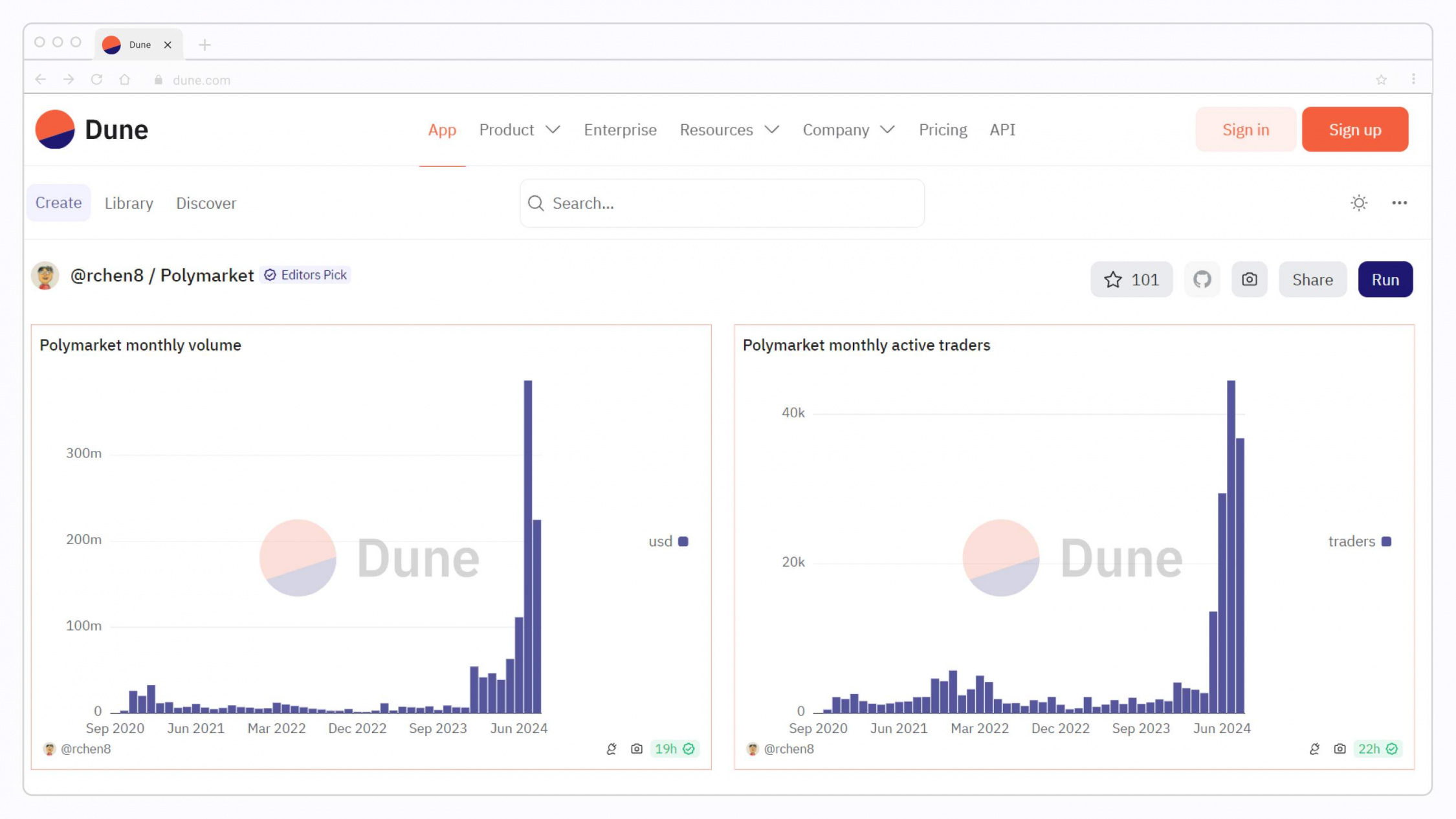

“Prediction Market Summer” doesn’t roll off the tongue quite the same way “DeFi Summer” does. But catchy hashtags aside, crypto prediction markets are the hottest onchain thing these days. On just one option — Polymarket — yearly trading volume to date has surpassed $1 billion.

