“Bitcoin is now more valuable than Alphabet.”

“Tesla is now the world’s most valuable car company.”🚗

Headlines like these are based on an asset’s market capitalization (or market cap). When a company’s or crypto project’s market cap grows substantially, it’s headline news in the finance section.

Of course, for every asset that rises in the ranks, others must fall — sometimes dramatically.

Kodak is a poster child for a sharp drop in market capitalization. In the mid-20th century, it was one of the largest companies in the world. Now, it doesn’t even rank in the top 600.

We’re here to give you a rundown on this important metric, how it’s used, and how it’s calculated in both traditional and decentralized finance (TradFi and DeFi).

What is market capitalization?

Market capitalization measures the value of a traditional company, crypto project, or commodity. The market cap of assets and industries is closely followed by fund managers, financial analysts, entrepreneurs, and investors of all shapes, sizes, and net worths.💰

Still, this key financial metric is something that everybody needs to understand. This holds true whether you want to start a business, launch a token, understand your current investments, or save for retirement.

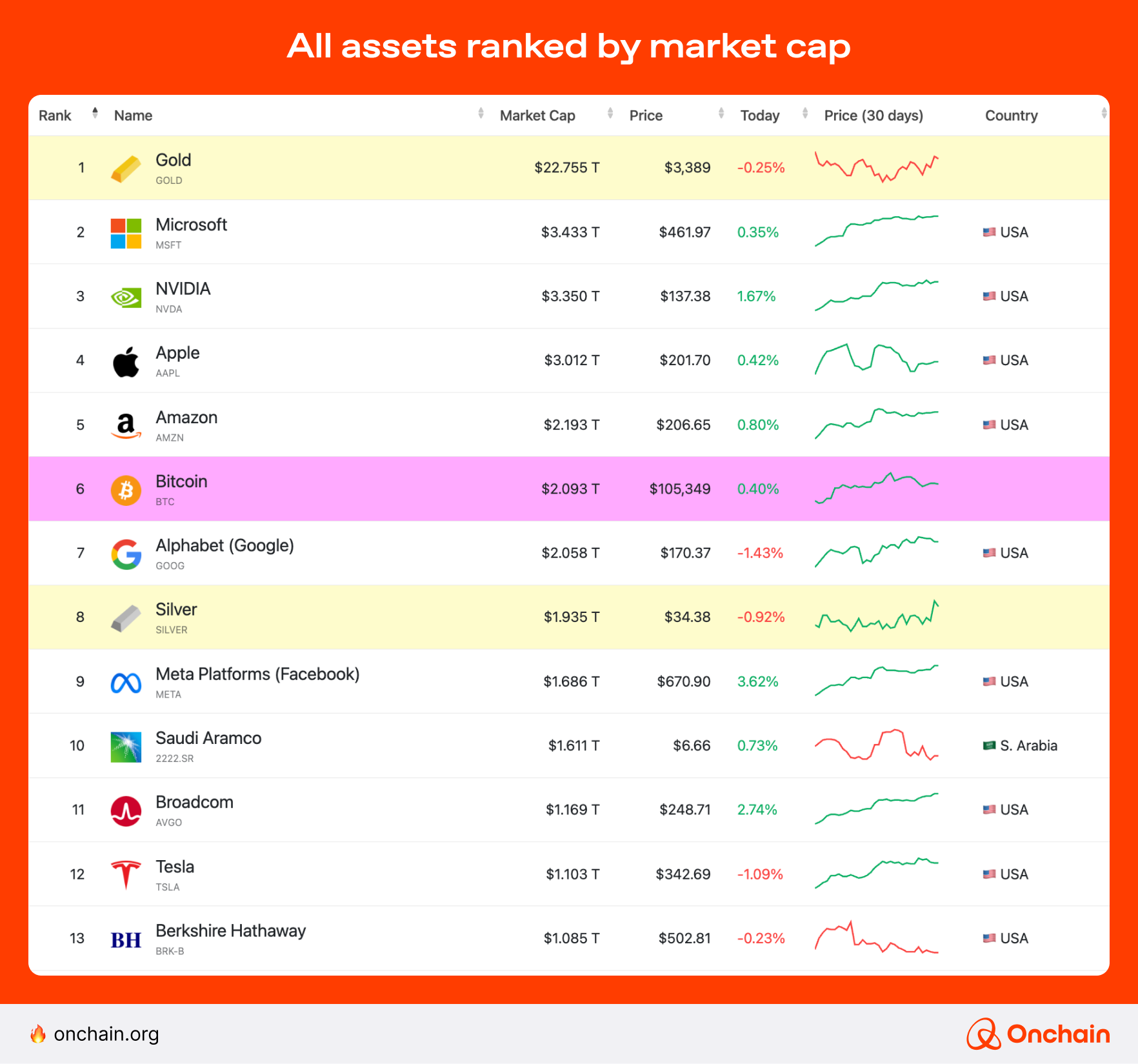

As of May 2025, the top assets by market cap are gold, silver, bitcoin (BTC), rounded out by some companies, mostly American tech behemoths.

BTC’s market cap is one reason even the harshest digital asset critics can no longer ignore this asset class. Do they still think BTC will go from $100,000+ to zero? 😎

You may find it surprising that many of the companies with the biggest market cap are relatively new. Many were startups from the 1990s and 2000s. On the other hand, gold has been around for millennia.

BTC is a 16-year-old teenager, while its younger sibling, ether (ETH), will turn ten in July 2025. By the way, ETH recently passed Coca-Cola (KO) to become the 34th most valuable asset by market cap.

