Globalization is changing markets, fast — but not for all. Where many have had access to banking across borders for decades, many more remain unbanked. This gap is the driving force of Web3 adoption in the Global South. Let’s unpack.

Though bank access is increasing, 14% of the global population are still unbanked. The most common barriers include access, financial inclusion, and a big lack of trust in institutions. After all, who would want to invest funds in an institution they don’t believe will keep their money safe or retain its value? Would you?

This creates a gap in the global market. Without banking, individuals are limited in work opportunities and risk financial insecurity due to emergency or inflation. They often rely on expensive third parties to temporarily break through those barriers.

Stablecoins and other tokenized business models change what investments look like for real world assets in the Global South and charge forward with innovation and adoption. Additionally, digital banks are making headway in access. Crypto closes the gaps where security and privacy concerns are high. Here are some exciting use cases to consider.

Stablecoins as digital dollars: Fighting currency volatility in Argentina and Nigeria

Stablecoins have made waves over the past several years. They gained in popularity and earned a massive market share in the Global South. They provide access to those who might otherwise struggle to obtain a bank membership and hedge against local currency volatility.

Nigeria has become the leader for stablecoin adoption worldwide due to the Nira losing 50% of its value over the past three years. The Nigerian market particularly favors coins tied to USD (such as USDC and USDT). Stablecoins secure the value of assets obtained through both local and international commerce, protect them against local inflation, and provide access to external markets where capital is more robust.

Likewise, 61.8% of Argentina’s transactions occur via stablecoins, putting them 17% higher than the global average. There, too, inflation drives adoption: Argentinians have experienced up to 100% inflation rates in recent years, sending individuals and businesses alike searching for a solution to protect their income. Stablecoins have answered the call and continue to grow in adoption.

Such cases drive stablecoin growth in many markets. It is faster, easier, and safer to send transactions into regions with high inflation rates via stablecoins than via traditional fiat currencies. Where a wire transfer is expensive and takes so long that it arrives with less value due to inflation, stablecoins grease the wheels of international commerce.

Tokenized treasuries: Yield-bearing savings in the Philippines and beyond

When it comes to crypto, there is a pop culture assumption that it always involves volatility and speculation. But what if you could build tokenized investment and savings accounts that provided stability and a positive future outlook?

That’s exactly what tokenized treasuries have to offer. You’ve already heard of high-yield savings accounts, though they’re hard to find at traditional banks these days. Instead, you can open a high-yield savings account through crypto apps like Nexo. Such programs offer the same savings mechanisms that traditional banks promote (though often at much higher return rates), transforming them into safe tokenized investments.

You may be surprised that governments have been getting in on the trend. In both the Philippines and Hong Kong, tokenized government bonds offer secure savings with fair-to-high yield (the PH bond coupon is 6.5%). These tokenized investments transform an old-school offering into a transparent and accessible savings opportunity.

Expanding even further, Abu Dhabi’s tokenized T-BILL developed by Realize provides crypto traders a trustless method for investing in the U.S. ETF market — through stablecoins. This changes the game for both accessibility and liquidity abroad. Where U.S. ETF investments were limited by paperwork and institutional red tape, Realize’s T-BILL opens the door wide through secure means.

Agriculture tokenization: Unlocking credit and investment in Kenya and Brazil

Where fractional ownership of stocks make T-BILL investments a solid bet, tokenized agriculture provides access to funds and ownership stakes thanks to fractionalization.

Fractional ownership of real estate is nothing new — REITs have been around since the 1960s — but the traditional barrier to entry was high. Fractional ownership of tokenized real assets breaks those barriers.

JustToken has been doing just that with its Landtokens, lowering the barrier in obtaining fieldland. Their go to market product, Agrotoken, digitizes grain yields. It proves that in farming, soil quality, organic yield, and livestock health all can be tokenized. The results are an immutable record of a farm’s production, ultimately guiding farmers with actionable data. But what about fractional loans based on those yields?

Groups like Farm-to-Us and LandX disrupt the traditional farm loan model by tokenizing projected yields in order to provide farmers in countries like Kenya with capital without the institutional hoops. These organizations can operate in regions where traditional loans might be totally out of reach due to systemic dead zones. Such programs also offer investors like you the opportunity to buy a stake in the loans, expanding the fund even further.

And in Brazil, Visa’s CBDC solution is providing farmers with tokenized capital, another program that provides financing faster while expanding access to the global market.

Tokenized finance innovations: A game-changer for emerging markets

From inflation protection to expanded capital, stablecoin adoption in emerging markets points to a strong and growing sector. Where fee structures would have been preventative for your cross-border payments, stablecoin transfers are fast, cost-effective, and secure. Stablecoins have been adopted in over 70 countries, bringing us closer to global tokenization. They pave the way for a truly global economy for business innovation and tokenized investments.

