4. Inside Blackbird: A Web3 Loyalty App Built for Mainstream Consumers

You’ll learn

- How Blackbird’s growth and numbers can be verified through onchain data.

- How restaurants use Blackbird user data to boost revenue and adapt to changing market conditions.

- How Blackbird works in practice with on-the-ground first impressions in NYC.

- How the app stacks up to its Web2 and Web3 competitors.

- Blackbird-based and Blackbird-inspired business opportunities.

You’ve learned about the differences in payment apps, which are unsurprisingly the most prevalent among crypto consumer apps. And we’ve taken you on a tour to discover the usefulness of some other service types offered. One other promising app is still on our list to test, and for that, we’re taking you through the restaurants of New York.

Blackbird is a Web3 loyalty and payment platform that combines blockchain-powered rewards with a seamless, modern dining experience.

In this chapter, we explore how Blackbird works, why it might be a game-changer for restaurants and diners, and what we found when we tested it in NYC.

4.1 What is Blackbird? The basics

Blackbird is a Web3 app focused on serving the restaurant industry. Currently applicable in a few select U.S. markets, its app strives to optimize the user interface (UI) and user experience (UX) for its customers. Most of its target user base isn’t interested in crypto details; they want an app with clear benefits and real-world utility.

If you're expecting to replace an existing business model with Web3 and suddenly scale, you're already making a mistake. Consumers won't switch just for speculative incentives; they need genuinely new value.

- Jennifer Roebuck, Chair, Lumen Prize

Promoting promising Web3 values like user self-sovereignty, transparency, and community engagement could re-energize the restaurant rewards industry. By providing extra benefits and perks not commonly found in other offerings, Blackbird could significantly disrupt the restaurant and hospitality industry’s loyalty rewards sector. Let’s see how.

U.S. restaurant industry overview: diners and restauranteurs

With over 1 million U.S. restaurants, an average American dines out 5–6 times a week. Recent data suggests that outside-the-home food spending accounts for over 58% of their overall food expenditure. Annual restaurant sales in the United States are in excess of $1 trillion — and growing. And nearly half of diners claim to be members of a loyalty program.

For restaurants, these loyalty members have an outsized effect on revenue. They spend an average of 5% more per meal. The top 10% of loyalty members make up 44% of restaurant visits and about half of overall loyalty spending. Accommodating and catering to these regulars can be critical when operating in the hyper-competitive restaurant landscape.

Restaurant costs and pain points

Restaurants often operate on tight margins, and costs add up. Credit card fees can be in excess of 3% of a bill.

On top of that, you need a point-of-sale (POS) system to accept these payments. Initial hardware costs (payment/touchscreen terminals, registers, card readers, printers, and more) can amount to thousands of dollars. These POS systems generally have monthly software subscription costs that can vary from $50–$200 per terminal.

Combined, credit card fees and POS costs can easily exceed 4% of a customer’s bill. That doesn’t even factor in chargeback costs and hidden fees. Beyond this, a loyalty program is an additional added cost.

Is there a better way? Blackbird’s goal is to provide one. Let’s see how.

Blackbird app: simple onchain rewards and payments

To be more than a flash-in-the-frying-pan solution, Blackbird must provide synergistic value to restaurant owners, diners, investors, and entrepreneurs. Many of the following perks and improvements benefit multiple stakeholders. Let’s examine each of them from these various angles.

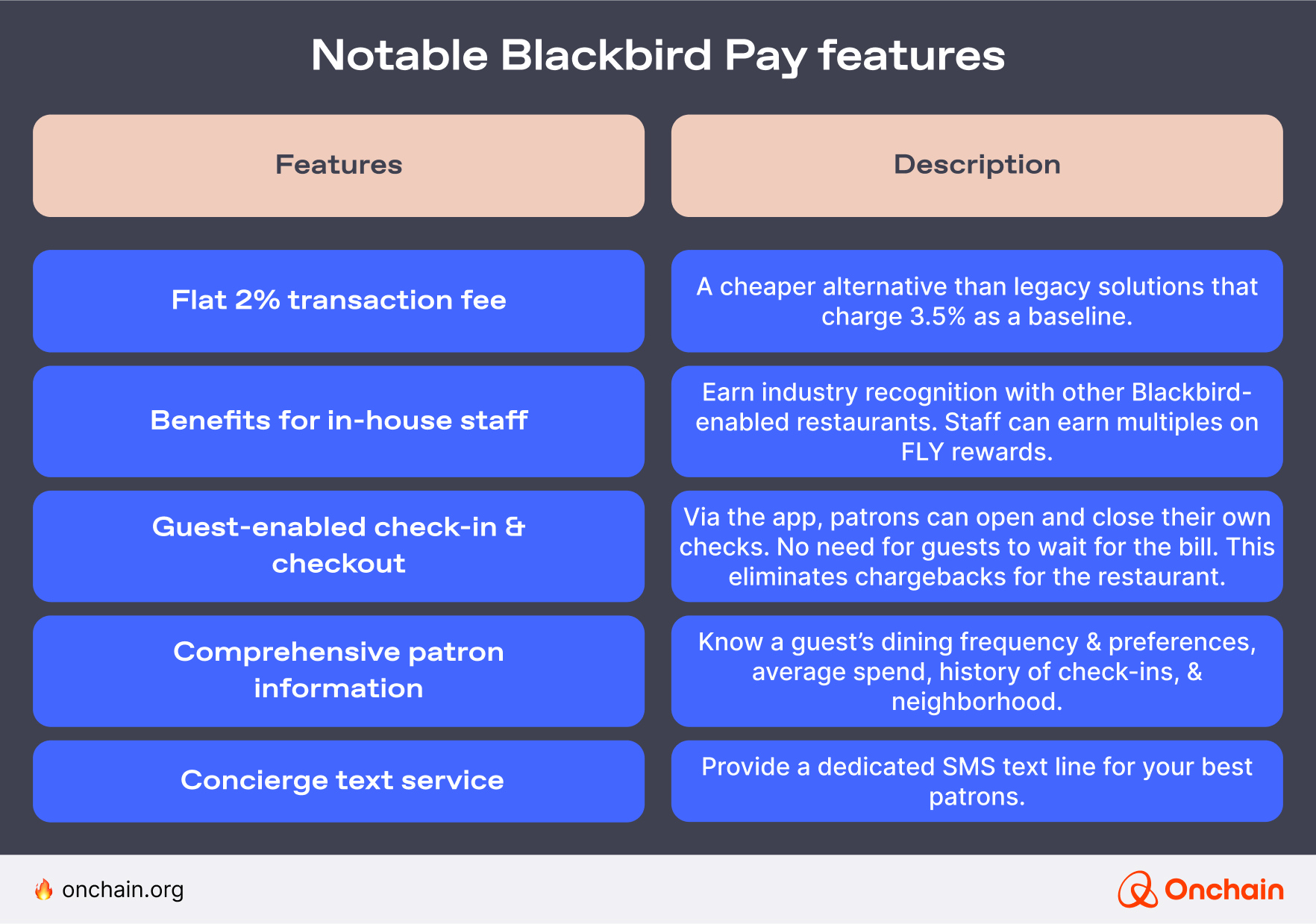

Blackbird Pay

The payment solution integrates with most existing POS systems. Blackbird Pay is a cost-saving feature that provides additional functionality, data, and customer perks.

