Wall Street is tinkering with tokenization. What can we expect? Well, it’s not going to be an overnight revolution, but growing institutional interest suggests it’s a trend worth watching closely.

Think seamless commodity trading and private equity markets at your fingertips. The big players are already making moves, and the yields are looking juicy – twice that of U.S. Treasuries, to be exact.

The Boston Consulting Group has estimated that tokenization could improve mutual fund returns by $100 billion.

Now that we’ve wet your appetite, let’s dive further into the world of tokenization of RWA assets, where the old rules no longer apply, and the possibilities are endless!

What is asset tokenization of stocks?

Tokenization is the process of transforming real-world assets into digital tokens, which can then be easily traded. It breaks down long-standing barriers between traditional finance and blockchain.

One simple example of a tokenized stock market asset is Tesla (TSLA) tokenized shares. These digital tokens are designed to represent fractional shares of actual Tesla stock, allowing users to trade them on blockchain-based platforms.

This opens the doors to streamlining operations, accessing previously illiquid markets, and unlocking new revenue streams. If you want a deeper understanding, read our article on Real-World Asset Tokenization.

How institutional players are driving tokenization

This move of tokenizing stocks into the digital economy will benefit institutional and retail investors. Let’s examine some of the market projections and new trends.

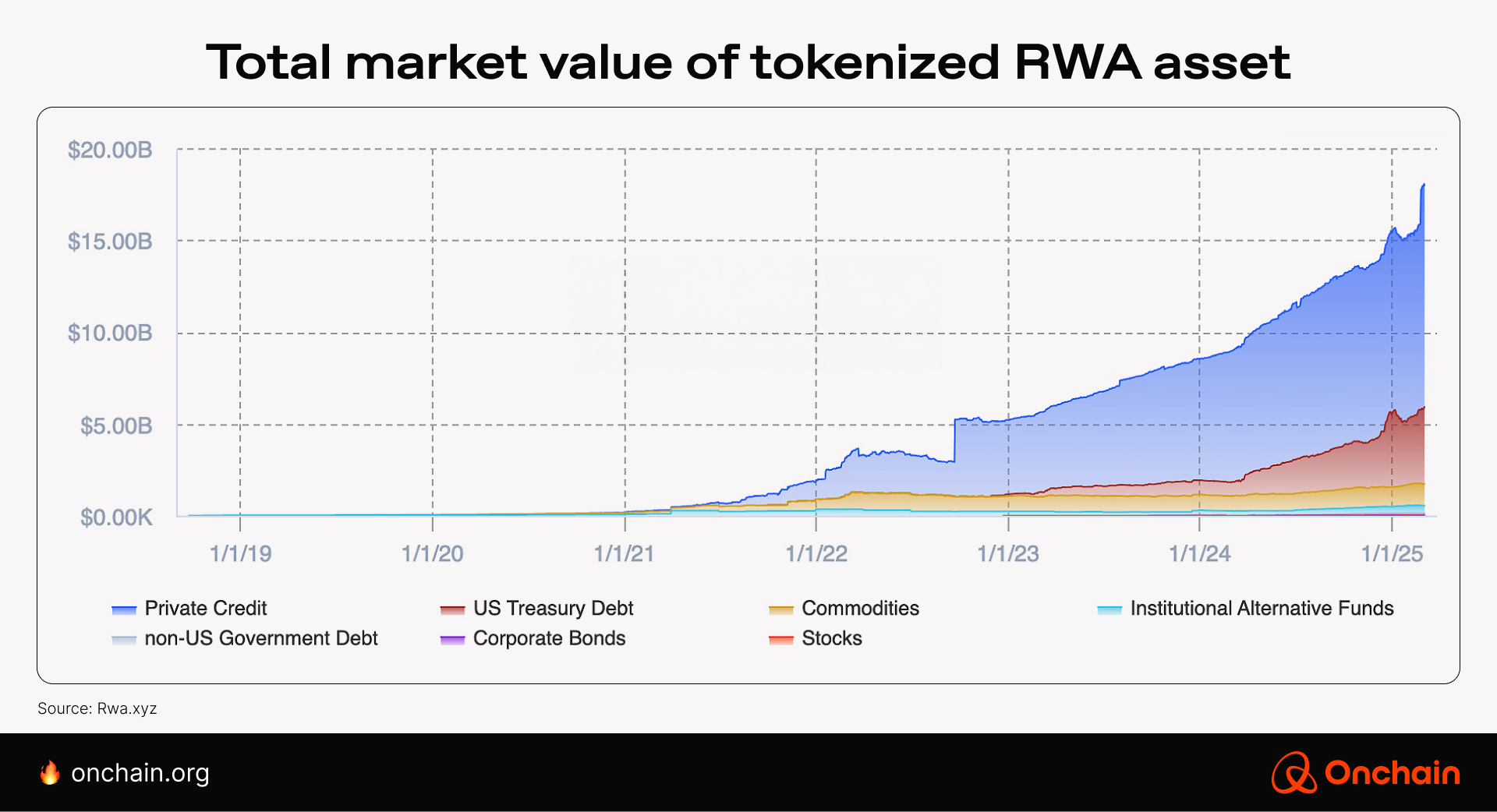

According to RWA.xyz, over the last 18 months, the total tokenized market has almost doubled in value, growing from $8.8 billion to $17.9 billion, with private credit and US treasuries fuelling the majority of the growth.

Market landscape and projections

Institutional adoption supports the growth of tokenized assets and brings more players to the field.

