What if social media platforms didn’t just profit from your data but allowed you to own it? What if, instead of a handful of companies reaping all the rewards, creators and users could directly benefit from their contributions?

These are the opportunities decentralized social media (DeSoc) offers, promising to change the game for creators, entrepreneurs, and tech-savvy users alike.

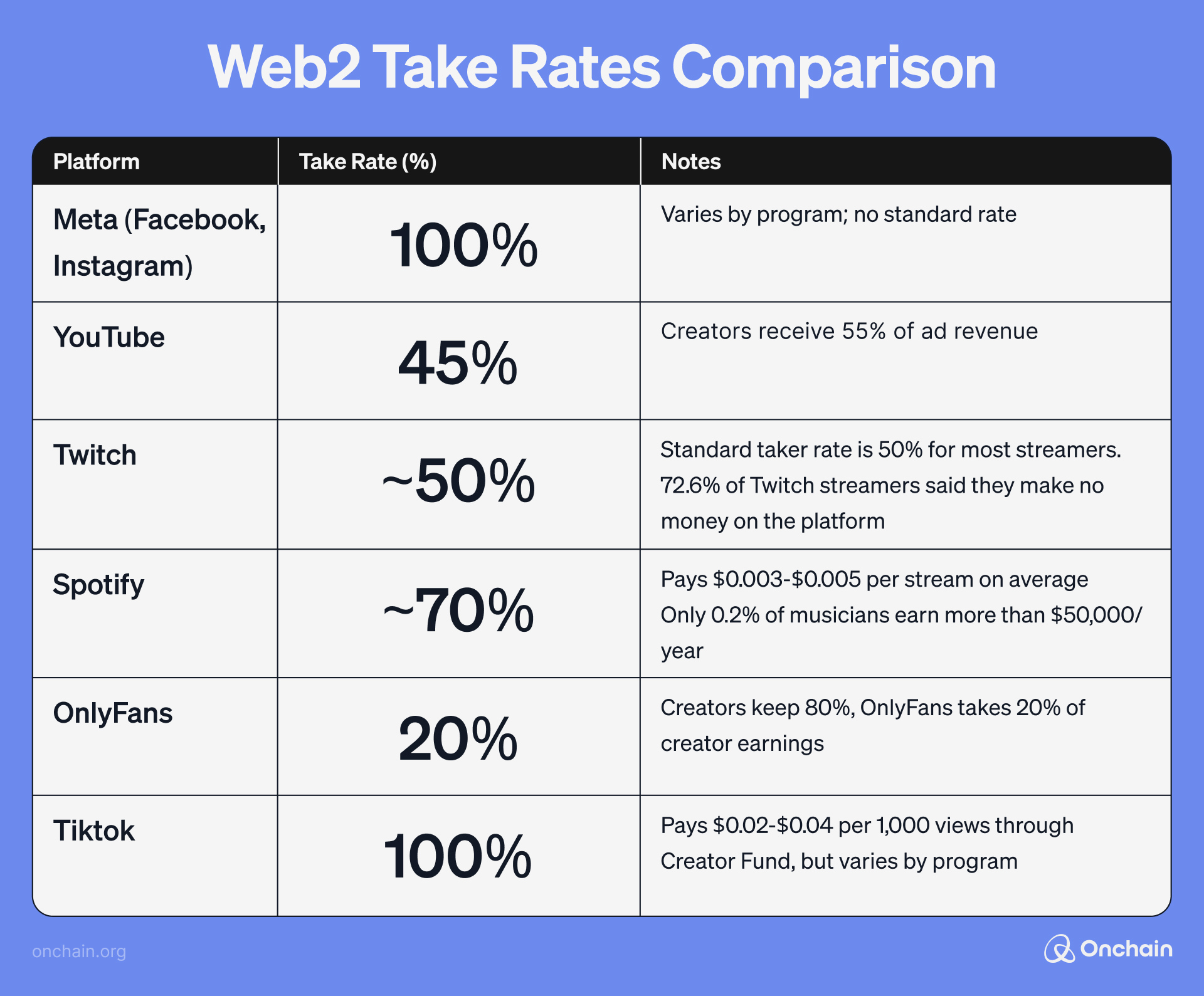

The social media advertising market alone is expected to reach $226.73 billion (from paid ads) in 2024. Yet creators see only a small portion of that wealth. Platforms like Meta keep up to 99% of the revenue, leaving creators reliant on ad-sharing programs or brand sponsorships for income.

