As we approach the second half of this decade, it’s becoming increasingly clear that AI agents are set to fundamentally disrupt the crypto landscape.

According to ChainChatcher, “The total market value of the crypto AI sector will reach $150 billion by 2025”

Could these new AI agents actually transform cryptocurrency trading and provide automated solutions for trading, portfolio management, and data analysis?

Before we answer that, try to imagine a future where AI agents don’t just execute a few onchain instructions or manage liquidity pools autonomously and what this means for your project.

Together, they can create entire ecosystems that can interact, adapt, and evolve, giving rise to an intelligent Web3 layer that is constantly learning and improving. Ultimately, this would reshape how automation and interactivity function in unison.

To get straight to the point, a hybrid approach that blends the consistency of trading bots with the adaptability of AI agents opens the door to the most effective strategy.

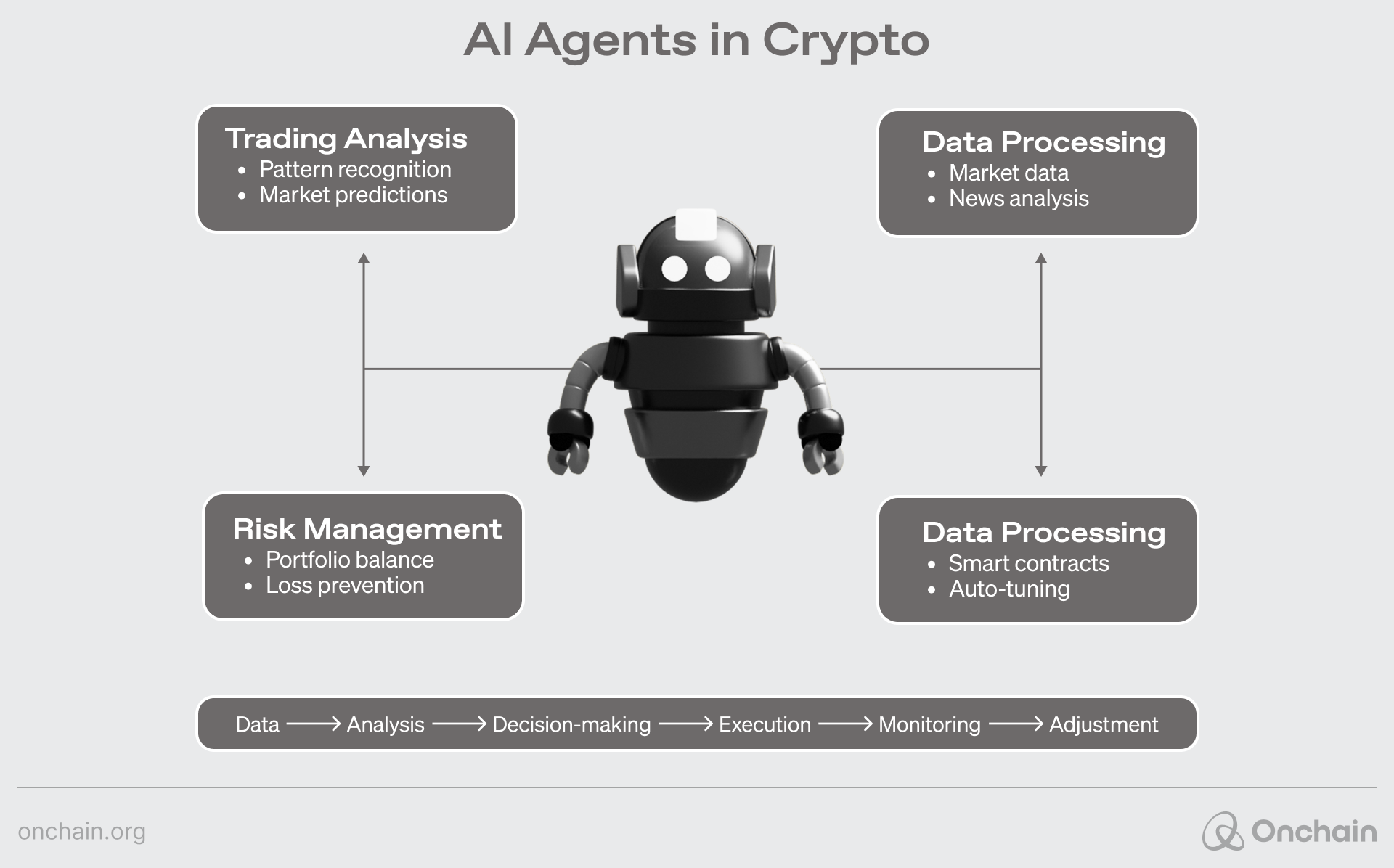

Crypto AI agents aren’t just following the game and playing along here — they’re redefining it. Using algorithmic trading, they can analyze market data with unmatched accuracy and execute transactions instantly.

