“To Layer 1 or Layer 2? That is the question.” -Web3 Shakespeare

But with hundreds of viable onchain options, how do you make up your mind?

The paradox of choice has caused many to experience Web3 decision paralysis. Even 15+ years after Bitcoin, companies like Circle, Google, and Stripe continue to release new Layer 1 (L1) blockchains.

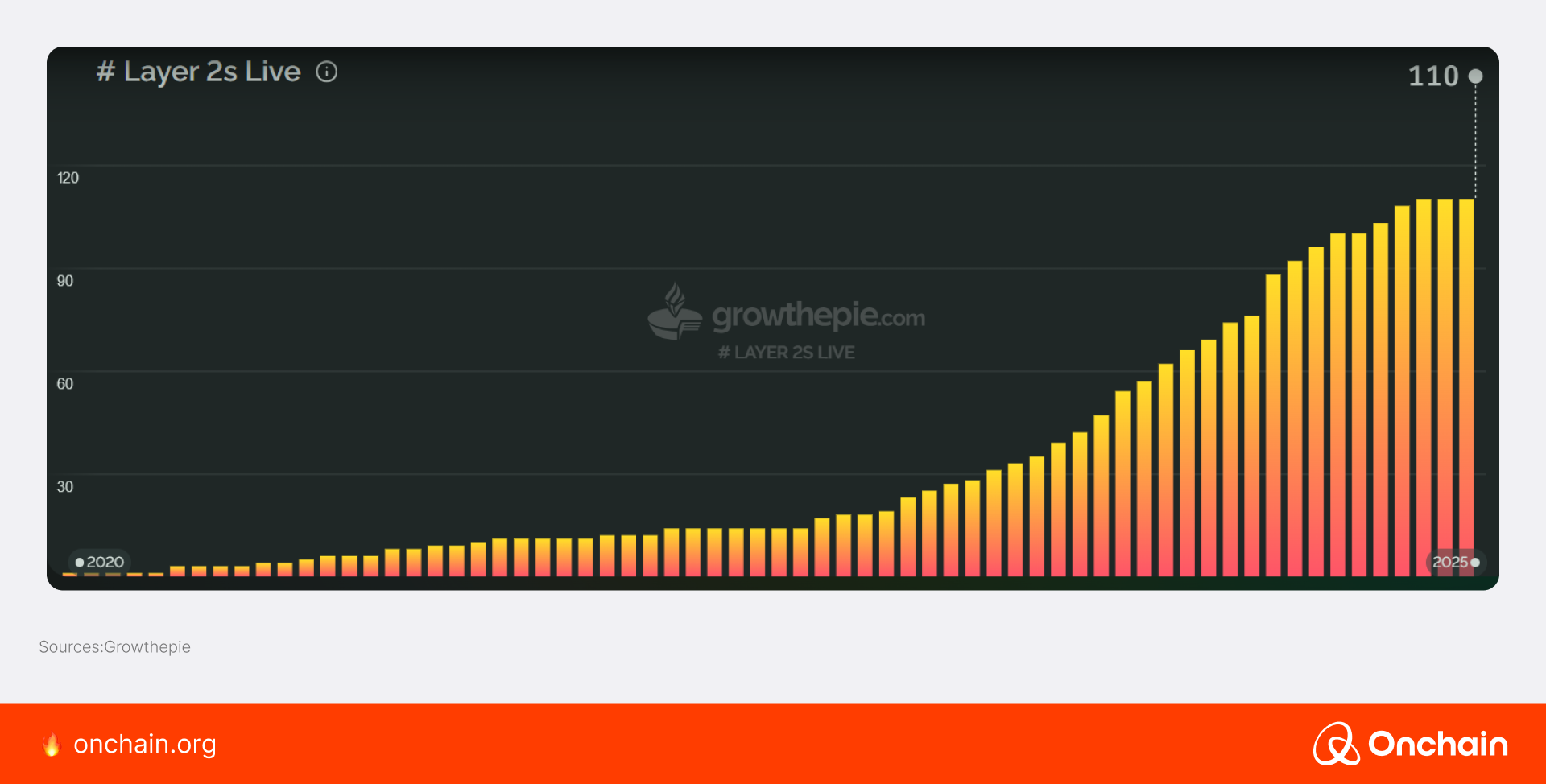

And Ethereum’s Layer 2 (L2) solution metrics went from one to triple digits in just five years.