How to calculate market cap

Calculating the market cap of a company, blockchain protocol, or any other asset is relatively straightforward. It’s a simple math formula.

Market cap 🟰 Asset price ✖️ Number of assets (stocks/tokens/etc)

If you have two of the three variables, you can easily calculate the last one. Of course, the way this is calculated depends on the asset class you look at. Let’s look at three different asset classes: commodities, crypto tokens, and major companies.

How to calculate market capitalization for stocks

To calculate the market cap of a publicly traded company, you need to know the stock price and the number of total shares. For example, if fictional company MNO has a million shares that are trading at $100/share, the company would be valued at $100 mil.

As the share price fluctuates, the market cap adjusts accordingly. If the stock price doubles, the market cap doubles — you get the idea.

If you are missing the number of total shares, you can calculate it based on the share price and the market cap. For example, the market cap of Tesla (TLSA) on the afternoon of May 21st, 2025, was $1.08 tril and the stock price was $346.48 per share. So, it’s straightforward to solve for the number of shares.

$1.08T 🟰 $346.48 ✖️ (number of TSLA shares)

So, solving for this, you would do the following:

$1.08T ➗ $346.48 🟰 3.117B TLSA shares (approximately)

As the market cap was rounded off in this example, the number of shares calculated here deviates from other sources that suggest around 3.22 bil shares in circulation. Still, this formula gave us a good approximation of the actual number of shares.

Tip: When calculating a company’s market cap, keep in mind that the exact number of issued shares can fluctuate slightly due to stock issuances, buybacks, splits, and other corporate actions.

How to calculate market capitalization for crypto

For crypto, the market cap formula is quite similar to that for stocks, with a few caveats. In general, it looks like this:

