Stock tokenization looks like the “next big thing.” Stocks are the latest real-world asset (RWA) to get the tokenization treatment.

And it wouldn’t be the first time that tokenized RWAs soared.

Tokenized fiat currency (stablecoins) took the world by storm. Tokenized U.S. Treasuries were next. Do you see a trend?

The discussion around tokenization of stocks has been going on for years, gained momentum in 2018, and now makes top headlines again. The puzzle pieces are in place: The blockchain tech, demand, awareness, and legislation are finally ready for the major 2025 rollout that’s happening.

Stock tokenization explained

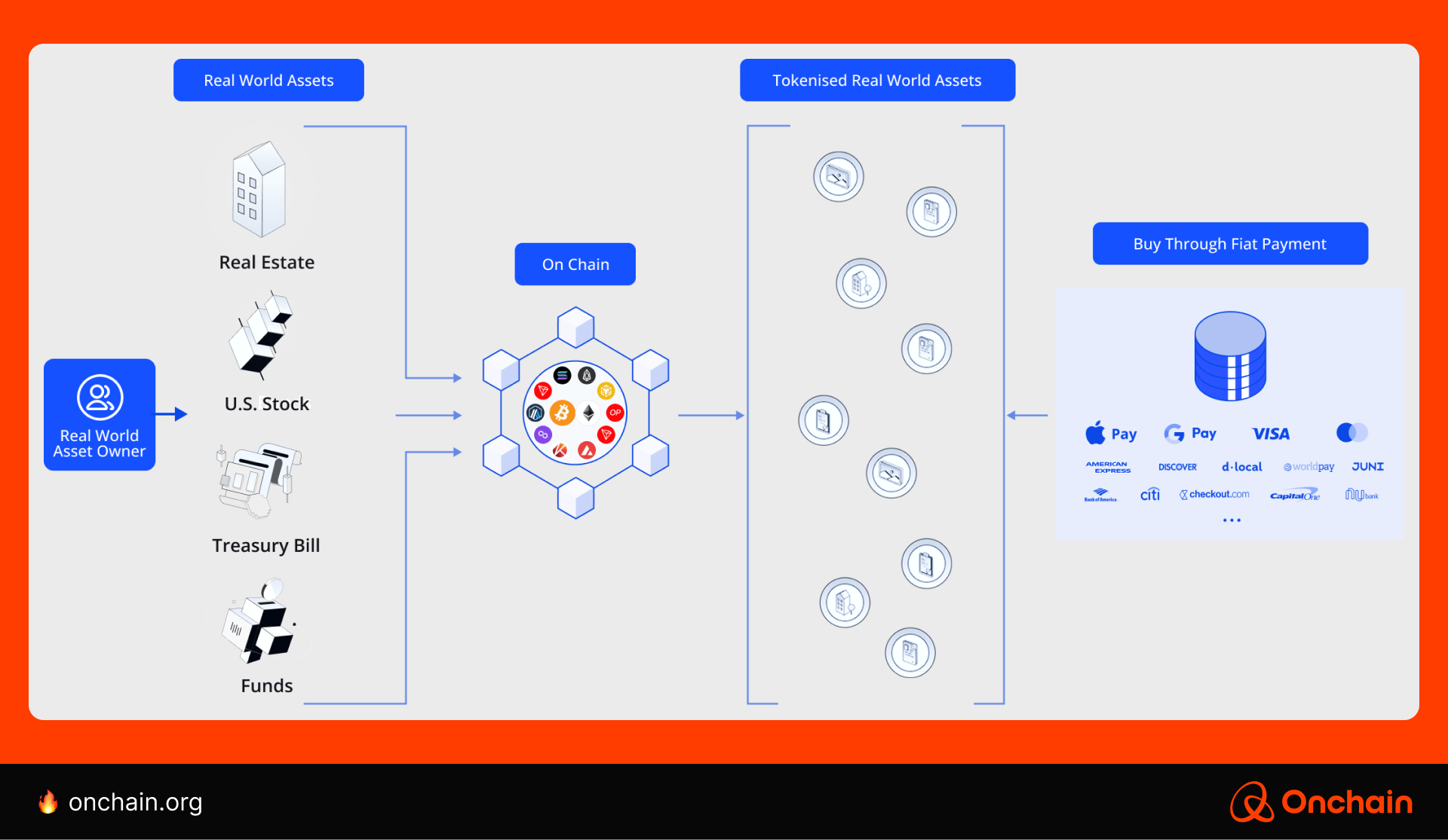

Stock tokenization follows the same RWA tokenization playbook that was used for fiat, treasuries, commodities, real estate, private credit, and other RWAs. You’re probably already familiar with this. If not, no worries, we’ve written about it extensively in our reports and articles.