There are layers to the blockchain ecosystem — literally. And new projects come and go, requiring constant ecosystem monitoring.

In this article you’ll learn about the tradeoffs and ongoing debate between blockchain Layer 1 and Layer 2 protocols.

Let’s start with some basics.

Blockchain Layer 1s explained

When people think of blockchain, they generally think of Layer 1s (L1s) like Bitcoin, Ethereum, Solana, or Cardano. Bitcoin and Ethereum are the two OG blockchain Layer 1s that started it all and continue to dominate in terms of mindshare, market capitalization, and usage.

L1s are the core blockchain networks and have their own native tokens (e.g., BTC, ETH). They have their own consensus rules, block times, and handle transaction confirmations onchain. The various Blockchain Layer 1s differ significantly in their designs.

Bitcoin and Ethereum can charge high transaction fees. Other L1s, such as Solana and Sui, were designed to offer faster and cheaper transactions, but come with tradeoffs. These high-throughput L1s often sacrifice decentralization and/or network security to achieve their transaction goals.

Blockchain Layer 2s explained

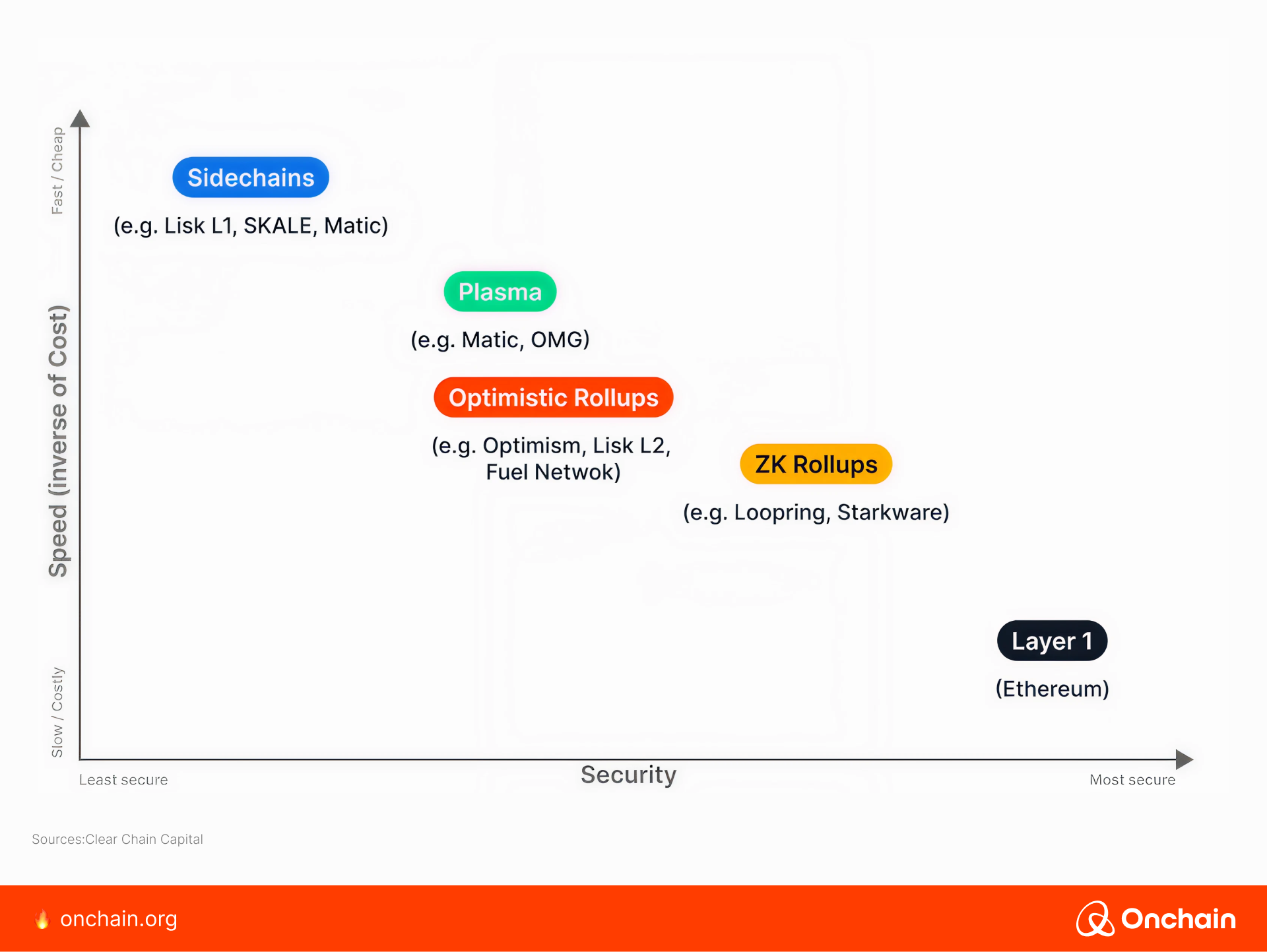

Blockchain Layer 2s (L2s) are built on top of an L1 protocol. Most L2s focus on scaling the L1 base layer. Layer 2 crypto solutions vary and typically sacrifice security and/or decentralization to improve scalability. Much like high-throughput L1s.

