Non-fungible tokens (NFTs) are like people: everyone is unique and irreplaceable. I can’t — and don’t want to — swap out my friends, my wife, or my kid. Would you?

In this explainer, we’re going to cover the ebb and flow of NFT market activity, current and emerging NFT market trends, real-world NFT use cases, and maybe a few surprises.

Put on your Web3 swimsuit. Let’s dive into the NFT deep end. 🥽

Understanding the new NFT era

You are verified by your ID or fingerprints. Any NFTs you own are verified by the blockchain. NFTs provide utility by verifying ownership of a unique or limited edition token.

The NFT landscape was initially dominated by NFT collections focused on digital art. Notable projects that have stood the test of time include Bored Ape Yacht Club (BAYC), CryptoPunks, and Mutant Ape Yacht Club (MAYC).

NFT market trends are changing. While art-focused NFTs are making a resurgent comeback — an NFT evolution is creating a host of use cases that expand what NFTs can do. From tickets and IDs to onchain gaming and loyalty programs, the NFT landscape is changing the online and onchain worlds.

The highs and lows of the NFT market: a retrospective

NFTs are like promising rappers and upcoming movie stars. Some burn bright for a moment and then fade into obscurity. Others remain relevant for decades. For every actor — or NFT collection — that “makes it big,” there are thousands that you’ve never heard of.