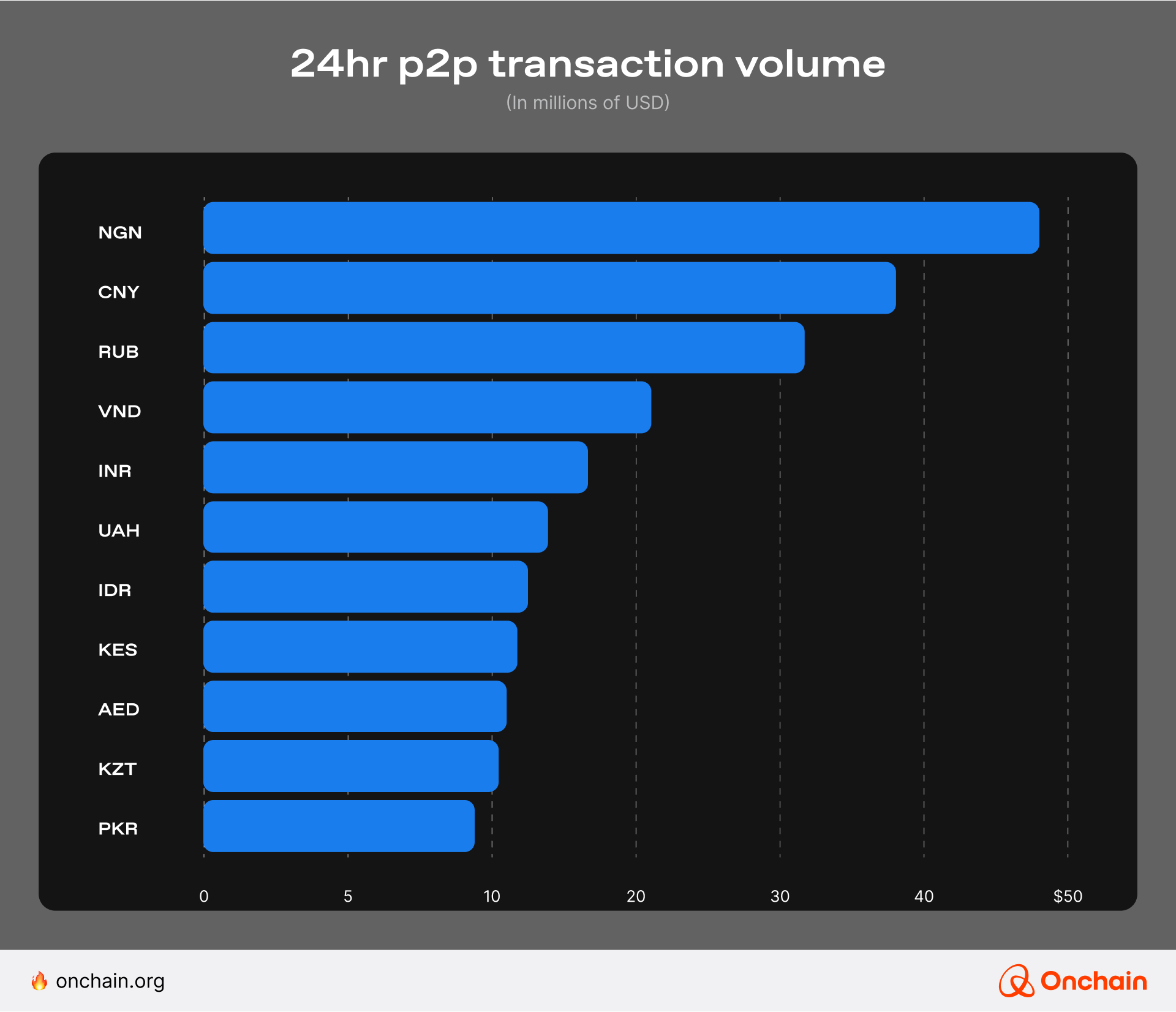

Founders, pay attention: stablecoin offerings focused in emerging markets have huge traction. Peer to peer (P2P) trades in emerging markets dominate the stablecoin market. The top movers are Nigeria with nearly $50M in daily P2P stablecoin trades; China with $38M daily trades; and Russia is close to follow with $33M in daily P2P trades. These trends give you a framework for mapping your project and investments abroad.

Overall, stablecoins have passed a $250B market cap globally and show no signs of slowing. Smart founders will invest in the wave by building local-first projects that reach users where they are and fill real gaps in financial access. With the infrastructure and investment in this space expanding to accommodate the growth, founders will find it easier than ever to enter the market.

A note on stablecoin regulations for founders

The regulatory landscape for crypto writ large is finding its fit. Here are the major regulatory bodies affecting stablecoins you need to know about:

- The U.S. SEC has smoothed the way for stablecoin use and is working toward a national outlook, with increasing interest on Wall Street;

- The EU’s MiCA regulations clarify crypto policy across the continent;

- Southeast Asia’s outlook is driven by Singapore’s regulations, though China and Japan are working on their own protocols;

- In LATAM, stablecoins are being considered as anti-inflationary measures, and Brazil is paving the way with regulations by denoting stablecoins as digital currency;

- Africa’s stablecoin regulation is largely driven by South Africa, with Nigeria’s policies a strong influence.

Time for you to build in emerging markets

If you were waiting for a sign to build a project with reach to emerging markets, look no further. From tokenized assets like farmland to tokenized student loans, stablecoins are paving the way for new asset classes and expanded access to the entire crypto ecosystem.

To learn more about how to leverage tokenized assets for effective marketing, move forward in the Learning Track.