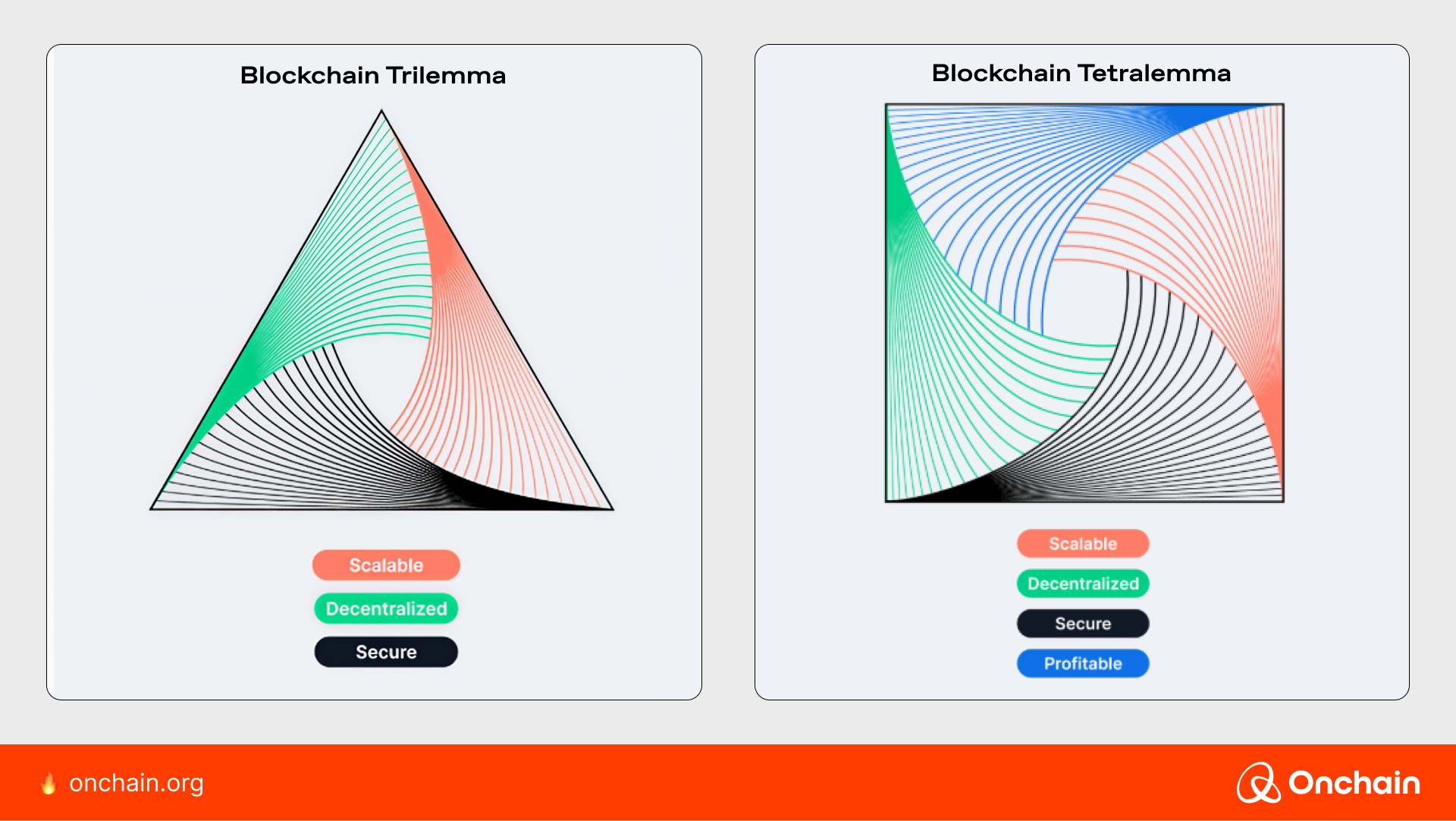

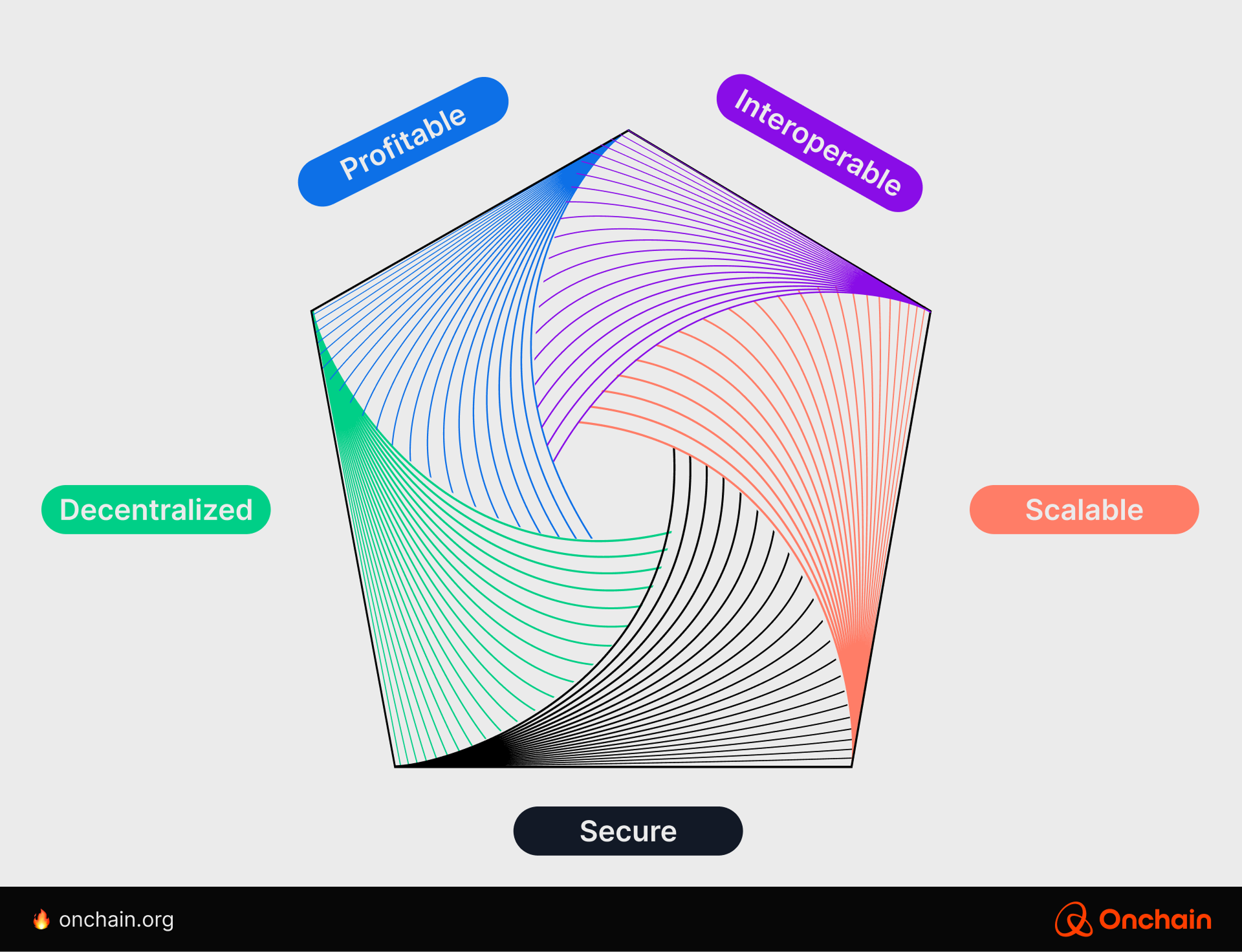

Blockchain Layer 2s were invented to mitigate or eliminate the downsides and tradeoffs of L1s. Coined by Vitalik Buterin, the blockchain trilemma states that blockchains have tradeoffs between security, decentralization, and scalability.