Let’s dive a bit deeper into the world of how AI agents are transforming crypto trading and whether you are a start-up or just a single user, why you should consider this.

The rise of AI agent trading bots – What are they?

Put simply, AI trading bots are software programs that leverage algorithms to automate asset trading in financial markets.

They are designed to interact seamlessly and analyze large datasets to spot potential opportunities, perform risk analysis, execute trades, and manage portfolios—all of which are possible without human input.

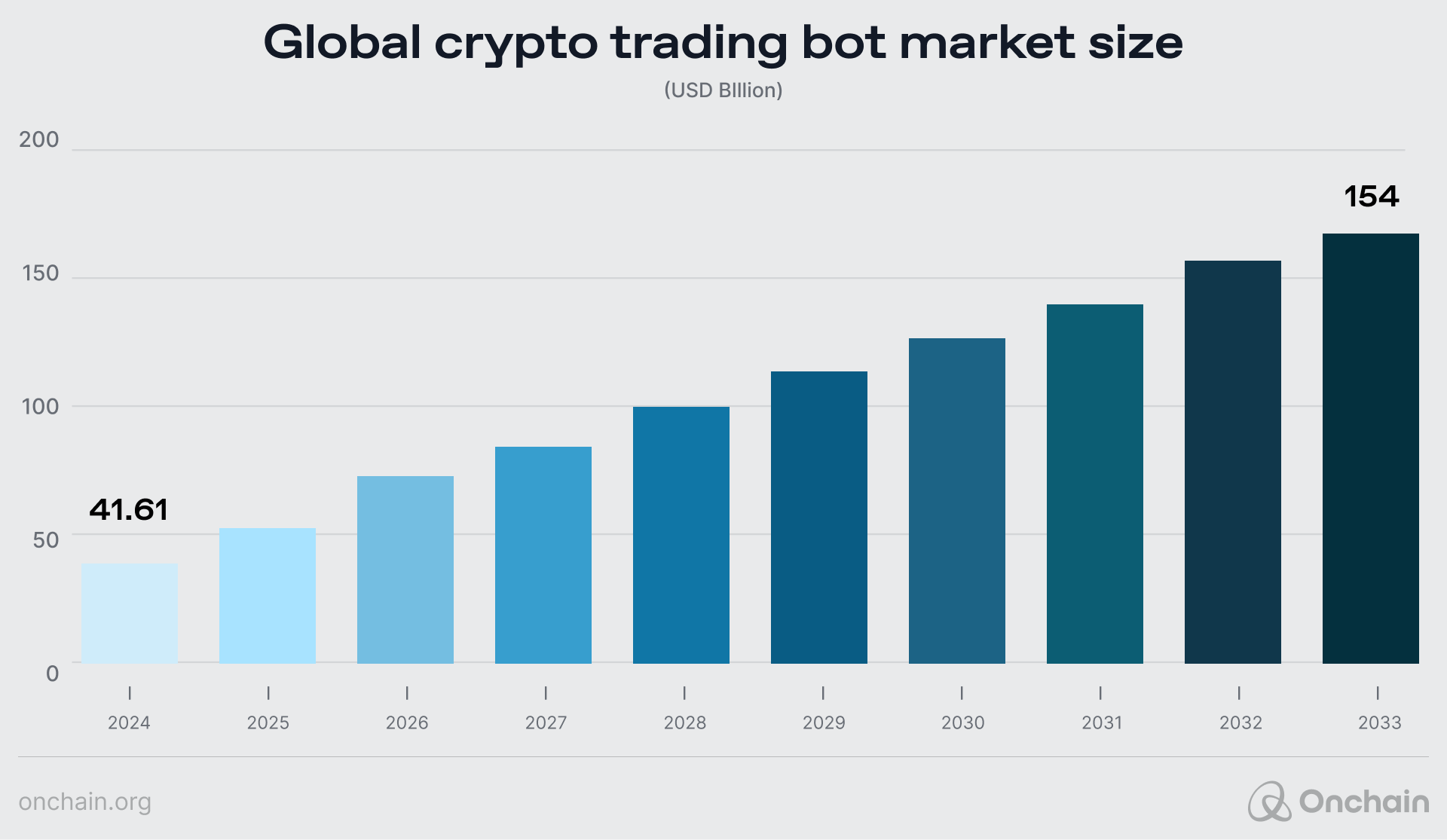

According to Business Research Insights: “The crypto trading bot market size was valued at approximately USD $41.61 billion in 2024 and is expected to reach USD $154 billion by 2033, growing at a compound annual growth rate (CAGR) of about 14% from 2025 to 2033.”

