For Web3 startups, choosing a blockchain is as critical as choosing the right jurisdiction for a traditional business.

The startup nations of blockchain

Blockchains are startup societies, almost state-like entities. And they are courting you – entrepreneurs, founders, startups – to migrate to and build on their network.

But each blockchain has its own unique blend of economy, currency, taxes (network fees), infrastructure and demographics.

So if you’re wondering which blockchain nation to call home, our in-depth Onchain Research Report provides some answers.

In this article, we take a closer look at Ethereum’s strengths, challenges and challengers, and what its dominance means for Web3.

Ethereum dominance – where does it come from?

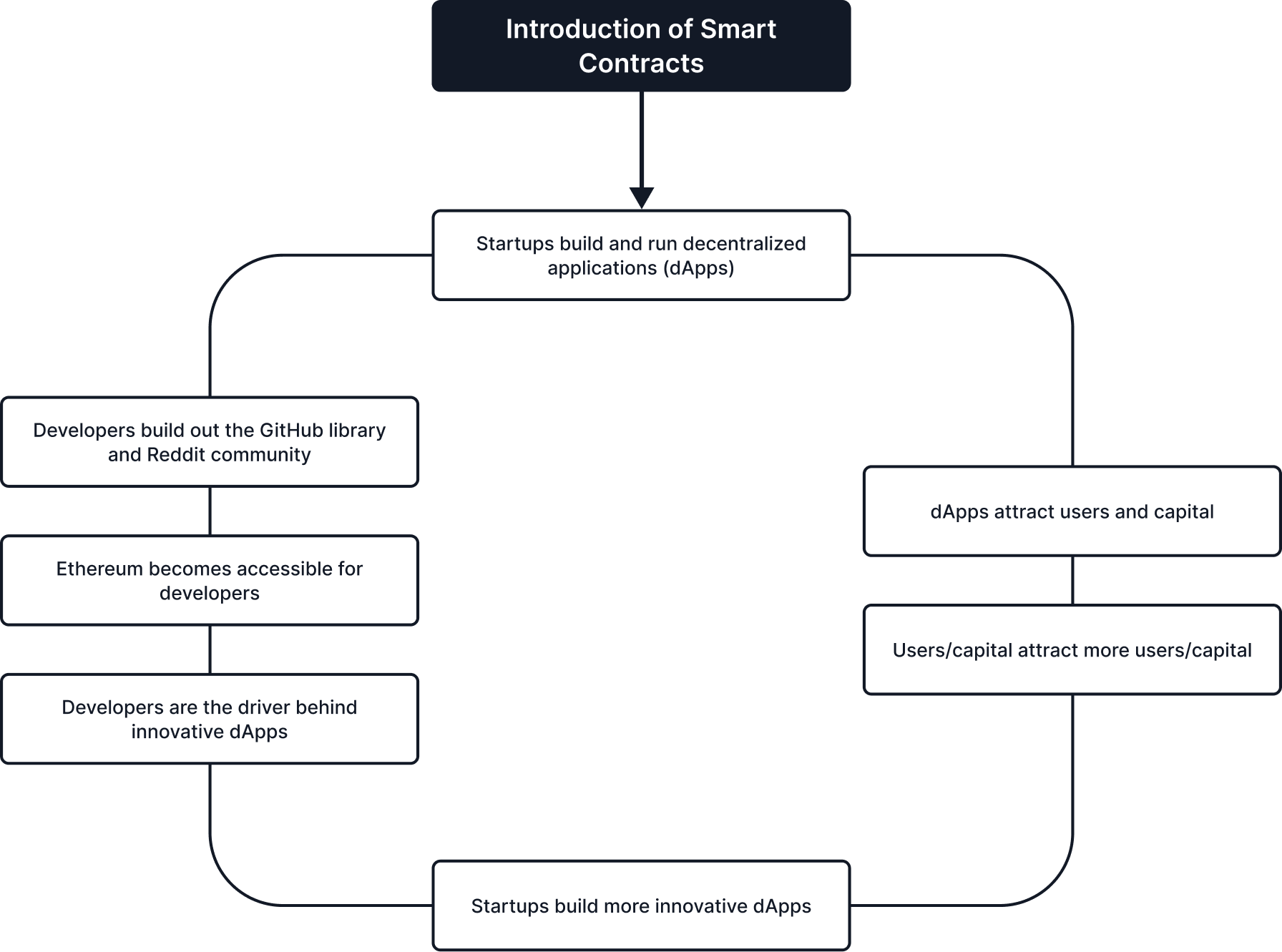

The first step is to understand Ethereum’s network effects.