Bitcoin and Ethereum are known for their strong security and decentralization. However, when they gained popularity, their weak trait was exposed: scalability. Transaction fees spiked, and transactions had to wait hours or even days for confirmation. This led to widespread complaints and frustration and the beginning of a now-flourishing L2 ecosystem. 👇

Blockchain protocols need to generate profit. Without revenue, the protocol can’t provide security incentives, grow its network, or develop its ecosystem. Onchain’s Michal Moneta added to Vitalik’s trio and dubbed it the blockchain tetralemma.

Philosophical ideals are great. However, without profit-generating revenue, every L1, L2, and company ends up at one destination: bankruptcy.

But if you’re an entrepreneur or founder, you already know this: revenue matters.

Blockchain Layer 1 vs Layer 2: What’s right for you?

The answer depends on your needs. That’s like trying to tell you what vehicle to buy without knowing what you need it for.

A friend asked me why I recently purchased a truck as a family car. I said, “Because I needed optionality.”

Here’s the thing: I need a vehicle that can tow trailers, haul cargo, and handle winter driving conditions. Sure, there are downsides, like a truck being more expensive, less fuel efficient, and harder to drive in busy cities.

And with different priorities, I’d be better off with a car, van, or SUV.

The same applies when choosing the right type of blockchain. First, assess what your onchain needs and priorities are.

Then you can make a better blockchain “purchasing decision” without “buyer’s remorse.”

Is security and decentralization of utmost importance? Go with an L1. Or is transaction throughput and cost more critical? Go with an L2. It’s all about tradeoffs.

You need to prioritize based on your goals while minimizing the downsides of various L1 and L2 options. It sounds simple, but there are multiple layers to reaching a final decision (pun intended).

L1 vs L2: competition, collaboration, or both?

Both L1 and L2 projects are developing enhanced scaling solutions. They want to make blockchains faster, cheaper, and more accommodating to a growing global user base. These strategies don’t have to be in competition. L1 networks like Ethereum, now ten years old, scale at the base level with a proliferation of L2 networks being built on top of it.

Some say that combining L2s with strong L1s is the ideal compromise. You get the increased L2 scalability without losing substantial onchain security or decentralization. But that’s still a hotly debated topic. Technically, L2s need to collaborate with their underlying L1.

They wouldn’t exist without the L1s as the base layers they’re built on. However, L2s can compete with L2s and L1s from other blockchains. For example, an Ethereum L2 competing with non-Ethereum L1s/L2s.

Speaking of Ethereum, it’s a good example of this ongoing blockchain L1 vs L2 debate.