Prediction markets are an exciting development in the blockchain space which has been dominated by DeFi and trends like decentralized social media (DeSO), blockchain-based gaming, and decentralized physical infrastructure networks (DePINs). But what are crypto prediction markets and what impact could they have on our understanding of future outcomes?

Understanding prediction markets

Predating the blockchain by centuries, prediction markets are a way to forecast the outcome of undecided events through financial wagers. While sports betting and futures markets for both traditional and crypto assets are some of the most widespread use cases, those applications are just the beginning. Crypto prediction markets like Polymarket allow you to financially speculate on a shockingly wide variety of event outcomes through the novel use of blockchain technology.

Even if you don’t wager on them, prediction markets can be a helpful resource for investors, entrepreneurs, and analysts. They are valuable for anyone who needs to predict future events as broad as the weather, the future price of BTC, or the likely outcome of a political election. They ostensibly serve as a more reliable and objective forecast source than, for example, polling data, which can be biased or politically motivated. The financial rewards and penalties associated with prediction markets serve to ameliorate that bias.

What’s unique about Polymarket and its decentralized competitors in the same niche is that they offer more markets, and access than their centralized alternatives. The underlying blockchain layer, whether it’s Layer 1 or Layer 2, ensure a higher level of privacy.

This is often accompanied by high trading liquidity. In July 2024 alone, Polymarket had over $387 million in trading volume.

What is Polymarket?

Polymarket isn’t the first prediction market, and certainly won’t be the last. However, it has become a dominant player in the decentralized sector — experiencing explosive growth in both trading volumes and monthly users in 2024. A crypto prediction market generally uses a blockchain to place wagers on the outcome of future events by locking cryptocurrency in a smart contract that settles when the market is finalized — meaning the outcome has been determined.

Polymarket users wager USDC — a USD-pegged stablecoin — on a plethora of outcomes using a share-based system. The vast majority of the time, the market outcome is clear. For the rare inconclusive or disputed edge case, disputes are resolved via UMA’s Optimistic Oracle system. It is designed to be resilient by financially punishing dishonest and malicious participants that dispute clear outcomes.

On Polymarket, you purchase shares ranging in price from $0.00–$1.00 that pay out $1 to winning shares and nothing to losing ones. Shares are priced based on probabilities determined by market participants. A winning $0.50 share and $0.25 share will see your money double and quadruple, respectively. A $0.01 share that resolves in your favor gives you a nice “to the moon” 100x return.