Crypto market cap 🟰 Token price ✖️ token circulating supply

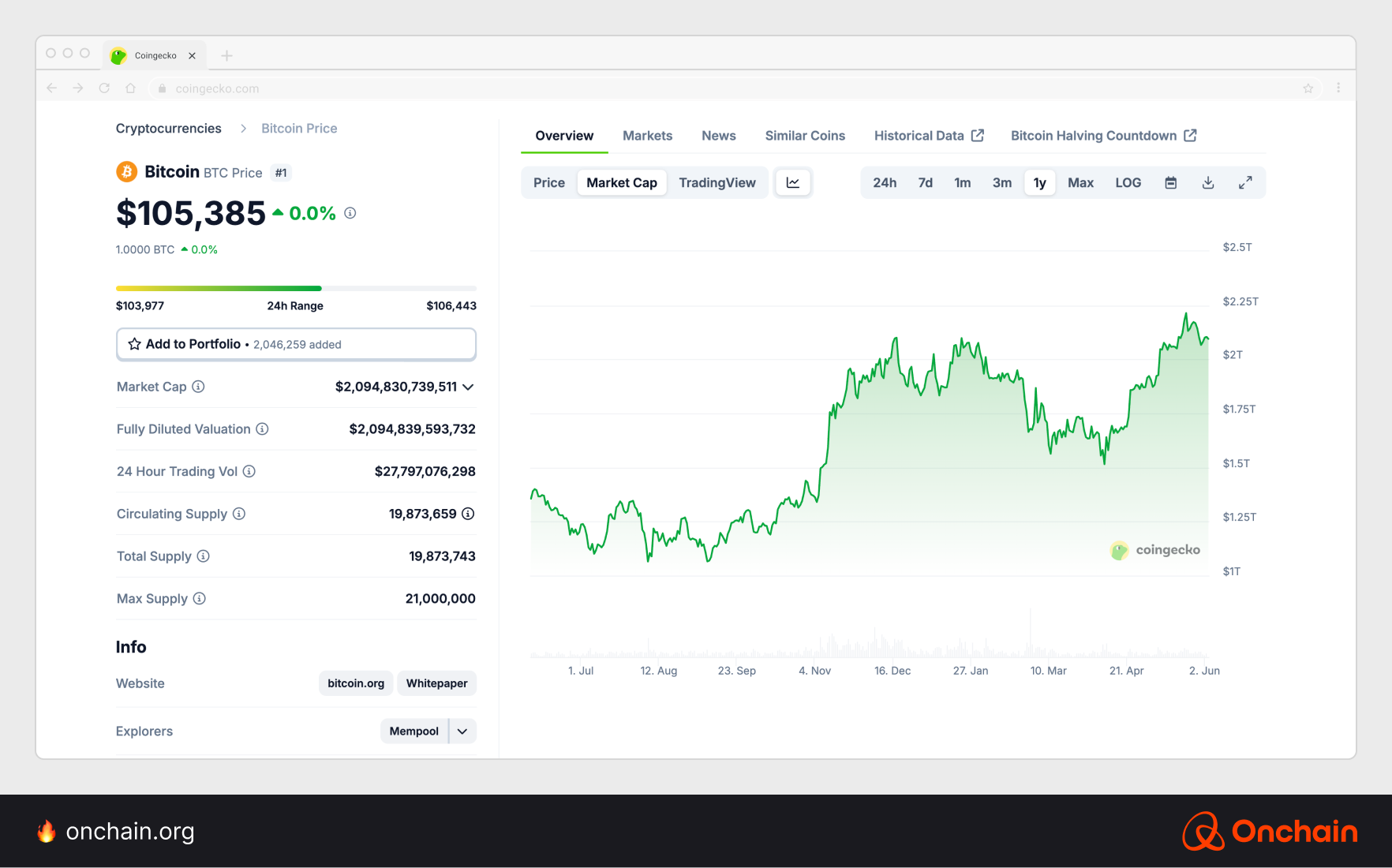

At the time of writing (May 2025), BTC hit a new all-time high (ATH) price. Combined with the new BTC issued with every block reward, this equates to a new ATH market cap.

As you probably know already, the Bitcoin protocol was designed to limit the BTC supply at 21 million, with the current supply of approximately 19.87 mil BTC. New Bitcoin blocks are confirmed every ten minutes on average, with each block distributing 3.125 BTC to the block reward winner.

This equates to an additional 450 BTC in new supply every day, which at current prices is adding nearly $50 mil in additional market cap every day ($110,000 * 450 = $49.5 mil).