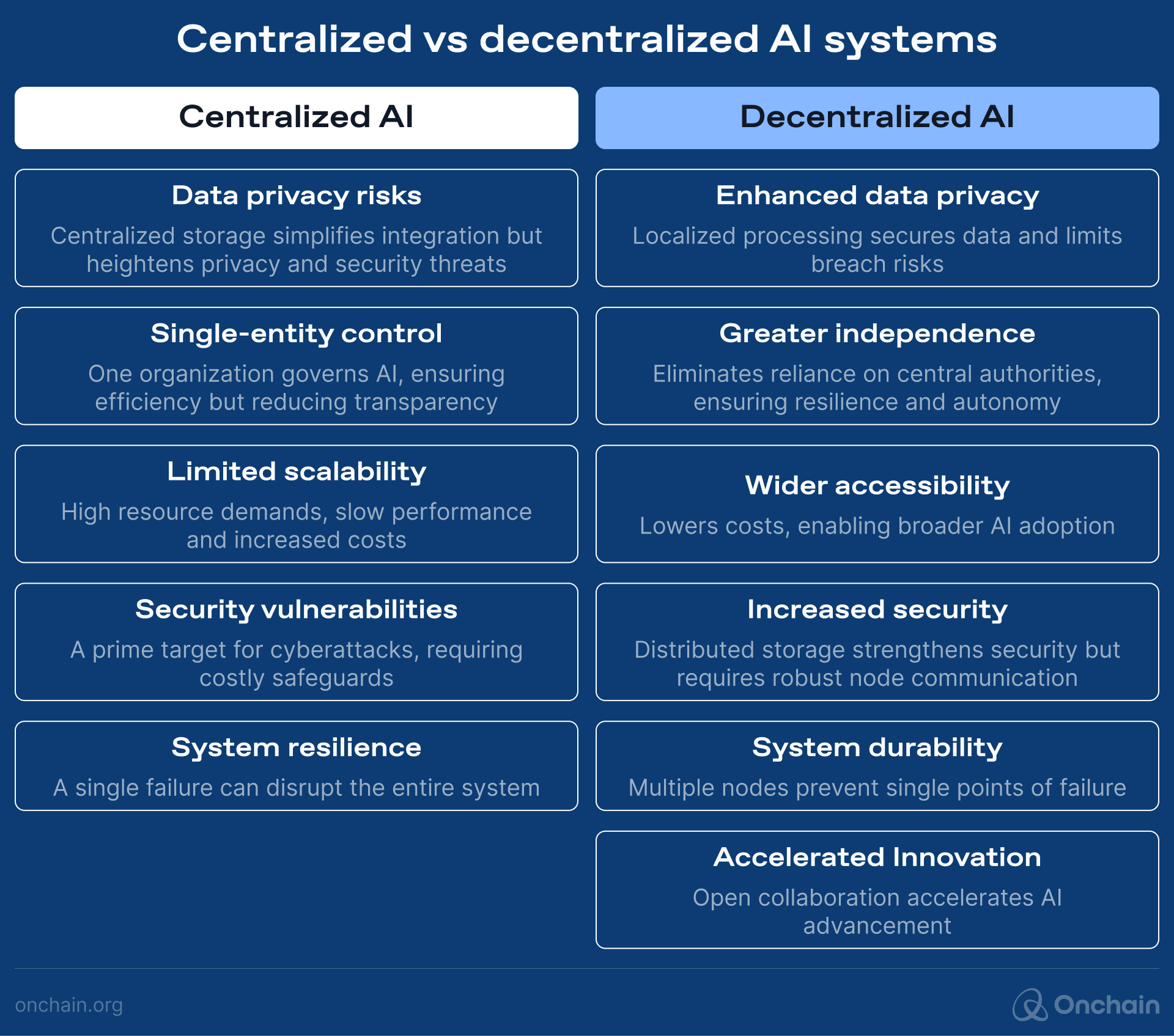

Firstly, let’s zoom out and take a look into the centralized and decentralized AI systems that could drive this AI agent market forward. From being able to offer crypto trading and MEV arbitrage bots to Gaming NPCs and DOA management, let’s weigh up the benefits and drawbacks here.

Centralized vs decentralized AI systems – What is the difference?

In short, centralized AI dominates with top-down control, but its single-point failures and data security risks are major liabilities.

On the other hand, decentralized AI disrupts the centralized model by distributing resources across a network. This has positive effects by amplifying privacy, resilience, and scalability.

With decentralized technology, built-in checks and balances can be integrated to safeguard users as well as AI agents being able to independently work together, each handling different tasks to achieve the end goal.