Ethereum blockchain: Layer 1 vs Layer 2

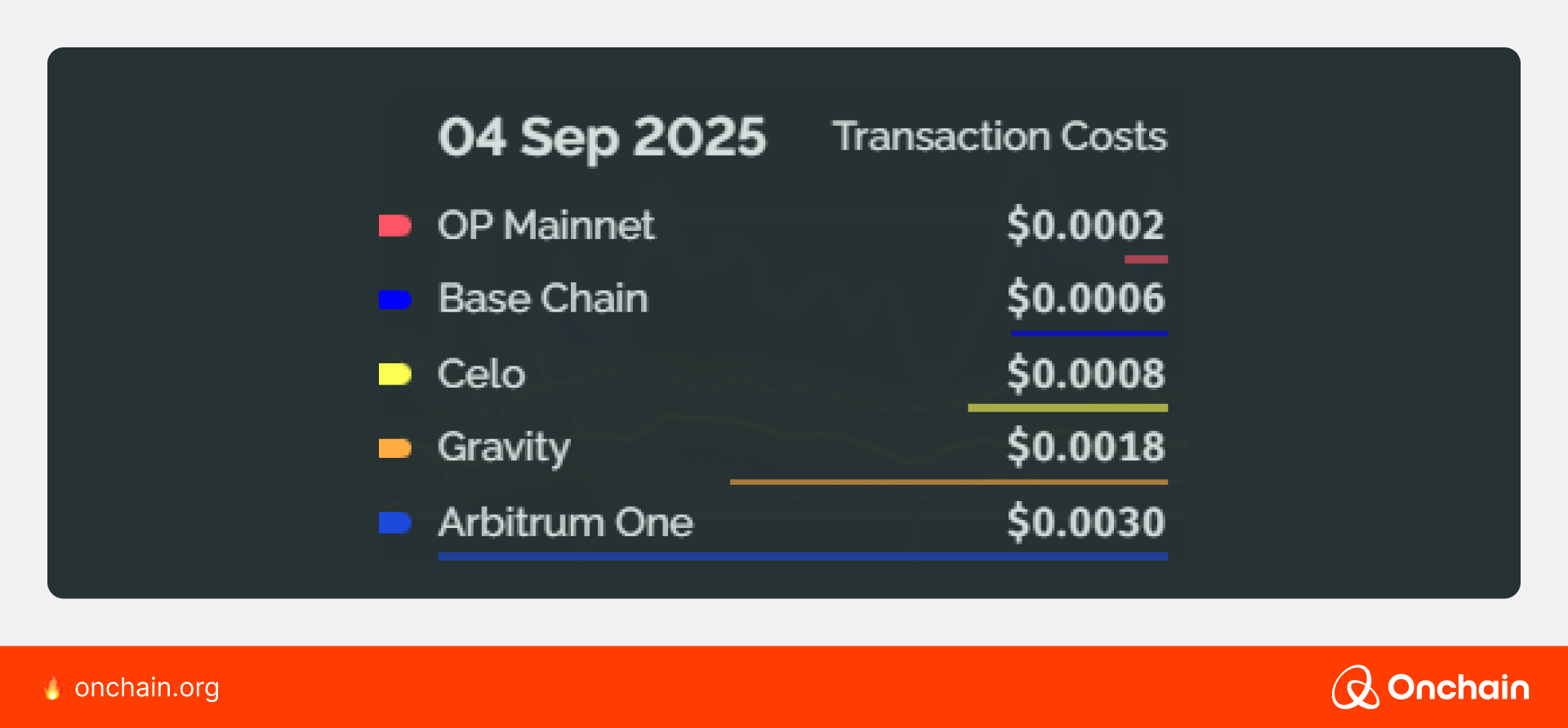

There are scaling solutions for Bitcoin and other protocols, but much of the L1 vs L2 debate centers around Ethereum. On Ethereum alone, there are over 150 L2 scaling solutions. This has led to record Ethereum transaction throughput and rock-bottom transaction fees.

But even with its L2 throughput, Ethereum block space was getting full. Still, Ethereum continues to evolve through new proposals, L2 interoperability solutions, and more.

Layer 2 crypto solutions help scale L1s by reducing network congestion (scalability) and lowering fees. But fees alone aren’t the only consideration. Businesses, including L2s and developers, want to build where the most activity and users are.

Ethereum’s network effects dominate due to its deep liquidity, established ecosystem, and seamless interoperability between decentralized applications (dApps). Increasing interoperability among Ethereum L2s and L1 chains like Hyperliquid is cementing its one-of-one status.

To leverage Ethereum’s security and network benefits, some L1s have transitioned into Ethereum L2s. To learn more, check out our report The Future is Modular.

Ethereum L2s also benefit by leveraging Ethereum’s strong protocol security. They earn their own transaction fees and only pay a fraction of that amount to Ethereum. This blockchain efficiency allows them to profit from the fee differential.

Ethereum L2 downsides and concerns

Some Ethereum maximalists worry about its L2s cannibalizing Ethereum’s fees, value, and users. Others point out that L2s are migrating to Ethereum, not leaving it.