Market capitalization for crypto: caveats and considerations

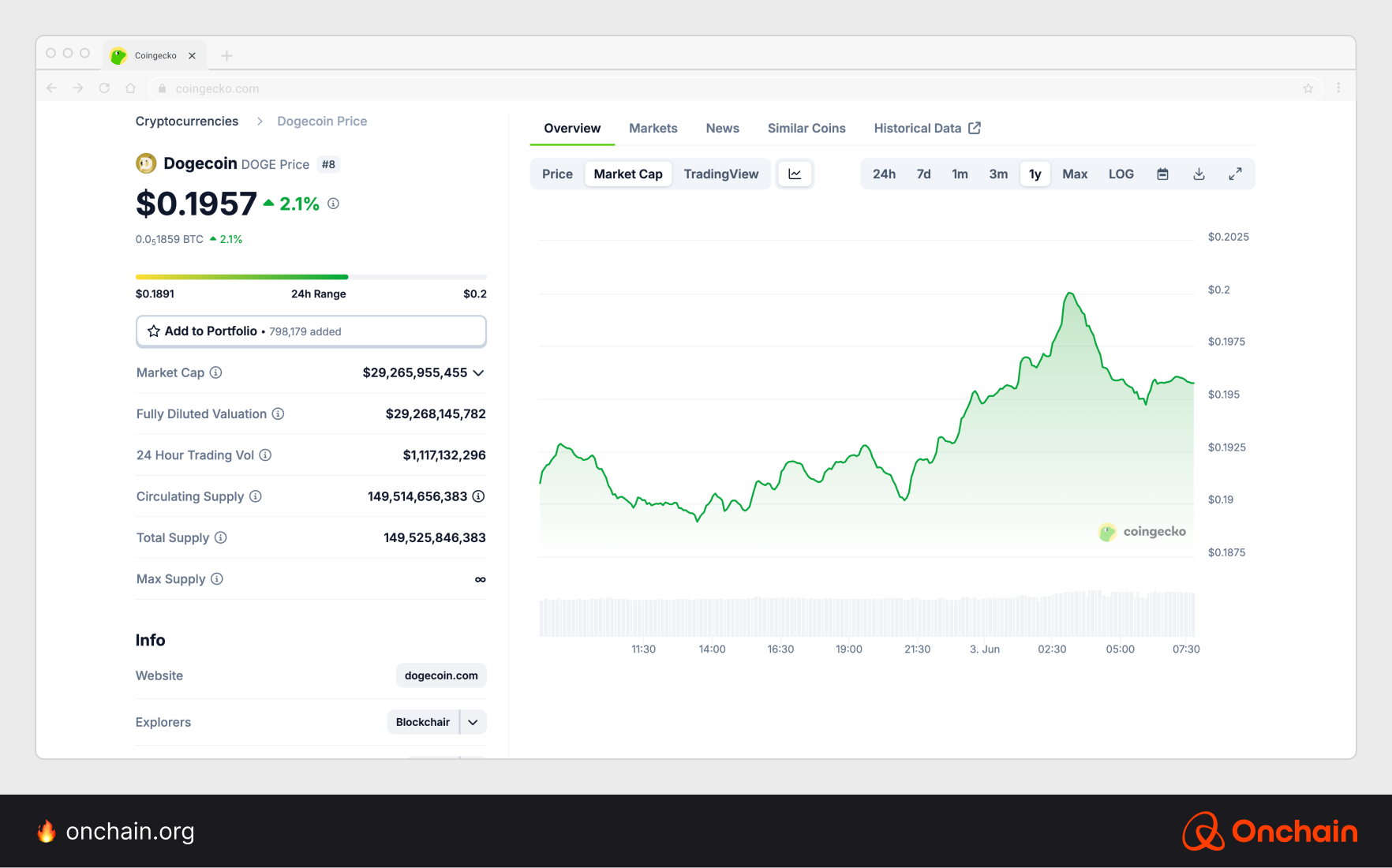

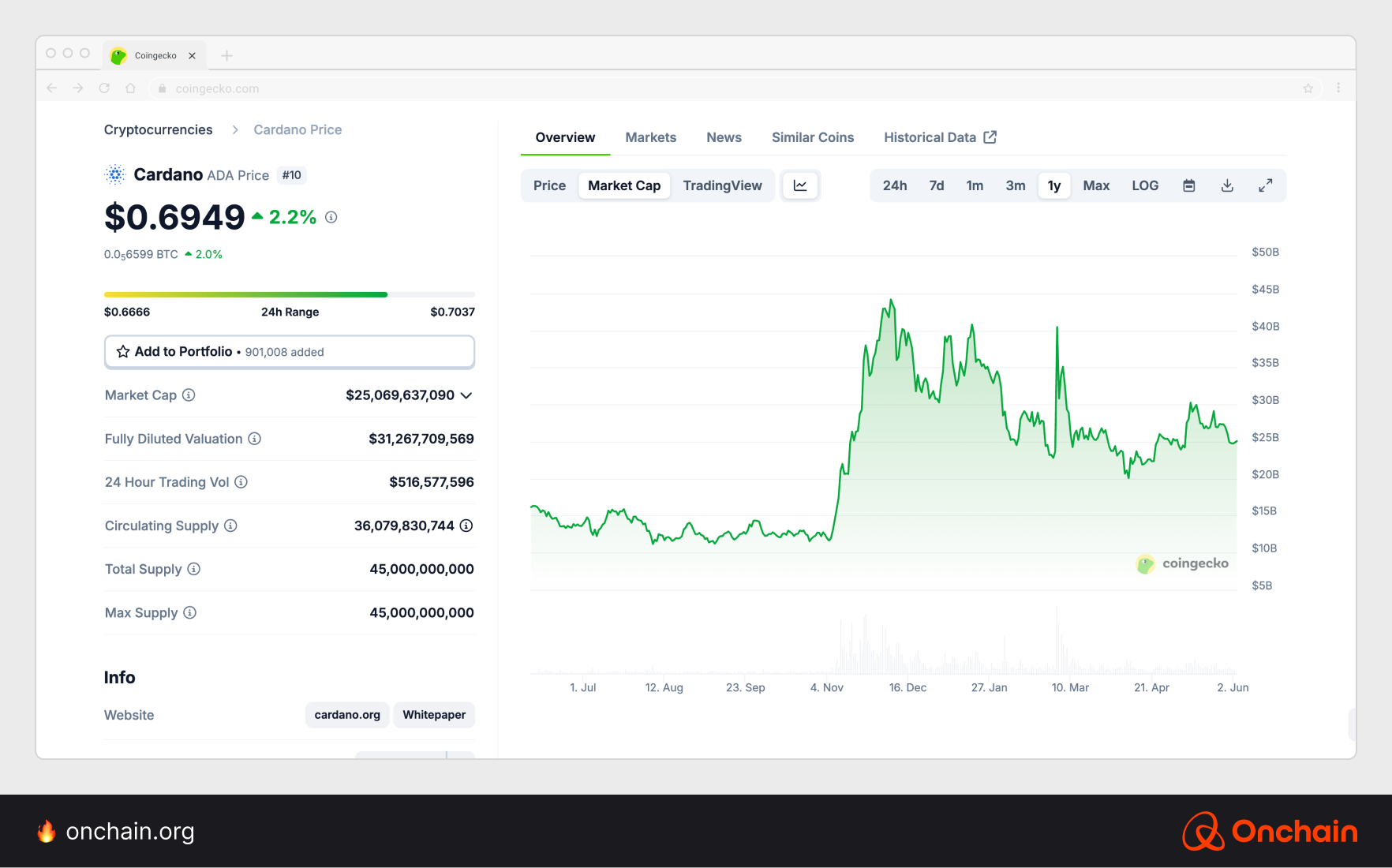

It’s important to know that many crypto projects distribute tokens differently than Bitcoin. Let’s compare Bitcoin with the token supply details of Cardano and Dogecoin, two popular projects with top-ten crypto market caps.

