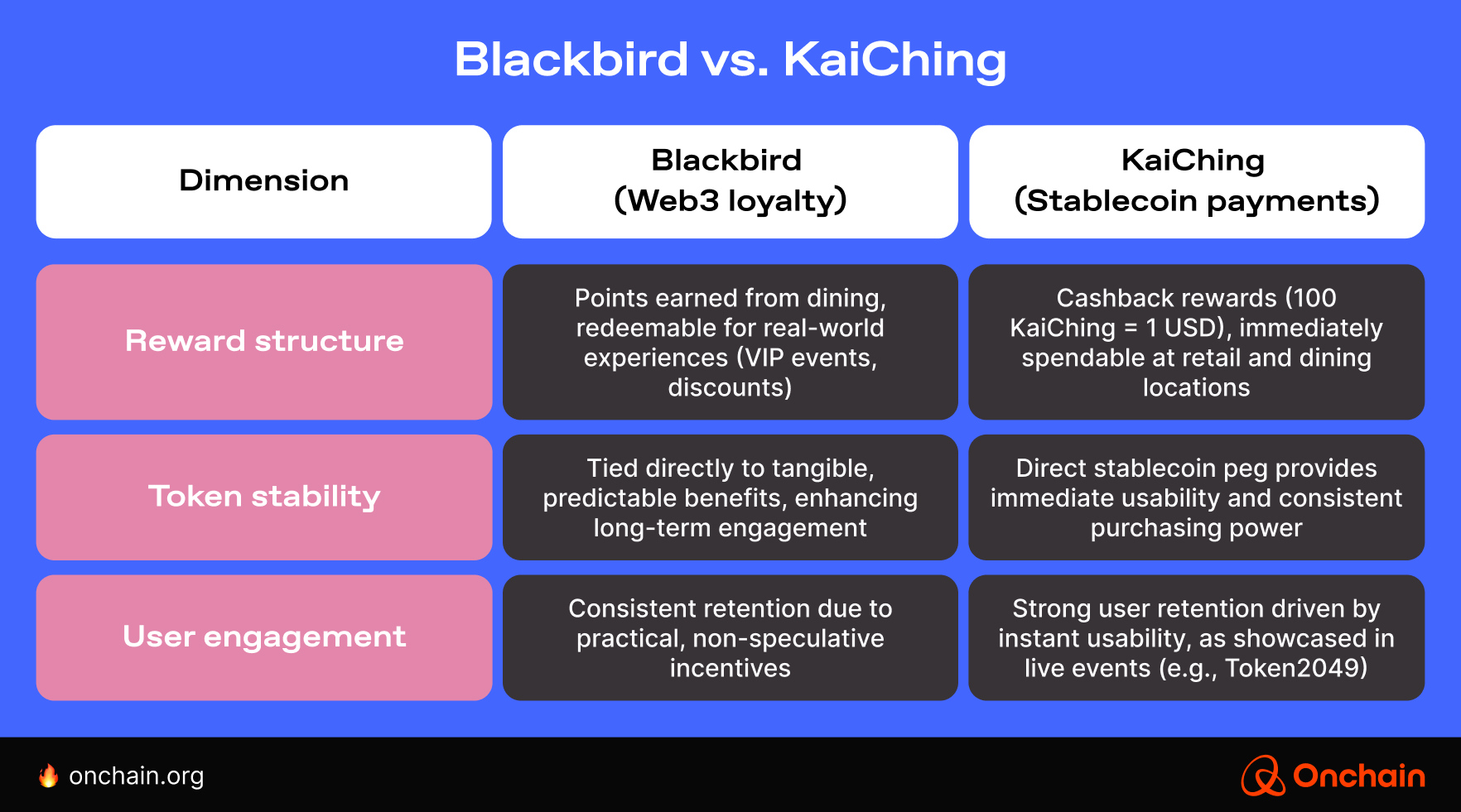

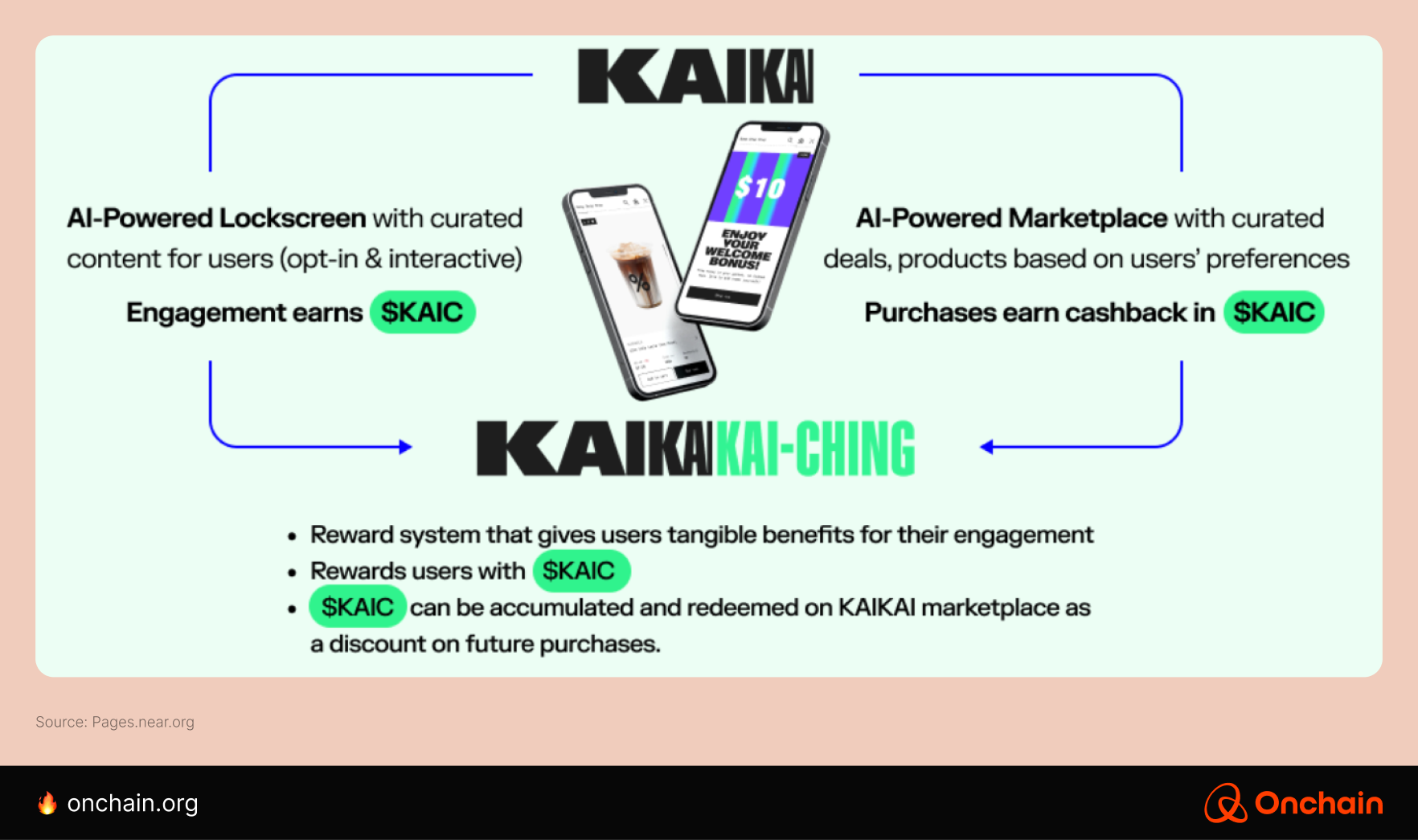

Case study comparison: Blackbird vs. KaiChing

To illustrate the difference practical token rewards make, consider Blackbird, a restaurant loyalty program, compared to KaiChing, a retail-focused stablecoin payment system:

Unlike purely speculative tokens, both applications deliver stable, tangible benefits that resonate strongly with mainstream users. However, KaiChing takes its rewards one step further by directly integrating token usage into everyday spending scenarios, creating an even more precise and immediate value proposition.

Yet, even these cases exhibit limitations. Blackbird’s impact largely depends on continuous brand partnerships, which poses a challenge to sustainability if partnerships stall. KaiChing provides stable value but does not fully leverage decentralized incentives like community governance or user empowerment.

🛠️ Recommended solutions for meaningful token incentives

To sustainably attract and retain mainstream users, Web3 apps should:

- Prioritize stablecoins or semi-stable tokens: Reward users with stable assets they can spend or convert effortlessly, removing volatility concerns.

- Redeemable real-world benefits: Link token rewards to everyday perks, such as gift cards, subscription discounts, or tangible goods and services.