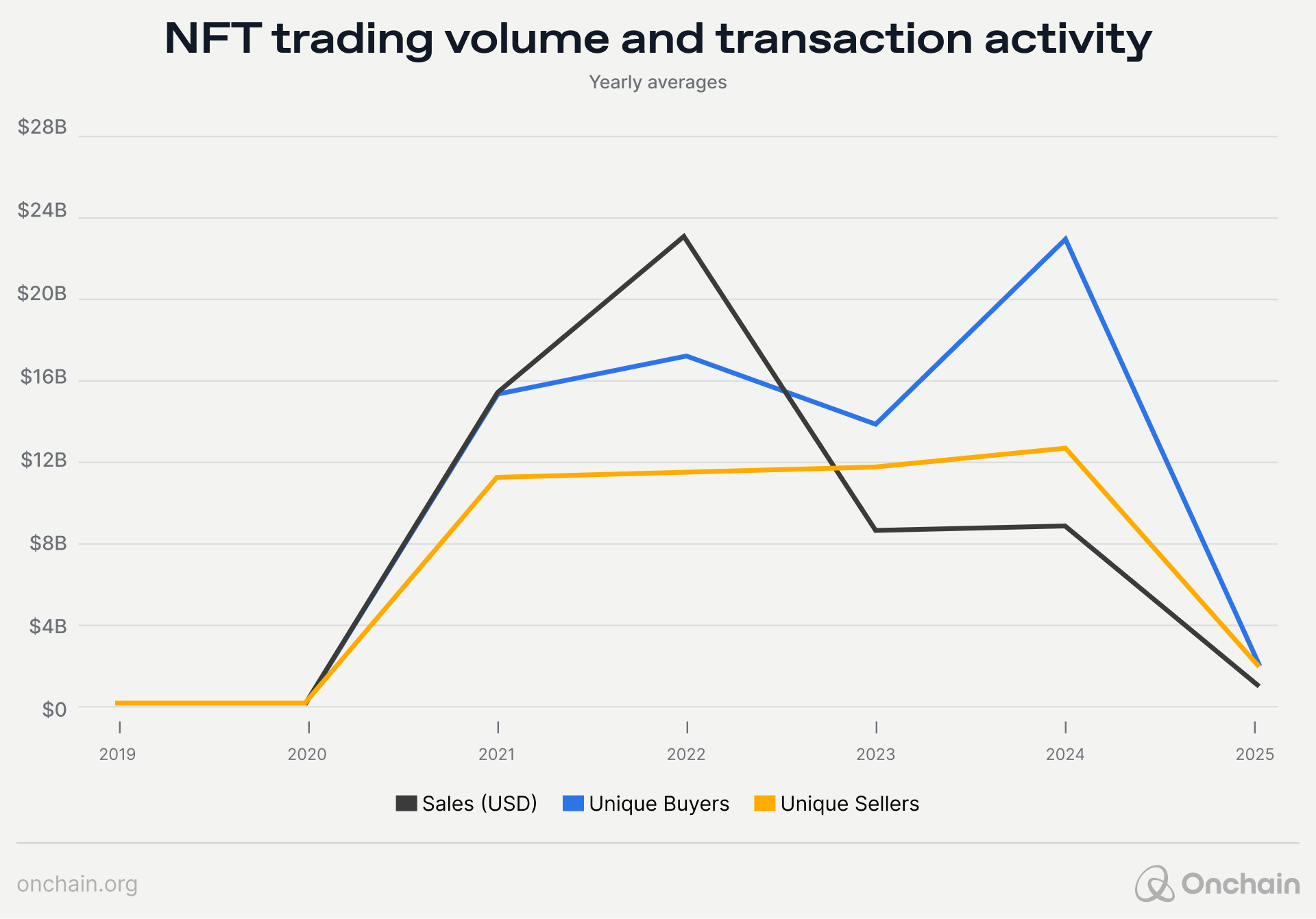

Some projects predate the initial NFT boom, that caused the initial market surge in 2021 and 2022:

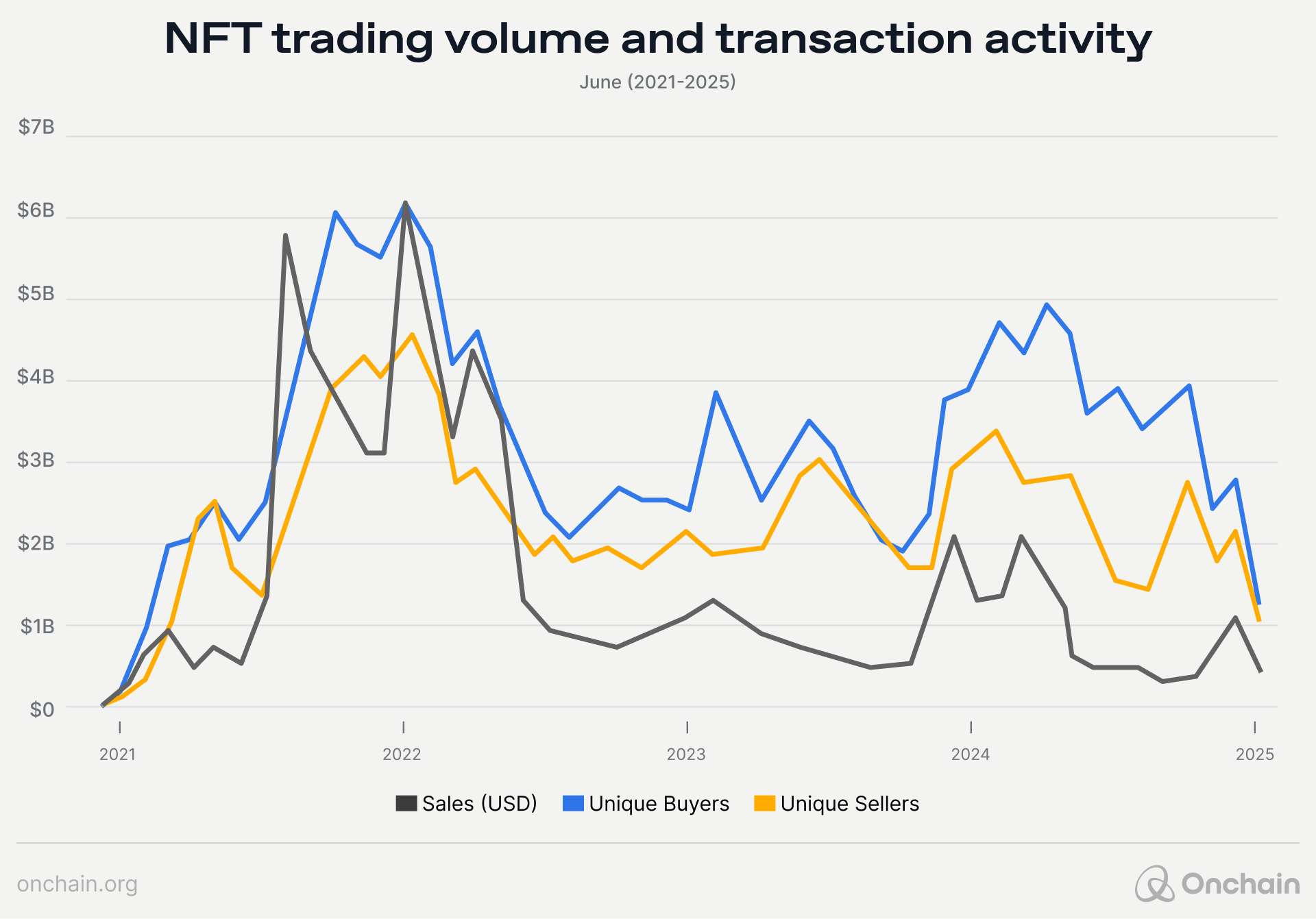

The above chart shows market activity by year, but the market is actually much more “choppy” than that. Here’s the same chart broken down by month:

