“Can we stop at a Western Union?” my mother-in-law asked as we sped across Morocco toward the Sahara. Her question almost made me choke on my water. Here we were, embarking on a journey through Africa’s largest desert, now on a side mission for a money transfer to the Philippines. Really?

It got me thinking. My mother-in-law is a first-generation immigrant to the United States who supports her family through remittances. I grew up privileged, in Germany. I had my own savings account since I was ten, and I write about how FinTech and blockchain will change our world for the better.

Well, it seemed they had not changed hers yet. Her son doesn’t have a bank account. And she had no choice but to rely on expensive services like Western Union. I witnessed frustration. The trip became a symbol of why financial inclusion matters. It was clear that we have a long way to go.

Here is the story of what financial technology has achieved and where we believe it is headed. Before we get there, let’s take a look at the status quo.

The unbanked, monetary instability & costly remittances

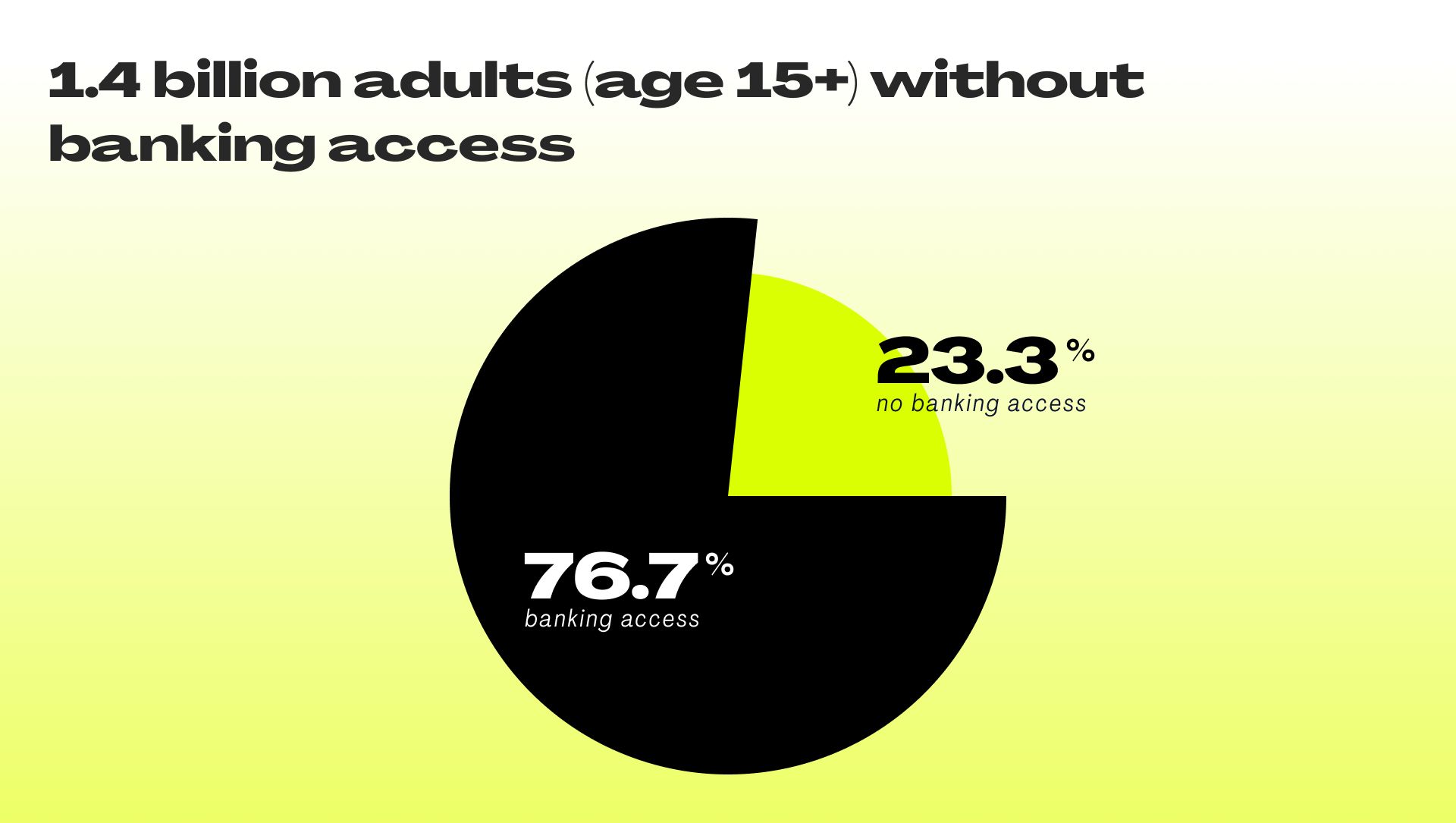

1.4 billion without banking access

In 2017, 33% of our adult population (age 15+) did not have access to an account at a financial institution. In 2021, this number dropped to 23%. The progress is a huge success – the status quo is not.