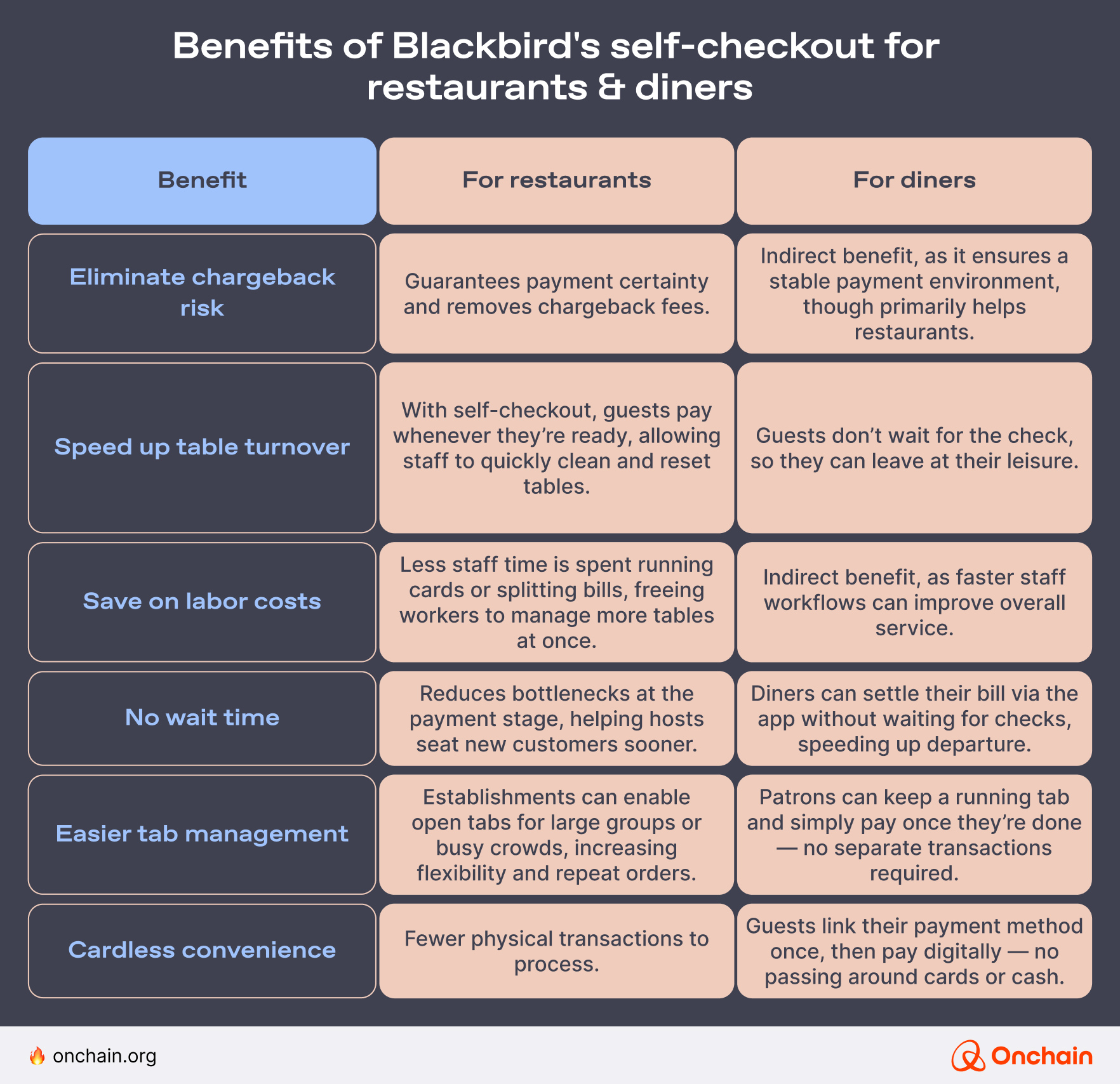

Detailed diner data is critical for restaurants that aim to retain customers. Blackbird offers features that solely benefit the restaurant’s bottom line, while other features provide benefits on both sides of the business-customer relationship.

The ability to self-checkout is a standout example and a win-win proposition for restaurants and dining enthusiasts alike.

4.2 Using Blackbird: the UI, the UX, and more

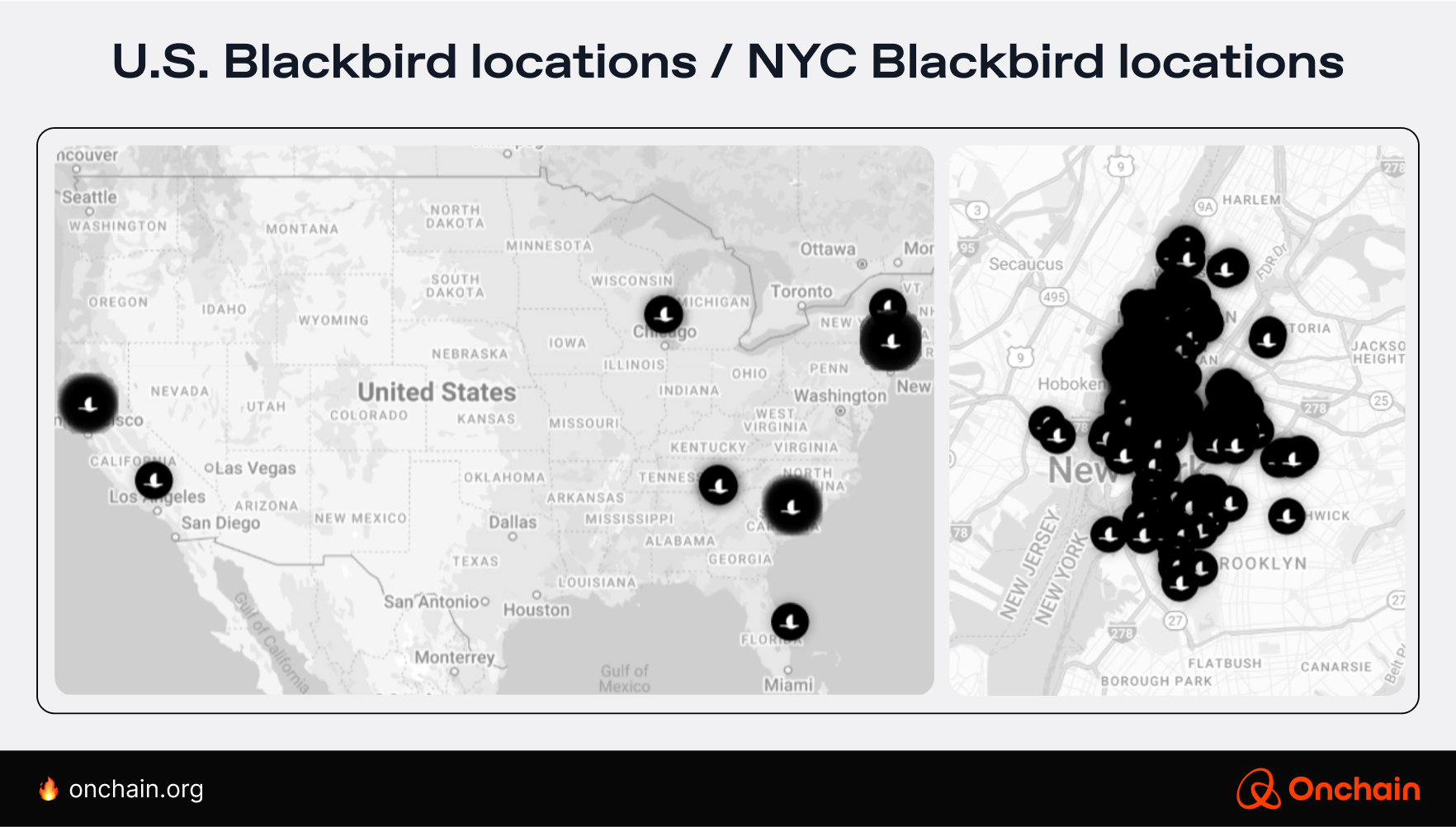

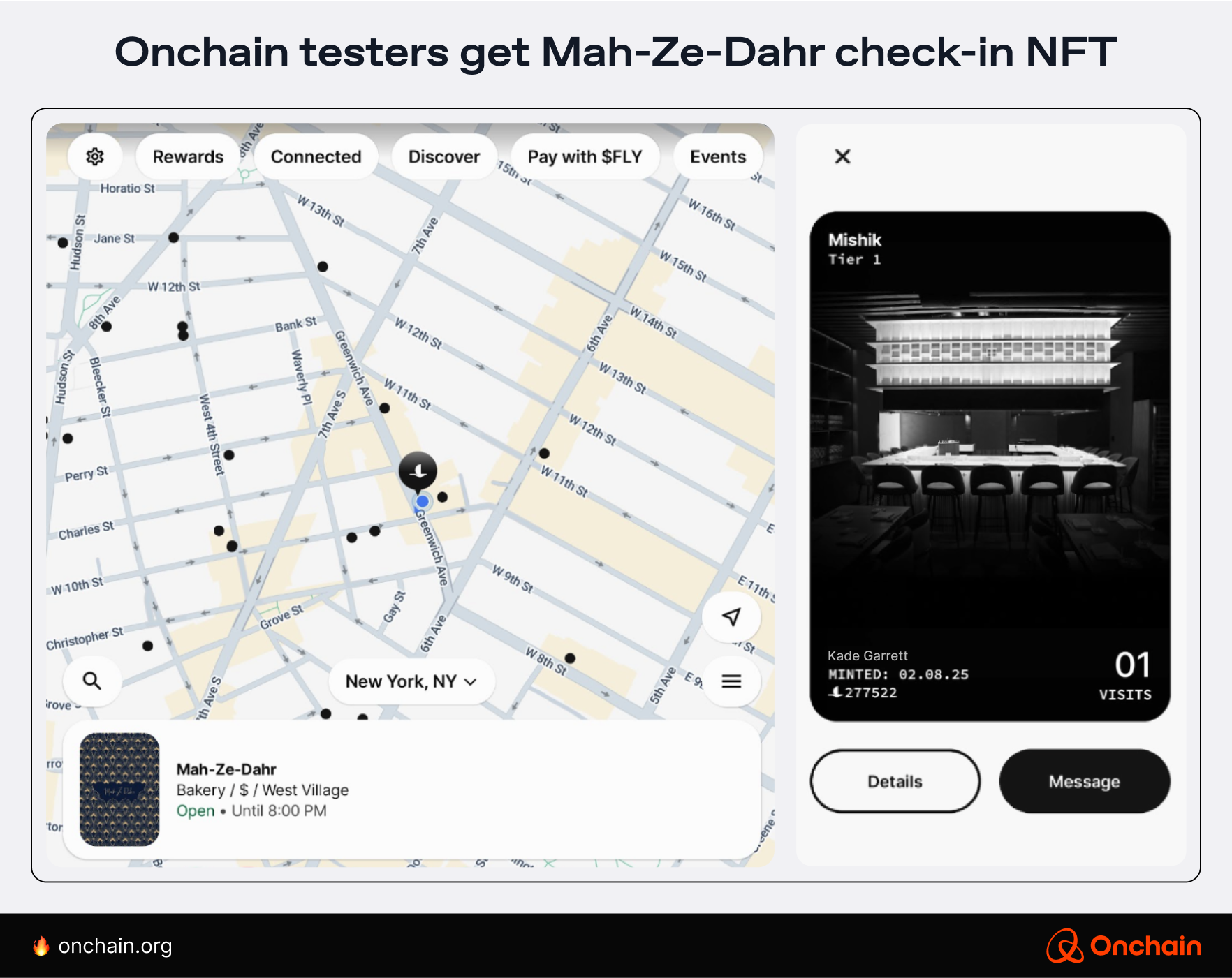

Everything looks great in theory, but how does it look and work in practice? On the app, the featured locations are New York, NY; Charleston, SC; and San Francisco, CA. The invitation to a crypto debate in Manhattan was an excellent opportunity for our crypto specialist and writer, Kade Garrett, to test the app. He collected initial reactions from other users, talked to restaurant workers, and tried it out at a few establishments.