Why such volatility? That’s hard to say, but the overall crypto market is known to fluctuate wildly. It should come as no surprise that NFTs aren’t an exception to the rule. A few reasons for this volatility include:

- NFTs were considered the “next big thing” in crypto in the early 2020s.

- There was a great deal of NFT investor speculation. Greed played a role.

- Wealthy crypto investors “flexed” their newfound wealth with status-seeking NFT purchases.

- Prices started receding or collapsing due to the plethora of new NFT releases seeking to strike it rich.

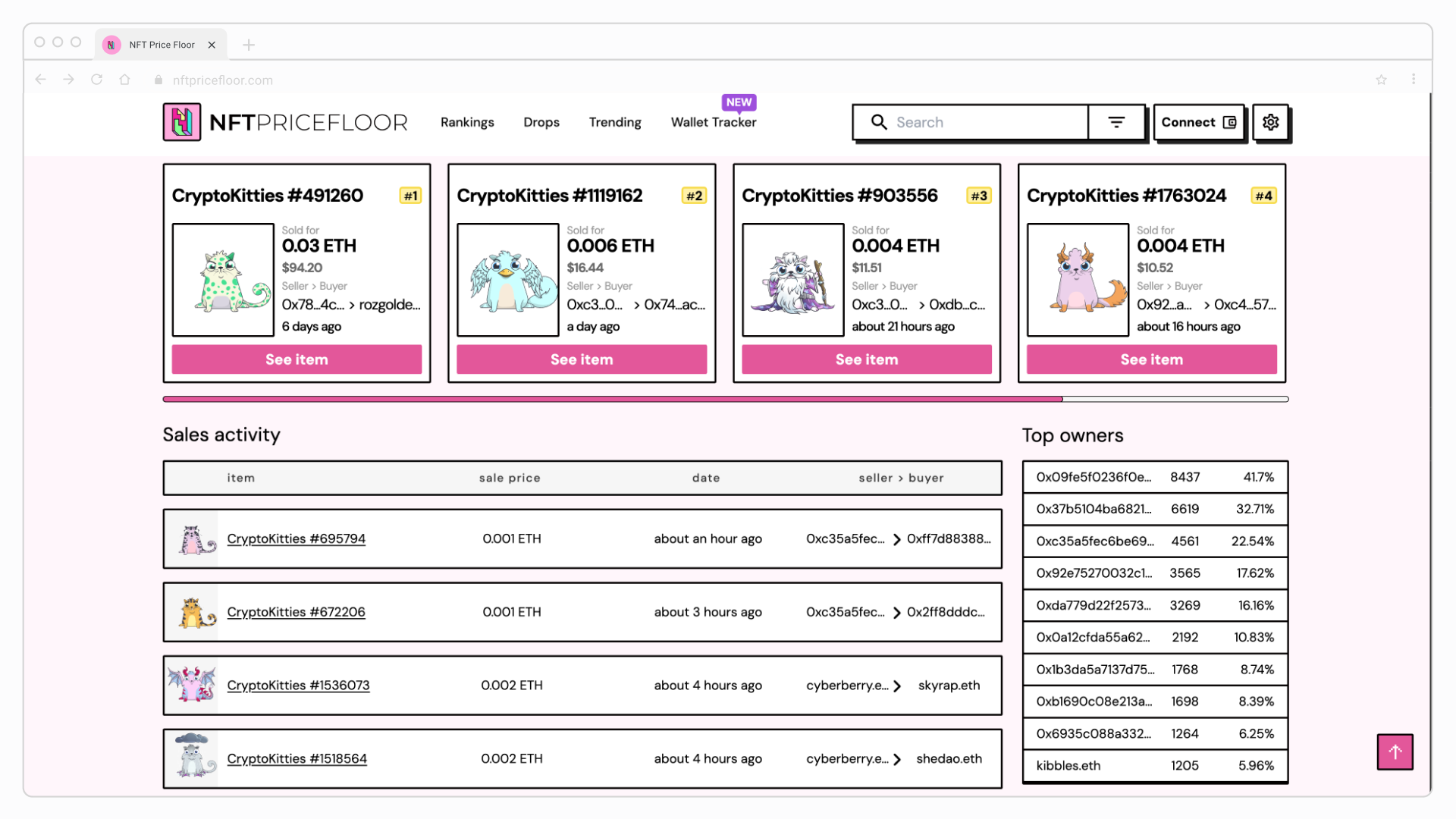

Few NFT collections have remained relevant. Many saw their prices collapse while followers abandoned the project. A good example of this volatility is CryptoKitties, an Ethereum game that featured NFTs. Launched in 2017, some of its Kitties sold for more than $100,000. In 2025, most of these NFTs are selling for far less:

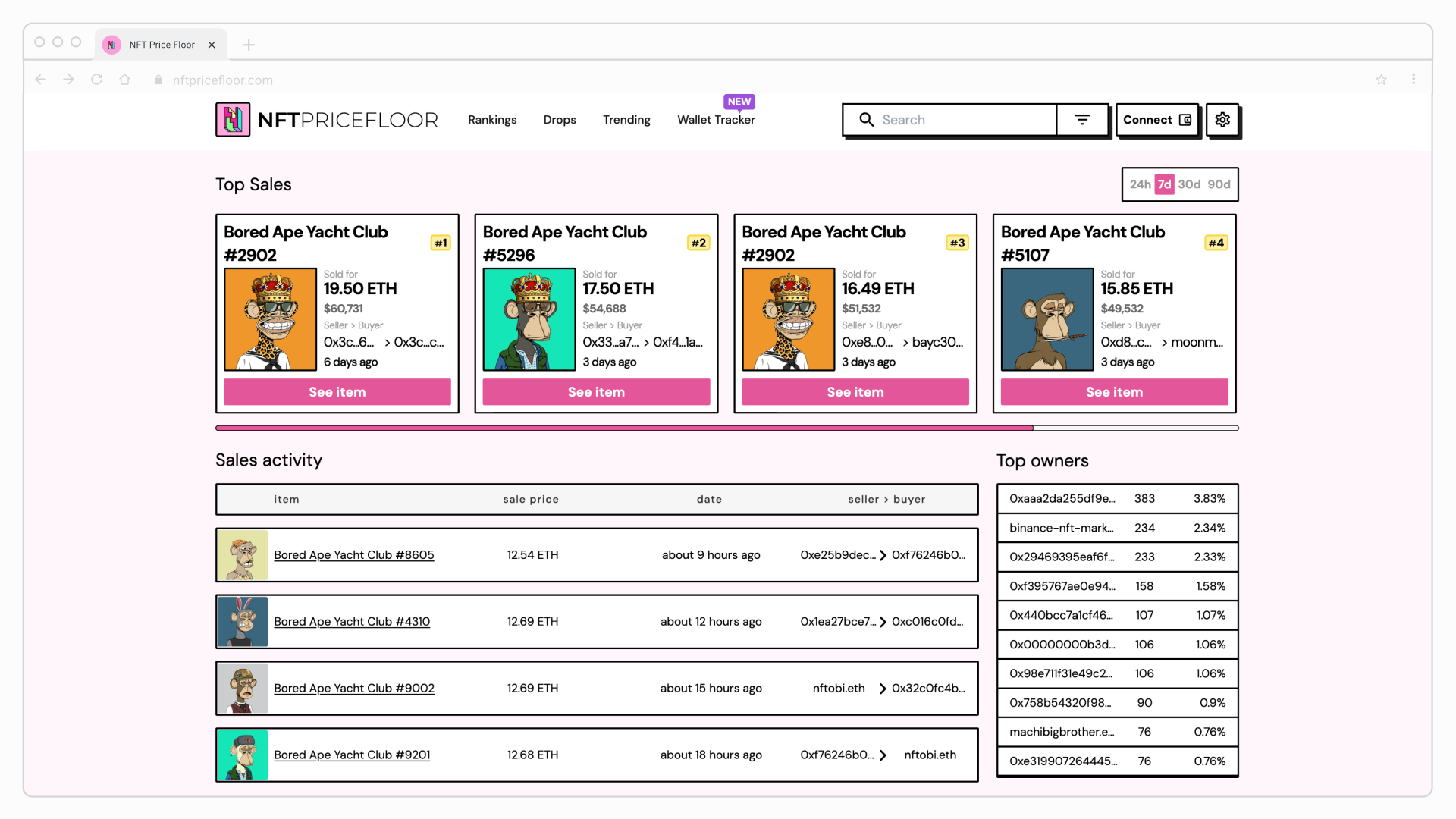

Even though BAYC’s Apes are down from their all-time high (ATH) prices, they continue to remain pricey and popular with the NFT community:

