You can launch a token and raise billions — with a b — of dollars.💰

You’re a Web3 insider, so that doesn’t shock you. People regularly make and lose astronomical sums of money. This happens through luck, misfortune, or savvily holding bitcoin (BTC) for years before selling.⌛

We’re here to give you a fun rundown of six of the best and biggest token launches of all time. At the same time, you’ll gain some insights into when, why, and how these token launches were so successful.

Can your token launch strategy follow the same recipe that worked in the 2010s? We’re here to answer this question — and entertain you along the way. Let’s get started.

Then and now: How have token launch strategies changed?

The crypto market cap has gone from zero to $3 tril+ in under 17 years. From fair launches to Initial Coin Offerings (ICOs) and beyond, token launches have been a key driver in: raising funds, incentivizing entrepreneurs, and creating innovative crypto projects.

Bitcoin arrived in 2009. It was the first example of a fair token launch: no private sale, no public sale, and no promotion. Even Bitcoin’s creator(s) themself/themselves had to mine bitcoin (BTC) with their computer(s).

To cut to the chase, with a few exceptions, not much happened with crypto token launches for years. Then, the 2017 ICO boom made headlines. Crypto projects commonly raised (tens of) millions of dollars.

Crypto projects from this era are responsible for many of the most successful token launches of all time. Some projects were outright money grabs, while others really tried but ultimately didn’t succeed. The rest are household Web3 names you’re already familiar with.

The ICO token launch era set records

With the growing adoption and success of early projects like Bitcoin and Ethereum, ICO investing exploded. Crypto investors were looking for the “next big thing” and were investing accordingly. And based on the amount raised, many considered EOS to be their best bet.

