While not new, semi-fungible tokens (or SFTs) are lately gaining traction. They provide more flexibility in token management than traditional NFTs. Equally, SFTs offer entrepreneurs a new tool for innovating in blockchain business models. Let’s have a look at how they work and unpack some of their unique functionalities for businesses.

What is the difference between an NFT and SFT?

Non-fungible tokens (NFTs) made a splash when they emerged with the advent of ERC-721 (and some earlier projects in the late twenty-teens) because they better represented real-world assets than their fungible counterparts. Their application started within the art world and quickly expanded to real estate, gaming assets, and IP ownership. However, once issued, the NFT is limited to the asset it represents in its smart contract.

Enter semi-fungible tokens. They can be issued as a typical fungible token, but later be converted into an NFT should the token identity change (typically upon trade or sale).

Consider concert tickets. A typical GA ticket is fungible — if you and I swap tickets in line, we still get inside and stand in the same general space. But let’s say that I get mine signed by the band after the concert. Now, mine is unique, and worth a lot of money (at least to fans). Here we have a great example of how a fungible item might become non-fungible thanks to the perceived value of the wider public.

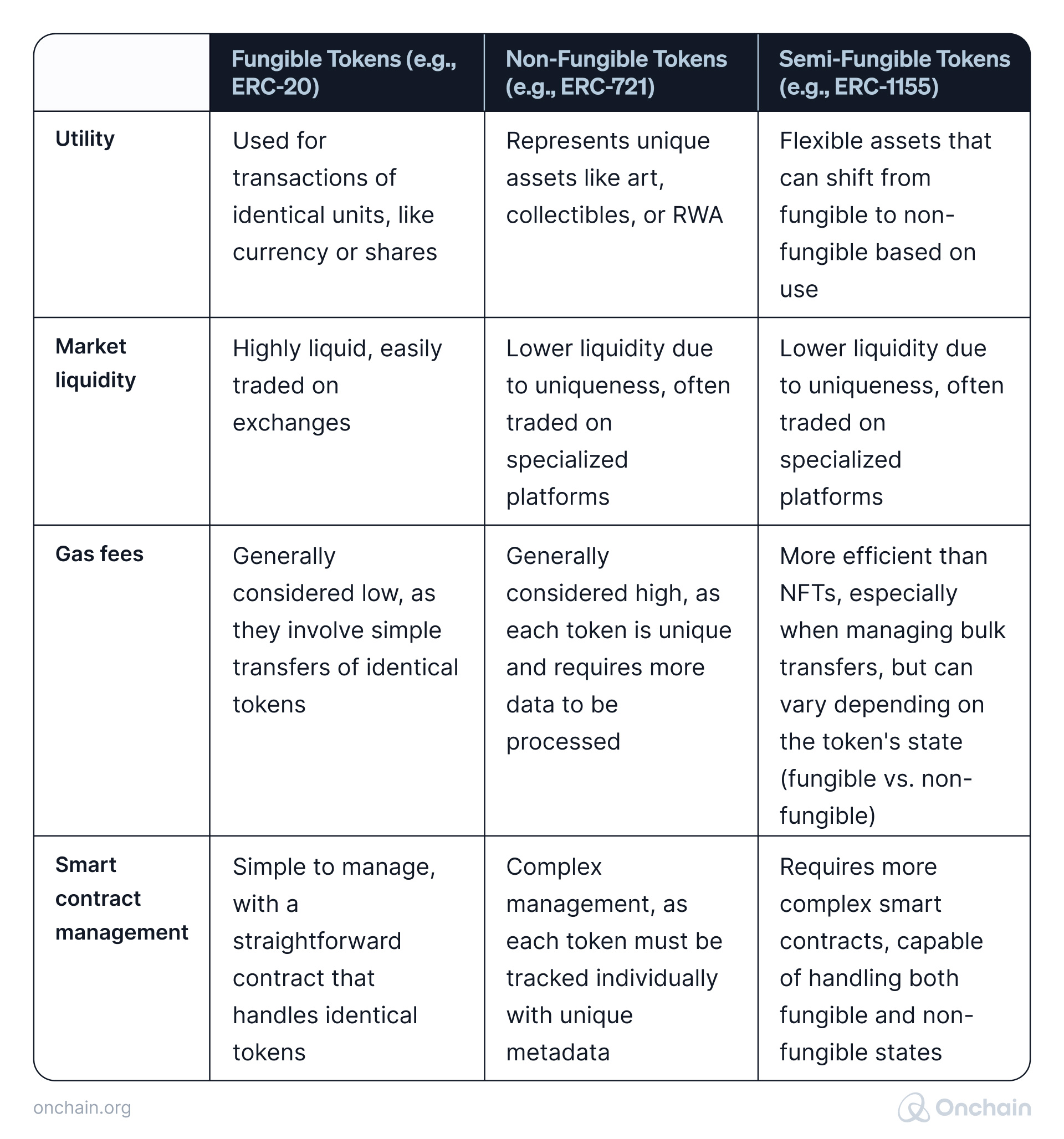

Fungible vs. NFT vs. SFT

Semi-fungible tokens: A quick history

In 2018, a blockchain gaming company called Enjin submitted the Etherium proposal that would lay the groundwork for semi-fungible tokens. The resulting ERC-1155 standard, which governs both fungible and non-fungible tokens, was published in 2019. The standard made it possible to use one smart contract to manage multiple token types, reducing gas fees and making asset management much easier. This makes it the ideal standard for semi-fungible token development. So why are SFTs garnering increasing attention nearly a half decade later?

The gaming industry has expanded significantly over the past several years, generating even greater SFT utility. In gaming, an SFT might look like a tool issued to your character. At genesis, the tool is the same as all other issued tools. However, your character’s unique timeline and utilization of the tool, from upgrades to encounters, make the tool unique. Should one wish to sell said tool, it is no longer fungible. An NFT makes more sense for representing the tool in the game.

Semi-fungible tokens have also gained wider traction because the NFT market has matured significantly over the past several years. This brings more interest to unique use cases and, as a result, SFTs. The expansion of Layer 2 protocols (such as Lisk) also expands the utility of SFTs on the open market.

It should be noted that a proposed protocol has surfaced that would make SFT management even more flexible. ERC-404 would create a standard for NFT fractionalization and may also offer developers more room for innovation, if not more complexity in writing contracts. However, the protocol has not yet been finalized by the Ethereum Foundation, so it is not an official standard and should be avoided for now.

Semi-fungible token utility in DeSci