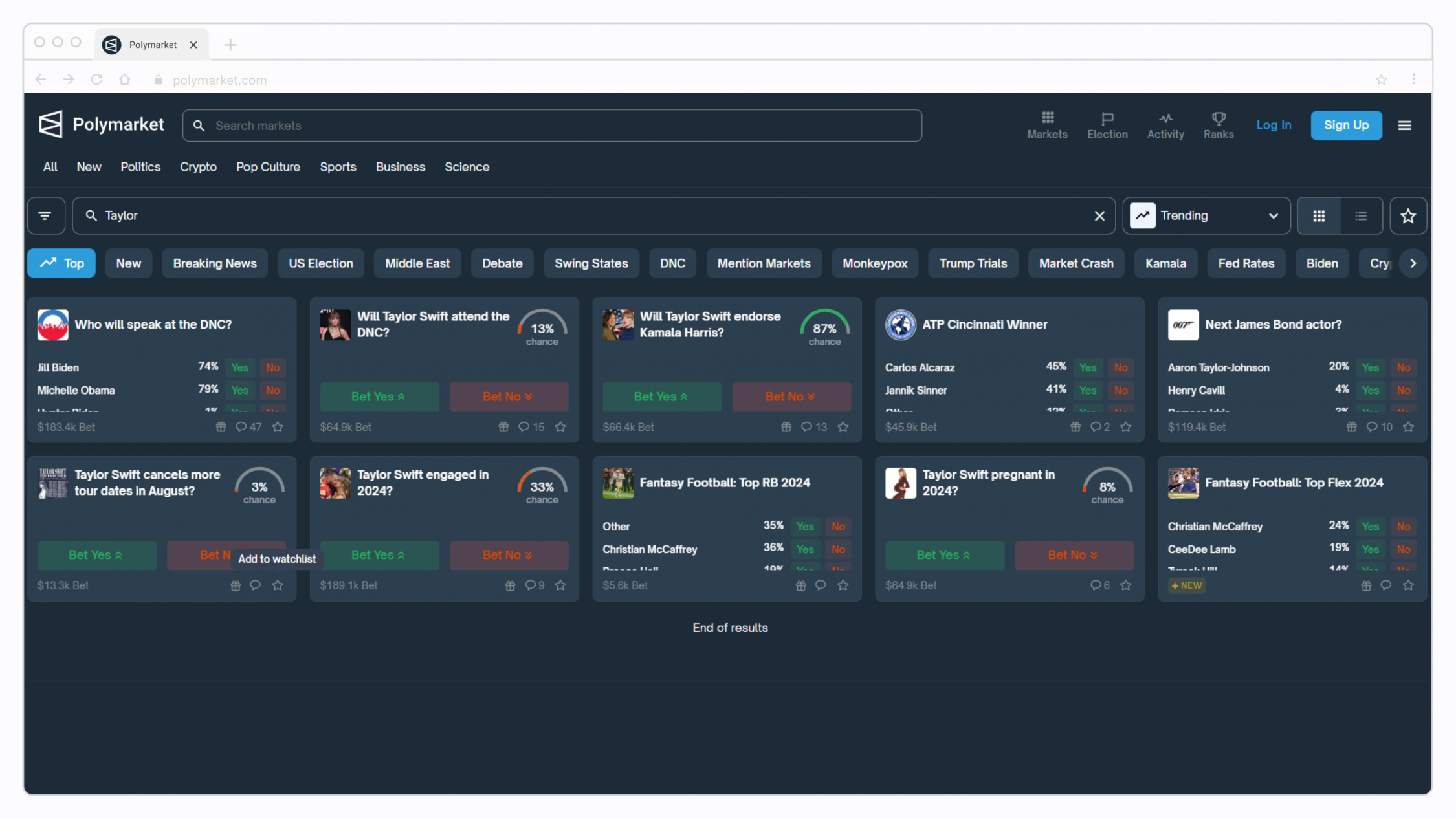

Polymarket uses two main types of markets: binary and categorical. This corresponds to either a “Yes/No” or a multiple choice question. Popular celebrity betting markets highlight Elon Musk, Taylor Swift, and Donald Trump — who features prominently in the Pop Culture, Crypto, and Election categories. Let’s examine some real Polymarket betting markets.