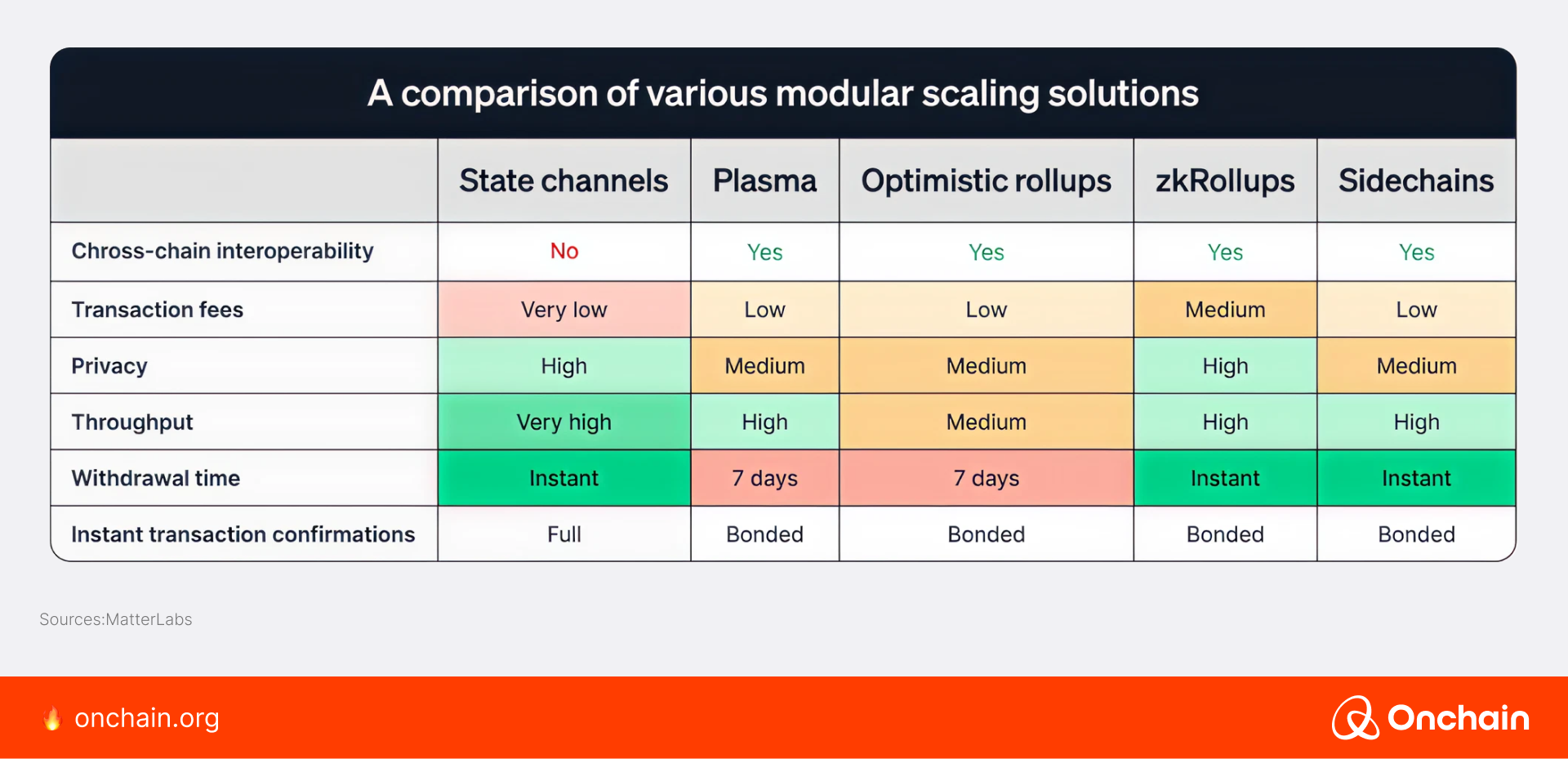

More importantly, there is a debate around what is and isn’t a true L2. There is a whole ecosystem of L2s (rollups, sidechains, and more) that come with a variety of tradeoffs.

Modularity: Layers within layers

We don’t want to confuse you, but even within distinct L1s and L2s, there can be layers. Called modular blockchains, these protocols can be split up into consensus, application, data, and network layers. The consensus layer processes and validates blocks of data.

The application layer is where you deploy dApps or smart contracts. While not all blockchains are modular, this approach is becoming increasingly popular for creating specialized blockchains.