Here’s a quick refresher on how RWAs, stocks in this case, are tokenized:

- First, the stocks need to be purchased and custodied. Just like other tokenized RWAs, you need the RWA or collateral that backs the asset.

- Two, the company mints (issues) tokens that you can purchase, sell, or hold, maintaining a 1:1 value with the underlying stock.

- These tokenized stocks can then be plugged into decentralized finance (DeFi) protocols to serve as collateral or tradable tokens. This feature depends on the token issuer, protocol, or design — we’ll get into the nuances below.

Like stablecoins or tokenized gold, you can now use these tokens in much the same way you’d send and receive bitcoin (BTC), ether (ETH), or any other token. But unlike onchain cryptos, tokenized RWAs tend to exhibit far less price volatility, which makes them well suited for DeFi lending and borrowing.

Tokenized stocks: the good, the bad, and the unknown

Besides its use as a more stable collateral option with upside return potential, tokenized stocks offer several additional benefits. Some of these perks are shared with other crypto tokens, but not all. Here are five big ones you should remember:

- Blockchain interoperability and composability allow you to trade, borrow, and lend tokenized stocks as easily as any other crypto.

- Cost efficiency: The potential to save yourself 30%+ on stock trading costs.

- Reduce capital settlement times on your stock trades, from T+2 to T+0.

- Enhanced liquidity: Onchain availability lets you trade 24/7 (or 24/5).

- Improved access: If you’re outside the United States, U.S. stock access has just become simpler, cheaper, and more accessible.

But what about the “bad,” the downsides? Let’s break it down:

- Trading window issues: Tokenized stocks can be traded around the clock; however, most U.S. stocks are traded from Monday to Friday, during daytime business hours. This creates liquidity, price spread, and market-making issues during the off-hours when tokenized stocks are still trading. In other words, imagine the BTC Kimchi Premium on steroids.

- U.S. regulatory issues: While crypto powerhouses aim to offer Americans tokenized stocks, a legal battle hides behind the headlines. In short, innovators want a preemptive exception from the U.S. Securities and Exchange Commission (SEC) to test tokenized stocks. Traditional finance (TradFi) incumbents are guarding their U.S. territory by urging the denial of this exemption.

- Global availability: It’s not just the United States. Various other countries are wary of approving tokenized stocks. For example, popular exchange Kraken doesn’t offer tokenized stock trading in various other countries due to legal concerns.