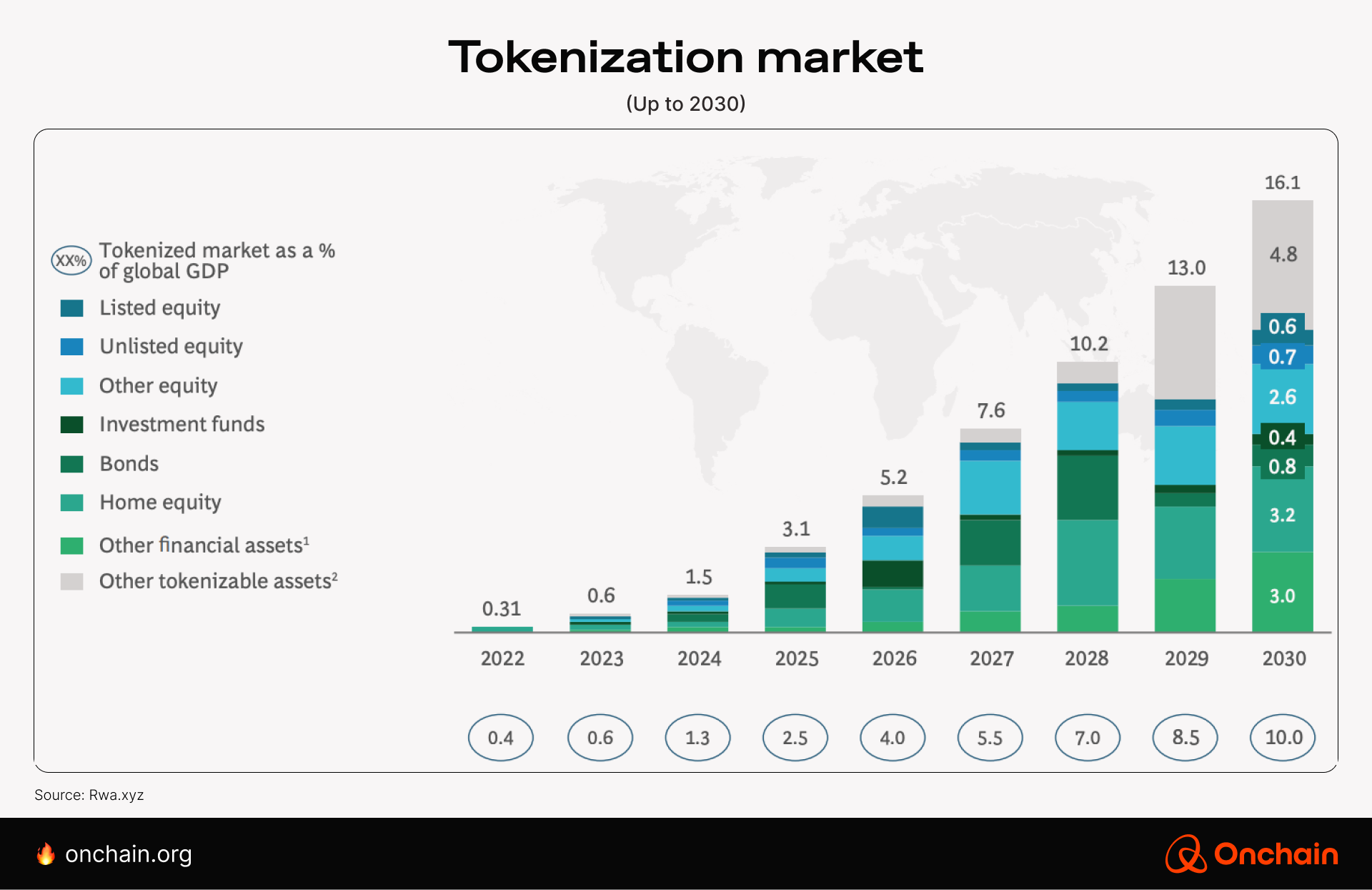

According to 21shares.com, “With a projected $5 trillion tokenized asset market by 2030, this innovative sector is about to turn traditional finance on its head.”

Major institutions are moving traditional funds onto blockchains.

Leading asset managers like BlackRock, Hamilton Lane, Franklin Templeton, and WisdomTree now offer blockchain-based versions of conventional investment vehicles. You’ll find a few of these examples explained in detail below.

The banking sector has also made great strides. HSBC launched its Orion platform to support tokenized deposits and gold transactions.

UBS, the infamous Swiss bank, has rolled out its “UBS Tokenize” service to tokenize bonds, funds, and other structured products.

Meanwhile, DBS introduced its comprehensive “Token Services,” featuring programmable rewards, treasury tokens, and conditional payment solutions.

According to Carlos Domingo, CEO of Securitize, “Tokenized real-world assets provide an excellent bridge between traditional finance and decentralized finance, bringing institutional-grade investments on-chain with unprecedented transparency and efficiency.”

Emerging trends and innovations

Not shy of being innovative, Singapore’s Monetary Authority (MAS) is spearheading Project Guardian. This involves testing over 15 tokenization use cases across bonds, asset management, and treasury operations.

Furthermore, emerging trends in settlement infrastructure are being led by settlement giant Euroclear. Together with DTCC, it has also joined forces to develop tokenized asset management frameworks, collaborating with crypto service providers like Chainlink.

Implications for global financial infrastructure

Tokenization is reshaping asset ownership and capital flows from bonds and investment funds to private equity. According to bcg.com, “The total tokenized market is predicted to reach 10% of global GDP by 2030”.

Turning traditionally illiquid assets, such as real estate, art, and private equity, into divisible, tradable units is a win-win situation.