Here’s his impression of using the app for the first time.

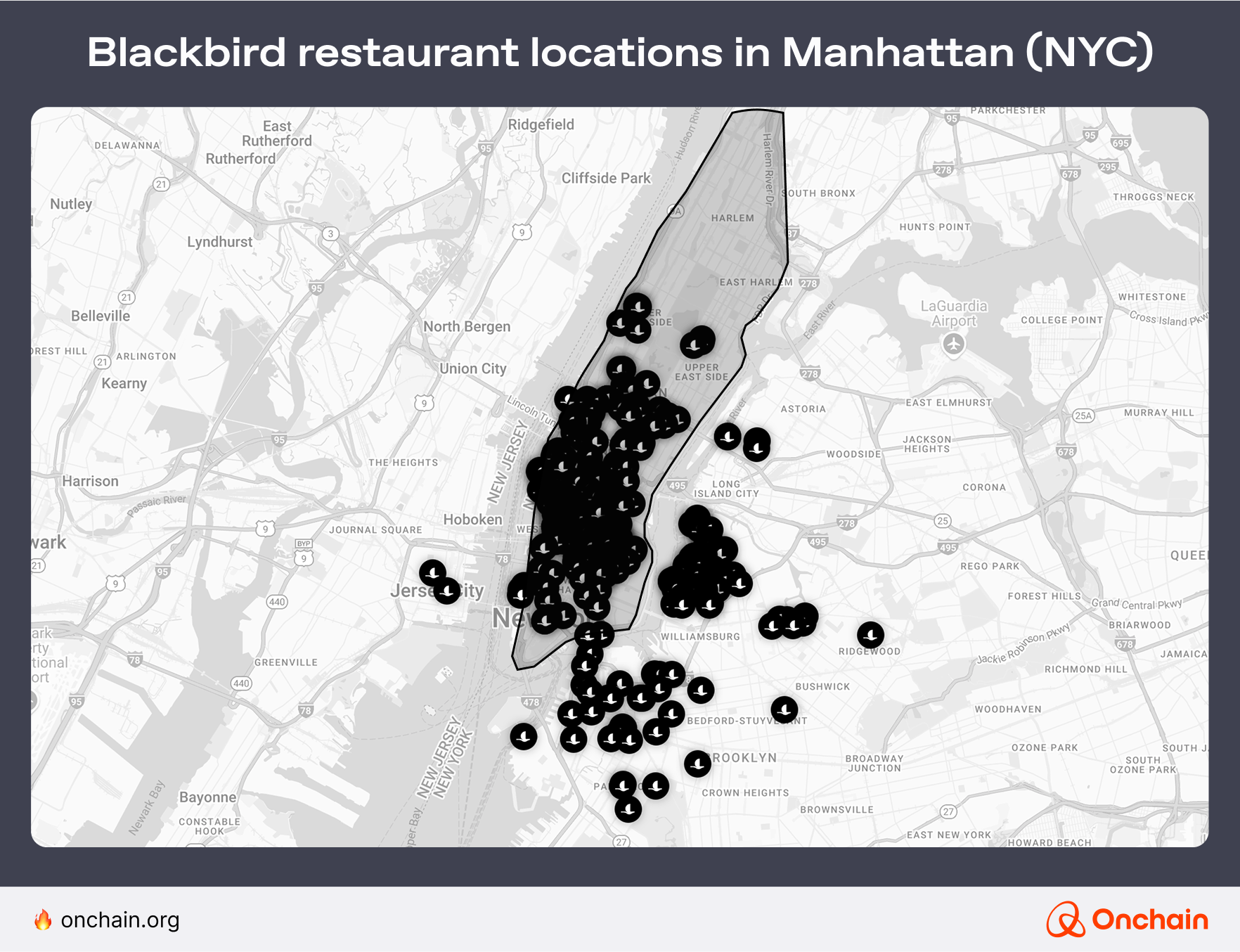

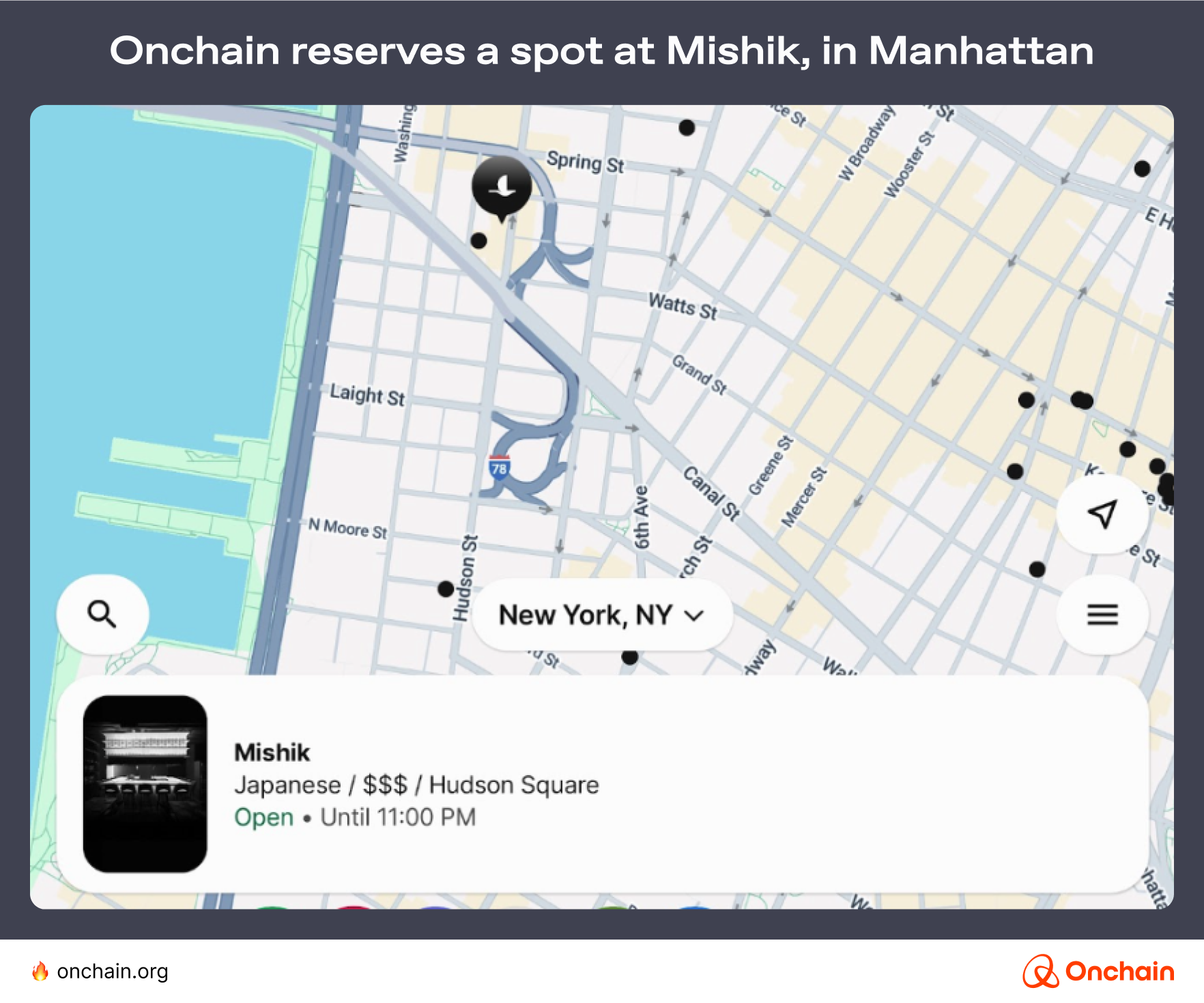

Currently, the app only supports a few cities, but I was impressed by the options I found in New York City.

Zooming in, you can see that there are numerous restaurants within walking distance from any point in Manhattan.

