Mainstream news loves ‘crypto crime’ talking points. Pop culture thinks NFTs are a scam. What our friends and family know of our profession is rug pulls.

Before you clutch your pearls, we need to have an honest discussion about the underbelly of crypto. Yes, the values of crypto ride on transparency and democratization (as I recently highlighted in my Web3 ethics article), but a tool is a tool. People will use it how they want.

Sanctions against crypto are en vogue. Let’s take a step back to check in with their validity, their fallout, and how you might prepare your project to align with regulations.

Crypto and crime: The dark side of decentralization

We wanted to decentralize. Nakamoto’s white paper launched in the midst of a heavy banking crisis during which no one felt safe. Bitcoin represented a way out; a future in which our money was secured through trustless means.

Wallet hashes felt like a dream — no one would look over our shoulders into our private transactions. Yet, that same anonymity unlocked new channels for financial fraud, money laundering, and more.

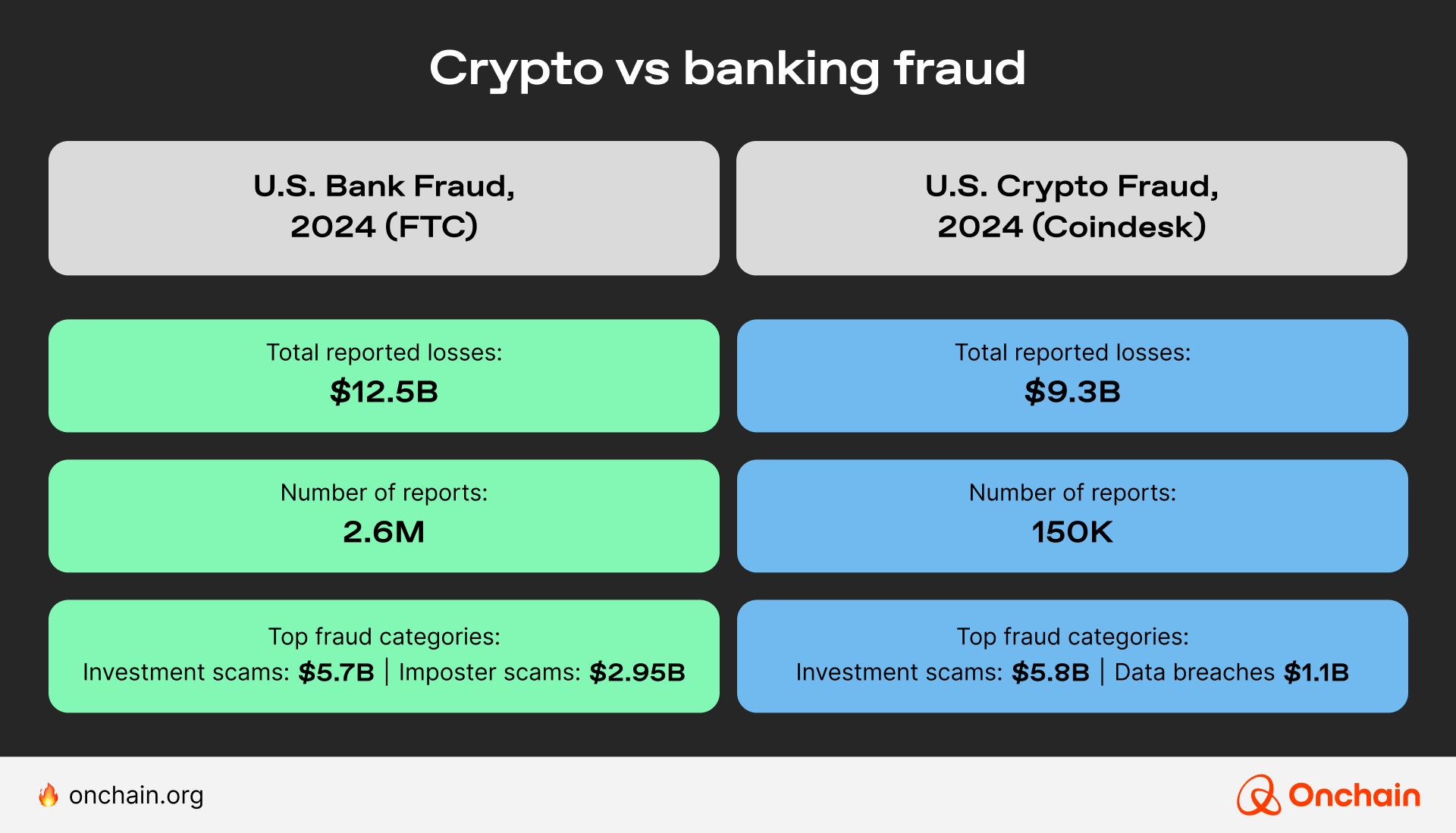

We might cringe at the news, but they don’t have it wrong, just skewed: crypto is much more than a venue for shady deals. A look at the numbers demonstrated that.