For instance, YouTube creators only receive 55% of ad revenue, and Twitch streamers face an average 50% cut from their earnings. It’s clear that the Web2 model heavily favors the platform over the individual.

The creator economy is booming. However, as seen in the table, traditional Web2 platforms take significant portions of creator earnings, leaving them with limited monetization opportunities.

Social media business models for the decentralized era

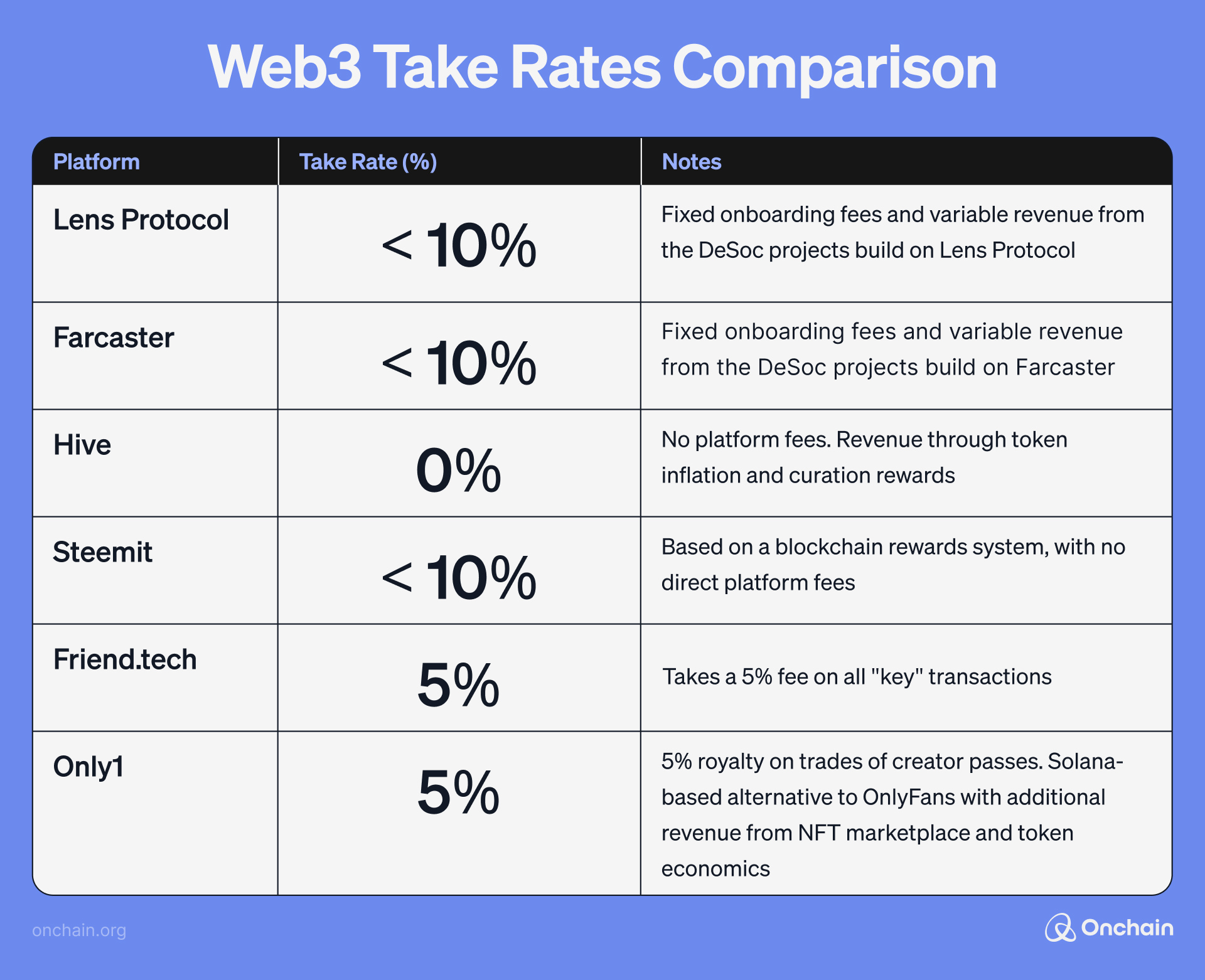

Decentralized social media business models take a very different approach to generating revenue, for protocol creators, content creators and users.

Here’s a deeper look into the different business cases that distinguish DeSoc platforms from traditional Web2 platforms.

Business case for DeSoc platforms

- Transaction fees: DeSoc platforms like Lens Protocol and Farcaster charge small fees for activities such as minting NFTs or subscribing to premium content. Since 2024, Lens revenue reached $5,540,000, with 93% coming from Profile NFTs and the rest from subscription fees, collections, and referral fees.

- Onboarding fees: Some platforms, such as Lens, charge users an onboarding fee (around $10) when creating profiles, which goes toward the platform treasury and developers, encouraging continuous innovation within the ecosystem.

- Token-based models: Platforms like Friend.tech and DeSo enable creators to issue social tokens, giving fans a stake in their success. Even though Friend.Tech shut down on 09 Sep, as of Aug 2024, Friend.tech had 917,124 addresses and $65.2 million in protocol revenue (50% of its protocol revenue went to Friend.tech team)

Business case for creators on DeSoc platforms

- NFT minting: Creators can mint and sell their content as NFTs on platforms like Lens or Zora.

- Subscriptions: Platforms like Access Protocol, Only1 allow creators to monetize premium content through subscription models. This direct connection between creators and audiences ensures consistent income and deeper engagement.

- Microtransactions and Tips: On platforms like Steemit and Hive, users can tip creators directly, offering another way for creators to earn from their content in real-time.

Business case for DeSoc users

Further DeSoc projects are reshaping the relationship between users and influencers by creating tokenized ecosystems that enable direct financial participation.

Unlike traditional social media networks, where interactions like upvoting or liking a post do not provide any tangible rewards, DeSoc platforms allow users to invest in influencers through tokens or NFTs, creating new opportunities for financial gain.