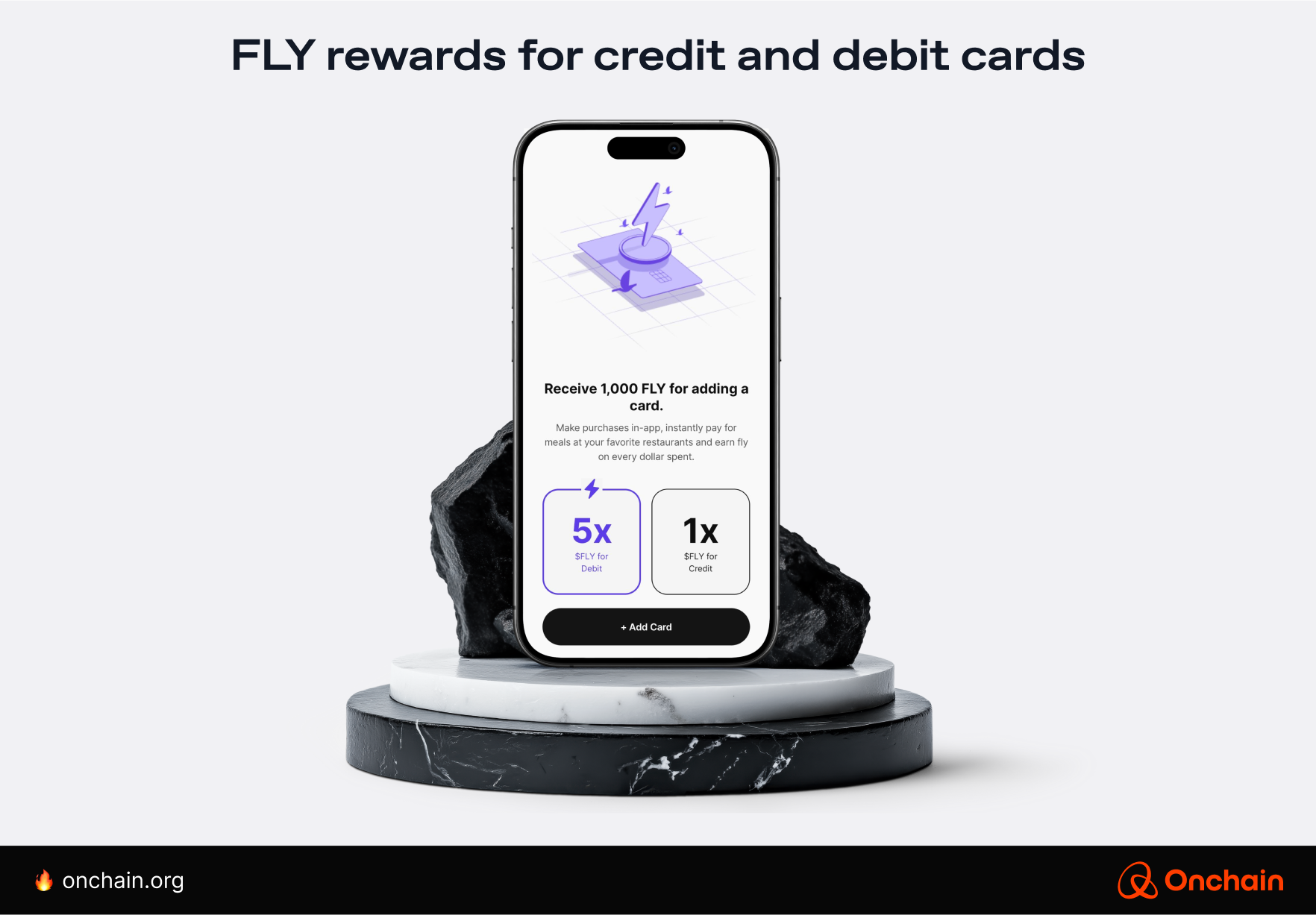

Downloading the app is straightforward and can be accomplished by scanning a QR code from the Blackbird homepage. FLY is one payment option, but you start by linking either a credit or debit card with Blackbird.

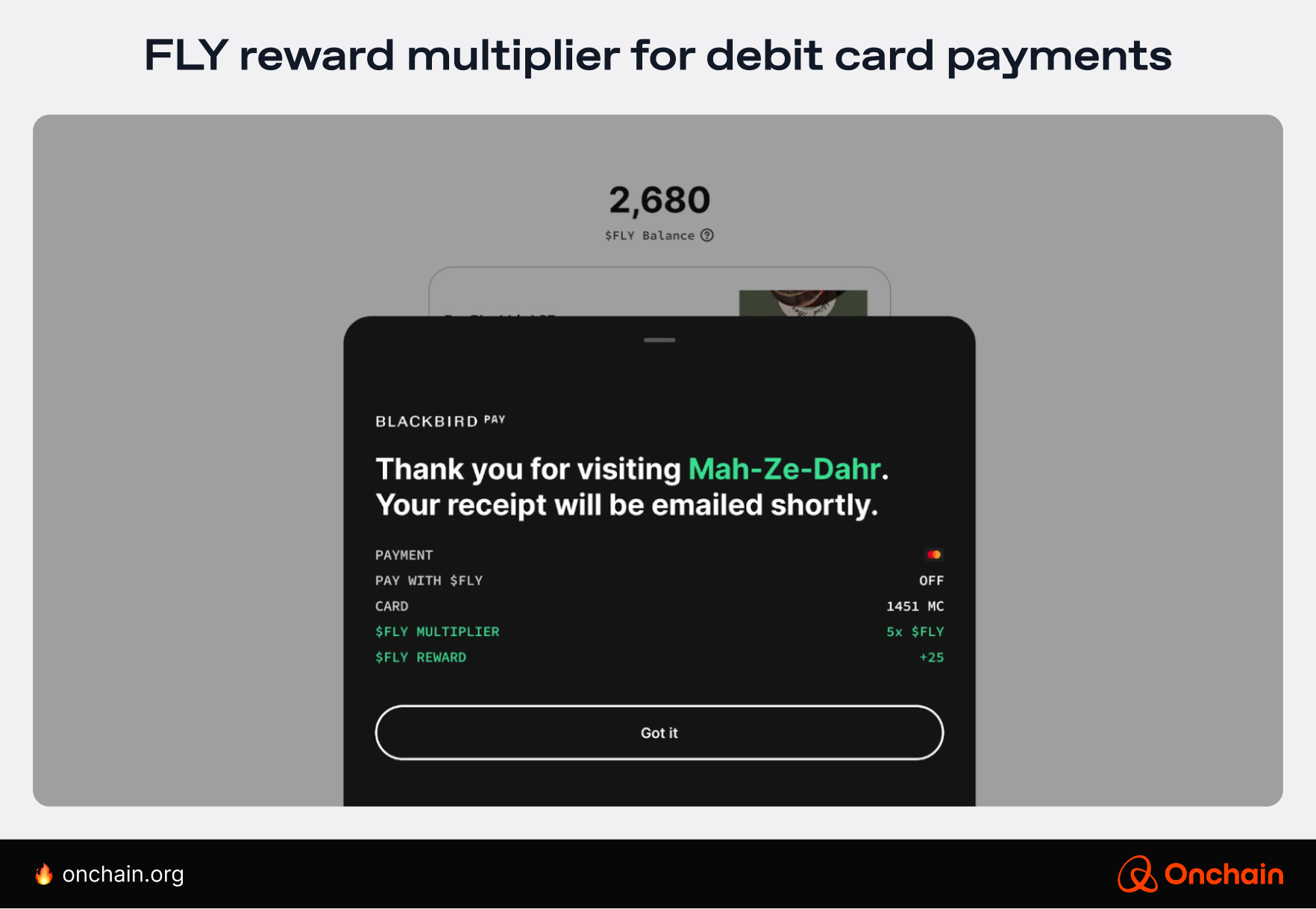

I chose a debit card to maximize my FLY rewards:

This incentivizes diners to choose a debit payment option and save Blackbird money on processing fees (hint: debit cards are cheaper to process).

Next, you can use the app to search for restaurants. I invited some people to join me so I could get feedback from people with little or no experience using Web3 apps. We decided to go to Mishik, a modern Japanese restaurant.

The check-in process is straightforward. You open the app and hold your phone near the Blackbird-branded “puck” that contains an NFC tag, and you’re done.

After checking in, we were seated at our table. I had to invite the others via QR code to be able to split the bill. Several people noticed a Blackbird deal. We chose it as one of the menu items we’d share.