Stock tokenization metrics and forecasts

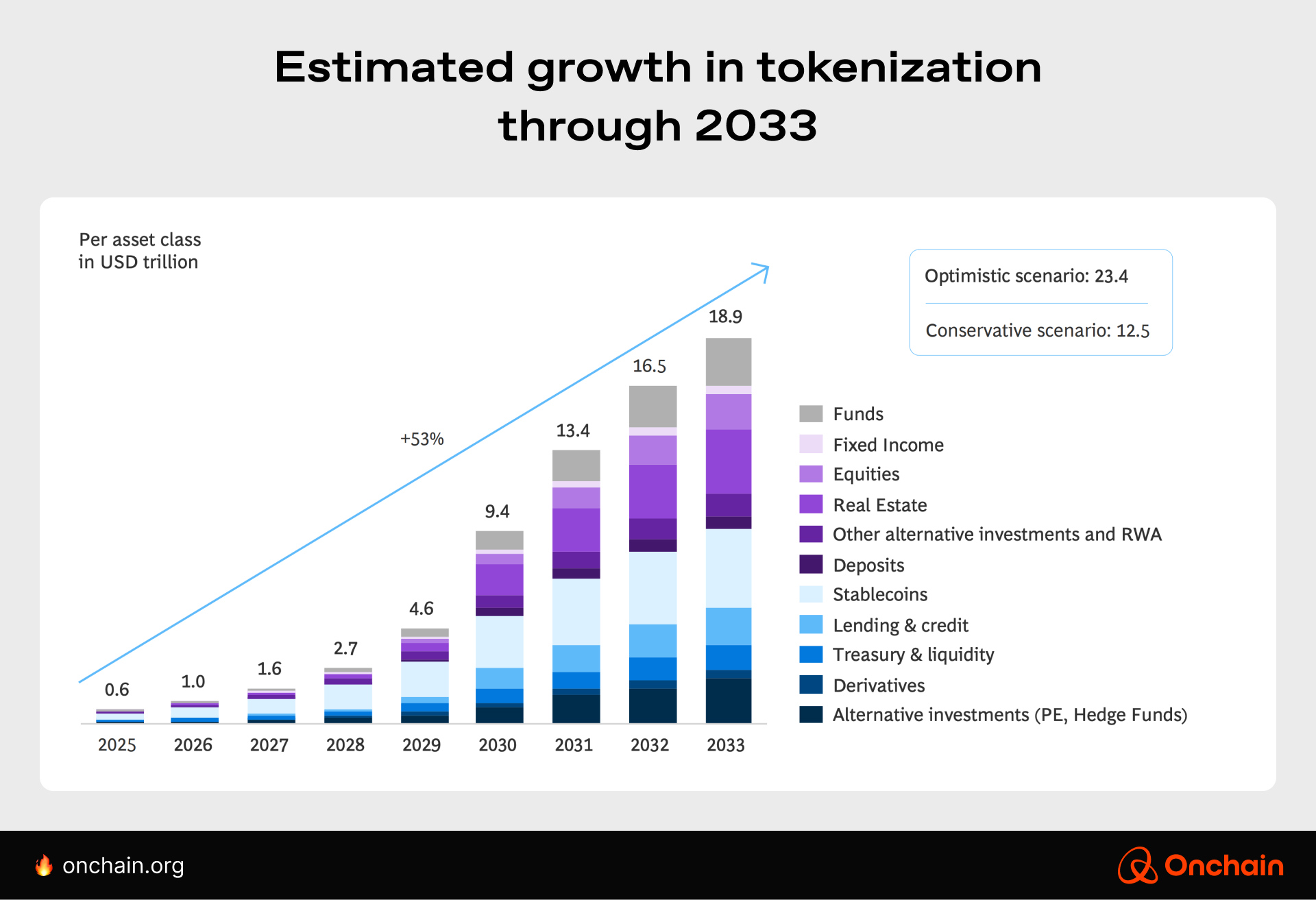

Both conservative and optimistic forecasts suggest a tokenized RWA market cap in the trillions. On the low end, some experts expect 5–10% of RWAs to be tokenized by 2030. Most firms expect a tokenized RWA market cap of $4–$30 tril.

More promising forecasts predict a tokenized market cap of $30–$50 tril by 2030. But this includes all tokenized RWAs. With a global market cap for stocks of around $124 tril, a 10% tokenized stock adoption rate would equate to over $12 tril in tokenized stocks.

Robinhood alone plans to reach a total value locked (TVL) of $10 bil in tokenized stocks by 2028. But in July 2025, the tokenized stock market cap is barely over $500 mil.

The market cap of tokenized stocks will go from millions to trillions of dollars. It’s not just the speed and cost savings driving this growth. You can do things with tokenized stocks that you simply can’t do with the offchain variety.

Tokenized stocks are here, now what can you do with them?

The cool thing about DeFi is that you can unlock financial possibilities that weren’t possible before: earn yield on stablecoins and crypto, send stateless money across the globe, or have a crypto wallet that functions as a pseudo-bank account.

Of course, you can simply treat tokenized stocks like regular stocks and aim to sell them for a profit in the future. It’s not the most exciting use case, but for those outside the United States, it makes accessing U.S. stocks significantly easier.

Another cool thing is that you can purchase fractional shares of a stock. For example, you could get 0.25 shares of tokenized Meta (METAx) or 0.60 shares of Tesla tokenized stock (TLSAx). This lowers the costs of stock ownership and portfolio diversification.

However, that’s just the beginning. In my opinion, one of the most appealing aspects of tokenized stocks is the ability to integrate them into DeFi as a low-volatility token option. In the DeFi lending and borrowing markets, this stability is a big deal.

Let’s run through a quick example, assuming you already have tokenized stocks in your wallet:

- Deposit TLSAx and AMZNx tokens (tokenized Amazon shares) into a DeFi protocol.

- Use the collateral to borrow stablecoins.

- Use the stablecoins as you see fit: earn yield, invest in other assets, or make a collateralized loan to yourself.

- Pay back the stablecoins plus interest, and you can withdraw your tokenized shares.

- Then, you can sell your shares, repeat the process, or continue to hold them.

This isn’t a future possibility; it’s already possible on Kamino, perhaps the first major decentralized money market to incorporate tokenized stocks as a collateral option. Kamino already has over $2.5 bil in TVL.

Tokenized stocks as low-volatility DeFi collateral with upside

While you could simply plug in other tokens in step one and repeat the process above, tokenized stocks could become a preferred DeFi collateral option. Why, you ask?