Before we compare tokens, it’s worth covering the various supply metrics as they influence both the token price and the overall market cap. Let’s break them down briefly.

- Total supply: The total number of tokens that have been minted (created), minus any tokens that have been burned (destroyed). When compared to TradFi, this would equate to the number of outstanding public shares. The total supply can equal, but never exceed, the max supply.

- Max supply: The theoretical maximum number of tokens that exist (or will ever exist). The total and circulating supplies can equal, but never exceed, the max supply.

- Circulating supply: The number of tokens that are publicly available for trading. This number is often lower than the total and max supply. Tokens aren’t in the circulating supply because they are privately held (by investors, team members, foundations, and so on) or haven’t been issued yet (like new block rewards for BTC). The circulating supply can equal, but never exceed, the total and max supplies.

Bitcoin’s total and circulating BTC supplies are identical (no privately held BTC), but are lower than the max supply.

Cardano has identical total and max ADA supplies, but the circulating supply is lower (there are privately held tokens, some of which are used for staking rewards).

Dogecoin is an important example of a project with an uncapped supply, otherwise known as an unlimited supply. Its block reward is 10,000 DOGE per block. With a block time of one minute, this equates to an increase of over 5 bil in DOGE tokens every year.

Unlike Bitcoin, Dogecoin doesn’t periodically halve the block rewards. This can potentially increase the market cap. However, that will only happen if there’s enough DOGE demand to keep the price from dropping significantly.

Tip: When it comes to calculating a token’s market cap and making future price projections, you have to look at the circulating, total, and max supplies. Unlimited supply tokens will always increase the supply, but that may not equate to an increased market cap due to token dilution and selling pressure (which can lead to lower prices per token).

How to calculate market capitalization for commodities

For commodities, the market cap calculation is slightly different but uses the same principles and general formula. You’re not evaluating the value of a crypto protocol or company; you’re evaluating the market cap of a widely traded and used commodity.

The largest commodities by market cap are precious metals (gold, silver, platinum, palladium), which are usually priced per ounce (oz). We’ll use them as the example here.

Commodity (precious metals) market cap 🟰 Price/oz ✖️ Total supply

When it comes to the market cap of commodities, you should know that the supply is more of an estimate. Unlike cryptos or stocks, there are different estimates on the total amount of precious metals (and other commodities).

For this reason, the estimated market cap for precious metals can vary by billions or even trillions of dollars, depending on the source you use.

Tip: The market cap of gold is $22.27 tril (as of May 2025) according to the World Gold Council. However, the estimates for the amount of above-ground gold reserves can vary by up to 20%. This places gold within the following market cap range: $17.7–$26.6 tril.