First proposed in 1980, Metcalfe’s Law states that the value of a telecommunications network is proportional to the square of the number of users.

Today it is still used to explain network effects in Web3. And Ethereum, the pioneer of smart contracts, exemplifies it with a flywheel effect. A flywheel effect that underpins its continued dominance.

This effect, and Ethereum’s resulting dominance, isn’t just theoretical; it’s in the numbers.

Ethereum dominance in numbers

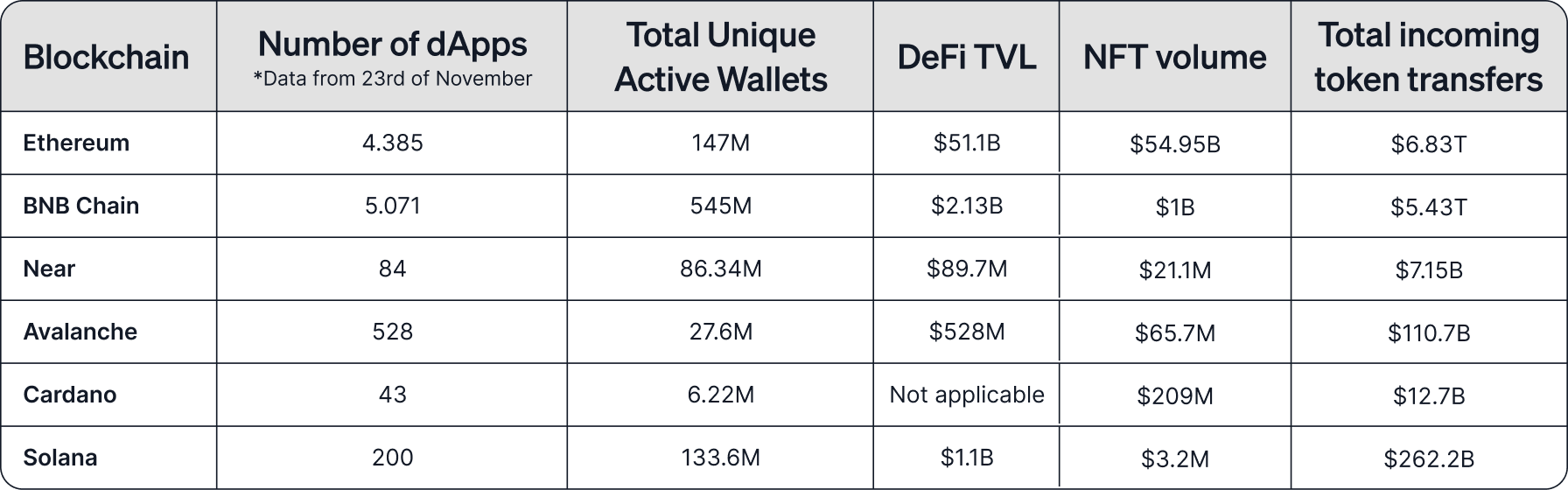

Ethereum is home to 55 times more NFT volume than BNB Chain, its closest competitor, and 24 times higher value locked in its DeFi protocols.

This raises the question: What draws big money to Ethereum?

Why Ethereum is dominating Web3

Ethereum is not only the herald of smart contracts, it also sets the bar for decentralization and security for all other Layer 1 blockchains.

- In a decentralized system, there is no single point of failure. This allows users to have control over their money without relying on a centralized authority.

- Security refers to a blockchain’s ability to ensure data integrity and protect that data from malicious actors.

This and the fact that Ethereum is battle tested since 2015, evokes the trust that attracts users, capital and entrepreneurs to the system.

However, Ethereum users pay a high price for these security guarantees.