As we love DeSci business models, we’ve gotta ask: can semi-fungible tokens play a role in decentralized science? Our research turned up some interesting results.

- Grants: A grant that is distributed to individual researchers may easily be managed by a fungible token. $50,000 is the same no matter who it is given to. But what of the research findings? That $50,000 turns into actionable IP. In the research world, an SFT would initially represent the distributed grant money, then convert into an NFT for the resulting IP when the research concludes.

- Intellectual property: A research paper often has many authors when it goes to publish. Each stake they have in the IP may initially be the same, making the tokens fungible. However, a patent resulting from the research may be weighed differently for each researcher, which will require conversion to an NFT.

- Research projects: At the initial signing of a project, everyone tends to start on equal footing. The work contributed by all is the same — zero. An SFT is issued, representing their equal standing. Over time, each researcher may contribute at various levels. Their SFTs could then convert to NFTs at the end of the project, accurately representing their stake in the project and future IP. This concept could also apply for citizen scientists embarking on a project together (a vision we really love).

Other semi-fungible token use cases

Semi-fungible tokens offer greater flexibility for managing blockchain projects with large and varied digital asset offerings. We’ve already touched on how SFTs might be utilized in gaming or ticketing. What other use cases might they offer emerging blockchain projects?

- Membership incentives: Points issued to members in a loyalty program might initially be fungible. However, one could convert their points into a single NFT representing their unique activities within the organization.

- Collectibles: Overlapping with membership incentives, collectibles might be issued as initially fungible items, but convert to NFTs after milestones based on member anniversaries, engagement, or attendance.

- Crowdfunding: Platforms like Kickstarter and Indiegogo focus on ‘rewards’ for backers. Traditionally, one might receive a nice branded sweatshirt or an early version of the product. What SFTs bring to crowdfunding are a unique way to reward initial backers. In the early stages of a project, the backers may receive a preset quantity of tokens. Over time, those tokens might convert to non-fungible equity within the project. This provides an interesting way to bootstrap an early-stage blockchain project.

- Supply chain management: Fungible tokens might be issued to track raw materials. As they move up the supply chain and convert into usable goods, the tokens could also convert to non-fungible tokens representative of their new form.

- Real estate: A property consisting of identical condos could start with fungible token ownership and transition to NFT ownership as they change in value over time with improvements and/or wear.

We’re certainly curious how semi-fungible tokens will be utilized for unique blockchain business models as they become more mainstream. They’re not the only new(ish) token on the market. Soulbound NFTs (or SFTs) are getting a lot of attention and present a unique token launch opportunity. Take a look at the next article to learn more.