Onchain’s Intelligence Dashboard and market cap data

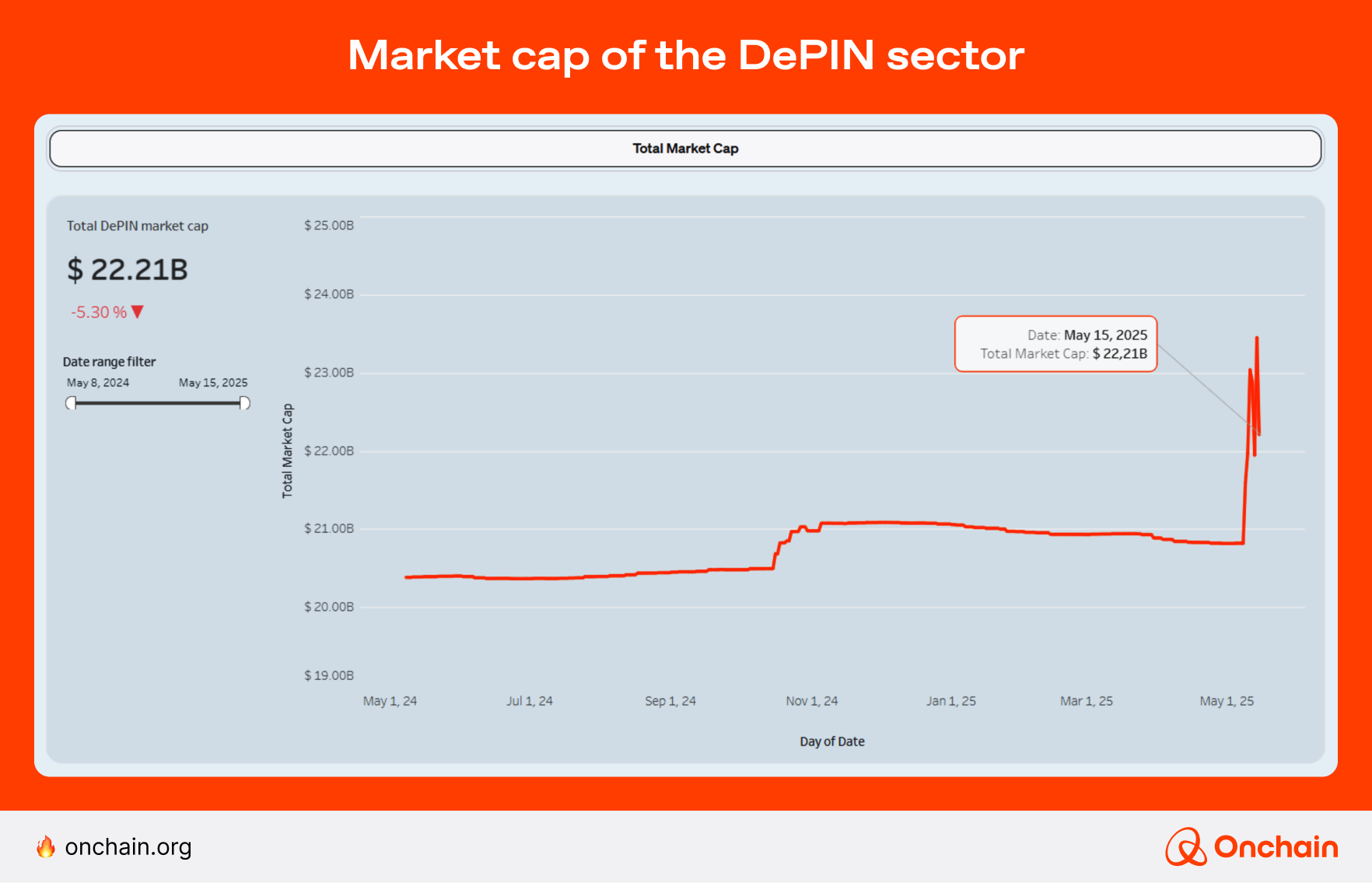

At Onchain, we think market cap data is valuable for entrepreneurs and founders who want to succeed. Our Onchain Intelligence Dashboard features a DePIN sector map that features an up-to-date chart on the total market capitalization of DePINs.

Market capitalization: low-, mid-, and high-cap assets

Market cap assets are often described as low, mid, or high. These ranges are somewhat subjective and vary depending on the asset class. However, it can help you quickly compare and categorize between and within different asset classes. Here are some commonly accepted ranges:

- Low-cap assets:

- Stocks: from $250 mil to $2 bil

- Tokens: less than $1 bil

- Mid-cap assets:

- Stocks: from $2 bil to $10 bil

- Tokens: from $1 bil to $10 bil

- Large-cap assets:

- Stocks: from $10 bil to $200 bil

- Tokens: over $10 bil

In addition, you may also see market-cap classifications for both the very large and small outliers. For stocks, companies with a market cap over $200 bil or under $250 mil are often referred to as mega-cap and micro-cap assets, respectively.

Market cap and investing: what you need to know

Market cap is a key metric is tracked by traders, prospective investors, and companies that want to launch a stock – or “go public” with an Initial Public Offering (IPO).

In general, higher-cap assets tend to be more stable. However, they are also less likely to appreciate dramatically in price. Of course, there are exceptions, like high-cap BTC.