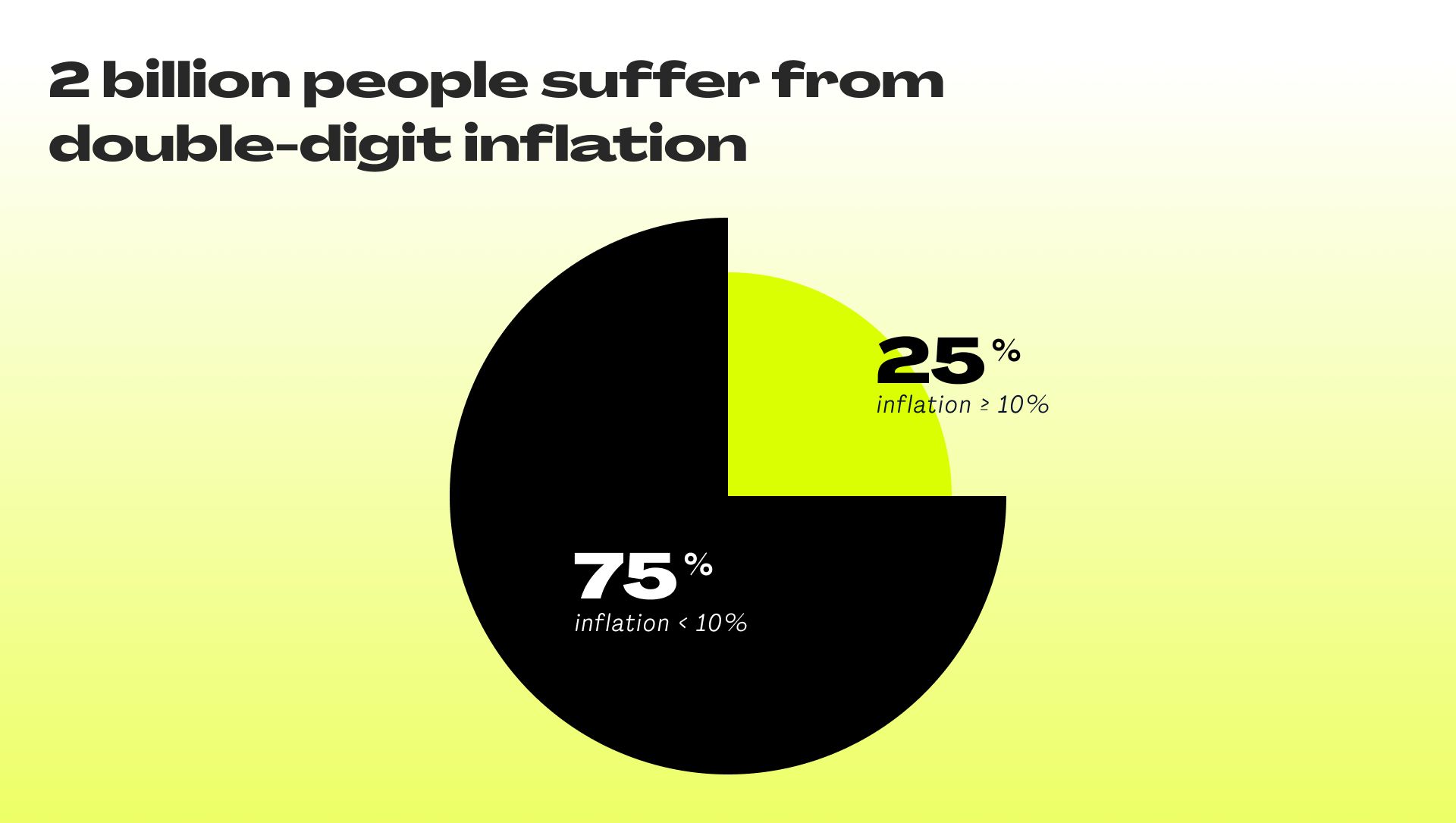

2 billion suffer from monetary instability

Dubbed the “tax on the poor” because it hits those with the lowest incomes the hardest, high inflation erodes individuals’ wealth and their ability to preserve the value of their earnings and achieve financial security.

This was the reality for one in four people in 2022, as they grappled with double-digit inflation.