- Controlled supply & redemption mechanisms: Implement semi-stable tokens or credits that prevent extreme volatility through managed tokenomics, ensuring consistent user value.

Key insights:

- Users favor token rewards with stable and real-world utility.

- Sustainable tokenomics focused on practical incentives outperform speculative schemes over time.

Actionable takeaways from these insights for founders & entrepreneurs:

- Align incentives directly with your target market’s everyday spending and consumption habits.

- Prioritize stable and predictable rewards to build long-term brand loyalty.

- Test reward models through phased rollouts to validate user appeal before broader deployment.

3. Regulatory uncertainty and compliance

Regulatory uncertainty remains one of the most significant challenges for Web3 consumer apps seeking mass adoption. The lack of a clear and consistent framework across jurisdictions creates considerable complexity, which, in turn, stifles innovation and slows down expansion efforts. According to our Onchain Web3 Consumer Survey, over 20% of Web3 founders identify regulatory compliance for KYC/AML (Know Your Customer/Anti-Money Laundering) and varying financial licensing requirements as their primary barriers limiting their market growth.

Primary consequences of this regulatory ambiguity:

- 📉 Restricted market access: Apps often remain confined to crypto-native markets where users are willing to stomach regulatory volatility.

- ⚠️ Innovation paralysis: Many projects hesitate or avoid incorporating token incentives and other Web3 features. Consequently, they miss opportunities to deliver genuine user value.