1. EOS token launch: an idea worth billions?

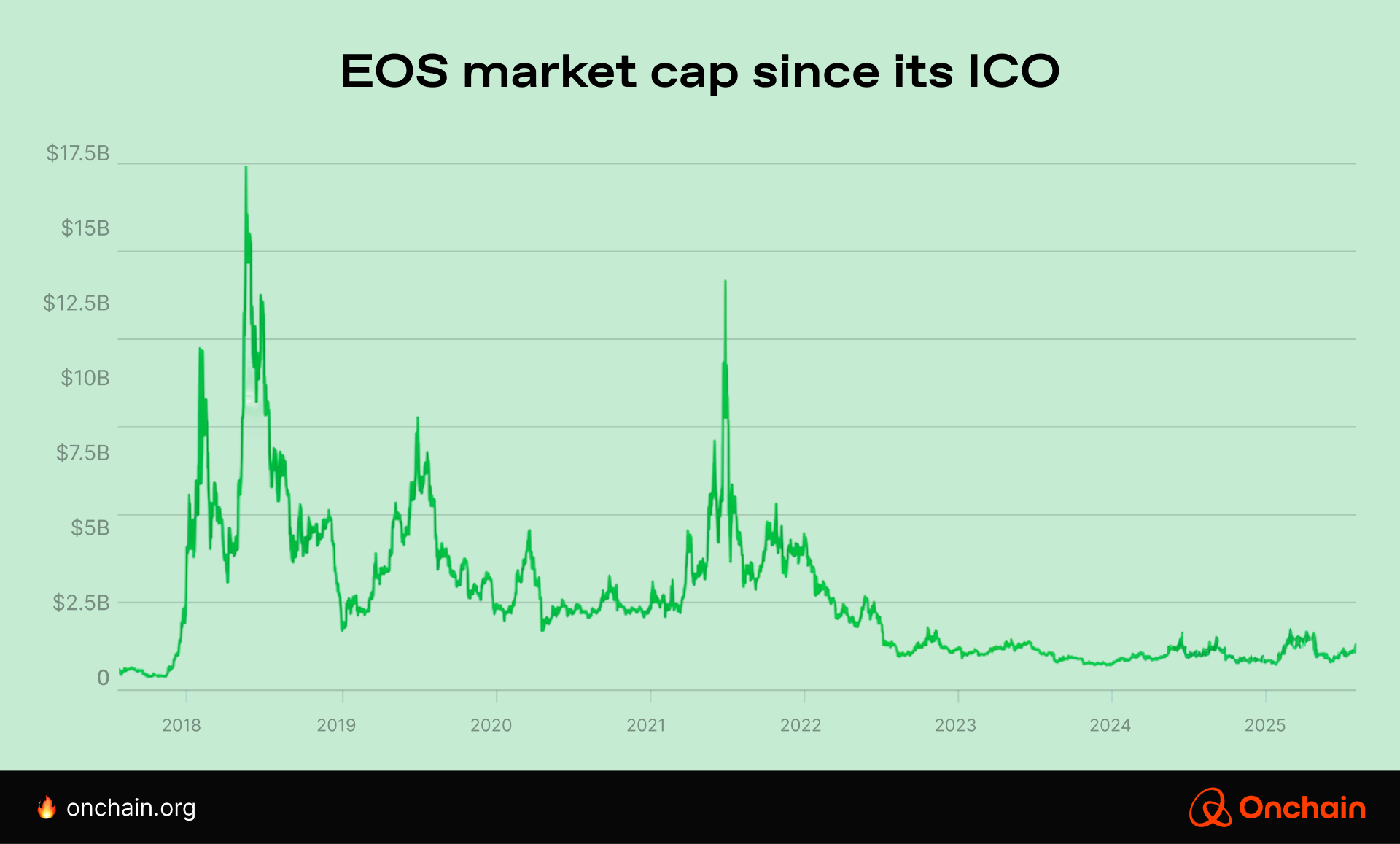

EOS raised over $4 bil in 2017, setting a record for the largest amount raised that stands to this day. Following the launch, the EOS market cap briefly rose over $17.5 bil in 2018. In November 2024, the entire EOS market cap was less than $700,000. In April 2025, it had recovered to a market cap of approximately $1.2 bil.

2. TEZOS token launch

The Tezos blockchain conducted a 2017 ICO for its XTZ token. It raised over $230 mil but was troubled by governance disputes and legal issues between its company and its Swiss foundation. While its market cap was once measured in billions, its market cap in May 2025 hovered around $600 mil.

3. FIL token launch

Another big launch from the ICO golden era was Filecoin. Filecoin raised around $233 mil with its FIL token. It remains a very relevant and important decentralized storage project.

It’s a top-75 project by market cap, valued at around $1.8 bil in May 2025. They continue to build and recently announced an initiative to launch a crosschain bridge with Avalanche.

4. DOT token launch

Polkadot raised around $145 mil with its DOT token. An early innovator in interoperability, Polkadot enables different blockchains to integrate with one another. It is currently a top-30 project by market cap ($6.9 bil, May 2025) and boasts over 600 projects within its ecosystem.

While Filecoin and Polkadot are still household names due to their prolonged success, there are many projects from this era that aren’t. Raising money is only part of the success equation.

ICOs before the crypto token boom

There were many more ICOs that raised massive amounts in 2017. Before this ICO explosion, a few big ones laid the onchain groundwork for what was to follow. Let’s cover a few notable launches that you’re probably already familiar with.

5. The Ethereum token launch strategy: accept BTC

One of the notable early standouts was Ethereum and its 2014 ICO. It raised less than $19 mil, small crypto change when compared to EOS and others. At the ICO, you could get 2,000 ether (ETH) for 1 BTC — not a bad return on investment (ROI).

The token launch raised significantly less than those from the ICO boom, however, it makes the list due to its ICO innovation and dominance in Web3. Ethereum has since become the second biggest onchain project. In May 2025, its market cap was valued at more than $280 bil.

6. Lisk token launch

In 2016, Lisk raised approximately $5.7 mil, making it the second-largest token launch at that time (after Ethereum). However, those millions of dollars were denominated in BTC; they raised over 14,000 BTC. At an updated BTC price of $100,000, those BTC would be worth $1.4 bil.

At the time, Lisk was described as an “up-and-coming dApp platform”. Originally, Lisk had its own Layer 1 blockchain. In 2023, the company announced it was moving to Ethereum via Optimism’s OP Stack (Lisk is Onchain’s sister company 👯).

Why were these six early token launches so successful?

ICOs are similar to the dot-com boom in the early 2000s; we’ll likely never see billion-dollar amounts raised again. There was a lot of crypto interest, it was a hyped industry, and people saw it as a way to make some, or a lot of, money.

Another factor is the sheer number of tokens launched. In 2024, there were over 5,000 token launches every day. In 2017, the number of token launches averaged out to less than one a day. With a lot of investor demand and fewer projects, some ICOs from this era raised far more than expected (or they deserved).

The one-stage token launch era

In 2017, the overall launch thesis was to raise all the money you needed at the very beginning. The idea was to use this large monetary bounty for years until the project became financially self-sustaining and profitable.