Sure, you can use crypto tokens like BTC, ETH, and others as collateral. The problem is that these assets have proven to be highly volatile. This often means using a collateral ratio of 2:1, 3:1, or even higher.

This ratio is often dictated by the borrowing platform. And if it isn’t, it’s highly recommended that you overcollateralize to avoid getting liquidated. If your collateral drops below the loan value, the protocol will sell your collateral tokens to recoup the loan value.

Obviously, this isn’t great. However, people engage in these loans because they want or need capital, and they don’t want to sell their crypto to obtain it. Perhaps they intend to sell it later when their tokens reach a higher value.

I’ve borrowed money using crypto collateral myself, and it all worked out. Still, when the collateral value began to drop, I worried.

You could also use stablecoins to get a fiat loan. For example, deposit stablecoins to get a fiat loan. It’s low-to-no risk, but you also don’t have the upside return potential of a crypto collateral option.

Tokenized stocks could ultimately prove to be the DeFi collateral with a better product-market fit (PMF), particularly in the institutional investing space.

How institutional investors could leverage tokenized stocks

Imagine a major money manager or fund depositing millions or billions of tokenized stock into a DeFi protocol. They could then borrow off the collateral to purchase yield-bearing stablecoins, tokenized treasuries, or other onchain assets.

If executed successfully, they could earn additional yield, repay the borrowed collateral, and boost returns for investors. If the stocks appreciate substantially over the borrowing period, it’s even better.

If the tokenized stocks don’t perform well, the yield could be used to offset or mitigate any losses (or underperformance) on the stock side of this DeFi investing equation.

Key early contenders in stock tokenization

Wall Street is tokenization at a pace that crypto critics didn’t see coming. If the summer of 2020 was “DeFi Summer,” 2025 could end up being named “Stock Tokenization Summer.” It’s not quite as catchy, I’ll admit it, but please credit me if it becomes reality.😇

You are on the cusp of another RWA tokenization boom. Here are a few projects and platforms worth paying attention to.