Polymarket’s numerous prediction markets

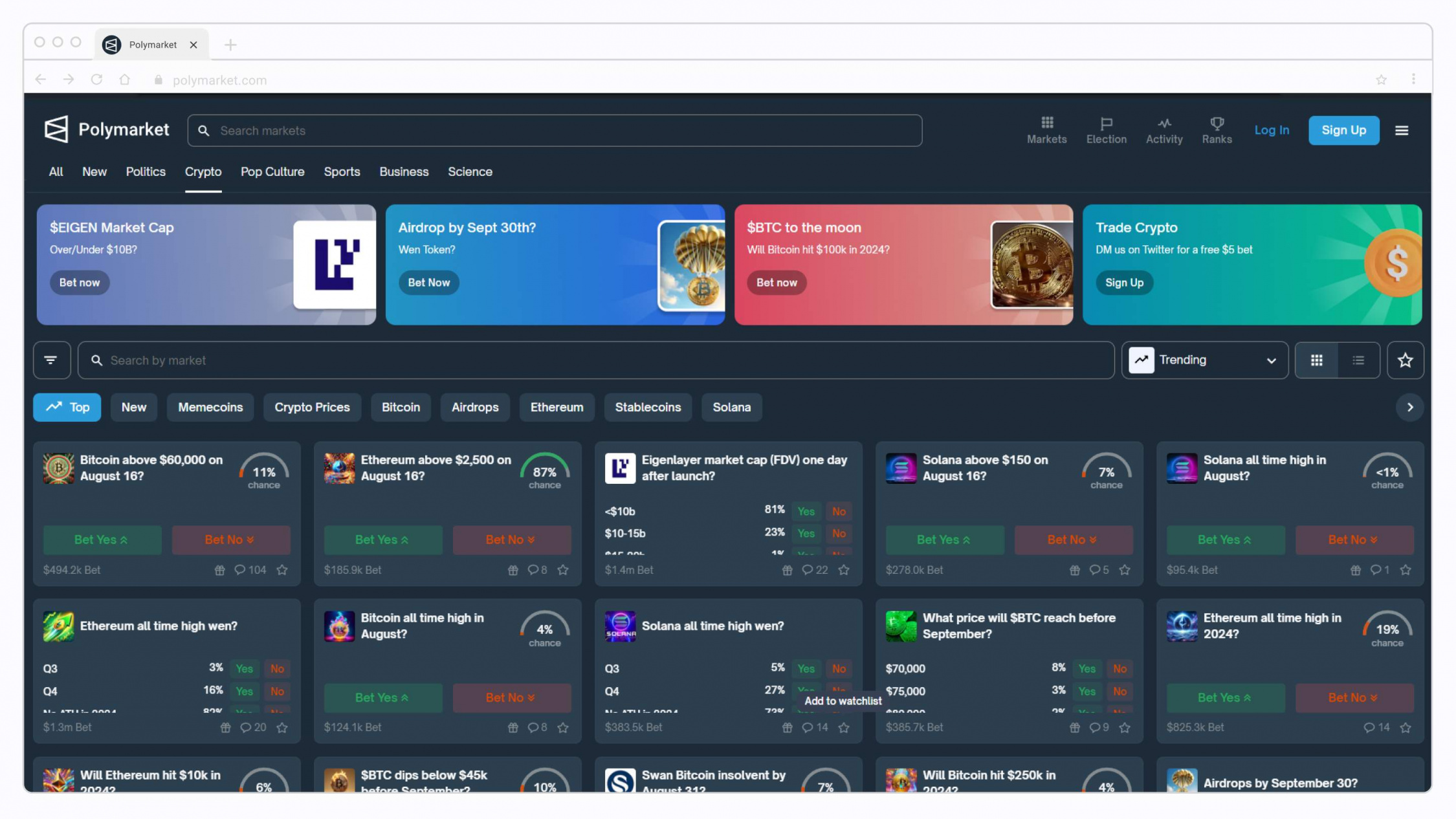

Aptly named and literally meaning “many markets,” Polymarket has set itself apart by providing far more prediction markets, in far more categories, than many of its competitors (Augur, Gnosis, Omen, DuelNow, Vega, and many others). It is run atop the Polygon blockchain, is pseudonymous, and benefits from lower transaction fees than prediction markets running on Ethereum. Current main categories include:

- Pop Culture

- Sports

- Business

- Science

- Crypto

- Olympics

- Politics

How to find a specific crypto market on Polymarket?