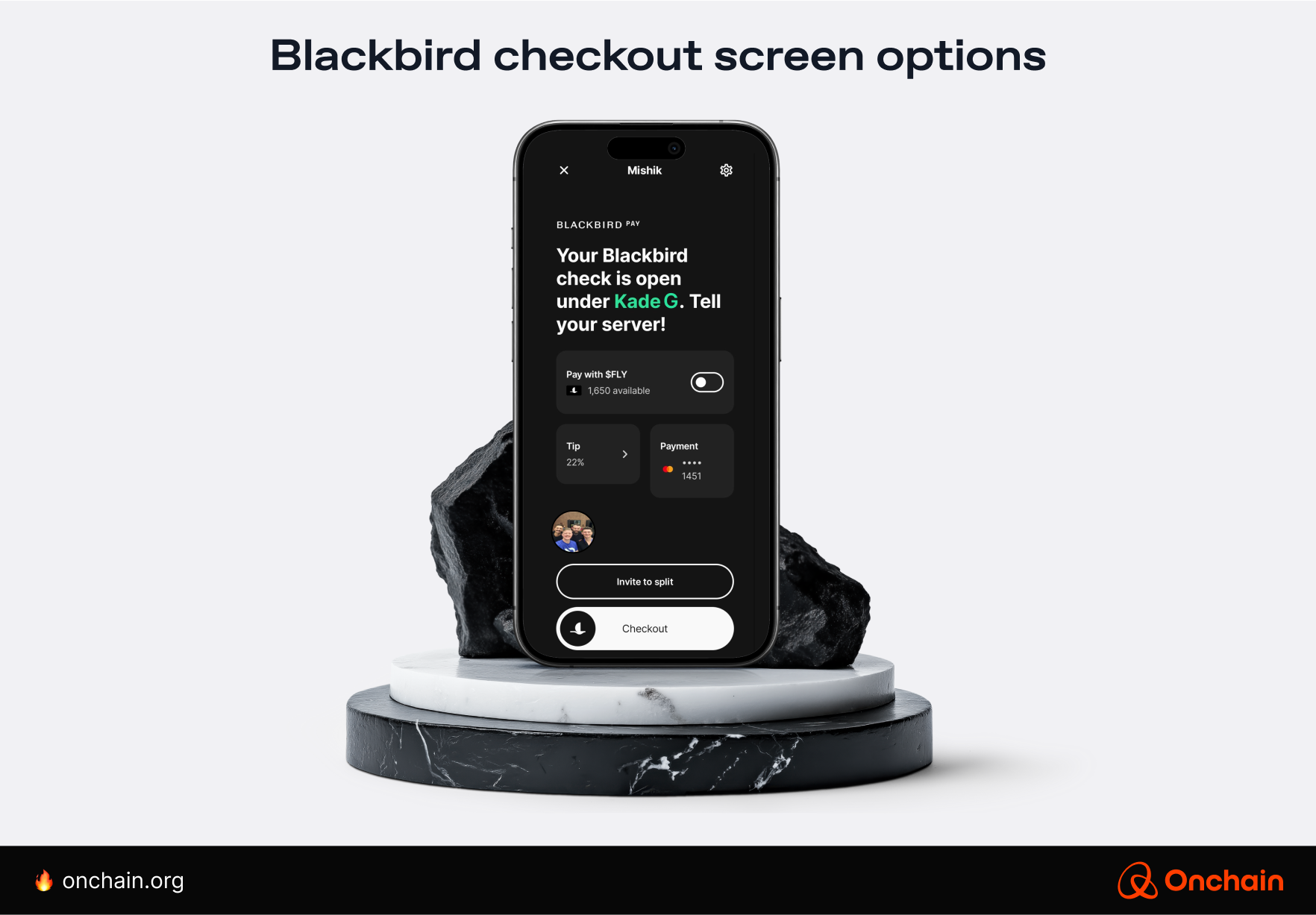

After enjoying our meals, we were ready to leave and pay via the app. The person who checked in (in this case, me) can pay the entire bill or invite others to split it via the app. To do that, you tap “Invite to split,” and the bill gets automatically divided among everyone who checked in.

From there, you choose a tip amount and toggle to pay with crypto if you have a FLY balance. Once you’re ready to pay, simply swipe the Blackbird logo over “Checkout,” and you’re done.

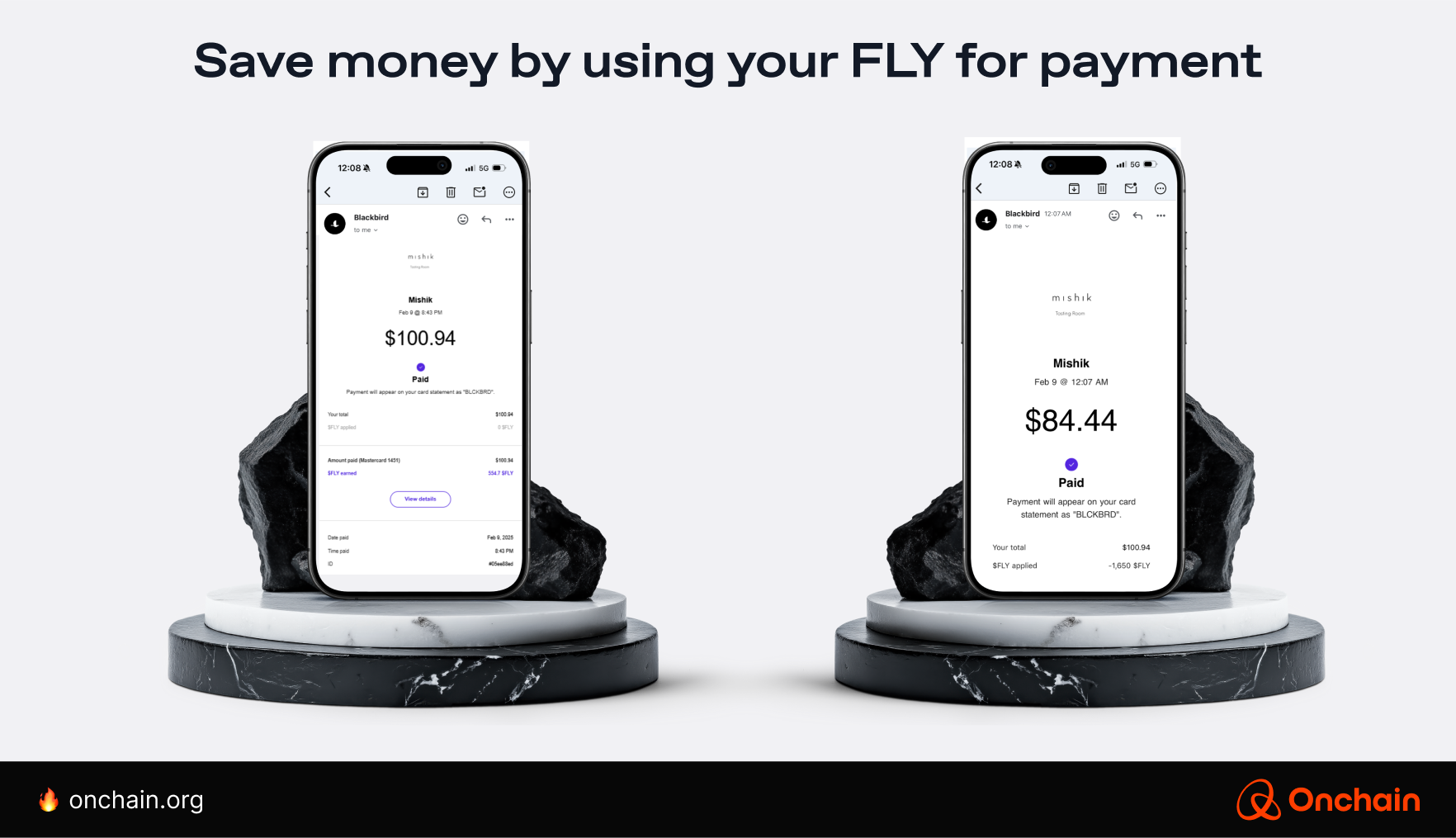

Some chose to keep their FLY; others decided to use their existing FLY balances toward the bill. As you can see below, this resulted in $16.50 in savings.

Upon leaving, I checked the app to look at my Mishik NFT. It went from zero to one visit and placed me in Tier 1 at this establishment. Repeat customers will see these visit numbers go up, which can lead to higher tiers with better perks and deals.

Mishik Restaurant: A mixed experience with some hurdles

Now, let’s break all that down and evaluate the experience in more detail.

What worked well

Many aspects of Blackbird were well received, especially regarding convenience and rewards. Users highlighted the following benefits:

- Immediate savings for those who redeemed FLY tokens

- Easy-to-use bill-splitting feature that simplified group payments

- A built-in social feed with restaurant videos and images

- Gamified rewards system using NFT-based loyalty tiers

- Sleek and intuitive app design that felt modern and user-friendly

I was surprised with how well Blackbird worked. Despite some first-time jitters, the feedback from the other users was largely positive. They perceived it as something like Uber, Lyft, Venmo, or any other payment app.

Where we struggled

Despite the positives, there were some notable pain points that made the experience less seamless than expected:

- Everyone at the table needed to use the app in order to split the bill.

- The check-in process required scanning from one person’s phone rather than individual check-ins.

- The bill could only be evenly split, with no option for custom splits.

- Restaurant search functionality within the app was limited.

- First-time users found the process somewhat confusing.

- There was no in-app display of the final bill total before checkout.

Key issues encountered

While the app functioned as expected, a lack of clear instructions caused unnecessary confusion for first-time users.

One issue was the check-in and checkout process. The NFC check-in and QR code scanning steps were not clearly explained, so diners had to figure it out on their own. This led to some initial hesitation and delays.

Another challenge was the lack of clarity for restaurant staff. The waiter seemed confused when we said we’d pay using Blackbird. It wasn’t clear whether the staff had received proper training or if the process itself needed more refinement.

Some of us ran into unexpected steps during checkout. After we had all paid via the app, the waiter still dropped off a paper bill, leaving us wondering if the payment had actually gone through. “We still don’t know who paid,” said Steve Sylvia, one of my fellow diners who helped me test the app.

Finally, delayed payment processing created more uncertainty. Card charges and email receipts took several hours to appear, making some users worried they had accidentally “dined and dashed.” A simple heads-up in the app or FAQ could have prevented this concern.

Overall, Mishik diners saw potential in Blackbird. The experience was generally positive, but it also brought up the importance of better onboarding, clearer instructions, and more staff training to ensure a smooth adoption process.

Mah-Ze-Dahr: A smoother, more positive experience

The following day, I was joined for breakfast at Mah-Ze-Dahr, a luxury bakery shop:

Mah-Ze-Dahr is a popular spot with counter service that does a lot of take-out business. After ordering, I tapped the Blackbird puck, saw my bill on the POS screen, and swiped. That’s it, I was done.