xStocks

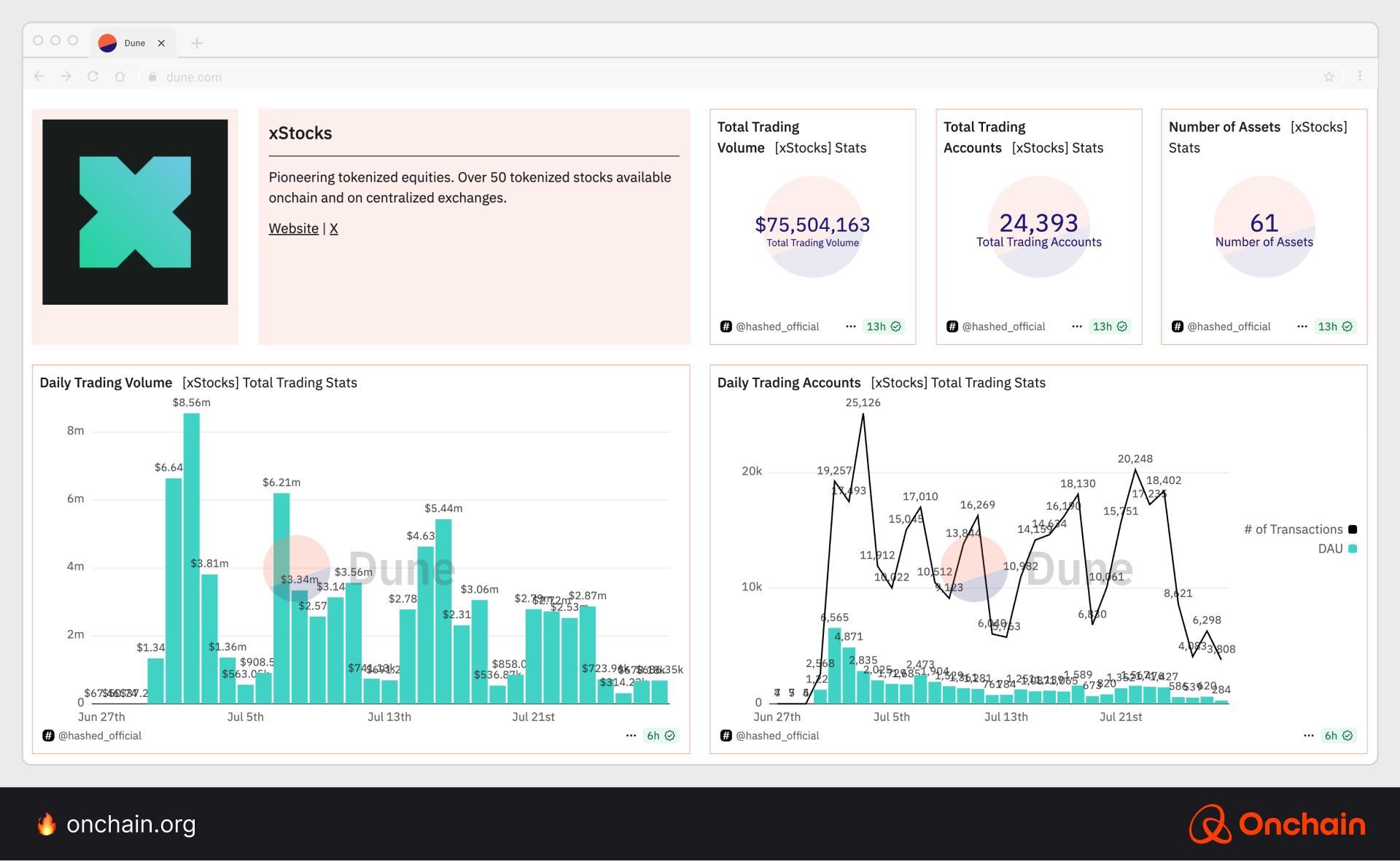

The xStocks platform is one of the early innovators in the industry. It launched live trading on June 30, 2025, with a focus on tokenizing major U.S. stocks and exchange-traded funds (ETFs). Major milestones include surpassing 20,000 traders and exceeding $50 mil in total trading volume in just a few weeks.