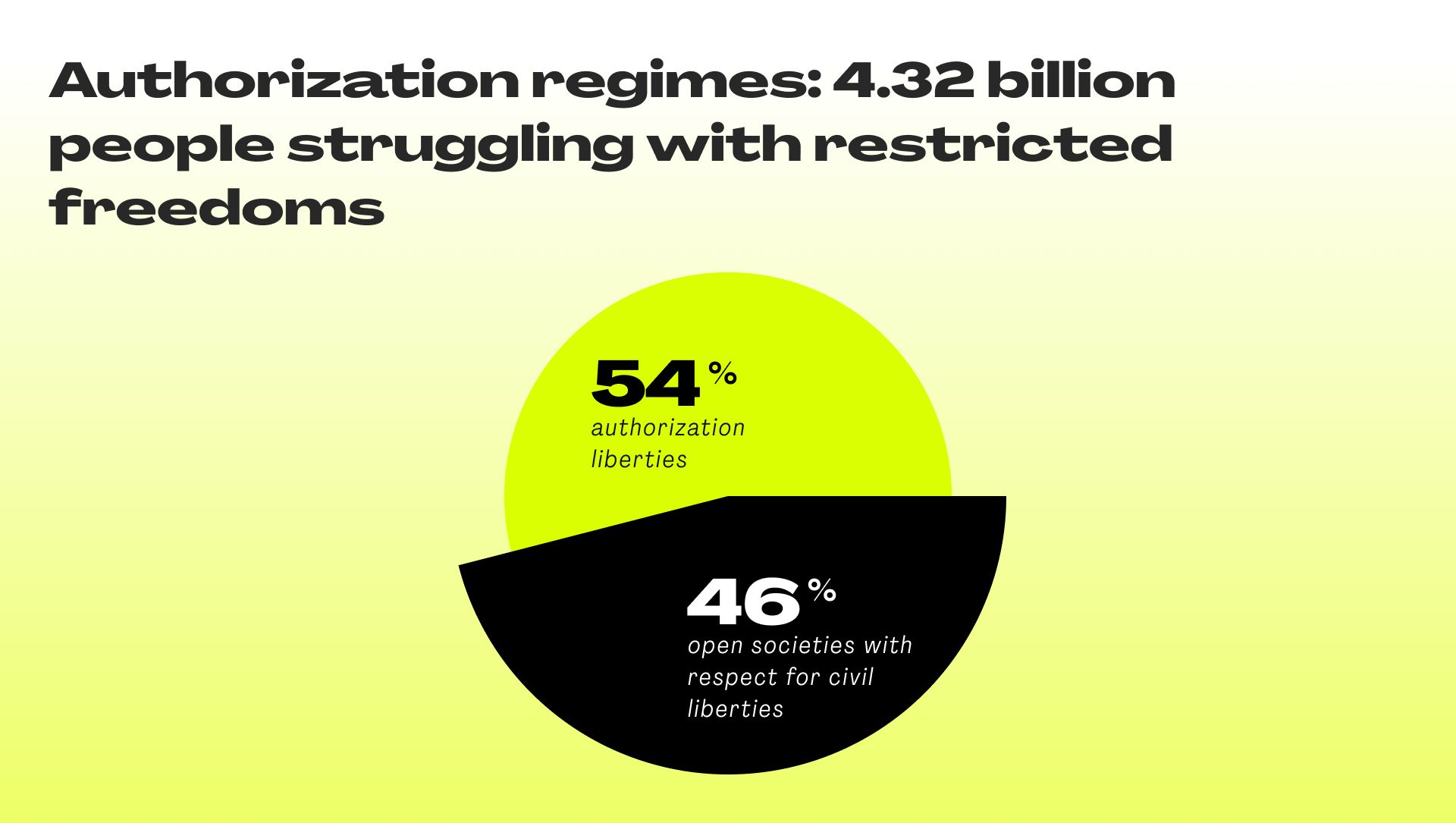

Over 4 billion people live in authoritarian regimes

Property rights are at risk under authoritarian regimes. And wealth accumulation, future investments, and social stability suffer hindrance. In 2022, more than half of our population lived in a fully or competitive authoritarian regime.