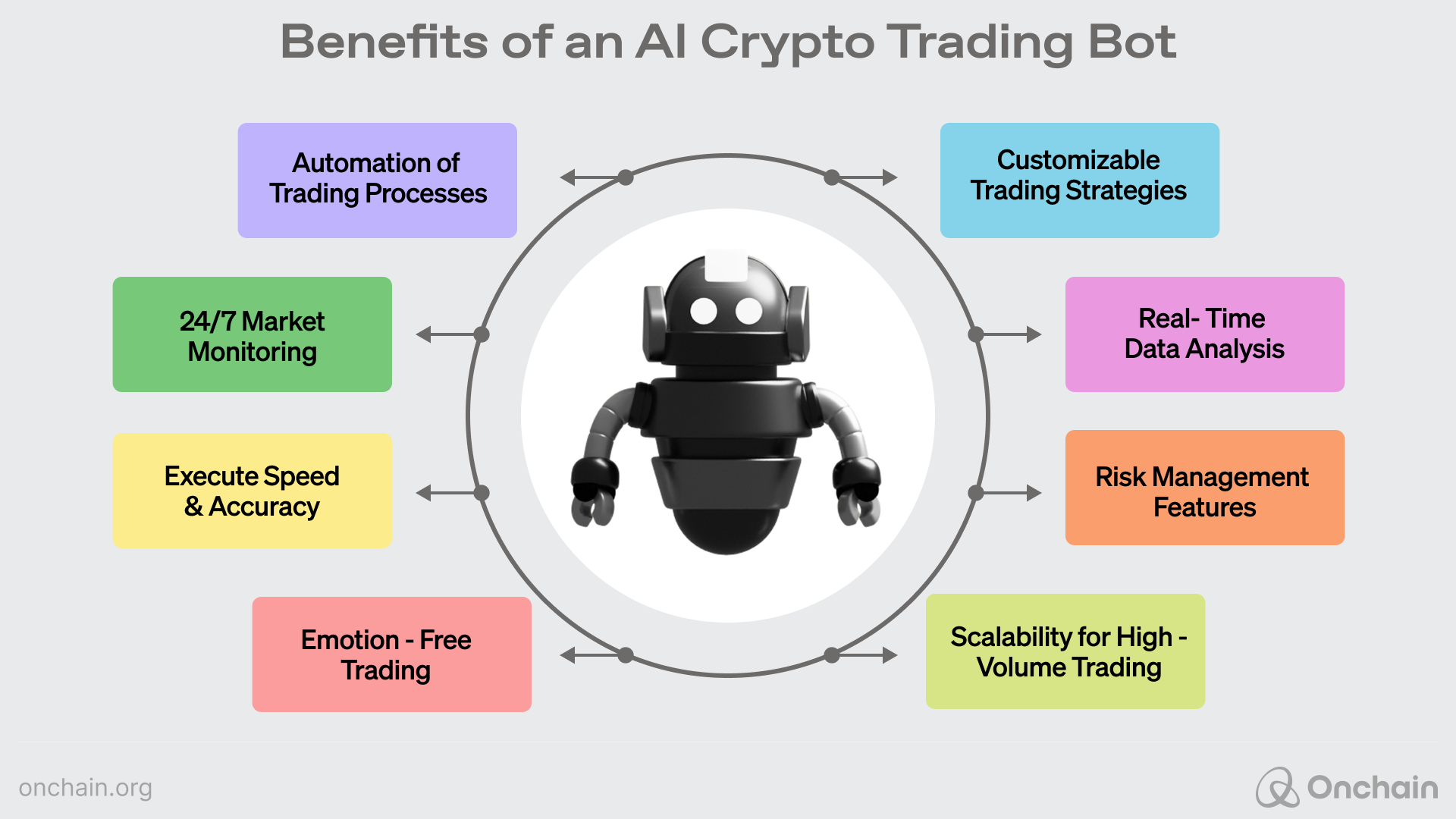

What are the benefits and drawbacks of AI crypto trading bots?

As shown below, automating processes results in data-driven, consistent results free from the irrationality of human emotions.

On the other hand, it is also important to consider the drawbacks and challenges.

Their inherent rigid, rule-based design poses risks that the user needs to be aware of. For example, they can struggle to adjust to sudden market shifts without manual updates, and programming errors can lead to repeated mistakes and mounting losses.

Lacking contextual awareness, these bots cannot process external factors such as predicting market crashes, breaking news, or geopolitical events, leaving them exposed and vulnerable to volatile conditions. Without adaptability, they remain vulnerable in dynamic trading environments.

Costs are another factor to be considered, as many bots charge subscription fees and can also include potential exchange fees.

Finally, crypto trading bots require more than an element of technical knowledge, as many bots demand an understanding of trading strategies and technical analysis, which can be challenging for beginners.

Drilling down a bit further, and to give you the broader picture here, it is important to recognize that the variety of crypto AI agents is quite extensive. It becomes evident by looking into some of the use case examples.

Real-world use cases of decentralized crypto AI Agent bots

To give you more of the flavor here, some of the key use cases that demonstrate the potential of decentralized AI bots in various domains, from finance to gaming and social interaction, are listed here:

- AI trading bots: These bots leverage advanced machine learning algorithms to analyze market data, predict trends, and execute trades. They can optimize profitability through real-time predictive analytics that can adapt to market conditions in real-time. A good example here is Cryptohopper, which automates trades across multiple exchanges and uses AI to optimize its trading strategies.