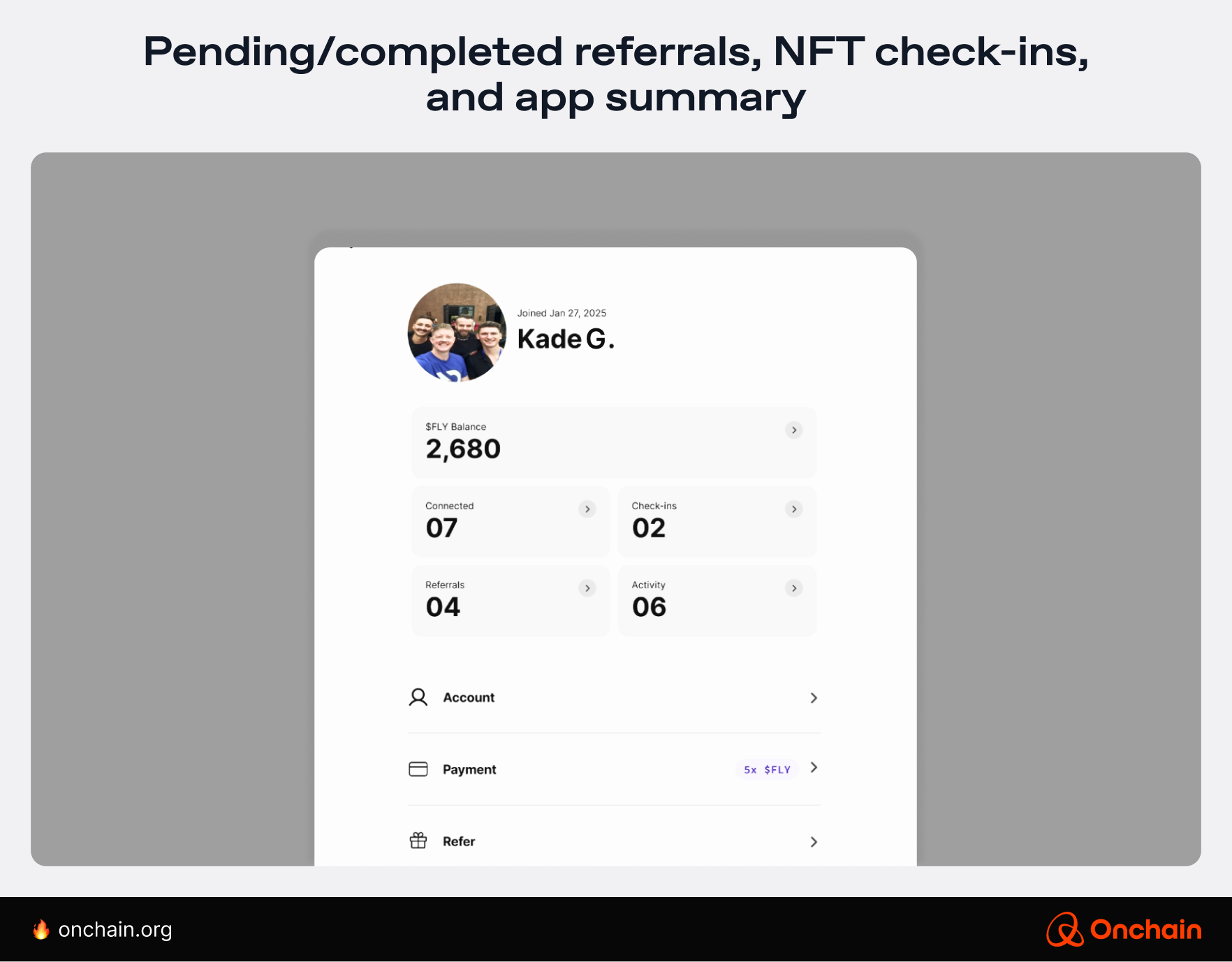

Through my check-ins, bill payments, and referrals I had earned 2,680 FLY (or $26.80), which I can continue accruing or use to pay for my next meal. My restaurant visits, pending/completed referrals, and NFTs of every restaurant I’ve checked into are displayed in the app.

Blackbird user feedback: Mah-Ze-Dahr patrons and workers

User feedback was more positive at Mah-Ze-Dahr. The barista explained the process well, and the screen-enabled counter service was simple, straightforward, and easy. Unlike dining in, the bill is displayed on a countertop POS screen, so there is no need to wait for a paper bill.

Blackbird also seemed more convenient than the legacy loyalty rewards system Mah-Ze-Dahr was using. While dining in, my companions noticed that other patrons had to type in their phone numbers to enable the other rewards program Mah-Ze-Dahr was running.

In contrast, Blackbird gives you rewards after a simple payment swipe. In addition, the workers had positive feedback on Blackbird as well.

The barista told me that Blackbird was popular during the morning rush. She also mentioned that the breakfast club [Breakfast Club NYC, NFT membership] brings in a lot of customers — including many customers from outside the neighborhood.

The contrast between Mishik and Mah-Ze-Dahr reveals an important takeaway: Blackbird’s effectiveness depends heavily on the type of establishment.

For sit-down restaurants like Mishik, Blackbird needs to refine the first-time UX, improve restaurant staff training, and offer a clearer checkout process to avoid confusion.

For counter-service venues like Mah-Ze-Dahr, the app feels like a natural fit, offering a modern alternative to traditional loyalty programs and a faster way to pay without extra friction.

4.3 Blackbird business analysis: by the onchain numbers

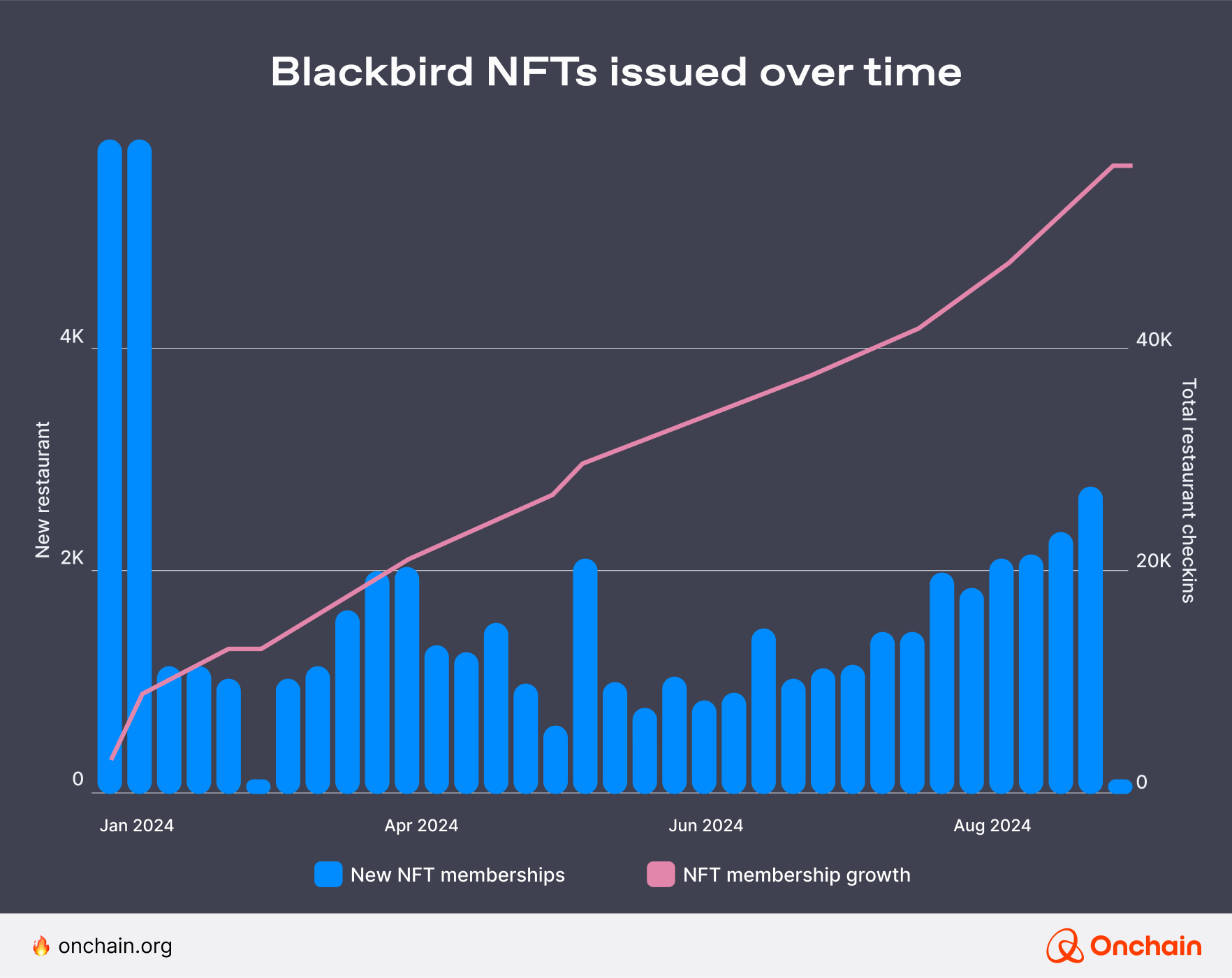

As a blockchain-based solution, Blackbird can easily be monitored for growth and usage via a blockchain explorer, its public NFT contract address, and other blockchain analysis tools. At first glance, it looks to have “slow-burn growth” that positions it well for sustainable expansion. Far too many crypto projects have an explode-upward-and-crash trajectory.

Blackbird membership NFTs are on a steady upward trend.