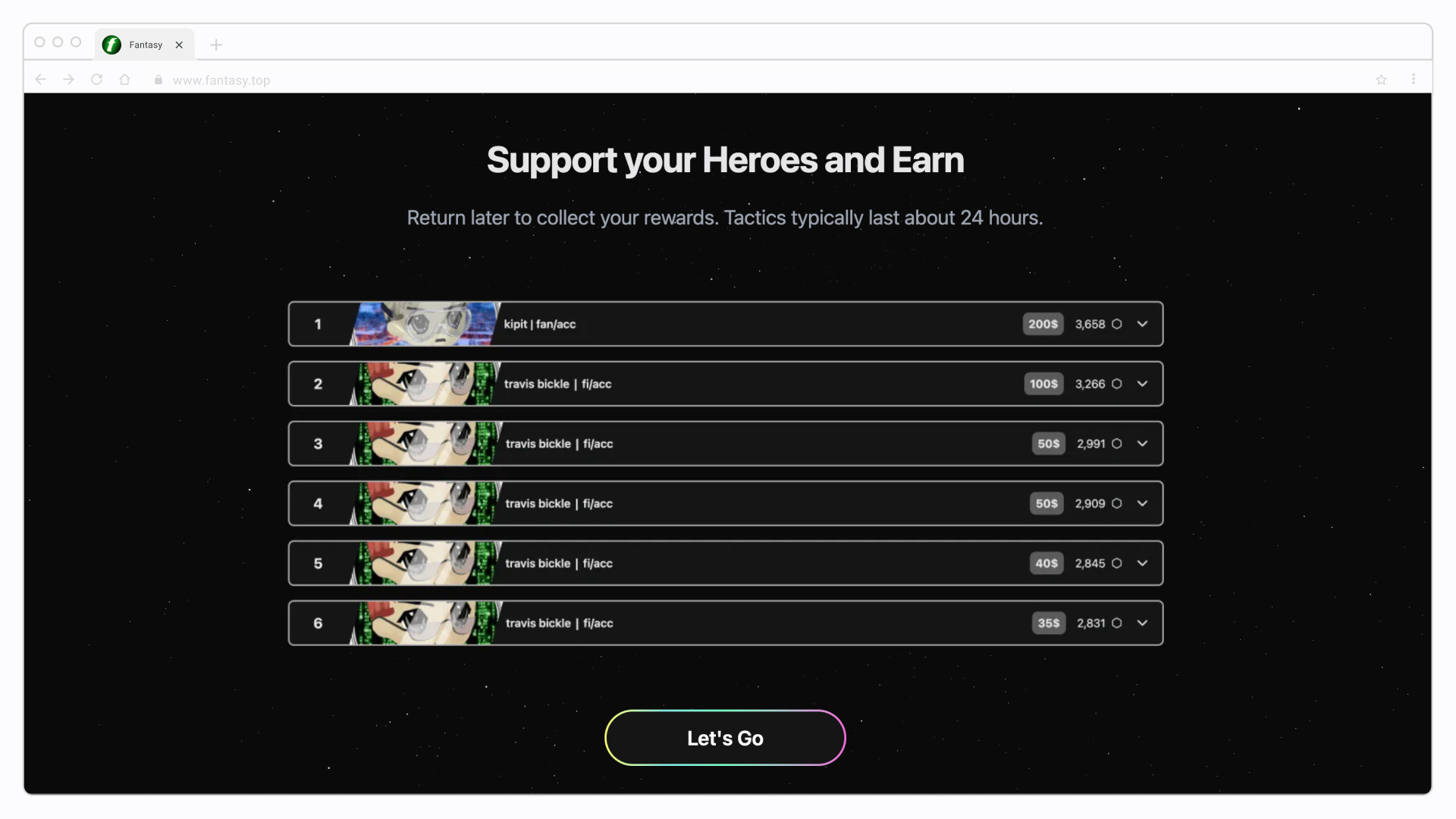

Monetizing engagement: the unique DeSoc business model of Fantasy Top

Fantasy Top offers a compelling example of how DeSoc platforms allow users to profit directly from the success of influencers.

Built on Blast, an Ethereum Layer 2, Fantasy Top blends gaming, social media, and decentralized finance (DeFi) by allowing users to own and trade NFTs, so-called “hero cards” that are tied to the performance of prominent crypto influencers on X.

In Fantasy Top, users can buy and sell shares of influencers, betting on their future popularity. As an influencer’s social media engagement increases — through likes, retweets, and comments — the value of their hero card rises, offering users a direct financial incentive to invest in and follow their favorite influencers.

Fantasy Top’s model introduces new revenue streams for creators, who can earn from trading volume and commissions on pack sales. This approach has attracted prominent influencers like Tyler Durden and Blast founder Pacman, further demonstrating how DeSoc platforms are already creating unique financial opportunities for both creators and users.

Business models in Web3 – a question of when, not if

As users and creators increasingly seek ownership and agency over their digital lives, the rise of DeSoc platforms could signal the dawn of a new era in social media—one where everyone has a stake in the digital world they’ve helped create.

In this vibrant new landscape, the potential for growth and innovation is boundless. The question now is not whether DeSoc can replace the giants of Web2, but how quickly these innovative platforms can capture the hearts and minds of a generation hungry for change and true digital ownership.

There are two major players in DeSoc and we take a look at them next. Click the arrow below to learn how to invest your time, energy, and content with confidence.