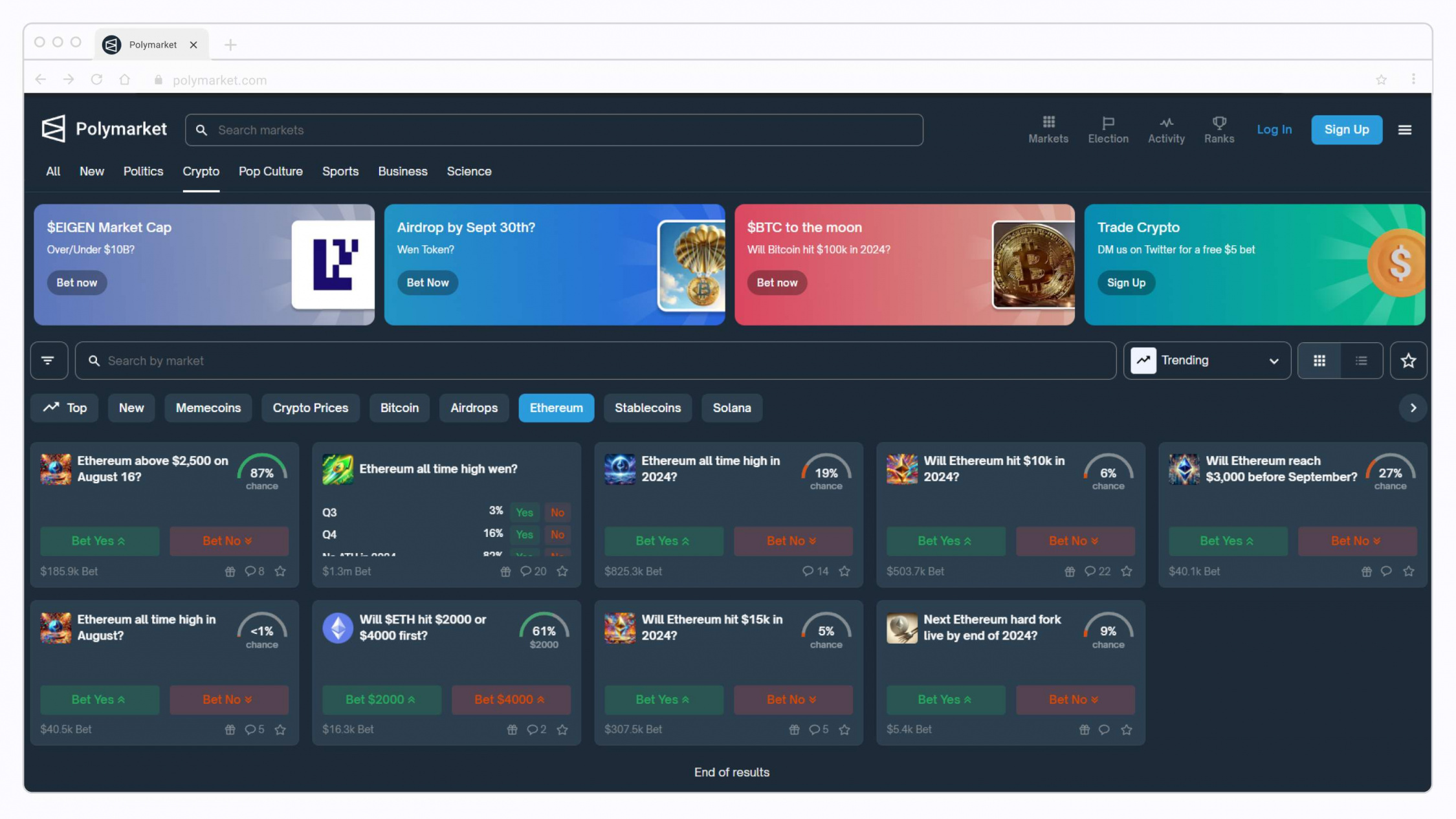

Let me walk you through an example. Filtering by subcategory, I select “Crypto” and see the top markets by trading volume:

Going further, I can then filter again by various blockchain categories. Now, I select “Ethereum” and can see the open Ethereum-focused markets:

There are a surprising number of betting markets merely in the Crypto category — and surprising levels of liquidity as well. I can find numerous options and deep order books in other categories as well. Just the 2024 Presidential Election Winner market alone has over $560 million in bets (at time of writing) — and counting.