It enables the larger players in the financial sector to capitalize on this and set the stage for a more agile and accessible financial infrastructure.

Lowering the entry barriers will empower a broader range of investors to join.

Defining tokenization now and in the future

Tokenization’s future in the finance sector hinges on multilateral collaboration, with pivotal roles played by governments, financial institutions, researchers, and tech innovators.

But where does blockchain fit in, and how can tokenization help to democratize investment for the mainstream investor?

What is the role of blockchain?

Blockchain plays a central role in tokenization by enabling secure, transparent, and immutable transactions.

It is key to transforming assets into digital tokens, enhancing liquidity, and automating processes via smart contracts.

Furthermore, blockchain’s smart contracts automate settlement, compliance, and other operational processes, reducing the need for intermediaries and streamlining transactions across global markets.

Democratizing investment

Tokenization enables fractional ownership, breaking down barriers for investors to access high-value assets.

This innovative methodology significantly reduces the capital needed to invest, allowing small-time investors to get a slice of the pie.

By converting assets into digital tokens on a blockchain, investors can buy and trade small fractions of traditionally illiquid investments, such as real estate, art, or private equity.

Benefits and challenges of tokenization in modern finance

The benefits will likely increase exponentially as more institutions see the advantages for themselves.

However, what are the challenges? Below, we have given a high-level overview of both.

Benefits

- Enhanced liquidity & access: Tokenization splits assets into tradable tokens, opening investment opportunities and boosting liquidity.

- Cost savings & transparency: Blockchain cuts out intermediaries and uses smart contracts to lower costs and increase transparency.

- Fractional ownership: Investors can purchase small portions of high-value assets, making investments more accessible.