Real-world implications: case studies

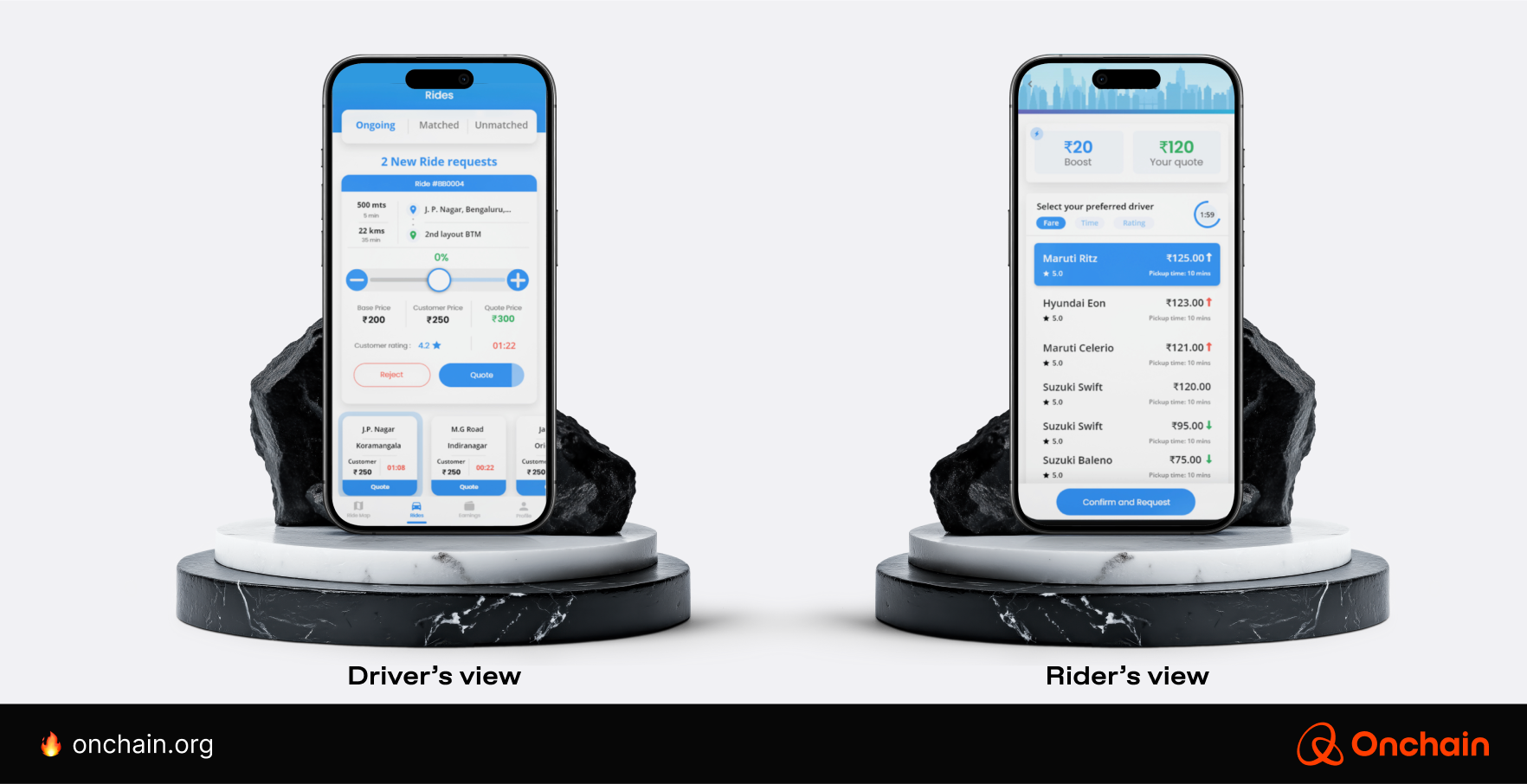

This challenge is evident in ride-sharing. For example, Drife, a decentralized ride-hailing platform, aims to disrupt centralized platforms like Uber but faces licensing and legal restrictions that prevent large-scale expansion. Unlike conventional ride-hailing services, Drife is built on a decentralized model with zero commission fees charged to its drivers and riders. Through its Taxi 3.0 vision, Drife seeks to eliminate intermediaries, enable fair pricing, and put control back into the hands of drivers. Its patented auction-based pricing model lets market forces determine fares, ensuring greater transparency and autonomy for users.

Beyond ride-hailing, Drife also integrates DeFi features that allow drivers to stake DRF tokens to access microloans and other financial services, such as crowdsourced vehicle financing. By further expanding into the DePIN sector, Drife plans to equip drivers with geolocation devices that help map existing routes and offer extra rewards for contributing valuable data.

The problem is that compliance requirements for ride-sharing services vary across jurisdictions. Despite its strong value proposition, regulatory roadblocks limit Drife’s ability to scale.

Car data monetization apps like DIMO face similar issues. The app would reward drivers for sharing vehicle data, however, mainstream consumers are hesitant to engage due to privacy regulations, data protections, and ownership concerns. These issues create a need for external hardware or complex integrations with car software, making it difficult for non-crypto users to adopt the technology.

In contrast, WiFi Map has found a compliance-friendly path to market, ensuring regulatory clarity by using offchain redeemable points before converting them into tokens. Bypassing legal gray areas ensures a clear value proposition for users, which is a good reason for businesses and regulators to support the concept. WiFi Map successfully navigated the compliance challenge without limiting adoption. The app started with a Web2-compatible model and gradually transitioned to Web3.