- MEV AI arbitrage bots: MEV (Maximal Extractable Value) bots scan unconfirmed mempool transactions, reordering them to exploit arbitrage opportunities: buying low and selling high within the same block. These AI bots can influence block composition, creating new profit strategies and enhancing market efficiency in DeFi. Flashbots, is an R&D organization that focuses on mitigating the negative externalities of MEV in Ethereum. It provides tools and strategies to manage MEV extraction.

- DeFi trading bots: These can automate liquidity management and adjust interest rates in lending protocols. Furthermore, DeFi bots can manage yield farming, staking, and optimizing returns. For start-ups offering these bots, they can connect users to DeFi’s growing ecosystem and seek out and dynamically provide seamless access to financial opportunities. Mizar provides a DeFi trading platform that encompasses various crypto trading tools and bots.

- Grid trading bots: Grid trading involves placing a series of buy and sell orders within set price levels in a grid pattern at preset intervals above and below a base price. This allows the bot to profit from volatility and market fluctuations. Pionex has a free built-in grid trading bot that can be deployed for this type of trading strategy.

- Gaming NPCs and social interaction bots: These AI agents can act as non-player characters in blockchain games, contests, or social platforms, providing adaptive and intelligent responses to enrich user interaction. Axie Infinity’s AI Opponents is a good example. It incorporates AI-controlled non-player characters (NPCs) to enhance gameplay and offers dynamic challenges for players.

- DAO management bots: AI-powered DAOs leverage machine learning to analyze blockchain data, track social media trends, enhance decision-making, and execute trades, making DAO management more efficient. They also enable community members to make more informed choices about proposals, governance changes, and other critical decisions. Aragon utilizes AI for DAO governance, voting processes, and proposal management automation.