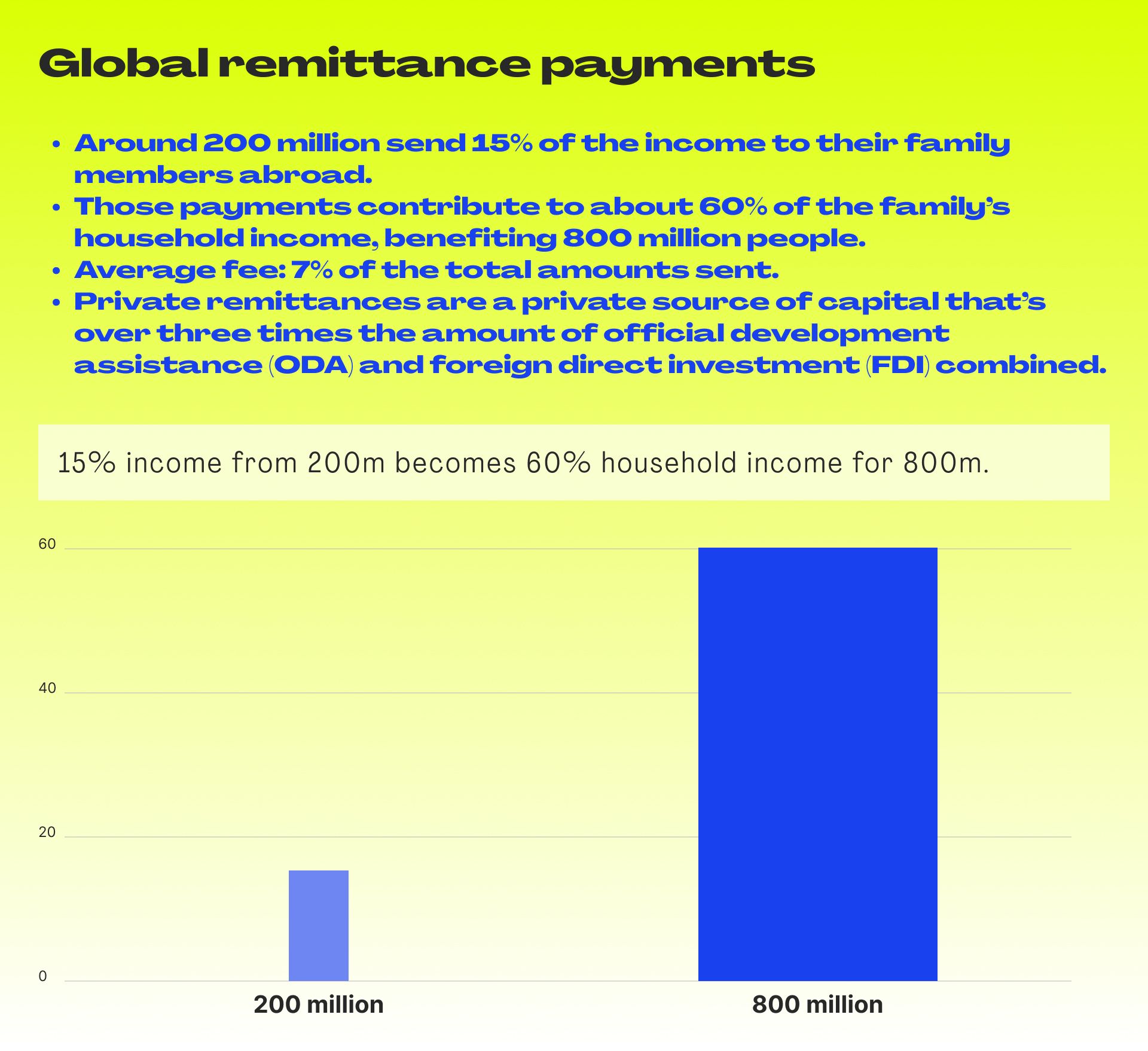

One billion rely on costly remittances

One out of eight people relies on global remittance payments. 50% of these funds go to rural areas, where the world’s poorest live.

For many, money does not make their world go round. But financial technology has made some big steps towards making finance accessible, affordable, and efficient. The product that does it all is the digital wallet.

How technology enables financial inclusion

A digital wallet does more than mimic a physical one. Modern digital wallets have become financial platforms. Some are evolving into super-applications. They offer services such as loans and remittance payments, hold credit cards, loyalty cards, boarding passes, train tickets, and soon ID documents and driver’s licenses.