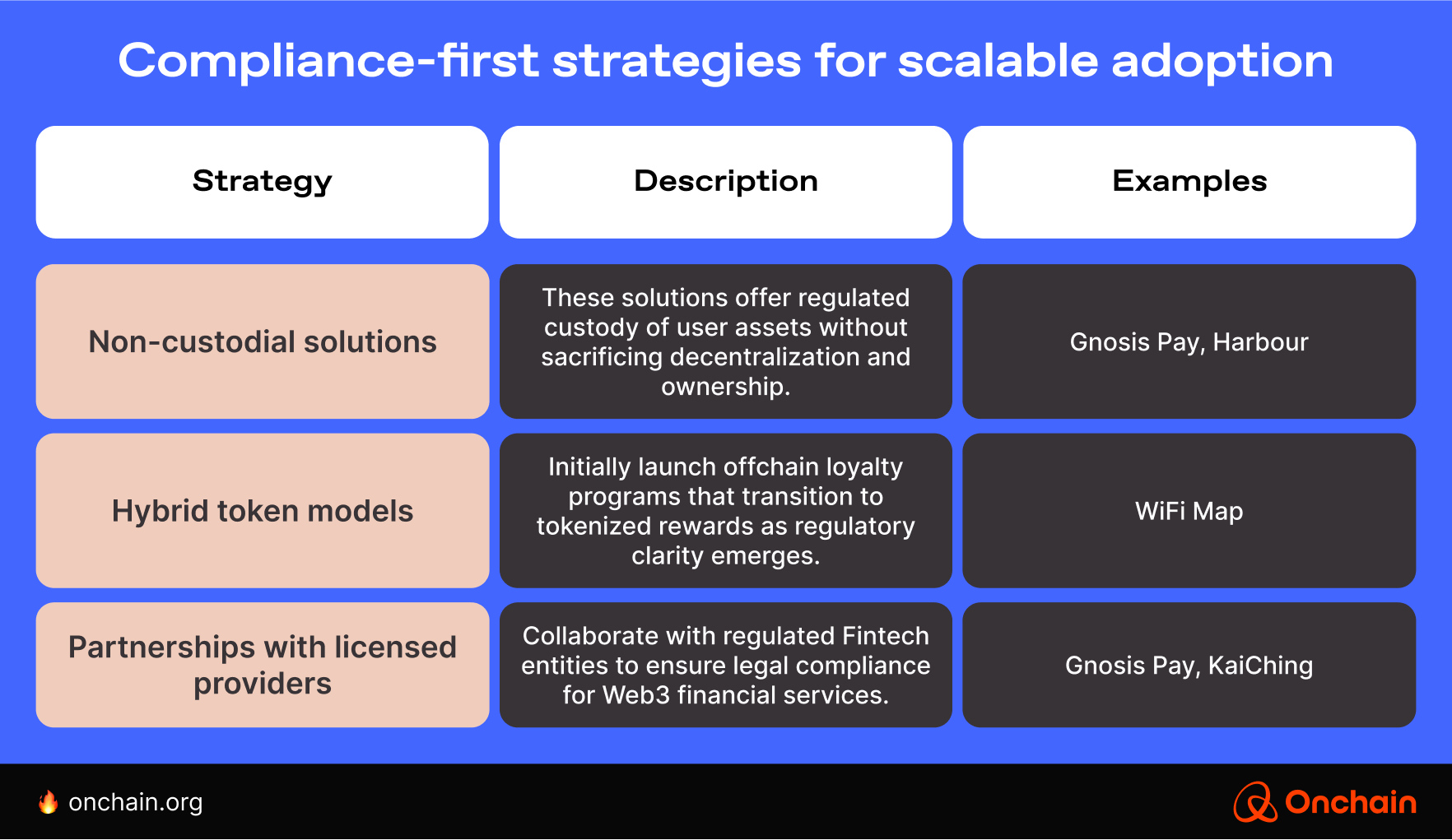

The solution: compliance-first Web3 models

Web3 must embed compliance into its foundation to move beyond crypto-native users. Projects need to include it in their strategies from the beginning. Find the most effective strategies to date in the following table.

Ignoring compliance is not an option. Web3 projects that proactively integrate legal frameworks have a much higher chance of achieving global adoption. Those that fail to address regulatory concerns will get lost in legal uncertainty.

Winning business models and ecosystems: What works in Web3 consumer apps?

Summing it all up, you may have noticed a golden thread running through the entire report: Today’s winning Web3 consumer apps prioritize ease of use, clear practical benefits, and robust regulatory alignment. Rather than chasing short-term speculative trends, successful applications focus on solving genuine consumer pain points and delivering sustained value.

To demonstrate the focal points successful apps share, we’ve organized them in the table below.

From speculation to sustainable value

Web3 consumer apps represent more than technological advancements — they embody a transformative shift toward user empowerment and economic democratization. Applications with staying power embed blockchain technology into everyday life in practical ways. In doing so, they actively convert users into stakeholders in a more transparent and equitable digital ecosystem.

Strategic action points for Web3 stakeholders

For founders & innovators:

- Rigorously validate consumer-driven use cases before implementing tokens.

- Prioritize intuitive, streamlined UX that rivals leading digital platforms.

- Leverage AI-driven abstraction to simplify blockchain interactions for mass adoption.

For investors & enterprises:

- Invest in projects with proven, sustainable value propositions and clear monetization paths.

- Support ventures with robust compliance strategies to enable safer, scalable growth.

- Focus on solutions with tangible mainstream appeal and measurable user retention.

For policymakers & industry leaders:

- Establish clear, adaptive regulatory frameworks to nurture responsible innovation.

- Collaborate with innovators to pilot real-world blockchain applications.

- Foster initiatives promoting social equity and broad economic inclusion through Web3 technology.

Charting the course for Web3’s future

Realizing the full potential of Web3 requires a holistic approach beyond mere technical innovation. Success hinges on seamless usability, practical utility, and thoughtful regulatory frameworks. If blockchain apps address these areas effectively, they can become integral to daily consumer activities, powering a more decentralized and equitable digital future.

Web3 offers profound opportunities to redefine digital interactions, disrupt traditional industry dynamics, and significantly enhance societal equity. The emerging generation of Web3 consumer applications is poised to reshape industries, unlock widespread digital empowerment, and foster inclusive economic growth.