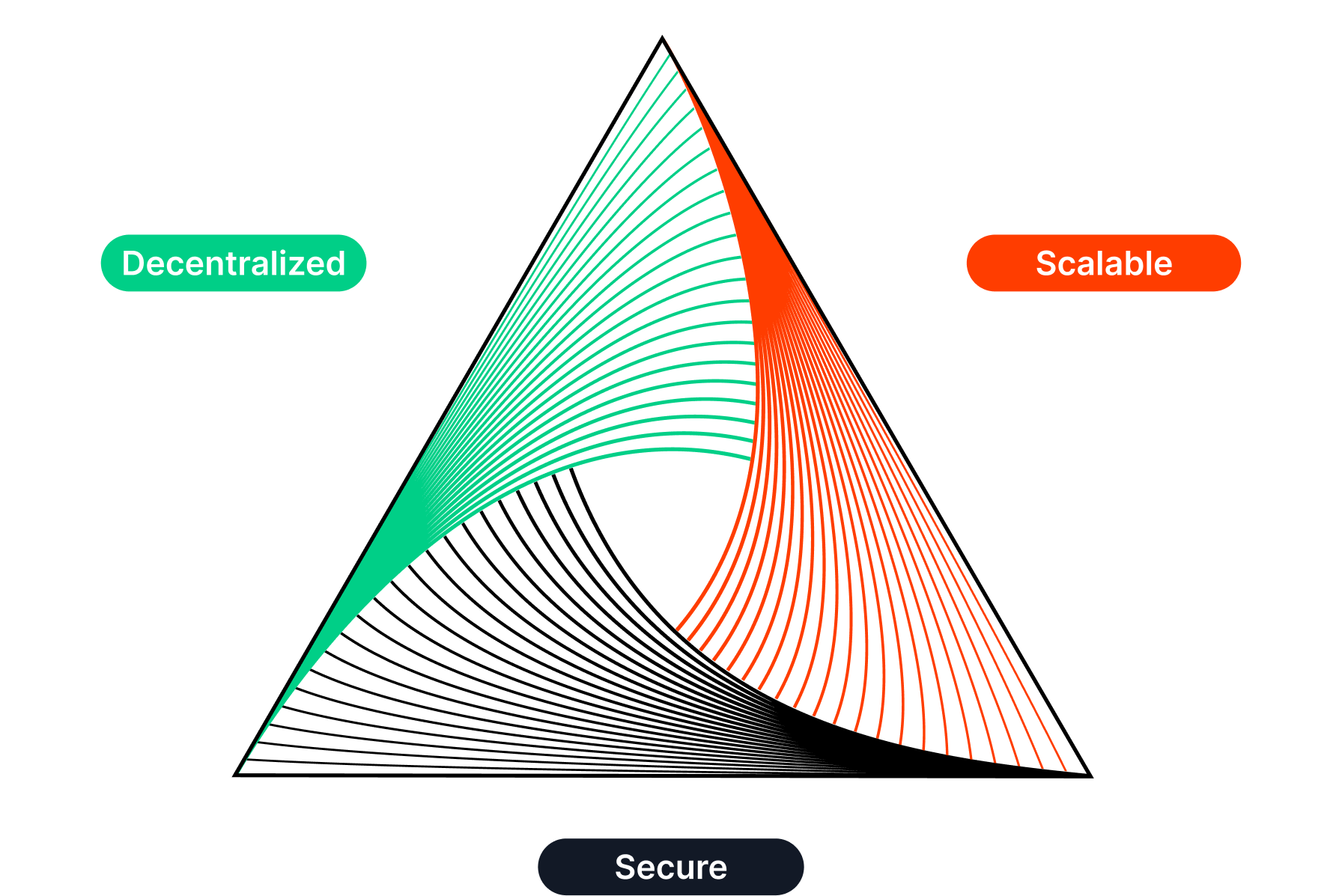

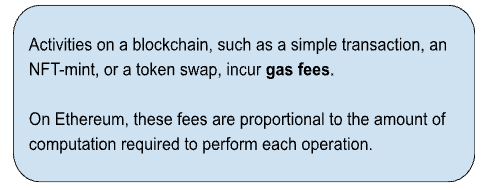

High gas fees and the blockchain trilemma

The blockchain trilemma states that a blockchain can only provide two of the three benefits of decentralization, security and scalability at any given time.

Ethereum’s DNA is decentralized and secure. The sacrifice in scalability results in higher gas fees and network congestion than on any other Layer 1 blockchain.

The median price for Ethereum gas fees in 2023 was $2.99. However, during periods of higher congestion, the median price per transaction exceeded $30.

The consequences of high gas fees

- High fees mean that Ethereum is profitable. It does not need to inflate its currency (ETH) to fund its own security and validators. In fact, Ethereum is deflationary since the Merge.

- Large entities like the National Australia Bank, which uses Ethereum for intra-bank cross-border transactions, won’t be as affected by high transaction fees as retail users.