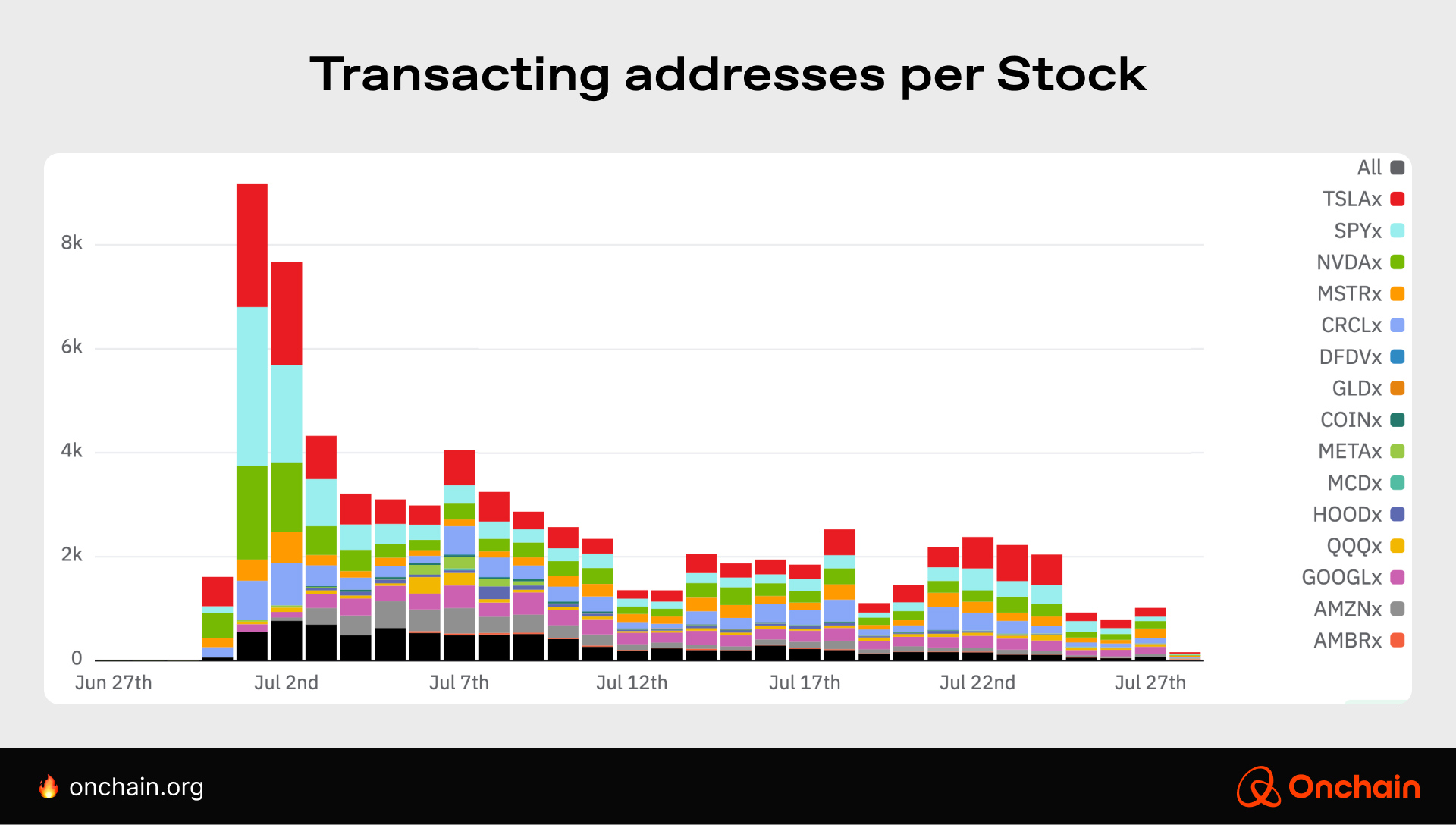

For analysts and traders, it’s worth mentioning that blockchain explorers can track tokenized stock-specific metrics. This is useful data that can’t be easily accessed in TradFi. Use it to gain insights into broad investor sentiment and market conditions.

For example, you can view real-time data for tokenized stock transaction volume, trades per stock, and even crypto addresses per stock.👇

Well positioned to grow, xStocks has already secured partnerships and distribution with major centralized exchanges (CEXs) and DeFi platforms:

- ByBit

- Kraken

- Gate

- Alchemy Pay

- Various Solana protocols

- And many others…

Dinari

Dinari is another project that has promising early traction. It has 25,000+ customers in 80 countries. Its tokenized products, which it calls “dShares,” include stocks, ETFs, and even real estate investment trusts (REITs).

Dinari is the first project to be granted a U.S. broker-dealer license, a critical early step in offering tokenized stocks to U.S. customers. The company is very transparent about its reserves, which are fully backed at all times.