Layer 1 and Layer 2 crypto debate

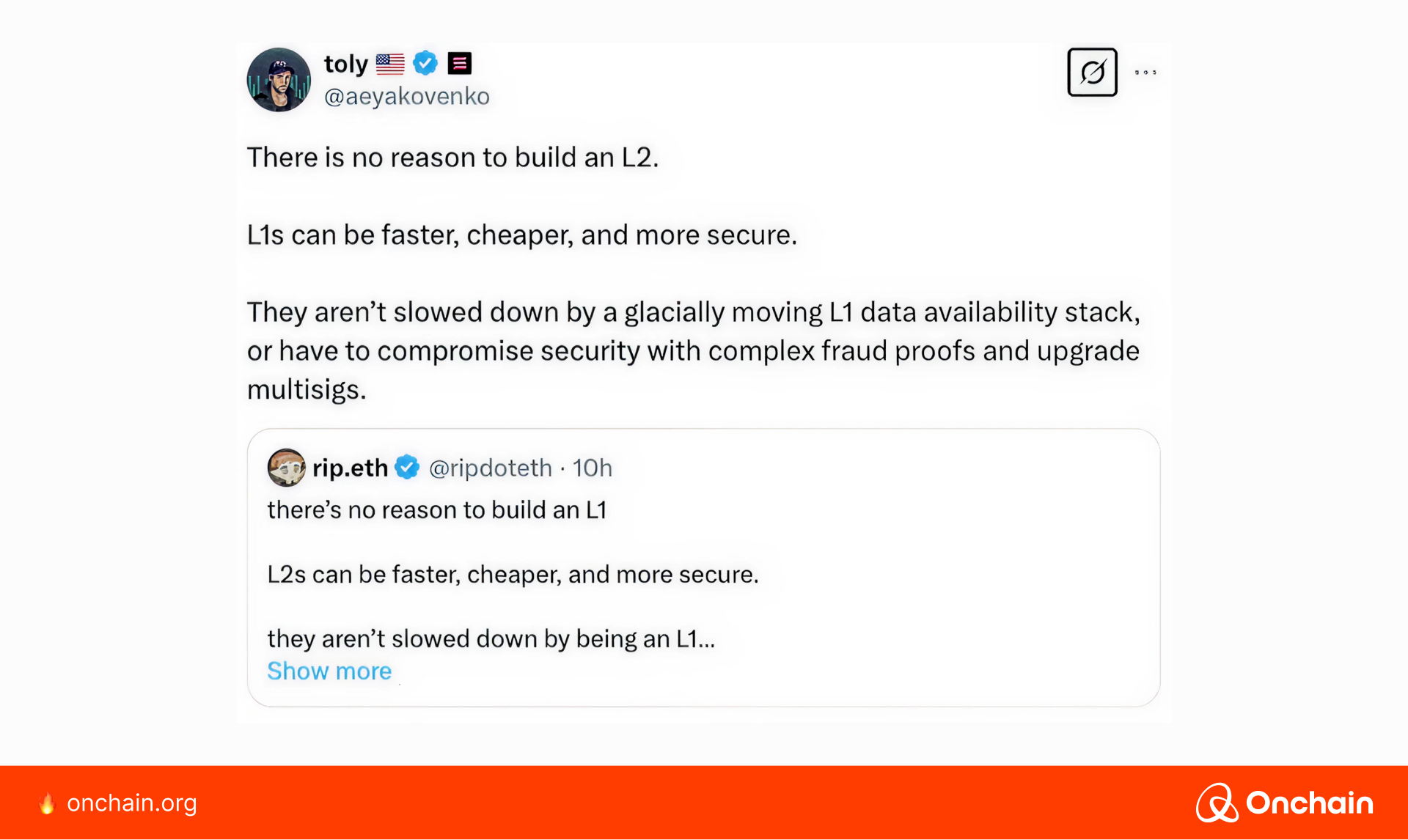

The pros and cons of Layer 2 crypto protocols are a much discussed topic. Some are strong advocates, others aren’t. Much of this conversation centers around tradeoff preferences and the differences between blockchain ecosystems. For example, Solana cofounder “Toly” sees L2s as inferior technology.

Others see L2s as being a net positive to the L1 on which they are built. Ultimately, it’s up to you to decide which onchain path to take. But if you need recommendations, we’re here to help. 🙂

Here’s one tip: To give yourself the most optionality, consider building something (or on something) that is also interoperable. We’ve turned the tetralemma into a business-focused pentalemma. Okay, we’ll stop here.

We recently covered Hyperliquid in depth. It started out as a standalone L1; it released an Ethereum compatibility layer earlier this year.

Hyperliquid has been dominating the headlines due to its high scalability, profitability, and interoperability. There is some debate over Hyperliquid’s security and decentralization, but three out of five (at a minimum) isn’t bad.

L1 vs L2, final thoughts

The L1 and L2 debate is still going on and is not likely to die down any time soon. Much talk is centered around Ethereum. The next article digs deeper into the subject, analyzing the dominance within both L1 and L2 crypto ecosystems.

How does Ethereum stack up against other L1s? And why is Ethereum’s L2 ecosystem so popular and dominant? Read on to get the Onchain crypto clarity you’ve come to expect.