- But retail users feel the pinch. High fees are a clear incentive to look for cheaper alternative Layer 1s.

- For startups, this suggests their potential customers might lean towards other blockchains.

The future of Layer 1s

Alternative Layer 1 blockchains lure users with cheaper gas fees, but they have their own challenges.

No “Ethereum Killer” has achieved comparable network effects as its prey. And scalability gains come at the expense of decentralization or security.

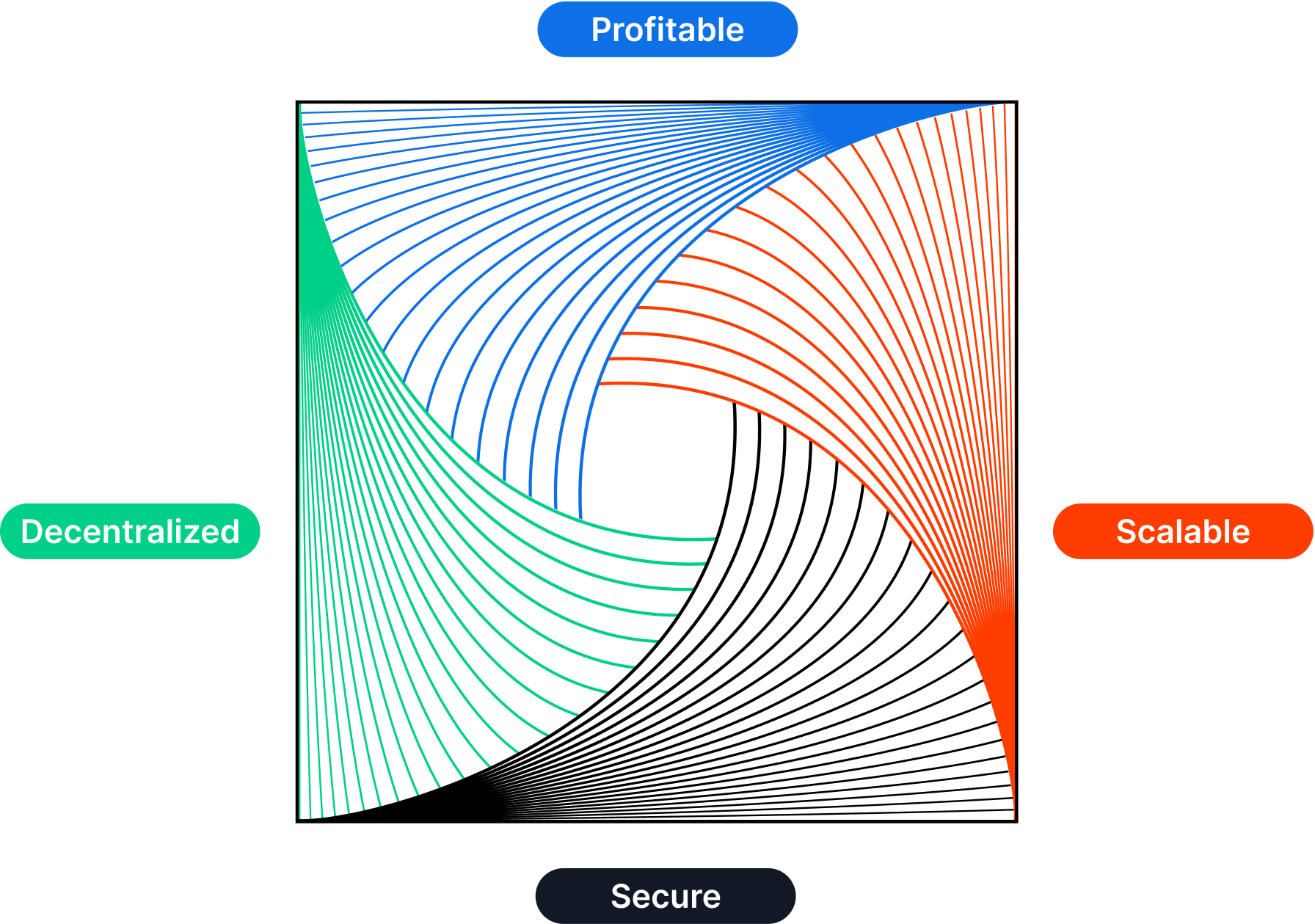

Besides, we need to weave in the sustainability of the business models of given blockchains. This brings us to the Blockchain Tetralemma, coined by our research team.