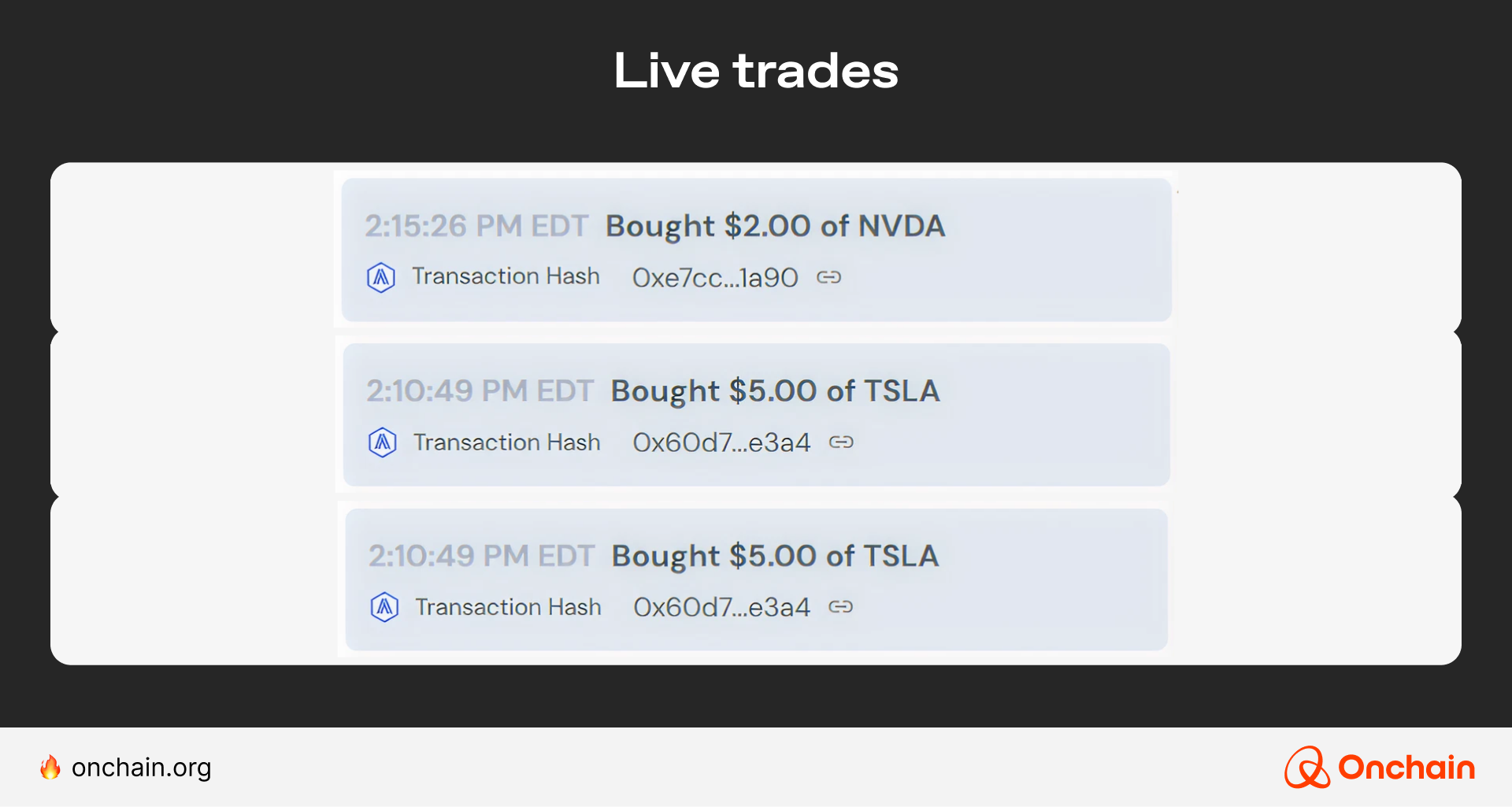

Dinari even features a live trading widget on its website that lets you view trades in real time.

As you can see in this snapshot, many of the trades involve modest sums that are only possible through stock fractionalization (these stocks all trade for well over $100 as of July 2025).

Gemini started offering dShares for EU customers on June 27, 2025. It has been reported that Dinari has secured other agreements that they haven’t publicly disclosed (at the time of writing).