Both BAYC and CryptoPunks remain highly relevant. They are the exception to the “NFT collection falls into obscurity” rule. You could think of their Punks and Apes like you’d think of a Monet or Picasso. These famous paintings and NFTs are highly valuable, and many expect their prestigious status to remain indefinitely.

Other paintings and NFTs? Who knows.🤷

The current NFT marketplace: not just onchain art

The NFT landscape has changed dramatically from its origins. The unique identity characteristics of NFTs make them ideal for a number of different use cases. With the security and transparency of blockchain, they are providing alternatives that are disrupting industries. Let’s briefly cover a few examples.

- NFT tickets: From concert tickets to airline tickets, NFT tickets are resilient to fraudulent scams.

- Gaming: You can trade NFT items like virtual weapons and outfits in games. In metaverse games, people are conducting metaverse land sales through NFTs.

- NFT memberships: An NFT provides access to clubs or platforms. For example, you can purchase a global golf club membership. At Onchain, we recently launched a research marketplace that has an NFT membership option.

- Identity: Verify your online identity with an NFT you independently control. This can be used during online commerce or as an NFT ID you show in person at a venue. Saudi Arabia has implemented a system based on NFTs that allows you to get a replacement passport in only 24 hours.

Far from a comprehensive list, there are dozens of existing applications for NFTs. Many more are likely to emerge in the coming years.

Emerging NFT use cases

More NFT use cases are emerging from the Web3 shadows as the global population increasingly adopts onchain solutions. Here are a few use cases that highlight how the NFT landscape is shifting:

- Titles and credentials: Tech enthusiasts and pragmatists alike use NFTs as land deeds, professional certificates, and academic credentials.

- Music: Not limited to static image formats, some NFTs are audio or visual files. Musicians benefit from streaming royalties, fan engagement models, and live events.

- Supply chain logistics: Companies track goods and services as they move from production to distribution using NFTs. This blockchain solution is used to manage manufacturing inventories, track food safety, or authenticate luxury goods.

- Intellectual property (IP): Forward-thinking creatives are using NFTs to prove ownership of IP. Combined with the booming AI industry, NFTs could provide a solution for issues relating to AI usage of IP. While promising, laws need to be changed to allow this use case to thrive.

- Real-world asset (RWA) tokenization: Like fungible tokens for stablecoins and other RWAs, NFTs serve a complementary role for RWAs that aren’t interchangeable. The real estate sector is a prime candidate for increased NFT usage.

These are just some of the recent NFT market trends that are capturing the onchain industry’s attention. It’s worth noting that some of these applications are relatively niche use cases when compared to the overall sector or industry. While real estate NFTs are promising, they currently represent only a small sliver of the whole real estate market.

Another issue is on the regulatory front. At what pace will governments adapt to the onchain paradigm? They typically are dragged into legislative action by the private sector. In the United States, the private sector expects the far more pro-crypto Trump administration to be a net positive for the domestic crypto sector.

The future outlook for NFTs

Like Bitcoin, Ethereum, stablecoins, and many other crypto projects and applications — NFTs aren’t a fad. They are here to stay — but I ask myself these questions:

- At what rate will these NFT use cases grow?

- Will governments in other regions embrace NFT market trends?

- How fast will NFT projects take market share from products that don’t utilize blockchain?

Opinions are certainly mixed on these topics. Many say gamers just want to play and not worry about crypto wallets and NFTs. On the other hand, Kraken founder Jesse Powell was selling in-game items for World of Warcraft — an offchain game that predates blockchain gaming.

Like the AI sector, the NFT landscape seems to be evolving at an ever more rapid pace. To gain valuable practical insights, be sure to read our in-depth research reports. Start with the researchers’ 2025 predictions for NFTs and Web3.