The blockchain tetralemma

A blockchain sells block space for a fee – that’s the business model. It is something we need to consider, but few do.

Lower fees mean less revenue.

Let us now take a look at why we have extended the Blockchain Trilemma using Solana as an example.

Solana – the price of cheap transactions is profitability

Imagine that Apple sells an iPhone 15 Pro Max for $30. That’s about the discount you got on Solana’s block space in December 2023.

In that month, Solana generated $9 million in fees against $174 million in expenses.

Solana is fast and affordable, and has attracted many users since its comeback in 2023. Its active wallet addresses in December 2023 grew 81% YoY.

When Solana grows, the organic demand for its token can offset the token inflation required to fund network security.

But in the future, Solana faces a tough choice: inflate SOL or increase fees to generate more revenue.

A comparison of the Layer 1 landscape

At this point, we can draw a conclusion about the Layer 1 landscape.

Blockchains like Solana have a clear edge in scalability.

Ethereum leads in sustainability, security, decentralization and network effects.

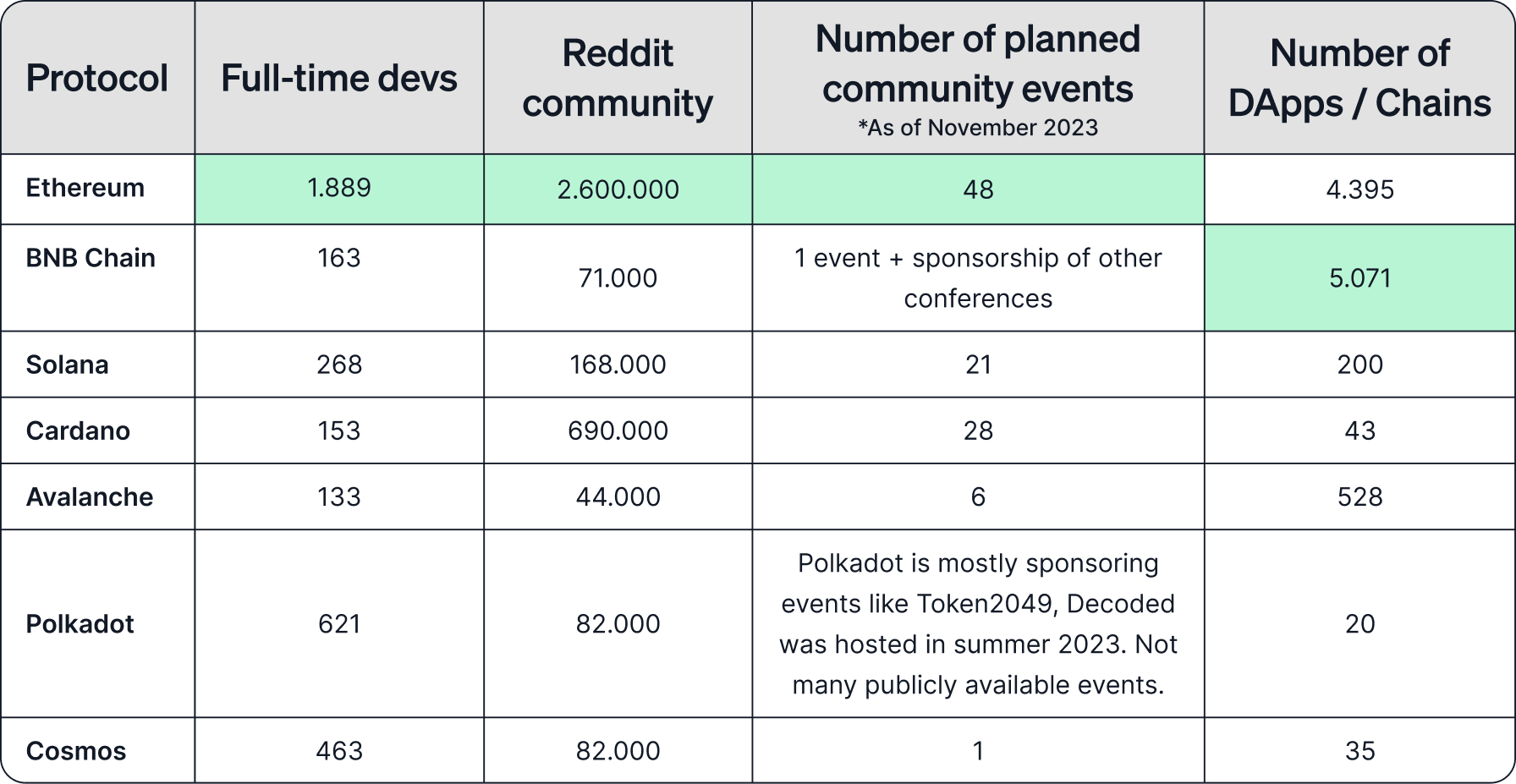

The chart below underscores Ethereum’s dominance in developer numbers, community events, and online presence.