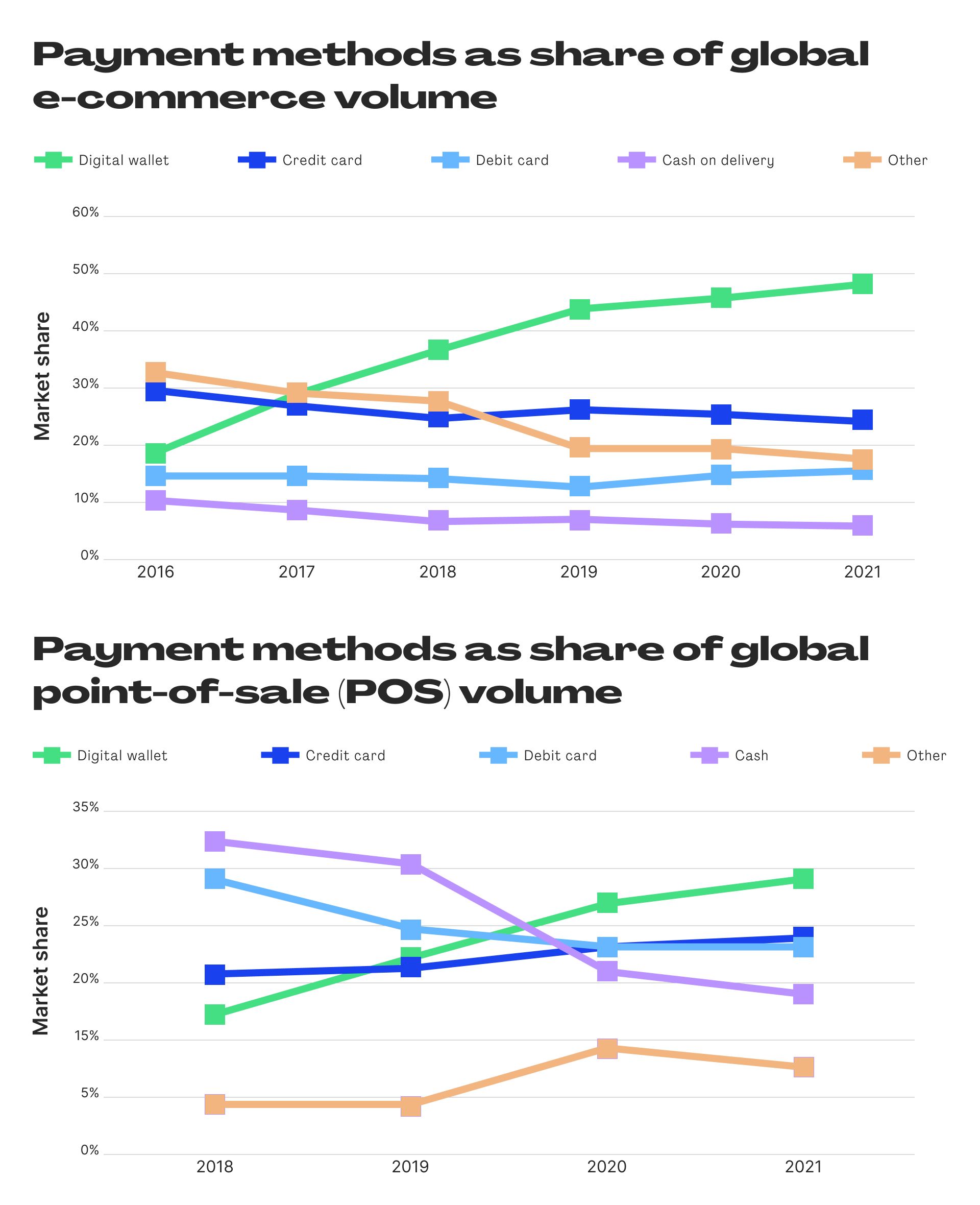

In 2021, digital wallets facilitated 49% of global e-commerce and 29% of offline transactions. Doubling their market share from 2018 and overtaking credit cards, bank transfers, and cash.

Digital wallet are affordable to maintain and are powerful agents of financial inclusion. They grant 3.2 billion users worldwide, 40% of the global population, access to essential financial services. In the process, they often overcome the barriers of traditional banking.

In Kenya, 84% of the population use digital wallets

In 2021, 44% of Kenya’s adult population had access to a bank account, but nearly double – 84% – have access to money transfers though M-Pesa.

The wallet enables customers to register at authorized agents and deposit cash in exchange for electronic money. Recipients can redeem the money for cash at agents or use it for purchases.

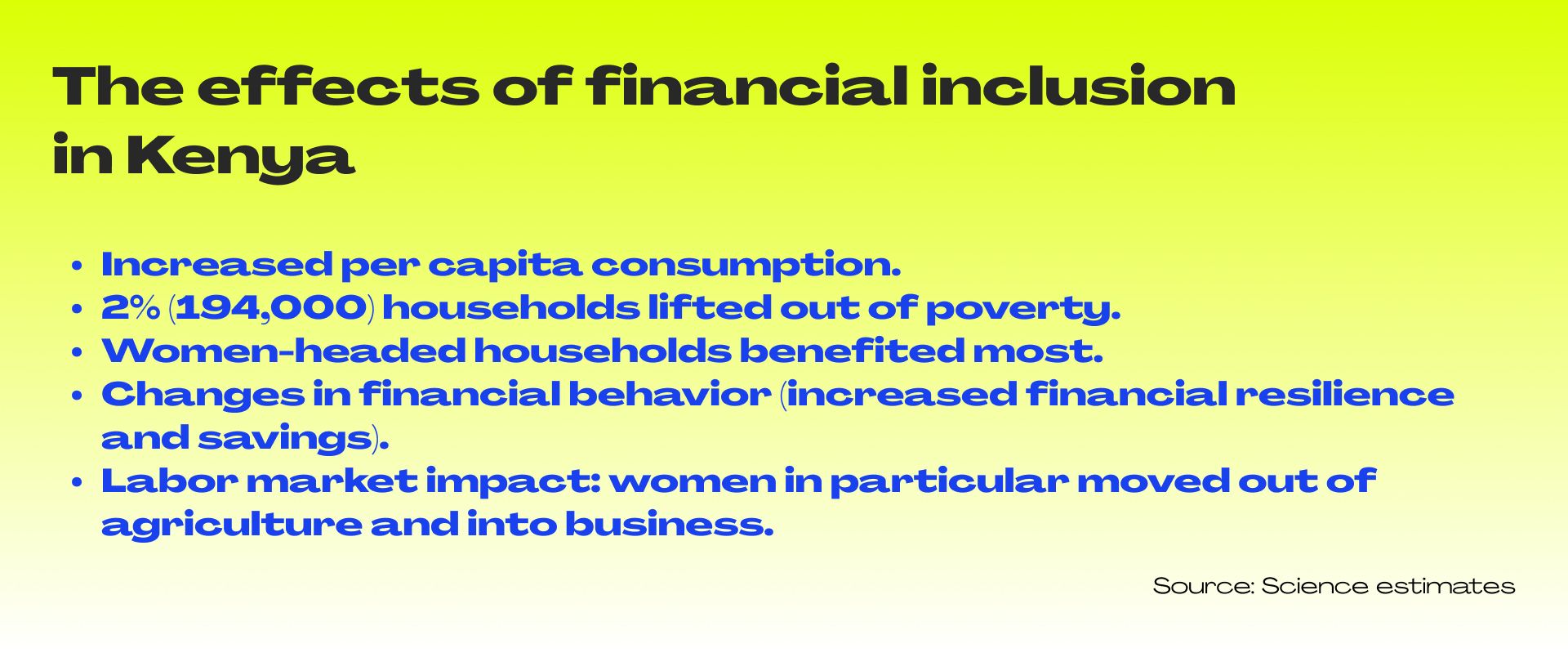

M-Pesa has played a significant role in propelling Kenya’s financial inclusion from a mere 26% in 2006 to an impressive 84% in 2021.