Low-cap assets are less stable. They tend to have more volatility, which leads to more upside price movement potential, but it cuts both ways. Low-cap assets can also drop more quickly. This volatility can make them a higher-risk investment.

For these reasons, some investors and financial planners recommend a mix of high- and low-cap assets. High-cap assets can provide more price stability, while low-cap assets have a chance to boost your rate of return.

Crypto assets, in particular, are known to be far more volatile than stocks, even large-cap assets like BTC and ETH. Therefore, they are often considered alternative assets with one of the highest risk profiles. Of course, if you bought BTC or ETH early and held it, you’ve made a healthy profit. 📈

Market cap fundamentals for Web3 entrepreneurs

If you’re running a Web3 startup or a blockchain company, the market cap fundamentals are similar to those on the stock market. Coinbase recently joined the S&P 500, putting crypto exposure in nearly every American’s investment portfolio. And stories continue to circulate about stablecoin behemoth Circle going public with an IPO.

But most crypto companies can’t, and have no plans to, “go public” on a stock exchange. They go public by launching a token. If you’re in the same onchain boat, here are some things to consider:

- Private and presale tokens: Used to financially bootstrap a Web3 startup, these tokens are often sold in bulk and at a discount to their perceived value. Later, the token is publicly launched and available for trading on crypto exchanges. Private and presale investors hope to get a return when the token is launched for the public. However, public retail investors are often wary of purchasing tokens when they know a large percentage of the supply was privately purchased and held prior to the public launch.

- Fair token launch: With a fair launch, no one gets special treatment — even the founders. Tokens are launched publicly for everyone at the same time. Examples of fair launches include Bitcoin, Bitcoin Cash, Yearn, and many others. While this token launch strategy often gets strong community buy-in, it can make it difficult to fund project expenses at the early stages. If capital runs out before a project starts generating profit, it often leads to the project shutting down entirely.

- Hybrid token launch strategies: These plans combine different funding rounds and capital-raising strategies, sometimes borrowing from TradFi customs. For example, Circle is expected to IPO in June 2025, but went through previous funding rounds when it was much smaller (seed funding, Series A, etc).

Now, crypto companies are following that blueprint to raise money in stages. For example, a hybrid launch could combine a small private sale with a larger Initial Exchange Offering (IEO) later. After that, it could also distribute tokens via an airdrop.

Market cap numbers don’t lie: create value to generate growth

To support long-term market cap growth, you need to create value for your investors, customers, users, and partners. This holds true in both the DeFi and TradFi world. For every Kodak that falls off the map (and S&P 500), there’s a Ford, AT&T, or Coca-Cola that has remained relevant and profitable for decades, with a market cap to back it up.

Bitcoin is the ancient OG token, but it accounts for over 60% of the total crypto market cap by itself.

To put that in perspective, a company that was worth over 60% of the global stock market would have a market cap of over $74 tril! 🤯

Understand market cap to attract investors and users

You now have a strong understanding of market caps for various asset classes. Communicating this knowledge can help you attract investments from presale token buyers, private equity investors, venture capital (VC) firms, and retail investors. First, you can explain how market cap mechanics vary between commodities, stocks, and tokens. This knowledge isn’t common, especially to those more familiar with the TradFi way of doing things.

Then, once they understand, you need to communicate these nuances to potential investors and partners so they can evaluate your company, business model, and generate data-driven predictions on future growth and revenue generation.

Detailed knowledge of market cap considerations can help you craft strategic long-term plans. These business decisions will be informed by your current market cap (if any) and projected financial trajectory.

“The bigger, the better” isn’t always the case when it comes to market cap. It depends on your goals. Are you an investor searching for impressive price appreciation? In that case, gold probably isn’t your best bet (although it’s the biggest by market cap). Is it asset price stability? In that case, gold might be a great choice.

If you’re planning to launch a project or add another funding round, it could be wise to match your funding round goals with the current stage of your project.

To learn more about matching your project’s token launch with its value, potential, or estimated market cap, check out Token Launch Guide: Insights from 600+ Web3 Stakeholders.