- Crypto wallet management bots: AI agents can automate tasks like tracking wallet balances, executing trades, and providing investment advice, making crypto investing easier. In addition, they can enhance wallet autonomy and reinvest rewards through smart contracts. Coinbase has various crypto wallet management bots, such as GoodCrypto, WunderTrading, and more.

The field of AI agent use cases is diverse and is experiencing perpetual growth as more opportunities arise. However, let’s continue to focus on the world of AI crypto trading.

Could these AI crypto agents drive the mainstream crypto trading landscape?

Whether you are a startup or entrepreneur looking to research the market or a sole trader, how do you navigate this maze and choose the right strategy and crypto AI bot to suit your purpose?

To steer you in the right direction, some of the top AI bots out there worth investigating are 3Commas, Alpaca, and ArbitrageScanner.io. These are driving the charge, offering user-friendly interfaces and sleek, easy-to-set-up automated features.

Another example of where it is possible to benefit from crypto AI agents in this space is the Armor Wallet. An AI-driven Web3 wallet, Armor combines the security of a non-custodial wallet with the intelligence of AI-powered trading agents. It learns from its users by processing vast amounts of market data to trade across multiple blockchains, executing complex trades seamlessly.

In addition, Pass App is an AI-powered crypto wallet that simplifies Web3 interactions while providing strong security and user control. It can also automate portfolio management and transaction tracking and provide investment insights to users.

Looking at all the options, it is also important to consider the different trading styles that can be deployed, from Grid and DCA (Dollar cost Averaging) to arbitrage and market making, to suit your specific needs.

Also, leveraging the right innovative tools will further help to navigate and counter the market volatility and maximize profits.

Let’s look a little further under the hood at some of these functionalities and tools.

The evolution of AI trading: GenAI and LLMs take the lead

Recent advances in Generative AI, Large language models (LLMs), knowledge graphs, retrieval-augmented generation (RAG), GraphRAG, and internal/private LLMs have transformed the crypto AI trading landscape.

GraphRAG, a combination of graph-based knowledge representation and RAG techniques, has also shown promise in expanding LLM accuracy, which will improve AI agents across the board.

As we move further into 2025, AI developers will likely have more tools available at their disposal for no-code development of “agentic” applications. These agentic applications will be capable of providing LLM-driven copilots, trading bots, chatbots, and other functionalities.

This will result in the creation of autonomous AI-powered systems that can drive further innovation and give rise to more sophisticated AI-powered trading bots.

The emergence of “large action models” will likely play a crucial role in intelligent process automation, allowing AI crypto trading bots to make faster and more complex data-driven decisions and optimize their trading strategies accordingly.

Embracing AI agents: Is this the beginning of the next era of crypto trading?

Looking ahead, the AI agent economy has now arrived in full force. AI agents are now impacting everything from MEV arbitrage bots and crypto trading to gaming NPCs and DAO management.

What is driving this rapid rise, and are AI agents more than just a fleeting bubble?

As AI infra protocols continue to mature, this will result in easier development of complex AI agents and their relevant use cases. This all highlights the ease of more cutting-edge AI agents coming to the foray, powering this evolving sector to the next level.

However, to keep this in perspective, the lack of clear regulations in the crypto trading bot industry creates uncertainty for investors and developers, which impacts broader adoption.

Future regulations could impose restrictions on AI bot operations, potentially limiting market growth and further hampering acceptance in the trading industry.

Additionally, the absence of any globally recognized standards could lead to inconsistent enforcement and anti-money laundering (AML) compliance gaps, increasing the risk of exploitation.

Furthermore, once AI agents become the future power users of crypto, this will likely result in an exponential increase in the amount of interactions, transactions, and collaborations between them.

As this gains further traction, such an enormous surge in AI-related activity will inevitably require substantial computing power and storage capacity. Most likely, this will need to be powered by decentralized physical infrastructure networks (DePIN) projects.

The likes of Akash, Render, io.net, and Grass tend to combine both AI and resources such as compute, storage, and bandwidth. This convergence could play a key role in keeping up with the growing demands of AI agents.

And it’s critical. AI has received plenty of criticism, and for good reason. It is so easy to breech and it hallucinates a lot. Blockchain fixes this — read the next article in this Track to learn exactly how.