In 2022, M-Pesa processed over a billion monthly transactions across Africa. At least one person in 94% of Kenyan households uses the service. And it’s having a transformative impact on the Kenyan economy.

8000 kilometers to the east, the situation is completely different.

In 2022, 68% of the Vietnamese population had a bank account. The number has doubled since 2017. In Vietnam, most bank transfers are instant and affordable, and feature-rich digital wallets like MoMo are becoming increasingly popular.

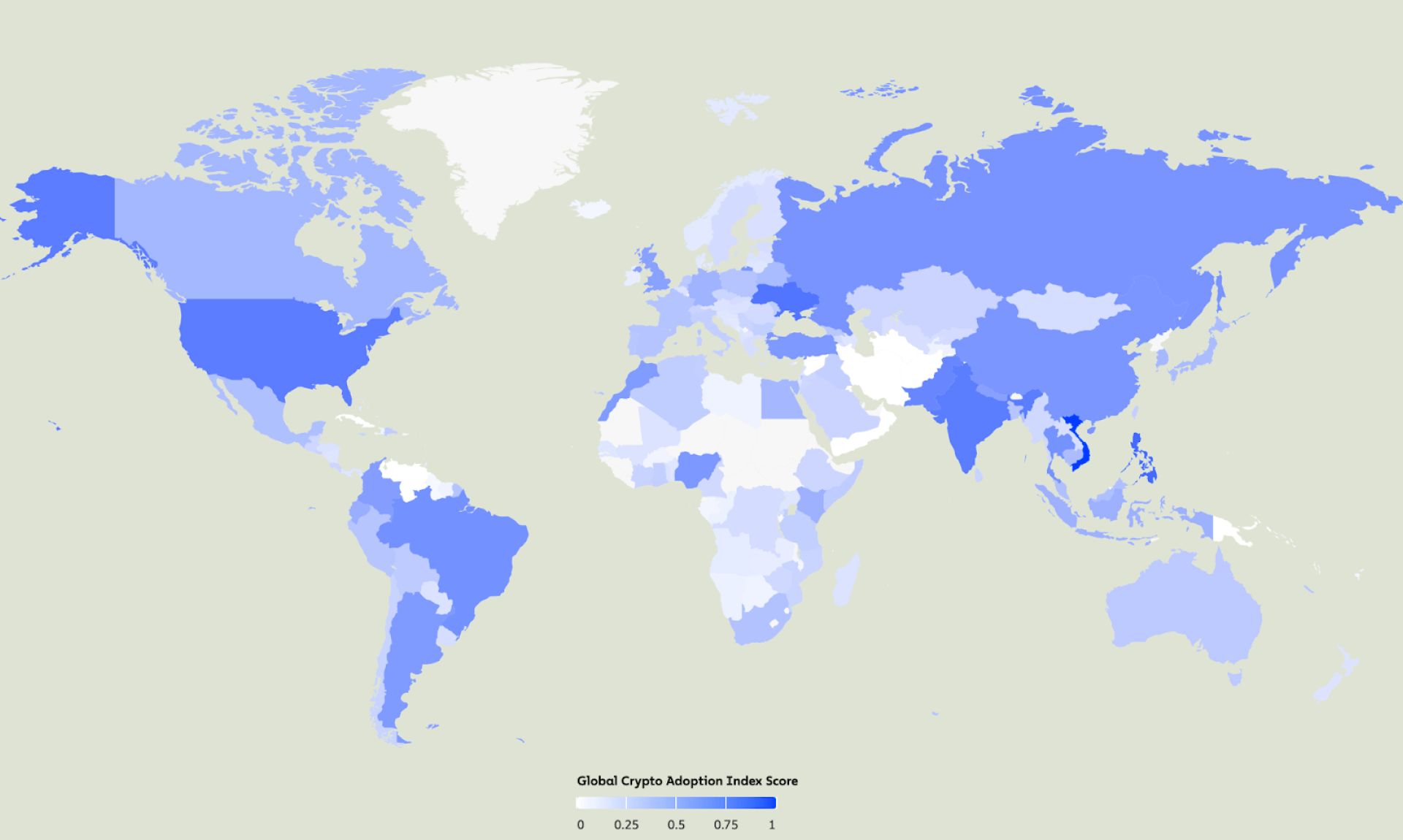

Financial services are accessible in Vietnam, but many are exploring alternative blockchain solutions. In 2020, 21% of the Vietnamese population were using cryptocurrencies and since then, the Southeast Asian country has emerged as a notable player in the cryptocurrency space, ranking #1 in Chainalysis’ 2022 Global Crypto Adoption Index.

Vietnamese adopt cryptocurrency despite accessible banking sector

We wanted to know why, and talked to a Vietnamese vendor who prefers to remain anonymous.

“The Vietnamese banking system is very archaic. I am very reluctant to use banks. Just to send money to my international suppliers, I have to provide a stamped and signed sales contract. Ideally written in English and Vietnamese.