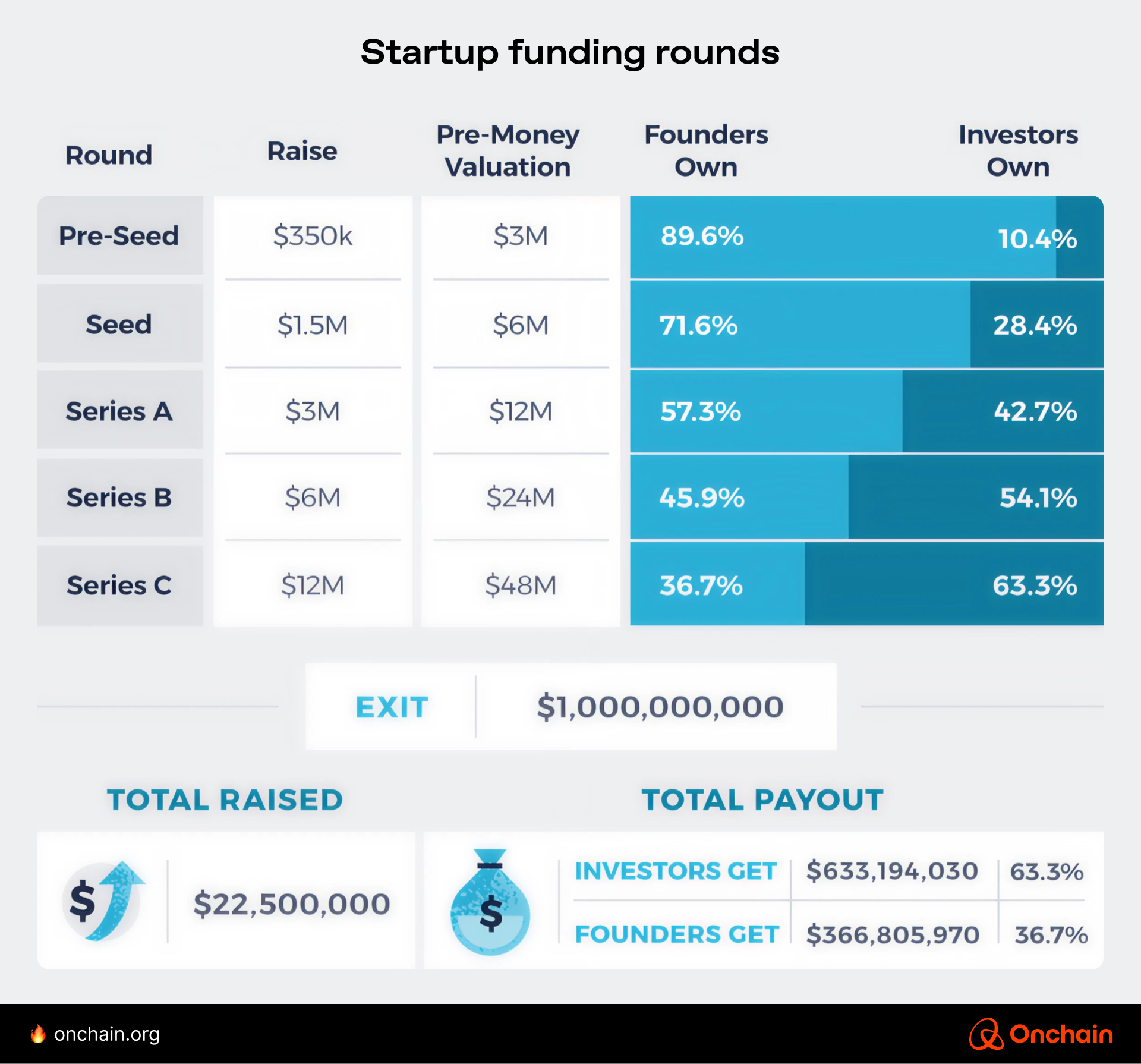

Many times, the project behind the ICO had little more than an idea, a small team, and a whitepaper. This is far different than the traditional fundraising model that raises funds in stages. In the normal traditional finance (TradFi) world, you’d start with sequential raises as your company grows. The stages might look something like this:

- $50,000 raise⬇️

- $500,000 raise⬇️

- $5 mil raise⬇️

- $50 mil raise😀

On the other hand, crypto token launches went all out. ICOs were raising initial amounts that far exceeded what established companies would raise in later-stage rounds. These ICOs often raised astronomical sums with nothing more than an idea or a developing product/prototype.

For some perspective, Circle set the record for the biggest traditional funding round in 2021 with a Series F raise of $440 mil. More recently, Binance set a new record in 2025 with a massive $2 bil funding round – still less than half of the monster EOS raise in 2017.

This record investment in Binance is also newsworthy because it will be done with stablecoins, not fiat currency. I guess it’s not surprising that Binance, a crypto exchange, would accept onchain funding. 😀

Token launch strategies have changed: it’s a new era

Crypto token launches have changed a lot in less than ten years, already reaching their fourth era. The 2017 ICOs feel as strange to us at Onchain as the Middle Ages would to you. Launching an ICO in 2025 is like driving an ox-drawn cart on the German Autobahn. It’s not a smart move.

If you want a good refresher on the various token launch strategies from these eras, check out Onchain’s elucidating token launch explainer.

What’s your token launch strategy?

If you plan to launch a token, you need to have a token launch plan. Simple as that. As you are ideating your vision or creating a crypto project prototype, you may be focused on the technical details.

However, you can’t forget to craft a well-thought-out token launch strategy (at the same time) that gives you the capital, resources, and time you need. Do that, and you’ll be giving yourself the best chance to succeed. Maybe your project will become the next Filecoin or Ethereum.

If you are a Web3 founder or crypto startup entrepreneur, and you’re ready to launch, we have something you’re going to find invaluable.

This article had a few nuggets of Web3 wisdom thrown in (thanks for reading to the end, BTW), but it was more of a fun retrospective on big token launches. If you’re serious about launching a token, we’ve got a whole report on how to launch a token successfully.

It covers the past, present, and future of token launches. We conducted extensive research and analysis and our own in-house surveys to provide you with insights you’re not going to get anywhere else.

Beyond the token launch strategy aspects, it covers important areas related to business strategy, marketing, and legal compliance. Are you aiming to have one of the best token launches of the 2020s?

Be sure to read — and study — our Token Launch Playbook.