U.S. elections markets: From congress to the president

It’s not just the presidential bets that are driving Polymarket crypto volume in the “Politics” category. Searching my home state of Minnesota (MN), I found the following markets:

- “Minnesota Presidential Election Winner”

- “Will Stancil wins Minnesota House Democratic Primary?”

- “Minnesota Senate Election Winner”

- “Tipping Point State in 2024 Election?”

- “MN-5 Democratic Primary Winner”

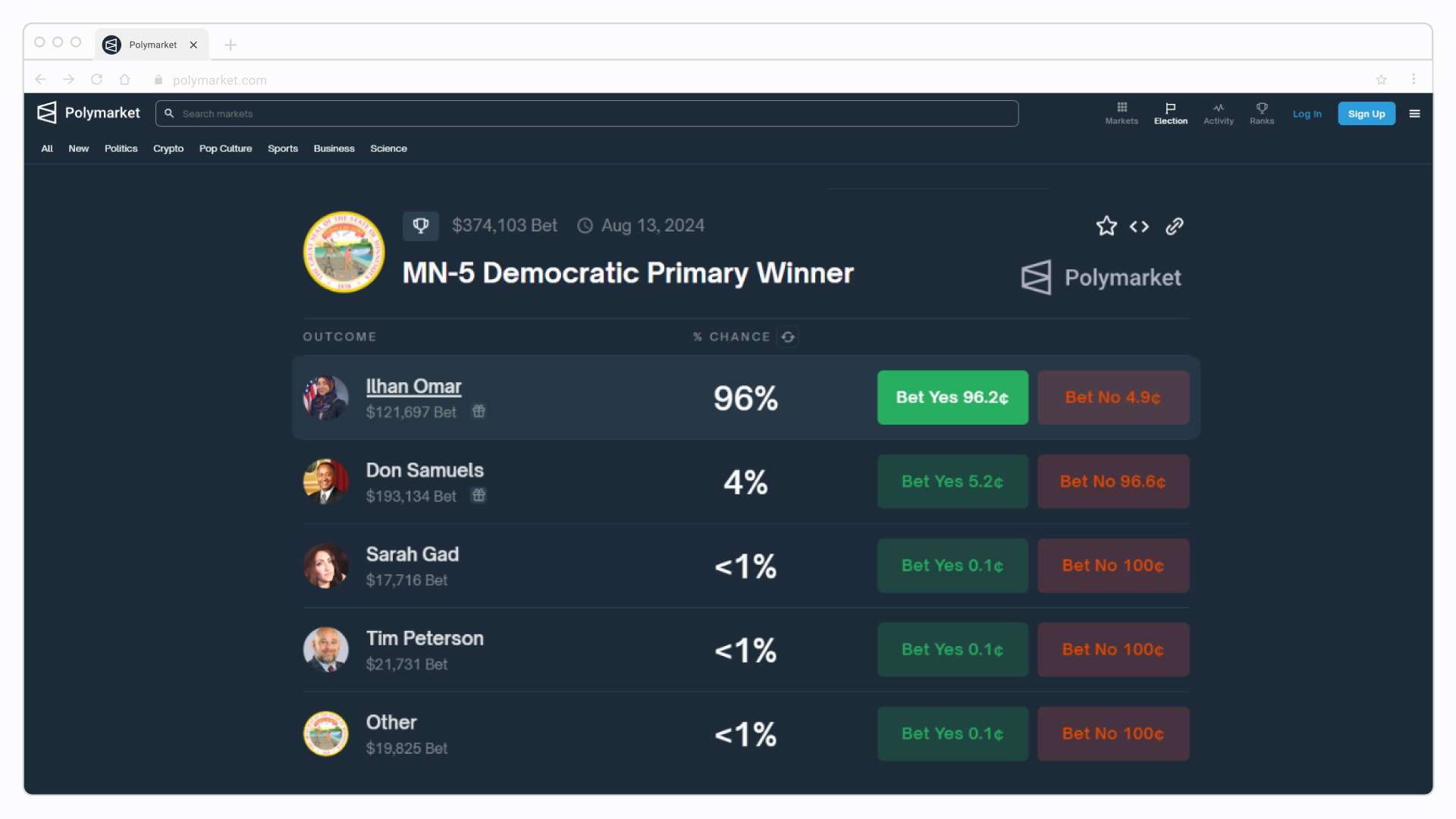

Perhaps surprisingly, people have bet over $374,000 solely on the “MN-5 Democratic Primary Winner”. The top vote getter earns the opportunity to run as a Democrat for one of 435 congressional seats. This Polymarket betting market is an example of a categorical market with five choices. It’s worth noting that while the incumbent (Omar) has a high probability of winning (at least according to this market), more money has been wagered on the candidate in second place (Samuels).

Image: Screenshot of Polymarket: Betting on who’s the democratic winner in Minnesota

Another thing you need to know is that you don’t need to wait for the outcome of a prediction market; you can trade your shares at any time. This allows you to lock in profits or minimize your losses — provided you have a willing counterparty. Let’s say you bought Samuels at $0.05/share and the price increased to $0.20/share. You could sell them immediately for a healthy guaranteed profit of $0.15/share.

On the other hand, let’s say the Samuel share price drops to $0.03/share and you want to exit your position. You would be able to preserve 60% of your original investment. In both instances, you’re being more conservative than the typical “all or nothing” binary outcome of waiting for your post-result shares to finalize at $0.00 or $1.00.

Where and how to win in this prediction market?