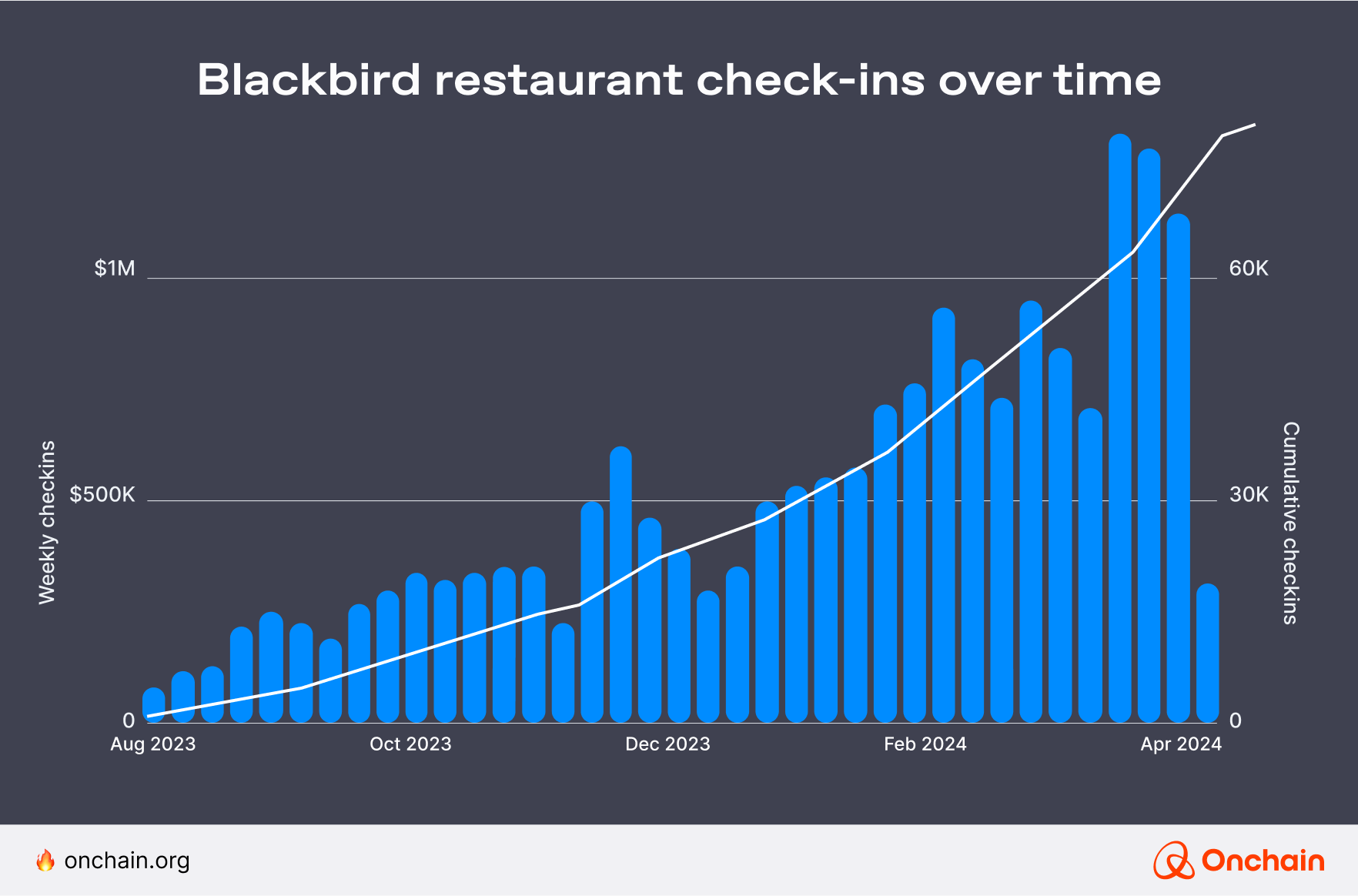

Restaurant check-ins are showing steady progress that is trending toward parabolic growth.

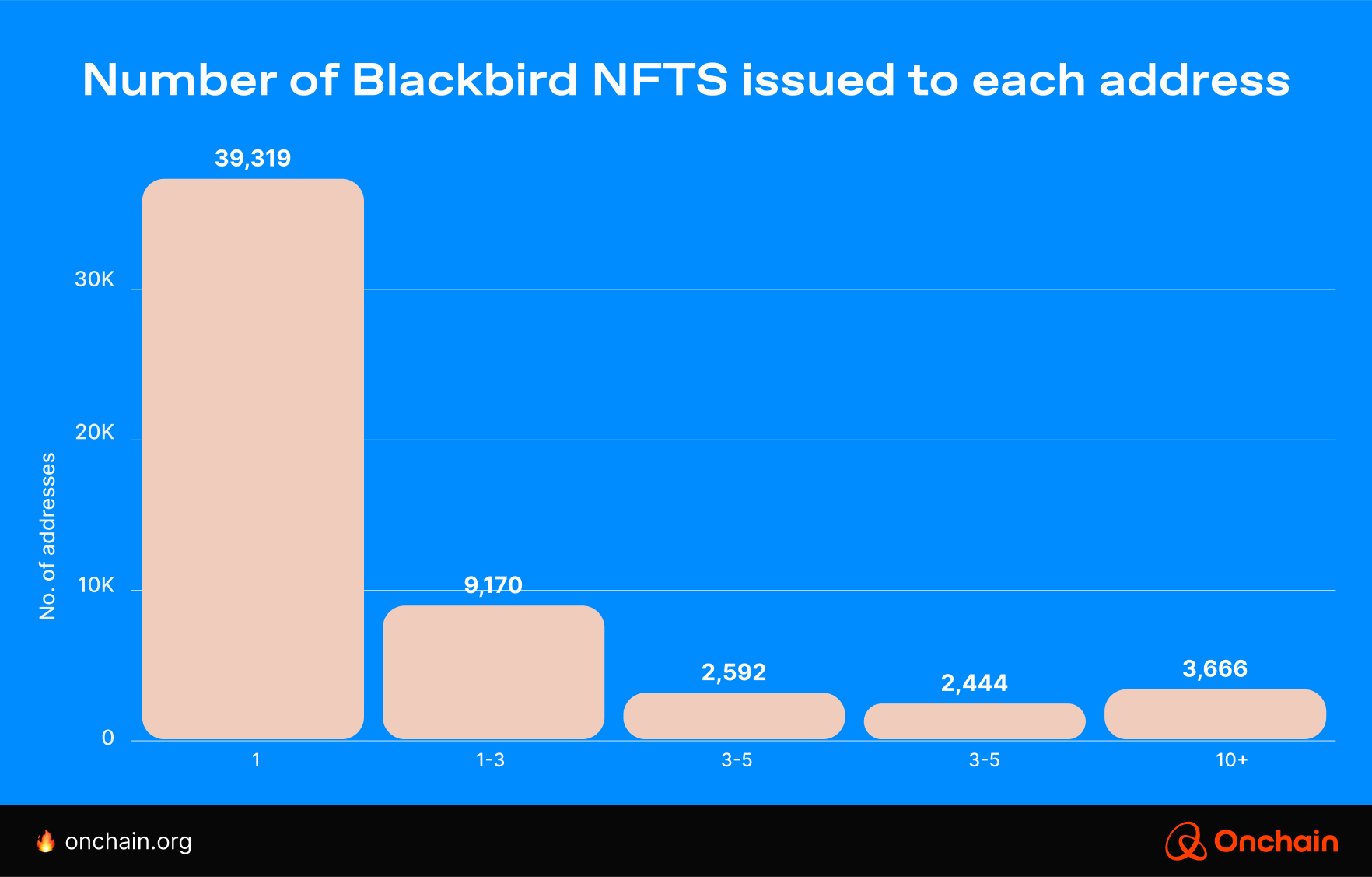

For hospitality-minded entrepreneurs and aspiring startup founders, this interesting metric shows the number of NFTs per wallet. It corresponds to the number of restaurants a Blackbird user has visited and checked in at. While one NFT is the most popular category, it’s worth noting that over 3,000 users have visited over 10 restaurants.

This shows a decent lock-in effect for Blackbird users that should be appealing to restaurants, founders, and entrepreneurs looking to incorporate Blackbird. Or you may have ideas for your own loyalty reward program.

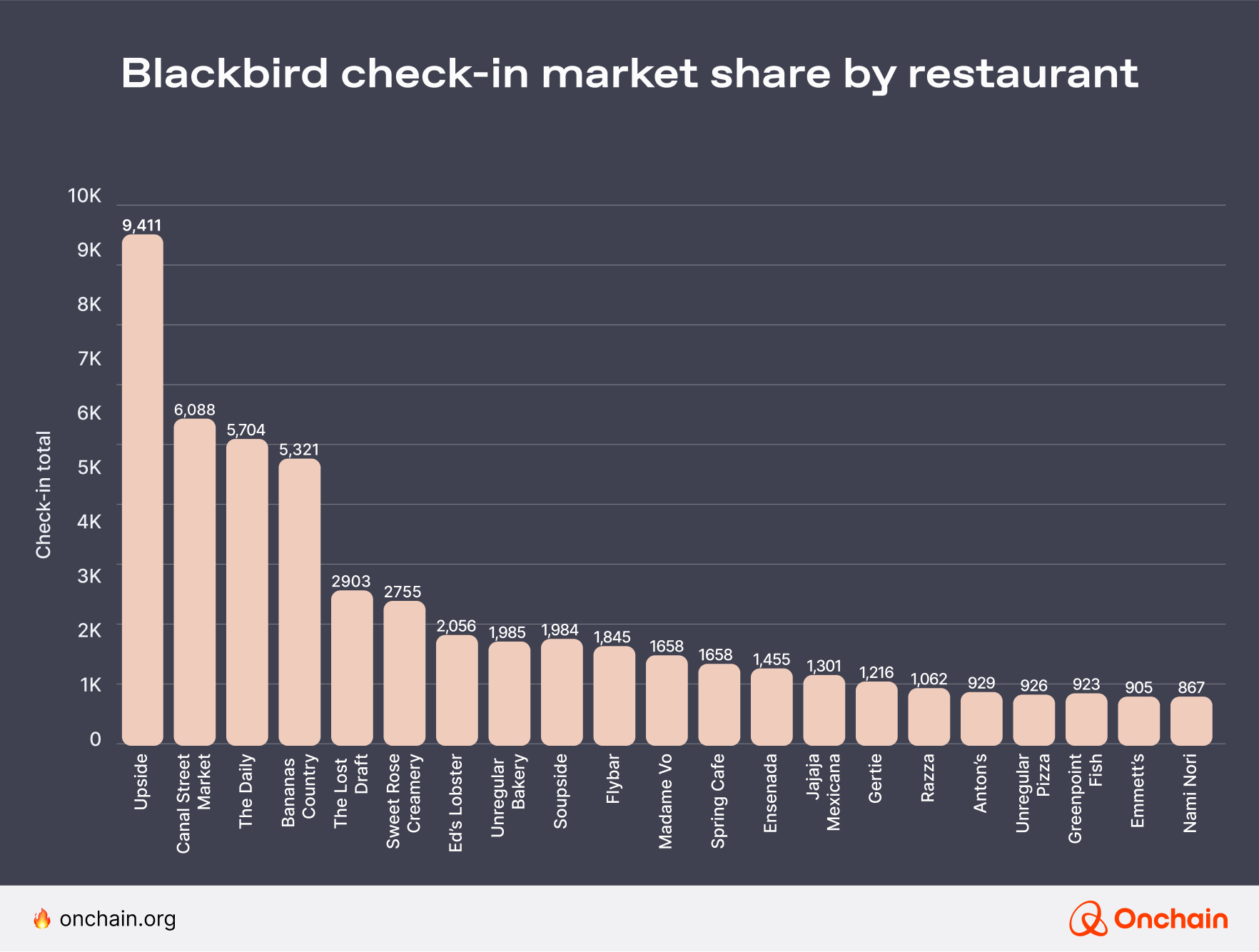

One potential downside is that only four restaurants currently account for nearly 35% of the total number of check-ins.