Ethereum, however, has reached its limits. High fees and congestion are not negligible and hinder further growth.

This leads us to Layer 2 solutions.

Built on top of Ethereum, these blockchains offer fast transactions and lower fees. At the same time, they tap into its network effects and security.

The future of Layer 2s: The Ethereum express

Layer 2s handle many transactions off-chain before bundling them into one for Ethereum, saving block space and fees for users.

This explains the growing popularity of these scaling solutions and why Layer 2 transactions surpassed Ethereum transactions for the first time in November 2022. Source: https://l2beat.com/scaling/activity

Source: https://l2beat.com/scaling/activity

Since then, the combined transaction count of Layer 2 continues to grow. Currently, Layer 2s process about 6 times more transactions than Ethereum itself.

Among Layer 2s, rollups shine as the leading solution. Rollups operate as scalable blockchains tethered to Ethereum via smart contracts.

Rollups ease the pain – Layer 2s in numbers

The impact? Striking.

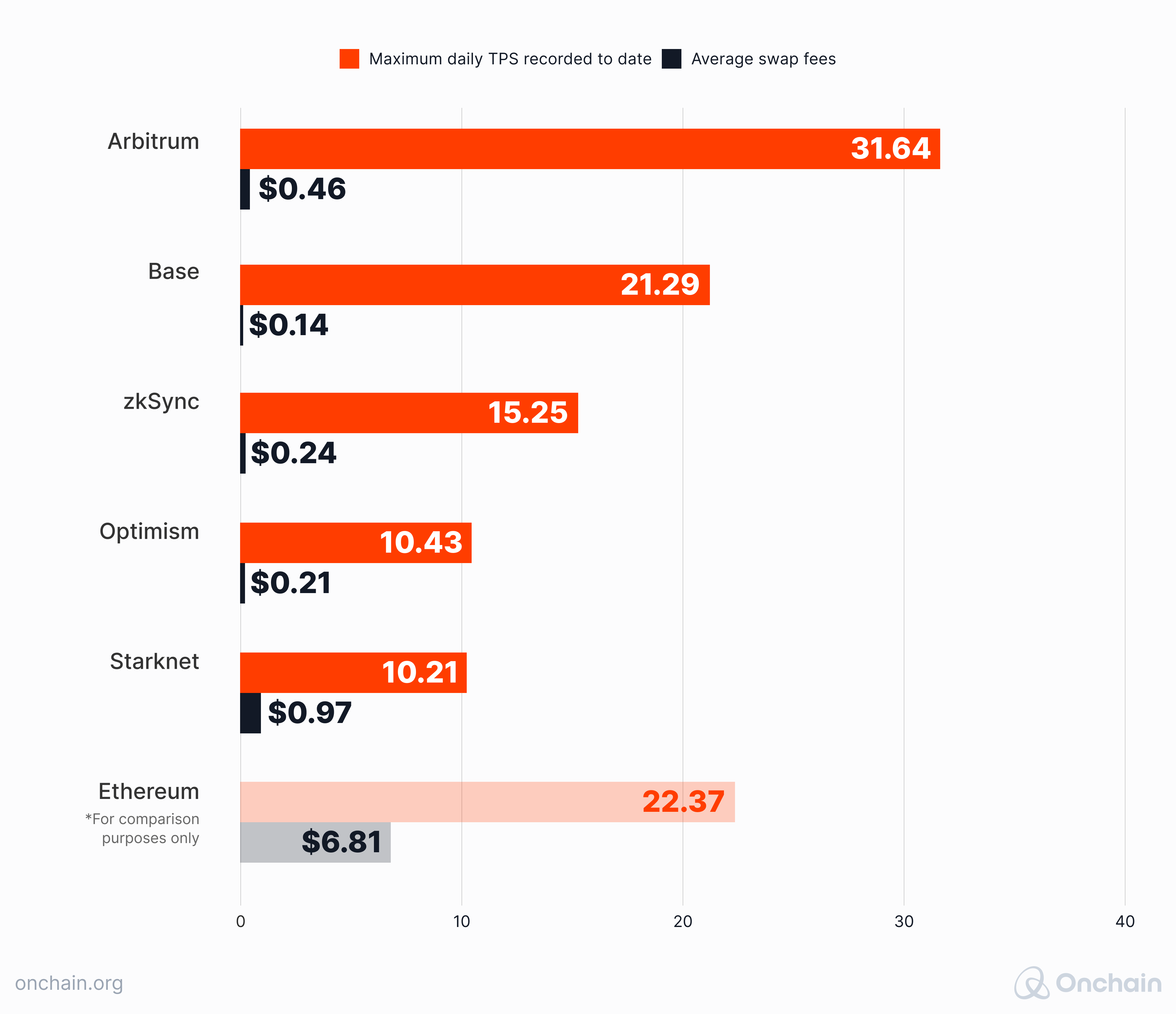

Take Base as an example: its swap fees are on average 48 times lower than Ethereum’s.

Ethereum’s growth, once stifled by high fees, is now amplified by rollups who removed Ethereum’s only bottleneck.

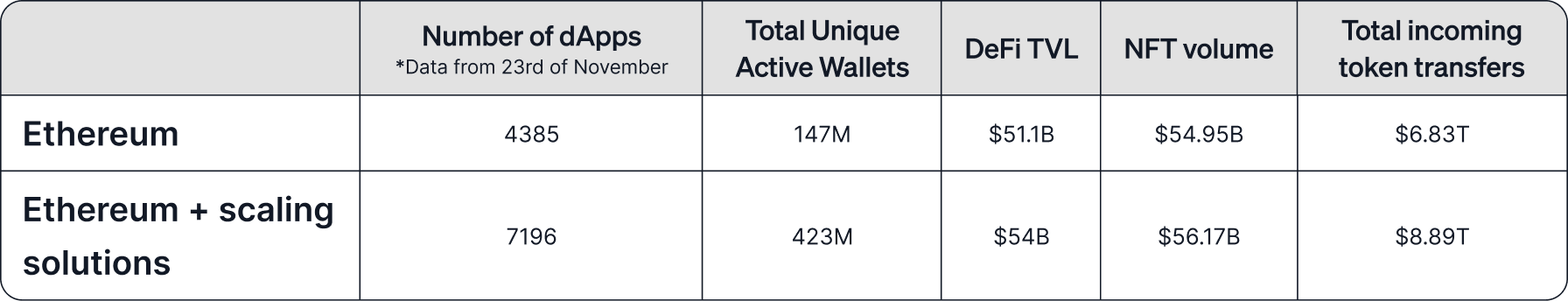

Factoring in Layer 2s, unique wallet addresses in the network nearly tripled and the number of dApps grew by 64%.

Despite all this, rollups need to scale further – $0.14 is still a magnitude away from what would make Ethereum accessible to every person on the planet.