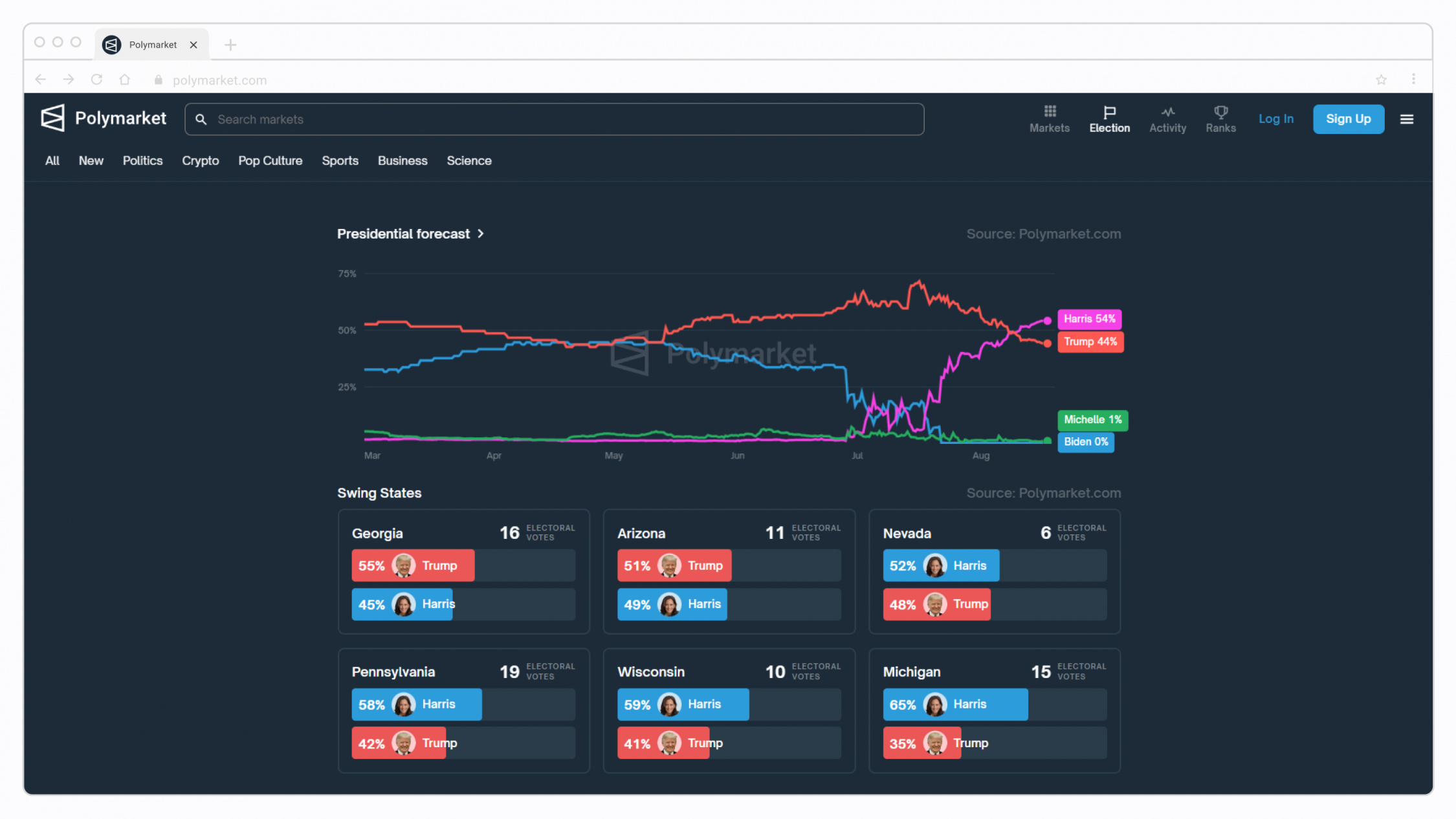

This example speaks volumes — pun intended — about the liquidity and depth of even obscure Polygon betting markets. However, the biggest 2024 summer market by a large margin is the U.S. presidential election between frontrunners Trump and Harris.

Looking at my home state of Minnesota (MN), the odds are 93:7 favoring Harris. Just across Minnesota’s southern border, odds in Iowa are flipped at 93:7 — favoring Trump. Bordering it on the east, Wisconsin is a swing state with odds hovering closer to 50:50.

In the high probability states, you can likely lock in some wins — but with conservative returns. Buying either of these aforementioned $0.93 shares, a winning $930 bet gets you $70 dollars — minus transaction fees. As these returns are modest by betting standards, much of the wagering is found in swing districts and states, meaning places that can “swing either way” and elect a candidate from either major party.

An accurate bet in these states will allow you to approximately double your wager — but share prices can fluctuate wildly, especially as the election date draws near. When there was heightened speculation that Biden would drop out, his share price started to decrease while Harris’ share price appreciated — forecasting Biden’s subsequent withdrawal from the race.

The future of Polymarket and prediction markets

More recently, Polymarket announced that it would now be accepting market bets via credit card and wire transfer through crypto services provider Moonpay. In addition, Polymarket released a widget integration that allows prediction markets to be inserted into the popular writing site Substack – an interesting option that allows writers to include live prediction market analysis in their articles (good for us 😀).

You can even get help placing bets using a crypto AI agent. One option is Polytrader, an AI agent designed specifically for prediction markets.

If you’re American, I should mention that Polymarket — though based in New York — is banned in the USA. This suggests that much of this betting volume — even for U.S. elections — is happening outside the USA. Like elections themselves, the use of prediction markets for forecasting election outcomes is a contentious topic. Eight members of the U.S. Congress have advocated for banning election-related prediction markets altogether.

For those with needs to predict future outcomes, the predictions on Polymarket can serve as an additional data point — along with other insights and research — to take probabilistic pre-event action.

This holds true whether you need to speculate on the weather-related effects of food commodity prices, the outcome of an Olympic event, or how an election outcome will influence future legislation that affects the crypto sector.

Just be warned, these are only probabilities — so don’t wager more than you can afford to lose. A 97% bet is wrong 3% of the time — provided the market has priced it correctly.

The only guarantees in life are death, taxes, and the immutability of past crypto transactions.