While bullish for these establishments, the other restaurants may not be receiving as much of an upside as these highly visited dining options. This lopsided dominance will likely diminish as more restaurants are onboarded to the app and it is rolled out in other cities and markets.

4.4 Case study causes for concern

We don’t want to rain on your onchain parade, but we also need to look at the potential drawbacks and downsides of Blackbird and similar offerings. Here are things worth considering before wading into these murky Web3 waters.

Product-market fit and diner preferences

Blackbird has excelled at abstracting away the “crypto” component of their app. It is highly customizable for participating restaurants but could also turn away users who may be confused by the variability of available options at different restaurants.

For example, restaurants can decide whether or not to accept FLY payments. For users, this could be a surprising and off-putting experience if they plan on using them for meal payments. “You have Blackbird and don’t accept FLY? Why?”

Blackbird believes that its enhanced data boosts customer retention and loyalty especially for independent restaurants and small chains. It also supplements their overall marketing strategy. Through the app, restaurants can target regular guests and big spenders with custom promotions. However, 63% of diners prefer generic discounts over custom offerings.

Blackbird vs. the Web2 competition

In the absence of business alternatives, all apps are profitable monopolies. Blackbird is just one of many loyalty solutions on the market. So, how does it stack up to its competition?

In general, Blackbird’s Web2 competitors are quite similar. You can find subtle differences in app UX/UI, bundling options, or price. Some target small restaurants that need a simple third-party solution. Other loyalty-focused companies build out white-label solutions for the major U.S. chains.

Some loyalty offerings use games and targeted messaging. More prevalent are features that offer financial incentives in the form of points, tokens, or similar rewards. These typically include:

- Sign-up and subscription rewards

- Online discounts

- Points-based loyalty tiers

- Promotions

These rewards can be redeemed for free menu items, discounts on future purchases, and various other perks. You can separate Blackbird’s Web2 foes into two major categories:

- Restaurant-focused apps are all-purpose restaurant solutions that offer staff and payroll programs, POS tools, tax software, loyalty programs, and other offerings. These loyalty programs vary greatly in their quality and features.

They do best by competing on price by bundling their services into packaged restaurant offerings. Examples include Thanx, Paytronix, Punchh, and TouchBistro.

- Loyalty-focused apps offer solutions for hotels, retail outlets, airlines, academic institutions, e-commerce, and more — including restaurants.

These apps don’t offer additional business solutions. Their most competitive edge is in providing loyalty apps with more features, greater customizability, and other advantages. Notable apps in this sector include Open Loyalty, Kalder, and Rewards Network.

Many of the loyalty programs offered cover fast-food chains and fast-casual restaurants, mid-tier and fine-dining establishments typically have enhanced offerings and, therefore choose loyalty-specific companies.

Rewards Network

Rewards Network is another competitor Blackbird needs to reckon with because it targets a similar market and demographic. Like Blackbird, the service partners with upscale restaurants and bars. In lieu of customer discounts, the “full-priced customer” model caters to higher-income individuals and dining enthusiasts, rather than the daily fast-food consumer.

Advantages of the Rewards Network over Blackbird include the large number of restaurants (20,000+) and users and partnerships with major airline, retail, and hotel brands. In addition, the pay-for-performance model only charges restaurants when guests pay a non-discounted price.

The main differentiator is the audience segment. Rewards Network caters to businesspeople who are constantly traveling.

In contrast, Blackbird’s model targets locals and returning customers. The app offers restaurants a unique “guest value score,” a data point that weighs various customer metrics.

The score calculates the predicted lifetime value of a customer. A visitor to NYC would get a different score than a local who lives down the block, even if both attend for the second or third time. Guest location may also affect FLY rewards.

4.5 Will AI and Web3 competition clip Blackbird’s wings?

Web3 loyalty programs are a relatively new development in the blockchain world. Thanks to next-gen high-throughput and low-cost blockchains, they are technically feasible, but switching costs are well established. This applies mainly in the loyalty perks sector, where changing programs results in the loss of long-term customer rewards.

Let’s take a look at some Web3 loyalty programs:

- Galxe Quest is a popular loyalty program for building Web3 followers. Galxe supports over 70 blockchains and also offers solutions for Web3 identity and onchain reputation scores.

- Kazm is a loyalty program for Web3, gaming, retail, and e-commerce that stands out for its Web2 and Web3 integrations with Stripe, Shopify, Discord, Ethereum, and Polygon. It is free for up to 100 users. Above that, it charges a per-user rate.

While these Web3 loyalty programs work well for their intended purpose, they primarily focus on rewarding online and onchain communities, not in-person dining or shopping. In addition, these apps don’t offer the NFC check-in tech. Even though Kazm has recently onboarded a cookie shop chain, they seem to be far behind Blackbird in terms of restaurant onboarding.

I also noticed that most Web3 loyalty apps feel way too crypto-native to attract customers who are not well-versed in the Web3 world. The UX/UI of Blackbird sets it apart from its Web3 competitors because it feels like an app rather than a dApp (decentralized application).

On the high-tech front, AI loyalty apps like Hang may pose a bigger threat than Web3 and Web2 challengers.

Will Blackbird spread its wings and soar to sustainability?

Blackbird has created a rich brand experience for its users. It functions as a payment app, loyalty program, and restaurant locator grounded in onchain tech. What matters for adoption are the UX and UI of the app and the perks and benefits that it provides.

According to RSM UK’s survey, around 50% of questioned Millenials and Gen Z would choose a restaurant that offers points over one that doesn’t, even if it’s less convenient. This appeals to users interested in cost savings and the gamification of points.

Combine that with the findings of Onchain’s survey which shows that most consumers use Web3 apps casually and nearly 45% prefer tokenized rewards with a stable value (like FLY). These results indicate that Blackbird is on the right track.

Indeed, the app shows a slow but steady adoption curve, which is good in the initial stages. At some point, Blackbird’s growth metrics need to pick up substantially to make the business model viable for recurring net cash flow. If it doesn’t scale, Blackbird’s wings will break and the project might plummet into bankruptcy like many crypto projects before it.

Here’s what Kade thinks after his extensive app test:

While I’m a crazy crypto native, like everyone else, I appreciate apps that are simple and easy to use. If they improve the check-out process, continue releasing improvements, and most importantly — continue onboarding new restaurants and users — I think Blackbird has viable long-term potential. I will continue to use the app for the foreseeable future. Besides, I need to use my FLY for some free drinks next time I’m in NYC.

- Kade Garrett

Key takeaways for entrepreneurs

- How to reach non-Web3 users: Chain abstraction allows customers to use the app and its corresponding features seamlessly without micromanaging the crypto rewards and perks associated with Blackbird. These benefits include optional NFT memberships and a rewards ecosystem that uses Blackbird’s FLY token. Restaurant patrons and owners can intuitively understand the app’s benefits without being aware that they are using blockchain technology.

- Blackbird-inspired onchain business opportunities

- Smart contracts and custom apps: Build out your own smart contracts and apps on Blackbird. In much the same way that immense value has been generated on Ethereum-based projects and apps, there are opportunities to build off the network effects found on Blackbird. Got any ideas?

- Blackbird alternative: Fund or build an alternative NFT loyalty and payment app. Maybe you have ideas on how this solution could be better. Maybe you want to include stablecoin payments or decentralized crypto payment options.

- Target a different market: This solution could be very lucrative in other markets as well. This case study is focused on the U.S. market, but there are many other countries where you could have the early-mover advantage. From Europe and Asia to burgeoning emerging economies. Where are you located?

- Do the same in a different vertical: There are endless consumer-facing service industries you could target. How about an NFT membership for independent amusement parks, ski resorts, or climbing gyms?

- Other NFT offerings: Create a beer/coffee/wine club that combines some of the perks mentioned above and expands on them. For those with good sales and marketing experience, this would be a good entrepreneurial opportunity. Think of these NFTs as a modern take on the 1990s-era coupon book that also leveraged network effects. Blackbird’s NFT clubs are far from the only offerings on the market. You can also find NFT clubs for collectible wine, brewery-specific mug club NFTs, and a host of other food and dining niches.

That should be sufficient food for thought. You can take it from here. Before you do, you might want to take a critical look at some of the challenges so you can avoid common pitfalls. Read on to the next chapter to get ready for potential hazards along the way.