Challenges

- Regulatory ambiguity: Varying global rules complicate compliance and slow adoption.

- Lack of standards: No universal tokenization standards hinder market integration.

- Security risks: Hacking, fraud, and smart contract vulnerabilities require strong safeguards.

Why the underlying blockchain infrastructure matters

The blockchain infrastructure holds everything together.

Its decentralized and immutable nature provides enhanced transparency, robust security, and global accessibility, ensuring that every transaction is recorded immutably and in real-time.

When integrated with DeFi protocols, it enables seamless, trustless financial operations.

This paves the way for innovative tokenized securities and borderless investment opportunities that democratize access to global markets.

Real-world applications: Real-world insights

Real-world applications, including tokenized real estate and digital collectibles, are changing the way we view asset management and investments.

Let’s examine a couple of real-world examples of conventional financial assets integrating with blockchain platforms to offer tokenized products.

These are not just confined to Wall Street; they are global.

BlackRock BUIDL Fund

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is a tokenized fund launched in March 2024. It operates on the Ethereum blockchain.

It offers qualified institutional investors access to U.S. dollar yields by investing in assets such as U.S. Treasury bills and repurchase agreements.

BUIDL has grown rapidly and has become the largest tokenized fund in the world, with over $517 million in assets under management (AUM) as of January 2025.

Furthermore, it has extended its reach beyond Ethereum to blockchains such as Polygon, Arbitrum, Avalanche, Optimism, and Aptos. And it also backs other projects, including Ethena’s USDtb stablecoin.

The fund provides immediate settlement and enhanced liquidity and distributes daily dividends directly to investors’ wallets.

DBS Token Services

DBS Singapore’s largest Bank with SGD 426 billion in AUM has launched its “DBS Token Services”

These consist of a new suite of blockchain-powered services designed to enhance liquidity management, streamline operations for institutional clients, and facilitate real-time payment settlements using the bank’s permissioned blockchain.

DBS Token Services introduced additional tokenization and smart contract-enabled capabilities into DBS’s existing banking systems, which are integrated with the bank’s Ethereum Virtual Machine-compatible permissioned blockchain.

This is the crux of its core payment engine and multiple industry payment infrastructures.

It provides programmability for institutions to govern the use of funds, including treasury tokens, conditional payments, and programmable rewards.

Lim Soon Chong, the Global Transaction Services Managing Director of DBS, stated: “Using a permissioned blockchain provides DBS full control over these services, enabling the bank to harness the benefits of blockchain technology while adhering to compliance standards.”

These are just two examples, as this is not just confined to specific products; other innovative tokenized assets in real estate, commodities such as gold, and private equity markets are also gaining traction.

Propy and RedSwan are good examples of tokenizing real estate. tZERO is active in the tokenized asset trading space, and Paxos offers investors digital tokens backed by gold.

Navigating the regulatory landscape

Regulatory clarity is moving in the right direction. Tokenized assets are now legitimized, making them more appealing to institutional investors.

Additionally, integrating compliance protocols into smart contracts ensures adherence to regulations like AML and KYC, enhancing trust and simplifying investor participation.

Just earlier in the month, in March 2025, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) started working with the SEC’s new Crypto Task Force.

Together with the CFTC’s focus on derivatives and market fraud, this joint effort aims to streamline oversight and foster a clearer regulatory framework.

Bridging traditional finance and blockchain: The next steps

Tokenization of real-world assets is well positioned to experience significant growth. It will be fueled by advancements in blockchain technology, clearer regulatory frameworks, and increased institutional adoption.

Ultimately, it will lead to deeper integration with both decentralized finance (DeFi) ecosystems and traditional markets.

Furthermore, AI will enter the mix and revolutionize the management of tokenized assets by automating compliance monitoring and providing advanced risk assessment capabilities and optimized trading strategies.

Global standards such as the Algorithmic Contract Types Unified Standards (ACTUS) are essential for achieving compliance and interoperability in tokenization.

These standards will establish uniform protocols to encourage widespread acceptance and simplify international trade.

As adoption grows, the financial sector, from Wall Street to the Hang Seng in Hong Kong, will benefit enormously as we progress into the second half of this decade.

To take a deeper dive into RWA tokenization and how they open access to strong financial systems, let’s move into tokenization in emerging markets. This fast-growing sector provides an interesting opportunity for businesses and investors.