You know, no one will stamp a sales contract outside of Vietnam, especially if it is in a foreign language. It’s a constant struggle.

I know that the restrictive regulatory environment is driving people to use cryptocurrency for international transactions. It’s cheap, it’s fast, and it allows you to bypass complicated and costly bureaucracy.”

A very brief history of Bitcoin, blockchain and Web3

Bitcoin

It’s fair to say that Bitcoin turned finance upside down. After, and possibly as a reaction to, the 2008 Global Financial Crisis, Bitcoin went live in January 2009.

The creators of Bitcoin designed it as a peer-to-peer electronic cash system, enabling anyone in the world to freely use the blockchain. Unlike any other payment rail at the time, Bitcoin is global, permissionless, and transparent.

Blockchain

At its core, a blockchain is an open, transparent and immutable ledger. It serves as a consensus point for account balances and transactions. Trust in the legitimacy of new transactions provides a consensus mechanism.

Decentralized finance

In 2020, decentralized finance (DeFi) applications gained traction. These autonomous financial protocols are, like the underlying blockchain, permissionless. Users can borrow and lend, trade or invest without intermediaries.

Invest in? Digital assets: cryptocurrencies, derivatives, insurance policies, tokenized real-world assets, and more.

In summary, a parallel financial system now exists, accessible to anyone with internet access and a smartphone. It’s permissionless, censorship resistant and transparent. Problem solved, one might say.

Of course, this is not the case – yet. The young system has its flaws. More on this later.

Web3

But there is a decentralized (not just financial) ecosystem based on blockchain, coined Web3.

To access this system, users need a Web3 wallet.

Creating a Web3 wallet simply involves securing a set of private keys (similar to a password) and does not require any documents. These keys unlock access to the assets held in the Web3 wallet. Unlike Web2 wallets such as M-Pesa and MoMo, users keep their digital assets in self-custody. This gives them more control over their assets – and the responsibility to secure them.

Worldwide, approximately 850 million people lack proper documentation required to open any traditional financial accounts, and one in three adults report difficulties in accessing financial services. For those with a smartphone or even a feature phone, Web3 could be the first point of access to financial services.

In December 2022, 425 million people owned cryptocurrency. The number increased by 39% in 2022. Very popular are stablecoins, tokens pegged to the US dollar. They are especially favored in regions where people suffer from high inflation.

Argentinians and Venezuelans escape inflation through stablecoins

Maintaining wealth is difficult for Argentinians and Venezuelans. The purchasing power of their fiat currencies is rapidly eroding. Even with a moderate inflation rate of 5%, purchasing power will decline by over 90% in 50 years.

During Argentina’s debt crisis in the 1980s, inflation peaked at 3,000% and averaged 206.2% per year until 2022. Meanwhile, Venezuela’s inflation outruns this at a yearly average of 3,608.8% from 1980 to 2020. Tight capital controls in Argentina mean citizens can only exchange $200 worth of pesos per month into their preferred store of value: the US dollar.