Robinhood

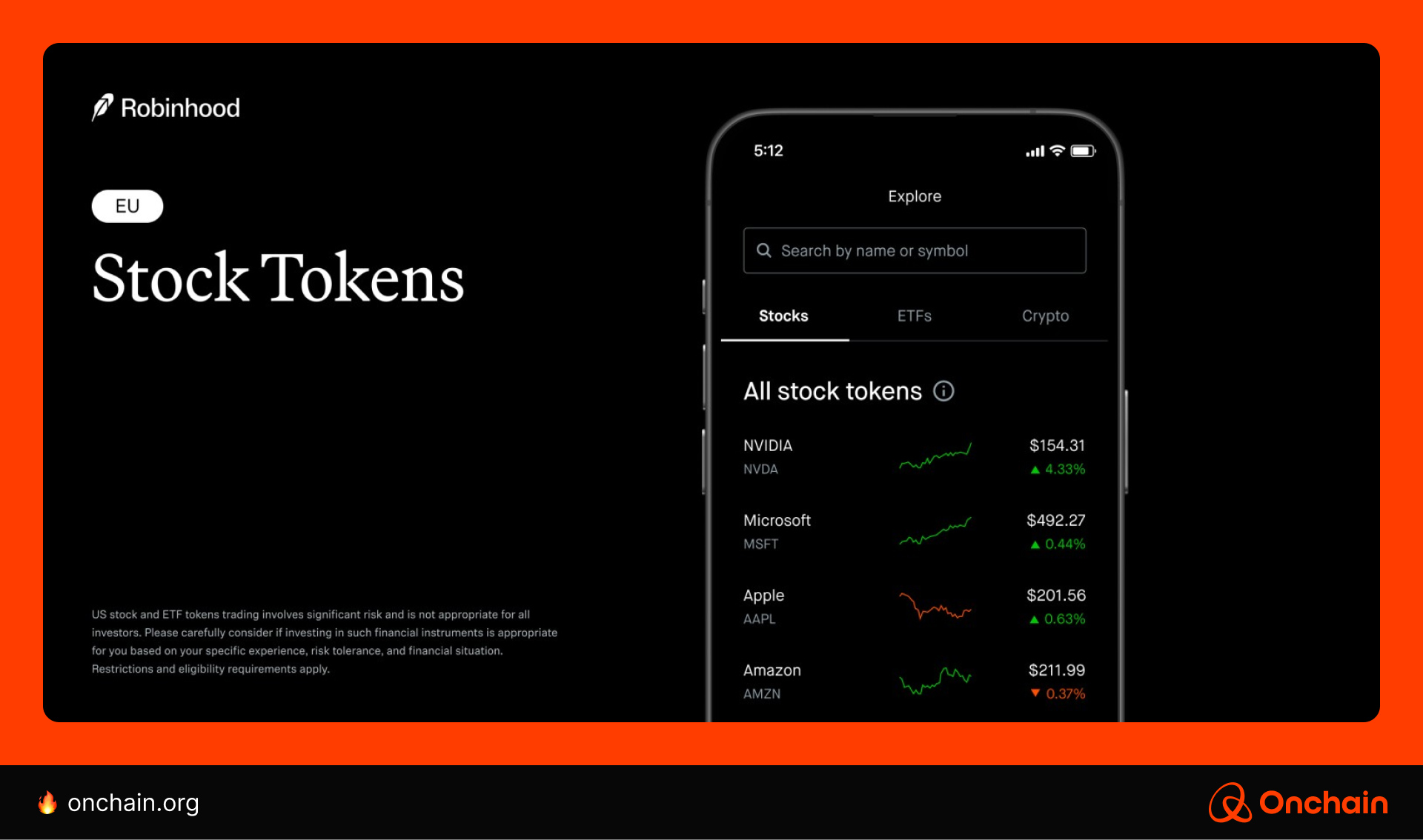

In June 2025, Robinhood announced it was giving away tokenized stocks, and the giveaway went viral. It even caused the associated stocks to hit new all-time highs (ATHs). Robinhood’s rollout is initially for EU customers and gives them access to 200+ tokenized stocks and ETFs.

Surprisingly, Robinhood was able to launch 213 tokenized stock contracts on Arbitrum for only $5 worth of ETH. Robinhood has future plans to launch its own Arbitrum-based Layer-2 (L2) chain to facilitate trades of its Stock Tokens.

Robinhood’s (offchain) stock trading scandal: The 2021 GameStop short squeeze captured the public’s attention. Large funds were shorting Gamestop (GME) shares. Then, a retail trading army started buying GME, initiating a short squeeze.

As these traders won, funds lost massive sums. Then, Robinhood inexplicably removed the ability to buy the stock. This left a bad taste in the mouths of many Robinhood users, and some haven’t forgotten. This action actually prompted many to enter the crypto and DeFi investing space for the first time.

If you’re a DeFi enthusiast who wants to utilize tokenized stocks, Robinhood isn’t the solution for you. You can only buy and sell these tokens; you can’t transfer them to a non-custodial wallet or platform.

Robinhood’s smart contracts route every token transfer through an allow-list that can block transactions to unapproved addresses.

Stock tokenization opportunities around the globe

When numerous crypto firms, Fintech firms, and full-on TradFi firms all agree, you know the Web3 writing is on the Web2 wall: Tokenized stocks are expected to grow dramatically, but where exactly?

With U.S. regulators stepping aside (at least at the SEC), large U.S. crypto companies and legacy TradFi firms can get off the sidelines and take the field. Some suggest the United Arab Emirates (UAE) could see a tokenization boom due to its Asset Referencing Virtual Assets (ARVA) token legislation.

Opinions on the EU are mixed. Some view the Markets in Crypto-Assets (MiCA) regulation as a net positive that eliminates legal guesswork. Others point out MiCA’s regulatory gaps and its inability to define or handle DeFi complexity.

Do you plan to launch a token? Find out where to launch by reading Token Regulation Playbook: From High Risk to High Trust. It covers the EU, Singapore, Switzerland, and more — providing you with the insights to make better strategic decisions.

The U.S. recently passed a trio of crypto bills with more legal leeway. Meanwhile, Europe is continually updating and revising MiCA. Many simply expect the EU to fall further behind the United States due to its track record of overregulation.

Entrepreneurial opportunities in stock tokenization

The stock tokenization trend presents opportunities that you can capitalize on. Getting involved in the tokenization of stocks in 2025 is like starting a crypto exchange in 2012 (Coinbase) or 2013 (Kraken). You are early. Here are a few opportunities worth exploring:

- Onchain brokerage and trading accounts: Develop legally compliant blockchain platforms that give users global access to U.S. equities.

- Innovative financial products: Tokenized ETFs and stocks bring about new possibilities, such as decentralized stock indices, tokenized stock-backed lending protocols, fractionalized onchain investing, and more.

- Infrastructure leadership: Become foundational service providers and reproduce the success of companies like Circle and Paxos that shaped the fiat- and commodity-backed stablecoin markets. Early product releases can strategically position you within the growing tokenized stock ecosystem.

The trajectory of the stock tokenization market cap suggests it will grow substantially by 2030. For TradFi firms involved in stocks and ETFs, a strategic plan to adapt to the tokenization of bonds and stocks is necessary.

For Web3 firms, this is an opportunity to capture market share from major companies that are slow to adapt to this changing onchain environment. That’s why we’re going to have a look at tokenization in emerging markets, next. Tokenized stocks aren’t the only real-world asset that is expanding financial borders. Use the nav below to move forward.