Crypto vs banking fraud

U.S. Bank Fraud, 2024 (FTC)

- Total Reported Losses: $12.5 billion

- Number of Reports: 2.6 million

- Top Fraud Categories:

- Investment Scams: $5.7 billion

- Imposter Scams: $2.95 billion

U.S. Crypto Fraud, 2024 (Coindesk)

- Total Losses: $9.3 billion

- Number of Complaints: Approximately 150,000

- Primary Fraud Types:

- Investment Scams: $5.8 billion

- Data Breaches: $1.1 billion

Though crypto fraud is lower than U.S. bank fraud, the negative narrative around it doesn’t cease. Stablecoins were called out as the fraudster favorite last year. The new interest in crypto from the White House shines a harsher light on these concerns. These, in turn, drive stricter regulation in view of curbing crypto crime.

Sanctions on crypto: A global regulatory response

MiCA is here. Russia is being sanctioned. And GDPR regulators consider deleting the blockchain altogether. So what is happening and how will it affect your crypto ambitions? Here’s the quick and dirty update:

- Last year, the U.S. Office of Foreign Assets Control (OFAC) sanctioned Russian companies for using crypto to… evade sanctions.

- The EU sanctioned Garantex, a Russian-based crypto exchange, for undermining Ukraine’s sovereignty.

- The EU and UK applied further sanctions to Russian entities, including crypto transactions, in May 2025.

- In contrast, the United States established a Bitcoin reserve in March 2025 and has been working toward deregulation.

- Concerns about Trump’s investments in crypto that dovetail with deregulation were equally raised.

Interestingly, crypto regulations increase investments from VCs. With greater clarity from regulating bodies comes greater assurance that an investment will survive, if not thrive. As long as your work stays above board.

Uhm, can crypto be sanctioned?

Sanctioning crypto is like a game of whackamole. Governing bodies can shut down wallets and put individuals on lists, but that only goes so far. Non-custodial wallets easily work around this problem. Sure, an individual may lose what was in the wallet, but they can usually spin up again someplace else like a hydra.

This begs the question: Without a centralized body governing the activities of its users, can traditional sanctions work in crypto?

KYC targeting helps to some extent: individuals from sanctioned countries or groups will find it difficult or impossible to open a wallet. Dual citizens and large organizations, however, can jump wallets and identities, though those wallets do typically get found and shut down, eventually.

The Lazarus Group, a crypto crime group out of North Korea, is famous for this. They use crypto to circumvent international sanctions. While hop scotching wallets may seem tedious, this group has it down to an art.

The impact of crypto sanctions on projects and markets

Unfortunately, crypto sanctions don’t happen in a silo. As a result, their implementation draws further attention to crypto crime, skewing the market in the public eye, and even tanking a project’s market cap. But for how long? Let’s take a look at a recent sanction and the subsequent fallout.

Tornado Cash: A case study

In 2022, the U.S. government announced sanctions against Tornado Cash, a cryptocurrency ‘mixer’ that obscures the connection between sender and receiver. The step was taken due to TC’s involvement with The Lazarus Group and other well-known nefarious players on the international stage.

In the subsequent weeks, TC’s token value fell by 33%. The following study conducted by the New York Federal Reserve Bank, determined that, “Despite gross drops in flows to and from Tornado Cash addresses, we find an increase in the total value deposited in Tornado Cash addresses, relative to pre-sanction levels, for all but the largest denominated pool.”

A quick glance at other sanctions

- Garantex — A crypto exchange sanctioned in 2022 by the U.S. and EU for supporting Russian funds in the war with Ukraine. By 2024, over $20B had passed through the exchange, calling into question the effectiveness of such sanctions.

- Sinbad — Another crypto mixer sanctioned in 2022 for its role in moving money for The Lazarus Group. The EU seized servers in Finland and The Netherlands, effectively shutting it down. Today, the Sinbad website displays a “seized” message from the U.S. government.

It would seem that crypto can be sanctioned. However, the effect does not seem to be lasting unless assets are seized. The broader market seems to continue unerred.

Moving towards a more regulated and positive crypto space

To be clear, regulation is not synonymous with control. Crypto projects across Europe report a positive outlook since MiCA laws went into effect, as they provide a clear understanding of legal operation. That peace of mind encourages growth, instead of stifling it.

We take regulation seriously and regularly publish on the topic to help you build with confidence. Take a look at our other articles to gain a better understanding of current regulations and project security.