The bottleneck of rollups? Calldata. The blockspace they buy from Ethereum makes up 90% of data storage costs.

Help comes from Ethereum’s core developers, who are already working on a solution. Time to return to Layer 1.

The future of Ethereum – the blobs are coming

On 17 January 2024, Ethereum’s Dencun upgrade introduced Proto-Danksharding to the Goerli testnet.

The upgrade introduces blob data, which is larger than calldata and reserved for rollups.

With blobs, there’s no competition for block space with Ethereum’s Layer 1 applications.

And so this innovation could slash fees for optimistic rollups by up to 100x.

If the optimism holds true, fees on Optimism could drop to an average of $0.0021 as early as March 2024.

Conclusion – which blockchain is the best to build on

At this point, no alternative Layer 1 blockchain matches Ethereum in decentralization, security, and sustainability.

Taxes are high, but Layer 2s present entrepreneurs with competitive infrastructure to generate stable revenue while benefiting from Ethereum’s established economy and network effects.

Ethereum’s team has a history of keeping its promises (although with some delays).

If they keep up the streak, Ethereum will be on its way to becoming a hub for scalable rollups – the foundation for a mass-adopted Web3.

Now it’s time to learn about network effects, which has significantly increased Ethereum’s value over time. Knowing about this phenomenon will help you choose your chain and develop effective strategy. Move forward in the learning track to dig in.