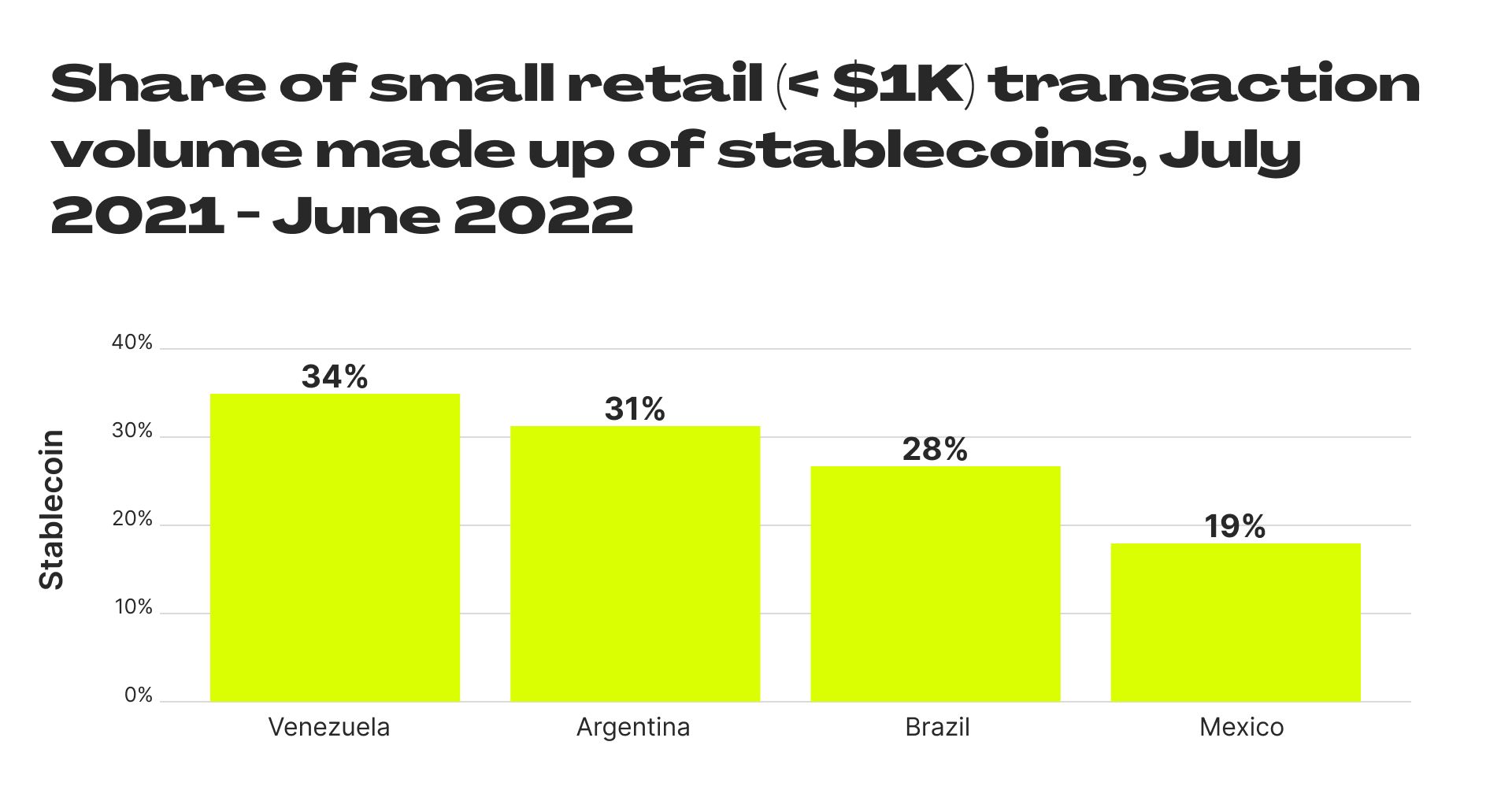

With these restrictions in place, stablecoins became popular. Argentina and Venezuela account for the highest share of retail stablecoin transactions between July 2021 and June 2022.

But stablecoins do not only serve as a store of value. They are also a popular solution to avoid high remittance fees.

Filipinos escape remittance fees through stablecoins

In 2021, 1.83 million overseas Filipino workers sent home $34.88 billion in remittances, accounting for 9.3% of the Philippines’ GDP. Users paid a staggering $1.4 billion in fees, equivalent to 0.37% of the GDP, with an average fee of 4%.

Could stablecoins be the answer? For some Filipinos, yes. Stablecoin remittance payments are a driving factor behind cryptocurrency adoption in the Philippines.

But could stablecoins be a solution for everyone (including my mother-in-law)?

We asked Paul Espinas, the co-founder of Hatid Ko Na Po (“Let Me Send It For You”) – an early-stage startup that aims to ease the remittance situation between the U.S. and the Philippines.

“In a way, Web3 is the ideal solution for sending money around the globe. It’s cheap, instant, and doesn’t require a bank account. The problems start when you try to take the money out of this parallel financial system. In the Philippines, you cannot use stablecoins to buy groceries.

And Web3 is still clunky. You hear about hacks and scams. Most people aren’t ready for that, and the technology isn’t ready either. The resources we’d have to spend to educate them on a pure Web3 solution would be immense.

I expect this to change as the years go by. With growing adoption and improved UX, we see the potential and will eventually partner with Web3 systems.

But keep in mind that we don’t want to be a global remittance system. We want to operate with a focus on helping our fellow Filipinos, so they don’t waste a dime of their hard-earned money. For now, the traditional Web2 route will get us there faster.”

Multifaceted challenges require multifaceted solutions

Financial inclusion is complex. The financial sector operates in 190 jurisdictions, each with different regulatory requirements. And the current system often leaves many on the margins.

Digital wallets have begun to bridge the gap. Blockchain is global, and has the potential to reach those that fintech has been unable to reach due to regulatory restrictions. Those among us without identification documents, for example.

But for now, the blockchain ecosystem has only a few links to the rest of the financial system. A barrier that will diminish over time. Perhaps when Apple integrates Bitcoin into its wallet, the time will have come to send money with the ease of an email. Until then, Hatid Ko Na Po has the potential to add 0.37% to the Philippines’ GDP.

This is what technology can do for people. But what can blockchain do for the broader financial system?

Outlook – The big picture

Our financial system is rife with duplications and operational inefficiencies. Each institution maintains its own siloed, opaque ledgers. These ledgers need constant updates and reconciliation to resolve discrepancies. Isolated payment systems cater only to domestic markets. A system that’s ineffective, expensive, and slow.

There is no fast, affordable, and compliant global payment rail.

It’s worth taking a moment to understand that blockchains have the potential to solve this.

Blockchains provide a shared, transparent, immutable, instant, distributed ledger. If parties transact on a blockchain, the blockchain adds the data automatically, once. Regulatory clarity would allow the programming of compliance into assets and wallets.

What we get is a fast, affordable and compliant global payment rail and operational efficiency.

Would large financial institutions trust the most fundamental aspect of their business to a public database? Most aren’t ready. But some are. The first Australian bank has just started using blockchain rails for cross-border transactions with its own stablecoin.

For some, blockchain adoption may seem daunting. But the potential isn’t going away. Adoption continues, and some would say the genie is out of the bottle.